Global Packaging Printing Market

Market Size in USD Billion

CAGR :

%

USD

461.40 Billion

USD

700.09 Billion

2024

2032

USD

461.40 Billion

USD

700.09 Billion

2024

2032

| 2025 –2032 | |

| USD 461.40 Billion | |

| USD 700.09 Billion | |

|

|

|

|

What is the Global Packaging Printing Market Size and Growth Rate?

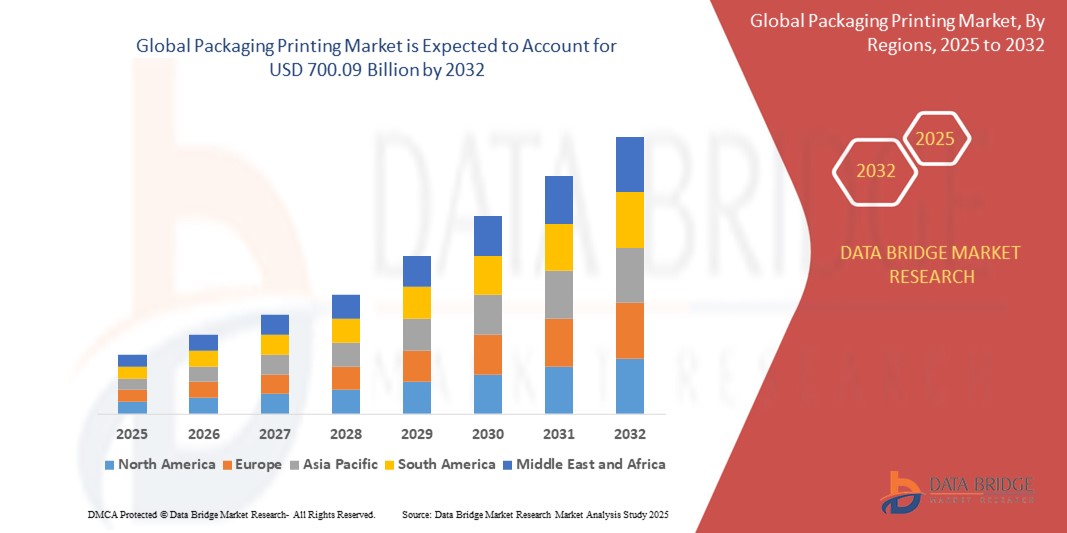

- The global packaging printing market size was valued at USD 461.40 billion in 2024 and is expected to reach USD 700.09 billion by 2032, at a CAGR of 5.35% during the forecast period

- The packaging printing market has experienced robust growth driven by the increasing demand for high-quality, attractive, and functional packaging solutions across various industries

- The rise in consumer preference for visually appealing and informative packaging has propelled advancements in printing technologies, leading to innovations such as digital printing and sustainable materials

What are the Major Takeaways of Packaging Printing Market?

- The market is influenced by the growing emphasis on sustainability, with companies seeking eco-friendly packaging solutions that minimize environmental impact

- This shift has led to a rise in the adoption of recyclable and biodegradable materials, as well as advancements in printing techniques that reduce waste and improve efficiency

- Asia-Pacific dominated the packaging printing market with the largest revenue share of 41.6% in 2024, driven by the region's expanding consumer base, rapid urbanization, and increasing demand for packaged goods across sectors such as food & beverage, pharmaceuticals, and personal care

- North America is projected to grow at the fastest CAGR of 12.8% from 2025 to 2032, driven by increasing demand for customized, short-run packaging and environmentally friendly inks

- The flexible packaging and corrugated boxes segment dominated the packaging printing market with the largest market revenue share of 33.8% in 2024, driven by its lightweight, cost-effective, and highly customizable nature

Report Scope and Packaging Printing Market Segmentation

|

Attributes |

Packaging Printing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Packaging Printing Market?

“Sustainable Inks and Eco-Friendly Printing Technologies”

- A significant trend in the global packaging printing market is the rapid shift toward bio-based inks, water-based coatings, and low-VOC solvents, as brands seek to meet sustainability mandates and reduce carbon emissions

- For example, in March 2024, HP Inc. launched a new range of water-based inks for flexible packaging, which are certified for compostability and meet stringent food safety regulations

- Increasing R&D investments are being directed toward UV-curable inks, solvent-free adhesives, and recyclable substrates, which help reduce environmental impact while maintaining high-quality output

- Leading converters are also integrating digital printing technologies that support on-demand customization, waste reduction, and energy-efficient operations

- Companies such as Mondi Group, Amcor, and Sealed Air are pioneering efforts by partnering with ink suppliers to co-develop sustainable packaging solutions that align with circular economy goals

- This trend is reshaping packaging value chains and influencing procurement policies, especially in FMCG, pharma, and e-commerce sectors, where eco-label compliance and traceability are now critical purchase criteria

What are the Key Drivers of Packaging Printing Market?

- The growing demand for visually impactful and customizable packaging across industries such as food & beverage, healthcare, and personal care is a major growth driver for the Packaging Printing market

- In January 2024, Xeikon expanded its digital label press line with eco-friendly toner technologies, enabling sustainable and cost-effective short-run production for packaging converters

- Stringent government regulations regarding packaging recyclability, labelling, and traceability are also accelerating innovation in substrates and inks, particularly in the European and North American markets

- The rise of e-commerce and direct-to-consumer brands is fueling demand for printed corrugated packaging with enhanced branding and real-time versioning

- Furthermore, the integration of smart packaging elements such as QR codes, NFC tags, and security features is boosting the need for specialized printing systems

- Advancements in automation, AI-based color calibration, and cloud-based print management are enabling converters to increase throughput, minimize errors, and reduce operational costs

Which Factor is challenging the Growth of the Packaging Printing Market?

- A key challenge facing the packaging printing market is the high cost of sustainable inks and substrates, which can strain margins for small and mid-sized converters

- In addition, inconsistent global regulations around food-contact safety, recycling standards, and eco-certifications create complexity for companies looking to scale their sustainable packaging offerings

- For instance, in 2023, the European Union introduced tighter rules on packaging recyclability and banned certain ink formulations, prompting many businesses to reformulate at higher costs

- There are also concerns around the durability and compatibility of bio-based inks with traditional printing hardware, particularly in high-speed, high-volume environments

- The capital-intensive nature of upgrading to hybrid and digital printing technologies poses a barrier for converters in emerging economies

- Addressing these challenges will require collaboration across the value chain, increased technical training, and policy standardization to ensure long-term scalability of sustainable packaging solutions

How is the Packaging Printing Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Packaging Type

On the basis of packaging type, the packaging printing market is segmented into Labels, Plastics, Glass, Metal, Paper and Paperboard, Flexible Packaging and Corrugated Boxes, Cartons, and Others. The Flexible Packaging and Corrugated Boxes segment dominated the Packaging Printing market with the largest market revenue share of 33.8% in 2024, driven by its lightweight, cost-effective, and highly customizable nature. This format is widely used in the FMCG and e-commerce sectors for primary and secondary packaging due to its ability to support vivid graphics and product protection.

The Labels segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the growing demand for smart, interactive, and regulatory-compliant labels, particularly in pharmaceuticals, food safety, and logistics tracking applications.

• By Printing Technology

On the basis of printing technology, the packaging printing market is segmented into Flexography Printing Technology, Rotogravure Printing Technology, Offset Printing Technology, Digital Printing Technology, and Screen Printing. The Flexography Printing Technology segment accounted for the largest market share of 37.6% in 2024, attributed to its high-speed operation, compatibility with diverse substrates, and cost efficiency in large-volume production. Flexography remains a preferred choice for printing on plastic films, paperboard, and corrugated materials.

The Digital Printing Technology segment is projected to register the fastest CAGR from 2025 to 2032, fueled by rising demand for short-run, on-demand, and personalized packaging. Advancements in inkjet and electrophotographic systems are also enhancing color quality and environmental performance.

• By Printing Ink

On the basis of printing ink, the packaging printing market is segmented into Solvent-Based Ink, UV-Curable Ink, Aqueous Ink, and Others. The Solvent-Based Ink segment led the market with the largest revenue share of 40.2% in 2024, due to its strong adhesion, fast drying time, and compatibility with a wide range of packaging substrates. It is heavily used in outdoor, food contact, and flexible film applications.

The UV-Curable Ink segment is expected to witness the fastest CAGR from 2025 to 2032, as it offers high print quality, energy efficiency, and zero VOC emissions. UV inks are gaining popularity in premium packaging and pharmaceutical labeling where precision and durability are essential.

• By Application

On the basis of application, the packaging printing market is segmented into Food and Beverage, Household and Cosmetic Products, Pharmaceuticals, and Others. The Food and Beverage segment dominated the market with the largest revenue share of 48.7% in 2024, driven by the surge in packaged food consumption, evolving branding needs, and regulatory requirements for product traceability and labeling. Packaging printing plays a vital role in communicating freshness, ingredients, and brand identity.

The Pharmaceuticals segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand for tamper-evident labels, serialization, and multilingual packaging. Increasing global pharmaceutical trade and stringent compliance with FDA and EU labeling laws are accelerating investments in high-precision printing technologies.

Which Region Holds the Largest Share of the Packaging Printing Maret?

- Asia-Pacific dominated the packaging printing market with the largest revenue share of 41.6% in 2024, driven by the region's expanding consumer base, rapid urbanization, and increasing demand for packaged goods across sectors such as food & beverage, pharmaceuticals, and personal care

- The region's cost-efficient manufacturing capabilities and strong presence of printing ink and substrate suppliers have created a robust supply chain, fostering high-volume production and competitive pricing

- In addition, regional growth is supported by government investments in smart packaging and the rise of e-commerce, which is amplifying the need for durable, high-quality printed packaging

China Packaging Printing Market Insight

China accounted for over 49% of Asia-Pacific’s packaging printing market share in 2024, backed by its massive packaging industry and strong export-driven economy. The growing shift toward premium printed labels and flexible packaging formats is driving demand from sectors such as electronics, cosmetics, and food services. China’s proactive stance on adopting digital and eco-friendly printing technologies, combined with increased R&D into biodegradable inks and substrates, is shaping the future of sustainable packaging solutions.

India Packaging Printing Market Insight

India is expected to record the fastest CAGR in Asia-Pacific from 2025 to 2032, fueled by rising middle-class consumption, expansion of retail chains, and increased demand for smart and tamper-proof packaging. Supportive government initiatives such as “Make in India” and rising investments in the pharmaceutical and processed food sectors are further accelerating growth. The increasing adoption of digital and flexographic printing technologies in tier-II and tier-III cities is creating new market opportunities for both domestic and international players.

Which Region Is the Fastest Growing in the Packaging Printing Market?

North America is projected to grow at the fastest CAGR of 12.8% from 2025 to 2032, driven by increasing demand for customized, short-run packaging and environmentally friendly inks. The region's strong innovation ecosystem, rising consumption of packaged health and organic food, and growth in personalized marketing strategies are pushing the use of digital and UV-curable printing methods. Moreover, stringent regulatory standards and sustainability mandates are encouraging the use of recyclable materials and low-VOC inks, especially in the pharmaceutical and food sectors.

U.S. Packaging Printing Market Insight

The U.S. contributed over 76% of North America’s market share in 2024, led by its advanced retail and e-commerce infrastructure, and high adoption of automated printing and labeling technologies. Sectors such as beverages, cosmetics, and healthcare continue to prioritize high-impact graphics, QR codes, and smart packaging, boosting demand for advanced digital printing solutions. The country is also witnessing rapid growth in sustainable packaging practices, reinforcing demand for water-based and bio-ink formulations.

Canada Packaging Printing Market Insight

Canada's packaging printing market is growing steadily due to increased investment in sustainable forestry products, artisanal food brands, and bilingual packaging requirements. The growing influence of environmental regulations and the push for eco-labeling is driving demand for compostable substrates and low-emission printing techniques. As local brands expand into global markets, demand for export-compliant, high-resolution packaging is accelerating the shift toward offset and hybrid printing technologies.

Which are the Top Companies in Packaging Printing Market?

The packaging printing industry is primarily led by well-established companies, including:

- Constantia Flexibles (Austria)

- TOPPAN Inc. (Japan)

- Duncan Print Group (U.K.)

- Belmont Packaging Ltd (U.K.)

- QUANTUM PACKAGING (U.K.)

- Mondi (U.K.)

- Sonoco Products Company (U.S.)

- Graphic Packaging International, LLC (U.S.)

- Quad/Graphics, Inc. (U.S.)

- Amcor plc (Australia)

- Quantum Packaging Store (U.K.)

- WS Packaging Group, Inc. (U.S.)

- Shree Arun Packaging Company Private Limited (India)

- Coveris (U.K.)

- Ahlstrom (Finland)

- AVERY DENNISON CORPORATION (U.S.)

- CCL Industries. (Canada)

- Smurfit Kappa (Ireland)

What are the Recent Developments in Global Packaging Printing Market?

- In November 2024, Sealed Air introduced its innovative AutoPrint on-demand digital printing system for protective packaging. This solution integrates directly into packaging lines, enabling late-stage, customized printing on sealed boxes, thereby reducing material waste, labor costs, and storage requirements. This development streamlines packaging workflows while supporting sustainable practices in packaging operations

- In June 2024, W&H revealed a revolutionary digital printing concept machine designed specifically for the flexible packaging market, set to launch in 2026. This concept blends the capabilities of digital and flexographic printing to create an efficient and adaptive solution for modern packaging demands. The innovation signifies W&H’s commitment to next-generation hybrid printing systems

- In March 2024, FUJIFILM Corporation launched its Jet Press FP790, a new water-based digital inkjet printing press designed for the flexible packaging industry. The press enables efficient, high-quality production for both food and household packaging in small-volume runs. This launch strengthens FUJIFILM’s position in the digital flexible packaging segment with a sustainable and versatile offering

- In March 2024, Flint Group released a detailed whitepaper emphasizing the role of inks and coatings in ensuring safe food packaging. The paper addresses challenges associated with food contact materials and highlights the importance of testing and high-quality ink formulations. This initiative reinforces Flint Group’s commitment to safety and compliance in packaging materials

- In September 2023, Tetra Pak announced a Custom Printing partnership with Flow Beverage Corp. and Live Nation Canada, enabling the distribution of uniquely designed alkaline spring water cartons across North America. The inkjet-based system supports customization while maintaining the eco-benefits of paper-based beverage cartons. This collaboration sets a benchmark for engaging, sustainable, and brand-enhancing packaging in the beverage industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaging Printing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaging Printing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaging Printing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.