Global Paint Thickeners Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

5.57 Billion

2025

2033

USD

4.10 Billion

USD

5.57 Billion

2025

2033

| 2026 –2033 | |

| USD 4.10 Billion | |

| USD 5.57 Billion | |

|

|

|

|

Paint Thickeners Market Size

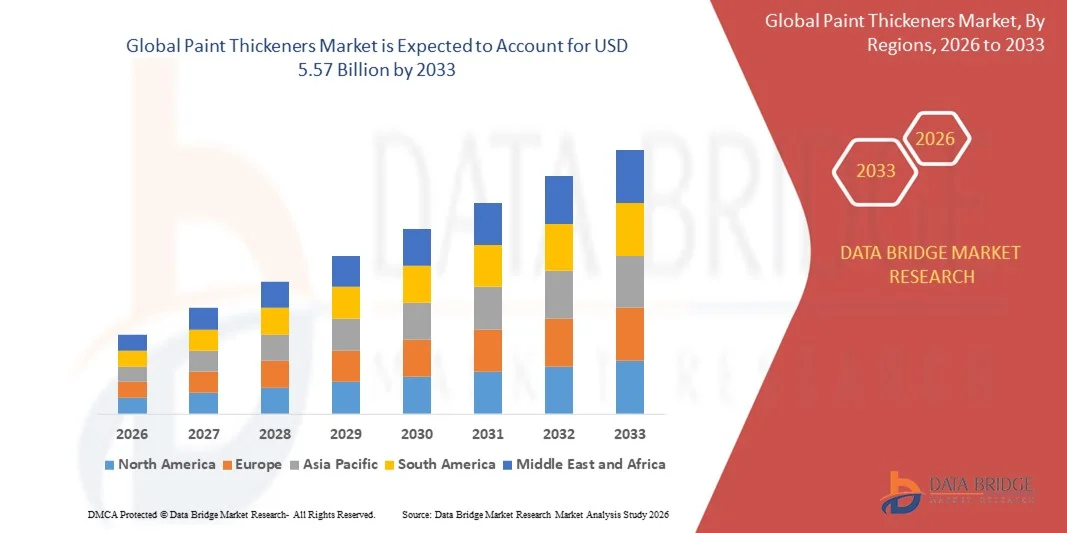

- The global paint thickeners market size was valued at USD 4.10 billion in 2025 and is expected to reach USD 5.57 billion by 2033, at a CAGR of 3.90% during the forecast period

- The market growth is largely fueled by increasing demand for high-performance paints across automotive, industrial, and architectural applications, as manufacturers focus on enhancing viscosity control, durability, and finish consistency to meet evolving performance standards in coatings

- Furthermore, rising interest in eco-friendly and water-based formulations due to tightening emission and sustainability regulations is driving the adoption of bio-based and low-VOC thickeners, accelerating innovation and portfolio expansion among key suppliers to support compatibility with next-generation paint systems

Paint Thickeners Market Analysis

- Paint thickeners, used to regulate viscosity, stabilize pigments, and improve application performance, are becoming an essential component in modern coating formulations as industries transition toward high-efficiency production, improved storage stability, and superior finish quality across diverse paint chemistries

- The escalating demand for paint thickeners is primarily driven by strong growth in construction and automotive manufacturing, rising adoption of water-borne coatings, and increasing emphasis on product consistency and user experience across professional and DIY painting applications, pushing manufacturers to invest in advanced rheology modifiers and customized thickening solutions

- North America dominated the paint thickeners market with a share of 38.6% in 2025, due to strong demand for premium quality paints, sustainable formulations, and ongoing investment in infrastructure renovation and residential construction

- Asia-Pacific is expected to be the fastest growing region in the paint thickeners market during the forecast period due to rising urbanization, growing construction spending, and expanding manufacturing and automotive sectors in countries such as China, Japan, and India

- Water-based paint segment dominated the market with a market share of 57.5% in 2025, due to rising regulatory restrictions on VOC emissions and increased consumer preference for safer and odor-free coating products. Water-based paints require effective thickening agents to achieve desired viscosity, leveling stability, and storage consistency, driving high usage of natural gums and modified cellulose derivatives. The expansion of sustainable building materials and the rapid shift toward environmentally compliant formulation technologies further strengthen water-based paint consumption globally. In addition, manufacturers are increasing product innovation in eco-certified water-borne paints for both residential and commercial facilities, which sustains the dominance of this segment through the forecast period

Report Scope and Paint Thickeners Market Segmentation

|

Attributes |

Paint Thickeners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paint Thickeners Market Trends

Increasing Demand for Bio-Based and Low-VOC Paint Thickeners

- A major trend in the paint thickeners market is the growing shift toward bio-based formulations and low-VOC solutions driven by rising environmental regulations and consumer preference for safer and sustainable paint ingredients. Manufacturers are increasingly focusing on developing formulations derived from renewable raw materials that offer reduced toxicity and improved environmental compatibility

- For instance, BASF SE has expanded its portfolio of bio-based rheology modifiers designed for low-VOC architectural coatings, supporting the rising demand for eco-friendly paints across residential and commercial applications

- Growing sustainability initiatives are encouraging the use of cellulose-based and modified starch thickeners that provide excellent viscosity control while meeting safety and regulatory standards. These solutions support compliance with strict air quality regulations such as VOC emission restrictions imposed by environmental agencies in Europe and North America

- Demand for water-based coatings is rising rapidly due to operational safety, low odor emission, and easier cleanup processes which further increases the need for compatible, low-VOC thickening agents. Waterborne paint systems require advanced rheology modifiers to maintain stability, consistency, and uniform application performance

- The expanding construction industry and increasing renovation activities are accelerating demand for eco-conscious coating solutions offering both high performance and environmental compliance. Companies are responding by investing in R&D to enhance the efficiency, compatibility, and sustainability of thickeners used in decorative and industrial paints

- This trend toward bio-friendly and low-emission thickeners reflects a long-term transformation of the coatings industry where sustainability, compliance, and environmental responsibility are becoming core purchasing criteria for manufacturers and end users, strengthening the demand for bio-based and low-VOC paint thickeners

Paint Thickeners Market Dynamics

Driver

Growing Use of Advanced Rheology Modifiers to Enhance Paint Performance

- The increasing adoption of advanced rheology modifiers is significantly driving the demand for paint thickeners as manufacturers aim to improve viscosity control, stability, and application characteristics across diverse paint systems. These modifiers support improved flow resistance, sag control, and surface leveling during paint application which enhances overall coating durability and finish quality

- For instance, Arkema Group introduced performance-enhanced rheology modifiers under the Coatex brand for automotive and industrial coatings to provide superior viscosity stability and improved compatibility with high-performance resin systems

- Advanced thickeners such as polyurethane-based, cellulose-derived, and synthetic associative modifiers are widely used in premium coating formulations, enabling better control over mechanical properties and long-term stability. These components ensure consistent texture, reduced settling, and precise paint behavior throughout storage and use

- The rising demand for high-performance coatings in construction, automotive refinishing, wood coatings, and protective coatings is increasing the adoption of specialized rheology modifiers. These modifiers support extreme weather resistance, chemical durability, and improved application control which enhances product value and long-term market adoption

- The growing focus on coating quality, ease of application, improved finish, and enhanced consumer experience is propelling demand for advanced paint thickeners. As coatings become more performance-driven, rheology modification will continue supporting innovation and technological development across premium paint categories

Restraint/Challenge

Fluctuating Raw Material Prices

- Volatility in the cost of key raw materials used in paint thickeners such as cellulose derivatives, petroleum-based chemicals, and synthetic polymers poses a significant challenge for manufacturers. These fluctuations impact production costs, pricing strategies, and supply chain stability which may reduce profitability margins for producers

- For instance, fluctuations in crude oil prices significantly affect petroleum-derived polymer thickeners manufactured by companies such as Dow Chemical Company, leading to unpredictable cost structures across industrial and decorative paint applications

- Changing global supply-demand dynamics, regional regulations, and trade restrictions can further contribute to instability in raw material sourcing. This may create supply disruptions, delayed production schedules, and increased dependence on alternative materials or sourcing strategies

- Manufacturers are required to continuously adjust their pricing and formulation strategies to compensate for the rising raw material uncertainties. The resulting cost variations often affect product affordability and purchasing decisions across price-sensitive markets

- To address these challenges, long-term procurement planning, investment in renewable raw material alternatives, and development of more cost-stable thickening formulations are becoming essential strategies as the industry works toward minimizing the effects of raw material price fluctuations and ensuring long-term market stability

Paint Thickeners Market Scope

The market is segmented on the basis of type, end-users, and paint type.

- By Type

On the basis of type, the paint thickeners market is segmented into starch, xanthan gum, carrageenan, guar gum, locust bean gum, gum arabic, and others. The starch segment dominated the market with the highest revenue share in 2025 due to its cost-effectiveness, wide availability, and ability to provide high viscosity in water-based formulations. Manufacturers prefer starch-based thickeners for architectural coatings where affordability and large-volume production are key priorities. The compatibility of starch with eco-friendly formulations and growing interest in biodegradable materials also support its dominance as regulatory bodies push the coatings industry toward sustainable ingredient usage. In addition, starch offers high stability against temperature fluctuations and shear stress, making it suitable for both indoor and outdoor paint applications where finish consistency matters. The widespread acceptance of starch across industrial, decorative, and commercial coatings strengthens its demand across developing and mature markets.

The xanthan gum segment is anticipated to witness the fastest growth rate from 2026 to 2033, propelled by rising adoption in premium quality paints requiring enhanced rheology control and anti-sag behavior. For instance, companies such as Cargill and CP Kelco are expanding production capacities to support increasing demand for xanthan gum in high-performance water-based and solvent-free coatings. The ability of xanthan gum to provide excellent shear-thinning properties makes it suitable for sprayable paints and modern precision-application tools in both commercial and do-it-yourself segments. In addition, its superior suspension properties prevent pigment settling and ensure uniform texture, which is a crucial feature in industrial protective coatings and automotive refinishing sectors. Increasing regulatory pressure toward sustainable and bio-derived ingredients further accelerates the adoption of xanthan gum as manufacturers transition to natural alternatives to synthetic polymer thickeners.

- By End-Users

On the basis of end-users, the paint thickeners market is categorized into building and construction, transportation, packaging, textile, industrial, and others. The building and construction segment accounted for the largest market share in 2025, driven by rising demand for architectural coatings, wall finishes, waterproof coatings, and decorative paints in residential and commercial infrastructure projects. Construction activities in developing economies and renovation trends in mature markets boost the requirement for high-performance paints where thickeners enhance texture consistency and application smoothness. The shift toward water-based and low-VOC wall paints has also supported growth, as thickener functionality becomes essential for stability and application flow. In addition, rising urbanization and increasing investment in aesthetic interior finishing solutions contribute to sustained demand for efficient thickening systems in the construction sector.

The transportation segment is projected to record the fastest growth rate from 2026 to 2033, supported by increasing consumption of high-performance coatings in automotive manufacturing, aerospace maintenance, marine infrastructure, and rail transport equipment. For instance, manufacturers such as BASF and AkzoNobel are adopting rheology modifiers to achieve advanced coating properties for corrosion protection and weather resistance. Demand for thickeners rises as transportation coatings require durable, smooth, and high-gloss finishes that maintain film thickness during spray, dip, or robotic application processes. In addition, the growing production of electric vehicles and expansion of global aerospace fleets strengthen the use of specialized thickeners in coating systems that must withstand environmental stress and mechanical wear.

- By Paint Type

On the basis of paint type, the market is segmented into water-based paint, oil-based paint, and solvent-based paint. The water-based paint segment dominated the market with the largest share of 57.5% in 2025, supported by rising regulatory restrictions on VOC emissions and increased consumer preference for safer and odor-free coating products. Water-based paints require effective thickening agents to achieve desired viscosity, leveling stability, and storage consistency, driving high usage of natural gums and modified cellulose derivatives. The expansion of sustainable building materials and the rapid shift toward environmentally compliant formulation technologies further strengthen water-based paint consumption globally. In addition, manufacturers are increasing product innovation in eco-certified water-borne paints for both residential and commercial facilities, which sustains the dominance of this segment through the forecast period.

The solvent-based paint segment is expected to grow at the fastest rate from 2026 to 2033, driven by its continued demand in industrial maintenance, marine protective coatings, and harsh-environment applications where durability remains essential. For instance, sectors such as oil and gas, heavy machinery, and shipbuilding rely on solvent-based formulations due to their superior adhesion, long film life, and weather resistance. While regulatory pressure impacts widespread usage, technological advancement in high-solid and low-toxicity thickener chemistry continues to support performance optimization in solvent-based paints. In addition, emerging markets with relaxed compliance frameworks and rapid industrialization are contributing to growing consumption across heavy-duty coating applications where water-based alternatives cannot yet match required performance levels.

Paint Thickeners Market Regional Analysis

- North America dominated the paint thickeners market with the largest revenue share of 38.6% in 2025, driven by strong demand for premium quality paints, sustainable formulations, and ongoing investment in infrastructure renovation and residential construction

- Consumers and industries across the region prioritize coating solutions with improved viscosity balance, smooth application, and long-term durability, increasing the use of natural and synthetic thickeners in decorative, industrial, automotive, and marine coatings

- The presence of established paint manufacturers and regulatory pressure supporting low-VOC and water-based paints continue to reinforce the region’s leadership in adoption of advanced rheology modifiers across multiple paint categories

U.S. Paint Thickeners Market Insight

The U.S. paint thickeners market captured the largest revenue share in 2025 within North America, driven by strong interest in advanced coating formulations supporting commercial infrastructure, residential upgrades, and industrial finishing applications. Demand is supported by high consumption of water-based coatings, technological innovation in formulation enhancement, and expanding use of high-performance paints in automotive refinishing, architectural coatings, and protective systems. The country’s adoption of sustainability standards and growing use of smart manufacturing processes in coating production further accelerate demand for enhanced thickening technologies across multiple sectors.

Europe Paint Thickeners Market Insight

The Europe paint thickeners market is projected to expand at a substantial CAGR during the forecast period owing to regulatory standards promoting low-VOC paints, sustainable building materials, and bio-based chemical usage. Rising demand for premium decorative paints, coupled with continuous investment in building restoration and infrastructure modernization, supports increasing usage of thickeners in both architectural and industrial coatings. The region shows consistent growth across both residential and commercial applications as consumers and manufacturers focus on high-quality finishes, coating longevity, and reduced environmental impact.

U.K. Paint Thickeners Market Insight

The U.K. market is anticipated to grow at a notable CAGR during the forecast period, fueled by rising demand for high-performance and eco-conscious paint formulations in both renovation and new construction activity. The market benefits from increasing adoption of water-based coatings, especially among residential consumers seeking safe, low-odor products with smooth texture and strong leveling performance. The expansion of commercial building upgrades and decorative interior finishing trends continues to drive demand for improved thickening solutions supporting formulation flexibility and application consistency.

Germany Paint Thickeners Market Insight

Germany is expected to experience considerable growth driven by increasing emphasis on sustainability, coating durability, and precision-engineered formulation performance. Demand is supported by widespread industrial activity and a strong manufacturing ecosystem requiring protective coatings for machinery, automotive systems, and industrial architecture. The nation’s focus on regulatory compliance and innovation in renewable and environmentally responsible ingredients accelerates the shift toward natural and hybrid thickener technologies across water-based and specialty coatings.

Asia-Pacific Paint Thickeners Market Insight

The Asia-Pacific paint thickeners market is positioned to grow at the fastest CAGR during 2026 to 2033, driven by rising urbanization, growing construction spending, and expanding manufacturing and automotive sectors in countries such as China, Japan, and India. Rising disposable incomes and rapid population-driven housing development support strong demand for decorative paints, while the region’s leadership in global paint and chemical production increases availability and affordability of thickening agents for multiple coating applications. Government-driven industrial expansion and smart city initiatives further enhance usage of performance-based paint formulations.

Japan Paint Thickeners Market Insight

Japan is experiencing growth due to strong interest in precision-engineered coatings offering durability, high purity, and controlled rheology performance for automotive, industrial, and architectural applications. The rise of smart homes, technologically advanced production facilities, and an aging population requiring user-friendly, low-odor coatings support demand for high-performance water-based paint thickeners. Integration of advanced formulation technologies continues to strengthen market adoption across multiple paint categories.

China Paint Thickeners Market Insight

China accounted for the largest revenue share in the Asia-Pacific paint thickeners market in 2025, supported by rapid industrialization, large-scale infrastructure development, and the country’s position as a high-volume paint and chemical manufacturing hub. Significant demand originates from residential construction, automotive refinishing, and industrial coating applications, supported by growing acceptance of eco-friendly and water-based paint solutions. Expanding local production capabilities and strong pricing competitiveness accelerate mass adoption of paint thickeners across consumer and industrial coatings markets.

Paint Thickeners Market Share

The paint thickeners industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Cargill Incorporated (U.S.)

- Henkel Adhesives Technologies India Private Limited (India)

- DuPont (U.S.)

- Ingredion Incorporated (U.S.)

- ADM (U.S.)

- Eastman Chemical Company (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Ashland (U.S.)

- CP Kelco U.S., Inc. (U.S.)

- Celanese Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- The Lubrizol Corporation (U.S.)

- Tate & Lyle (U.K.)

- PQ Corporation (U.S.)

- BYK-Chemie GmbH (Germany)

- The Sherwin-Williams Company (U.S.)

- SAN NOPCO LIMITED (Japan)

- Clariant (Switzerland)

- Dow (U.S.)

Latest Developments in Global Paint Thickeners Market

- In January 2025, MÜNZING CHEMIE GmbH expanded its global footprint by establishing its Asia-Pacific regional headquarters in Singapore, reinforcing its operational presence in one of the fastest-growing coatings and construction markets. This development is expected to significantly enhance regional product availability, shorten logistical timelines, and strengthen customer access to advanced paint thickener portfolios. As APAC demand intensifies for water-based, high-performance, and environmentally aligned coatings, this strategic move positions the company to accelerate market share expansion, support regional partnerships, and respond more efficiently to evolving formulation requirements within decorative and industrial paint applications

- In 2024, MÜNZING introduced TAFIGEL PUR 82 and the renewable alternative TAFIGEL PUR 82 R, offering enhanced rheology stability and performance for water-based paint formulations while reducing environmental impact. These new solutions are engineered to improve sag resistance, film build, and flow behavior, meeting growing expectations for consistent finish quality in both premium and mass-market coatings. The introduction of a renewable content variant reflects a wider shift in the market toward circular and bio-based ingredient strategies, and this launch is expected to accelerate competitive innovation and influence purchasing decisions among environmentally driven manufacturers

- In 2024, BASF advanced its sustainability roadmap with the release of automotive clearcoat coatings produced under its ChemCycling process, which uses chemically recycled feedstock. While the launch focuses on coatings rather than standalone thickeners, it has a cascading effect on the entire coatings additives supply chain, including rheology modifiers. As downstream manufacturers adopt more recycled and low-carbon ingredient standards, paint thickener suppliers are expected to align formulations with these performance and sustainability requirements, accelerating the transition toward advanced, compliant thickener grades supporting long-term environmental targets within the coatings ecosystem

- In May 2024, AkzoNobel partnered with BASF to introduce a next-generation paint line in the U.K. featuring BMB-certified acrylic binders, signaling expanding momentum toward traceable, low-carbon material sourcing in coatings production. This collaboration is likely to influence formulation trends for paint thickeners, as high-performance binder systems often require precision rheology control and enhanced compatibility with water-based and hybrid paint chemistries. The initiative strengthens industry confidence in certified sustainable supply chains and is expected to encourage other manufacturers to adopt similar eco-aligned coating formulations, creating new growth momentum for rheology modifiers designed for advancing regulatory and performance expectations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paint Thickeners Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paint Thickeners Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paint Thickeners Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.