Global Paint Bucket Market

Market Size in USD Billion

CAGR :

%

USD

26.37 Billion

USD

38.37 Billion

2024

2032

USD

26.37 Billion

USD

38.37 Billion

2024

2032

| 2025 –2032 | |

| USD 26.37 Billion | |

| USD 38.37 Billion | |

|

|

|

|

Paint Bucket Market Size

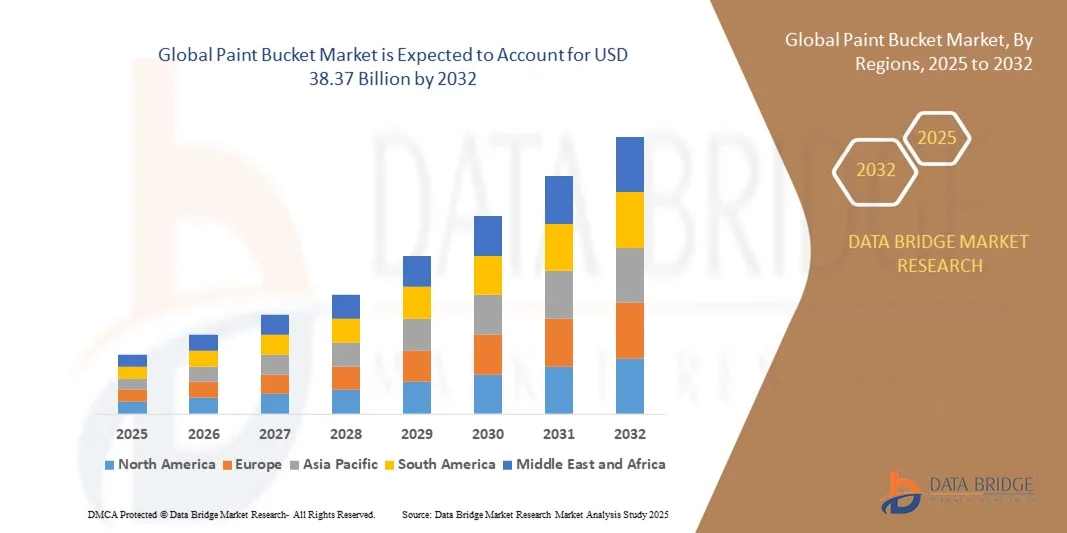

- The global paint bucket market size was valued at USD 26.37 billion in 2024 and is expected to reach USD 38.37 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by increasing construction activities, rapid urbanization, and expanding industrial and commercial projects, driving higher demand for paint and associated storage solutions such as paint buckets

- Furthermore, rising consumer and industrial preference for durable, easy-to-handle, and reusable paint buckets is establishing them as the standard packaging solution for residential, commercial, and industrial coatings. These converging factors are accelerating the adoption of high-quality paint buckets, thereby significantly boosting the industry's growth

Paint Bucket Market Analysis

- Paint buckets, serving as essential packaging for paints and coatings, are increasingly vital for ensuring safe storage, transportation, and application in residential, commercial, and industrial settings due to their durability, leak-proof design, and ease of handling

- The escalating demand for paint buckets is primarily fueled by growth in construction, renovations, DIY activities, and industrial coating applications, along with rising awareness about packaging sustainability, material quality, and ergonomic design

- North America dominated the paint bucket market in 2024, due to rising construction activities, industrial projects, and growing demand for high-quality paint storage solutions

- Asia-Pacific is expected to be the fastest growing region in the paint bucket market during the forecast period due to rapid urbanization, increasing construction projects, and rising industrial activities in countries such as China, Japan, and India

- Plastic segment dominated the market with a market share of 57.9% in 2024, due to its lightweight nature, cost-effectiveness, and ease of handling for both manufacturers and end-users. Plastic paint buckets are preferred for their resistance to corrosion, making them suitable for storing a wide range of paint types, including water-based and solvent-based paints. Manufacturers also favor plastic due to its versatility in molding and customization options for size, shape, and branding. The growing demand from residential and commercial sectors further reinforces the dominance of plastic buckets, as they are easier to transport, stack, and store compared to metal counterparts. The environmental initiatives to adopt recyclable plastics in packaging also add to their increasing preference in the market

Report Scope and Paint Bucket Market Segmentation

|

Attributes |

Paint Bucket Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paint Bucket Market Trends

Increasing Adoption of Eco-Friendly and Recycled-Material Paint Buckets

- The paint bucket market is witnessing a steady shift toward eco-friendly and recycled-material production driven by rising environmental awareness and sustainability regulations across the packaging industry. Manufacturers are prioritizing recyclable plastics and biodegradable materials to reduce environmental impact while maintaining product durability and performance in diverse storage conditions

- For instance, companies such as Greif Inc. and Mauser Packaging Solutions are introducing paint buckets made from post-consumer resin (PCR) and other recycled polymers. These products are designed to reduce carbon footprints and support circular economy initiatives while offering the same structural integrity as traditional plastic containers used for paints and coatings

- The adoption of sustainable manufacturing practices, including energy-efficient molding techniques and reduced chemical usage, is becoming a key market differentiator. Companies are incorporating lightweight bucket designs that consume less material while maintaining stability, helping lower logistics emissions and overall production costs

- The increasing popularity of water-based and low-VOC paints is driving matching innovations in eco-compatible packaging materials. This alignment between sustainable coatings and environmentally friendly containers enhances overall product branding and appeals strongly to both industrial users and DIY consumers focused on green construction solutions

- In addition, regulatory bodies across various regions are encouraging the use of recyclable and non-toxic packaging materials. This has led to a broader acceptance of metal and bio-based polymer buckets that are easier to recycle and repurpose for secondary applications in industrial and consumer markets

- The ongoing integration of sustainability into design, material sourcing, and lifecycle management is reshaping the global paint bucket market. As consumers and industries demand greater environmental accountability, manufacturers are expected to continue investing in recycled materials, resource-efficient production, and closed-loop packaging systems

Paint Bucket Market Dynamics

Driver

Rising Construction Activities and Industrial Coating Demand

- The continuous expansion of construction and infrastructure projects worldwide has become a key driver for the paint bucket market. Increasing demand for decorative and protective paints in residential, commercial, and industrial applications requires reliable and high-quality containers capable of withstanding varying climatic and storage conditions

- For instance, major paint producers including AkzoNobel N.V. and Asian Paints Limited are increasing their consumption of durable high-density polyethylene (HDPE) and metal buckets to meet escalating needs in large-scale projects. The stability and easy handling of these buckets ensure efficient material utilization and smooth site operations

- The growth of industrial coating applications in sectors such as automotive, marine, and heavy equipment manufacturing is further fueling paint bucket consumption. These industries rely on robust packaging to store specialized coatings resistant to abrasion, corrosion, and chemical exposure

- In addition, urbanization and renovation trends across emerging economies are driving sales of smaller bucket formats suitable for household painting applications. Manufacturers are diversifying sizes and lid designs to improve usability and appeal to both professional painters and domestic consumers

- The rising global investment in infrastructure and industrial development will continue to generate consistent demand for paint buckets. As a result, the market is poised for sustained growth supported by innovation in container design, material efficiency, and supply chain optimization

Restraint/Challenge

Volatility in Raw Material Prices

- Fluctuations in raw material prices, particularly in plastics and metals, represent a significant challenge for paint bucket manufacturers. Variations in crude oil and resin prices directly influence the production costs of HDPE and polypropylene buckets, impacting manufacturer margins and retail pricing strategies

- For instance, companies such as RPC Group and Berry Global Group often face increased production expenses during periods of raw material shortages or price surges. These uncertainties complicate procurement planning and can limit the ability of smaller producers to maintain consistent output levels

- Dependence on petroleum-based feedstocks exposes the industry to global economic and geopolitical risks that affect supply stability. Unpredictable price movements also hinder long-term contracts with paint manufacturers, adding complexity to cost forecasting

- In addition, the transition toward sustainable materials such as bio-based polymers or recycled resins introduces further cost variability. While these alternatives enhance environmental performance, they often entail higher processing and certification expenditures compared to conventional raw materials

- Addressing these challenges through efficient resource management, long-term supplier partnerships, and the integration of recycled content in manufacturing will be essential. As the market stabilizes through technological advancements and broader recycling infrastructure, the impact of raw material price fluctuations is expected to moderate over time

Paint Bucket Market Scope

The market is segmented on the basis of material, capacity, application, and end-user.

- By Material

On the basis of material, the paint bucket market is segmented into metal and plastic. The plastic segment dominated the market with the largest market revenue share of 57.9% in 2024, driven by its lightweight nature, cost-effectiveness, and ease of handling for both manufacturers and end-users. Plastic paint buckets are preferred for their resistance to corrosion, making them suitable for storing a wide range of paint types, including water-based and solvent-based paints. Manufacturers also favor plastic due to its versatility in molding and customization options for size, shape, and branding. The growing demand from residential and commercial sectors further reinforces the dominance of plastic buckets, as they are easier to transport, stack, and store compared to metal counterparts. The environmental initiatives to adopt recyclable plastics in packaging also add to their increasing preference in the market.

The metal segment is anticipated to witness the fastest growth rate of 19.6% from 2025 to 2032, fueled by industrial requirements for high-durability containers that can withstand extreme conditions during storage and transportation. Metal buckets are particularly popular for oil-based paints and chemicals, as they provide enhanced protection against leaks and external damage. Their recyclability and sturdiness make them a preferred choice in construction and chemical industries where repeated use is common. The aesthetic and premium perception of metal containers also supports their growing adoption for specialized architectural coating applications.

- By Capacity

On the basis of capacity, the paint bucket market is segmented into less than 1 liter, 1 to 10 liters, 11 to 50 liters, and more than 50 liters. The 1 to 10 liters segment dominated the market with the largest revenue share in 2024, driven by its widespread use among residential and small-scale commercial customers. Buckets in this range offer a balanced combination of portability and sufficient volume for single projects, making them convenient for DIY users and professional painters alike. Their compatibility with various paint types, ease of storage, and handling advantages contribute to strong market preference. Retailers also favor this segment as it meets the demand for manageable quantities while minimizing waste. The ready availability of ergonomic designs and airtight sealing mechanisms further enhances the appeal of 1 to 10-liter paint buckets.

The 11 to 50 liters segment is anticipated to witness the fastest growth rate of 18.2% from 2025 to 2032, driven by increasing industrial and large-scale commercial applications that require bulk storage. For instance, paint manufacturers and contractors prefer larger buckets for cost efficiency and to reduce frequent refills on-site. The robust construction of these buckets ensures safe transportation of heavy paint volumes, while stackable designs facilitate storage optimization in warehouses and job sites. Growth in the building and construction sectors globally also supports the rising demand for this capacity range.

- By Application

On the basis of application, the paint bucket market is segmented into industrial coating and architectural coating. The architectural coating segment dominated the market with the largest revenue share in 2024, fueled by the growing residential and commercial infrastructure development worldwide. Architectural paint buckets are increasingly preferred due to their design-oriented packaging, user-friendly handling, and compatibility with interior and exterior decorative paints. The market benefits from the rising DIY culture, urbanization, and home renovation trends, which drive demand for easy-to-use and aesthetically packaged paint buckets. Manufacturers also focus on offering UV-resistant and moisture-proof buckets to maintain paint quality, further enhancing adoption. The presence of multiple color-coded and reusable packaging options supports the dominance of architectural coating buckets in the market.

The industrial coating segment is anticipated to witness the fastest growth rate of 17.8% from 2025 to 2032, driven by the rising demand for protective coatings in automotive, machinery, and infrastructure applications. For instance, metal and plastic paint buckets used for industrial coatings are designed to withstand harsh chemicals and maintain paint integrity over long storage periods. The growth in industrial manufacturing and maintenance activities globally contributes to the increasing adoption of these specialized buckets. Features such as tamper-proof lids and reinforced body strength enhance their suitability for industrial usage.

- By End User

On the basis of end user, the paint bucket market is segmented into building and construction industries, paint industries, chemical industries, and others. The building and construction industries segment dominated the market with the largest revenue share in 2024, driven by the growing demand for paints in residential, commercial, and infrastructural projects. Construction projects require reliable and standardized packaging for ease of transportation and on-site handling, making paint buckets an essential component. The increasing construction activities in emerging markets and rapid urbanization reinforce the dominance of this segment. Manufacturers are focusing on durable, stackable, and spill-resistant designs to meet industry requirements. The compatibility of these buckets with a wide range of paint types used in construction also strengthens their market share.

The paint industries segment is anticipated to witness the fastest growth rate of 16.9% from 2025 to 2032, fueled by increasing paint production and the need for bulk and retail packaging solutions. For instance, paint manufacturers rely on both metal and plastic buckets for safe storage, branding, and transportation of finished products. Rising demand for decorative and protective coatings globally accelerates the requirement for standardized and durable paint buckets. The ability to customize buckets with labels, handles, and sealing mechanisms also contributes to the rapid growth of this segment.

Paint Bucket Market Regional Analysis

- North America dominated the paint bucket market with the largest revenue share in 2024, driven by rising construction activities, industrial projects, and growing demand for high-quality paint storage solutions

- Consumers in the region highly value durable, reusable, and easy-to-handle paint buckets for residential, commercial, and industrial applications

- This widespread adoption is further supported by advanced manufacturing infrastructure, high awareness of product quality standards, and strong safety regulations, establishing paint buckets as a preferred packaging solution in North America

U.S. Paint Bucket Market Insight

The U.S. paint bucket market captured the largest revenue share in 2024 within North America, fueled by increasing urbanization, renovation projects, and a strong DIY culture. Manufacturers and contractors prefer robust, standardized buckets that ensure safe storage and transportation of paints. The growing demand for plastic paint buckets due to their lightweight and corrosion-resistant properties, combined with rising focus on environmentally friendly packaging, further propels the paint bucket industry.

Europe Paint Bucket Market Insight

The Europe paint bucket market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent safety regulations, increasing industrial and construction activities, and the demand for high-quality storage solutions. European consumers and industries are emphasizing durable and reusable paint buckets to reduce waste and improve handling efficiency. The market is witnessing significant growth across architectural and industrial coating applications, with ergonomic, stackable, and airtight designs further encouraging adoption.

U.K. Paint Bucket Market Insight

The U.K. paint bucket market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by renovation and new construction projects, rising DIY trends, and increased industrial coating activities. Consumers and businesses in the U.K. prioritize spill-proof, convenient, and standardized packaging for efficient paint storage and transport. The adoption of plastic paint buckets, due to their lightweight and corrosion-resistant properties, is expected to continue stimulating market growth.

Germany Paint Bucket Market Insight

The Germany paint bucket market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s well-developed construction sector, industrial growth, and emphasis on quality and sustainability. Manufacturers and end-users prefer robust metal and plastic buckets for safe storage, long shelf life, and ease of handling. Innovations in ergonomic designs, stackable containers, and secure lids are further promoting adoption across both industrial and architectural coating applications.

Asia-Pacific Paint Bucket Market Insight

The Asia-Pacific paint bucket market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing construction projects, and rising industrial activities in countries such as China, Japan, and India. The region's growing demand for affordable, durable, and easy-to-use paint buckets for residential, commercial, and industrial applications is fueling adoption. Government initiatives promoting infrastructure development and urban housing projects are expanding the market, while local manufacturing hubs enhance product accessibility and reduce costs.

Japan Paint Bucket Market Insight

The Japan paint bucket market is gaining momentum due to high-quality construction standards, urbanization, and the emphasis on efficiency and convenience. Consumers prefer durable and reusable buckets that support architectural and industrial coating applications. The adoption of compact, lightweight, and ergonomically designed paint buckets is driving demand, especially in residential and commercial construction projects.

China Paint Bucket Market Insight

The China paint bucket market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing industrialization, and the expanding construction sector. Plastic and metal buckets are widely adopted due to their durability, cost-effectiveness, and versatility across residential, commercial, and industrial applications. The availability of locally manufactured, affordable buckets, alongside increasing demand from DIY and professional users, supports robust growth in China.

Paint Bucket Market Share

The paint bucket industry is primarily led by well-established companies, including:

- Berry Global Inc. (U.S.)

- BWAY Corporation (U.S.)

- CL Smith (U.S.)

- Symlux Plastics (U.S.)

- Affordable Buckets, LLC (U.S.)

- Leaktite Corporation (U.S.)

- Letica Corporation (U.S.)

- FDL Packaging Group (U.S.)

- Kelly-Moore Paints (U.S.)

- Pro-Western Plastics (U.S.)

- RL Plastics Ltd. (U.K.)

- Aaron Packaging (U.S.)

- Paragon Manufacturing, Inc. (U.S.)

- Kansai Plascon (PTY) LTD. (South Africa)

- Reliance Plastic Containers (India)

- Priya Enterprises (India)

- TIRUPATI PLASTICS (India)

- Balaji Industries (India)

- Hitech Group (India)

- SLJ UDYOG (India)

- Mold-Tek Packaging Ltd. (India)

Latest Developments in Global Paint Bucket Market

- In August 2025, Amcor and Flügger launched a paint container made with 50% post‑consumer recycled (PCR) plastic, supporting Flügger’s ambition to reduce virgin-plastic use while preserving packaging quality and user experience. This move enhances brand recognition through a distinctive design and colour-coded lids, and sets a new standard for sustainability in paint containers by aligning with ecolabels such as the Nordic Swan. The impact on the market includes reinforcing circular-economy trends, increasing recycled-content adoption by competitors, and strengthening the appeal of environmentally responsible packaging to professional painters and DIY consumers alike

- In July 2025, Śnieżka and Jokey announced a partnership for sustainable decorative-paint packaging in Poland, delivering buckets where approximately 70% of the body material is recycled plastic and achieving a minimum of 40% recycled content overall in the final packaging. This initiative addresses regulatory and consumer pressure for recycled-material use and demonstrates how aesthetics, functionality, and circularity can be combined. The market effect is to strengthen regional supply chains for recycled resins, encourage similar strategic collaborations, and raise the bar for premium packaging in decorative paints

- In March 2025, Mondi introduced its “re/cycle SpoutedPouch” in collaboration with Sherwin-Williams for paint concentrates, offering a lightweight 950 ml mono-material pouch that replaces traditional 5 L rigid plastic tubs and reduces plastic consumption by up to 90%. This innovation significantly improves logistic efficiency (230% more units per pallet) and shelf-space utilization while addressing sustainability demands in packaging. The market impact includes shifting preference toward flexible refill formats, accelerating packaging-innovation cycles in the coatings sector, and enabling retailers and manufacturers to reduce both weight and environmental footprint

- In April 2024, Pact Group and Dulux launched a 15 L paint pail in Australia containing 50% recycled polypropylene (rPP) for the Dulux EnviroO2 range, diverting approximately 32 tonnes of plastic from landfill annually and reducing roughly 71 tonnes of CO₂ emissions per annum. This development demonstrates how mainstream brands are integrating high recycled-content packaging at scale, thereby influencing supplier standards, strengthening local circular economies, and reducing carbon footprints. The effect in the market includes increased competitive pressure to offer sustainable packaging and heightened expectations from consumers for greener solutions

- In December 2023, Berry Global received multiple awards for its closed-loop recycled paint container project, which combines container recovery, recycling, and reuse of materials to significantly reduce waste and CO₂ emissions. This achievement underscores the environmental benefit of circular packaging systems and signals to the market that recycled-content solutions can achieve similar performance to virgin plastics. The impact is to validate closed-loop programs, drive adoption of corporate-sustainability commitments, and influence packaging decisions across the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paint Bucket Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paint Bucket Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paint Bucket Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.