Global Palletizers Market

Market Size in USD Billion

CAGR :

%

USD

923.49 Billion

USD

1,438.90 Billion

2024

2032

USD

923.49 Billion

USD

1,438.90 Billion

2024

2032

| 2025 –2032 | |

| USD 923.49 Billion | |

| USD 1,438.90 Billion | |

|

|

|

|

Palletizers Market Size

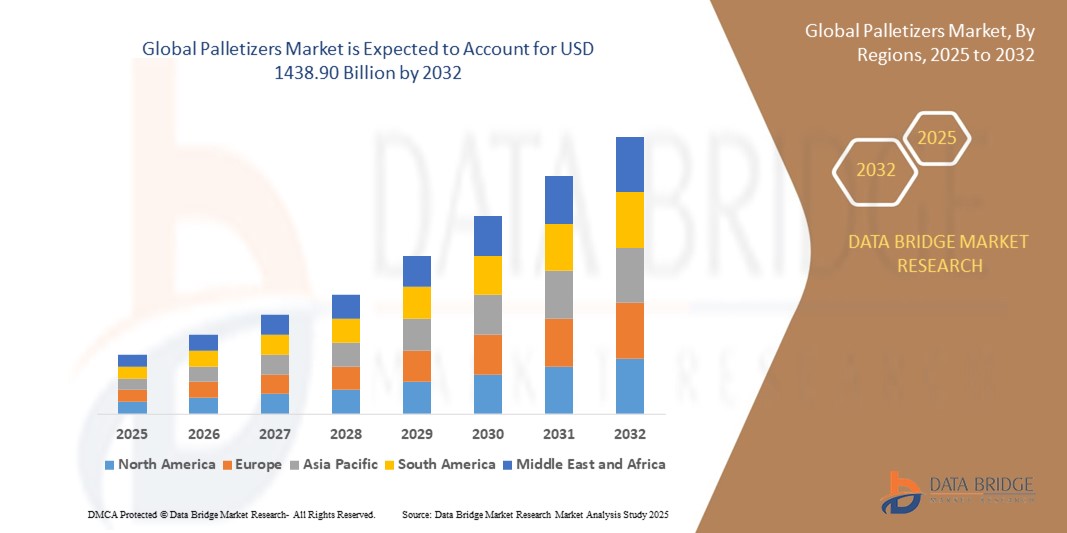

- The global palletizers market size was valued at USD 923.49 billion in 2024 and is expected to reach USD 1438.90 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is primarily driven by the increasing demand for automation in material handling, advancements in robotic technologies, and the need for efficient supply chain operations across various industries

- The growing adoption of palletizers in warehouses and manufacturing facilities, coupled with the rising focus on reducing manual labor and improving operational efficiency, is significantly boosting market expansion

Palletizers Market Analysis

- Palletizers, essential for automating the stacking and organization of goods on pallets, are critical components in modern supply chain and logistics systems, offering enhanced efficiency, precision, and scalability in material handling

- The surge in demand for palletizers is fueled by the rapid growth of e-commerce, increasing adoption of automation in industries, and the need for optimized warehouse management systems

- North America dominated the palletizers market with the largest revenue share of 38.5% in 2024, driven by early adoption of automation technologies, a strong manufacturing base, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, expanding manufacturing sectors, and increasing investments in automation in countries such as China, India, and Japan

- The conventional palletizers segment dominated the largest market revenue share of 54.2% in 2024, driven by its widespread adoption in high-productivity settings due to reliability, cost-effectiveness, and ability to handle diverse product types at high speeds, processing up to 150 cases per minute

Report Scope and Palletizers Market Segmentation

|

Attributes |

Palletizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Palletizers Market Trends

“Increasing Integration of AI and Automation Technologies”

- The global palletizers market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and automation technologies

- These technologies enable advanced process optimization, predictive maintenance, and real-time monitoring of palletizing operations

- AI-driven palletizers can analyze operational data to optimize stacking patterns, improve efficiency, and reduce errors in material handling

- For instance, companies are developing AI-powered robotic palletizers that adapt to varying product sizes and packaging formats, enhancing flexibility in industries such as food and beverage and pharmaceuticals

- This trend is increasing the appeal of palletizing systems for manufacturers and logistics providers by improving throughput and reducing operational downtime

- AI algorithms can also monitor equipment performance, predict maintenance needs, and minimize disruptions by addressing potential issues proactively

Palletizers Market Dynamics

Driver

“Rising Demand for Automation and Efficiency in Supply Chains”

- The growing need for streamlined supply chain operations and increased operational efficiency is a key driver for the global palletizers market

- Palletizing systems enhance productivity by automating repetitive tasks, reducing manual labor, and ensuring precise stacking for storage and transportation

- Government initiatives promoting Industry 4.0 and smart manufacturing, particularly in regions such as North America and Europe, are accelerating the adoption of advanced palletizing solutions

- The expansion of e-commerce and the need for rapid order fulfillment are driving demand for robotic palletizers, which offer scalability and flexibility for handling diverse product types

- Manufacturers are increasingly integrating factory-fitted palletizing systems to meet rising production demands and improve operational accuracy

Restraint/Challenge

“High Initial Investment and Data Security Concerns”

- The high upfront costs associated with acquiring, installing, and integrating advanced palletizing systems, particularly robotic palletizers, pose a significant barrier, especially for small and medium-sized enterprises in emerging market

- Retrofitting existing facilities with automated palletizing systems can be complex and expensive, requiring specialized expertise and infrastructure upgrades.

- Data security and privacy concerns are also a major challenge, as modern palletizers often rely on IoT and cloud-based systems that collect and transmit operational data, raising risks of cyberattacks and data breaches

- Compliance with varying global regulations on data protection and industrial automation standards adds complexity for manufacturers operating across multiple regions

- These factors can limit market growth in cost-sensitive regions or industries with stringent data privacy requirements

Palletizers market Scope

The market is segmented on the basis of technology, product type, and end-user.

- By Technology

On the basis of technology, the global palletizers market is segmented into Conventional Palletizers and Robotic Palletizers. The Conventional Palletizers segment dominated the largest market revenue share of 54.2% in 2024, driven by its widespread adoption in high-productivity settings due to reliability, cost-effectiveness, and ability to handle diverse product types at high speeds, processing up to 150 cases per minute. These systems are well-established in industries such as food and beverage and pharmaceuticals, where consistent output is critical.

The Robotic Palletizers segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by advancements in robotics, AI integration, and the ability to handle varied packaging formats with precision and flexibility. The increasing adoption of robotic systems in e-commerce and logistics, along with their ability to reduce labor costs and enhance operational efficiency, drives this growth.

- By Product Type

On the basis of product type, the global palletizers market is segmented into Cases and Boxes, Bags and Sacks, Pails and Drums, Trays and Crates, and Bundles. The Cases and Boxes segment dominated the market with a revenue share of 45.2% in 2024, attributed to its extensive use in standardized packaging across industries such as food and beverage, pharmaceuticals, and consumer goods. These palletizers optimize stacking patterns and ensure load stability for efficient storage and transportation.

The Bags and Sacks segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increasing demand in industries such as agriculture, chemicals, and food processing, where bags are used for packaging grains, powders, and other bulk products. The versatility of palletizers in handling various bag sizes and weights supports this segment's growth.

- By End-User

On the basis of end-user, the global palletizers market is segmented into Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, Chemicals, Construction Industry, and Others. The Food and Beverage segment held the largest market revenue share of 33.0% in 2024, driven by high production volumes and the need for efficient, hygienic packaging solutions to meet strict regulatory standards. Palletizers in this segment handle diverse packaging formats such as bottles, cans, and cartons, ensuring compliance with food safety requirements.

The Pharmaceuticals segment is expected to witness the fastest growth rate of 7.1% from 2025 to 2032, fueled by the expanding pharmaceutical industry and stringent regulations requiring precise handling to prevent contamination and errors. The adoption of palletizers for automating the palletization of drugs, vials, and cartons enhances efficiency and reduces transportation time, particularly for time-sensitive medications.

Palletizers Market Regional Analysis

- North America dominated the palletizers market with the largest revenue share of 38.5% in 2024, driven by early adoption of automation technologies, a strong manufacturing base, and the presence of key industry players

- Businesses prioritize palletizers to enhance operational efficiency, reduce labor costs, and improve workplace safety, particularly in regions with high manufacturing and logistics activities

- Growth is supported by advancements in palletizing technology, including robotic and conventional systems, alongside rising adoption in both large-scale and small-scale operations

U.S. Palletizers Market Insight

The U.S. palletizers market captured the largest revenue share of 88.2% in 2024 within North America, fueled by strong demand for automated solutions in the food and beverage, pharmaceuticals, and logistics sectors. The trend towards warehouse automation and increasing focus on supply chain optimization boost market expansion. The integration of advanced palletizers in manufacturing facilities and distribution centers complements aftermarket upgrades, creating a dynamic market ecosystem.

Europe Palletizers Market Insight

The Europe palletizers market is expected to witness significant growth, supported by regulatory emphasis on workplace safety and operational efficiency. Businesses seek palletizers that streamline material handling while reducing manual labor. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing notable uptake due to advanced manufacturing sectors and sustainability initiatives.

U.K. Palletizers Market Insight

The U.K. market for palletizers is expected to witness rapid growth, driven by demand for automation in logistics and manufacturing in urban and suburban settings. Increased focus on operational efficiency and workplace safety encourages adoption. Evolving regulations promoting automation and ergonomic standards influence business choices, balancing technology integration with compliance.

Germany Palletizers Market Insight

Germany is expected to witness a high growth rate in the palletizers market, attributed to its advanced manufacturing sector and strong focus on automation and energy efficiency. German businesses prefer technologically advanced palletizers that optimize material handling and contribute to lower operational costs. The integration of these systems in premium manufacturing facilities and aftermarket solutions supports sustained market growth.

Asia-Pacific Palletizers Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding industrial production and rising investments in automation in countries such as China, India, and Japan. Increasing awareness of operational efficiency, workplace safety, and cost reduction is boosting demand. Government initiatives promoting industrial automation and smart manufacturing further encourage the adoption of advanced palletizers.

Japan Palletizers Market Insight

Japan’s palletizers market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced palletizing systems that enhance operational efficiency and safety. The presence of major manufacturers and the integration of palletizers in automated production lines accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Palletizers Market Insight

China holds the largest share of the Asia-Pacific palletizers market, propelled by rapid industrialization, rising manufacturing output, and increasing demand for automated material handling solutions. The country’s growing industrial base and focus on smart manufacturing support the adoption of advanced palletizers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Palletizers Market Share

The palletizers industry is primarily led by well-established companies, including:

- A-B-C Packaging Machine Corporation (U.S.)

- ABB (Sweden)

- Columbia Machine, Inc. (Columbia)

- Premier Tech Ltd. (Canada)

- 3M (U.S)

- Berry Global Inc. (U.S)

- Cedo Ltd (U.K)

- FANUC America Corporation (Japan)

- KION GROUP AG (Germany)

- KUKA AG (Germany)

- Honeywell International Inc (U.S.)

- Krones AG (Germany)

- Wildeck (U.S.)

- Schneider Packaging Equipment Co. Inc. (U.S.)

- Okura Yusoki Co., Ltd. (Japan)

- Fuji Robotics Americas (U.S.)

- Concetti S.P.A (Italy)

What are the Recent Developments in Global Palletizers Market?

- In May 2024, Doosan Robotics Inc. unveiled its most advanced P-SERIES (PRIME-SERIES) collaborative robots at Automate 2024 in Chicago. Headlining the launch was the P3020, the world’s most powerful palletizing cobot, boasting a 30 kg payload and an unmatched reach of 2,030 mm. Designed for high-efficiency industrial tasks, the P-SERIES features reduced power consumption, enhanced safety (PL e, Cat 4), and a wrist-singularity-free design. Its simplified 5-axis movement and increased speed make it ideal for palletizing, manufacturing, logistics, and more—delivering a new standard in human-robot collaboration

- In January 2024, KUKA AG launched the second generation of its KR QUANTEC PA palletizer, setting a new benchmark in high-speed palletizing. This upgraded model features an optimized weight distribution and center of gravity, along with enhanced drive units powered by the latest gear and motor technologies. These improvements enable a perfect balance between axis speed and acceleration, resulting in up to 10% faster cycle times compared to its predecessor. With a payload capacity of up to 240 kg and a compact footprint, it’s ideal for demanding applications, including those in the food industry, thanks to its Hygienic Oil (HO) variant

- In January 2024, FANUC CORPORATION introduced the M-950iA/500, a powerful serial-link palletizing robot designed to handle payloads up to 500 kg. Unlike traditional parallel-link robots, the M-950iA/500 features a wider range of motion, including the ability to extend its arm upright and rotate backward with minimal interference—ideal for tight workspaces and complex palletizing layouts. It boasts a 2,830 mm reach, high rigidity, and a robust wrist capable of managing large and heavy components such as EV batteries and automotive castings. The robot is also optimized for friction stir welding and machining, thanks to its precision and stiffness enhancement options

- In October 2023, Schneider Packaging Equipment Company, Inc., a Pacteon Group company, entered the robotic high-speed palletizing market through a strategic licensing agreement with ITW Hartness Division. This partnership enables Schneider to offer Hartness’s High-Speed Layer Palletizing Tool for future projects and to support existing Hartness systems already in operation. The agreement followed Hartness’s decision to reposition its product portfolio, and Schneider’s team underwent specialized training to ensure seamless integration. This move expands Schneider’s capabilities in end-of-line automation, reinforcing its position as a leader in robotic palletizing solutions

- In August 2023, Dexterity Inc. released Version 3.0 of its Palletizing and Depalletizing (PDP) software, bringing a suite of enhancements to warehouse automation. The update introduced features such as print-and-apply integration, pallet stacking, rolling cart loading, fly-by barcode scanning, and direct sortation to pallets—all aimed at boosting throughput, reducing installation time and cost, and increasing operational flexibility. These upgrades enable third-party logistics providers, retailers, and manufacturers to automate complex pallet operations more efficiently, supporting higher case-per-hour rates and seamless integration into existing workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Palletizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Palletizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Palletizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.