Global Palm Fibre Packaging Market

Market Size in USD Million

CAGR :

%

USD

654.81 Million

USD

974.85 Million

2024

2032

USD

654.81 Million

USD

974.85 Million

2024

2032

| 2025 –2032 | |

| USD 654.81 Million | |

| USD 974.85 Million | |

|

|

|

|

Palm Fiber Packaging Market Size

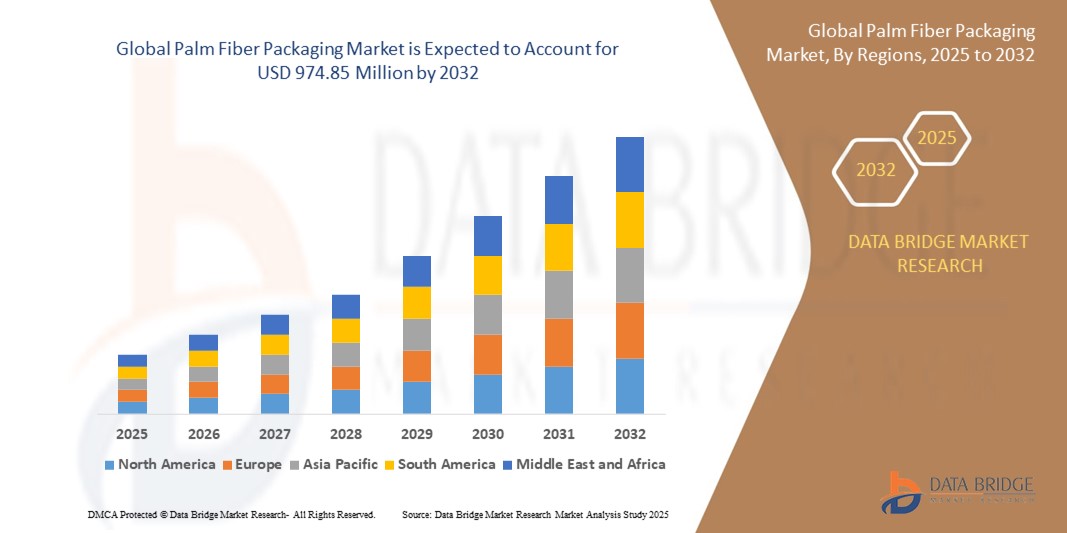

- The global palm fiber packaging market size was valued at USD 654.81 million in 2024 and is expected to reach USD 974.85 million by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and biodegradable packaging alternatives across industries such as food and beverages, consumer goods, and e-commerce

- Growing environmental concerns and stringent regulatory pressures to reduce plastic usage have accelerated the shift towards eco-friendly packaging materials, with palm fiber gaining traction due to its renewable origin, durability, and compostability

Palm Fiber Packaging Market Analysis

- The market is experiencing rising investments in green packaging technologies and manufacturing infrastructure, particularly in emerging economies where palm oil production is abundant

- Manufacturers are innovating with molded pulp technology and advanced fiber extraction methods to enhance the structural integrity and aesthetic appeal of palm fiber packaging, positioning it as a viable replacement for plastic and foam-based alternatives

- Asia-Pacific dominated the palm fiber packaging market with the largest revenue share of 39.25% in 2024, driven by abundant availability of raw materials, a booming foodservice industry, and increasing environmental consciousness across key economies such as China, India, and Indonesia

- Europe region is expected to witness the highest growth rate in the global palm fiber packaging market, driven by rising legislative bans on single-use plastics, growing environmental consciousness among consumers, and increased adoption of bio-based materials by retailers and food brands. European Union directives promoting sustainable packaging are incentivizing innovation in the fiber-based packaging space, including palm-derived solutions, especially in markets such as France, the Netherlands, and the U.K.

- The non-wood segment dominated the market with the largest revenue share in 2024, driven by the increasing focus on agricultural waste valorization and circular economy practices. Palm fibers derived from agricultural by-products such as oil palm residues offer a sustainable and cost-effective raw material source, especially in Southeast Asian countries where palm cultivation is abundant. The non-wood segment is also gaining traction due to regulatory support for biodegradable packaging sourced from renewable biomass

Report Scope and Palm Fiber Packaging Market Segmentation

|

Attributes |

Palm Fiber Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption of Biodegradable Packaging Solutions Across Emerging Economies • Increasing Investments in Sustainable Material Research and Development |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Palm Fiber Packaging Market Trends

“Rising Use of Palm Fiber Packaging in E-Commerce and Retail Sectors”

- E-commerce platforms are increasingly shifting to biodegradable materials such as palm fiber to reduce plastic waste and meet customer expectations for eco-conscious practices. This trend is particularly strong in packaging for electronics, cosmetics, and food products where protective yet sustainable solutions are needed

- Retail chains are partnering with suppliers offering palm fiber-based trays, wraps, and containers to comply with growing regulatory pressure and enhance brand sustainability. These materials are being integrated into both in-store packaging and online delivery formats

- Innovation in design and printing techniques is enabling palm fiber packaging to replace visually appealing plastic alternatives without compromising on branding, shelf appeal, or consumer convenience. This is helping drive adoption across premium product lines

- For instance, major Southeast Asian retailers have begun replacing conventional plastic packaging with molded palm fiber containers in their personal care and ready-to-eat food sections, responding to both environmental mandates and consumer demand

- Overall, the integration of palm fiber packaging in e-commerce and retail is expected to accelerate as sustainability becomes a competitive advantage and supply chain standards increasingly favor biodegradable alternatives

Palm Fiber Packaging Market Dynamics

Driver

“Growing Environmental Regulations and Ban on Single-Use Plastics”

- Governments worldwide are enacting strict regulations against single-use plastics, prompting industries to transition to eco-friendly packaging solutions such as palm fiber. These initiatives are often backed by fines or incentives that steer companies toward sustainable practices

- Palm fiber packaging, derived from agricultural waste, aligns with circular economy principles and offers compostable, biodegradable alternatives without requiring major chemical treatments, making it more acceptable under green packaging laws

- Consumer awareness is also influencing purchasing behavior, with many preferring products wrapped in plant-based or recycled materials. This demand supports companies in their sustainability reporting and enhances brand loyalty among eco-conscious shoppers

- For instance, the European Union’s directive banning single-use plastics has accelerated the shift toward palm fiber packaging, especially in the foodservice and hospitality sectors where disposables are heavily used

- With tightening legislation and global climate commitments, palm fiber packaging stands as a key material driving sustainable innovation across industries, positioning it as a long-term driver of growth in the packaging sector

Restraint/Challenge

“Limited Manufacturing Infrastructure and High Initial Costs”

- The commercial production of palm fiber packaging requires specialized machinery for molding and treating fibers, which many developing markets currently lack. This creates geographic disparities in availability and scalability

- Initial setup costs for production units remain high due to the need for customized tooling, quality control systems, and regulatory compliance, making entry into this space difficult for small and mid-sized enterprises

- Inconsistent availability of raw palm biomass, especially in non-producing countries, further adds to cost volatility and limits reliable production output, restricting adoption in mass-market packaging

- For instance, several packaging startups in Latin America have faced delays in scaling palm fiber production due to high import costs of processing equipment and irregular supply of palm waste material

- These cost and infrastructure barriers continue to hamper broader market penetration, highlighting the need for regional investments, technology transfers, and policy support to realize the full potential of palm fiber packaging on a global scale

Palm Fiber Packaging Market Scope

The market is segmented on the basis of source, process, product, and application.

- By Source

On the basis of source, the palm fiber packaging market is segmented into wood and non-wood. The non-wood segment dominated the market with the largest revenue share in 2024, driven by the increasing focus on agricultural waste valorization and circular economy practices. Palm fibers derived from agricultural by-products such as oil palm residues offer a sustainable and cost-effective raw material source, especially in Southeast Asian countries where palm cultivation is abundant. The non-wood segment is also gaining traction due to regulatory support for biodegradable packaging sourced from renewable biomass.

The wood segment is projected to witness fastest growth rate from 2025 to 2032, primarily supported by advancements in processing technologies that enhance fiber strength and molding capabilities. While less sustainable than non-wood options, wood-derived palm fiber products still find applications in premium packaging solutions where durability and rigidity are essential.

- By Process

On the basis of process, the market is segmented into thermoforming, thick wall, transfer, and others. The thermoforming segment accounted for the largest market share in 2024, supported by its high-speed production capabilities and adaptability in producing lightweight and aesthetically pleasing packaging formats. Thermoforming allows precision molding, making it ideal for producing consumer-facing packaging for food, electronics, and cosmetics.

The thick wall segment is projected to witness fastest growth rate from 2025 to 2032, owing to its suitability for heavy-duty applications requiring sturdier protection. Thick wall packaging is especially relevant in industrial and logistics settings, where cushioning and stackability are key considerations.

- By Product

Based on product, the market is categorized into plates, trays, cups, clamshell, bowls, and others. The trays segment dominated the market in 2024, fueled by strong demand from food and beverage manufacturers seeking sustainable alternatives to plastic and foam-based packaging. Palm fiber trays offer excellent thermal resistance and rigidity, making them suitable for ready-to-eat meals and food delivery.

The clamshell segment is projected to witness fastest growth rate from 2025 to 2032, as e-commerce platforms and retail brands increasingly adopt clamshell packaging for electronics, personal care, and bakery items. The resealable and tamper-evident features of palm fiber clamshells enhance consumer convenience while reinforcing eco-friendly branding.

- By Application

On the basis of application, the palm fiber packaging market is segmented into food and beverages, industrial, cosmetics, logistics, electrical and electronics, pharmaceuticals, and others. The food and beverages segment held the largest revenue share in 2024, driven by the growing shift toward compostable packaging solutions in quick-service restaurants, organic grocery chains, and food delivery services. Palm fiber packaging’s food-safe properties and thermal insulation make it a strong contender for disposable food containers and utensils.

The cosmetics segment is projected to witness fastest growth rate from 2025 to 2032, supported by the beauty industry's increasing adoption of biodegradable and visually appealing packaging formats. Premium cosmetic brands are leveraging palm fiber packaging for its texture, printability, and alignment with clean beauty narratives, enhancing both shelf presence and sustainability goals.

Palm Fiber Packaging Market Regional Analysis

• Asia-Pacific dominated the palm fiber packaging market with the largest revenue share of 39.25% in 2024, driven by abundant availability of raw materials, a booming foodservice industry, and increasing environmental consciousness across key economies such as China, India, and Indonesia

• Regional manufacturers are heavily investing in sustainable alternatives to plastic packaging, leveraging government support and rising consumer demand for eco-friendly products

• Furthermore, the region benefits from low-cost labor and a well-established agricultural base, facilitating large-scale production of palm-based pulp packaging for domestic use and export

China Palm Fiber Packaging Market Insight

The China palm fiber packaging market accounted for the highest revenue share within Asia-Pacific in 2024, supported by strong government policies on single-use plastic bans and significant advancements in biodegradable packaging technologies. The country’s thriving food delivery sector and growing health-conscious population are increasingly turning to compostable, palm fiber-based trays, bowls, and containers. Chinese manufacturers are also expanding production capacities to meet both domestic and global demand, positioning China as a key supplier in the sustainable packaging value chain.

Japan Palm Fiber Packaging Market Insight

The Japan palm fiber packaging market is projected to witness fastest growth rate from 2025 to 2032, propelled by the country’s strong emphasis on environmental sustainability and innovation in packaging technologies. Japanese consumers and companies alike are highly responsive to eco-friendly alternatives, leading to increased adoption of palm fiber packaging in sectors such as food and cosmetics. In addition, Japan’s strict waste management laws and its pursuit of a circular economy are driving both domestic production and imports of biodegradable packaging solutions.

Europe Palm Fiber Packaging Market Insight

The Europe palm fiber packaging market is projected to witness fastest growth rate from 2025 to 2032, driven by stringent European Union regulations on plastic usage and a growing circular economy framework. Increased consumer preference for sustainable food and cosmetic packaging solutions is prompting industries to switch to molded fiber alternatives. Moreover, several European brands are investing in palm fiber-based packaging to align with corporate sustainability goals and reduce their environmental footprint.

Germany Palm Fiber Packaging Market Insight

The Germany palm fiber packaging market i is projected to witness fastest growth rate from 2025 to 2032, supported by strong environmental advocacy and advanced packaging innovation. Germany’s focus on industrial composting and reduction of carbon emissions has encouraged the adoption of bio-based materials such as palm fiber. The country’s robust manufacturing infrastructure and emphasis on premium, recyclable packaging solutions are also helping boost demand across foodservice, cosmetics, and logistics applications.

U.K. Palm Fiber Packaging Market Insight

The U.K. palm fiber packaging market is projected to witness fastest growth rate from 2025 to 2032, supported by robust government initiatives targeting plastic reduction and the rising popularity of sustainable lifestyle choices. Businesses across the foodservice and retail sectors are increasingly shifting towards compostable palm fiber packaging to comply with environmental regulations and meet evolving consumer preferences. Moreover, the U.K.’s strong e-commerce sector and increasing demand for recyclable, protective packaging further contribute to market growth.

North America Palm Fiber Packaging Market Insight

The North America palm fiber packaging market is projected to witness fastest growth rate from 2025 to 2032, driven by rising awareness of environmental issues and consumer demand for plastic-free packaging. The food and beverage sector in the region is increasingly adopting compostable trays, cups, and clamshells made from palm fiber to appeal to eco-conscious consumers. In addition, the market benefits from a growing preference for locally sourced, biodegradable packaging and increased collaborations between packaging companies and sustainable agricultural producers.

U.S. Palm Fiber Packaging Market Insight

The U.S. palm fiber packaging market captured the largest revenue share within North America in 2024, fueled by corporate sustainability initiatives and state-level plastic bans in regions such as California and New York. U.S. companies across foodservice, retail, and personal care are prioritizing eco-packaging solutions to reduce plastic use. Moreover, consumer demand for plant-based, microwave-safe packaging products is driving investment in palm fiber-based alternatives, particularly in the quick-service restaurant and ready-to-eat meal sectors.

Palm Fiber Packaging Market Share

The Palm Fiber Packaging industry is primarily led by well-established companies, including:

- HHRG Berhad (Malaysia)

- CKF Inc. (Canada)

- Global Green Synergy Sdn. Bhd. (Malaysia)

- Nextgreen Global Berhad (Malaysia)

- Palm. (Japan)

- ADVANCED PAPER FORMING (U.S.)

- buhl-paperform GmbH (Germany)

- Atlantic Pulp (U.S.)

Latest Developments in Global Palm Fiber Packaging Market

- In October 2021, Heng Huat Resources Group Berhad completed the acquisition of MG Furniture Sdn Bhd, aiming to boost its palm fiber production capabilities. This strategic move is set to enhance the company's position in the global palm fiber market by expanding its regional market presence and reinforcing its ability to meet the growing demand for sustainable packaging solutions through increased production capacity and operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Palm Fibre Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Palm Fibre Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Palm Fibre Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.