Global Packaged Foods Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.01 Billion

USD

4.00 Billion

2024

2032

USD

2.01 Billion

USD

4.00 Billion

2024

2032

| 2025 –2032 | |

| USD 2.01 Billion | |

| USD 4.00 Billion | |

|

|

|

|

What is the Global Packaged Foods Testing Market Size and Growth Rate?

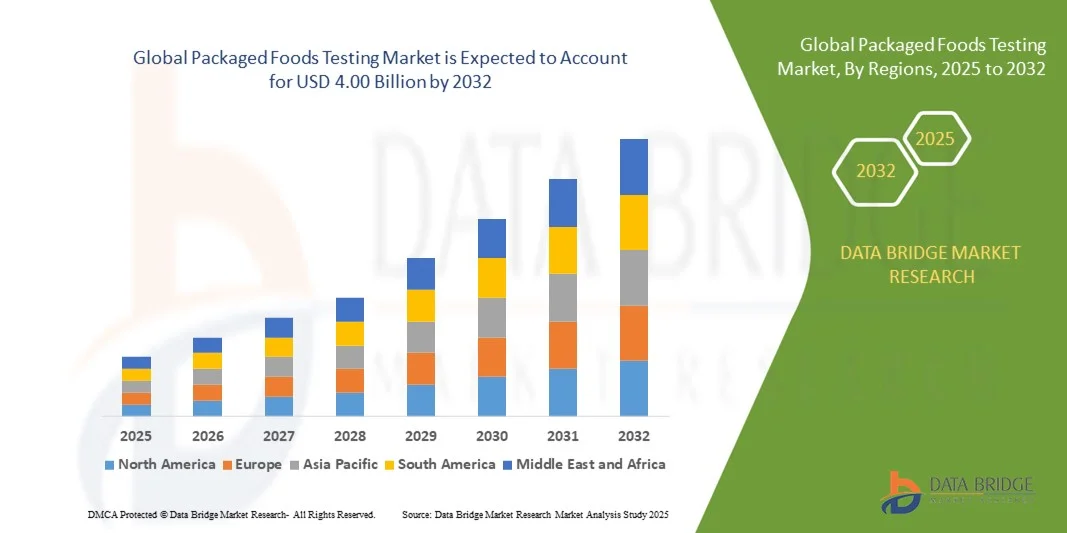

- The global packaged foods testing market size was valued at USD 2.01 billion in 2024 and is expected to reach USD 4.00 billion by 2032, at a CAGR of 9.00% during the forecast period

- The increase in demand for packaged and processed food among people globally owning to busy lifestyle, growing population and rising trend of quick-service restaurants is one of the major factors driving the packaged foods testing market

- The consumption of contaminated food product, consisting of radioactive material or toxic chemical cause foodborne illness which could be fatal increases the need of the food testing. The prevalence of food fraud activities such as unsafe food handling processes, sale of food products past their use period, recycling of animal by-products and inclusion of harmful materials also influence the packaged foods testing market

What are the Major Takeaways of Packaged Foods Testing Market?

- Stringent regulations associated with the food safety by various organizations including Food Standards Agency, Food Safety and Standards Authority of India, Canadian Food Inspection Agency and European Food Safety Authority for preventing consumers from frauds and ill health accelerate the packaged foods testing market growth

- In addition, availability of advanced rapid technology and growth in consumer’s awareness regarding food safety positively affect the packaged foods testing market

- Europe dominated the packaged foods testing market with the largest revenue share of 43.5% in 2024, driven by stringent food safety regulations, growing consumer awareness regarding quality and safety, and a highly organized food industry infrastructure

- The Asia-Pacific packaged foods testing market is poised to grow at the fastest CAGR of 9.21% during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing awareness of food safety standards in countries such as China, Japan, and India

- The pathogens segment dominated the market with the largest revenue share of 38.7% in 2024, driven by increasing global concerns over foodborne illnesses and outbreaks of diseases such as Salmonella, E. coli, and Listeria

Report Scope and Packaged Foods Testing Market Segmentation

|

Attributes |

Packaged Foods Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Packaged Foods Testing Market?

Rising Adoption of Rapid Testing and Automation Technologies

- A major trend shaping the global Packaged Foods Testing market is the increasing use of rapid testing methods and automation-based solutions to enhance testing accuracy, reduce turnaround times, and improve overall food safety compliance. Companies are investing in automated testing platforms that integrate robotics, machine learning (ML), and advanced sensors to ensure faster and more reliable results

- For instance, Eurofins Scientific introduced automated microbiological testing systems that can analyze multiple food samples simultaneously, significantly reducing manual intervention and human error. Similarly, SGS SA launched digital food safety platforms that enable real-time data collection and traceability across the supply chain, allowing for quicker decision-making and response to contamination events

- The integration of AI and IoT technologies in packaged food testing enables predictive analytics and real-time monitoring of production environments. Automated sampling and AI-driven contamination detection tools are helping companies ensure consistent quality and compliance with international standards

- These technologies are being increasingly adopted by major food producers and laboratories to streamline quality assurance processes, especially in large-scale manufacturing environments. The ability to detect pathogens, allergens, and chemical residues more efficiently aligns with growing consumer expectations for transparency and safety

- This trend is leading to a transformation in the global food testing ecosystem, as laboratories and manufacturers shift toward data-driven, automated quality management systems. Companies such as Intertek Group plc and Bureau Veritas are expanding their service portfolios with smart food testing labs equipped with automated analyzers and digital reporting platforms to meet the evolving needs of the food industry

- As a result, the demand for automated, high-throughput packaged food testing systems is expected to surge, driven by the dual goals of operational efficiency and enhanced public health protection

What are the Key Drivers of Packaged Foods Testing Market?

- The growing global concern over food safety, coupled with stringent regulatory frameworks such as the Food Safety Modernization Act (FSMA) in the U.S. and the General Food Law (GFL) in the European Union, is one of the primary drivers of the Packaged Foods Testing market. Increasing incidences of foodborne illnesses and contamination outbreaks have intensified the need for rigorous testing and quality control

- For instance, in March 2024, Mérieux NutriSciences expanded its laboratory operations in Italy, focusing on microbiological and allergen testing for packaged and processed foods to meet the rising European demand for safety compliance. Similarly, ALS Limited launched advanced testing services in Australia to strengthen national food quality standards

- The rising demand for processed and packaged foods, driven by rapid urbanization and changing consumer lifestyles, is further propelling the market. Consumers increasingly seek convenience without compromising safety, pushing manufacturers to invest in more comprehensive testing methods, including microbiological, chemical, and nutritional analyses

- Technological advancements, such as PCR-based testing, chromatography, and mass spectrometry, are enhancing detection capabilities, enabling quicker identification of contaminants and adulterants. Moreover, the globalization of food trade has made cross-border quality assurance and regulatory compliance critical to ensuring consumer safety and brand reputation

- In addition, the emergence of contract testing laboratories and outsourced food testing services is contributing to market growth, as manufacturers look to reduce operational costs while maintaining high safety standards. The rise in consumer awareness about food labeling and traceability further strengthens the demand for packaged food testing services worldwide

Which Factor is Challenging the Growth of the Packaged Foods Testing Market?

- One of the major challenges facing the Packaged Foods Testing market is the high cost associated with advanced testing technologies and the lack of standardized testing infrastructure in developing regions. Many small- and medium-sized enterprises (SMEs) face financial and technical barriers to implementing comprehensive testing protocols

- For instance, high-end analytical instruments such as HPLC (High-Performance Liquid Chromatography) and LC-MS/MS (Liquid Chromatography–Mass Spectrometry) require significant investment and skilled operators, limiting adoption in cost-sensitive markets

- Moreover, variations in global regulatory standards create complexities for multinational food manufacturers that need to comply with multiple regional requirements. Discrepancies between national food safety regulations can delay testing approvals, affect exports, and increase operational costs

- In addition, shortage of skilled professionals in analytical chemistry and microbiology poses another hurdle. Laboratories in emerging economies often struggle to maintain consistent testing quality due to limited training and certification resources

- For instance, reports by FAO and WHO highlight that inconsistent testing practices in parts of Asia and Africa lead to gaps in contamination detection, posing risks to food safety and international trade. Furthermore, frequent changes in regulatory policies and evolving contaminant standards create uncertainty for testing companies and manufacturers asuch as

- Addressing these challenges through increased public–private collaboration, government funding for laboratory infrastructure, and wider adoption of automated, user-friendly testing platforms will be essential to achieving sustainable market growth and ensuring global food safety standards

How is the Packaged Foods Testing Market Segmented?

The market is segmented on the basis of target tested, technology, and food.

- By Target Tested

On the basis of target tested, the packaged foods testing market is segmented into pathogens, allergens, pesticides, chemical and nutrition, genetically modified organisms (GMO), microbiological, residues and contamination testing, and others. The pathogens segment dominated the market with the largest revenue share of 38.7% in 2024, driven by increasing global concerns over foodborne illnesses and outbreaks of diseases such as Salmonella, E. coli, and Listeria. Food manufacturers and testing laboratories prioritize pathogen testing to ensure consumer safety and comply with stringent regulatory standards.

The allergens segment is anticipated to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising consumer awareness of allergen-related health risks and stringent labeling requirements. The growing prevalence of packaged and processed foods that may contain hidden allergens has accelerated demand for reliable allergen detection solutions, particularly in dairy, bakery, and confectionery segments. Laboratories are increasingly adopting sensitive ELISA and PCR-based methods to meet this demand.

- By Technology

On the basis of technology, the packaged foods testing market is segmented into traditional and rapid testing methods. The traditional testing segment held the largest market revenue share of 55.4% in 2024, attributed to its established reliability, regulatory recognition, and wide adoption across testing laboratories worldwide. Traditional microbiological, chemical, and GMO testing techniques remain the standard in ensuring food safety compliance.

The rapid testing segment is expected to witness the fastest CAGR of 24.1% from 2025 to 2032, driven by the growing demand for faster results, increased efficiency, and reduced turnaround times in large-scale food production and supply chains. Rapid technologies such as PCR-based methods, lateral flow assays, and biosensors enable food producers and laboratories to quickly detect contaminants and allergens without compromising accuracy. The rising adoption of on-site rapid testing kits in food processing plants, retail chains, and catering services is further supporting this growth trend.

- By Food

On the basis of food type, the packaged foods testing market is segmented into meat, poultry and seafood, dairy products, processed food, fruits and vegetables, cereals and grains, and others. The meat, poultry, and seafood segment dominated the market with the largest revenue share of 42.8% in 2024, owing to the high susceptibility of these foods to microbial contamination and strict regulatory scrutiny for pathogens and residues.

The processed food segment is expected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by the global surge in demand for packaged and ready-to-eat foods. Increasing consumer reliance on convenience foods, coupled with the risk of chemical residues, allergens, and microbial contamination, has prompted manufacturers to adopt rigorous testing protocols. Rapid detection methods, allergen screening, and advanced chemical analyses are increasingly applied in processed food production to ensure safety, compliance, and consumer trust.

Which Region Holds the Largest Share of the Packaged Foods Testing Market?

- Europe dominated the Packaged Foods Testing market with the largest revenue share of 43.5% in 2024, driven by stringent food safety regulations, growing consumer awareness regarding quality and safety, and a highly organized food industry infrastructure

- Consumers and businesses in the region prioritize compliance with EU food safety directives, making testing for pathogens, allergens, pesticides, and GMO content a critical requirement

- The widespread adoption is further supported by advanced laboratory networks, technological expertise, and the presence of leading testing service providers, establishing Europe as a hub for reliable and standardized packaged foods testing solutions across the continent

Germany Packaged Foods Testing Market Insight

The Germany packaged foods testing market captured the largest revenue share of 27% in Europe in 2024, owing to a strong regulatory framework, robust food processing industry, and high consumer awareness regarding food safety. Germany’s focus on quality, traceability, and compliance with EU food safety regulations drives demand for advanced testing services, including rapid detection technologies and comprehensive allergen screening. The country’s well-developed laboratory infrastructure supports both domestic and export-oriented testing needs.

U.K. Packaged Foods Testing Market Insight

The U.K. packaged foods testing market is projected to grow at a notable CAGR during the forecast period, fueled by increasing awareness of foodborne diseases, regulatory compliance requirements, and rising demand for high-quality packaged and processed foods. The presence of modern laboratory facilities and a strong focus on imported and domestic food testing further strengthens market growth.

France Packaged Foods Testing Market Insight

The France packaged foods testing market is expected to expand at a substantial CAGR, driven by stringent EU regulatory frameworks, growth in the packaged and processed food segment, and the increasing emphasis on quality assurance. French food manufacturers are increasingly relying on advanced testing services for pathogens, allergens, and chemical residues to maintain compliance and consumer trust.

Which Region is the Fastest Growing Region in the Packaged Foods Testing Market?

The Asia-Pacific packaged foods testing market is poised to grow at the fastest CAGR of 9.21% during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing awareness of food safety standards in countries such as China, Japan, and India. The region’s growing packaged food industry, government regulations promoting food quality, and expanding laboratory infrastructure support this growth. In addition, APAC is becoming a manufacturing hub for testing kits and technologies, enhancing accessibility and affordability.

China Packaged Foods Testing Market Insight

The China packaged foods testing market accounted for the largest market revenue share in Asia-Pacific in 2024, owing to rapid industrialization, increasing consumption of packaged foods, and stringent domestic food safety regulations. Growing investment in laboratory infrastructure and technological advancements in rapid testing solutions are key growth drivers.

Japan Packaged Foods Testing Market Insight

The Japan packaged foods testing market is gaining momentum due to high consumer focus on food quality, a technologically advanced food industry, and increasing demand for processed and packaged foods. Rapid testing methods and allergen detection solutions are widely adopted to ensure compliance and food safety.

Which are the Top Companies in Packaged Foods Testing Market?

The packaged foods testing industry is primarily led by well-established companies, including:

- SGS SA (Switzerland)

- Intertek Group plc (U.K.)

- Romer Labs (Austria)

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- Covance (U.S.)

- Mérieux NutriSciences (France)

- Microbac Laboratories, Inc (U.S.)

- NSF International (U.S.)

- Nova Biologicals (U.S.)

- Campden BRI (U.K.)

- Certified Laboratories (U.S.)

- AsureQuality (New Zealand)

- ALS (Australia)

- FoodChain ID Group Inc. (U.S.)

- AGROLAB GROUP (Germany)

- World Survey Services SA (Argentina)

- Seidlaboratory Cía. Ltda (Ecuador)

- AGQ Labs USA (U.S.)

- TÜV SÜD (Germany)

- TÜV NORD GROUP (Germany)

What are the Recent Developments in Global Packaged Foods Testing Market?

- In September 2025, Mérieux NutriSciences completed its global acquisition of Bureau Veritas' food testing operations, integrating all countries involved in the transaction. In Peru, the final acquisition added two laboratories, over 220 employees, and specialized expertise in seafood, aquaculture, and agribusiness, strengthening Mérieux NutriSciences' presence in the region and reinforcing its global food testing capabilities

- In March 2025, Food Safety Net Services (FSNS), a Certified Group company, inaugurated a new testing laboratory in St. Louis, Missouri. In doing so, FSNS expanded its North American network to more than 30 ISO-accredited laboratories, enhancing its ability to provide comprehensive food safety testing services to manufacturers and processors across the region

- In March 2025, Bio-Rad introduced the XP-Design Assay Salmonella Serotyping Solution, enabling rapid and precise identification of Salmonella serotypes in food and environmental samples. Incorporating real-time PCR technology with fluorescent probes, this assay supports quick outbreak decision-making and integrates seamlessly into existing food safety monitoring workflows, providing enhanced reliability and efficiency for laboratories

- In October 2024, Bureau Veritas opted to sell its global food testing business to Mérieux NutriSciences for €360 million. In this transaction, 34 laboratories and around 1,900 employees worldwide were included, allowing Bureau Veritas to focus on its core priorities while supporting Mérieux NutriSciences’ strategic growth and future acquisitions

- In September 2024, Eurofins Scientific expanded its operations through the acquisition of Infinity Laboratories. In the US, this addition included eight laboratories and approximately 100 staff, offering microbiology, chemistry, sterilization, and package testing services, thereby strengthening Eurofins’ package testing capabilities for pharmaceutical, biotech, and medical device clients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaged Foods Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaged Foods Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaged Foods Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.