Global Packaged Currants Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

2.70 Billion

2025

2033

USD

1.69 Billion

USD

2.70 Billion

2025

2033

| 2026 –2033 | |

| USD 1.69 Billion | |

| USD 2.70 Billion | |

|

|

|

|

Packaged Currants Market Size

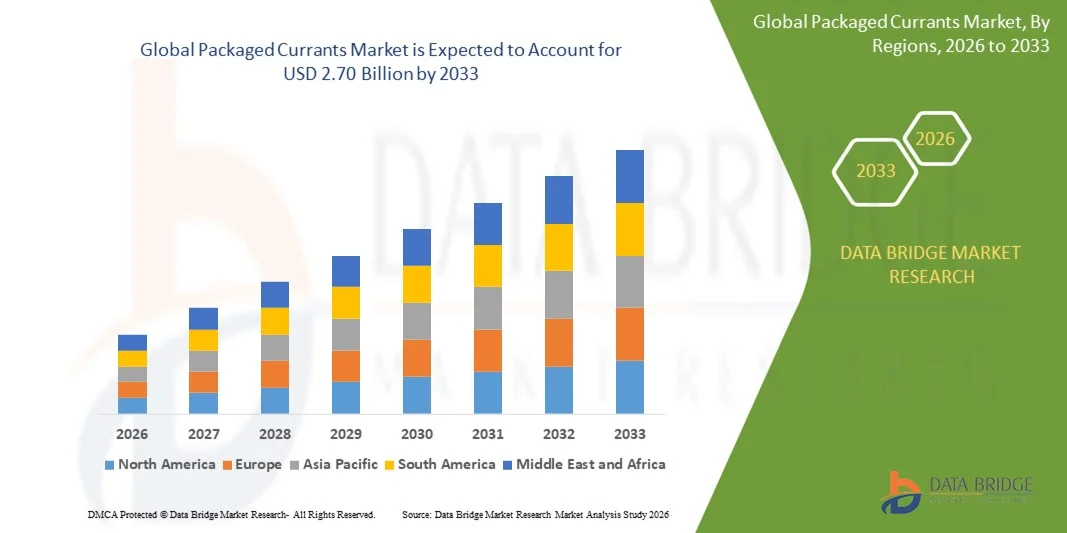

- The global packaged currants market size was valued at USD 1.69 billion in 2025 and is expected to reach USD 2.70 billion by 2033, at a CAGR of 6.0% during the forecast period

- The market growth is largely fueled by rising consumer awareness of health and wellness, leading to increased demand for nutritious, convenient, and ready-to-eat fruit products such as packaged currants

- Furthermore, expanding retail and e-commerce channels, coupled with innovations in packaging and processing that preserve freshness and extend shelf life, are driving broader adoption of packaged currants across both household and commercial applications. These converging factors are accelerating market penetration, thereby significantly boosting the industry's growth

Packaged Currants Market Analysis

- Packaged currants, offering dried blackcurrants, redcurrants, and other varieties in convenient formats, are increasingly vital components of modern snacking, bakery, confectionery, and beverage products due to their nutritional benefits, long shelf life, and versatility in recipes

- The escalating demand for packaged currants is primarily fueled by growing consumer preference for healthy snacks, increased incorporation in processed foods and functional beverages, and rising availability through supermarkets, convenience stores, and online retail channels

- Asia-Pacific dominated the packaged currants market in 2025, due to increasing consumer preference for healthy snacks, expanding retail chains, and rising demand for processed fruits in beverages, bakery, and confectionery industries

- North America is expected to be the fastest growing region in the packaged currants market during the forecast period due to rising demand for nutritious snacks, increasing use of currants in bakery and beverage industries, and expanding online sales channels

- Blackcurrant segment dominated the market with a market share of 52.9% in 2025, due to its high nutritional content, rich antioxidant properties, and widespread use in jams, juices, and confectioneries. Consumers increasingly prefer blackcurrants for their health benefits, including immune support and cardiovascular wellness, which boosts demand across retail and online channels. Major manufacturers such as Ocean Spray and Rabenhorst emphasize blackcurrant-based products in their portfolios, further strengthening its market presence. The segment also benefits from strong adoption in functional beverages and nutraceutical products, enhancing its overall market share

Report Scope and Packaged Currants Market Segmentation

|

Attributes |

Packaged Currants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaged Currants Market Trends

Rising Consumer Preference for Healthy and Functional Snacks

- A significant trend in the packaged currants market is the increasing consumer inclination toward healthy and functional snacks, driven by rising awareness of diet-related health benefits and the nutritional profile of dried fruits. Consumers are seeking convenient, nutrient-dense options that provide antioxidants, fiber, and natural energy, positioning packaged currants as a preferred snack alternative

- For instance, Ocean Spray markets packaged currants and other dried fruits as part of its healthy snack portfolio, emphasizing their natural nutritional benefits and suitability for on-the-go consumption. Such offerings strengthen brand visibility while addressing evolving consumer demand for functional food products

- The integration of currants into baked goods, cereals, and trail mixes is expanding, as manufacturers respond to the trend of fortifying snacks with natural ingredients. This is fostering partnerships between currant suppliers and food processing companies to deliver value-added products

- Retailers are increasingly dedicating shelf space to packaged currants within health-focused snack sections, enhancing accessibility and visibility for consumers. This trend is encouraging more frequent purchases and brand recognition in both offline and online channels

- E-commerce platforms are promoting currants through subscription snack boxes and curated health-food selections, broadening their reach to tech-savvy and health-conscious consumers. This digital expansion is positioning packaged currants as an integral component of modern snacking habits

- The demand for organic and sustainably sourced currants is rising as consumers prioritize environmentally responsible and ethically produced foods. This is driving innovation in packaging and sourcing strategies, reinforcing the market’s alignment with broader health and sustainability trends

Packaged Currants Market Dynamics

Driver

Expanding Retail and E-commerce Channels

- The growth of retail chains and e-commerce platforms is significantly enhancing the availability of packaged currants, enabling consumers to access a wider variety of products conveniently. This expansion is driving higher sales volumes and increasing brand penetration across regional and global markets

- For instance, Kerry Group collaborates with online and offline retailers to distribute its branded currants, ensuring widespread market coverage and consistent product availability. Such partnerships strengthen the supply chain and support market growth by meeting consumer demand in multiple channels

- Retail modernization is encouraging supermarkets, convenience stores, and health-food outlets to allocate dedicated space for dried fruits, promoting product discovery and impulse purchases. This is increasing the visibility of packaged currants in high-traffic retail environments

- E-commerce platforms leverage digital marketing and targeted promotions to introduce new currant varieties and flavors, stimulating demand through consumer engagement and online convenience. This trend is accelerating the adoption of packaged currants among younger, digitally active demographics

- The cumulative effect of retail and e-commerce expansion is driving the packaged currants market toward higher revenue generation and broader consumer adoption. This sustained channel growth is positioning the market for continued long-term development

Restraint/Challenge

High Cost of Quality Raw Currants

- The packaged currants market faces challenges due to the high cost of premium-quality raw currants, which are affected by seasonal fluctuations, labor-intensive harvesting, and limited production regions. These factors increase sourcing expenses and influence overall product pricing in retail and online channels

- For instance, Sun-Maid sources premium currants from California’s Central Valley, where crop yields and quality control measures contribute to higher procurement costs. Such cost pressures can limit competitive pricing and pose challenges for smaller processors and retailers

- Processing and drying currants to preserve flavor, texture, and nutritional content involves energy-intensive procedures, adding to production costs. These steps are essential to maintain product standards but impact profit margins for manufacturers

- Supply chain volatility, driven by climate variations and regional crop conditions, further affects the availability and cost of high-quality currants. This unpredictability can disrupt consistent market supply and hinder expansion strategies

- The market continues to grapple with balancing affordability with quality, as consumers increasingly demand premium, sustainably sourced currants. These constraints collectively challenge manufacturers to optimize sourcing, improve processing efficiency, and maintain product competitiveness

Packaged Currants Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the packaged currants market is segmented into blackcurrant, redcurrant, and others. The blackcurrant segment dominated the market with the largest market revenue share of 52.9% in 2025, driven by its high nutritional content, rich antioxidant properties, and widespread use in jams, juices, and confectioneries. Consumers increasingly prefer blackcurrants for their health benefits, including immune support and cardiovascular wellness, which boosts demand across retail and online channels. Major manufacturers such as Ocean Spray and Rabenhorst emphasize blackcurrant-based products in their portfolios, further strengthening its market presence. The segment also benefits from strong adoption in functional beverages and nutraceutical products, enhancing its overall market share.

The redcurrant segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing incorporation into gourmet food products, bakery items, and premium confectionery. For instance, companies such as Bonduelle have introduced ready-to-use redcurrant packs targeting convenience-seeking consumers, which supports rapid market expansion. Redcurrants are favored for their tart flavor and versatility, making them a popular choice for both household and commercial applications. Rising consumer interest in exotic and flavorful ingredients further drives the adoption of redcurrants. Packaging innovations ensuring freshness and extended shelf life also contribute to the growth of this segment.

- By Application

On the basis of application, the packaged currants market is segmented into supermarket, convenience store, grocery store, and online sales. The supermarket segment dominated the market with the largest revenue share in 2025, driven by the high visibility of products, bulk purchase options, and promotional campaigns that attract health-conscious consumers. Supermarkets often stock a wide variety of currants, including blackcurrant and redcurrant packs, allowing consumers to choose based on preference and dietary needs. Retailers such as Tesco and Walmart emphasize premium and organic currant varieties, enhancing customer trust and loyalty. The availability of value-added products such as pre-washed and portioned currants also increases sales volume.

The online sales segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing e-commerce penetration, doorstep delivery convenience, and targeted digital marketing strategies. For instance, Amazon and BigBasket offer curated currant packs with subscription options, attracting busy consumers seeking high-quality and fresh products. The segment benefits from the ability to reach a broader audience and provide niche varieties that may not be available in local stores. Rising consumer preference for online grocery shopping and home delivery contributes to the rapid growth of this application segment. Packaging innovations for longer shelf life and freshness also support the adoption of online sales channels.

Packaged Currants Market Regional Analysis

- Asia-Pacific dominated the packaged currants market with the largest revenue share in 2025, driven by increasing consumer preference for healthy snacks, expanding retail chains, and rising demand for processed fruits in beverages, bakery, and confectionery industries

- The region’s cost-effective production landscape, growing horticultural output, and strong presence of fruit processing hubs are accelerating market expansion

- The availability of skilled labor, favorable agricultural policies, and rising urbanization across developing economies are contributing to increased consumption of packaged currants in both retail and online channels

China Packaged Currants Market Insight

China held the largest share in the Asia-Pacific packaged currants market in 2025, owing to its robust fruit processing industry, increasing production of blackcurrants and redcurrants, and strong distribution networks. The country’s investment in modern packaging technology, expanding retail and e-commerce infrastructure, and growing health-conscious consumer base are major growth drivers. Demand is further supported by export opportunities and rising incorporation of currants in processed food and beverage products.

India Packaged Currants Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising consumer awareness of nutritional benefits, increasing disposable income, and growing adoption of packaged fruit products. For instance, companies such as FunFresh and RealGood are expanding their packaged currant offerings targeting convenience-seeking urban consumers. In addition, government initiatives promoting horticulture, modern processing facilities, and organized retail expansion are contributing to robust market growth.

Europe Packaged Currants Market Insight

The Europe packaged currants market is expanding steadily, supported by high consumer demand for organic and premium fruit products, stringent food safety regulations, and investments in sustainable agriculture. The region places strong emphasis on quality, eco-friendly packaging, and nutritional labeling, particularly in health-focused retail chains and e-commerce platforms. Increasing use of currants in bakery, confectionery, and functional foods is further enhancing market growth.

Germany Packaged Currants Market Insight

Germany’s packaged currants market is driven by consumer preference for organic and value-added products, strong retail penetration, and established food processing infrastructure. The country has well-developed cold chain logistics, enabling year-round distribution of fresh and packaged currants. Demand is particularly strong in bakery, confectionery, and ready-to-eat food segments.

U.K. Packaged Currants Market Insight

The U.K. market is supported by growing health-conscious consumer behavior, expansion of online grocery platforms, and increasing incorporation of currants in functional and convenience food products. With rising focus on organic and sustainably sourced ingredients, companies such as Renshaw and Whitworths are actively promoting packaged currants across retail and e-commerce channels.

North America Packaged Currants Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for nutritious snacks, increasing use of currants in bakery and beverage industries, and expanding online sales channels. A strong focus on functional foods, dietary supplements, and innovative packaging solutions is boosting demand.

U.S. Packaged Currants Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by high consumer awareness of health and wellness trends, significant investment in food processing technologies, and well-established retail and e-commerce networks. Companies such as Ocean Spray and Sun-Maid are driving growth through product innovation, ready-to-use currant packs, and targeted marketing campaigns.

Packaged Currants Market Share

The packaged currants industry is primarily led by well-established companies, including:

- Kabako Gruppe (Germany)

- Karelia Berries LLC (Russia)

- Special Fruit NV (Belgium)

- Windmill Hill Fruits (U.K.)

- Xi’an Xiyu Minnong Natural Food Co., Ltd. (China)

- Rind Snacks, Inc. (U.S.)

- Truly Good Foods (U.S.)

- Dole Packaged Foods, LLC (U.S.)

- Lion Raisins (U.S.)

- JAB Dried Fruit Products Pty Ltd (Australia)

- Bergin Fruit & Nut Co (U.S.)

- Kiantama Oy (Finland)

- Sun-Maid Growers of California (U.S.)

- Traina Foods (U.S.)

- SUNBEAM FOODS (Australia)

- Red River Foods, Nuts (Canada)

- Geobres (Brazil)

- Jiangsu Palarich Food Co., Ltd. (China)

- Decas Cranberry Products, Inc. (Canada)

- SUNSWEET (U.S.)

Latest Developments in Global Packaged Currants Market

- In May 2025, Sun-Maid Growers of California entered a strategic partnership with The Fruit Company to co-create currant-rich snack products, enabling both brands to leverage each other’s strengths in product innovation and distribution. This collaboration allows for the launch of new snack offerings that cater to health-conscious consumers, expanding the appeal of currants beyond traditional uses such as baking and jams. The partnership accelerates market penetration by improving availability in retail and online channels while reinforcing brand recognition and consumer trust in premium currant products

- In April 2025, Dole Packaged Foods completed the acquisition of Bergin Fruit and Nut Company, strengthening its position in the packaged currants market by expanding its dried fruit portfolio. This acquisition enhances Dole’s supply chain integration, allowing for more consistent and large-scale production of currant products. It also increases the company’s market reach across North America and globally, enabling it to offer a more diversified product range. The move is expected to intensify competition by setting higher standards for product quality and distribution efficiency, encouraging other market players to adopt similar growth strategies

- In April 2025, Oregon Fruit Products launched new Currant Crunch Bars, representing a strategic product expansion aimed at increasing currants’ presence in the ready-to-eat snacking category. These bars target busy, health-focused consumers seeking convenient, nutritious options, which drives incremental consumption of packaged currants. The launch strengthens the company’s market share by introducing value-added products, enhancing brand visibility, and tapping into the growing trend of functional snacks. This also encourages other players to diversify offerings, supporting overall market growth

- In 2024, SPECIAL FRUIT formed a distribution alliance with a major German e-commerce platform, significantly expanding online accessibility of packaged currants. The alliance resulted in a substantial increase in sales volume, demonstrating the growing role of digital channels in consumer purchasing behavior. By reaching a broader audience and offering convenient doorstep delivery, the company boosted revenue and also strengthened brand presence in the European market. This development underscores the importance of e-commerce in shaping market dynamics and accelerating adoption of packaged currants

- In 2023, Xi’an Xiyu Minnong Natural Food received ISO 22000 certification and expanded into Middle Eastern markets, enhancing its credibility in food safety and quality standards. This certification supports the company’s entry into new regions, enabling increased export volumes and establishing trust among distributors and consumers. By opening new revenue streams in emerging markets, the company contributes to the overall growth of the packaged currants market while setting benchmarks for compliance and quality that other players may follow

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaged Currants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaged Currants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaged Currants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.