Global Outdoor Led Lighting Market

Market Size in USD Billion

CAGR :

%

USD

14.20 Billion

USD

29.30 Billion

2024

2032

USD

14.20 Billion

USD

29.30 Billion

2024

2032

| 2025 –2032 | |

| USD 14.20 Billion | |

| USD 29.30 Billion | |

|

|

|

|

Outdoor Light-emitting Diode (LED) Lighting Market Size

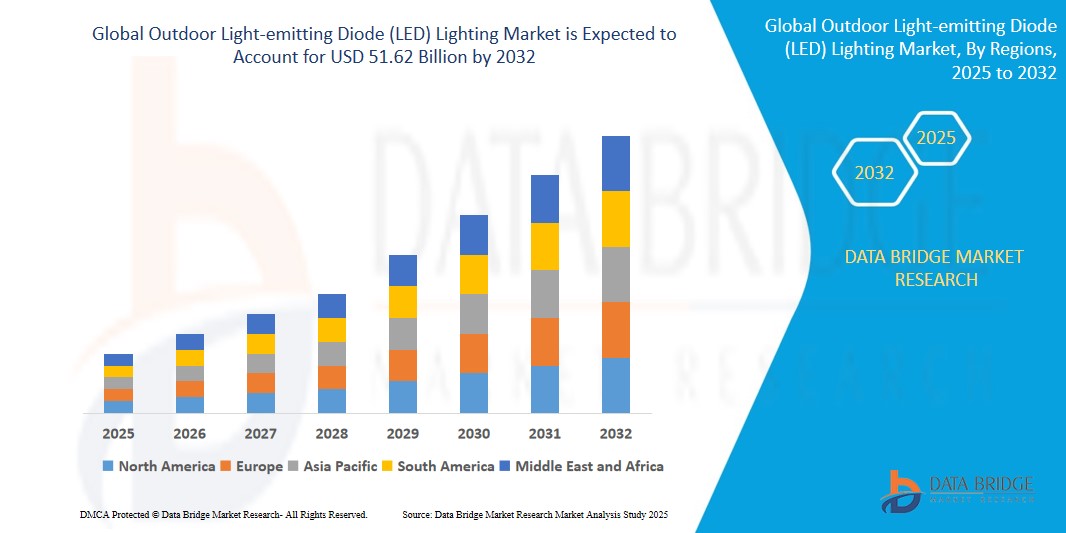

- The global Outdoor Light-emitting Diode (LED) Lighting market size was valued at USD 29.73 billion in 2024 and is expected to reach USD 51.62 billion by 2032, at a CAGR of 7.14% during the forecast period.

- Growth is propelled by rising demand for energy-efficient lighting, government initiatives promoting smart city projects, and increasing adoption of LED technology for street lighting, security, and architectural applications due to its long lifespan and low maintenance.

Outdoor Light-emitting Diode (LED) Lighting Market Analysis

- Outdoor LED lighting involves the use of light-emitting diodes for illuminating outdoor spaces such as streets, landscapes, building exteriors, and public areas. These solutions are highly energy-efficient, durable, and offer superior brightness compared to traditional lighting technologies like incandescent or high-intensity discharge (HID) lamps.

- Key growth drivers include global urbanization, the push for sustainability, and the integration of smart lighting systems with IoT for real-time monitoring and energy optimization. The market is further boosted by government policies promoting energy conservation and the replacement of conventional lighting with LEDs in public infrastructure.

- Asia-Pacific is expected to dominate the market due to rapid infrastructure development, smart city initiatives, and the presence of major LED manufacturers in countries like China, Japan, and South Korea.

- Europe is projected to be the fastest-growing region, driven by stringent energy efficiency regulations and widespread adoption of smart LED lighting systems in urban areas.

- The LED segment is expected to dominate the Outdoor Light-emitting Diode (LED) Lighting market, with a market share of 38.5% during the forecast period. This leadership is driven by the increasing demand for high-brightness, energy-efficient, and scalable display solutions, growing adoption in digital signage, retail, and public infrastructure, and ongoing advancements in LED technology enhancing durability and visual performance.

Report Scope and Outdoor Light-emitting Diode (LED) Lighting market Segmentation

|

Attributes |

Outdoor Light-emitting Diode (LED) LightingKey Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Outdoor Light-emitting Diode (LED) Lighting market Trends

“Integration of Smart and IoT-Enabled LED Lighting Systems”

- The market is shifting toward smart outdoor LED lighting systems integrated with IoT, enabling remote monitoring, adaptive lighting adjustments, and energy optimization for applications like street and security lighting.

- Advancements in LED technology are delivering higher lumens per watt, longer lifespans, and improved durability, making them ideal for harsh outdoor environments

- For instance, in January 2021, Signify expanded its Philips Hue portfolio with outdoor LEDs, including the Amarant linear spotlight and Appear wall light, designed for smart control and aesthetic enhancement.

- Demand for motion-sensitive lighting and automatic dimming functions is growing, especially in commercial and public safety zones to reduce energy wastage and improve surveillance

Outdoor Light-emitting Diode (LED) Lighting market Dynamics

Driver

“Rising Demand for Energy-Efficient Lighting in Smart Cities”

- The global push for energy conservation and smart city development is driving the adoption of LED lighting for streetlights, public spaces, and infrastructure, reducing energy consumption by up to 90% compared to traditional lighting.

- Government initiatives, such as New York’s plan to convert 250,000 streetlights to LEDs, are accelerating market growth

- LED lighting reduces maintenance costs and improves urban safety by offering better visibility and integrating features like emergency signaling.

- For instance, In 2025, Ukraine’s government approved a national energy-efficiency program aimed at replacing traditional incandescent bulbs with energy-saving LED lighting across households and public institutions. This initiative is part of the country’s broader strategy to reduce energy consumption, cut electricity costs, and lower carbon emissions.

- Standardization of LED modules and smart interfaces is making it easier for municipalities to upgrade legacy lighting infrastructure with efficient, interconnected systems.

Opportunity

“Expansion of Smart Street Lighting in Urban Infrastructure”

- Smart street lighting systems, combining LEDs with sensors and IoT, are being deployed in smart cities for real-time monitoring, traffic management, and environmental data collection.

- The adoption of IoT-enabled LFDs with cloud-based content management systems enhances scalability and operational efficiency in urban environments.

- The adoption of IoT-enabled LFDs with cloud-based content management systems enhances scalability and operational efficiency in urban environments.

- For instance, Barcelona installed 3,000 LED-based smart streetlights equipped with environmental sensors to monitor noise levels, humidity, air quality, and pollution, significantly advancing the city’s smart urban infrastructure. These intelligent streetlights are part of Barcelona’s broader smart city strategy aimed at enhancing urban sustainability, energy efficiency, and real-time data-driven governance.

- Public-private partnerships are emerging to finance LED upgrades, creating new avenues for vendors to offer performance-based contracts and managed lighting services.

Restraint/Challenge

“High Initial Costs and Installation Challenges”

- The high upfront cost of LED lighting systems, including smart components and IoT integration, limits adoption in developing regions and small municipalities.

- Retrofitting existing infrastructure with LEDs requires significant investment and technical expertise, posing challenges for widespread deployment

- Retrofitting existing infrastructure with LEDs requires significant investment and technical expertise, posing challenges for widespread deployment

- For instance, In 2024, several European municipalities reported delays in their LED streetlight upgrade projects due to budgetary constraints and persistent supply chain disruptions, particularly affecting high-wattage LED components. While local governments continue to prioritize energy-efficient infrastructure, economic pressures—stemming from inflation, increased energy costs, and post-pandemic recovery efforts—have limited funding allocations for large-scale lighting initiatives.

- Additionally, Complex regulatory and technical approval processes for smart infrastructure can hinder deployment timelines, especially for large-scale public LED lighting projects.

Outdoor Light-emitting Diode (LED) Lighting Market Scope

The market is segmented on the By offering, installation type, wattage and application.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Installation |

|

|

By Wattage |

|

|

By Application |

|

In 2025, the Hardware is projected to dominate the market with a largest share in by offering segment

The Hardware segment is expected to hold the largest share of approximately 65% during the forecast period, driven by the widespread adoption of LED lamps and luminaires for street and security lighting applications.

The Street Lighting is expected to account for the largest share during the forecast period in Outdoor Light-emitting Diode (LED) Lighting market

In 2025, the Street Lighting segment is projected to hold a share of approximately 40%, attributed to large-scale municipal projects and government incentives for energy-efficient public lighting.

Outdoor Light-emitting Diode (LED) Lighting market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Outdoor Light-emitting Diode (LED) Lighting market”

- Asia-Pacific leads the Outdoor LED Lighting market due to large-scale infrastructure expansion, urban development, and widespread adoption of energy-efficient lighting solutions in countries like China, India, South Korea, and Japan.

- China and South Korea play a critical role, leveraging strong manufacturing ecosystems and aggressive government programs supporting sustainable public lighting and smart city frameworks.

- Japan’s commitment to high-performance, durable, and intelligent lighting technologies also contributes to regional dominance, especially in transportation hubs, urban streetscapes, and disaster-resilient lighting systems.

- Supportive government policies, export-driven production, and large population bases needing urban infrastructure upgrades fuel consistent demand in this region.

“Europe is Projected to Register the Highest CAGR in the Outdoor Light-emitting Diode (LED) Lighting market”

- Europe is expected to witness the fastest growth in the Outdoor LED Lighting market, driven by stringent EU regulations on energy efficiency and carbon emissions.

- Countries like Germany, France, the Netherlands, and the Nordic nations are aggressively transitioning to LED lighting across municipal, historical, and smart city projects.

- The region benefits from strong public-private partnerships, smart grid integration, and emphasis on sustainable urban development through initiatives like the European Green Deal.

- Additionally, the adoption of connected LED systems with environmental monitoring, adaptive brightness, and motion sensors is growing rapidly in line with Europe's digital and green transformation goals.

- Local governments are allocating significant funding for streetlight retrofitting, urban renewal, and smart lighting infrastructure—contributing to Europe’s rapid market acceleration.

Outdoor Light-emitting Diode (LED) Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Signify (Philips Lighting) (Netherlands)

- Osram GmbH (Germany)

- Cree Lighting (U.S.)

- Zumtobel Group (Austria)

- Acuity Brands, Inc. (U.S.)

- Hubbell Incorporated (U.S.)

- Dialight PLC (U.K.)

- Syska LED (India)

- Nichia Corporation (Japan)

- Samsung LED (South Korea)

- Everlight Electronics (Taiwan)

- Delta Electronics, Inc. (Taiwan)

- Halco Lighting Technologies (U.S.)

- Evluma (U.S.)

- Virtual Extension (Israel)

Latest Developments in Global Outdoor Light-emitting Diode (LED) Lighting market

-

On May 10, 2023, Signify NV launched a durable outdoor LED lighting line engineered to endure extreme weather conditions. These lights offer high energy efficiency, UV resistance, and are ideal for coastal or humid climates, supporting municipalities and businesses aiming to reduce energy costs and enhance environmental resilience..

- On May 17, 2023, Acuity Brands’ Cyclone Lighting launched Elencia, a high-style outdoor LED post-top luminaire. Designed for parks and city streets, it combines elegant aesthetics with advanced optics for uniform illumination, making it a premium choice for enhancing urban landscapes and pedestrian areas.

- On May 2024, ATP Lighting introduced Metrópoli Color, an RGBW LED outdoor light with Bluetooth and DMX control. The system can display over 250 million colors, making it ideal for ornamental and decorative lighting in parks, squares, and public installations requiring dynamic and programmable lighting effects

- On March 2022, Evluma launched RoadMax, a new LED highway fixture featuring anti-glare optics and field-adjustable wattage. Designed for safe and efficient road illumination, it includes customizable light shields and supports sustainability goals while ensuring precise light distribution on highways and wide streets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Outdoor Led Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Outdoor Led Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Outdoor Led Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.