Global Panoramic And Cephalometric Radiography Systems Market

Market Size in USD Billion

CAGR :

%

USD

837.44 Billion

USD

1,367.33 Billion

2025

2033

USD

837.44 Billion

USD

1,367.33 Billion

2025

2033

| 2026 –2033 | |

| USD 837.44 Billion | |

| USD 1,367.33 Billion | |

|

|

|

|

Panoramic and Cephalometric Radiography Systems Market Size

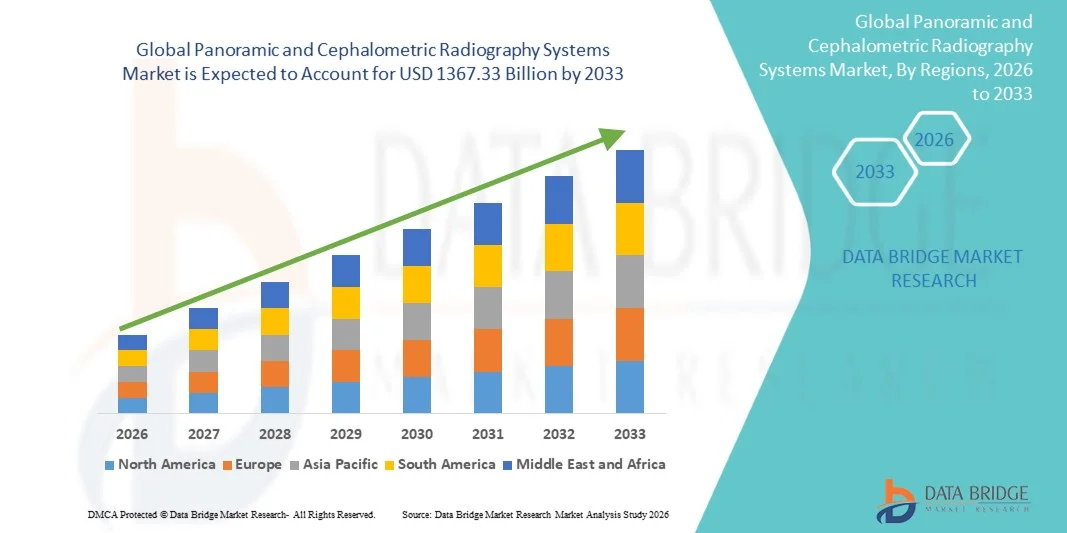

- The global panoramic and cephalometric radiography systems market size was valued at USD 837.44 billion in 2025 and is expected to reach USD 1367.33 billion by 2033, at a CAGR of 6.32% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced dental imaging technologies and ongoing innovations in radiography systems, leading to enhanced digital workflows and improved diagnostic capabilities in both dental clinics and hospitals

- Furthermore, rising demand for precise, efficient, and patient-friendly imaging solutions is establishing panoramic and cephalometric radiography systems as essential tools in dental diagnostics, orthodontics, and maxillofacial care. These converging factors are accelerating the uptake of these radiography solutions, thereby significantly boosting the market’s growth

Panoramic and Cephalometric Radiography Systems Market Analysis

- Panoramic and Cephalometric Radiography Systems, which provide high-precision dental and maxillofacial imaging, are increasingly essential in modern dental clinics, orthodontic practices, and hospitals due to their ability to improve diagnostic accuracy, treatment planning, and patient workflow efficiency

- The market growth is primarily driven by rising demand for advanced dental imaging solutions, growing awareness of oral health, increasing adoption of digital radiography systems, and continuous technological advancements such as 3D imaging integration and AI-assisted analysis. These factors are accelerating the uptake of panoramic and cephalometric radiography systems, thereby significantly boosting market growth

- North America dominated the panoramic and cephalometric radiography systems market in 2025, accounting for approximately 38% of global revenue, supported by well-established dental healthcare infrastructure, high adoption of digital imaging technologies, and strong presence of leading system manufacturers such as Carestream, Planmeca, and Sirona Dental Systems

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period, with a projected CAGR driven by expanding dental care services, rising disposable incomes, and increased investment in dental diagnostic infrastructure in countries such as China, India, and Japan

- The 2‑D Dimensional Scanning segment accounted for the largest market revenue share of 56.1% in 2025, driven by its established use in routine dental diagnostics, orthodontics, and implant planning

Report Scope and Panoramic and Cephalometric Radiography Systems Market Segmentation

|

Attributes |

Panoramic and Cephalometric Radiography Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Panoramic and Cephalometric Radiography Systems Market Trends

“Advancements in Imaging Technology and Workflow Efficiency”

- A significant and accelerating trend in the global panoramic and cephalometric radiography systems market is the ongoing development of high-resolution imaging systems that provide improved diagnostic accuracy for dental and orthodontic applications

- For instance, in March 2024, Planmeca launched the Planmeca ProMax 3D Plus system, offering enhanced panoramic and cephalometric imaging with advanced sensor technology, supporting more precise treatment planning for dental and orthodontic practices

- Manufacturers are focusing on innovations such as dose reduction technologies, faster image acquisition, and enhanced 3D reconstruction capabilities to improve patient safety and streamline clinical workflows

- Integration of these radiography systems with digital imaging software and practice management platforms is enabling efficient data storage, retrieval, and analysis, improving both diagnostic and operational efficiency

- This trend toward more precise, reliable, and workflow-optimized imaging solutions is driving adoption in dental clinics, hospitals, and specialized radiology centers, particularly in regions transitioning from analog to digital radiography systems

- The growing emphasis on patient safety, comfort, and diagnostic quality continues to support investment in advanced panoramic and cephalometric radiography solutions across healthcare facilities

Panoramic and Cephalometric Radiography Systems Market Dynamics

Driver

“Increasing Demand for Dental and Orthodontic Diagnostics”

- The rising prevalence of dental disorders, malocclusions, and orthodontic treatments is driving the demand for high-quality panoramic and cephalometric imaging systems that provide accurate diagnostic information

- For instance, in June 2025, Sirona Dental expanded its Orthophos® SL platform to offer faster panoramic and cephalometric scans with integrated 3D imaging, catering to growing clinical needs in orthodontics and implant planning

- The increasing adoption of preventive dental care, early diagnosis, and complex orthodontic procedures is encouraging dental clinics and hospitals to invest in advanced imaging systems

- Furthermore, the expansion of dental clinics and diagnostic centers, particularly in emerging regions, is supporting market growth by creating demand for reliable and cost-effective imaging solutions

- Improved workflow efficiency, faster scan times, and enhanced image clarity are key factors motivating adoption among dental and orthodontic practitioners worldwide

Restraint/Challenge

“High Equipment Costs and Maintenance Requirements”

- The relatively high cost of advanced panoramic and cephalometric radiography systems, including sensors, imaging software, and 3D reconstruction capabilities, can limit adoption among smaller clinics and cost-sensitive facilities

- For instance, in September 2023, several mid-sized dental clinics in Southeast Asia reported delays in upgrading to fully digital radiography systems due to high capital investment and operational costs

- Regular maintenance, calibration, and the need for trained personnel to operate sophisticated systems add to the total cost of ownership, posing challenges for resource-limited practices

- Compliance with radiation safety standards, quality assurance, and equipment certification requirements adds complexity and may slow implementation, particularly in emerging markets

- Overcoming these challenges through cost-effective solutions, simplified system operation, and enhanced support services will be crucial to sustaining market growth in the panoramic and cephalometric radiography segment

Panoramic and Cephalometric Radiography Systems Market Scope

The market is segmented on the basis of type, technology, and end user.

• By Type

On the basis of type, the Panoramic and Cephalometric Radiography Systems market is segmented into Digital Panoramic and Cephalometric X‑Ray Systems and Analog Panoramic and Cephalometric X‑Ray Systems. The Digital Panoramic and Cephalometric X‑Ray Systems segment dominated the largest market revenue share of 52.4% in 2025, driven by its superior image quality, faster processing times, and enhanced diagnostic capabilities. Digital systems allow real-time imaging, lower radiation exposure, and easier storage and sharing of patient records, which is highly valued in dental hospitals and clinics. The ability to integrate with electronic health records (EHR) and dental practice management software further supports adoption. Dental professionals prefer digital systems for orthodontic, implant planning, and general diagnostic applications. Rising patient demand for precise imaging and reduced exposure drives growth. The segment benefits from the trend of replacing legacy analog systems. Digital systems’ compatibility with 3-D reconstruction and advanced imaging software increases clinical utility. Maintenance costs are lower than analog alternatives, strengthening their market dominance. Growing awareness about workflow efficiency and regulatory support in developed markets accelerate adoption. The convenience of multi-functional units that combine panoramic and cephalometric imaging adds to revenue share. Continuous innovations in digital detector technology further consolidate leadership.

The Analog Panoramic and Cephalometric X‑Ray Systems segment is expected to witness the fastest CAGR of 17.6% from 2026 to 2033, particularly in emerging markets where lower capital expenditure and simpler technology adoption are key considerations. Analog systems continue to be favored in smaller dental clinics, academic institutions, and remote areas due to lower cost of acquisition and ease of maintenance. The segment benefits from retrofitting opportunities with hybrid solutions that bridge analog and digital workflows. Training and educational use in dental schools drives adoption. Simpler hardware and minimal software dependency appeal to low-resource settings. Emerging countries are upgrading clinics incrementally, supporting CAGR growth. Analog systems remain reliable for basic diagnostic imaging in forensic labs and research institutes. The market also sees growth in analog systems with digital conversion modules to enable partial digital workflows. Increasing awareness among practitioners about hybrid solutions supports adoption. Flexibility in radiation dose adjustments enhances safety and usability. Overall, analog systems represent a fast-growing, cost-sensitive segment in the global market.

• By Technology

On the basis of technology, the market is segmented into 2‑D Dimensional Scanning and 3‑D Dimensional Scanning. The 2‑D Dimensional Scanning segment accounted for the largest market revenue share of 56.1% in 2025, driven by its established use in routine dental diagnostics, orthodontics, and implant planning. 2‑D imaging provides clear panoramic and cephalometric views at lower radiation doses and cost, making it the preferred choice in dental hospitals and clinics worldwide. Ease of interpretation by clinicians supports high adoption. Integration with practice management software enhances workflow efficiency. Regulatory compliance and standardized protocols favor 2‑D imaging. Rapid image acquisition and lower operational costs drive hospital and clinic preference. The technology supports patient education and case presentation effectively. Compatibility with digital or hybrid detectors enhances usability. Widespread availability and training ensure continued market dominance. The combination of affordability, reliability, and versatility underpins leadership. Growing replacement of conventional analog films in developed markets further supports revenue share.

The 3‑D Dimensional Scanning segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by increasing adoption in advanced dental procedures, implantology, and complex orthodontics. 3‑D imaging provides volumetric data, allowing precise anatomical analysis and surgical planning. Cone-beam computed tomography (CBCT) applications in dentistry are expanding rapidly. Hospitals and specialty clinics favor 3‑D systems for precision diagnosis and treatment planning. Integration with CAD/CAM and 3‑D printing workflows enhances clinical utility. Rising patient awareness and demand for minimally invasive procedures accelerate adoption. Research and forensic applications increasingly rely on 3‑D imaging for high-accuracy analysis. Technological innovations, such as lower radiation dose protocols and faster scanning, improve adoption. Training programs for dental professionals and academic institutes further support growth. The trend toward hybrid 2‑D/3‑D units enhances multi-functional use. Overall, 3‑D scanning represents the most dynamic technology segment in the global market.

• By End User

On the basis of end user, the market is segmented into Dental Hospitals and Clinics, Dental Academic and Research Institutes, and Forensic Laboratories. The Dental Hospitals and Clinics segment dominated the largest market revenue share of 61.2% in 2025, driven by high patient volumes and increasing integration of panoramic and cephalometric systems for routine diagnostics and treatment planning. Hospitals and multi-specialty clinics prioritize digital and 3-D systems for orthodontics, implantology, and general dental care. Adoption is supported by workflow efficiency, reduced radiation exposure, and enhanced diagnostic accuracy. Integration with patient management software enhances operational efficiency. Regulatory approvals and reimbursement policies favor system adoption. Continuous technological advancements improve image quality and throughput. Multi-functional units supporting both panoramic and cephalometric imaging strengthen usage. Clinics and hospitals benefit from improved patient communication and case documentation. Growing urbanization and dental awareness contribute to revenue dominance. Training and staff expertise facilitate implementation. Overall, hospitals and clinics remain the primary driver of market revenue.

The Dental Academic and Research Institutes segment is expected to witness the fastest CAGR of 16.7% from 2026 to 2033, driven by increasing dental research activities, training programs, and experimental studies requiring high-precision imaging. Academic institutions adopt both 2-D and 3-D systems to educate students on advanced diagnostic techniques and surgical planning. Research centers utilize imaging for orthodontic studies, anatomical mapping, and forensic applications. Integration with digital simulation tools enhances learning outcomes. Government grants and institutional funding for infrastructure development support growth. Adoption in forensic and experimental studies expands use cases. Emerging markets with expanding dental education programs further accelerate growth. Multi-modality imaging units support versatile training. Investments in modern laboratories ensure access to cutting-edge systems. Partnerships with manufacturers for training and research projects strengthen adoption. Overall, academic and research institutes represent the fastest-growing end-user segment globally.

Panoramic and Cephalometric Radiography Systems Market Regional Analysis

- North America dominated the panoramic and cephalometric radiography systems market in 2025, accounting for approximately 38% of global revenue

- The region’s leadership is supported by well-established dental healthcare infrastructure, high adoption of digital imaging technologies, and the strong presence of leading system manufacturers such as Carestream, Planmeca, and Sirona Dental Systems

- Widespread use in dental clinics, hospitals, and specialty centers, along with ongoing equipment upgrades, contributes to robust market growth

U.S. Panoramic and Cephalometric Radiography Systems Market Insight

The U.S. panoramic and cephalometric radiography systems market captured the largest revenue share within North America in 2025, fueled by high adoption of advanced digital dental imaging systems in private dental clinics, hospital dental departments, and diagnostic centers. Demand for integrated imaging solutions, enhanced image quality, and workflow efficiency continues to drive market expansion. Leading manufacturers maintain strong distribution networks, further supporting growth.

Europe Panoramic and Cephalometric Radiography Systems Market Insight

The Europe panoramic and cephalometric radiography systems market is expected to expand steadily during the forecast period, driven by modernization of dental diagnostic equipment, increasing demand for preventive dental care, and adoption of digital radiography in clinics and hospitals. Government regulations promoting quality dental care and reimbursement policies for diagnostic imaging support market penetration across key European countries.

U.K. Panoramic and Cephalometric Radiography Systems Market Insight

The U.K. panoramic and cephalometric radiography systems market is projected to grow at a moderate CAGR, supported by increasing adoption of digital dental radiography in NHS dental facilities and private dental clinics. Rising awareness of preventive dentistry, along with the replacement of older analog systems, is boosting demand for panoramic and cephalometric imaging systems.

Germany Panoramic and Cephalometric Radiography Systems Market Insight

Germany panoramic and cephalometric radiography systems market is expected to witness steady growth due to its advanced dental healthcare infrastructure and strong focus on digitalization of imaging technologies. Adoption of panoramic and cephalometric radiography systems is increasing across private dental practices, hospitals, and university dental departments, driven by the need for precise diagnostics and efficient workflow integration.

Asia-Pacific Panoramic and Cephalometric Radiography Systems Market Insight

Asia-Pacific panoramic and cephalometric radiography systems market is expected to be the fastest-growing region during the forecast period, driven by expanding dental care services, rising disposable incomes, and increased investment in dental diagnostic infrastructure in countries such as China, India, and Japan. Rapid urbanization, growing awareness of oral health, and expanding dental clinic networks are further supporting the adoption of advanced radiography systems.

China Panoramic and Cephalometric Radiography Systems Market Insight

China panoramic and cephalometric radiography systems market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to increasing dental service demand, expansion of dental clinics, and rising adoption of digital imaging technologies. Strong domestic manufacturing capabilities and government support for healthcare infrastructure are key factors propelling market growth.

Japan Panoramic and Cephalometric Radiography Systems Market Insight

Japan’s panoramic and cephalometric radiography systems market is gaining momentum due to high penetration of dental digital technologies, advanced clinical infrastructure, and increasing demand for high-precision diagnostics in dental care. Aging population and focus on preventive dentistry are driving the adoption of panoramic and cephalometric systems across hospitals and private clinics.

Panoramic and Cephalometric Radiography Systems Market Share

The Panoramic and Cephalometric Radiography Systems industry is primarily led by well-established companies, including:

- Carestream Health (U.S.)

- Planmeca Oy (Finland)

- Dentsply Sirona (Germany)

- Vatech Co., Ltd. (South Korea)

- Sirona Dental Systems (Germany)

- Owandy Radiology (France)

- Morita Corporation (Japan)

- Gendex Dental Systems (U.S.)

- Suni Medical Imaging (U.S.)

- Kodak Dental Systems (U.S.)

- Instrumentarium Dental (Finland)

- KaVo Kerr Group (Germany/U.S.)

- Promax Imaging (Italy)

- Trophy Radiologie (France)

- Genoray Co., Ltd. (South Korea)

- MyRay (Italy)

- NewTom (Italy)

- HexaDent (China)

- Acteon Group (France)

Latest Developments in Global Panoramic and Cephalometric Radiography Systems Market

- In February 2024, Carestream Dental launched the CS 8200 3D Access system, a user‑friendly 4‑in‑1 imaging platform that combines 2D panoramic imaging with CBCT and optional cephalometric capabilities. This advanced unit enables dental practices to perform a wider range of in‑office imaging procedures, from full‑arch panoramic views to high‑resolution 3D scans, and includes AI‑powered features like automatic panoramic curve mapping and nerve mapping — expanding access to sophisticated imaging for general dental practices

- In March 2025, Planmeca announced the expansion of its Planmeca Viso imaging family with three powerful new imaging units, including the Planmeca Viso® G1 and two 2D panoramic devices (Viso® 2D Pro and Viso 2D Classic). These systems combine intuitive user interfaces, advanced sensor technology, and seamless integration with Planmeca’s Romexis software, enhancing both 2D panoramic and optional cephalometric imaging workflows

- In January 2025, Planmeca introduced the Planmeca UltraPan, a next‑generation panoramic X‑ray and CBCT hybrid system featuring ultra‑low dose imaging and enhanced image quality, aimed at high‑volume dental practices requiring detailed diagnostics with improved patient safety

- In July 2025, Carestream Dental’s CS 9600 and CS 8200 3D Family CBCT systems earned prestigious certification from the Digital Dentistry Society (DDS), validating their clinical reliability, innovation, and seamless workflow integration for panoramic, cephalometric, and CBCT imaging — marking an industry milestone for certified high‑performance dental imaging solutions

- In October 2025, Planmeca announced a major partnership with The Aspen Group, which includes integrating Planmeca’s advanced imaging technologies — including Viso and ProMax CBCT and panoramic units — across more than 1,100 Aspen Dental locations in the U.S., enhancing patient‑centric diagnostic capability and operational efficiency in a broad dental network

- In February 2025, Carestream Dental unveiled the Advance Edition of the CS 8200 3D system with extended fields of view and AI‑enhanced implant planning tools, enabling comprehensive panoramic, 3D, and optional cephalometric imaging plus automated treatment workflows — reflecting growing integration of AI in dental imaging platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.