Global Paprika Market

Market Size in USD Million

CAGR :

%

USD

588.20 Million

USD

885.73 Million

2024

2032

USD

588.20 Million

USD

885.73 Million

2024

2032

| 2025 –2032 | |

| USD 588.20 Million | |

| USD 885.73 Million | |

|

|

|

|

Paprika Market Size

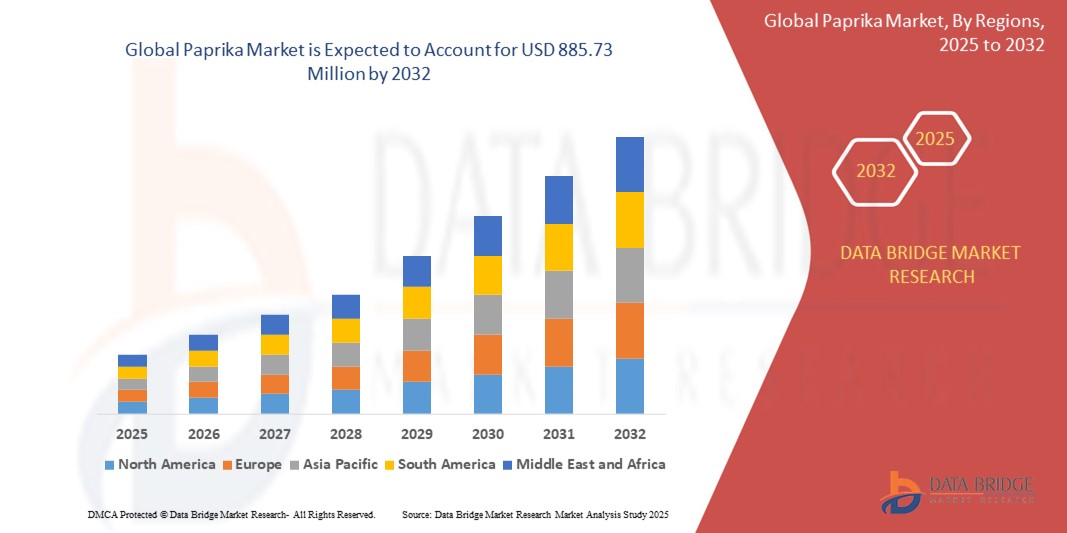

- The global paprika market size was valued at USD 588.20 million in 2024 and is expected to reach USD 885.73 million by 2032, at a CAGR of 5.25% during the forecast period

- The market growth is primarily driven by increasing consumer demand for natural food colorants, growing popularity of ethnic cuisines, and rising awareness of the health benefits associated with paprika, such as its antioxidant properties

- The shift toward organic and natural ingredients in food, cosmetics, and pharmaceutical industries is further propelling the adoption of paprika-based products, establishing it as a versatile ingredient across multiple applications

Paprika Market Analysis

- Paprika, derived from dried and ground Capsicum annuum peppers, is a key ingredient in food, cosmetics, and pharmaceutical industries due to its vibrant color, flavor, and health benefits

- The rising demand for paprika is fueled by its widespread use in culinary applications, increasing preference for clean-label and natural products, and its growing incorporation in cosmetics and personal care products for natural coloring and anti-inflammatory properties

- Europe dominated the paprika market with the largest revenue share of 42.5% in 2024, driven by its strong culinary tradition, high consumption of paprika in European cuisines, and a robust supply chain for both conventional and organic paprika. Spain, in particular, leads in paprika production and export

- North America is expected to be the fastest-growing region during the forecast period due to increasing adoption of ethnic foods, rising demand for natural food colorants, and growing health-conscious consumer trends

- The conventional segment dominated the largest market revenue share of 68.2% in 2024, driven by its widespread availability, lower production costs, and extensive use in food processing industries globally. Conventional paprika remains a cost-effective choice for manufacturers due to established supply chains and high-yield farming practices

Report Scope and Paprika Market Segmentation

|

Attributes |

Paprika Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paprika Market Trends

“Increasing Integration of Advanced Processing Technologies and Natural Ingredient Innovations”

- The global paprika market is experiencing a significant trend toward the integration of advanced processing technologies, such as supercritical fluid extraction and advanced solvent extraction techniques, to enhance the efficiency and purity of paprika products, particularly paprika oleoresins

- These technologies enable precise extraction of flavor and color compounds, providing high-quality paprika extracts that meet the growing demand for natural and potent flavoring agents in the food industry

- Innovations in processing, such as improved drying techniques and freeze-drying technology, preserve the vibrant color and flavor of paprika, enhancing its shelf life and appeal for culinary and industrial applications

- For instance, companies are developing specialized paprika products, such as La Chinata’s gourmet smoked paprika varieties, which cater to culinary enthusiasts and professional chefs seeking unique flavor profiles

- This trend is increasing the value proposition of paprika products, making them more attractive to food and beverage manufacturers, cosmetic companies, and pharmaceutical industries

- Advanced technologies also allow for the customization of paprika products, such as water-soluble and oil-soluble oleoresins, to meet specific application needs across industries such as sauces, snacks, and personal care products

Paprika Market Dynamics

Driver

“Rising Demand for Natural and Organic Food Ingredients”

- Increasing consumer preference for natural and organic ingredients over synthetic colorants and flavorings is a major driver for the global paprika market

- Paprika’s natural coloring properties and health benefits, such as its antioxidant, anti-inflammatory, and vitamin-rich content, make it a popular choice for food and beverage products such as sauces, snacks, and ready-to-eat meals

- Government regulations and consumer awareness, particularly in Europe, are encouraging the use of clean-label and organic paprika products, further boosting market growth

- The proliferation of e-commerce platforms and the growing popularity of ethnic cuisines, such as Hungarian, Spanish, and Mexican, are expanding paprika’s applications, driving demand for diverse paprika forms such as powder, flakes, and oleoresins

- Manufacturers are increasingly offering organic paprika options, such as those by La Chinata, to meet consumer expectations for premium, health-conscious, and sustainable products

Restraint/Challenge

“High Production Costs and Regulatory Compliance Issues”

- The substantial costs associated with producing high-quality paprika, including specialized fertilizers, pest control measures, and advanced processing technologies, pose a significant barrier to market expansion, particularly for smaller producers in emerging markets

- Implementing advanced extraction and processing techniques, such as supercritical fluid extraction, requires significant investment in equipment and expertise, increasing production costs

- In addition, regulatory compliance and varying standards for food safety, organic certification, and labeling across different countries, particularly in Europe and North America, create challenges for manufacturers and suppliers

- Concerns over price volatility of raw materials and competition from alternative spices, such as chipotle or cayenne pepper, can further limit market growth, especially in price-sensitive regions

- These factors may deter smaller producers and limit market penetration in regions with high cost sensitivity or stringent regulatory environments

Paprika market Scope

The market is segmented on the basis of nature, product type, form, end-use, and distribution channel.

- By Nature

On the basis of nature, the global paprika market is segmented into organic and conventional. The conventional segment dominated the largest market revenue share of 68.2% in 2024, driven by its widespread availability, lower production costs, and extensive use in food processing industries globally. Conventional paprika remains a cost-effective choice for manufacturers due to established supply chains and high-yield farming practices.

The organic segment is expected to witness the fastest growth rate of 8.5% from 2025 to 2032, fueled by increasing consumer preference for natural and chemical-free products. Growing awareness of health, sustainability, and environmental concerns is driving demand for organic paprika, particularly in developed markets such as Europe and North America.

- By Product Type

On the basis of product type, the global paprika market is segmented into paprika oleoresin, vegetable paprika, spice paprika, colorant paprika, sweet paprika, and smoked paprika. The spice paprika segment dominated the market with a revenue share of 42.3% in 2024, owing to its extensive use in culinary applications across households and food service industries. Its versatility in enhancing flavor and color in dishes drives its widespread adoption.

The paprika oleoresin segment is anticipated to experience the fastest growth rate of 9.1% from 2025 to 2032, driven by its increasing application in food processing, cosmetics, and pharmaceuticals. Paprika oleoresin’s concentrated flavor and color properties, along with its stability in processed foods, make it highly sought after by manufacturers.

- By Form

On the basis of form, the global paprika market is segmented into powder, flakes, liquid, and paste. The powder segment held the largest market revenue share of 55.7% in 2024, attributed to its ease of use, long shelf life, and widespread application in food preparation, seasoning blends, and processed foods. Powdered paprika is preferred for its convenience in both commercial and household settings.

The liquid segment is expected to witness the fastest growth rate of 8.8% from 2025 to 2032, driven by rising demand in ready-to-use food products, sauces, and marinades. Liquid paprika’s ability to blend seamlessly into recipes and its growing use in premium culinary products contribute to its rapid adoption.

- By End-Use

On the basis of end-use, the global paprika market is segmented into food and beverage industry, cosmetics industry, pharmaceutical industry, and personal care products. The food and beverage industry segment dominated the market with a revenue share of 70.4% in 2024, driven by paprika’s extensive use as a flavoring and coloring agent in snacks, sauces, meats, and ready-to-eat meals. Its role in enhancing visual appeal and taste profiles solidifies its dominance.

The cosmetics industry segment is anticipated to witness significant growth from 2025 to 2032, driven by the increasing use of paprika-derived ingredients in natural and organic cosmetic formulations. Paprika’s antioxidant properties and vibrant color make it a valuable component in skincare and makeup products.

- By Distribution Channel

On the basis of distribution channel, the global paprika market is segmented into direct sales/B2B and indirect sales/B2C. The indirect sales/B2C segment held the largest market revenue share of 62.8% in 2024, driven by the widespread availability of paprika products through supermarkets, hypermarkets, online retail, and specialty stores. The growing popularity of e-commerce platforms has further boosted B2C sales.

The direct sales/B2B segment is expected to witness rapid growth of 7.9% from 2025 to 2032, fueled by increasing demand from food processing companies, restaurants, and cosmetic manufacturers. Bulk purchasing and long-term supply contracts with paprika producers are driving growth in this segment.

Paprika Market Regional Analysis

- Europe dominated the paprika market with the largest revenue share of 42.5% in 2024, driven by its strong culinary tradition, high consumption of paprika in European cuisines, and a robust supply chain for both conventional and organic paprika. Spain, in particular, leads in paprika production and export

- Consumers prioritize paprika for its flavor, color, and health benefits, particularly in regions with diverse food cultures and growing interest in natural ingredients

- Growth is supported by advancements in paprika processing technologies, including organic and smoked variants, alongside rising adoption in food, cosmetics, and pharmaceutical industries

U.K. Paprika Market Insight

The U.K. market is experiencing robust growth within Europe, driven by increasing consumer interest in diverse cuisines and natural food additives. Demand for organic and smoked paprika is rising due to health-conscious consumer preferences and the popularity of Mediterranean and Eastern European dishes. Evolving regulations on food safety and clean-label products further encourage the adoption of paprika in food and personal care products.

Germany Paprika Market Insight

Germany is a key contributor to the European paprika market, with strong growth driven by its advanced food processing industry and consumer focus on natural and organic ingredients. German consumers prefer paprika for its versatility in culinary applications and health benefits, such as anti-inflammatory properties. The integration of paprika in premium food products and cosmetics, alongside growing B2B demand, supports sustained market growth.

U.S. Paprika Market Insight

The U.S. paprika market is expected to witness significant growth, fueled by increasing consumer demand for natural food colorants and flavor enhancers. The trend towards clean-label products and growing awareness of paprika’s antioxidant properties drive market expansion. The food and beverage industry’s adoption of paprika in processed foods, snacks, and seasonings, combined with rising interest in ethnic cuisines, supports both B2B and B2C sales.

Asia-Pacific Paprika Market Insight

The Asia-Pacific region is witnessing significant growth in the paprika market, driven by expanding food and beverage industries and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of paprika’s flavor, color, and health benefits is boosting demand. Government initiatives promoting natural food additives and sustainable production practices further encourage the use of paprika across various industries.

Japan Paprika Market Insight

Japan’s paprika market is growing steadily, driven by consumer preference for high-quality, natural food ingredients that enhance flavor and visual appeal. The presence of major food manufacturers and the integration of paprika in processed foods and seasonings accelerate market penetration. Rising interest in health-focused products and aftermarket customization in cosmetics also contributes to growth.

China Paprika Market Insight

China holds the largest share of the Asia-Pacific paprika market, propelled by rapid urbanization, growing food processing industries, and increasing demand for natural flavor and color solutions. The country emulatecountry’s expanding middle class and focus on healthy eating support the adoption of paprika in food, cosmetics, and pharmaceuticals. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Paprika Market Share

The paprika industry is primarily led by well-established companies, including:

- Chr. Hansen A/S (Denmark)

- EVESA (Spain)

- Synthite Industries Ltd (India)

- Kalsec Inc (U.S.)

- Mane KANCOR (India)

- Plant Lipids (India)

- Adani Pharmachem Private Limited (India)

- Givaudan (Switzerland)

- Ozone Naturals (India)

- Universal Oleoresins (India)

- Lionel Hitchen Limited (U.K.)

- Naturex (France)

- Kancor Ingredients Limited (India)

- Fuchs Gruppe (Germany)

- Sensient Technologies Corporation (U.S.)

What are the Recent Developments in Global Paprika Market?

- In October 2024, China maintained its status as the world’s leading exporter of paprika, with substantial trade flows to major markets such as Spain and the United States. This dominant position reflects China’s robust production capacity and strategic role in the global spice supply chain. Despite fluctuations in other regions, China’s consistent output and competitive pricing continue to support international demand for both culinary and industrial-grade paprika. The country’s leadership in paprika exports underscores its influence in shaping global market dynamics and ensuring reliable supply to key importing nations

- In September 2024, India’s paprika crop saw over 90% of sowing completed, particularly in key producing regions such as Karnataka and Maharashtra, signaling a robust production effort. Despite this progress, some areas experienced rain-related damage, prompting replanting to ensure crop viability. These efforts reflect the resilience and adaptability of farmers in maintaining consistent supply amid environmental challenges. While medium-grade paprika availability remains stable, the limited supply of high-grade IPM varieties poses market pressures. The situation underscores the importance of strategic planning in spice production to meet both domestic and export demands

- In July 2024, Mexico’s paprika export volumes declined by 5.12%, despite sustained global demand, leading to upward pressure on prices. The drop in supply, particularly of high-grade paprika, has created challenges for buyers seeking premium quality. This imbalance between demand and availability underscores the volatility of the spice trade and the importance of strategic sourcing. As global markets continue to favor paprika for its culinary and industrial applications, exporters must navigate environmental and logistical hurdles to maintain competitiveness and meet rising expectations for quality and consistency

- In April 2024, the United Kingdom recorded a 7.32% increase in paprika imports, helping to stabilize market prices amid global supply fluctuations. This growth reflects steady consumer demand and the country’s role as a key importer in the international spice trade. The rise in imports also helped offset shortages of high-grade paprika from other regions, ensuring consistent availability for food manufacturers and retailers. As global demand for paprika remains strong, the UK’s import expansion highlights the importance of resilient supply chains and diversified sourcing strategies in maintaining market balance

- In January 2024, South Africa experienced a notable shift in its paprika trade dynamics. Despite a modest 0.15% increase in production, the country’s paprika export values plummeted by 46.18%, reflecting broader market challenges. This sharp decline suggests increased competition, pricing pressures, or changing global demand patterns that may be affecting South Africa’s position in the spice export market. The disparity between production and export value highlights the importance of strategic market engagement and adaptability in maintaining competitiveness amid evolving international trade conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paprika Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paprika Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paprika Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.