Global Paper Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

35.01 Billion

USD

51.13 Billion

2024

2032

USD

35.01 Billion

USD

51.13 Billion

2024

2032

| 2025 –2032 | |

| USD 35.01 Billion | |

| USD 51.13 Billion | |

|

|

|

|

Paper Chemicals Market Size

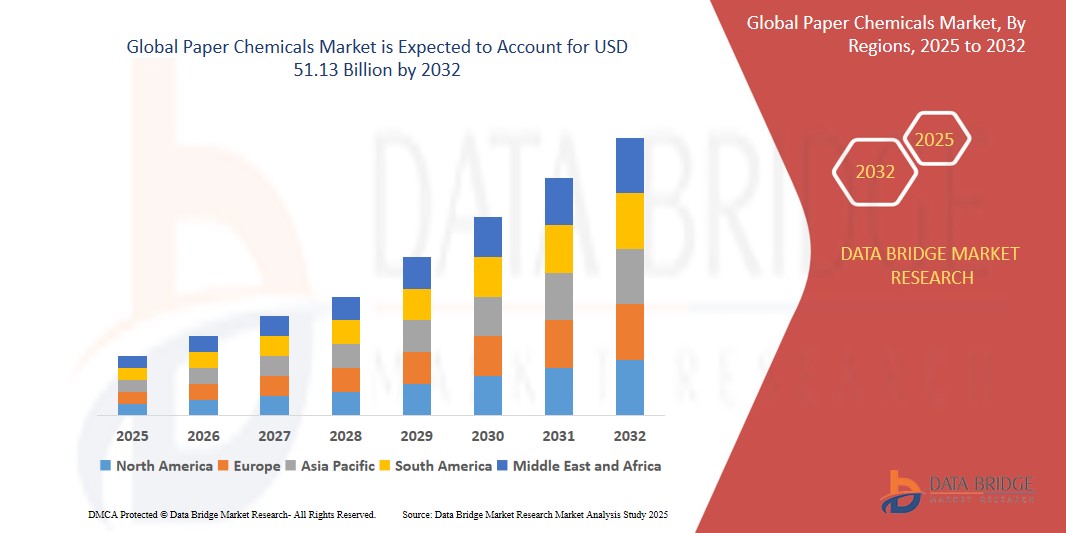

- The global Paper Chemicals market size was valued at USD 35.01 billion in 2024 and is expected to reach USD 51.13 billion by 2032, at a CAGR of 4.3% during the forecast period

- The market growth is largely fueled by the increasing demand in the paper chemicals market, driven by advancements in paper manufacturing processes and rising consumption of packaging and tissue papers.

- Furthermore, the growth of the market is primarily driven by the expanding paper chemical sector, which is benefiting from innovations in chemical formulations, rising environmental regulations, and the global push toward sustainable and high-performance paper products.

Paper Chemicals Market Analysis

- The surge in e-commerce and hygiene awareness has boosted demand for paper-based packaging and tissue products, driving growth in the paper chemicals market, especially for strength-enhancing agents, sizing chemicals, and functional additives.

- Growing environmental regulations and consumer preference for eco-friendly products are accelerating the adoption of biodegradable and specialty paper chemicals, encouraging innovation in green formulations and creating opportunities for sustainable solutions in pulp processing and paper finishing applications.

- Asia-Pacific dominated the paper chemical market with the largest revenue share of 42% in 2025, driven by rapid industrialization, high paper consumption in packaging and printing, and strong demand from countries like China and India. The region benefits from a large manufacturing base, rising literacy rates, and expanding e-commerce sectors.

- Asia-Pacific is projected to be the fastest-growing region in the Paper Chemicals market during the forecast period due to increasing urbanization and rising disposable incomes

- Specialty Chemicals segment is expected to dominate the Paper Chemicals market with a 50% share in 2025, driven by rising demand for improved paper strength, printability, and water resistance across packaging, labeling, and specialty paper applications amid growing sustainability and performance requirements.

Report Scope and Paper Chemicals Market Segmentation

|

Attributes |

Paper Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

Akzo Nobel N.V. (Netherlands) BASF SE (Germany) Archroma (Switzerland) Kemira (Finland) Solenis (United States) Buckman (United States) IVAX Paper Chemicals Limited (India) Ecolab (United States) Harima Chemicals Group, Inc. (Japan) Thermax Limited (India) Axchem Group (United Kingdom) Clariant (Switzerland) Evonik Industries AG (Germany) Ashland (United States) KOLB Distribution Ltd. (Switzerland) Pon Pure Chemicals Group (India) Associated Chemical (India) Imerys (France) ACURO ORGANICS LIMITED (India) PeroxyChem (United States) Papertex Speciality Chemicals Pvt. Ltd. (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paper Chemicals Market Trends

“Sustainable packaging demand drives eco-friendly paper chemical innovation”

- Growing consumer awareness about environmental impact is pushing companies to develop biodegradable and recyclable paper chemicals, reducing reliance on harmful synthetic additives and promoting circular economy practices.

- Regulations worldwide increasingly mandate the use of sustainable materials, encouraging innovation in paper chemicals that improve recyclability, compostability, and reduce carbon footprint throughout the paper production lifecycle

- Advances in bio-based and natural raw materials enable manufacturers to create eco-friendly Specialty Chemicals, such as sizing agents and coatings, which maintain paper strength while minimizing ecological damage.

- Demand for lightweight and durable packaging fuels the development of high-performance, non-toxic paper chemicals that enhance product protection without compromising sustainability goals.

- Collaboration between chemical producers and packaging companies accelerates research into green chemical formulations that comply with safety standards and consumer preferences for environmentally responsible packaging solutions.

Paper Chemicals Market Dynamics

Driver

“Environmental concerns accelerate green paper chemical adoption”

- Increasing global environmental regulations are compelling paper manufacturers to adopt eco-friendly chemicals that reduce pollution, enhance recyclability, and lower carbon emissions, thereby driving innovation in sustainable packaging materials to meet strict compliance standards and consumer expectations worldwide.

- Rising consumer awareness about climate change and plastic pollution is encouraging brands to switch to biodegradable and recyclable paper packaging, pushing chemical companies to develop safer, non-toxic, and biodegradable paper chemicals that maintain product quality without compromising environmental responsibility.

- The rapid growth of e-commerce and food packaging sectors demands lightweight, durable, and sustainable paper packaging solutions, prompting innovations in functional paper chemicals that improve strength, water resistance, and printability while minimizing environmental footprint throughout the supply chain.

- Advances in bio-based raw materials and green chemistry enable the formulation of novel paper chemicals derived from renewable resources, helping manufacturers replace petrochemical-based additives with sustainable alternatives that support circular economy principles and reduce dependency on fossil fuels.

For Instance,

- Levi Strauss & Co.’s Screened Chemistry Program proactively eliminates hazardous chemicals by screening formulations for health and environmental risks before use., it promotes safer chemical adoption in apparel manufacturing, aiming for zero hazardous chemical discharge by 2020 through industry collaboration.

- Collaborations between chemical producers, paper manufacturers, and packaging brands accelerate research and commercialization of eco-friendly chemical solutions, fostering development of specialty chemicals that comply with evolving safety regulations and meet the rising market demand for environmentally responsible packaging options.

Restraint/Challenge

“High costs and regulatory hurdles limit market growth”

- High research and development costs for eco-friendly paper chemicals discourage small and medium enterprises from entering the market, limiting innovation and slowing overall industry growth despite rising demand for sustainable solutions.

- Strict and complex regulatory frameworks across different countries increase compliance costs and create barriers for manufacturers, especially in emerging markets, hindering the rapid introduction of new chemical formulations.

- Expensive raw materials used in green chemistry, such as bio-based feedstocks, often lead to higher production costs compared to conventional chemicals, reducing price competitiveness and restricting widespread adoption by paper manufacturers.

- Lengthy approval and certification processes delay product launches, increasing time-to-market and raising financial risks for chemical companies, which can restrict investment in developing innovative, sustainable paper chemical products.

- Inconsistent global regulations and standards create challenges in product formulation and distribution for multinational companies, complicating market expansion and causing delays or withdrawals from certain regions, thereby limiting overall market growth.

Paper Chemicals Market Scope

The market is segmented on the basis of form and product type.

- By Form

The Specialty Chemicals segment dominates with a 50% revenue share in 2025, driven by rising demand for enhanced paper properties like strength, printability, and water resistance, alongside growing use in packaging, labeling, and specialty paper applications requiring advanced performance and sustainability.

The specialty chemicals segment is anticipated to witness the fastest growth rate of 6.2% from 2025 to 2032. This segment encompasses additives, coatings, and treatments that enhance paper properties, catering to niche applications and specific paper products. The demand for superior-quality paper goods with exceptional performance is driving the expansion of this segment. spaces.

- By Product Type

The Specialty Chemicals segment held the largest market revenue share in 2025, driven by increasing demand for paper products with improved strength, water resistance, and printability, especially in packaging and specialty papers, supporting enhanced performance and sustainability requirements globally.

The Specialty Chemicals segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for high-performance paper products, increased adoption in sustainable packaging, and innovations enhancing durability, water repellency, and print quality in various paper applications worldwide.

Paper Chemicals Market Regional Analysis

- Asia Pacific dominates the Paper Chemicals market with a 42% revenue share in 2024, driven by rapid industrialization, growing paper production, increasing demand for sustainable packaging, and expanding end-use industries like packaging, printing, and tissue paper manufacturing.

- Asia Pacific’s rapid industrialization and expanding manufacturing sectors have significantly boosted paper production, creating a strong demand for paper chemicals. This growth is fueled by increasing urbanization, infrastructure development, and rising consumer awareness about sustainable packaging solutions.

- The region’s expanding end-use industries—such as packaging, printing, and tissue paper manufacturing—drive the demand for advanced paper chemicals. Rising e-commerce, food packaging needs, and environmental regulations further encourage adoption of eco-friendly and high-performance chemical additives in paper products.

Paper Chemicals Market Insight

The U.S. Paper Chemicals market captured the largest revenue share of 78% within North America in 2025, fueled by the presence of advanced manufacturing infrastructure, strong demand for specialty and sustainable paper products, and continuous innovation in eco-friendly chemical formulations. Additionally, a mature packaging industry and increasing environmental regulations support the adoption of high-performance, green paper chemical solutions.

Europe Paper Chemicals Market Insight

The European Paper Chemicals market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental regulations, growing emphasis on sustainable and recyclable paper products, and increased R&D in green chemistry. Rising demand from packaging, printing, and hygiene sectors, along with strong government support for eco-friendly manufacturing practices, further accelerates regional market growth.

U.K. Paper Chemicals Market Insight

The U.K. paper chemicals market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for sustainable and recyclable paper products, stringent environmental regulations promoting eco-friendly manufacturing practices, and advancements in green chemistry technologies. Additionally, the expansion of packaging and tissue paper industries, coupled with rising consumer awareness about environmental issues, further propels market growth.

Germany Paper Chemicals Market Insight

The German paper chemicals market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing demand for sustainable and recyclable paper products, stringent environmental regulations promoting eco-friendly manufacturing practices, and advancements in green chemistry technologies. Additionally, the expansion of packaging and tissue paper industries, coupled with rising consumer awareness about environmental issues, further propels market growth.

Asia-Pacific Paper Chemicals Market Insight

The Asia-Pacific Paper Chemicals market is poised to grow at the fastest CAGR of over 5.8% in 2025, driven by rapid industrialization, rising demand for packaging and tissue products, and increasing investments in sustainable paper production. Expanding consumer markets, favorable government initiatives, and the shift toward eco-friendly chemicals further accelerate regional market growth across countries like China, India, and Southeast Asia.

Japan Paper Chemicals Market Insight

The Japan paper chemicals market is gaining momentum due to several key factors. A significant driver is the increasing demand for sustainable and recyclable paper products, propelled by stringent environmental regulations and a societal shift towards eco-friendly practices. This trend is particularly evident in the packaging and labeling sectors, where there's a growing preference for paper-based alternatives over plastics. Additionally, advancements in green chemistry technologies are enabling the development of innovative paper chemical formulations that enhance product performance while minimizing environmental impact. The Specialty Chemicals segment, including coatings, pigments, and dyes, is expected to hold the largest market share, reflecting the industry's focus on value-added paper products.

China Paper Chemicals Market Insight

The China Paper Chemicals market accounted for the largest market revenue share in Asia Pacific attributed to its expansive paper and paperboard manufacturing industry, \This growth is driven by surging demand from the e-commerce, food packaging, and retail sectors, leading to increased consumption of pulp and paper chemicals..

Paper Chemicals Market Share

The Paper Chemicals industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- BASF SE (Germany)

- Archroma (Switzerland)

- Kemira (Finland)

- Solenis (United States)

- Buckman (United States)

- IVAX Paper Chemicals Limited (India)

- Ecolab (United States)

- Harima Chemicals Group, Inc. (Japan)

- Thermax Limited (India)

- Axchem Group (United Kingdom)

- Clariant (Switzerland)

- Evonik Industries AG (Germany)

- Ashland (United States)

- KOLB Distribution Ltd. (Switzerland)

- Pon Pure Chemicals Group (India)

- Associated Chemical (India)

- Imerys (France)

- ACURO ORGANICS LIMITED (India)

- PeroxyChem (United States)

- Papertex Speciality Chemicals Pvt. Ltd. (India)

Latest Developments in Global Paper Chemicals Market

- In February 2024, Kemira entered into an exclusive distribution agreement with BIM Kemi to market BIM's pulp defoamer products in Brazil. This partnership enables Kemira to exclusively provide Brazil's pulp industry with BIM's defoamer and drainage technology, enhancing Kemira's product offerings in the region.

- In April 2024, Australian startup Earthodic raised $6 million to advance its recyclable protective coating for paper and cardboard packaging. The lignin-based coating strengthens boxes and renders them waterproof, offering an eco-friendly alternative to non-recyclable coatings. The funding will support the establishment of a U.S. headquarters and further R&D efforts.

- In May 2023, Valmet introduced the Polarox6, an inline measurement solution designed to optimize the pulp bleaching process. The technology enhances measurement and control accuracy, ensuring precise chemical dosing, which improves efficiency and reduces chemical waste in pulp bleaching operations.

- In February 2023, Solenis completed the acquisition of KLK Kolb Group's paper process chemicals business, aiming to broaden its product offerings and deliver more cost-effective solutions tailored for the pulp and paper industry. This strategic move enhances Solenis's position in the specialty chemicals market.

- In April 2024, Artek US, a subsidiary of the Praana Group, acquired Kemira's energy-related division for approximately $280 million. This acquisition allows Artek to merge with Sterling Specialty Chemicals, positioning the company for growth and global expansion in response to increasing demand for sustainable solutions in the water and energy sectors.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paper Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paper Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paper Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.