Global Outdoor Power Equipment Market

Market Size in USD Billion

CAGR :

%

USD

53.92 Billion

USD

75.05 Billion

2024

2032

USD

53.92 Billion

USD

75.05 Billion

2024

2032

| 2025 –2032 | |

| USD 53.92 Billion | |

| USD 75.05 Billion | |

|

|

|

|

Outdoor Power Equipment Market Size

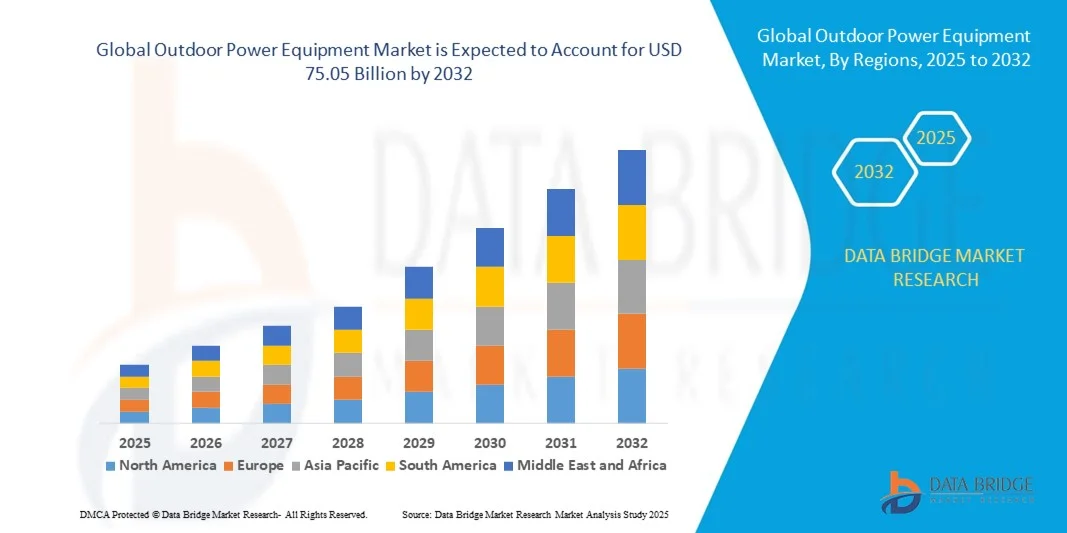

- The global outdoor power equipment market size was valued at USD 53.92 billion in 2024 and is expected to reach USD 75.05 billion by 2032, at a CAGR of 4.22% during the forecast period

- The market growth of outdoor power equipment is largely fueled by increasing residential and commercial landscaping activities, coupled with rising awareness of efficient lawn and garden maintenance practices

- Furthermore, growing adoption of battery-powered and electric tools, along with technological advancements such as robotic mowers, GPS-guided equipment, and smart connectivity, is enhancing convenience, performance, and sustainability. These converging factors are driving higher demand across both professional and residential segments, significantly boosting market expansion

Outdoor Power Equipment Market Analysis

- Outdoor power equipment includes tools such as lawn mowers, trimmers, blowers, saws, and snow throwers, designed for residential, commercial, and municipal landscaping applications. These tools vary by power source, including fuel-powered and electric-powered options, and increasingly integrate advanced features for improved efficiency, safety, and environmental sustainability

- The escalating demand for outdoor power equipment is primarily driven by rising home gardening trends, expansion of commercial landscaping services, and the growing preference for eco-friendly, low-noise, and low-maintenance battery-powered solutions

- North America dominated the outdoor power equipment market with a share of 35.78% in 2024, due to the strong culture of lawn care, extensive use of residential gardens, and increasing adoption of advanced landscaping tools

- Asia-Pacific is expected to be the fastest growing region in the outdoor power equipment market during the forecast period due to rapid urbanization, increasing disposable incomes, and rising adoption of landscaping activities in countries such as China, Japan, and India

- Fuel powered segment dominated the market with a market share of 60.5% in 2024, due to its widespread use in heavy-duty applications and ability to deliver higher power output for extended operations. Gasoline-powered mowers, chainsaws, and blowers remain preferred for large-scale commercial landscaping and municipal projects where high torque and longer runtime are essential. Their durability and availability of robust engine options further reinforce dominance despite increasing environmental regulations

Report Scope and Outdoor Power Equipment Market Segmentation

|

Attributes |

Outdoor Power Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Outdoor Power Equipment Market Trends

Growth of Battery-Powered and Robotic Equipment

- The outdoor power equipment market is witnessing strong momentum in the adoption of battery-powered solutions due to rising environmental concerns and demand for quieter, low-maintenance operations. Consumers are actively shifting from gasoline-powered tools to lithium-ion battery-operated variants that provide comparable performance while reducing emissions and operating costs

- For instance, Husqvarna has introduced advanced battery-powered lawn mowers and chainsaws designed to cater to both residential and professional users. Similarly, companies such as Greenworks Commercial are expanding their portfolio of cordless equipment to meet the increasing demand for eco-friendly landscaping tools

- The growing trend of robotic mowers is transforming lawn care by offering autonomous operations that save time and reduce labor requirements. These robotic machines are equipped with GPS, sensors, and AI technologies that enable efficient navigation, obstacle avoidance, and smart scheduling. Customers are embracing these innovations as they deliver consistent results with minimal intervention

- Integration of IoT and smart connectivity into outdoor equipment is expanding the appeal of these products, as users can now monitor performance, track usage, and even schedule tasks remotely. This interconnected ecosystem aligns with the broader adoption of smart home and commercial automation technologies, driving interest in robotic and battery-powered tools

- Manufacturers are further diversifying their battery-operated offerings such as trimmers, blowers, and hedge cutters, ensuring that customers have access to a complete product ecosystem. This compatibility across multiple tools within the same rechargeable battery platform increases convenience and reduces replacement costs for users

- The shift toward battery-powered and robotic outdoor power equipment highlights a clear transition toward sustainability, convenience, and automation. With increasing expectations for eco-friendly technologies and labor-saving solutions, these innovations are set to become the cornerstone of future landscaping practices across residential and commercial environments

Outdoor Power Equipment Market Dynamics

Driver

Rising Residential and Commercial Landscaping

- The steady increase in residential landscaping demand, coupled with booming commercial sectors such as golf courses, parks, and urban green spaces, is driving higher adoption of outdoor power equipment. Consumers prioritize maintaining property aesthetics and functionality, which significantly fuels equipment purchases

- For instance, Deere & Company continues to lead the market by aligning with residential customers and municipalities through the launch of updated electric mowers and landscaping solutions. Such targeted expansions exemplify how manufacturers are capitalizing on the growing emphasis on beautification and sustainable maintenance practices

- Professional landscaping services and homeowners are embracing outdoor tools that provide efficiency, durability, and adaptability to a wide range of applications such as mowing, trimming, pruning, and clearing. The broad need for high-performance equipment across multiple tasks continues to sustain strong demand

- The rising trend of urban development projects is also elevating requirements for compact, efficient outdoor equipment capable of operating in varied terrains. Landscaping companies and municipalities are investing in advanced equipment to support regulatory compliance on emissions as well as noise reduction requirements in densely populated areas

- The steady expansion of households, increasing disposable incomes, and institutional landscaping sectors collectively reinforce long-term growth in the outdoor power equipment market. This highlights the importance of landscaping as both a lifestyle choice and an essential upkeep activity for residential and professional properties

Restraint/Challenge

High Upfront Cost of Advanced Tools

- High initial investment costs for advanced battery-powered and robotic outdoor equipment remain a significant barrier to mass adoption. Compared to conventional gasoline tools, the upfront pricing of technologically advanced models can impede access for cost-sensitive buyers

- For instance, robotic lawn mowers offered by Husqvarna or Stihl are often priced at a premium, making them less accessible for average homeowners compared to traditional push mowers. The pricing gap has slowed adoption despite the long-term savings these tools offer in maintenance and fuel costs

- Battery-powered outdoor products carry additional costs due to lithium-ion battery modules and integrated smart technologies such as IoT and automation. These expenses can discourage segment growth when buyers prioritize affordability over sustainability and innovation

- Another challenge is the lack of awareness among some consumers regarding the total cost-of-ownership advantages of advanced solutions. Although reduced fuel usage and lower maintenance needs provide value over time, many buyers focus on immediate expenses when making purchase decisions

- Bridging the affordability gap with cost-effective product ranges, financing programs, and broader consumer awareness campaigns will be key in addressing this restraint. Cost optimization by manufacturers and economies of scale in battery technology will further support the mass adoption of these tools in the coming years

Outdoor Power Equipment Market Scope

The market is segmented on the basis of equipment type, power source, and application.

- By Equipment Type

On the basis of equipment type, the outdoor power equipment market is segmented into lawn mowers, saws, trimmers and edgers, blowers, tillers and cultivators, snow throwers, and others. The lawn mowers segment dominated the largest market revenue share in 2024, driven by extensive use in residential landscaping and municipal maintenance projects. High demand for walk-behind and ride-on mowers stems from the growing trend of home gardening, increasing urban green spaces, and the need for efficient grass management in sports fields and parks. Technological enhancements such as robotic and autonomous mowers, improved cutting efficiency, and smart connectivity further support strong adoption across developed regions.

The trimmers and edgers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer preference for precision lawn care and the popularity of DIY gardening activities. Lightweight designs, cordless electric options, and improved battery life are making trimmers and edgers more convenient for homeowners and landscaping professionals. Their ability to provide clean finishing around fences, driveways, and tight spaces enhances their demand, particularly in urban residential settings where compact and efficient tools are valued.

- By Power Source

On the basis of power source, the outdoor power equipment market is segmented into fuel powered and electric powered. The fuel powered segment held the largest market revenue share of 60.5% in 2024, supported by its widespread use in heavy-duty applications and ability to deliver higher power output for extended operations. Gasoline-powered mowers, chainsaws, and blowers remain preferred for large-scale commercial landscaping and municipal projects where high torque and longer runtime are essential. Their durability and availability of robust engine options further reinforce dominance despite increasing environmental regulations.

The electric powered segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing environmental awareness and advancements in battery technology. Cordless battery-powered tools are gaining popularity due to zero emissions, reduced noise levels, and lower maintenance requirements compared to fuel-based equipment. Government incentives for sustainable solutions, combined with rapid improvements in lithium-ion battery efficiency and charging speed, are accelerating the transition toward electric outdoor equipment across residential and commercial users.

- By Application

On the basis of application, the outdoor power equipment market is segmented into commercial and residential. The residential segment dominated the largest market revenue share in 2024, fueled by rising consumer interest in home gardening, backyard beautification, and DIY landscaping projects. Increasing suburban housing developments and higher disposable incomes are encouraging homeowners to invest in lawn mowers, trimmers, and compact blowers for personal property maintenance. The availability of user-friendly, lightweight equipment and smart-connected devices further drives adoption in this segment.

The commercial segment is projected to record the fastest growth rate from 2025 to 2032, driven by expanding landscaping services, sports field maintenance, and municipal green space development. The growing need for efficient equipment to maintain large areas, coupled with rising investments in infrastructure and public parks, supports the demand for high-performance, durable outdoor power tools. Commercial buyers also benefit from advanced features such as GPS-enabled fleet management and automation, enhancing productivity and reducing operational costs.

Outdoor Power Equipment Market Regional Analysis

- North America dominated the outdoor power equipment market with the largest revenue share of 35.78% in 2024, driven by the strong culture of lawn care, extensive use of residential gardens, and increasing adoption of advanced landscaping tools

- Consumers in the region value the performance, durability, and efficiency of high-quality outdoor equipment for both residential and commercial applications

- The prevalence of large yards, higher disposable incomes, and a strong DIY gardening trend further support market expansion. Increasing technological integration, including battery-powered solutions and smart connectivity, is also enhancing user convenience and fueling regional demand

U.S. Outdoor Power Equipment Market Insight

The U.S. outdoor power equipment market captured the largest revenue share in North America in 2024, supported by a well-established landscaping industry and high household spending on lawn and garden maintenance. The rapid adoption of cordless electric mowers, trimmers, and blowers reflects consumer interest in low-maintenance, eco-friendly solutions. The growth of commercial landscaping services, municipal park maintenance, and rising popularity of robotic lawn mowers also contribute to the strong market performance.

Europe Outdoor Power Equipment Market Insight

The Europe outdoor power equipment market is projected to expand at a substantial CAGR during the forecast period, fueled by the rising emphasis on sustainable landscaping practices and stricter environmental regulations. Increasing urban green initiatives and government support for eco-friendly equipment are accelerating the shift toward electric and battery-powered products. Consumers across Europe are also adopting robotic mowers and smart gardening tools to reduce labor costs and improve efficiency in both residential and commercial settings.

U.K. Outdoor Power Equipment Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, driven by the country’s strong gardening culture and the increasing popularity of residential landscaping. Rising consumer awareness of eco-friendly solutions is encouraging the adoption of electric mowers, trimmers, and cordless equipment. Growth in professional landscaping services for urban parks and housing developments also supports market expansion.

Germany Outdoor Power Equipment Market Insight

Germany is expected to register significant growth during the forecast period, driven by its focus on sustainable landscaping and high-quality engineering standards. The country’s preference for durable, technologically advanced equipment, coupled with a growing trend of smart and automated lawn care solutions, is supporting strong adoption in both residential and municipal projects.

Asia-Pacific Outdoor Power Equipment Market Insight

The Asia-Pacific outdoor power equipment market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and rising adoption of landscaping activities in countries such as China, Japan, and India. Expanding residential construction, coupled with the development of public parks and recreational areas, is fueling equipment demand. Government initiatives promoting green spaces and the growing availability of affordable electric tools are further accelerating market penetration.

China Outdoor Power Equipment Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, supported by large-scale urban development, increasing interest in home gardening, and strong domestic manufacturing capabilities. The rising adoption of battery-powered equipment and government-led green initiatives are enhancing growth opportunities.

Japan Outdoor Power Equipment Market Insight

Japan is experiencing steady market growth driven by urban gardening trends, compact landscaping equipment demand, and the adoption of robotic lawn mowers. The country’s focus on technological innovation and eco-friendly products is encouraging the shift toward advanced electric and smart outdoor equipment.

Outdoor Power Equipment Market Share

The outdoor power equipment industry is primarily led by well-established companies, including:

- American Honda Motor Co., Inc. (U.S.)

- The Toro Company (U.S.)

- Stihl (Germany)

- MTD (U.S.)

- Ariens. (U.S.)

- YAMABIKO Corporation (Japan)

- Stanley Black & Decker, Inc (U.S.)

- Techtronic Industries Co. Ltd (Hong Kong)

- Briggs & Stratton Corporation (U.S.)

- AL-KO. (Germany)

- Stiga S.P.A. (Italy)

- Emak S.p.A. (Italy)

- Robert Bosch GmbH (Germany)

- Makita U.S.A., Inc. (U.S.)

- Schiller Grounds Care, Inc. (U.S.)

- Excel Industries Inc (U.S.)

- CHERVON (China) Trading Co., Ltd. (China)

- Jacobsen Division of Textron. (U.K.)

- Husqvarna AB (publ) (Sweden)

- Deere & Company. (U.S.)

Latest Developments in Global Outdoor Power Equipment Market

- In October 2024, Husqvarna Group introduced four new robotic lawnmowers—580L EPOS, 580 EPOS, 560 EPOS, and an upgraded 535 AWD EPOS—expanding its boundary wire-free lineup for professional turf management. Available globally from March 2025, these advanced models incorporate precision GPS navigation and customizable cutting patterns, significantly enhancing operational efficiency, sustainability, and cost-effectiveness for commercial users. This launch reinforces Husqvarna’s leadership in robotic outdoor power equipment, catering to the growing demand for automated and eco-friendly landscaping solutions

- In September 2023, DK2 unveiled ELITE ENERGY, its first collection of large-scale battery-powered outdoor tools for the residential market. The innovative line integrates proprietary LiFePO4 batteries and EV-grade motors, offering a 50% increase in power and convenience. Designed for clean, quiet, and reliable performance, the battery also functions as a flexible backup power source for the home and is compatible with other ELITE ENERGY tools. This development positions DK2 as a key player in the rapidly expanding residential battery-powered OPE segment, responding to rising consumer demand for sustainable and high-performance equipment

- In September 2023, The Toro Company and Lowe’s Companies, Inc. announced a strategic retail partnership to offer Toro zero-turn riding mowers, walk-behind mowers, portable power equipment, and snow blowers in both traditional gas-powered and battery-powered options. This collaboration enhances Toro’s market presence in the U.S. and expands access to battery-powered outdoor equipment, reflecting the increasing consumer shift toward sustainable, low-maintenance solutions

- In July 2023, Kress Commercial launched its battery-powered outdoor power equipment line at selected U.S. and Canadian dealerships, targeting professional landscapers. The range is engineered to meet high-performance and durability requirements while providing clean, quiet, and reliable operation. This move positions Kress Commercial as an early adopter in the professional battery-powered OPE market, addressing the growing demand for eco-friendly and high-efficiency landscaping tools

- In January 2022, Robert Bosch GmbH introduced Keo, a cordless garden saw, as part of its 18V Power for All System alliance with Husqvarna Group. Equipped with a powerful interchangeable battery pack and replaceable saw blades, Keo is designed for DIY applications, offering convenience, versatility, and reliable performance. This launch strengthens Bosch’s footprint in the residential battery-powered tool segment, catering to the rising consumer preference for cordless, modular outdoor equipment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OUTDOOR POWER EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OUTDOOR POWER EQUIPMENT MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OUTDOOR POWER EQUIPMENT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.1.1 RESEARCH AND DEVELOPMENT

5.1.2 COMPONENT MANUFACTURERS AND SUPPLIERS

5.1.3 OUTDOOR POWER EQUIPMENT MANUFACTURERS

5.1.4 DISTRIBUTORS AND RETAILERS

5.1.5 END USERS

5.1.6 POST-SALES SERVICES

5.2 SRENGTH OF PRODUCT PORTFOLIO

5.3 BUSINESS STRATEGY EXCELLENCE

5.4 CASE STUDIES

5.5 REGULATORY FRAMEWORK

5.6 TECHNOLOGICAL TRENDS

5.7 PRICING ANALYSIS

5.8 SUPPLY CHAIN ANALYSIS

5.9 IMPORT/EXPORT ANALYSIS

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 LAWN MOWERS

7.2.1 RIDING LAWN MOWERS

7.2.1.1. LAWN TRACTORS & GARDEN TRACTORS

7.2.1.2. REAR ENGINE RIDING MOWERS

7.2.1.3. ZERO-TURN-RADIUS (ZTR) MOWERS

7.2.2 NON-RIDING LAWN MOWERS

7.2.2.1. WALK-BEHIND LAWN MOWERS

7.2.2.2. ROBOTIC LAWN MOWERS

7.3 SAWS

7.3.1 CHAINSAWS

7.4 TRIMMERS & EDGERS

7.4.1 TRIMMERS & BRUSH CUTTERS

7.4.2 HEDGE TRIMMERS

7.4.3 WALK-BEHIND EDGERS AND TRIMMERS

7.5 BLOWERS

7.5.1 BACKPACK BLOWERS

7.5.2 HANDHELD BLOWERS

7.6 TILLERS & CULTIVATORS

7.6.1 BY APPLICATION

7.6.1.1. FARM

7.6.1.2. GARDEN

7.6.1.3. OTHERS

7.7 SNOW THROWERS

7.7.1 BY POWER

7.7.1.1. BELOW 7 HP

7.7.1.2. 7 HP TO 12 HP

7.7.1.3. MORE THAN 12 HP

7.8 EARTH/ICE AUGURS

7.9 POLE PRUNERS

7.9.1 BY LENGTH WISE

7.9.1.1. LESS THAN 250 CM

7.9.1.2. MORE THAN 250 CM

7.1 SPLIT BOOM

7.11 BED REDEFINERS

7.12 PRESSURE WASHERS

7.13 SPRAYERS

7.13.1 BY USAGE

7.13.1.1. FIELD SPRAYERS

7.13.1.2. ORCHARD SPRAYERS

7.13.1.3. GARDENING SPRAYERS

7.14 HEDGE TRIMMER

7.14.1 BY BLADE LENGTH

7.14.1.1. UPTO 46 CM

7.14.1.2. 47 TO 56 CM

7.14.1.3. ABOVE 56 CM

7.15 WET/DRY VACCUM

7.16 CONCRETE CUTTERS

7.17 AUGERS & DRILLS

7.17.1 BY APPLICATION

7.17.1.1. MASS FLOWER PLANTINGS

7.17.1.2. DEEP ROOT FERTILIZATION

7.18 OTHERS

8 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY POWER SOURCE

8.1 OVERVIEW

8.2 MANUAL

8.3 FUEL POWERED

8.4 ELECTRIC POWERED/ROBOTIC

8.4.1 CORDED

8.4.2 CORDLESS

9 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY MOTOR SPEED

9.1 OVERVIEW

9.2 LESS THAN 50000 RPM

9.3 MORE THAN 50000 RPM

10 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY SIZE

10.1 OVERVIEW

10.2 SMALL SIZED

10.3 MEDIUM SIZED

10.4 LARGE SIZED

11 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY MOVE TYPE

11.1 OVERVIEW

11.2 WALK BEHIND

11.3 HAND-HELD

12 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY CONNECTIVITY

12.1 OVERVIEW

12.2 WITH CONNECTIVITY

12.3 WITHOUT CONNECTIVITY

13 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 ONLINE

13.3 OFFLINE

13.3.1 DEPARTMENTAL STORES

13.3.2 DISCOUNT RETAILERS

13.3.3 WAREHOUSE RETAILERS

13.3.4 FRANCHISES

13.3.5 OTHERS

14 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COMMERCIAL

14.2.1 BY TYPE

14.2.1.1. LAWN MOWERS

14.2.1.2. SAWS

14.2.1.3. TRIMMERS & EDGERS

14.2.1.4. BLOWERS

14.2.1.5. TILLERS & CULTIVATORS

14.2.1.6. SNOW THROWERS

14.2.1.7. EARTH/ICE AUGURS

14.2.1.8. POLE PRUNERS

14.2.1.9. SPLIT BOOM

14.2.1.10. BED REDEFINERS

14.2.1.11. PRESSURE WASHERS

14.2.1.12. SPRAYERS

14.2.1.13. HEDGE TRIMMER

14.2.1.14. WET/DRY VACCUM

14.2.1.15. CONCRETE CUTTERS

14.2.1.16. AUGERS & DRILLS

14.2.1.17. OTHERS

14.2.2 COMMERCIAL, TYPE

14.2.2.1. OFFICE BUILDINGS

14.2.2.2. MEDICAL CENTERS

14.2.2.3. HOTELS

14.2.2.4. MALLS

14.2.2.5. RETAIL STORES

14.2.2.6. MULTIFAMILY HOUSING BUILDINGS

14.2.2.7. FARM LAND

14.2.2.8. WAREHOUSES

14.2.2.9. GARAGES

14.2.2.10. OTHERS

14.3 RESIDENTIAL/DIY

14.3.1 LAWN MOWERS

14.3.2 SAWS

14.3.3 TRIMMERS & EDGERS

14.3.4 BLOWERS

14.3.5 TILLERS & CULTIVATORS

14.3.6 SNOW THROWERS

14.3.7 EARTH/ICE AUGURS

14.3.8 POLE PRUNERS

14.3.9 SPLIT BOOM

14.3.10 BED REDEFINERS

14.3.11 PRESSURE WASHERS

14.3.12 SPRAYERS

14.3.13 HEDGE TRIMMER

14.3.14 WET/DRY VACCUM

14.3.15 CONCRETE CUTTERS

14.3.16 AUGERS & DRILLS

14.3.17 OTHERS

14.4 INDUSTRIAL

15 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, BY GEOGRAPHY

15.1 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1.1 NORTH AMERICA

15.1.1.1. U.S.

15.1.1.2. CANADA

15.1.1.3. MEXICO

15.1.2 EUROPE

15.1.2.1. GERMANY

15.1.2.2. FRANCE

15.1.2.3. U.K.

15.1.2.4. ITALY

15.1.2.5. SPAIN

15.1.2.6. RUSSIA

15.1.2.7. TURKEY

15.1.2.8. BELGIUM

15.1.2.9. NETHERLANDS

15.1.2.10. SWITZERLAND

15.1.2.11. REST OF EUROPE

15.1.3 ASIA PACIFIC

15.1.3.1. JAPAN

15.1.3.2. CHINA

15.1.3.3. SOUTH KOREA

15.1.3.4. INDIA

15.1.3.5. AUSTRALIA

15.1.3.6. SINGAPORE

15.1.3.7. THAILAND

15.1.3.8. MALAYSIA

15.1.3.9. INDONESIA

15.1.3.10. PHILIPPINES

15.1.3.11. REST OF ASIA PACIFIC

15.1.4 SOUTH AMERICA

15.1.4.1. BRAZIL

15.1.4.2. ARGENTINA

15.1.4.3. REST OF SOUTH AMERICA

15.1.5 MIDDLE EAST AND AFRICA

15.1.5.1. SOUTH AFRICA

15.1.5.2. EGYPT

15.1.5.3. SAUDI ARABIA

15.1.5.4. U.A.E

15.1.5.5. ISRAEL

15.1.5.6. REST OF MIDDLE EAST AND AFRICA

15.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL OUTDOOR POWER EQUIPMENT MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL OUTDOOR POWER EQUIPMENT MARKET , SWOT & DBMR ANALYSIS

18 GLOBAL OUTDOOR POWER EQUIPMENT MARKET, COMPANY PROFILE

18.1 HUSQVARNA GROUP

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 DEERE & COMPANY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 THE TORO COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 HONDA MOTOR CO., LTD.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 STIHL PVT. LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 MTD PRODUCTS

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 ARIENS COMPANY

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 YAMABIKO CORPORATION

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 STANLEY BLACK & DECKER

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 TECHTRONIC INDUSTRIES TTI

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 BRIGGS & STRATTON CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 STIGA S.P.A.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13

18.14 AL-KO KOBER GROUP

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 EMAK S.P.A.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 ROBERT BOSCH TOOL CORPORATION

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MAKITA CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 SCHILLER GROUND CARE

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 EXCEL INDUSTRIES, INC.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 CHERVON GROUP

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 JACOBSEN

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 BRIGGS AND STRATTON

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 JOHN DEERE

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 CRAFTSMAN

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 RYOBI

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 GREENWORKS

18.26.1 COMPANY SNAPSHOT

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 DAYE

18.27.1 COMPANY SNAPSHOT

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 SNOW JOE

18.28.1 COMPANY SNAPSHOT

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

18.29 POWERSMART

18.29.1 COMPANY SNAPSHOT

18.29.2 REVENUE ANALYSIS

18.29.3 GEOGRAPHIC PRESENCE

18.29.4 PRODUCT PORTFOLIO

18.29.5 RECENT DEVELOPMENTS

18.3 VICON

18.30.1 COMPANY SNAPSHOT

18.30.2 REVENUE ANALYSIS

18.30.3 GEOGRAPHIC PRESENCE

18.30.4 PRODUCT PORTFOLIO

18.30.5 RECENT DEVELOPMENTS

18.31 KAREY

18.31.1 COMPANY SNAPSHOT

18.31.2 REVENUE ANALYSIS

18.31.3 GEOGRAPHIC PRESENCE

18.31.4 PRODUCT PORTFOLIO

18.31.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 CONCLUSION

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Outdoor Power Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Outdoor Power Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Outdoor Power Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.