Global Ovum Aspiration Pumps Market

Market Size in USD Billion

CAGR :

%

USD

437.10 Billion

USD

1,309.44 Billion

2025

2033

USD

437.10 Billion

USD

1,309.44 Billion

2025

2033

| 2026 –2033 | |

| USD 437.10 Billion | |

| USD 1,309.44 Billion | |

|

|

|

|

Ovum Aspiration Pumps Market Size

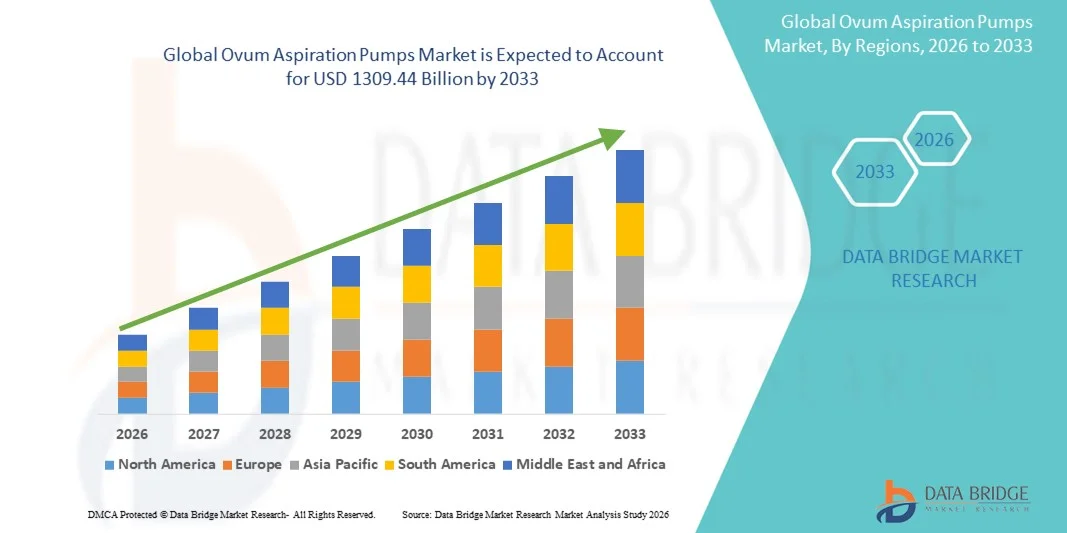

- The global ovum aspiration pumps market size was valued at USD 437.1 billion in 2025 and is expected to reach USD 1309.44 billion by 2033, at a CAGR of 14.70% during the forecast period

- The market growth is largely fueled by the increasing adoption of assisted reproductive technologies (ART), rising infertility rates, and growing awareness about advanced fertility treatments, leading to higher demand for ovum aspiration pumps in fertility clinics and hospitals

- Furthermore, technological advancements in minimally invasive procedures, precision-controlled aspiration systems, and user-friendly devices are driving the uptake of ovum aspiration pumps, thereby significantly boosting the overall growth of the Ovum Aspiration Pumps market

Ovum Aspiration Pumps Market Analysis

- Ovum aspiration pumps, which are specialized medical devices used in assisted reproductive procedures to retrieve oocytes safely and efficiently, are increasingly vital in fertility clinics and hospitals due to their precision, reliability, and ability to support minimally invasive procedures

- The growing demand for ovum aspiration pumps is primarily driven by rising infertility rates, increasing adoption of assisted reproductive technologies (ART), and the focus on improving success rates in in-vitro fertilization (IVF) procedures

- North America dominated the ovum aspiration pumps market, accounting for approximately 41.5% of the global revenue share in 2025, supported by high healthcare expenditure, a well-established fertility clinic network, and the presence of key market players introducing advanced, precision-controlled aspiration systems

- Asia-Pacific is expected to be the fastest-growing region in the ovum aspiration pumps market during the forecast period, with an estimated CAGR of 8.4%, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing awareness and adoption of fertility treatments

- The Single Vac Aspiration Pumps segment dominated the largest market revenue share of 51.3% in 2025, driven by their simplicity, ease of use, and reliable performance in routine IVF procedures

Report Scope and Ovum Aspiration Pumps Market Segmentation

|

Attributes |

Ovum Aspiration Pumps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cook Medical (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ovum Aspiration Pumps Market Trends

Advancements in Efficiency and Precision in Ovum Aspiration Pumps

- A significant and accelerating trend in the global ovum aspiration pumps market is the development of highly precise, automated, and user-friendly pumps designed to improve oocyte retrieval efficiency in IVF and assisted reproductive procedures

- For instance, in June 2023, Cook Medical launched its new Cook Aspiration Pump System, featuring enhanced microprocessor-controlled suction and ergonomic design to reduce oocyte trauma during retrieval and improve IVF success rates

- Modern ovum aspiration pumps incorporate microprocessor-controlled aspiration pressure systems, enabling clinicians to maintain uniform suction and reduce the risk of oocyte trauma during retrieval

- Some pumps now offer integrated safety features such as real-time pressure monitoring and automatic shut-off, ensuring both patient safety and procedural reliability

- The trend toward compact, portable, and easy-to-sterilize devices is improving clinical workflow and reducing laboratory setup times

- Manufacturers such as Cook Medical, Labotect GmbH, and Vitrolife are investing in product enhancements, focusing on ergonomics, digital controls, and adjustable aspiration parameters to meet varying clinical protocols

- Increasing adoption of minimally invasive reproductive techniques and the rising number of IVF cycles globally are driving demand for precise and reliable ovum aspiration pumps. Integration with fertility lab equipment and IVF workflow management systems is enhancing procedural efficiency and reducing manual errors

- There is also a growing emphasis on pumps that minimize noise and vibration, ensuring patient comfort during procedures. Technological improvements are expanding the use of ovum aspiration pumps across diverse patient age groups and clinical scenarios, including high-risk IVF cases

- Rising awareness among fertility specialists about the importance of controlled aspiration for oocyte quality is encouraging adoption of advanced pumps. Overall, the shift toward precision, efficiency, and patient safety is shaping market expectations and product innovation

Ovum Aspiration Pumps Market Dynamics

Driver

Rising Infertility Cases and Increasing IVF Procedures

- The global rise in infertility rates, attributed to factors such as delayed parenthood, lifestyle changes, and reproductive disorders, is a major driver for the ovum aspiration pumps market

- For instance, IVF cycles have increased significantly worldwide, with fertility clinics demanding high-precision aspiration systems to improve success rates

- Advanced ovum aspiration pumps help achieve higher oocyte retrieval efficiency, reducing procedural time and enhancing patient outcomes

- Increasing accessibility of fertility treatments in emerging regions is also boosting device adoption

- Growing investments in fertility clinics, research centers, and assisted reproductive technologies further propel market growth

- Clinicians are increasingly prioritizing devices that minimize oocyte damage and support consistent performance, driving demand for technologically advanced pumps

- Rising awareness about fertility preservation and assisted reproduction options is contributing to higher IVF adoption, indirectly benefiting the ovum aspiration pumps market

- Hospitals and specialty fertility clinics are upgrading equipment to include pumps with improved control features, digital displays, and programmable suction parameters

- Government initiatives promoting reproductive health and funding for assisted reproductive technologies support market expansion

- The increasing number of high-quality fertility clinics in North America, Europe, and Asia-Pacific is driving demand for reliable, precision pumps

- As IVF adoption grows globally, the demand for automated and efficient ovum aspiration pumps is expected to rise steadily

Restraint/Challenge

High Cost and Need for Skilled Operators

- The relatively high cost of advanced ovum aspiration pumps can limit adoption, particularly among small clinics and in developing regions

- For instance, in February 2023, Labotect highlighted that its high-end multi-channel ovum aspiration pumps are not widely adopted in smaller clinics due to premium pricing and technical training requirements

- Some pumps with automated control systems, integrated safety features, and multi-parameter settings are priced at a premium, making them less accessible to price-sensitive clinics

- Proper operation of these devices requires trained personnel with experience in IVF procedures, which can increase operational costs

- Maintenance, calibration, and sterilization requirements add to the total cost of ownership, posing a challenge for smaller fertility centers

- Limited awareness about the benefits of advanced aspiration pumps in certain regions can slow adoption

- Clinics may hesitate to invest in high-end pumps without clear evidence of improved oocyte yield and patient outcomes

- While entry-level pumps are available at lower costs, they may lack the precision and safety features offered by premium model

- Ensuring proper training and technical support is crucial for safe and effective use

- Infrastructure limitations, such as inadequate laboratory facilities, can also restrict adoption in emerging markets

- Addressing cost barriers through affordable models and enhanced operator training will be essential for broader market growth

- Overcoming these challenges through demonstration of clinical efficacy, operational efficiency, and patient safety is critical for long-term market expansion

Ovum Aspiration Pumps Market Scope

The market is segmented on the basis of product, technology type, and application.

- By Product

On the basis of product, the Ovum Aspiration Pumps market is segmented into Single Vac Aspiration Pumps and Dual Vac Aspiration Pumps. The Single Vac Aspiration Pumps segment dominated the largest market revenue share of 51.3% in 2025, driven by their simplicity, ease of use, and reliable performance in routine IVF procedures. These pumps are widely adopted in fertility clinics for standard oocyte retrieval due to consistent aspiration pressure, minimal risk of oocyte trauma, and lower operational costs compared to dual vac systems. The compact design and straightforward controls make them suitable for small- to medium-sized fertility centers. Growing awareness among clinicians about minimizing oocyte damage and improving IVF outcomes further supports demand. Single vac pumps are compatible with multiple needle types and follicle sizes, increasing procedural flexibility. They are increasingly integrated with fertility lab workflows to optimize retrieval efficiency. The segment’s dominance is also supported by availability from established brands such as Cook Medical and Vitrolife. Reliability, clinical efficacy, and lower upfront cost make it the preferred choice for most clinics globally.

The Dual Vac Aspiration Pumps segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, fueled by rising demand for high-throughput IVF procedures and advanced fertility centers requiring simultaneous multi-patient retrieval capability. Dual vac pumps allow independent control of suction pressures, offering precision for complex IVF cases. Adoption is increasing in large hospitals, specialty fertility clinics, and research institutes where high-volume oocyte retrieval is common. Technological improvements, such as programmable aspiration cycles and digital pressure displays, enhance procedural safety and efficiency. Rising investments in advanced fertility infrastructure globally are further boosting growth. Increasing adoption of dual vac pumps for donor egg and frozen embryo IVF programs is also contributing. The segment’s ability to improve IVF success rates and reduce operator dependency makes it a preferred choice in high-end clinical setups.

- By Technology Type

On the basis of technology type, the market is segmented into Fresh Embryo IVF, Frozen Embryo IVF, and Donor Egg IVF. The Fresh Embryo IVF segment dominated the market with a revenue share of 47.8% in 2025, as it represents the most widely performed assisted reproduction procedure worldwide. Clinics prefer fresh embryo protocols for higher implantation success in standard IVF cases. Ovum aspiration pumps used in this procedure are typically calibrated for optimal pressure control, ensuring minimal oocyte damage and enhanced fertilization rates. Continuous monitoring of suction pressure and procedural ergonomics increases clinician confidence and patient outcomes. The segment benefits from high adoption in hospitals, fertility centers, and private IVF clinics. Technological improvements such as digital control panels, adjustable suction, and compact design enhance reliability. Growing infertility awareness and increased IVF cycles across North America, Europe, and Asia-Pacific further support segment dominance.

The Frozen Embryo IVF segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, driven by the rising popularity of cryopreservation and deferred embryo transfer procedures. Clinics are increasingly opting for frozen embryo protocols to improve cumulative pregnancy rates, especially in high-risk or older patients. Pumps designed for frozen embryo IVF enable precise control and gentle aspiration to maintain oocyte quality. Technological advancements, such as programmable pressure cycles and integration with lab management software, support growing adoption. The segment benefits from expanding IVF access in emerging economies and fertility preservation programs.

- By Application

On the basis of application, the Ovum Aspiration Pumps market is segmented into Hospitals and Clinics, Cryobanks, Fertility Centers, Surgical Centers, Research Institutes, and Others. The Fertility Centers segment dominated the market with a revenue share of 45.6% in 2025, owing to the concentrated use of ovum aspiration pumps in high-volume IVF clinics. Fertility centers prioritize pumps with precise pressure control, digital monitoring, and ergonomic design to ensure high oocyte retrieval efficiency. The adoption is further driven by the increasing number of IVF cycles, focus on patient safety, and emphasis on improving fertilization rates. Integration with lab workflows and cryopreservation protocols enhances procedural efficiency. Rising investments in private fertility clinics in North America, Europe, and Asia-Pacific support the segment’s dominance. Clinics also prefer multi-parameter and portable pumps for enhanced flexibility.

The Hospitals and Clinics segment is expected to witness the fastest CAGR of 13.4% from 2026 to 2033, driven by the rising adoption of IVF procedures in tertiary care hospitals and multidisciplinary reproductive health centers. Hospitals are increasingly incorporating ovum aspiration pumps to expand their reproductive services and reduce dependence on external fertility centers. Advanced pumps with dual vac and automated controls are being adopted for complex IVF and donor egg cycles. Rising patient demand for in-house IVF services, coupled with government initiatives supporting reproductive health, further fuels growth. Increased awareness among gynecologists and reproductive specialists about the benefits of precise oocyte retrieval enhances adoption. The segment also benefits from expanding fertility services in developing regions, boosting market potential.

Ovum Aspiration Pumps Market Regional Analysis

- North America dominated the ovum aspiration pumps market, accounting for approximately 41.5% of the global revenue share in 2025

- Supported by high healthcare expenditure, a well-established fertility clinic network, and the presence of key market players introducing advanced, precision-controlled aspiration systems

- The region benefits from increasing demand for assisted reproductive technologies (ART), high adoption of technologically advanced fertility devices, and strong R&D investments in reproductive healthcare

U.S. Ovum Aspiration Pumps Market Insight

The U.S. ovum aspiration pumps market captured the largest revenue share within North America in 2025, fueled by the growing adoption of advanced aspiration systems in fertility clinics and hospitals. Increasing patient awareness about assisted reproductive technologies, rising infertility rates, and the preference for minimally invasive, precise ovum retrieval procedures are driving market growth. The presence of major device manufacturers and continuous technological innovations further support market expansion.

Europe Ovum Aspiration Pumps Market Insight

The Europe ovum aspiration pumps market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising infertility awareness, technological advancements in ART, and the increasing number of fertility clinics. Countries such as Germany, France, and the U.K. are witnessing higher adoption due to favorable reimbursement policies and growing investments in reproductive healthcare infrastructure.

U.K. Ovum Aspiration Pumps Market Insight

The U.K. ovum aspiration pumps market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing prevalence of infertility, the expansion of fertility clinics, and increasing adoption of precision ovum aspiration systems. Supportive government policies and a strong focus on healthcare innovation are also expected to stimulate market growth.

Germany Ovum Aspiration Pumps Market Insight

The Germany ovum aspiration pumps market is expected to expand at a considerable CAGR during the forecast period, fueled by a well-developed healthcare infrastructure, increasing awareness about assisted reproductive technologies, and the demand for technologically advanced, safe, and precise ovum retrieval systems. Research initiatives and innovation-focused reproductive healthcare solutions are further driving market adoption.

Asia-Pacific Ovum Aspiration Pumps Market Insight

The Asia-Pacific ovum aspiration pumps market is expected to be the fastest-growing region, with an estimated CAGR of 8.4%, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing awareness and adoption of fertility treatments. Countries such as China, India, and Japan are witnessing significant growth due to rising infertility rates, expansion of fertility clinics, and government initiatives promoting reproductive healthcare.

Japan Ovum Aspiration Pumps Market Insight

The Japan ovum aspiration pumps market is gaining momentum due to the country’s advanced healthcare system, high acceptance of assisted reproductive technologies, and increasing demand for minimally invasive fertility procedures. Fertility clinics are increasingly adopting precision ovum aspiration pumps to enhance patient outcomes and procedure efficiency.

China Ovum Aspiration Pumps Market Insight

The China ovum aspiration pumps market accounted for the largest revenue share in the Asia-Pacific region in 2025. Growth is driven by rapid urbanization, expanding middle-class population, increasing infertility awareness, and adoption of assisted reproductive technologies. The presence of domestic manufacturers providing cost-effective solutions and government support for reproductive health initiatives further boost market expansion.

Ovum Aspiration Pumps Market Share

The Ovum Aspiration Pumps industry is primarily led by well-established companies, including:

• Cook Medical (U.S.)

• Vitrolife AB (Sweden)

• Hamilton Thorne (U.S.)

• Gynemed GmbH & Co. KG (Germany)

• Esco Medical (Singapore)

• Labotect GmbH (Germany)

• Ormed (France)

• Labotect IVF (Germany)

• Ferticare (Denmark)

• Genea Biomedx (Australia)

• Kite IVF (U.S.)

• REPROMED (U.K.)

• Zhejiang Risen Medical (China)

• Cryo Innovations (U.S.)

• Medical Innovations Ltd. (U.K.)

• IGENOMIX (Spain)

• Esco Lifesciences (Singapore)

• Origio (Denmark)

• Labotect AG (Germany)

Latest Developments in Global Ovum Aspiration Pumps Market

- In May 2025, a comprehensive market study on IVF Aspiration Pumps, including ovum aspiration pumps, highlighted increasing innovation and competitive activity among leading players such as Cook Medical, CooperSurgical, Rocket Medical, Vitrolife, Kitazato, and SOMATEX, reflecting expansion of product portfolios and strategic emphasis on improved suction mechanisms and real‑time monitoring systems to enhance ART procedures

- In January 2025, 6Wresearch published updated market insights reporting steady growth and technological adoption in the global ovum aspiration pumps market, driven by rising infertility rates and demand for ART procedures, indicating commercial momentum in equipment development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.