Global Panty Liners Market

Market Size in USD Million

CAGR :

%

USD

820.00 Million

USD

1,796.46 Million

2025

2033

USD

820.00 Million

USD

1,796.46 Million

2025

2033

| 2026 –2033 | |

| USD 820.00 Million | |

| USD 1,796.46 Million | |

|

|

|

|

Panty Liners Market Size

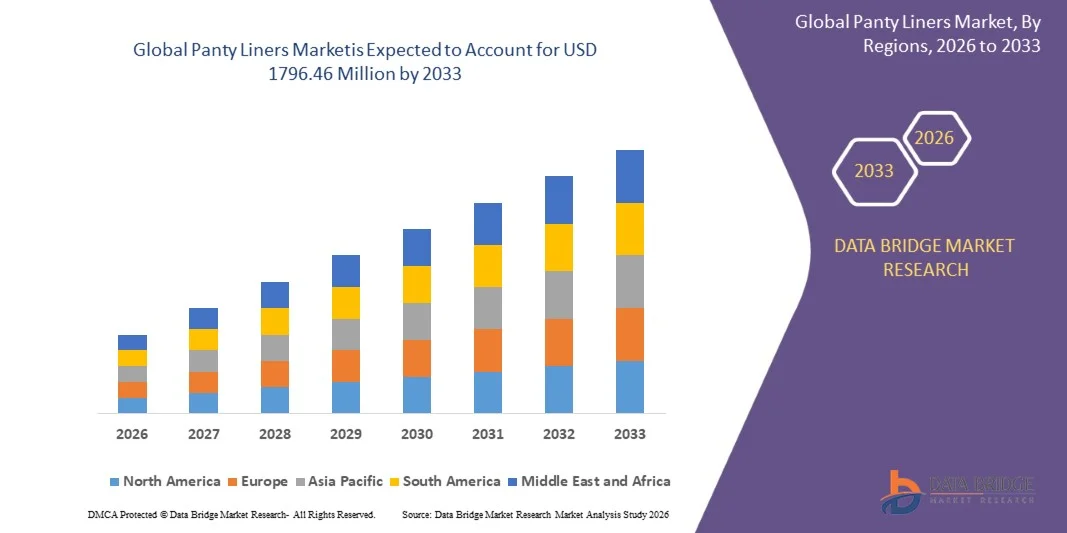

- The global panty liners market size was valued at USD 820 million in 2025 and is expected to reach USD 1796.46 million by 2033, at a CAGR of 10.30% during the forecast period

- The market growth is largely fueled by rising awareness of intimate hygiene, increasing female workforce participation, and the growing use of panty liners for daily freshness and comfort across diverse age groups

- Furthermore, expanding availability through supermarkets, pharmacies, and online platforms, along with product innovations focused on comfort, breathability, and skin safety, are accelerating adoption and significantly boosting overall market growth

Panty Liners Market Analysis

- Panty liners are thin absorbent feminine hygiene products designed for daily use to manage light discharge, maintain freshness, and support intimate hygiene between menstrual cycles

- The increasing demand for panty liners is primarily driven by changing lifestyle patterns, higher hygiene consciousness, and growing acceptance of preventive personal care products, particularly in urban and emerging markets

- Asia-Pacific dominated panty liners market with a share of over 30% in 2025, due to a large female population, rising hygiene awareness, and increasing adoption of daily intimate care products across urban and semi-urban areas

- North America is expected to be the fastest growing region in the panty liners market during the forecast period due to high product awareness, strong emphasis on personal hygiene, and rising demand for premium and sustainable feminine care products

- Disposable segment dominated the market with a market share of 85.5% in 2025, due to high convenience, widespread availability, and strong consumer preference for single-use hygiene products. Consumers prioritize disposables for daily freshness, ease of disposal, and consistent performance during travel and work routines. Strong retail penetration across supermarkets, pharmacies, and online platforms further supports volume sales. In addition, frequent product innovations focused on thinness, absorbency, and odor control continue to reinforce dominance

Report Scope and Panty Liners Market Segmentation

|

Attributes |

Panty Liners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Panty Liners Market Trends

“Rising Demand for Organic and Sustainable Panty Liners”

- A key trend in the panty liners market is the growing consumer preference for organic and sustainable products, driven by increasing concerns around skin sensitivity, chemical exposure, and environmental impact. Consumers are actively seeking panty liners made from organic cotton, biodegradable materials, and chlorine-free components as part of a broader shift toward safer feminine hygiene solutions

- For instance, Natracare and Organyc have expanded their portfolios with certified organic cotton panty liners that are free from plastics and synthetic fragrances. These products cater to health-conscious consumers and reinforce trust by aligning with global sustainability and eco-label standards

- Brands are increasingly highlighting transparency in sourcing and manufacturing processes to differentiate their organic panty liner offerings. This focus is strengthening brand loyalty among consumers who prioritize ethical production and environmentally responsible practices

- The demand for sustainable panty liners is also supported by rising awareness campaigns related to menstrual health and eco-friendly personal care. These initiatives are encouraging consumers to switch from conventional disposable liners to organic alternatives

- Retailers and e-commerce platforms are expanding shelf space for sustainable feminine hygiene products, improving accessibility and visibility of organic panty liners. This expanded availability is accelerating adoption across both developed and emerging markets

- Overall, the shift toward organic and sustainable panty liners is reshaping product innovation, packaging choices, and brand positioning, reinforcing long-term growth opportunities for manufacturers aligned with clean-label and sustainability trends

Panty Liners Market Dynamics

Driver

“Increasing Awareness of Intimate Hygiene and Daily Personal Care”

- Growing awareness around intimate hygiene and daily personal care is a major driver for the panty liners market, as consumers increasingly view panty liners as essential products for maintaining freshness and comfort. Educational initiatives and health-focused messaging are encouraging regular usage beyond menstrual cycles

- For instance, Procter & Gamble, through its Whisper brand, has actively promoted daily panty liner usage via awareness campaigns focused on intimate hygiene and confidence. These initiatives have contributed to higher product penetration among urban consumers

- Healthcare professionals and women’s health organizations are emphasizing the importance of proper intimate hygiene to prevent discomfort and infections. This guidance is influencing purchasing behavior and increasing demand for breathable and dermatologically tested panty liners

- Rising participation of women in professional and active lifestyles is further supporting the need for convenient hygiene solutions that offer comfort throughout the day. Panty liners are increasingly positioned as part of everyday personal care routines

- The growing normalization of discussions around feminine hygiene is reinforcing long-term demand, positioning panty liners as indispensable daily-use products across diverse age groups

Restraint/Challenge

“Price Sensitivity and Limited Awareness in Developing Regions”

- The panty liners market faces challenges related to high price sensitivity and limited awareness in developing regions, where consumers often prioritize basic hygiene products over specialized offerings. Cost considerations significantly influence purchasing decisions in these markets

- For instance, in price-sensitive markets, local manufacturers often compete with multinational brands by offering low-cost sanitary products, while panty liners remain perceived as non-essential. This limits penetration of premium and organic panty liner products from companies such as Kimberly-Clark and Essity

- Limited access to education on feminine hygiene and lack of targeted awareness campaigns further restrict adoption in rural and semi-urban areas. Cultural taboos surrounding intimate care products also reduce open discussions and product trial

- Distribution challenges, including limited retail reach and inconsistent availability, affect market expansion in developing economies. These factors make it difficult for global brands to establish consistent demand

- Overall, overcoming price sensitivity and awareness gaps remains a critical challenge, requiring localized education initiatives, affordable product variants, and stronger distribution networks to unlock growth potential in developing regions

Panty Liners Market Scope

The market is segmented on the basis of product type, category, price range, and sales channel.

• By Product Type

On the basis of product type, the panty liners market is segmented into disposable and reusable. The disposable segment dominated the largest market revenue share of 85.5% in 2025, driven by high convenience, widespread availability, and strong consumer preference for single-use hygiene products. Consumers prioritize disposables for daily freshness, ease of disposal, and consistent performance during travel and work routines. Strong retail penetration across supermarkets, pharmacies, and online platforms further supports volume sales. In addition, frequent product innovations focused on thinness, absorbency, and odor control continue to reinforce dominance.

The reusable segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising sustainability awareness and cost efficiency over long-term use. Environment-conscious consumers are increasingly adopting washable liners to reduce waste and recurring expenses. Improved fabric technologies offering better absorbency, breathability, and comfort are accelerating acceptance. Growing visibility through online channels and social advocacy around eco-friendly menstrual care further supports rapid growth.

• By Category

On the basis of category, the panty liners market is segmented into organic and non-organic. The non-organic segment held the largest market revenue share in 2025 due to its broad consumer base, lower price points, and long-standing availability across mass retail channels. These products remain widely preferred for daily use owing to consistent quality, wide size variants, and strong brand trust. High promotional activity by leading manufacturers sustains repeat purchases. In addition, extensive distribution in emerging markets reinforces volume leadership.

The organic segment is expected to register the fastest growth rate during the forecast period, driven by increasing concerns around skin sensitivity and chemical exposure. Consumers are shifting toward products made from organic cotton and biodegradable materials for enhanced comfort and safety. Premium positioning and transparent labeling practices are improving consumer confidence. Rising awareness campaigns around intimate health and sustainability further accelerate demand.

• By Price Range

On the basis of price range, the panty liners market is segmented into economy, mid-range, and premium. The economy segment dominated the market revenue share in 2025, supported by high demand from price-sensitive consumers and frequent daily usage patterns. Affordable pricing enables bulk purchases, especially in developing regions with large female populations. Private-label brands and local manufacturers strengthen accessibility across offline retail. In addition, basic functional performance meets the needs of routine hygiene maintenance.

The premium segment is projected to grow at the fastest pace from 2026 to 2033, driven by rising disposable incomes and demand for enhanced comfort features. Premium panty liners offer benefits such as ultra-thin designs, organic materials, superior breathability, and dermatologically tested formulations. Urban consumers increasingly associate premium products with better health outcomes and lifestyle alignment. Expanding e-commerce penetration further supports premium brand visibility and adoption.

• By Sales Channel

On the basis of sales channel, the panty liners market is segmented into supermarket or hypermarket, pharmacy, online, and other sales channels. Supermarkets and hypermarkets accounted for the largest revenue share in 2025 due to strong product visibility, competitive pricing, and one-stop shopping convenience. Consumers prefer these outlets for immediate availability and promotional discounts. Wide shelf space enables comparison across brands and variants. In addition, consistent foot traffic sustains high-volume sales.

The online segment is anticipated to witness the fastest growth during the forecast period, driven by privacy, convenience, and access to a broader product range. Digital platforms enable subscription models, doorstep delivery, and detailed product information that supports informed purchasing decisions. Growing smartphone penetration and digital payment adoption further strengthen online sales. Targeted marketing and influencer-led awareness are accelerating channel expansion.

Panty Liners Market Regional Analysis

- Asia-Pacific dominated the panty liners market with the largest revenue share of over 30% in 2025, driven by a large female population, rising hygiene awareness, and increasing adoption of daily intimate care products across urban and semi-urban areas

- The region benefits from cost-effective manufacturing, strong presence of domestic and international hygiene brands, and expanding retail penetration through supermarkets, pharmacies, and online platforms

- Rapid urbanization, improving disposable incomes, and government-led menstrual health awareness initiatives are further accelerating panty liner consumption across developing economies

China Panty Liners Market Insight

China held the largest share in the Asia-Pacific panty liners market in 2025, supported by its massive consumer base, well-established personal hygiene manufacturing ecosystem, and strong domestic brand presence. High penetration of disposable hygiene products, extensive retail networks, and growing preference for convenience-focused feminine care solutions are key growth drivers. In addition, increasing e-commerce adoption is strengthening product accessibility and sales volume.

India Panty Liners Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising awareness of intimate hygiene, increasing female workforce participation, and expanding urban middle-class population. Government and NGO-led menstrual hygiene programs, along with aggressive marketing by leading brands, are improving product acceptance. Growth in online retail and affordable economy-priced products is further supporting rapid market expansion.

Europe Panty Liners Market Insight

The Europe panty liners market is growing steadily, supported by high hygiene standards, strong consumer focus on comfort and skin safety, and increasing demand for organic and sustainable feminine care products. The region shows strong adoption of premium and eco-friendly variants. Well-developed retail infrastructure and regulatory emphasis on product quality further support consistent demand.

Germany Panty Liners Market Insight

Germany’s market is driven by strong consumer preference for high-quality, dermatologically tested, and sustainable hygiene products. The country’s emphasis on organic materials, environmental responsibility, and premium personal care solutions supports steady demand. Established retail chains and growing online sales channels contribute to market stability and growth.

U.K. Panty Liners Market Insight

The U.K. market is supported by rising awareness of intimate health, increasing demand for organic and chemical-free products, and strong penetration of private-label brands. Consumers show growing preference for premium and reusable panty liner options. Expansion of online retail and subscription-based purchasing models is further strengthening market presence.

North America Panty Liners Market Insight

North America is expected to grow at a significant CAGR from 2026 to 2033, driven by high product awareness, strong emphasis on personal hygiene, and rising demand for premium and sustainable feminine care products. Innovation in ultra-thin, breathable, and organic panty liners is boosting adoption. The region also benefits from strong brand loyalty and advanced distribution networks.

U.S. Panty Liners Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by high consumer spending on personal care, strong presence of leading hygiene brands, and widespread availability across offline and online channels. Growing preference for premium, organic, and dermatologist-approved products is shaping demand patterns. Continuous product innovation and effective marketing strategies further reinforce the U.S. market leadership.

Panty Liners Market Share

The panty liners industry is primarily led by well-established companies, including:

- Procter & Gamble Company (U.S.)

- Johnson & Johnson Services Inc. (U.S.)

- Unilever PLC (U.K.)

- Kimberly-Clark Corporation (U.S.)

- Essity AB (Sweden)

- Kao Corporation (Japan)

- Unicharm Corp (Japan)

- First Quality Enterprises Inc. (U.S.)

- Hengan Group (China)

- Edgewell Personal Care Company (U.S.)

- Ontex (Belgium)

- The Honest Company (U.S.)

- Seventh Generation (U.S.)

- GladRags (U.S.)

- Rael Inc (U.S.)

- Bella Flor Enterprises (Brazil)

- Intimina (Sweden)

- Nua Woman (Ireland)

- Winner Medical Ltd. (China)

- Natracare LLC (U.K.)

- Carmesi (India)

- Redcliffe Hygiene Private Limited (India)

- CORA (U.S.)

Latest Developments in Global Panty Liners Market

- In December 2025, Ausepic Group launched Jusbeyu, a new women’s care brand focused on everyday comfort, safety, and wellness, with plans to introduce panty liners and other intimate care products under this portfolio. This strategic entry into the feminine hygiene segment enhances competition and consumer choice while strengthening Ausepic’s presence in global personal care categories. By combining market insights, sustainability commitments, and product transparency, the Jusbeyu launch is expected to expand the panty liners market by appealing to consumers seeking high-quality, reliable daily hygiene solutions, thereby driving category adoption across diverse regions

- In November 2024, Unicharm strengthened its global footprint by entering the African panty liners and feminine hygiene market through the launch of its Sofy product series in Ghana, Cote d'Ivoire, and Kenya. This move is expected to significantly enhance market penetration in Africa by addressing unmet demand for affordable and high-quality hygiene products. Leveraging its manufacturing base in Egypt allows Unicharm to optimize supply chains, reduce costs, and improve product accessibility, thereby accelerating category adoption and long-term market growth in emerging African economies

- In October 2024, Rael expanded its market reach by introducing its holistic cycle care and beauty portfolio at Ulta Beauty stores and online, strengthening the convergence between feminine hygiene and wellness retail. This expansion enhances brand visibility among premium and health-conscious consumers while positioning panty liners as part of a broader lifestyle and self-care routine. The partnership supports market growth by normalizing organic and hormone-conscious feminine products within mainstream beauty retail environments

- In May 2024, Edgewell Personal Care broadened the scope of its Carefree brand by extending beyond panty liners into pads, reinforcing its position as a comprehensive feminine care provider. This strategic portfolio expansion increases cross-category consumption and brand loyalty while addressing evolving consumer needs for multi-fluid absorption and odor control. The introduction of advanced materials such as Lyocell fibers enhances product differentiation and raises performance standards across the panty liners market

- In April 2024, Kimberly-Clark advanced product innovation in the U.S. market with the launch of its “Liv by Kotex” range, offering panty liners designed for dual protection against menstruation and bladder leaks. This development supports market expansion by targeting a broader consumer base seeking multifunctional hygiene solutions. By bridging feminine care and light incontinence, the launch is expected to drive higher usage frequency and open new growth avenues within the panty liners segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.