Global Paint Packaging Market

Market Size in USD Billion

CAGR :

%

USD

31.57 Billion

USD

43.21 Billion

2025

2033

USD

31.57 Billion

USD

43.21 Billion

2025

2033

| 2026 –2033 | |

| USD 31.57 Billion | |

| USD 43.21 Billion | |

|

|

|

|

Paint Packaging Market Size

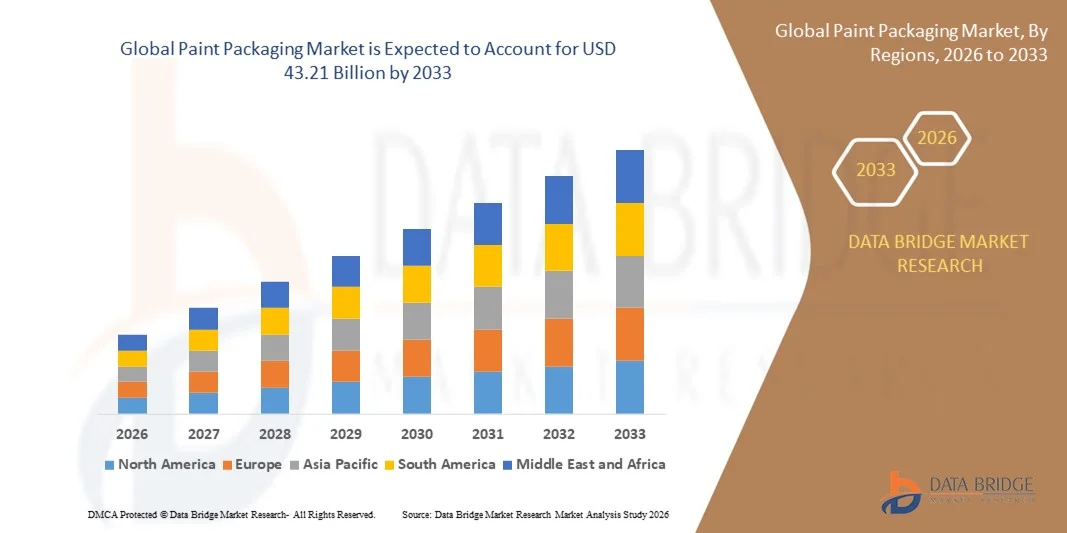

- The global paint packaging market size was valued at USD 31.57 billion in 2025 and is expected to reach USD 43.21 billion by 2033, at a CAGR of 4.0% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and recyclable packaging solutions in the paint industry, driven by rising awareness about environmental impact and regulatory mandates promoting eco-friendly materials

- Furthermore, growing demand for durable, convenient, and aesthetically appealing packaging formats is encouraging manufacturers to innovate with materials such as metal, PET, and upcycled plastics. These converging factors are accelerating the adoption of advanced paint packaging solutions, thereby significantly boosting the industry's growth

Paint Packaging Market Analysis

- Paint packaging, providing safe, durable, and transportable containers for decorative and industrial paints, is increasingly vital for preserving product quality, ensuring user convenience, and supporting supply chain efficiency in both professional and consumer segments

- The escalating demand for paint packaging is primarily fueled by rising construction and renovation activities, increasing DIY projects, and growing preference for eco-friendly and innovative packaging formats. This trend is driving manufacturers to invest in sustainable materials, flexible designs, and technologically advanced packaging solutions to meet evolving market needs

- Asia-Pacific dominated the paint packaging market with a share of 54.4% in 2025, due to rapid urbanization, expanding construction and real estate projects, and increasing demand for both decorative and industrial paints

- North America is expected to be the fastest growing region in the paint packaging market during the forecast period due to robust demand from residential, commercial, and industrial construction sectors

- Cans segment dominated the market with a market share of 77.5% in 2025, due to its widespread use for both industrial and decorative paints. Cans provide excellent airtight sealing, protecting paint from drying, contamination, and exposure to environmental factors. Manufacturers prefer cans due to their robustness during transportation and their compatibility with automated filling lines. The segment also benefits from strong consumer familiarity and trust in cans for long-term storage of paints. Cans are available in multiple sizes, catering to both small-scale residential projects and large commercial orders, which further drives adoption

Report Scope and Paint Packaging Market Segmentation

|

Attributes |

Paint Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paint Packaging Market Trends

Growing Adoption of Sustainable Paint Packaging

- The global paint packaging market is witnessing a strong trend towards the adoption of sustainable and recyclable packaging solutions, driven by increasing environmental awareness among consumers and regulatory mandates promoting eco-friendly materials

- For instance, in August 2025, Flügger and Amcor launched a paint container made from 50% post-consumer recycled plastic, offering a high-performance and eco-conscious option for decorative paints. Such initiatives by key companies are encouraging other manufacturers to explore sustainable packaging formats, accelerating the market shift towards circular solutions

- Sustainable paint packaging solutions are increasingly designed to preserve product quality while minimizing environmental impact, supporting long-term storage and reducing wastage during transport and handling. In addition, consumers are showing a preference for packaging that clearly communicates sustainability credentials, influencing brand choice and loyalty

- The use of materials such as metal, PET, and upcycled plastics is gaining momentum, as these options provide durability, chemical resistance, and recyclability while meeting both professional and consumer needs. In addition, companies are investing in innovative designs that combine convenience and environmental responsibility, catering to evolving consumer expectations

- This trend is driving collaboration between paint manufacturers and packaging companies to develop eco-friendly solutions that integrate durability, aesthetics, and sustainability. Companies such as Asian Paints and The Sherwin-Williams Company are increasingly emphasizing recycled-content packaging and refillable options for both industrial and decorative paints

- The adoption of sustainable paint packaging is expected to continue rising across residential, commercial, and industrial segments, with innovation in materials, design, and recyclability shaping market growth and setting new industry standards

Paint Packaging Market Dynamics

Driver

Rising Demand for Durable and Convenient Packaging

- The increasing demand for packaging that offers durability, convenience, and protection for paint products is a key driver for the paint packaging market. Consumers and professionals require containers that maintain product integrity while facilitating ease of use and transport

- For instance, in July 2025, Mondi and Sherwin-Williams introduced a re/cycle spouted pouch for concentrated paint, reducing plastic use by up to 90% compared to rigid containers and enabling efficient transportation. Such product innovations are driving adoption of advanced packaging solutions and meeting evolving market requirements

- Durable and convenient packaging protects paints from contamination, leakage, and drying, ensuring a longer shelf-life and improved performance during storage and handling. In addition, packaging innovations allow for easier pouring, refilling, and storage, enhancing user experience across both professional and consumer segments

- The growing construction, renovation, and DIY activities are further increasing demand for packaging that combines robustness with ease of handling. In addition, paint manufacturers are emphasizing packaging designs that provide functional and ergonomic benefits without compromising sustainability

- This rising demand is motivating companies to develop versatile packaging solutions that cater to various paint types, volumes, and end-user preferences. Manufacturers such as Amcor, Berry Global, and Flügger are investing in durable, lightweight, and convenient packaging formats, which in turn is significantly driving market growth

Restraint/Challenge

High Cost and Limited Availability of Recycled Materials

- The high cost and limited availability of recycled and advanced packaging materials are major challenges hindering growth in the paint packaging market. Sustainable materials often require specialized processing, leading to higher production costs and supply constraints

- For instance, companies aiming to meet recycled-content targets face challenges in sourcing consistent, high-quality recycled plastics and metals, which can delay production and increase operational costs. Such limitations can restrict the adoption of eco-friendly packaging across small and medium-scale manufacturers

- Limited supply of recycled materials can lead to dependency on virgin materials, which increases costs and impacts sustainability goals. In addition, fluctuations in global availability of recycled polymers and metals create uncertainty for manufacturers planning long-term investments in sustainable packaging

- The higher cost of recycled-content packaging can also influence pricing strategies, making eco-friendly products less competitive in price-sensitive markets. In addition, smaller paint brands may struggle to implement sustainable solutions due to resource constraints and higher capital requirements

- Addressing these challenges through increased recycling infrastructure, partnerships with material suppliers, and investment in innovative material technologies will be crucial. Companies such as Amcor and Asian Paints are actively pursuing these strategies to ensure sustainable and cost-effective paint packaging, gradually overcoming the market constraints

Paint Packaging Market Scope

The market is segmented on the basis of material, product, and end-user.

- By Material

On the basis of material, the paint packaging market is segmented into Metal, Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), and Others. The Metal segment dominated the market in 2025, driven by its high durability, excellent barrier properties, and long shelf-life for both solvent-based and water-based paints. Metal containers are widely preferred for industrial and professional paints due to their resistance to corrosion, puncture, and chemical reactions with paint formulations. The strong adoption is further supported by their recyclability and compatibility with automated filling and sealing systems, which enhances operational efficiency for manufacturers. Metal packaging also provides superior protection during transportation and storage, minimizing paint wastage and maintaining product quality. The reliability and established usage in the industry make metal the material of choice for bulk and premium paints.

The Polyethylene Terephthalate (PET) segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand in the consumer segment for lightweight, transparent, and reusable containers. PET packaging allows for easy visibility of paint color and quantity, providing convenience for end-users and retailers. The material’s chemical resistance, shatter-proof nature, and ease of handling make it suitable for small to medium-sized paint volumes. PET’s compatibility with modern printing and labeling techniques also enhances brand appeal and consumer engagement. In addition, the growing focus on sustainable and recyclable materials further accelerates PET adoption across both professional and DIY paint markets.

- By Product

On the basis of product, the paint packaging market is segmented into Bag-In-Box, Pouches, Liquid Cartons, Paperboard Containers, PET Bottles, Cans, and Others. The Cans segment dominated the market with the largest share of 77.5% in 2025, driven by its widespread use for both industrial and decorative paints. Cans provide excellent airtight sealing, protecting paint from drying, contamination, and exposure to environmental factors. Manufacturers prefer cans due to their robustness during transportation and their compatibility with automated filling lines. The segment also benefits from strong consumer familiarity and trust in cans for long-term storage of paints. Cans are available in multiple sizes, catering to both small-scale residential projects and large commercial orders, which further drives adoption.

The Pouches segment is anticipated to witness the fastest CAGR from 2026 to 2033, fueled by rising demand for compact, lightweight, and flexible packaging solutions for paints. Pouches are convenient for single-use or small-volume paint applications and offer ease of storage and reduced transportation costs. Their flexible design enables innovative packaging formats, making them suitable for DIY consumers and promotional campaigns. Pouches also reduce material usage and environmental footprint compared to rigid containers, aligning with sustainability initiatives by paint brands. The growth of e-commerce in paints further accelerates pouch adoption due to their lightweight and cost-effective shipping advantages.

- By End-User

On the basis of end-user, the paint packaging market is segmented into Professional and Consumer. The Professional segment dominated the market in 2025, driven by bulk purchases for commercial, industrial, and large-scale residential projects. Professionals often require high-quality, durable packaging that ensures paint integrity during storage, handling, and frequent transportation across job sites. The segment’s growth is supported by large-scale contractors and institutional buyers who prioritize efficiency and reliability in packaging. Manufacturers focus on offering standardized containers, tamper-proof sealing, and bulk sizes to cater to the professional market. The established trust and preference for robust packaging solutions make the professional segment the leading end-user category in the market.

The Consumer segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing DIY projects, urban housing renovations, and rising disposable income. Consumers prefer convenient, small-volume, and easy-to-handle packaging options, which enhance usability for home painting tasks. Brands are increasingly offering attractive, colorful, and resealable packaging formats to appeal to end-users, while ensuring product protection. The growth of retail and e-commerce channels has expanded access to smaller paint packaging options, further driving adoption. Sustainability initiatives and demand for recyclable packaging also contribute to the rising preference for consumer-oriented paint packaging solutions.

Paint Packaging Market Regional Analysis

- Asia-Pacific dominated the paint packaging market with the largest revenue share of 54.4% in 2025, driven by rapid urbanization, expanding construction and real estate projects, and increasing demand for both decorative and industrial paints

- The region’s cost-effective manufacturing landscape, rising investments in packaging technologies, and growing exports of paints are accelerating market expansion

- The availability of skilled labor, favorable government policies promoting industrial growth, and rapid adoption of modern packaging solutions are contributing to increased consumption of paint packaging across residential, commercial, and industrial sectors

China Paint Packaging Market Insight

China held the largest share in the Asia-Pacific paint packaging market in 2025, owing to its strong industrial base, extensive manufacturing capabilities, and significant export potential for paints. The country’s growing construction and infrastructure development, along with government initiatives supporting industrial modernization, are major growth drivers. Demand is further bolstered by increasing adoption of innovative and sustainable packaging formats for both domestic and international paint markets.

India Paint Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding construction sector, rising urban housing projects, and growing DIY consumer trends. Initiatives such as “Make in India” and investments in modern packaging technologies are strengthening demand for efficient, durable, and sustainable paint packaging solutions. In addition, rising awareness about product protection, ease of handling, and innovative packaging designs are contributing to robust market expansion.

Europe Paint Packaging Market Insight

The Europe paint packaging market is expanding steadily, supported by stringent regulatory standards, high demand for high-quality and safe paint containers, and growing investments in sustainable and recyclable packaging materials. The region emphasizes product safety, environmental compliance, and innovation in packaging designs for both decorative and industrial paints. Increasing adoption of eco-friendly packaging solutions and demand for premium-quality paint products are further enhancing market growth.

Germany Paint Packaging Market Insight

Germany’s paint packaging market is driven by its leadership in high-quality industrial and decorative paint production, strong focus on sustainability, and export-oriented manufacturing model. The country has well-established R&D networks and partnerships between packaging manufacturers and paint producers, fostering continuous innovation in packaging materials and formats. Demand is particularly strong for metal cans, PET bottles, and sustainable packaging for premium and industrial paints.

U.K. Paint Packaging Market Insight

The U.K. market is supported by a mature construction and home improvement industry, growing DIY trends, and increased emphasis on eco-friendly and recyclable packaging solutions. With rising focus on R&D, packaging innovation, and sustainability initiatives, the U.K. continues to play a significant role in the adoption of advanced paint packaging solutions across both professional and consumer segments.

North America Paint Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand from residential, commercial, and industrial construction sectors. Increasing focus on product safety, sustainable packaging, and innovative container formats is boosting demand. In addition, growing urbanization, rising DIY projects, and reshoring of manufacturing operations are supporting market expansion.

U.S. Paint Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive construction industry, strong consumer demand for high-quality paints, and significant investment in sustainable packaging solutions. The country’s focus on innovation, environmental compliance, and adoption of durable and convenient packaging formats is encouraging growth. Presence of key players and an established distribution network further solidify the U.S.'s leading position in the region.

Paint Packaging Market Share

The paint packaging industry is primarily led by well-established companies, including:

- Mondi (Austria)

- BALL Corporation (U.S.)

- Crown (U.K.)

- Smurfit Kappa (Ireland)

- Superfos (Denmark)

- HUBER Packaging Group GmbH (Germany)

- BWAY Corporation (U.S.)

- Dow (U.S.)

- PLZ Aeroscience (U.S.)

- The Sherwin-Williams Company (U.S.)

- Asian Paints (India)

- Teknos Group (Finland)

- Beckers Group (Sweden)

- PPG Industries, Inc. (U.S.)

- Berger Paints India Limited (India)

- Silgan Plastics (U.S.)

- Berry Global Inc. (U.S.)

- Hitech Group (India)

- Tech Pack (India)

- KARSHNI PACKS PRIVATE LIMITED (India)

Latest Developments in Global Paint Packaging Market

- In August 2025, Flügger and Amcor launched a new paint container made from 50% post-consumer recycled (PCR) plastic. This container enhances circularity in the decorative paint segment and reduces reliance on virgin plastics. The initiative highlights the companies’ focus on sustainability, offering high-performance, eco-conscious packaging options that could accelerate the adoption of recycled-content solutions among professional and consumer paint users

- In July 2025, Mondi and Sherwin-Williams introduced a re/cycle spouted pouch for concentrated paint, designed with a mono-material structure to optimize recyclability and reduce waste. This innovative packaging format decreases plastic usage by up to 90% compared to traditional rigid containers and enables efficient transportation. The launch underscores a shift toward sustainable, convenient, and cost-effective paint packaging formats that support refills and eco-friendly consumption

- In April 2025, global packaging firms ramped up production of upcycled materials to meet ESG targets, driven by regulatory support and investor demand. This increase in upcycled polymer availability strengthens the supply chain for sustainable paint packaging solutions. The development reflects a broader market trend toward eco-conscious materials, helping manufacturers meet recycled-content goals and cater to sustainability-oriented paint brands

- In 2024, Asian Paints significantly increased the use of recycled plastic in its packaging, with nearly 29.9% of its plastic containers now made from recycled material. This move showcases the company’s dedication to circular packaging and extended producer responsibility initiatives. The scale of implementation sets a benchmark for sustainability in the paint packaging market, encouraging wider adoption of recycled-content solutions

- In October 2023, Amcor plc announced a partnership with SK Geo Centric, under which SK Geo Centric will supply recycled packaging material to Amcor starting from 2025 in the Asia Pacific region. This collaboration empowers Amcor to achieve its target of 30% recycled content in its portfolio by 2030. The partnership demonstrates Amcor’s commitment to sustainability and reinforces the market trend toward eco-friendly, circular paint packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paint Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paint Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paint Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.