Global Packaged Soy Chunks Market

Market Size in USD Million

CAGR :

%

USD

770.15 Million

USD

1,181.93 Million

2024

2032

USD

770.15 Million

USD

1,181.93 Million

2024

2032

| 2025 –2032 | |

| USD 770.15 Million | |

| USD 1,181.93 Million | |

|

|

|

|

Packaged Soy Chunks Market Size

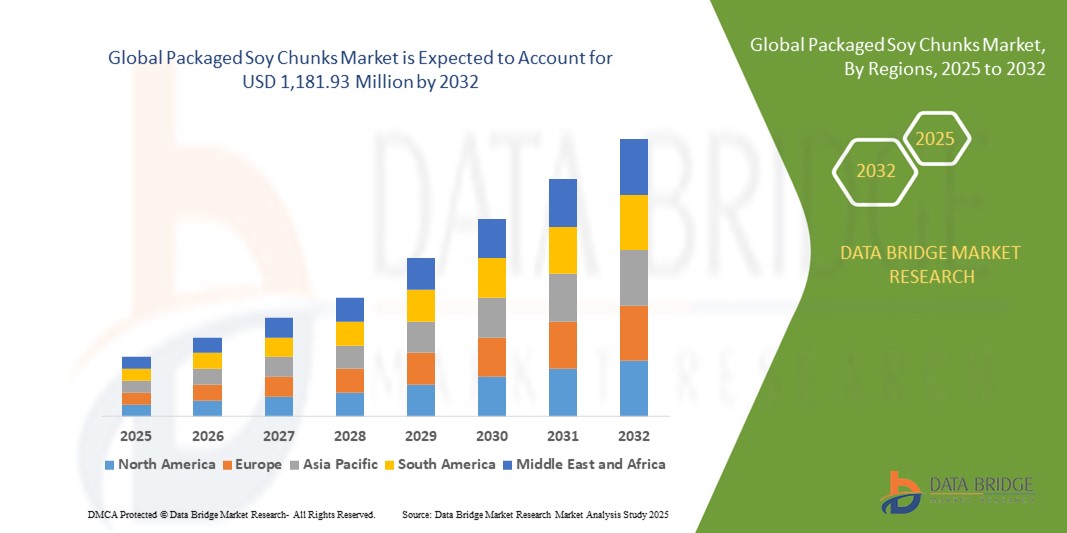

- The global packaged soy chunks market size was valued at USD 770.15 million in 2024 and is expected to reach USD 1,181.93 million by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for plant-based protein alternatives and the increasing popularity of vegetarian and vegan diets

- Growing awareness of the health benefits of soy, including its role in weight management, heart health, and sustainable nutrition, is boosting demand

Packaged Soy Chunks Market Analysis

- The packaged soy chunks market is witnessing consistent growth, driven by the surge in demand for protein-rich and meat-free food options among health-conscious consumers

- Manufacturers are focusing on innovative product formulations, improved packaging, and fortified variants to cater to evolving consumer preferences

- Asia-Pacific dominated the packaged soy chunks market with the largest revenue share of 46.5% in 2024, driven by a strong vegetarian population, increasing health awareness, and the rising popularity of plant-based diets

- North America region is expected to witness the highest growth rate in the global packaged soy chunks market, driven by shifting dietary preferences toward plant-based nutrition, strong retail penetration, and supportive initiatives promoting healthier and eco-friendly food choices

- The Non-Flavored segment held the largest market revenue share in 2024, driven by its wide availability, affordability, and versatility in household cooking. Non-flavored soy chunks are often purchased in bulk and used in a variety of regional dishes, making them a staple choice among health-conscious and cost-sensitive consumers

Report Scope and Packaged Soy Chunks Market Segmentation

|

Attributes |

Packaged Soy Chunks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaged Soy Chunks Market Trends

Rising Popularity of Plant-Based Protein Alternatives

- The growing demand for plant-based protein is transforming the packaged soy chunks market by offering consumers a healthy and affordable meat substitute. Their high protein content, coupled with low fat, makes them an attractive option for health-conscious individuals and vegetarian households worldwide. This trend is also supported by rising awareness of the health benefits associated with soy-based diets

- The surge in flexitarian and vegan lifestyles is accelerating the adoption of soy chunks in daily diets. Increasing demand for sustainable food sources is driving the popularity of soy-based meat alternatives in both developed and developing economies. Retailers and food manufacturers are capitalizing on this demand by introducing innovative product variants

- The affordability and versatility of soy chunks are making them a staple in both urban and rural households. Their long shelf life and ease of preparation further enhance adoption, particularly in regions where meat is expensive or less accessible. This is boosting their role as a reliable protein source across diverse demographic

- For instance, in 2023, several quick-service restaurant chains in India introduced soy chunk–based curries and biryanis to cater to vegetarian consumers, which significantly improved menu diversity and consumer acceptance. This integration highlights the expanding role of soy chunks in mainstream food services

- While packaged soy chunks continue to gain traction, their long-term growth depends on product innovation, taste enhancement, and awareness campaigns. Manufacturers must focus on marketing strategies, nutritional fortification, and eco-friendly packaging to fully capitalize on this rising demand

Packaged Soy Chunks Market Dynamics

Driver

Rising Consumer Preference for Plant-Based and Protein-Rich Diets

- Growing health consciousness is driving consumers toward plant-based proteins as alternatives to animal products. Packaged soy chunks, known for their rich protein content and low cholesterol, are increasingly adopted as a daily protein source. This shift is strongly supported by dietary recommendations promoting plant-based nutrition and fitness-driven diets across both urban and semi-urban populations

- The affordability and easy availability of soy chunks in supermarkets, online platforms, and local stores make them accessible to a wide consumer base. Rising vegetarian and vegan populations across Asia-Pacific, Europe, and North America are further fueling demand. Expanding retail channels and online food delivery platforms are also improving consumer reach and convenience

- Food manufacturers are launching fortified and flavored soy chunk variants to attract a wider audience. From protein-rich ready-to-cook meals to convenient snack formats, innovation is broadening consumer choice and acceptance. Increasing focus on clean-label products and health-oriented marketing is further accelerating market penetration

- For instance, in 2022, leading food brands launched soy chunk variants enriched with vitamins and minerals to address nutritional deficiencies in emerging economies. Such initiatives boosted adoption, particularly in low- and middle-income households. Collaborations with local distributors and retailers also enhanced availability in rural and semi-urban markets

- While health trends and affordability continue to drive the market, consistent innovation, effective marketing, and global retail expansion remain key to long-term market penetration. Companies must also address taste preferences and highlight nutritional benefits to maintain consumer loyalty in a competitive plant-based protein market

Restraint/Challenge

Consumer Perception Issues and Limited Awareness in Certain Regions

- Despite nutritional benefits, soy chunks face consumer perception challenges such as taste preferences and misconceptions regarding soy consumption. In some regions, traditional dietary habits limit the acceptance of soy as a mainstream protein source. Addressing flavor innovations, recipe education, and marketing campaigns is critical to overcoming these cultural barriers

- Lack of awareness about the nutritional profile of soy chunks in rural and underdeveloped areas reduces adoption. In these regions, protein intake is often reliant on traditional sources, leaving soy products underutilized despite their affordability and availability. Limited exposure to soy-based meals further restricts consumption patterns

- Market penetration is further restricted by limited product innovation and branding in certain economies. Without effective promotion and consumer education, soy chunks often struggle to compete with meat and other plant-based proteins. Inconsistent labeling standards and lack of aggressive marketing strategies exacerbate this challenge

- For instance, in 2023, surveys across African and Middle Eastern markets revealed that a large section of consumers was unaware of soy chunks as a protein option, with adoption restricted to urbanized segments. Local food cultures and weak product placement in retail further limited awareness and consumer acceptance

- While packaged soy chunks are gaining traction, addressing consumer perception, improving taste profiles, and expanding awareness campaigns are essential for unlocking growth potential across untapped regions. Focused investments in regional marketing, nutritional education, and affordable product innovation will be crucial for long-term adoption

Packaged Soy Chunks Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the packaged soy chunks market is segmented into Non-Flavored and Flavored. The Non-Flavored segment held the largest market revenue share in 2024, driven by its wide availability, affordability, and versatility in household cooking. Non-flavored soy chunks are often purchased in bulk and used in a variety of regional dishes, making them a staple choice among health-conscious and cost-sensitive consumers.

The Flavored segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for convenient, ready-to-cook, and taste-enhanced protein products. Flavored soy chunks, often enriched with spices and seasonings, are gaining traction among younger consumers and urban households seeking quick, nutritious meal solutions.

- By Application

On the basis of application, the packaged soy chunks market is segmented into Online Retail Stores and Brick and Mortar. The Brick and Mortar segment held the largest market revenue share in 2024, owing to the strong presence of supermarkets, hypermarkets, and local grocery stores where soy chunks are traditionally purchased. Easy accessibility, product visibility, and trusted retail channels continue to drive consumer preference for offline shopping.

The Online Retail Stores segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing penetration of e-commerce platforms and shifting consumer preference toward doorstep delivery. Increasing internet access, digital promotions, and wider product variety offered by online platforms are accelerating sales of packaged soy chunks through this channel.

Packaged Soy Chunks Market Regional Analysis

- Asia-Pacific dominated the packaged soy chunks market with the largest revenue share of 46.5% in 2024, driven by a strong vegetarian population, increasing health awareness, and the rising popularity of plant-based diets

- Consumers in the region highly value soy chunks as an affordable, protein-rich alternative to meat, with widespread adoption across India, China, and Southeast Asian countries

- This growth is further supported by expanding retail penetration, government-backed nutrition programs, and increasing consumer preference for sustainable and plant-derived protein sources

Europe Packaged Soy Chunks Market Insight

The Europe packaged soy chunks market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the growing shift toward plant-based diets and vegan lifestyles. The increasing demand for high-protein, low-cholesterol food products is fostering adoption across both households and foodservice channels. European consumers are also drawn to flavored and ready-to-cook soy chunk variants, offering both convenience and nutrition. The region is witnessing strong growth in supermarkets, health food chains, and online retail, fueling greater accessibility.

U.K. Packaged Soy Chunks Market Insight

The U.K. packaged soy chunks market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health consciousness, flexitarian diets, and concerns over meat consumption. The trend of veganism and plant-based nutrition is particularly strong among younger consumers, boosting soy chunk demand. In addition, the U.K.’s well-developed retail infrastructure and robust e-commerce penetration are supporting broader market access, further fueling growth.

Germany Packaged Soy Chunks Market Insight

The Germany packaged soy chunks market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption of plant-based proteins and demand for eco-friendly dietary options. German consumers are highly receptive to sustainable food products, and soy chunks are gaining traction as an affordable, protein-dense choice. Flavored and fortified variants are particularly popular in urban markets, with supermarkets and health-focused retailers playing a pivotal role in distribution.

North America Packaged Soy Chunks Market Insight

The North America packaged soy chunks market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for meat alternatives and growing health awareness in the U.S. and Canada. The popularity of plant-based proteins, coupled with innovations in fortified soy products, is stimulating market growth. Increasing vegan and flexitarian populations, along with strong retail and online sales networks, are further expanding consumer reach across the region.

U.S. Packaged Soy Chunks Market Insight

The U.S. packaged soy chunks market is expected to witness the fastest growth rate from 2025 to 2032, attributed to the country’s growing shift toward plant-based diets, increasing cases of lifestyle-related diseases, and strong demand for protein-rich foods. Soy chunks are gaining popularity not only among vegans but also among fitness-focused consumers looking for affordable protein alternatives. The presence of key food manufacturers, innovative marketing campaigns, and expanding availability across supermarkets and online channels are key factors boosting adoption.

Packaged Soy Chunks Market Share

The Packaged Soy Chunks industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- CHS Inc. (U.S.)

- Wilmar International Ltd (Singapore)

- The Scoular Company (U.S.)

- Kerry Group plc (Ireland)

- Ingredion (U.S.)

- AGT Food and Ingredients Inc. (Canada)

Latest Developments in Global Packaged Soy Chunks Market

- In September 2023, Beyond Meat introduced a new product development by launching a range of flavored soy chunks. This expansion is designed to provide consumers with more variety in plant-based protein options while catering to diverse culinary preferences. The move is expected to attract a broader customer base, particularly those seeking flavorful and nutritious alternatives to meat. By diversifying its portfolio, Beyond Meat strengthens its competitive position in the packaged soy chunks market. This initiative is likely to boost adoption rates and drive market growth through enhanced consumer engagement and product innovation

- In August 2023, Cargill announced a strategic partnership with Foodtech Innovations focused on developing ready-to-cook soy chunk meal kits. The collaboration aims to meet rising consumer demand for convenient, healthy, and sustainable plant-based meal solutions, particularly in fast-paced urban markets. By combining Cargill’s expertise in soy-based proteins with Foodtech Innovations’ meal kit capabilities, the companies seek to enhance accessibility and convenience for health-conscious consumers. This initiative is expected to accelerate the mainstream adoption of soy chunks, reinforcing their role as a staple protein source in the global packaged soy chunks market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaged Soy Chunks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaged Soy Chunks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaged Soy Chunks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.