Global Packaging Inserts And Cushions Market

Market Size in USD Billion

CAGR :

%

USD

135.02 Billion

USD

201.01 Billion

2025

2033

USD

135.02 Billion

USD

201.01 Billion

2025

2033

| 2026 –2033 | |

| USD 135.02 Billion | |

| USD 201.01 Billion | |

|

|

|

|

Packaging Inserts and Cushions Market Size

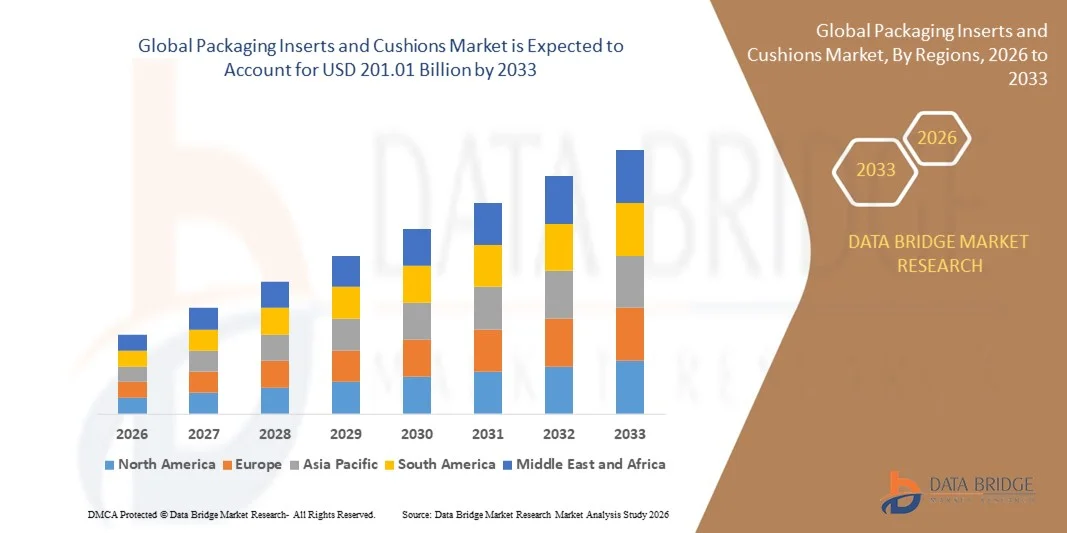

- The global packaging inserts and cushions market size was valued at USD 135.02 billion in 2025 and is expected to reach USD 201.01 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the rising demand for protective and sustainable packaging solutions across e-commerce, electronics, and personal care sectors, driving companies to adopt innovative inserts and cushioning materials that ensure product safety during storage and transit

- Furthermore, increasing focus on reducing plastic use and adopting recyclable or biodegradable materials is encouraging manufacturers to develop eco-friendly packaging inserts and cushions. These converging factors are accelerating the adoption of advanced protective packaging solutions, thereby significantly boosting the market's growth

Packaging Inserts and Cushions Market Analysis

- Packaging inserts and cushions, including foam, rigid, and molded fiber solutions, are becoming essential for safeguarding fragile and high-value products across multiple industries due to their ability to absorb shocks, prevent damage, and enhance overall product presentation

- The escalating demand for these solutions is primarily fueled by the growth of e-commerce, increasing global electronics shipments, and rising consumer awareness about product protection and sustainability. Manufacturers are increasingly prioritizing customizable, lightweight, and recyclable inserts to meet market requirements and maintain competitiveness

- Asia-Pacific dominated the packaging inserts and cushions market with a share of over 43% in 2025, due to expanding electronics manufacturing, rising e-commerce activities, and a strong presence of packaging material suppliers

- North America is expected to be the fastest growing region in the packaging inserts and cushions market during the forecast period due to robust demand in electronics, e-commerce, and personal care sectors

- Foam packaging segment dominated the market with a market share of 58.5% in 2025, due to its superior shock absorption, lightweight nature, and cost-effectiveness. Foam packaging is widely preferred across industries for protecting fragile products during transportation and storage. Its adaptability to various shapes and sizes, along with the availability of custom-designed inserts, enhances its application across electronics, personal care, and e-commerce sectors. In addition, foam packaging offers recyclability and reusability options, supporting sustainability initiatives adopted by manufacturers. The segment also benefits from innovations in high-resilience and environmentally friendly foams, further strengthening its dominance in the market

Report Scope and Packaging Inserts and Cushions Market Segmentation

|

Attributes |

Packaging Inserts and Cushions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaging Inserts and Cushions Market Trends

Rising Adoption of Sustainable and Recyclable Packaging Inserts

- A significant trend in the packaging inserts and cushions market is the growing shift toward sustainable and recyclable cushioning solutions, driven by rising environmental awareness among consumers and regulatory pressures to reduce plastic waste. This trend is shaping packaging strategies across e-commerce, electronics, and personal care industries, where product protection must be balanced with sustainability goals

- For instance, in February 2022, Mondi launched 100 % recyclable corrugated packaging solutions with integrated cushioning inserts, replacing expanded polystyrene foam, which enhanced recyclability while maintaining protective performance. Such innovations are prompting other manufacturers to explore eco-friendly alternatives that reduce environmental impact

- Retailers and manufacturers are increasingly prioritizing packaging solutions that minimize plastic usage while providing adequate cushioning. Tesco, in April 2023, replaced conventional top wrap packs for fresh mince with pillow packs using 70 % less plastic, reflecting growing adoption of lightweight and recyclable inserts

- The rising integration of recycled and biodegradable materials is driving innovation in protective packaging design, enabling companies to meet sustainability targets and appeal to environmentally conscious consumers. This is reinforcing the role of packaging inserts and cushions as both functional and eco-friendly components in global supply chains

- The demand for sustainable inserts is also rising in logistics-intensive sectors such as e-commerce, where repeated handling and shipment require reliable, recyclable cushioning solutions that do not compromise product safety. Companies such as Storapak, which launched 100 % recycled air pillow film in August 2022, are supporting this transition with high-performance, eco-conscious products

- The trend is accelerating adoption of advanced materials and design innovations that combine protection, recyclability, and cost-efficiency, strengthening market growth and encouraging broader industry-wide sustainability initiatives

Packaging Inserts and Cushions Market Dynamics

Driver

Growing e-commerce and electronics shipment volumes

- The market is witnessing strong growth due to the increasing volume of e-commerce shipments and rising global electronics demand, which require reliable protective packaging to prevent damage during transit. Businesses are seeking durable, lightweight, and customizable inserts and cushions to protect fragile items while optimizing shipping efficiency

- For instance, companies such as DS Smith have developed molded fiber inserts for high-value electronics that ensure safe transit while reducing plastic usage. Such solutions help maintain product integrity and brand reputation, particularly in sectors where fragile shipments are common

- Rising cross-border shipments of consumer electronics, personal care products, and premium goods are driving the adoption of innovative cushioning solutions that can absorb shocks, vibrations, and impacts during handling and logistics. Packaging inserts and cushions are becoming indispensable in maintaining product quality throughout the supply chain

- The e-commerce boom is also prompting investments in automated and scalable packaging solutions, which integrate custom inserts to enhance operational efficiency and reduce damages. This reliance on high-performance cushioning is positioning the market as a critical enabler for secure and efficient product distribution

- Growing consumer expectations for safe and intact deliveries are further reinforcing the importance of advanced packaging inserts, particularly for electronics and high-value items. Companies providing durable and adaptable cushioning solutions are benefiting from expanding opportunities across global logistics and e-commerce networks

Restraint/Challenge

High Cost of Advanced and Custom Packaging Solutions

- The market faces challenges due to the high cost of producing advanced, customizable, and sustainable packaging inserts and cushions, which often require specialized materials, precision molding, and innovative design processes. These factors can limit adoption, particularly among smaller manufacturers or companies with tight cost constraints

- For instance, high-performance molded fiber inserts and 100 % recyclable solutions from companies such as Pregis LLC and DS Smith involve more expensive raw materials and production techniques compared to traditional foam inserts, impacting overall cost structures

- Meeting both protective and environmental requirements adds complexity to manufacturing, including sourcing recyclable or biodegradable materials, ensuring sufficient cushioning properties, and complying with industry-specific regulations. These requirements increase capital investment, operational expenses, and production timelines

- The market continues to face pressure in balancing performance, cost efficiency, and sustainability, especially as demand grows for custom-fit inserts for fragile or high-value products. High upfront costs can act as a barrier for adoption despite strong interest in sustainable packaging

- Scaling production of advanced inserts without compromising quality or increasing unit costs remains a critical challenge for manufacturers seeking to expand in e-commerce, electronics, and personal care sectors. This challenge underscores the need for ongoing innovation in cost-effective, sustainable cushioning solutions while maintaining high performance standards

Packaging Inserts and Cushions Market Scope

The market is segmented on the basis of product type, material type, and end-use industry.

- By Product Type

On the basis of product type, the packaging inserts and cushions market is segmented into foam packaging and rigid packaging. The foam packaging segment dominated the market with the largest revenue share of 58.5% in 2025, driven by its superior shock absorption, lightweight nature, and cost-effectiveness. Foam packaging is widely preferred across industries for protecting fragile products during transportation and storage. Its adaptability to various shapes and sizes, along with the availability of custom-designed inserts, enhances its application across electronics, personal care, and e-commerce sectors. In addition, foam packaging offers recyclability and reusability options, supporting sustainability initiatives adopted by manufacturers. The segment also benefits from innovations in high-resilience and environmentally friendly foams, further strengthening its dominance in the market.

The rigid packaging segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand in high-value electronics and luxury goods packaging. Rigid packaging offers enhanced structural integrity and superior product protection, making it suitable for premium and sensitive items. For instance, companies such as Sealed Air are developing rigid packaging solutions with integrated cushioning for fragile electronics and glassware. The rising preference for reusable and display-ready packaging also contributes to the growing adoption of rigid packaging in retail and e-commerce channels. Businesses are increasingly opting for rigid inserts to combine protection with aesthetic appeal, driving their accelerated market growth.

- By Material Type

On the basis of material type, the market is segmented into expanded polystyrene (EPS), expanded polyethylene (EPE), expanded polypropylene (EPP), paper and paperboard, and others. The EPS segment dominated the market in 2025 due to its high cushioning properties, lightweight design, and cost efficiency for mass shipments. EPS inserts provide excellent protection for delicate items during transportation, making them a standard choice in electronics and appliance packaging. For instance, manufacturers in the personal care sector use EPS inserts for fragile cosmetic containers to reduce breakage and maintain product presentation. The ease of molding and customization further enhances EPS adoption, enabling tailored protection for diverse product dimensions. In addition, EPS offers resistance to moisture and thermal variations, supporting supply chain reliability. The material’s long-standing availability and proven effectiveness in protecting goods maintain its leading position in the market.

The EPE segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its flexibility, lightweight structure, and superior shock absorption. EPE is increasingly used in electronics, e-commerce, and personal care sectors for protective packaging requiring resilience against repeated impacts. For instance, companies such as Pregis offer EPE sheets and molded inserts for high-value shipments that require both cushioning and lightweight properties. Its eco-friendly variants and compatibility with automated packaging lines further accelerate adoption. Businesses are focusing on reducing shipping costs while ensuring product safety, positioning EPE as a high-growth material segment in the market.

- By End Use Industry

On the basis of end use industry, the packaging inserts and cushions market is segmented into electronics, personal care, e-commerce, and others. The electronics segment dominated the market in 2025, driven by the need for superior protection of high-value devices such as smartphones, laptops, and home appliances. Electronics manufacturers rely heavily on foam and rigid inserts to prevent damage during shipping, handling, and storage. For instance, companies such as Samsung and Apple use custom-designed packaging inserts to ensure product safety and maintain brand reputation. The increasing complexity of electronic devices, combined with rising e-commerce sales, further reinforces demand for specialized protective packaging solutions. The segment benefits from the integration of advanced materials and design innovations that provide enhanced cushioning and shock resistance. Electronics remain a primary revenue contributor due to the continuous launch of new devices requiring robust protective solutions.

The personal care segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing global demand for premium and delicate cosmetic products that require secure transport. Personal care manufacturers are investing in custom inserts and cushioning to protect fragile bottles, jars, and glass containers during shipment and display. For instance, companies such as Amcor are developing tailored packaging solutions that combine functionality and aesthetic appeal for luxury cosmetics. Rising e-commerce sales of personal care products, along with consumer preference for visually appealing unboxing experiences, drive the adoption of protective inserts. The growth is also supported by sustainable material innovations that align with environmentally conscious packaging trends, ensuring long-term segment expansion.

Packaging Inserts and Cushions Market Regional Analysis

- Asia-Pacific dominated the packaging inserts and cushions market with the largest revenue share of over 43% in 2025, driven by expanding electronics manufacturing, rising e-commerce activities, and a strong presence of packaging material suppliers

- The region’s cost-effective production landscape, growing investments in protective packaging solutions, and increasing exports of packaged goods are accelerating market expansion

- Availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of packaging inserts and cushions across electronics, personal care, and e-commerce sectors

China Packaging Inserts and Cushions Market Insight

China held the largest share in the Asia-Pacific packaging inserts and cushions market in 2025, owing to its status as a global leader in electronics manufacturing and e-commerce logistics. The country's strong industrial base, favorable policies supporting packaging material production, and extensive export capabilities are major growth drivers. Demand is further bolstered by increasing adoption of custom and sustainable inserts for fragile and high-value goods.

India Packaging Inserts and Cushions Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the expanding e-commerce sector, rising electronics exports, and growing personal care product shipments. Government initiatives promoting domestic manufacturing and self-reliance in packaging solutions are strengthening demand. In addition, increasing awareness of product safety and sustainable packaging is contributing to robust market expansion.

Europe Packaging Inserts and Cushions Market Insight

The Europe market is expanding steadily, supported by stringent regulatory standards, high demand for sustainable and recyclable packaging materials, and growing investments in advanced protective solutions. The region emphasizes quality, environmental compliance, and material innovation, particularly in electronics and luxury personal care packaging. The rising adoption of custom inserts for fragile items is further enhancing market growth.

Germany Packaging Inserts and Cushions Market Insight

Germany’s market is driven by leadership in precision manufacturing, strong industrial base, and focus on export-oriented production. The country has well-established R&D networks and collaborations between academic institutions and packaging companies, fostering innovations in cushioning and insert solutions. Demand is particularly strong in electronics, automotive components, and high-value industrial products.

U.K. Packaging Inserts and Cushions Market Insight

The U.K. market is supported by a mature retail and e-commerce sector, increasing localization of supply chains, and rising demand for sustainable packaging. Growing R&D in custom and reusable inserts, along with industry-academia collaborations, continues to strengthen market presence. Companies are increasingly adopting advanced cushioning solutions to protect high-value and delicate products.

North America Packaging Inserts and Cushions Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand in electronics, e-commerce, and personal care sectors. Rising focus on sustainability, advanced packaging solutions, and increasing reshoring of manufacturing activities are boosting market growth. The region benefits from technological advancements and integration of protective inserts with smart packaging solutions.

U.S. Packaging Inserts and Cushions Market Insight

The U.S. accounted for the largest share in the North American market in 2025, supported by a strong electronics and e-commerce industry, extensive R&D infrastructure, and significant investment in innovative packaging solutions. The country’s focus on product safety, sustainability, and high-performance inserts is encouraging widespread adoption across industrial and consumer goods. Presence of key packaging material suppliers and a mature distribution network solidify the U.S.'s leading position in the region.

Packaging Inserts and Cushions Market Share

The packaging inserts and cushions industry is primarily led by well-established companies, including:

- Smurfit Kappa (Ireland)

- Sealed Air (U.S.)

- DS Smith (U.K.)

- Reflex Packaging Inc. (U.S.)

- Pregis LLC (U.S.)

- Sonoco Products Company (U.S.)

- Huhtamaki Oyj (Finland)

- Pro-Pac Packaging Limited (Australia)

- Plastifoam Company (U.S.)

- UFP Technologies, Inc. (U.S.)

- AFP, Inc. (U.S.)

- Atlantic Packaging (Canada)

- Packman Packaging Private Limited (India)

- Hanchett Paper Company (U.S.)

- Veritiv Corporation (U.S.)

- Airfil Protective Packaging Ltd. (U.K.)

Latest Developments in Global Packaging Inserts and Cushions Market

- In February 2025, Storopack introduced AIRfiber paper-based air cushion packaging that delivers equivalent protective performance to traditional air pillows while being fully recyclable with paper recycling streams. This innovation reduces material waste and transportation costs due to lighter packaging and supports sustainability initiatives increasingly demanded by brands and logistics providers. The launch strengthens the adoption of eco-friendly cushioning solutions in e-commerce and electronics sectors, providing businesses with a high-performance alternative to conventional plastic-based protective packaging. The move also encourages companies to align with circular economy principles, enhancing their environmental credentials while maintaining reliable product protection

- In July 2025, DS Smith unveiled a fully recyclable molded fiber insert designed specifically for high-end electronics packaging. This development responds to growing market demand for plastic-free cushioning solutions and allows electronics and e-commerce companies to reduce their reliance on traditional foam inserts. The product ensures adequate protection during transit while offering sustainability benefits, positioning it as a preferred option for environmentally conscious brands. Its adoption is expected to accelerate the shift toward biodegradable and recyclable inserts across premium product segments, supporting the market’s long-term growth and sustainability trends

- In April 2023, U.K.-based Tesco replaced conventional top wrap packs with new fresh mince pillow packs using 70 % less plastic. This initiative highlights the growing trend among retailers to reduce plastic use in protective packaging while maintaining product integrity. The lightweight, efficient pillow packs reduce environmental impact and also lower packaging and transportation costs. By adopting this solution, Tesco is influencing supplier practices and setting benchmarks for sustainable packaging in the food retail industry, which is expected to encourage wider market adoption of similar reduced-plastic packaging solutions

- In August 2022, protective packaging specialist Storapak launched an air pillow film made from 100 % recycled materials, offering the same protective properties as conventional air pillows. This innovation supports the transition to circular packaging materials, enabling companies to lower their environmental footprint without compromising cushioning performance. The product is particularly appealing to e-commerce and logistics companies that require reliable, lightweight packaging solutions while meeting sustainability targets. Its launch reflects the market’s focus on eco-friendly innovations and demonstrates the increasing value placed on recyclable protective inserts in supply chains worldwide

- In February 2022, Mondi introduced 100 % recyclable corrugated packaging solutions with integrated cushioning inserts to replace expanded polystyrene foam. The new monocorr boxes provide effective product protection while significantly improving recycling rates compared to traditional foam inserts. This development addresses environmental concerns associated with low-recycling materials and aligns with the growing regulatory and consumer focus on sustainable packaging. The solution is particularly relevant for electronics, personal care, and e-commerce sectors, helping companies reduce plastic usage while maintaining safe transport and storage of fragile products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaging Inserts And Cushions Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaging Inserts And Cushions Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaging Inserts And Cushions Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.