Global Over The Counter Direct To Consumer Infectious Disease Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

1.64 Billion

USD

4.12 Billion

2025

2033

USD

1.64 Billion

USD

4.12 Billion

2025

2033

| 2026 –2033 | |

| USD 1.64 Billion | |

| USD 4.12 Billion | |

|

|

|

|

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Size

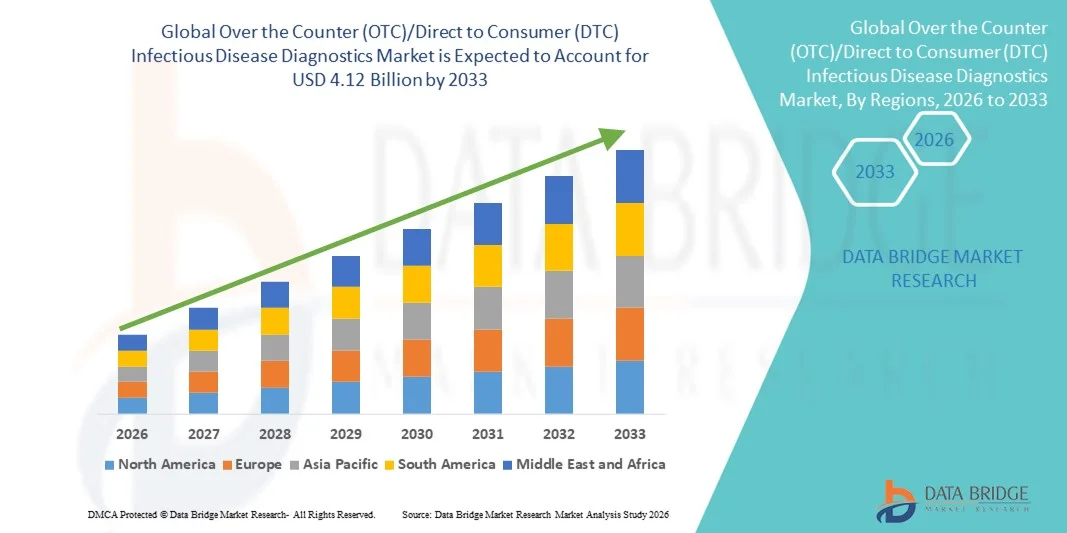

- The global Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics market size was valued at USD 1.64 billion in 2025 and is expected to reach USD 4.12 billion by 2033, at a CAGR of 12.23% during the forecast period

- The market growth is largely fueled by increasing consumer preference for convenient, rapid, and at-home diagnostic solutions, along with continuous technological advancements in point-of-care testing, digital health integration, and user-friendly diagnostic kits that enable early detection of infectious diseases outside traditional clinical settings

- Furthermore, rising awareness of preventive healthcare, growing emphasis on self-testing, and expanding regulatory support for OTC and DTC diagnostics are establishing these products as a preferred choice for timely disease screening. These converging factors are accelerating the uptake of Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics solutions, thereby significantly boosting the industry’s growth

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Analysis

- Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics solutions are increasingly important in modern healthcare due to their ability to provide rapid, convenient, and accurate disease detection outside traditional clinical settings, enabling early diagnosis, timely treatment, and reduced pressure on hospitals and diagnostic laboratories

- The growing adoption of OTC/DTC infectious disease diagnostics is primarily driven by rising awareness of preventive healthcare, increasing preference for self-testing, and continuous technological advancements in rapid diagnostic kits, including antigen-based and molecular tests that offer improved accuracy and ease of use

- North America dominated the over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market with the largest revenue share of 36.8% in 2025, supported by strong regulatory support for home-based diagnostics, high consumer awareness, widespread availability of test kits through pharmacies and online platforms, and the presence of major diagnostic manufacturers in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market during the forecast period, registering a CAGR of 23.1%, driven by expanding healthcare infrastructure, rising infectious disease burden, increasing disposable income, and growing acceptance of self-diagnostic solutions in countries such as China, India, and Southeast Asian nations

- The COVID-19 segment dominated the market with the largest revenue share of 45.7% in 2025, driven by ongoing testing demand and strong consumer awareness. COVID-19 home testing remains critical for rapid detection and isolation during outbreaks

Report Scope and Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Segmentation

|

Attributes |

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Trends

Rapid Growth in Home-Based Infectious Disease Testing

- A major and accelerating trend in the global over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market is the shift toward home-based testing and self-collection kits, driven by rising consumer preference for convenience, privacy, and quick results

- For instance, home-based test kits for respiratory infections such as influenza and COVID-19 have become increasingly popular, allowing consumers to perform tests at home without visiting healthcare facilities. This shift is boosting demand for rapid antigen tests, self-collected swabs, and at-home sample collection kits

- The market is also witnessing an increasing focus on digital integration, where test results can be uploaded to smartphone apps or online portals, enabling remote interpretation, telehealth consultations, and faster access to treatment recommendations

- Moreover, self-testing is expanding beyond COVID-19, with more products being developed for diseases such as HIV, STIs, influenza, and other infectious conditions, allowing consumers to monitor their health privately and regularly

- Companies are increasingly investing in user-friendly designs, clear instructions, and simplified procedures to reduce user errors, enhance reliability, and increase adoption. This trend is being further supported by rising awareness about preventive healthcare and early disease detection

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Dynamics

Driver

Increasing Demand for Rapid, Accessible Testing and Growing Consumer Health Awareness

- A significant driver for the OTC/DTC infectious disease diagnostics market is the growing demand for rapid, convenient, and accessible testing solutions, especially in regions with limited healthcare access. Consumers are seeking tests that can deliver quick results without the need to visit clinics or laboratories

- For instance, in November 2021, the FDA authorized the first OTC HIV self-test by OraSure Technologies, enabling consumers to test for HIV at home and receive results in 20 minutes, marking a major step in consumer-led infectious disease diagnostics

- The rise of telehealth and online healthcare platforms has strengthened the demand for OTC tests. Consumers can now buy test kits online, perform tests at home, and consult medical professionals remotely if needed, improving accessibility and reducing time to treatment

- Government and public health initiatives promoting self-testing and early diagnosis are also contributing to market growth. For instance, many health agencies have supported self-testing as part of pandemic management and disease surveillance programs

- In addition, the growing trend of personalized healthcare and preventive screening is encouraging consumers to adopt home-based tests for conditions like HIV, STIs, and seasonal flu, which further drives market expansion

Restraint/Challenge

Accuracy Concerns, Regulatory Barriers, and Limited Consumer Trust

- One of the major challenges limiting market growth is concerns over test accuracy and reliability, particularly for self-administered tests. Factors such as incorrect sample collection, improper handling, and user error can lead to inaccurate results, which may affect consumer trust and adoption

- For instance, in April 2022, the U.S. FDA issued warnings about the performance variability of some OTC COVID-19 rapid tests and advised consumers to verify results with professional tests if symptoms persist, highlighting concerns about accuracy and trust

- Many consumers still rely on professional diagnostic settings due to the fear of misinterpretation of results, which restricts the growth of OTC tests in certain demographics

- Regulatory approval processes and compliance requirements can also be time-consuming and complex, especially for new products entering multiple markets. This can delay product launches and reduce market availability

- In some regions, limited reimbursement policies and high out-of-pocket costs for advanced diagnostic kits act as a barrier, especially for low-income consumers who may not afford premium self-test solutions

- Moreover, privacy concerns and data security issues related to digital reporting of test results can also restrain adoption, as consumers may hesitate to share health data online

- Overall, these challenges require manufacturers to invest in higher accuracy, better packaging, clearer instructions, and stronger regulatory compliance to build consumer confidence and expand market penetration

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Scope

The market is segmented on the basis of technology, disease type, and end user.

- By Technology

On the basis of technology, the Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics market is segmented into PCR, Immunodiagnostics, Clinical Microbiology, INAAT, DNA Sequencing and NGS, DNA Microarrays, and Others. The Immunodiagnostics segment dominated the market with the largest revenue share of 38.4% in 2025, driven by its rapid testing formats, user-friendly design, and cost-effective manufacturing. Rapid immunoassays like lateral flow tests are widely used due to their quick results and minimal training requirements. The strong demand is supported by increased self-testing adoption and widespread availability in pharmacies and online platforms. The segment benefits from growing consumer awareness about early diagnosis and the convenience of home-based testing. In addition, ongoing product innovations and regulatory approvals are boosting adoption globally. The increasing prevalence of infectious diseases and frequent outbreaks are further strengthening the segment’s position. Immunodiagnostics remains preferred for initial screening due to speed, affordability, and ease of use. The segment is also supported by strong distribution networks and partnerships with healthcare providers. Manufacturers are focusing on improving sensitivity and specificity to maintain leadership in the market.

The PCR segment is expected to witness the fastest CAGR of 22.1% during 2026–2033, driven by high sensitivity, accuracy, and growing demand for confirmatory testing. PCR-based OTC diagnostics are gaining traction due to improved affordability and increased consumer trust in molecular testing. The segment benefits from advancements in portable PCR devices and simplified testing workflows. Growing regulatory approvals for home PCR kits and increasing healthcare investments are accelerating growth. PCR tests are widely used for detecting viral infections, especially where accuracy is critical. The rising adoption of digital reporting and integration with telehealth services is further supporting expansion. Market players are investing in miniaturized PCR platforms for easier home use. In addition, increased public health focus on early detection and surveillance is boosting demand. The segment is also strengthened by rising awareness of molecular diagnostics among consumers.

- By Disease Type

On the basis of disease type, the Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics market is segmented into COVID-19, HIV, HAIs, Hepatitis, CT/NG, HPV, TB, Influenza, and Other. The COVID-19 segment dominated the market with the largest revenue share of 45.7% in 2025, driven by ongoing testing demand and strong consumer awareness. COVID-19 home testing remains critical for rapid detection and isolation during outbreaks. The segment benefits from government support, public health campaigns, and high availability of testing kits. Consumers prefer at-home COVID tests due to convenience and reduced exposure risk. The high prevalence of variants and seasonal waves continues to support market dominance. Many manufacturers continue to expand product lines and improve sensitivity for new strains. In addition, frequent travel and workplace testing policies are fueling demand. The segment also benefits from strong online and retail distribution channels. COVID-19 testing is often bundled with other respiratory panels, further boosting market share.

The Influenza segment is expected to register the fastest CAGR of 18.4% during 2026–2033, driven by rising seasonal outbreaks and growing demand for rapid differential diagnosis. Home flu tests are increasingly preferred to quickly determine the need for medical consultation. The segment is supported by rising awareness about early treatment and reduced hospital burden. Integration of flu testing with telemedicine platforms is accelerating adoption. The segment also benefits from improved test accuracy and faster result times. Manufacturers are launching combo tests for flu and COVID-19, further expanding market reach. Public health initiatives promoting respiratory illness management are strengthening growth. Increasing access to healthcare and self-testing culture in developed countries also support expansion.

- By End User

On the basis of end user, the Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics market is segmented into Diagnostic Laboratories, Hospitals and Clinics, Academic Research Institutes, and Others. The Hospitals and Clinics segment dominated the market with a revenue share of 42.2% in 2025, due to high testing volumes, strong clinical adoption, and established healthcare infrastructure. Hospitals and clinics are primary buyers for advanced diagnostic kits and confirmatory testing solutions. The segment benefits from continuous patient inflow, routine screening programs, and high demand for rapid diagnostic tools. The strong presence of integrated healthcare systems supports quick adoption. Hospitals also rely on validated diagnostic solutions with regulatory approvals. The segment is further strengthened by growing hospital investments in diagnostic technologies and training. The demand is boosted by infectious disease surveillance and infection control protocols. The segment also benefits from long-term procurement contracts and partnerships with manufacturers.

The Diagnostic Laboratories segment is expected to witness the fastest CAGR of 19.6% during 2026–2033, driven by increasing outsourcing of testing, high demand for specialized diagnostic services, and rising volumes of infectious disease screening. Laboratories are adopting advanced OTC/DTC solutions for confirmatory and surveillance testing. The segment benefits from strong investments in diagnostic infrastructure and automation. Rising demand for high-throughput testing and faster turnaround time is accelerating growth. Laboratories also play a key role in validating new diagnostic kits and technologies. In addition, expanding private laboratory networks and partnerships with healthcare providers are supporting growth. The segment is strengthened by growing need for accurate diagnostic reporting and data analytics.

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Regional Analysis

- North America dominated the over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market with the largest revenue share of 36.8% in 2025

- Supported by strong regulatory support for home-based diagnostics

- High consumer awareness, widespread availability of test kits through pharmacies and online platforms, and the presence of major diagnostic manufacturers in the U.S.

U.S. Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The U.S. over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market captured the largest revenue share in 2025 within North America, driven by strong consumer demand for convenient self-testing solutions and a well-established healthcare infrastructure. Rapid adoption of COVID-19 and influenza self-test kits, coupled with robust distribution channels through pharmacies and e-commerce, continues to fuel market growth. Increasing public health initiatives promoting home testing and high awareness about infectious diseases further support expansion. Ongoing innovations in rapid diagnostics and mobile-connected testing are strengthening the market position.

Europe Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The Europe over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising demand for home-based testing, strong healthcare systems, and increasing adoption of digital health platforms. Growing awareness about early disease detection and preventive healthcare is encouraging consumers to use self-testing kits. The region is also supported by favorable regulatory policies and reimbursement frameworks that promote self-diagnostic solutions. Increasing presence of key diagnostic manufacturers and strong retail networks further enhance market growth.

U.K. Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The U.K. over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer preference for home-based diagnostics and rising demand for quick and reliable self-test kits. The country’s strong healthcare awareness, well-established pharmacy networks, and increasing e-commerce adoption support market growth. Additionally, the UK government’s public health campaigns and initiatives to promote early disease detection are fueling demand for OTC infectious disease tests.

Germany Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The Germany over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness about self-diagnosis and preventive healthcare. Germany’s strong healthcare infrastructure and regulatory support for home diagnostics promote market growth. Rising demand for rapid testing kits, especially for respiratory infections and STDs, is supporting the market. Increasing collaborations between diagnostic manufacturers and pharmacies further strengthen the market presence.

Asia-Pacific Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The Asia-Pacific over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market is poised to grow at the fastest CAGR of 23.1% during the forecast period, driven by expanding healthcare infrastructure, rising infectious disease burden, increasing disposable income, and growing acceptance of self-diagnostic solutions in countries such as China, India, and Southeast Asian nations. Increasing access to healthcare and growing penetration of online retail platforms are accelerating adoption of OTC test kits. Government initiatives promoting preventive healthcare and disease surveillance are further boosting the market.

Japan Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The Japan over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market is gaining momentum due to high healthcare awareness, advanced diagnostic infrastructure, and increasing demand for convenient self-testing solutions. Rising prevalence of seasonal infections and strong government support for preventive healthcare are driving market growth. Japanese consumers are increasingly adopting home testing kits, supported by a strong retail and online distribution network.

China Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Insight

The China over the counter (OTC)/direct to consumer (DTC) infectious disease diagnostics market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rising healthcare expenditure, expanding diagnostic infrastructure, and growing acceptance of self-testing solutions. The increasing prevalence of infectious diseases, rapid urbanization, and strong government initiatives promoting public health are driving market expansion. The presence of major domestic manufacturers and affordability of test kits further supports growth.

Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market Share

The Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics industry is primarily led by well-established companies, including:

• Abbott (U.S.)

• Roche Diagnostics (Switzerland)

• BD (U.S.)

• Thermo Fisher Scientific (U.S.)

• Siemens Healthineers (Germany)

• QuidelOrtho Corporation (U.S.)

• Hologic (U.S.)

• bioMérieux (France)

• Qiagen (Germany)

• Danaher Corporation (U.S.)

• Luminex Corporation (U.S.)

• PerkinElmer (U.S.)

• F. Hoffmann-La Roche Ltd. (Switzerland)

• Becton Dickinson (U.S.)

• Sartorius AG (Germany)

• OraSure Technologies (U.S.)

• Cepheid (U.S.)

• GSK (U.K.)

• Bayer AG (Germany)

Latest Developments in Global Over the Counter (OTC)/Direct to Consumer (DTC) Infectious Disease Diagnostics Market

- In February 2023, the U.S. Food and Drug Administration (FDA) issued an Emergency Use Authorization (EUA) for the first OTC at-home diagnostic test that can differentiate and detect both influenza A and B viruses alongside SARS-CoV-2, enabling consumers to test for flu and COVID-19 from a self-collected nasal swab with results in around 30 minutes, significantly expanding access to multi-pathogen home diagnostics

- In October 2024, the FDA granted De Novo marketing authorization to Healgen Scientific’s Rapid Check COVID-19/Flu A&B Antigen Test for OTC use, marking the first at-home combination test for COVID-19 and influenza that is authorized for non-emergency use and providing a reliable, user-friendly option for consumers to detect multiple respiratory infections at home

- In May 2024, several home OTC diagnostic tests for respiratory pathogens, including COVID-19/Flu A&B and multi-analyte lateral flow tests from brands such as iHealth Labs, Watmind USA and Wondfo USA, received updated Emergency Use Authorization (EUA) letters from the FDA, reflecting the continued expansion of available at-home COVID-19 and influenza antigen tests and broader product availability in the OTC space

- In March 2024, the FDA published a detailed update on advances in OTC in vitro diagnostic tests for infectious pathogens, highlighting continued regulatory support for at-home testing options for SARS-CoV-2, influenza, and respiratory syncytial virus (RSV) that allow home collection of samples with results delivered via digital portals or apps, showing the growing ecosystem around OTC diagnostics

- In April 2025, the FDA authorized additional revisions to OTC home diagnostic test EUAs, including new listings such as ACON Laboratories’ Flowflex Plus COVID-19 and Flu A/B Home Test, pointing to ongoing growth in the availability and diversity of home infectious disease tests that consumers can purchase and use without a prescription

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.