Global Paint Protection Film Market

Market Size in USD Million

CAGR :

%

USD

349.04 Million

USD

627.15 Million

2024

2032

USD

349.04 Million

USD

627.15 Million

2024

2032

| 2025 –2032 | |

| USD 349.04 Million | |

| USD 627.15 Million | |

|

|

|

|

Paint Protection Film Market Size

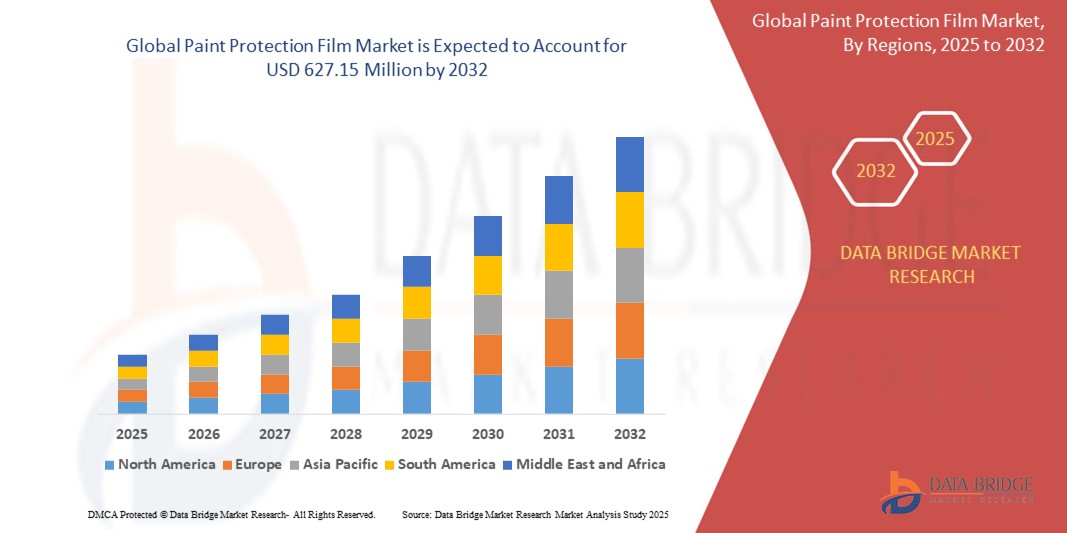

- The global paint protection film market size was valued at USD 349.04 million in 2024 and is expected to reach USD 627.15 million by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fuelled by the rising demand for high-performance automotive surface protection and increasing consumer awareness regarding vehicle aesthetics and long-term maintenance

- Growing adoption of electric vehicles and luxury cars globally is further boosting the demand for durable and self-healing paint protection films in both OEM and aftermarket segments

Paint Protection Film Market Analysis

- The paint protection film market is seeing rising popularity in automotive detailing as consumers focus more on maintaining vehicle aesthetics and resale value

- Increasing awareness about vehicle surface protection is encouraging both individual car owners and professional service providers to invest in premium film products

- North America led the paint protection film market in 2024 with the highest revenue share, driven by the widespread adoption of automotive appearance-enhancing products and growing consumer awareness of vehicle preservation

- The Asia-Pacific region is expected to witness the highest growth rate in the global paint protection film market, driven by rapid urbanization, rising disposable incomes, and the expanding automotive sector in countries such as China, India, and Japan

- The thermoplastic polyurethane (TPU) segment dominated the market with the largest market revenue share in 2024, driven by its superior self-healing properties, elasticity, and resistance to abrasion and yellowing. TPU films are widely preferred for their ability to maintain clarity and provide long-lasting protection against environmental damage, making them ideal for high-performance and luxury vehicles. The material’s flexibility and durability further enhance its application across curved vehicle surfaces, contributing to its strong market position

Report Scope and Paint Protection Film Market Segmentation

|

Attributes |

Paint Protection Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand for EVS and Luxury Cars • Expansion of Detailing Services in Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paint Protection Film Market Trends

“Rising Adoption of Self-Healing Films in Vehicle Protection”

- The market is witnessing growing demand for self-healing paint protection films due to their ability to automatically repair light scratches and swirl marks through heat exposure

- These films help maintain the original finish of vehicles while reducing the need for frequent servicing or replacements

- Luxury car owners, particularly in cities such as Los Angeles, are increasingly choosing self-healing films for superior appearance retention

- Fleet operators and rental services are adopting these films to minimize refurbishment costs and protect vehicle resale value

- Manufacturers are using self-healing technology as a unique value proposition to differentiate their offerings in a highly competitive market

Paint Protection Film Market Dynamics

Driver

“Rising Demand for Vehicle Aesthetic Preservation and Surface Protection”

- Consumers are increasingly investing in solutions that preserve the visual appeal and resale value of their vehicles

- Paint protection films offer defense against daily wear such as stone chips, UV rays, and chemical stains while maintaining a clear finish

- High adoption is seen in premium segments including luxury cars and performance bikes, as reported by detailing studios in cities such as Mumbai and Shanghai

- Innovations such as self-healing and hydrophobic films are gaining traction, appealing to customers who want long-lasting, low-maintenance protection

- Car dealerships and aftermarket service providers are promoting paint protection films as value-added offerings, driving awareness and market expansion

Restraint/Challenge

“High Installation Costs and Limited Consumer Awareness”

- High installation costs and the need for professional application often discourage price-sensitive customers from opting for paint protection films

- The film’s labor-intensive process requires trained professionals to avoid defects such as air bubbles or misalignment, increasing the overall service price

- Many consumers in non-premium or rural markets are unaware of the benefits of paint protection films and prefer traditional methods such as waxing

- In countries such as Indonesia and Vietnam, surface protection is still widely achieved using ceramic coatings due to lower costs and wider availability

- Expanding awareness campaigns and training programs for installers can help improve adoption across broader vehicle segments and geographic areas

Paint Protection Film Market Scope

The paint protection film market is segmented on the basis of material and application.

- By Material

On the basis of material, the paint protection film market is segmented into thermoplastic polyurethane (TPU), polyvinyl chloride (PVC), and others. The thermoplastic polyurethane (TPU) segment dominated the market with the largest market revenue share in 2024, driven by its superior self-healing properties, elasticity, and resistance to abrasion and yellowing. TPU films are widely preferred for their ability to maintain clarity and provide long-lasting protection against environmental damage, making them ideal for high-performance and luxury vehicles. The material’s flexibility and durability further enhance its application across curved vehicle surfaces, contributing to its strong market position.

The polyvinyl chloride (PVC) segment is expected to witness the fastest growth rate from 2025 to 2032, due to its cost-effectiveness and ease of manufacturing. PVC-based films offer adequate surface protection and are commonly used in entry-level and budget vehicle segments. The growing demand for affordable vehicle protection solutions, especially in emerging markets, supports the expansion of this segment.

- By Application

On the basis of application, the paint protection film market is segmented into automotive and transportation, electrical and electronics, aerospace and defense, and others. The automotive and transportation segment accounted for the largest market revenue share in 2024, driven by the increasing consumer focus on maintaining vehicle aesthetics and resale value. Paint protection films are extensively used to safeguard vehicle surfaces from road debris, insect stains, and minor abrasions, particularly in high-end cars and motorcycles.

The electrical and electronics segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising need for surface protection in displays, screens, and sensitive components. The miniaturization of devices and demand for sleek, scratch-free designs are contributing to the adoption of protective films in this industry.

Paint Protection Film Market Regional Analysis

- North America led the paint protection film market in 2024 with the highest revenue share, driven by the widespread adoption of automotive appearance-enhancing products and growing consumer awareness of vehicle preservation

- The region's preference for high-end vehicles and frequent vehicle customization significantly contributes to the demand for protective film solutions

- Technological advancements, the presence of leading film manufacturers, and a well-established distribution network support consistent market expansion across the U.S. and Canada

U.S. Paint Protection Film Market Insight

The U.S. paint protection film market accounted for the largest share in North America in 2024, attributed to high vehicle ownership rates, strong aftermarket services, and a growing culture of vehicle personalization. The demand is rising particularly among luxury car owners and auto detailing businesses, who seek durable protection solutions to maintain paint finish and resale value. An increase in automotive wraps and custom aesthetics is further driving adoption across the country.

Europe Paint Protection Film Market Insight

The Europe’s paint protection film market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising automotive exports, stringent vehicle appearance standards, and increasing investments in luxury car segments. Consumers across Germany, the U.K., and France are adopting paint protection films to prolong vehicle aesthetics and reduce maintenance costs. Innovations in self-healing and eco-friendly films are also contributing to broader acceptance across private and fleet vehicles.

Germany Paint Protection Film Market Insight

The Germany holds a key share in the European paint protection film market, driven by its strong automotive manufacturing base and consumer demand for high-quality, long-lasting paint protection. The country’s premium car brands and export-driven industry increase the necessity for advanced surface protection. In addition, detailing and auto care service providers are increasingly offering paint protection film installations as a value-added service to meet consumer expectations.

U.K. Paint Protection Film Market Insight

The U.K. paint protection film market is expected to witness the fastest growth rate from 2025 to 2032, supported by growing demand for premium vehicle care, increasing automotive customization, and heightened awareness of long-term paint preservation. Car owners are showing a stronger preference for non-invasive protection methods that maintain resale value. The presence of high-end automotive brands and detailing services further promotes adoption of paint protection films across the country.

Asia-Pacific Paint Protection Film Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid vehicle production, urbanization, and an expanding middle-class population in countries such as China, India, and South Korea. Rising awareness of vehicle protection, coupled with increasing disposable incomes, is accelerating product adoption. Regional manufacturers are also introducing cost-effective and innovative film solutions, making PPF more accessible across both premium and mid-range vehicle segments.

China Paint Protection Film Market Insight

The China held the largest market revenue share in Asia-Pacific in 2024, owing to the high demand for automotive aesthetic solutions, increasing car sales, and a rapidly growing car enthusiast community. The expanding number of detailing workshops, combined with consumer interest in long-term vehicle preservation, is fueling strong demand for paint protection films. Moreover, domestic manufacturers are actively developing competitive offerings to cater to both export and local demand.

Japan Paint Protection Film Market Insight

The Japan’s paint protection film market is expected to witness the fastest growth rate from 2025 to 2032, due to a well-established automotive sector, consumer preference for precision-engineered products, and the increasing focus on maintaining vehicle appearance. Urban vehicle owners are adopting PPF as part of regular maintenance routines, particularly for luxury and imported vehicles. Moreover, technological advancements and the availability of self-healing films are strengthening demand in both the consumer and dealership segments.

Paint Protection Film Market Share

The Paint Protection Film industry is primarily led by well-established companies, including:

- 3M (U.S.)

- XPEL, Inc. (U.S.)

- Dow (U.S.)

- Eastman Chemical Company (U.S.)

- Hexis S.A.S (France)

- PremiumShield (U.S.)

- STEK-USA (U.S.)

- Reflek Technologies Corporation (U.S.)

- GRAFITYP (Belgium)

- ORAFOL Europe GmbH (Germany)

- DuPont (U.S.)

- DAIKIN (Japan)

- Optic Shield (Czechia)

- Solvay (Belgium)

- SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (U.S.)

- Saint-Gobain (France)

- Avery Dennison Corporation (U.S.)

Latest Developments in Global Paint Protection Film Market

- In May 2023, Covestro AG, a Germany-based leader in high-performance materials, launched a state-of-the-art production line in Taiwan dedicated to manufacturing thermoplastic polyurethane (TPU) specifically for paint protection film (PPF) grades. This initiative not only demonstrates Covestro's commitment to innovation in automotive materials but also introduces a new product series, Desmopan UP TPU, tailored for applications in the automotive and wind energy sectors, enhancing durability and performance

- In July 2022, SWM, Inc. and Neenah, Inc., prominent global manufacturers in specialty materials, announced a strategic merger to form Mativ Holdings, Inc. While both companies will continue to operate independently, this merger is expected to significantly enhance their geographic presence and improve distribution networks. The collaboration aims to leverage their combined resources, facilitating better service delivery and expanded market reach in specialty material sectors

- In June 2022, HEXIS S.A.S. unveiled three new series of paint protection films under the HEXIS BODYFENCE range, namely BFWIDE, DFENCEXTRM, and BODYFENCEXM. These innovative films are designed with self-healing properties, which allow them to maintain their pristine appearance even after minor scratches and abrasions. This launch positions HEXIS S.A.S. to tap into the burgeoning automobile industry, where demand for high-performance protective films continues to rise

- In November 2021, XPEL expanded its non-automotive product portfolio through the acquisition of invisiFRAME, Ltd., a designer and manufacturer specializing in paint protection film patterns for bicycles. This strategic move allows XPEL to diversify its offerings and cater to a broader market segment. The acquisition enhances XPEL's position in the protective film industry by tapping into the growing interest in bicycle customization and protection

- In October 2021, XPEL, Inc. secured a multi-year sponsorship with the Mercedes-Benz Club of America, Inc., becoming the exclusive provider of paint protection films, ceramic coatings, and window films. This partnership significantly boosts XPEL's brand visibility among Mercedes-Benz enthusiasts, allowing the company to engage directly with a vast community of car owners through club-sponsored activities and events, thereby increasing brand awareness and product usage

- In June 2021, Avery Dennison launched specialized training classes aimed at enhancing skills in the application of automotive paint protection films and window films. These classes are designed to equip participants with advanced techniques to improve installation efficiency and reduce labor time. By focusing on maximizing productivity, Avery Dennison supports professionals in delivering high-quality installations, ultimately benefiting both installers and vehicle owners

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paint Protection Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paint Protection Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paint Protection Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.