Global Packaged Coconut Water Market

Market Size in USD Billion

CAGR :

%

USD

4.43 Billion

USD

8.19 Billion

2024

2032

USD

4.43 Billion

USD

8.19 Billion

2024

2032

| 2025 –2032 | |

| USD 4.43 Billion | |

| USD 8.19 Billion | |

|

|

|

|

Global Packaged Coconut Water Market Size

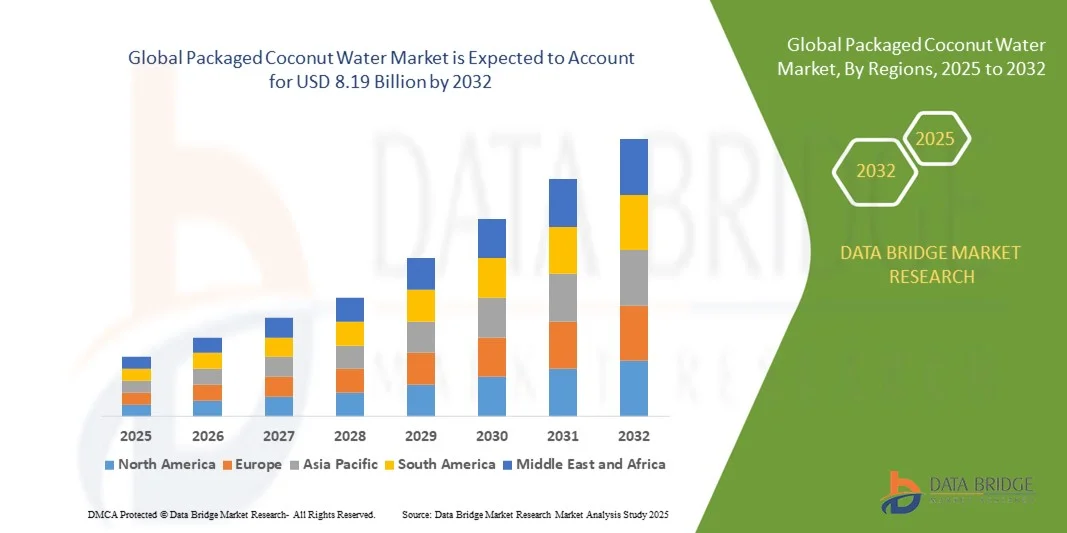

- The global Packaged Coconut Water Market size was valued at USD 4.43 billion in 2024 and is expected to reach USD 8.19 billion by 2032, at a CAGR of 8.00% during the forecast period.

- The market growth is largely driven by increasing consumer preference for natural, healthy, and functional beverages, along with rising awareness about hydration and wellness benefits associated with coconut water.

- Furthermore, expanding distribution channels, innovative packaging, and product fortification with vitamins and minerals are encouraging wider adoption among health-conscious consumers, thereby significantly boosting the market's growth.

Global Packaged Coconut Water Market Analysis

- Packaged coconut water, a natural and ready-to-drink beverage, is increasingly recognized for its hydration, electrolytes, and health benefits, making it a popular choice among health-conscious consumers in both urban and rural markets.

- The rising demand for packaged coconut water is primarily driven by growing awareness of its nutritional value, increasing adoption of healthy lifestyle habits, and a shift from carbonated and sugary beverages to natural alternatives.

- Asia-Pacific dominated the Global Packaged Coconut Water Market with the largest revenue share of 35.4% in 2024, supported by high consumer awareness of wellness products, strong retail and e-commerce networks, and the presence of leading market players, with the U.S. witnessing substantial growth in flavored and fortified coconut water offerings, fueled by innovative product launches and premium packaging trends.

- Europe is expected to be the fastest-growing region in the Global Packaged Coconut Water Market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing demand for convenient, natural beverages among millennials and working professionals.

- The conventional coconut water segment dominated the market with a revenue share of 57% in 2024, owing to its widespread availability, affordability, and established consumer trust.

Report Scope and Global Packaged Coconut Water Market Segmentation

|

Attributes |

Packaged Coconut Water Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Packaged Coconut Water Market Trends

Innovation Through Functional and Flavored Variants

- A significant and accelerating trend in the global Packaged Coconut Water Market is the introduction of functional and flavored variants. Brands are increasingly fortifying coconut water with vitamins, minerals, electrolytes, and natural flavors to cater to health-conscious consumers and differentiate their products in a competitive market.

- For instance, Vita Coco offers flavored coconut water options such as pineapple, mango, and watermelon, while ZICO has introduced variants enriched with potassium and antioxidants, targeting fitness enthusiasts and consumers seeking enhanced hydration benefits.

- Functional innovations also include added protein, probiotics, and natural sweeteners to appeal to consumers looking for beverages that support wellness, digestion, and energy. Some premium products are marketed with cold-pressed technology to preserve nutrients and natural taste, creating a premium positioning.

- The expansion into flavored and fortified coconut water allows brands to cater to varied consumer preferences, from casual daily hydration to fitness-focused consumption, driving higher repeat purchases and market penetration.

- This trend towards more functional, nutritious, and flavorful offerings is reshaping consumer expectations for packaged beverages. Companies such as O.N.E. Coconut Water and Chaokoh are actively developing innovative formulations that combine taste, convenience, and health benefits, targeting both domestic and international markets.

- The demand for functional and flavored coconut water is growing rapidly across both developed and emerging markets, as consumers increasingly prioritize beverages that deliver both hydration and added wellness benefits.

Global Packaged Coconut Water Market Dynamics

Driver

Growing Need Due to Rising Health Awareness and Lifestyle Changes

- The increasing focus on health and wellness among consumers, combined with a shift away from sugary and carbonated beverages, is a significant driver for the heightened demand for packaged coconut water.

- For instance, in 2024, Vita Coco launched a line of functional coconut waters enriched with electrolytes and vitamins, targeting fitness enthusiasts and health-conscious consumers. Strategies such as these by key companies are expected to drive market growth during the forecast period.

- As consumers become more aware of hydration benefits, low-calorie content, and natural electrolytes in coconut water, packaged options offer a convenient and safe alternative to fresh coconut water, particularly in urban and export markets.

- Furthermore, the rising popularity of convenient, ready-to-drink beverages and the desire for natural, functional drinks are making packaged coconut water a preferred choice among millennials, athletes, and working professionals.

- The convenience of portable packaging, easy availability through retail and e-commerce channels, and the ability to enjoy flavored or fortified options are key factors propelling the adoption of packaged coconut water worldwide. The trend towards on-the-go healthy consumption and increasing distribution through modern trade further contributes to market growth.

Restraint/Challenge

Concerns Regarding Price Sensitivity and Product Shelf Life

- High product prices and limited shelf life of natural coconut water pose significant challenges to broader market penetration. Premium and fortified variants are often priced higher than traditional beverages, which may limit adoption among price-sensitive consumers in developing regions.

- For instance, packaged coconut water with added flavors or vitamins often carries a premium, making it less accessible for some consumer segments despite the health benefits.

- Addressing these challenges through improved cold-chain logistics, innovative packaging solutions, and competitive pricing strategies is crucial for building consumer trust and encouraging repeat purchases. Companies such as ZICO and O.N.E. Coconut Water emphasize product quality and sustainable sourcing in their marketing to reassure buyers.

- Additionally, concerns about shelf life and spoilage can limit market growth, particularly in regions with limited cold storage infrastructure. Efforts to extend shelf stability through aseptic processing and Tetra Pak or PET packaging are helping mitigate these issues.

- Overcoming these challenges through affordable product variants, enhanced packaging technologies, and consumer education on product benefits will be vital for sustained market growth in the global packaged coconut water industry.

Global Packaged Coconut Water Market Scope

Packaged coconut water market is segmented on the basis of product, packaging type and distribution channel.

- By Product

On the basis of product, the Global Packaged Coconut Water Market is segmented into organic coconut water and conventional coconut water. The conventional coconut water segment dominated the market with a revenue share of 57% in 2024, owing to its widespread availability, affordability, and established consumer trust. Conventional coconut water is widely consumed for its natural hydration properties, consistent taste, and accessibility in retail and online channels. Its established presence across emerging and mature markets drives sustained demand.

The organic coconut water segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by growing health consciousness, rising preference for chemical-free and sustainably sourced beverages, and increasing disposable income in urban areas. The market is also witnessing product innovations such as flavored, fortified, and functional organic coconut waters, which appeal to millennials, fitness enthusiasts, and premium consumers. Increasing marketing campaigns and awareness about sustainable sourcing are further supporting its growth globally.

- By Packaging Type

On the basis of packaging type, the Global Packaged Coconut Water Market is segmented into bottles, cans, pouches, Tetra Packs, and cartons. The Tetra Pack segment dominated the market with a revenue share of 41% in 2024, due to its ability to preserve freshness, extend shelf life, and facilitate large-scale distribution. Tetra Packs are convenient for retailers and consumers alike, offering portability and long-term storage while maintaining product quality.

The pouch segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for single-serve, lightweight, and portable packaging options. Pouches are particularly popular among students, working professionals, and fitness enthusiasts seeking on-the-go hydration solutions. Moreover, eco-friendly innovations in pouch packaging and growing consumer preference for recyclable and sustainable materials are further fueling adoption, especially in environmentally conscious markets in North America, Europe, and Asia-Pacific.

- By Distribution Channel

On the basis of distribution channel, the Global Packaged Coconut Water Market is segmented into online and offline channels. The offline segment dominated the market with a revenue share of 62% in 2024, driven by the widespread presence of supermarkets, hypermarkets, convenience stores, and traditional retail outlets. Offline channels offer consumers easy product accessibility, bulk purchasing options, and trust in authenticity, particularly in emerging markets.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing e-commerce adoption, mobile shopping, and convenience of doorstep delivery. Online distribution also provides access to a wider range of products, including premium and organic variants, along with subscription models and targeted promotions. The growth of online channels is further accelerated by rising consumer preference for contactless shopping and the ability to compare prices, read reviews, and access product information easily.

Global Packaged Coconut Water Market Regional Analysis

- Asia-Pacific dominated the Global Packaged Coconut Water Market with the largest revenue share of 35.4% in 2024, driven by increasing consumer awareness of health and wellness, rising demand for natural and functional beverages, and the established retail and e-commerce infrastructure.

- Consumers in the region increasingly prefer packaged coconut water for its hydration benefits, natural electrolytes, and convenience as a ready-to-drink beverage. The popularity of both conventional and organic variants is fueled by fitness trends, sports nutrition awareness, and a growing preference for clean-label products.

- This widespread adoption is further supported by high disposable incomes, busy lifestyles, and the rising trend of on-the-go consumption, with packaged coconut water becoming a favored choice for residential, commercial, and hospitality applications. The availability across multiple packaging formats, including bottles, Tetra Packs, and pouches, also strengthens its appeal in North America.

U.S. Packaged Coconut Water Market Insight

The U.S. packaged coconut water market captured the largest revenue share of 38% in 2024 within North America, driven by growing consumer awareness of health and wellness, rising demand for natural and functional beverages, and the expanding trend of fitness and hydration-focused lifestyles. Consumers increasingly prefer coconut water for its natural electrolytes, low-calorie content, and convenience as a ready-to-drink product. The market is further propelled by the popularity of both organic and conventional variants, supported by widespread availability in retail stores, supermarkets, and online channels. Additionally, the increasing adoption of on-the-go consumption and clean-label preferences encourages the incorporation of packaged coconut water into daily diets.

Europe Packaged Coconut Water Market Insight

The Europe packaged coconut water market is projected to expand at a steady CAGR during the forecast period, driven by rising health consciousness, growing demand for natural and organic beverages, and increasing urbanization. Consumers are attracted to coconut water for its hydration benefits, nutritional content, and natural ingredients. Adoption is particularly strong across residential, hospitality, and fitness-oriented applications. The market is also boosted by environmentally conscious packaging trends, such as recyclable Tetra Packs and bottles, along with the availability of premium and organic options.

U.K. Packaged Coconut Water Market Insight

The U.K. packaged coconut water market is anticipated to grow at a notable CAGR throughout the forecast period, fueled by rising consumer preference for natural beverages, increasing awareness of health and wellness, and the growing popularity of fitness and lifestyle drinks. The convenience of ready-to-drink packaging, coupled with the availability of organic and flavored variants, supports market growth. Supermarkets, convenience stores, and online channels play a crucial role in distribution, making coconut water widely accessible. Additionally, the focus on sustainable and eco-friendly packaging is further encouraging consumer adoption.

Germany Packaged Coconut Water Market Insight

The Germany packaged coconut water market is expected to grow at a considerable CAGR during the forecast period, driven by increasing health consciousness, demand for natural and organic products, and adoption of functional beverages. Consumers favor packaged coconut water for its natural hydration and nutrient content. Germany’s developed retail infrastructure, growing preference for sustainable packaging, and the rising influence of wellness trends in both residential and commercial settings contribute to the market expansion. Premium and organic variants are particularly popular among urban and health-conscious consumers.

Asia-Pacific Packaged Coconut Water Market Insight

The Asia-Pacific packaged coconut water market is poised to grow at the fastest CAGR of 23% from 2025 to 2032, driven by rising disposable incomes, increasing urbanization, and growing health awareness in countries such as China, India, Japan, and Australia. Consumers are increasingly adopting packaged coconut water as a natural, low-calorie, and hydrating beverage. The market is further supported by government initiatives promoting nutrition and wellness, expansion of modern retail channels, and growing online sales platforms. Availability of affordable, locally produced, and imported variants enhances accessibility and adoption across diverse consumer segments.

Japan Packaged Coconut Water Market Insight

The Japan packaged coconut water market is gaining momentum due to the country’s health-focused culture, high urbanization, and demand for functional beverages. Consumers prefer coconut water for its natural electrolytes, hydration benefits, and low sugar content. The integration of coconut water into fitness, wellness, and dietary routines supports market growth. Premium and organic options are particularly appealing in the Japanese market, with distribution across convenience stores, supermarkets, and online channels. Additionally, Japan’s focus on sustainable and recyclable packaging aligns with consumer preferences, further promoting adoption.

China Packaged Coconut Water Market Insight

The China packaged coconut water market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising disposable incomes, and growing health and wellness awareness. Coconut water is increasingly consumed in residential, commercial, and hospitality sectors for its natural hydration and nutritional benefits. Strong domestic manufacturing, availability of both conventional and organic variants, and increasing e-commerce penetration contribute to market growth. Government initiatives promoting healthier diets and functional beverages, combined with expanding modern retail infrastructure, are key factors accelerating adoption of packaged coconut water in China.

Global Packaged Coconut Water Market Share

The Packaged Coconut Water industry is primarily led by well-established companies, including:

• Vita Coco (U.S.)

• Zico (U.S.)

• Harness (Thailand)

• Harmless Harvest (U.S.)

• Coco Joy (Philippines)

• Naked Juice (U.S.)

• O.N.E. Coconut Water (U.S.)

• Trader Joe’s (U.S.)

• Real Coco (Thailand)

• Chaokoh (Thailand)

• Grace Foods (Jamaica)

• Juicy Jay’s (U.S.)

• Bali Coconut (Indonesia)

• Cocojune (U.S.)

• Flow Alkaline Spring Water & Coconut Water (Canada)

• Foco (Vietnam)

• Coconut Water Company (U.K.)

• Natural Coco (India)

• Tropicana Coco (U.S.)

• Coco Libre (U.S.)

• Hansen’s Natural (U.S.)

What are the Recent Developments in Global Packaged Coconut Water Market?

- In April 2023, Vita Coco, a leading global coconut water brand, launched a new line of organic coconut water in the South African market. This initiative underscores the company’s commitment to expanding its footprint in emerging markets while catering to increasing consumer demand for natural and health-oriented beverages. By leveraging its global expertise in production and distribution, Vita Coco aims to provide premium-quality coconut water that meets local taste preferences, supporting healthier lifestyles and reinforcing its position in the growing global packaged coconut water market.

- In March 2023, Harmless Harvest introduced a sustainably sourced coconut water variant in the U.S., targeting health-conscious consumers and fitness enthusiasts. The product is marketed as non-GMO, organic, and preservative-free, highlighting the brand’s commitment to clean-label, environmentally responsible beverages. This launch demonstrates Harmless Harvest’s dedication to innovation in the functional beverage segment and its strategic focus on expanding its reach in the competitive packaged coconut water market.

- In March 2023, CBL Natural Foods successfully expanded its distribution network across major metropolitan areas in India. The initiative aims to make packaged coconut water more accessible to urban consumers seeking natural hydration solutions. By implementing modern cold-chain logistics and retail partnerships, CBL Natural Foods emphasizes the growing importance of distribution efficiency in ensuring product quality and consumer satisfaction, contributing to the expansion of the packaged coconut water market in Asia-Pacific.

- In February 2023, Coco Joy partnered with a major online grocery platform in Europe to launch a direct-to-consumer sales channel for its coconut water products. This collaboration is designed to increase convenience for consumers, streamline delivery, and expand brand visibility in the digital marketplace. The initiative underscores Coco Joy’s commitment to innovation in distribution strategies and highlights the growing role of e-commerce in shaping the global packaged coconut water market.

- In January 2023, PepsiCo introduced a new tetra pack line of its Tropicana coconut water in North America at the Natural Products Expo West 2023. The new packaging focuses on sustainability and portability, catering to environmentally conscious consumers and the growing demand for on-the-go hydration. This product launch demonstrates PepsiCo’s dedication to integrating advanced packaging solutions and sustainable practices while expanding its presence in the global packaged coconut water market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaged Coconut Water Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaged Coconut Water Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaged Coconut Water Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.