Global Oxidized Polyethylene Wax Market

Market Size in USD Million

CAGR :

%

USD

856.90 Million

USD

1,315.07 Million

2024

2032

USD

856.90 Million

USD

1,315.07 Million

2024

2032

| 2025 –2032 | |

| USD 856.90 Million | |

| USD 1,315.07 Million | |

|

|

|

|

Global Oxidized Polyethylene Wax Market Size

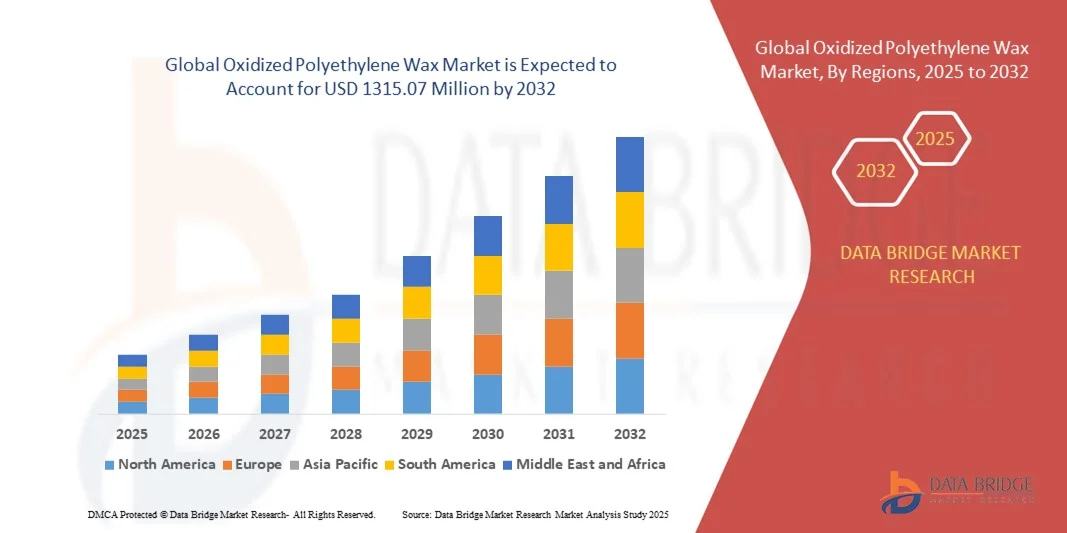

- The global oxidized polyethylene wax market size was valued at USD 856.90 million in 2024 and is expected to reach USD 1315.07 million by 2032, growing at a CAGR of 5.50% during the forecast period.

- The market expansion is driven by rising demand across industries such as plastics, rubber, coatings, and adhesives, due to the wax's excellent lubricating, dispersing, and thermal stability properties.

- Additionally, increasing focus on sustainable and high-performance additives, along with advancements in polymer processing technologies, is boosting the adoption of oxidized polyethylene wax across manufacturing sectors, thereby fueling significant market growth

Global Oxidized Polyethylene Wax Market Analysis

- Oxidized polyethylene wax, a synthetic wax known for its superior hardness, thermal stability, and compatibility with various formulations, is becoming increasingly essential in industries such as plastics, rubber, coatings, textiles, and adhesives for its role as a lubricant, dispersing agent, and matting additive.

- The growing demand for high-performance processing aids, especially in PVC and rubber manufacturing, coupled with increased focus on sustainable and efficient production processes, is significantly driving the uptake of oxidized polyethylene wax worldwide.

- North America dominated the global oxidized polyethylene wax market, accounting for the largest revenue share of 85.1% in 2024, supported by advanced industrial infrastructure, high demand in plastic processing, and strong presence of major manufacturers and chemical processing companies, particularly in the U.S. and Canada.

- Asia-Pacific is projected to be the fastest growing region in the global oxidized polyethylene wax market during the forecast period, driven by rapid industrialization, expansion in plastic and rubber manufacturing, and rising investments in infrastructure and automotive sectors, especially in China, India, and Southeast Asia.

- The High-Density segment dominated the market with the largest revenue share of 74.3% in 2024, owing to its superior hardness, abrasion resistance, and thermal stability, making it highly suitable for use in plastic processing, hot-melt adhesives, and coatings.

Report Scope and Global Oxidized Polyethylene Wax Market Segmentation

|

Attributes |

Oxidized Polyethylene Wax Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Oxidized Polyethylene Wax Market Trends

Performance Enhancement Through Advanced Processing Technologies

- A significant and accelerating trend in the Global Oxidized Polyethylene Wax Market is the integration of advanced polymer processing technologies, enabling improved performance characteristics such as enhanced thermal stability, better dispersion, and superior lubrication in end-use applications across plastics, rubber, and coatings industries.

- For instance, modern high-speed extrusion and compounding systems now utilize oxidized polyethylene wax for optimized internal and external lubrication in PVC and polyolefin processing, reducing friction and improving surface finish and dimensional stability of final products.

- Technological advancements have also led to tailor-made oxidized wax grades, which provide improved pigment dispersion in masterbatches and better flow control in hot melt adhesives. Companies are increasingly investing in R&D to formulate application-specific wax blends that enhance processing efficiency while meeting evolving regulatory and performance standards.

- In rubber processing, the use of OPE waxes has expanded with the introduction of functionalized and emulsifiable grades, allowing better compatibility with a wide range of elastomers and contributing to improved mold release and processing flow. These innovations help reduce production cycle times and energy consumption.

- This trend towards high-performance, application-specific oxidized polyethylene waxes is reshaping user expectations within polymer and chemical processing industries. Leading players such as Honeywell and Baerlocher are developing advanced wax technologies focused on consistent particle size distribution, oxidation control, and eco-friendly formulations to meet growing industrial demands.

- The demand for technologically enhanced oxidized polyethylene waxes is rising rapidly across automotive, construction, packaging, and textile sectors, where improved processing performance, regulatory compliance, and material durability are increasingly prioritized.

Global Oxidized Polyethylene Wax Market Dynamics

Driver

Growing Need Due to Industrial Expansion and Demand for Processing Efficiency

-

The rapid growth of end-use industries such as plastics, rubber, coatings, textiles, and adhesives, especially in emerging economies, is a key driver for the rising demand in the Global Oxidized Polyethylene Wax Market. As manufacturers seek to optimize production efficiency and product quality, oxidized polyethylene wax is increasingly favored for its lubricating, dispersing, and anti-blocking properties.

- For instance, leading market players like SCG Chemicals and Lubrizol are investing in the development of high-performance wax additives tailored for specific industrial processes, enhancing compatibility with polymers like PVC, EVA, and polyolefins. These innovations are expected to significantly boost demand over the forecast period.

- Furthermore, the material's ability to improve melt flow, reduce friction, and enhance surface finish has made it an indispensable processing aid in plastic extrusion and compounding, while also playing a critical role in pigment dispersion for masterbatches and coatings.

- The expanding global focus on infrastructure development, automotive production, and sustainable packaging has created a surge in demand for engineered materials, where oxidized polyethylene wax serves as a performance-enhancing additive.

- Manufacturers are also leveraging the wax’s emulsifiable properties in water-based formulations, aligning with the shift towards eco-friendly and low-VOC products. This makes oxidized polyethylene wax a vital ingredient in modern industrial formulations, driving adoption across both developed and developing markets.

Restraint/Challenge

Fluctuating Raw Material Prices and Environmental Regulations

- The volatility of raw material prices, particularly those derived from petrochemicals, poses a major restraint for the oxidized polyethylene wax market. Since the product is often synthesized from ethylene-based feedstocks, fluctuations in crude oil prices directly impact production costs, affecting pricing and profit margins.

- For Instance, during periods of crude oil price surges, manufacturers face cost pressures, leading to reduced competitiveness in price-sensitive markets or substitution with alternative additives. Additionally, supply chain disruptions, especially in global logistics and chemical intermediates, can further exacerbate cost challenges.

- Another significant challenge lies in the tightening of environmental regulations, particularly in North America and Europe, concerning the use of non-biodegradable and VOC-emitting materials. As a synthetic polymer wax, oxidized polyethylene wax must comply with evolving regulatory standards, especially in applications involving food contact, packaging, or emissions-sensitive environments.

- In response, companies such as DEUREX AG and Baerlocher are focusing on developing bio-based or lower-emission alternatives and investing in cleaner production technologies. However, these sustainable innovations often involve higher R&D investments and longer time-to-market, which can slow immediate scalability.

- Overcoming these challenges will require strategic sourcing, innovations in green chemistry, and proactive regulatory compliance to ensure continued growth and long-term sustainability in the global oxidized polyethylene wax market.

Global Oxidized Polyethylene Wax Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the global oxidized polyethylene wax market is segmented into high-density and low-density wax. The high-density segment dominated the market with the largest revenue share of 74.3% in 2024, owing to its superior hardness, abrasion resistance, and thermal stability, making it highly suitable for use in plastic processing, hot-melt adhesives, and coatings. High-density oxidized polyethylene wax is widely preferred for applications requiring precise dimensional stability and improved processing efficiency, particularly in PVC extrusion and compounding.

The Low-Density segment is anticipated to witness the fastest CAGR of 21.4% from 2025 to 2032, driven by its increased use in emulsion applications, especially in water-based coatings, polishes, and inks. Its emulsifiable nature, coupled with ease of application and compatibility with waterborne systems, makes low-density variants attractive for manufacturers seeking eco-friendly, low-VOC solutions, especially in Asia-Pacific and Europe, where environmental compliance is strict.

- By Application

On the basis of application, the global oxidized polyethylene wax market is segmented into paints & coatings, printing inks, plastic processing, and textiles. The Plastic Processing segment dominated the market with the largest revenue share of 43.2% in 2024, as oxidized polyethylene wax is extensively used as an internal and external lubricant in PVC, helping reduce friction, improve surface finish, and ensure smooth extrusion. Its function as a processing aid enhances efficiency, reduces production defects, and supports the demand for high-performance polymers in automotive, construction, and packaging sectors.

The Printing Inks segment is projected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by the growing use of water-based and solvent-based inks in packaging and publication. OPE wax improves scuff resistance, gloss control, and pigment dispersion in ink formulations. As global demand for sustainable and durable packaging solutions rises, especially in e-commerce and food industries, printing ink manufacturers increasingly rely on OPE wax to enhance product quality and functionality. pplication.

Global Oxidized Polyethylene Wax Market Regional Analysis

- North America dominated the global oxidized polyethylene wax market with the largest revenue share of 85.1% in 2024, driven by strong industrial demand from the plastics, rubber, and coatings sectors, as well as advancements in polymer processing technologies.

- Manufacturers in the region prioritize high-performance additives that improve processing efficiency, surface finish, and product durability, leading to increased use of oxidized polyethylene wax in applications such as PVC extrusion, hot melt adhesives, and masterbatches.

- The market is further supported by the presence of key players such as Honeywell, Lubrizol, and Baerlocher, along with robust R&D infrastructure, strict quality standards, and a growing push toward sustainable and eco-friendly formulations. These factors contribute to the widespread adoption of OPE wax across both established industries and emerging applications in automotive, construction, and packaging.

U.S. Global Oxidized Polyethylene Wax Market Insight

The U.S. oxidized polyethylene wax market captured the largest revenue share of 80% in 2024 within North America, driven by the country's leadership in plastics processing, coatings, and adhesives industries. The rapid advancement in polymer technologies, coupled with the demand for high-performance additives, is fueling widespread adoption of oxidized polyethylene wax across various sectors. Applications in PVC extrusion, masterbatches, and hot-melt adhesives are seeing significant uptake due to OPE wax’s ability to improve surface quality, reduce friction, and enhance processability. Moreover, the presence of major manufacturers such as The Lubrizol Corporation and Honeywell supports innovation and consistent product availability, contributing to continued market growth.

Europe Global Oxidized Polyethylene Wax Market Insight

The Europe oxidized polyethylene wax market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental regulations and growing demand for eco-friendly additives in industrial applications. The market is witnessing rising usage of OPE wax in water-based coatings, printing inks, and PVC formulations, especially as European manufacturers shift toward sustainable production practices. Increasing investment in green technologies, along with rising applications in the automotive, construction, and packaging sectors, supports market expansion. Both residential and industrial product manufacturers are incorporating oxidized wax to improve performance while aligning with regulatory standards.

U.K. Global Oxidized Polyethylene Wax Market Insight

The U.K. oxidized polyethylene wax market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by an increased focus on formulated coatings, masterbatches, and low-VOC additive solutions. As U.K. manufacturers align with stringent environmental policies and market demand for sustainable materials, OPE wax is becoming a preferred ingredient for enhancing lubrication, dispersion, and anti-blocking properties. Growth is also supported by innovation in polymer processing and specialty chemicals, especially in the packaging and paints industries. The evolving industrial landscape and demand for high-quality, eco-conscious materials are expected to boost future market growth.

Germany Global Oxidized Polyethylene Wax Market Insight

The Germany oxidized polyethylene wax market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced chemical and plastics industries and its commitment to sustainable manufacturing. Germany’s leadership in automotive, building materials, and engineered plastics creates strong demand for high-performance additives like OPE wax. Increasing focus on energy-efficient processing, regulatory compliance, and eco-friendly product development encourages manufacturers to adopt oxidized polyethylene wax in PVC, adhesives, and coatings. The integration of smart manufacturing practices further enhances product customization and process efficiency.

Asia-Pacific Global Oxidized Polyethylene Wax Market Insight

The Asia-Pacific oxidized polyethylene wax market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by industrialization, urbanization, and rising production capacities in key economies such as China, India, Japan, and South Korea. The region’s booming plastics, packaging, and coatings sectors are major consumers of oxidized polyethylene wax due to its versatile functionality in improving processing speed, material flow, and dispersion. Supportive government policies for manufacturing and export industries, as well as the increasing shift towards environmentally friendly materials, are making OPE wax more accessible and affordable across the region.

Japan Global Oxidized Polyethylene Wax Market Insight

The Japan oxidized polyethylene wax market is gaining momentum due to the country’s technological advancement, demand for precision-engineered materials, and preference for clean, efficient processing additives. Japanese manufacturers use OPE wax extensively in specialty coatings, rubber formulations, and polymer processing, where performance consistency and regulatory compliance are paramount. The integration of oxidized wax into eco-conscious and low-VOC formulations aligns with national sustainability goals. As the country continues to prioritize automation and high-quality industrial outputs, demand for advanced wax solutions is expected to grow across both industrial and consumer product applications.

China Global Oxidized Polyethylene Wax Market Insight

The China oxidized polyethylene wax market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by the country’s dominance in plastic manufacturing, PVC processing, and packaging production. The rapid expansion of industrial sectors, growing middle class, and strong domestic supply chain infrastructure contribute to widespread adoption of OPE wax in adhesives, coatings, and extrusion applications. As China promotes the development of smart factories and sustainable manufacturing, the use of oxidized polyethylene wax is expected to grow steadily. Affordable production costs and technological innovation by local suppliers are also enhancing competitiveness in global markets.

Global Oxidized Polyethylene Wax Market Share

The Oxidized Polyethylene Wax industry is primarily led by well-established companies, including:

- Baerlocher GmbH (Germany)

- The Lubrizol Corp. (U.S.)

- SCG Chemicals Co., Ltd. (Thailand)

- Münzing Chemie GmbH (Germany)

- Honeywell International Inc. (U.S.)

- Cosmic Petrochem Pvt. Ltd. (India)

- Micro Powders Inc. (U.S.)

- MPI Chemie B.V. (Netherlands)

- DEUREX AG (Switzerland)

- Shanghai Fine Chemical Co. Ltd. (China)

- Sanyo Chemical Industries Ltd. (Japan)

What are the Recent Developments in Global Oxidized Polyethylene Wax Market?

- In April 2023, Baerlocher GmbH, a global leader in specialty chemical additives, launched a strategic initiative in South Africa aimed at enhancing the performance and sustainability of local industrial coatings and plastics through its advanced oxidized polyethylene wax formulations. This move reflects Baerlocher’s commitment to delivering innovative, high-quality additive solutions tailored to regional manufacturing needs. By leveraging its global expertise and cutting-edge products, Baerlocher is addressing local market challenges while strengthening its position in the rapidly expanding Global Oxidized Polyethylene Wax Market.

- In March 2023, SCG Chemicals Co., Ltd., a major Asian chemical manufacturer, introduced a new line of high-performance oxidized polyethylene waxes designed specifically for applications in printing inks and plastic processing. These innovative waxes provide superior dispersion and surface finish, enhancing product quality for industrial customers. This product launch underscores SCG Chemicals’ dedication to innovation and meeting evolving industry demands for efficient and eco-friendly additives.

- In March 2023, Honeywell International Inc. successfully partnered with leading PVC manufacturers in India to supply advanced oxidized polyethylene wax formulations aimed at improving extrusion efficiency and product durability. This collaboration supports local industrial growth while promoting the adoption of high-performance wax additives. Honeywell’s initiative highlights the increasing importance of specialized chemical additives in emerging markets and its commitment to sustainable manufacturing solutions.

- In February 2023, Shanghai Fine Chemical Co. Ltd., a key player in the Chinese specialty chemicals sector, announced a strategic partnership with several regional paint and coating manufacturers to introduce premium oxidized polyethylene wax grades that enhance scratch resistance and flow properties. This collaboration is designed to boost product quality and operational efficiency in the highly competitive coatings market. The initiative emphasizes Shanghai Fine Chemical’s drive toward innovation and market expansion.

- In January 2023, Munzing Chemie GmbH, a global leader in chemical additives, unveiled a new eco-friendly oxidized polyethylene wax variant at the European Coatings Show 2023. The new product, optimized for water-based coatings and environmentally conscious formulations, allows manufacturers to meet stringent sustainability standards without compromising performance. Munzing’s launch reflects the industry-wide shift toward greener additive solutions and its commitment to supporting sustainable growth in the Global Oxidized Polyethylene Wax Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oxidized Polyethylene Wax Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oxidized Polyethylene Wax Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oxidized Polyethylene Wax Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.