Global Pad Mounted Switch Gear Market

Market Size in USD Billion

CAGR :

%

USD

5.88 Billion

USD

8.76 Billion

2024

2032

USD

5.88 Billion

USD

8.76 Billion

2024

2032

| 2025 –2032 | |

| USD 5.88 Billion | |

| USD 8.76 Billion | |

|

|

|

|

Pad Mounted Switch Gear Market Size

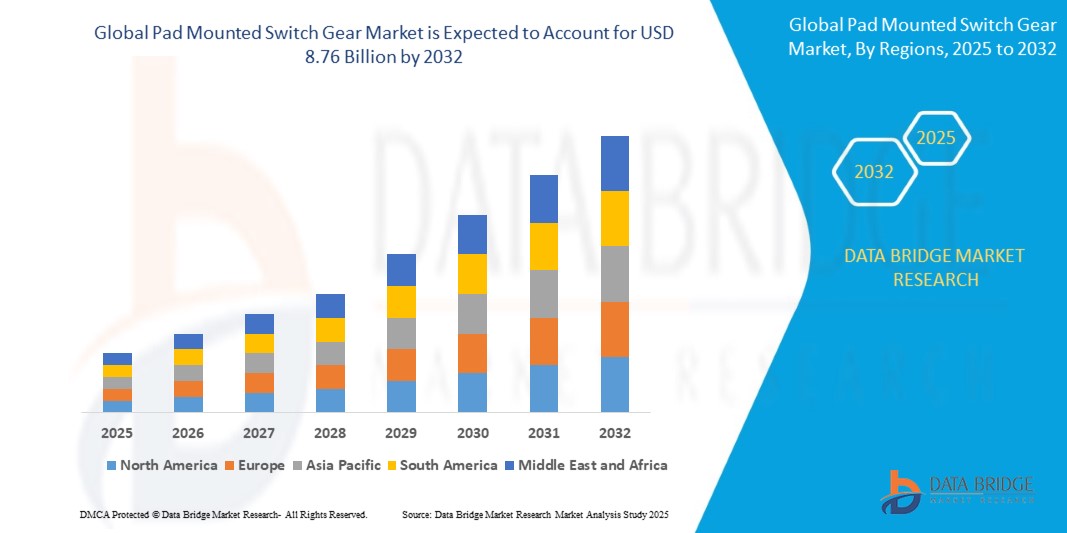

- The global pad mounted switch gear market size was valued at USD 5.88 billion in 2024 and is expected to reach USD 8.76 billion by 2032, at a CAGR of 5.1% during the forecast period

- The Pad Mounted Switch Gear market is primarily driven by the increasing need for reliable, efficient, and safe power distribution solutions across urban and industrial sectors, supporting the modernization of electrical grids and industrial automation initiatives

- Furthermore, rising investments in renewable energy projects, smart grid implementations, and infrastructure upgrades are boosting demand for advanced pad-mounted switchgear with features such as compact design, enhanced safety, and remote monitoring capabilities, accelerating market growth

Pad Mounted Switch Gear Market Analysis

- Pad Mounted Switch Gear consists of fully enclosed, grounded electrical distribution units installed outdoors to house transformers, switches, and protection devices, providing safe and efficient voltage regulation for residential, commercial, and industrial applications

- The market expansion is fueled by growing urbanization, increased electricity consumption, and the push for grid modernization, which drive the adoption of pad-mounted switchgear solutions offering enhanced reliability, low maintenance, and improved operational efficiency

- Europe dominated the pad mounted switch gear market with a share of 37.4% in 2024, due to increasing investments in grid modernization, renewable energy integration, and stringent safety and regulatory standards

- Asia-Pacific is expected to be the fastest growing region in the pad mounted switch gear market during the forecast period due to rapid urbanization, industrialization, and rising electricity demand in countries such as China, India, and Japan

- Industrial segment dominated the market with a market share of 59.5% in 2024, due to the high demand for reliable power distribution systems in manufacturing plants, heavy industries, and processing facilities. Industrial users prioritize pad mounted switchgear for its ability to handle high loads, withstand harsh operating conditions, and ensure operational continuity, which is critical for maintaining production efficiency. The market is further supported by growing industrialization and the need for modernization of aging electrical infrastructure

Report Scope and Pad Mounted Switch Gear Market Segmentation

|

Attributes |

Pad Mounted Switch Gear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Pad Mounted Switch Gear Market Trends

Rising Focus on Grid Modernization

- The increasing focus on modernizing aging electrical infrastructure is driving greater deployment of pad mounted switchgear as utilities seek advanced solutions to ensure grid reliability, efficiency, and resilience. With rising energy demand and distributed power generation, pad mounted switchgear is playing a critical role in controlling and protecting power distribution systems

- For instance, ABB has enhanced its pad mounted switchgear offerings with smart grid-ready designs that integrate monitoring and automation capabilities. These solutions are being adopted by utilities looking to improve remote management, fault detection, and service continuity in expanding urban and industrial areas

- The rapid integration of renewable energy sources such as wind and solar into distribution networks is accelerating the need for equipment that can handle variable loads and ensure operational stability. Pad mounted switchgear is increasingly being deployed to improve grid connectivity and effectively manage distributed energy resources

- The expansion of underground distribution networks, particularly in urban areas, is further supporting the demand for pad mounted switchgear. Unlike overhead systems, underground cable networks require compact, efficient, and safe switching solutions that fit seamlessly into constrained urban infrastructure

- In addition, technological advancements in switchgear design such as vacuum insulation, SF6-free alternatives, and digital monitoring systems are reshaping the market. These innovations align with sustainability targets and regulatory compliance related to safety and greenhouse gas mitigation

- The rising demand for reliable electricity supply in critical infrastructural applications such as hospitals, data centers, and transportation systems is creating a growing market for advanced pad mounted switchgear. These facilities require high-performance solutions to protect against outages and ensure business continuity

Pad Mounted Switch Gear Market Dynamics

Driver

Increasing Urbanization and Industrialization

- The rapid pace of urbanization and industrial growth is significantly driving electricity demand, placing increasing importance on secure and efficient power distribution systems. Pad mounted switchgear plays a critical role in addressing these needs across residential, commercial, and industrial applications

- For instance, Eaton Corporation has expanded its pad mounted switchgear solutions catering to the needs of rapidly urbanizing regions in Asia-Pacific, providing compact and reliable designs suited for high-density environments with limited space availability. This adoption highlights how key manufacturers are aligning with infrastructure growth trends worldwide

- The expansion of manufacturing activities and industrial hubs requires robust and efficient power distribution to minimize downtime and ensure optimal operations. Pad mounted switchgear offers reliable fault isolation and load management solutions that cater to these growing requirements

- In addition, construction activity and infrastructure development in emerging economies are accelerating demand for efficient grid distribution. Governments are emphasizing construction of smart cities and industrial parks where safe underground power systems magnify the role of pad mounted switchgear

- The continuous shift toward automation within industrial plants is also reinforcing demand for reliable distribution systems. With higher loads and the need for consistent uptime, industries are investing in advanced pad mounted switchgear that integrates seamlessly into modernized power networks

Restraint/Challenge

High Initial Investment

- Despite technological advancements and scalability, the high upfront cost of pad mounted switchgear remains a key barrier to market penetration, especially for small-scale utilities and developing economies. Investments in advanced switchgear and supporting hardware can be substantial, impacting affordability

- For instance, smaller utility providers often find it financially challenging to adopt advanced pad mounted switchgear offered by global leaders such as ABB and Eaton due to high upfront acquisition and installation costs, despite the long-term benefits of efficiency and reliability

- The initial investment also includes costly ancillary requirements such as installation in underground networks, training for operators, and integration with monitoring software, making the adoption even more capital intensive

- In addition, public utilities and government-funded projects in developing regions often face budget constraints, which slow down modernization initiatives despite growing electricity demand. This delays adoption of newer switchgear installations

- The risk perception of high-cost infrastructure investment creates hesitancy among some buyers, particularly when regulatory policies or demand forecasts do not ensure immediate returns, further restraining widespread adoption of pad mounted switchgear solutions

Pad Mounted Switch Gear Market Scope

The market is segmented on the basis of type, application, voltage rating, insulation, and end-user.

• By Type

On the basis of type, the pad mounted switchgear market is segmented into SF6, solid dielectric, and vacuum. The SF6 segment dominated the largest market revenue share in 2024, driven by its high reliability, compact design, and superior insulation properties. SF6 switchgear is widely preferred for its capability to handle high voltage applications while ensuring minimal maintenance and long service life. Utilities and industrial operators often prioritize SF6 solutions for their proven performance in harsh environmental conditions and integration ease with existing distribution networks. Moreover, regulatory compliance and enhanced safety features further boost demand for SF6-based switchgear.

The solid dielectric segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing emphasis on environmentally friendly alternatives to SF6 gas. Solid dielectric switchgear offers reduced environmental impact, lower maintenance requirements, and higher flexibility in installation, making it suitable for urban and commercial power distribution. The growing trend toward sustainable energy infrastructure and government incentives for green technologies are expected to accelerate adoption of solid dielectric switchgear.

• By Application

On the basis of application, the pad mounted switchgear market is segmented into industrial, commercial, and residential. The industrial segment held the largest market revenue share of 59.5% in 2024, driven by the high demand for reliable power distribution systems in manufacturing plants, heavy industries, and processing facilities. Industrial users prioritize pad mounted switchgear for its ability to handle high loads, withstand harsh operating conditions, and ensure operational continuity, which is critical for maintaining production efficiency. The market is further supported by growing industrialization and the need for modernization of aging electrical infrastructure.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid expansion in office complexes, retail spaces, and commercial centers. Commercial establishments favor pad mounted switchgear for its compact footprint, safety features, and adaptability to smart building power management systems. Rising urbanization and investments in infrastructure development are likely to further drive adoption of switchgear solutions in commercial applications.

• By Voltage Rating

On the basis of voltage rating, the pad mounted switchgear market is segmented into 0–15 kV, 16–25 kV, and above 25 kV. The 16–25 kV segment dominated the largest market revenue share in 2024, driven by its suitability for medium-voltage distribution networks that are widely used in utilities and industrial sectors. These switchgear solutions offer a balanced combination of performance, reliability, and safety for regional and urban power grids. Operators often prefer this voltage range for its ability to maintain stable power supply and reduce downtime in distribution networks.

The above 25 kV segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-capacity transmission systems in industrial hubs and large urban developments. Higher voltage switchgear enables efficient long-distance power distribution, minimizes losses, and supports the growing electricity demand from expanding commercial and industrial establishments. Technological advancements and modular designs are expected to further accelerate adoption in this segment.

• By Insulation

On the basis of insulation, the pad mounted switchgear market is segmented into indoor and outdoor. The outdoor segment dominated the largest market revenue share in 2024, driven by its ability to withstand extreme weather conditions while providing secure and reliable power distribution. Outdoor switchgear is commonly deployed in urban and suburban networks where space constraints and environmental exposure are key considerations. Operators also value outdoor solutions for their ease of installation, low maintenance, and scalability to meet future power distribution needs.

The indoor segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of compact, modular switchgear for commercial and residential buildings. Indoor installations benefit from enhanced protection, reduced environmental exposure, and integration with intelligent power monitoring systems. The trend toward urban high-rise developments and smart building infrastructures is likely to accelerate demand for indoor pad mounted switchgear.

• By End-User

On the basis of end-user, the pad mounted switchgear market is segmented into utilities, industrial, and commercial & residential. The utilities segment dominated the largest market revenue share in 2024, driven by the critical role of switchgear in ensuring uninterrupted electricity supply across transmission and distribution networks. Utility companies prioritize reliability, safety, and compliance with grid standards, which makes pad mounted switchgear an essential component for medium- and high-voltage distribution systems. Increasing investments in grid modernization and network expansion further support demand in this segment.

The commercial & residential segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising urbanization, increasing electricity consumption, and growing demand for reliable and safe power distribution in apartments, office complexes, and commercial spaces. Compact, modular, and user-friendly switchgear solutions are driving adoption in this segment, alongside growing awareness of energy efficiency and smart grid integration.

Pad Mounted Switch Gear Market Regional Analysis

- Europe dominated the pad mounted switch gear market with the largest revenue share of 37.4% in 2024, driven by increasing investments in grid modernization, renewable energy integration, and stringent safety and regulatory standards

- Utilities and industrial operators in the region prioritize reliable, compact, and environmentally compliant switchgear solutions, supporting widespread adoption across urban and suburban distribution networks

- The growing need for efficient power distribution, coupled with technological advancements in SF6 alternatives and smart monitoring solutions, is establishing pad mounted switchgear as a preferred choice for both new installations and upgrades of existing infrastructure

Germany Pad Mounted Switchgear Market Insight

The Germany market captured the largest share in Europe in 2024, fueled by high industrial activity, government incentives for sustainable power infrastructure, and stringent safety regulations. Operators are increasingly adopting advanced switchgear technologies to enhance grid reliability, reduce downtime, and integrate renewable energy sources. Germany’s focus on innovation, energy efficiency, and infrastructure modernization is driving demand across industrial, commercial, and utility segments.

U.K. Pad Mounted Switchgear Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, driven by rapid urbanization, smart city initiatives, and increasing industrial electricity demand. Utilities and commercial establishments are favoring modular, compact switchgear solutions for efficient power distribution, lower maintenance requirements, and improved safety. The adoption of environmentally friendly insulation technologies, such as solid dielectric, further supports market growth.

North America Pad Mounted Switchgear Market Insight

The North American market is projected to expand steadily, driven by infrastructure upgrades, smart grid deployment, and rising demand for reliable medium-voltage distribution systems. The U.S. remains the largest contributor within the region, fueled by investments in industrial power distribution, renewable energy integration, and modernization of aging networks. Technologically advanced switchgear solutions with remote monitoring capabilities are increasingly being deployed across utilities and commercial sectors.

Asia-Pacific Pad Mounted Switchgear Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, industrialization, and rising electricity demand in countries such as China, India, and Japan. Expanding industrial hubs, government initiatives promoting smart grids, and increasing investments in renewable energy are fueling adoption. The region is also witnessing a surge in demand for compact, modular, and cost-effective switchgear solutions to support growing residential, commercial, and industrial power distribution needs.

China Pad Mounted Switchgear Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, driven by massive urban development, growing industrial capacity, and aggressive grid expansion programs. The country is witnessing increasing adoption of SF6 and solid dielectric switchgear solutions due to their reliability, safety, and suitability for high-voltage distribution networks. Government policies supporting smart grid deployment and modernization of power infrastructure further accelerate market growth.

Japan Pad Mounted Switchgear Market Insight

The Japan market is gaining momentum due to rising demand for industrial automation, renewable energy integration, and reliable power distribution in urban and commercial sectors. Operators are focusing on compact and efficient switchgear solutions that minimize maintenance while supporting smart grid applications. Increasing emphasis on safety, environmental compliance, and technological advancements in insulation and monitoring systems is expected to drive continued adoption in the country.

Pad Mounted Switch Gear Market Share

The pad mounted switch gear industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Eaton (Ireland)

- Schneider Electric (France)

- Siemens AG (Germany)

- General Electric (U.S.)

- Hubbell Incorporated (U.S.)

- S&C Electric Company (U.S.)

- Federal Pacific (U.S.)

- G&W Electric (U.S.)

- ERMCO (U.S.)

- Wilson Power Solutions (U.K.)

- NOJA Power (Australia)

- L&T Electrical & Automation (India)

- C&S Electric Limited (India)

- Entec Electric & Electronic Co., Ltd. (South Korea)

Latest Developments in Global Pad Mounted Switch Gear Market

- In March 2024, ABB Ltd. introduced a new generation of pad-mounted switchgear equipped with advanced monitoring and diagnostic capabilities. This development significantly enhances the operational efficiency and reliability of electrical distribution networks by enabling utilities and industrial users to remotely track the performance and condition of their switchgear assets. The integration of intelligent monitoring tools supports predictive maintenance, reduces downtime, and improves overall asset management, thereby strengthening ABB’s competitive position in the pad-mounted switchgear market

- In October 2022, Schneider Electric launched a next-generation solid dielectric pad-mounted switchgear solution designed for outdoor applications. The innovative modular design and advanced insulation materials improve reliability, safety, and ease of installation, making it particularly appealing for utilities and industrial operators seeking sustainable and low-maintenance solutions. This launch reinforces Schneider Electric’s focus on environmentally friendly switchgear technologies while expanding its presence in the medium-voltage distribution segment

- In March 2023, S&C Electric Company expanded its U.S. manufacturing footprint with a 275,000-square-foot facility in Palatine, Illinois, enhancing its capacity to produce pad-mounted switchgear and related distribution equipment. This expansion allows the company to meet growing domestic and regional demand more efficiently, strengthens its supply chain, and positions S&C Electric as a leading provider of reliable, resilient power distribution solutions in North America

- In July 2021, Siemens Energy introduced a compact, eco-friendly vacuum-insulated pad-mounted switchgear solution targeting urban and industrial distribution networks. The product features reduced SF6 emissions and a modular configuration, offering enhanced safety, space efficiency, and environmental compliance. This launch supports Siemens Energy’s strategy to provide sustainable, high-performance switchgear solutions and is expected to accelerate adoption in both new installations and infrastructure upgrade projects globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pad Mounted Switch Gear Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pad Mounted Switch Gear Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pad Mounted Switch Gear Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.