Global Packaging Tensioner Market

Market Size in USD Million

CAGR :

%

USD

320.91 Million

USD

523.19 Million

2024

2032

USD

320.91 Million

USD

523.19 Million

2024

2032

| 2025 –2032 | |

| USD 320.91 Million | |

| USD 523.19 Million | |

|

|

|

|

Packaging Tensioner Market Size

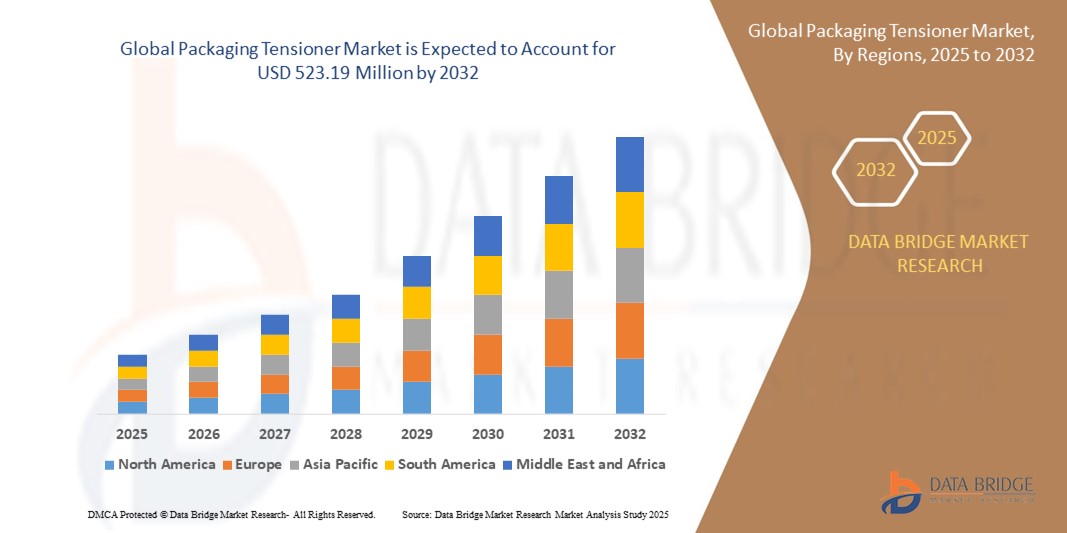

- The global packaging tensioner market size was valued at USD 320.91 million in 2024 and is expected to reach USD 523.19 million by 2032, at a CAGR of 6.3% during the forecast period

- The market growth is largely fueled by the increasing demand for secure, efficient, and ergonomic packaging solutions across industries such as logistics, automotive, and construction, where load stability and operational speed are critical. As global trade and e-commerce activities expand, businesses are investing in advanced tensioning tools to ensure safe and damage-free transportation of goods, driving the adoption of both manual and battery-powered packaging tensioners

- Furthermore, the rise in automation across warehousing and industrial packaging operations is accelerating the use of battery-operated and semi-automatic tensioners, which offer improved performance, reduced labor dependency, and enhanced safety. These factors, combined with the need for standardized, reliable packaging across supply chains, are significantly propelling market expansion

Packaging Tensioner Market Analysis

- Packaging tensioners are mechanical or battery-operated tools used to tighten strapping material around packages, pallets, or bundled goods to ensure load stability during handling and transport. These tools are critical in industries where secure, consistent packaging is essential for minimizing damage, improving logistics efficiency, and maintaining compliance with load safety regulations

- The growing preference for portable, easy-to-use, and low-maintenance packaging tools is a key driver, particularly in fast-paced sectors such as logistics and manufacturing. In addition, advancements in battery technology and tool ergonomics are enhancing performance, leading to broader adoption of battery-powered tensioners in high-volume packaging environments

- Asia-Pacific dominated the packaging tensioner market with a share of 38.93% in 2024, due to rapid industrialization, rising exports, and the presence of major manufacturing hubs across sectors such as automotive, electronics, and consumer goods

- North America is expected to be the fastest growing region in the packaging tensioner market during the forecast period due to a strong focus on automation, packaging efficiency, and supply chain optimization

- Manual segment dominated the market with a market share of 58.8% in 2024, due to its affordability, portability, and simplicity of use, especially in small-scale operations. These tools are ideal for businesses that require moderate packaging tasks without significant investment in automation. Manual tensioners are also preferred in remote or mobile settings where electric charging or battery replacement is impractical. Their ease of maintenance and low failure rate contribute to continued dominance in cost-sensitive industries

Report Scope and Packaging Tensioner Market Segmentation

|

Attributes |

Packaging Tensioner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaging Tensioner Market Trends

Rising Adoption of Battery-Powered and Ergonomically Designed Tensioners

- There is rapid growth in the adoption of battery-powered and ergonomically designed packaging tensioners, as industries seek faster, safer, and more efficient packaging tools to meet high-volume operational demands, particularly in logistics, e-commerce, and manufacturing

- For instance, companies such as Signode Industrial Group, FROMM Packaging Systems, and Mosca GmbH have launched advanced battery-operated tensioners with lightweight lithium-ion batteries, auto-locking mechanisms, adjustable torque, and ergonomic grips that reduce operator fatigue and minimize manual errors

- IoT-enabled tensioners—with features such as Bluetooth connectivity, remote monitoring, and real-time tension adjustment—are becoming more prevalent, supporting smart packaging and Industry 4.0 initiatives

- The push for automation is leading to design innovations such as compact, easily integrable, modular systems that allow plug-and-play use and minimal physical exertion

- Ongoing R&D is producing tensioners with enhanced safety features, such as anti-fatigue measures, safety interlocks, and tools designed to reduce risk of repetitive strain injuries

- Sustainability is influencing material choices and the development of energy-efficient, recyclable, or solar-powered tensioners, which align with green packaging practices in modern supply chains

Packaging Tensioner Market Dynamics

Driver

Growing Pharmaceutical Packaging Requirements

- Increasing regulatory scrutiny, product integrity standards, and anti-counterfeiting needs in the pharmaceutical industry are intensifying demand for specialized tensioners, which ensure packages are securely strapped and tamper-evident throughout supply chains

- For instance, the rise in pharmaceutical production—highlighted by ongoing expansions and strict GMP compliance in Europe and North America—is driving extensive adoption of precision tensioning tools capable of delicate yet robust sealing for sensitive medical products

- The need to maintain product safety and quality during shipment and storage, especially for temperature-sensitive or high-value pharmaceuticals, places a premium on high-performance tensioners that meet rigorous standards

- Packaging tensioners are critical for the prevention of pilferage, damage, and non-compliance in regulated industries, directly impacting market demand as pharmaceutical packaging volumes surge globally

- Evolving healthcare logistics, with growing cold chain and specialty pharma needs, requires next-generation tensioners able to adapt quickly to different packaging formats and regulatory changes

Restraint/Challenge

Availability of Alternatives

- The widespread availability of alternative packaging solutions, such as heat-sealing, adhesive-based closures, shrink-wrapping, and newer bio-based or compostable bands, can limit the adoption of packaging tensioners, especially where cost or flexibility is prioritized over maximum security

- For instance, industries with less stringent transit requirements may find glue, tape, or wrap systems sufficient and more economical, reducing reliance on tensioners for certain applications, while smaller businesses may opt for manual or semi-automated systems to control costs

- Rising environmental concerns about plastic strapping and the regulatory push for biodegradable or reusable materials can also divert demand toward alternative packaging technologies

- Initial investment and maintenance costs for advanced automated or battery-powered tensioners may be prohibitive for SMEs compared to lower-cost alternatives

- Compatibility and customization issues—where some packaging forms are not suitable for tensioning—pose practical limits to market penetration, particularly as companies seek versatile or universal solutions for diverse product lines

Packaging Tensioner Market Scope

The market is segmented on the basis of material, operation, and end-user.

- By Material

On the basis of material, the packaging tensioner market is segmented into plastic, polyester, polypropylene, metal, steel, and aluminum. The steel segment dominated the largest revenue share in 2024 due to its unmatched strength, resistance to deformation, and ability to handle high-tension loads. It is extensively used in demanding applications such as industrial packaging, heavy machinery, and construction materials where load security is non-negotiable. Steel tensioners are also favored for their long service life and compatibility with high-tensile steel straps, offering unmatched performance under extreme conditions.

The plastic segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by its lightweight nature, low cost, and ease of handling. Plastic tensioners are increasingly adopted in sectors such as food & beverages, pharmaceuticals, and homecare where loads are lighter and hygiene is crucial. Their corrosion resistance, flexibility, and compatibility with synthetic strapping materials such as polypropylene and polyester make them ideal for disposable and short-cycle packaging operations.

- By Operation

On the basis of operation, the market is segmented into manual and battery-operated tensioners. The manual segment held the highest revenue share of 58.8% in 2024 due to its affordability, portability, and simplicity of use, especially in small-scale operations. These tools are ideal for businesses that require moderate packaging tasks without significant investment in automation. Manual tensioners are also preferred in remote or mobile settings where electric charging or battery replacement is impractical. Their ease of maintenance and low failure rate contribute to continued dominance in cost-sensitive industries.

The battery-operated segment is expected to register the fastest growth from 2025 to 2032, driven by the rising need for productivity and ergonomic efficiency in large-scale packaging environments. Battery-operated tensioners enable faster, more consistent tensioning and sealing, reducing operator fatigue and error. As supply chain operations scale, these tools become essential for improving throughput and meeting tight timelines. Enhanced battery life, digital interfaces, and programmable tension settings further support adoption in automotive, logistics, and manufacturing sectors.

- By End-User

On the basis of end-user, the packaging tensioner market is categorized into food & beverages, pharmaceuticals, chemicals, building & construction, agriculture, automotive, logistics & transportation, homecare, and others. The logistics & transportation segment led the market in 2024, backed by increased global shipping activities and the need for secure strapping during long-distance transit. Packaging tensioners are critical in ensuring load stability, preventing shifting, and protecting cargo integrity, especially for palletized goods. Their role becomes even more important with the surge in e-commerce and third-party logistics services across global markets.

The automotive segment is projected to experience the fastest growth rate from 2025 to 2032, as the industry relies on safe and efficient packaging for bulky components, engines, and spare parts. High-value automotive parts require strong, vibration-resistant strapping solutions, where tensioners play a key role in ensuring safety and compliance. Growing international trade of auto parts and rising investments in electric vehicle production are also pushing manufacturers to adopt advanced tensioning tools for optimized packaging efficiency.

Packaging Tensioner Market Regional Analysis

- Asia-Pacific dominated the packaging tensioner market with the largest revenue share of 38.93% in 2024, driven by rapid industrialization, rising exports, and the presence of major manufacturing hubs across sectors such as automotive, electronics, and consumer goods

- The region’s growing logistics and warehousing activities, increasing adoption of modern packaging technologies, and the expansion of e-commerce platforms are fueling demand for tensioning tools and systems

- Government investments in infrastructure development, coupled with rising adoption of automation in packaging operations, are significantly accelerating market expansion across emerging economies in Asia-Pacific

China Packaging Tensioner Market Insight

China held the largest share in the Asia-Pacific packaging tensioner market in 2024, owing to its dominance in manufacturing and export-led logistics. With strong industrial output and high-volume packaging requirements across automotive, electronics, and chemicals, demand for tensioners continues to surge. The government's support for industrial automation, along with an established base of domestic tool manufacturers, further boosts market penetration across both heavy and light packaging applications.

India Packaging Tensioner Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing adoption of efficient packaging solutions in agriculture, building & construction, and FMCG sectors. The rapid expansion of the e-commerce sector, along with rising investments in logistics infrastructure and warehouse automation, is boosting demand for tensioners. The government's "Make in India" initiative and emphasis on modernizing industrial processes are further propelling market growth.

Europe Packaging Tensioner Market Insight

The Europe packaging tensioner market is expanding steadily, supported by stringent packaging standards, high demand for automation, and growing sustainability-focused initiatives. Industries such as food & beverages, automotive, and pharmaceuticals are adopting advanced tensioning tools to ensure safe, consistent, and eco-friendly packaging. Emphasis on reducing packaging waste and increasing operational efficiency is driving the shift toward battery-operated and ergonomic tensioners.

Germany Packaging Tensioner Market Insight

Germany’s market is driven by its strong industrial sector, focus on precision packaging, and advanced manufacturing technologies. The presence of major automotive and machinery exporters necessitates secure and reliable packaging systems, where high-performance tensioners are crucial. Germany’s leadership in packaging innovation and its focus on automated solutions further stimulate product adoption across industrial and logistics chains.

U.K. Packaging Tensioner Market Insight

The U.K. market benefits from a mature logistics and retail ecosystem, increased domestic manufacturing post-Brexit, and growing investment in smart packaging solutions. The country’s food & beverage and pharmaceutical sectors contribute significantly to demand for efficient tensioning tools. In addition, the adoption of lightweight, easy-to-operate battery tools in mid-sized packaging operations is supporting market growth.

North America Packaging Tensioner Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by a strong focus on automation, packaging efficiency, and supply chain optimization. The surge in e-commerce fulfillment centers, coupled with labor cost concerns, is increasing the uptake of battery-operated and semi-automatic tensioners. The region’s emphasis on operational safety and compliance with load-securing standards also supports the demand for high-precision packaging tools.

U.S. Packaging Tensioner Market Insight

The U.S. accounted for the largest share in the North America packaging tensioner market in 2024, supported by its extensive logistics infrastructure, high volume of packaged goods, and leadership in industrial automation. The growing need for durable, ergonomic, and high-speed packaging solutions in industries such as automotive, agriculture, and pharmaceuticals is driving market growth. Strong presence of global tool manufacturers and advanced warehousing capabilities further reinforce the U.S.’s market dominance.

Packaging Tensioner Market Share

The packaging tensioner industry is primarily led by well-established companies, including:

- FROMM Packaging Systems (Switzerland)

- Dynaric, Inc. (U.S.)

- North Shore Strapping Inc. (Canada)

- Samuel Packaging Systems Group (Canada)

- Transpak Equipment Corp (Taiwan)

- Tiger Pack, Inc. (U.S.)

- Venus Hartung Pty Ltd. (Australia)

- Wenzhou Zhenda Packing Machine Co., Ltd. (China)

- Sal-Tech Easy Packaging (Denmark)

- Yang Bey Industrial Co., Ltd. (Taiwan)

- Signode India (India)

- ASN Packaging Private Limited (India)

- Mandsorwala Packaging (India)

- KGN Enterprises (India)

- Sai Packaging Industries (India)

- TITAN Umreifungstechnik GmbH and Co. KG (Germany)

- Polychem Corp. (U.S.)

- Teknika Strapping Systems (U.S.)

- Vijay Enterprise (India)

Latest Developments in Global Packaging Tensioner Market

- In August 2024, Samuel Packaging Systems Group completed the acquisition of select assets from Transpak Equipment Corp., aiming to strengthen its product portfolio and service capabilities across North America. This strategic move allows Samuel to expand its offerings in both manual and automated tensioning systems, enhance its customer base, and address increasing demand in key sectors such as automotive, logistics, and building materials. The acquisition reflects Samuel’s ongoing commitment to growth through consolidation and innovation in protective packaging technologies

- In June 2024, FROMM Packaging Systems introduced an upgraded version of its P331 battery-powered tensioning tool, integrating brushless motor technology and adjustable tension settings for superior control and performance. Supporting PET strapping up to 32mm, the new model offers improved durability and user-friendliness, making it ideal for heavy-duty packaging environments. This development emphasizes FROMM’s continued focus on delivering robust, efficient, and maintenance-friendly tools for industrial strapping applications

- In May 2024, Cyklop International launched the CMT 260, a lightweight and compact battery-operated tensioning tool tailored for medium-duty packaging tasks. Compatible with 12mm to 19mm PET and PP strapping, the tool offers simplified operation, reduced physical strain, and enhanced mobility, making it ideal for warehouse, distribution, and light industrial use. This launch supports Cyklop’s strategy to meet rising demand for portable and user-friendly strapping solutions in decentralized packaging environments

- In March 2024, Orgapack, a division of Signode, launched the OR-T 260, a next-generation battery-powered strapping tool designed for automatic and semi-automatic use. The tool features an intuitive touchscreen interface, ergonomic design, and seamless functionality for mid- to heavy-duty packaging. With this launch, Orgapack aims to strengthen its foothold in industries prioritizing efficiency, precision, and modernized packaging workflows

- In February 2024, Signode, a leading global manufacturer of protective packaging systems, introduced the BXT3, a high-performance battery-powered hand strapping tool capable of handling plastic strapping widths from 9mm to 32mm. The BXT3 combines speed, ergonomic handling, and digital controls, enabling faster strapping cycles and improved reliability. This launch reinforces Signode’s leadership in industrial packaging automation and its focus on user-centered tool design

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Packaging Tensioner Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Packaging Tensioner Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Packaging Tensioner Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.