Global Paralleling Switchgear Market

Market Size in USD Billion

CAGR :

%

USD

1.63 Billion

USD

2.50 Billion

2024

2032

USD

1.63 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.63 Billion | |

| USD 2.50 Billion | |

|

|

|

|

Paralleling Switchgear Market Size

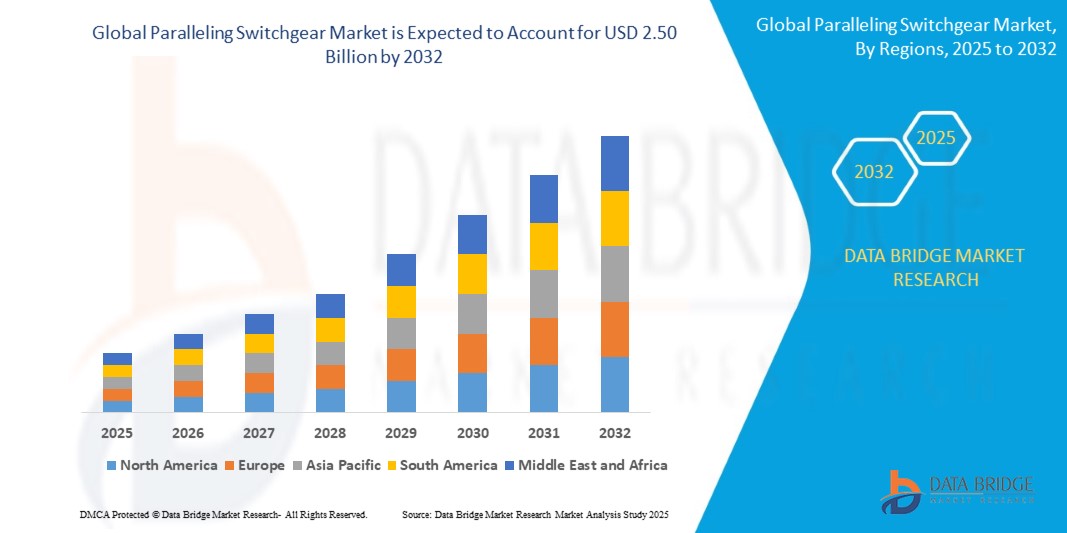

- The global paralleling switchgear market size was valued at USD 1.63 billion in 2024 and is expected to reach USD 2.50 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by increasing industrialization, rapid expansion of data centers, and the growing need for uninterrupted power supply across commercial and industrial facilities. The rising adoption of automated and smart power management solutions is driving the deployment of advanced paralleling switchgear systems, enabling seamless load distribution and operational continuity

- Furthermore, the demand for reliable, scalable, and flexible power solutions in critical applications, such as hospitals, manufacturing plants, and IT infrastructure, is establishing paralleling switchgear as an essential component of modern power management systems. These converging factors are accelerating the adoption of both low- and medium-voltage switchgear, significantly boosting overall market growth

Paralleling Switchgear Market Analysis

- Paralleling switchgear systems are advanced electrical devices that manage the distribution of power from multiple sources, ensuring uninterrupted electricity supply and optimized load sharing. These systems integrate with industrial automation and monitoring platforms, enhancing operational efficiency, reliability, and grid stability for commercial, industrial, and renewable energy applications

- The escalating demand for paralleling switchgear is primarily driven by the need for high-performance, energy-efficient, and digitally controllable systems, the integration of renewable energy into existing grids, and increasing investments in smart infrastructure and industrial automation. The trend toward resilient and intelligent power systems continues to propel market growth globally

- North America dominated the paralleling switchgear market with a share of 30.6% in 2024, due to rising investments in reliable power infrastructure and the growing demand for uninterrupted electricity in industrial and commercial facilities

- Asia-Pacific is expected to be the fastest growing region in the paralleling switchgear market during the forecast period due to rapid industrialization, urbanization, and infrastructure development in countries such as China, Japan, and India

- Standby segment dominated the market with a market share of 62.5% in 2024, due to the growing need for backup power in hospitals, commercial buildings, and data centers. Standby paralleling switchgear ensures operational continuity during outages, which is crucial for sectors where downtime can result in significant financial and operational losses. Increasing reliance on digital infrastructure, coupled with rising urbanization, has created a strong market for reliable standby systems, making them the dominant choice in various mission-critical industries

Report Scope and Paralleling Switchgear Market Segmentation

|

Attributes |

Paralleling Switchgear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Paralleling Switchgear Market Trends

Integration of Renewable Energy Source

- The paralleling switchgear market is increasingly influenced by the integration of renewable energy sources such as solar, wind, and hydropower into power grids. This integration demands sophisticated switchgear solutions capable of managing variable energy loads and ensuring seamless power distribution

- For instance, Schneider Electric has developed advanced paralleling switchgear optimized for hybrid power systems that combine renewable generation with traditional grids. Their solutions facilitate efficient load sharing and enhance grid stability in diverse renewable energy projects

- The rise of microgrids and distributed energy resources is accelerating demand for intelligent switchgear that coordinates multiple power sources and storage systems to deliver reliable and flexible energy

- Growing investments in smart grid technologies drive the adoption of paralleling switchgear with enhanced communication and automation capabilities, enabling real-time system control and fault detection

- In addition, the expansion of off-grid and remote renewable power installations requires paralleling switchgear that supports independent or islanded operation with high reliability. Emerging battery energy storage systems (BESS) integrated with renewables increase the complexity of power management, prompting demand for switchgear solutions that facilitate smooth transition between sources and ensure safety

- The market is also shaped by regulatory incentives worldwide that encourage cleaner energy adoption, further pushing innovations in switchgear tailored to renewable energy integration

Paralleling Switchgear Market Dynamics

Driver

Rising Demand for Reliable Power Supply

- The need for continuous and reliable power supply across industrial, commercial, and critical infrastructure sectors is a strong driver for the paralleling switchgear market. Switchgear systems ensure optimal load management, redundancy, and failover capabilities to prevent downtime

- For instance, Eaton supplies paralleling switchgear to data centers and hospitals where power reliability is critical. Their systems enable seamless switching between multiple power sources, ensuring uninterruptible operations and reducing risks of power failure

- The rapid urbanization and industrialization globally increase demand for resilient power infrastructure capable of supporting expanding electricity loads without interruptions

- In addition, growing adoption of backup and emergency power systems in commercial complexes, telecom towers, and manufacturing plants reinforces the need for switchgear solutions that facilitate effective power source management and load balancing

- Increasing utility modernization programs that upgrade aging infrastructure actively promote paralleling switchgear to enhance grid reliability and reduce outage durations. The rising complexity of power generation from mixed sources—including conventional, renewable, and storage—necessitates sophisticated switchgear for safe, coordinated operations

Restraint/Challenge

High Initial Investment

- High upfront capital costs associated with procuring, installing, and commissioning advanced paralleling switchgear systems pose a significant barrier to market growth. This challenge is particularly acute in emerging markets and for small-to-medium enterprises

- For instance, small manufacturing units and commercial establishments have reported delaying switchgear upgrades from companies such as Mitsubishi Electric due to budget constraints despite clear long-term benefits in operational reliability and cost savings

- Costs related to integration with existing infrastructure and specialized training for personnel add to the investment burden, complicating decision-making for facility managers and project stakeholders

- In addition, return on investment (ROI) periods can be long, especially in regions with unstable power grids where backup and paralleling systems are less frequently used, limiting willingness to invest

- Limited availability of financing and leasing options for high-capital equipment further restrains adoption in price-sensitive industries and regions. Complex project management related to switchgear installation and commissioning introduces additional indirect costs and risks, impacting project timelines and budgets

Paralleling Switchgear Market Scope

The market is segmented on the basis of voltage, application, and end user.

• By Voltage

On the basis of voltage, the paralleling switchgear market is segmented into low voltage and medium voltage. The low voltage segment dominated the largest market revenue share in 2024, attributed to its extensive use across commercial buildings, healthcare facilities, and small-scale industrial setups. Low voltage paralleling switchgear offers flexibility in installation, cost efficiency, and reliable power distribution for applications where critical load management is essential. Growing emphasis on uninterrupted power supply in IT infrastructure, hospitals, and educational institutions continues to drive demand for low voltage systems, making it the preferred option for sectors requiring seamless transition between power sources.

The medium voltage segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand in large-scale industrial facilities, data centers, and utility applications. Medium voltage paralleling switchgear provides higher efficiency and robustness for managing significant electrical loads and supporting grid stability. Expansion of renewable energy projects, especially solar and wind farms, also necessitates medium voltage systems for effective power distribution and grid synchronization. This growing integration of renewable and industrial power requirements positions medium voltage systems as the fastest-expanding segment in the coming years.

• By Application

On the basis of application, the market is segmented into prime and standby. The standby segment held the largest revenue share of 62.5% in 2024, driven by the growing need for backup power in hospitals, commercial buildings, and data centers. Standby paralleling switchgear ensures operational continuity during outages, which is crucial for sectors where downtime can result in significant financial and operational losses. Increasing reliance on digital infrastructure, coupled with rising urbanization, has created a strong market for reliable standby systems, making them the dominant choice in various mission-critical industries.

The prime segment is anticipated to register the fastest CAGR from 2025 to 2032, supported by the expansion of off-grid applications and remote industrial operations. Prime power paralleling switchgear is widely used in oil & gas, mining, and construction projects where consistent power supply is required in areas without stable grid connectivity. Growing adoption of decentralized power generation, including renewable-based microgrids, further accelerates demand for prime application systems. Their ability to ensure continuous power availability in challenging environments is positioning prime applications as the fastest-growing area in the market.

• By End User

On the basis of end user, the market is segmented into commercial and industrial. The industrial segment dominated the largest share in 2024, owing to high demand from manufacturing, oil & gas, mining, and utility sectors. Industrial facilities require robust and scalable paralleling switchgear to ensure uninterrupted operations, reduce downtime, and manage complex power needs. With industries increasingly prioritizing operational reliability and energy efficiency, the adoption of paralleling switchgear has become essential for optimizing load distribution and maintaining productivity in large-scale operations.

The commercial segment is expected to record the fastest growth rate from 2025 to 2032, driven by the rapid expansion of data centers, healthcare infrastructure, and commercial complexes. Commercial users are increasingly investing in paralleling switchgear to ensure reliable power supply for critical operations, particularly with the rising reliance on digital technologies and cloud-based services. The ongoing urbanization trend and the growth of smart cities are also fueling demand for advanced power management systems in the commercial sector. These factors collectively contribute to the segment’s rapid expansion trajectory over the forecast period.

Paralleling Switchgear Market Regional Analysis

- North America dominated the paralleling switchgear market with the largest revenue share of 30.6% in 2024, driven by rising investments in reliable power infrastructure and the growing demand for uninterrupted electricity in industrial and commercial facilities

- Consumers and enterprises in the region prioritize robust, scalable, and technologically advanced switchgear solutions to ensure operational continuity and energy efficiency

- The market is further supported by well-established power grids, high adoption of industrial automation, and stringent reliability standards, making paralleling switchgear a critical solution for both industrial and commercial applications

U.S. Paralleling Switchgear Market Insight

The U.S. paralleling switchgear market captured the largest revenue share in North America in 2024, fueled by increasing industrialization, rapid expansion of data centers, and the growing adoption of backup and prime power systems. Businesses are focusing on ensuring seamless power distribution and minimizing downtime through advanced switchgear solutions. Moreover, government incentives for energy reliability and modernization of aging electrical infrastructure are significantly contributing to market growth. The integration of smart monitoring and automation features in paralleling switchgear systems further enhances operational efficiency, driving the U.S. market forward.

Europe Paralleling Switchgear Market Insight

The Europe paralleling switchgear market is expected to grow steadily at a notable CAGR during the forecast period, driven by stringent electrical safety regulations and the increasing focus on reliable power supply in industrial and commercial setups. The growing trend toward energy-efficient systems and adoption of smart power management solutions is supporting market growth. Countries such as Germany, France, and Italy are witnessing rising demand in manufacturing plants, data centers, and healthcare facilities, where uninterrupted power supply is critical. The region’s emphasis on sustainable energy solutions and modernization of existing electrical infrastructure further fuels market adoption.

U.K. Paralleling Switchgear Market Insight

The U.K. paralleling switchgear market is projected to expand at a significant CAGR, driven by industrial modernization, increasing energy reliability requirements, and growing investments in commercial infrastructure. Enterprises in the U.K. are prioritizing automated and flexible switchgear solutions to ensure continuous power supply and efficient energy management. The government’s initiatives for resilient electrical infrastructure, coupled with the adoption of industrial automation technologies, are expected to sustain market growth over the forecast period.

Germany Paralleling Switchgear Market Insight

The Germany paralleling switchgear market is anticipated to witness robust growth, driven by the country’s industrial base, high standards for electrical safety, and focus on energy efficiency. Germany’s manufacturing and utility sectors are increasingly deploying advanced paralleling switchgear systems to minimize downtime and optimize power management. The adoption of intelligent monitoring systems and integration with renewable energy sources further strengthens the market outlook, as businesses seek reliable and sustainable power solutions.

Asia-Pacific Paralleling Switchgear Market Insight

The Asia-Pacific paralleling switchgear market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid industrialization, urbanization, and infrastructure development in countries such as China, Japan, and India. The increasing demand for uninterrupted power supply in manufacturing, commercial, and data center applications is propelling market growth. In addition, the rise of smart grids, renewable energy integration, and the establishment of domestic switchgear manufacturing hubs are enhancing accessibility and affordability, accelerating adoption across the region.

Japan Paralleling Switchgear Market Insight

The Japan market is gaining traction due to the country’s high industrial standards, emphasis on energy reliability, and technological advancement in power management solutions. Growing investments in automated and digitally controlled switchgear systems are driven by the need to ensure operational continuity in industrial and commercial facilities. Japan’s aging infrastructure and focus on resilient power supply solutions are also expected to support long-term market growth.

China Paralleling Switchgear Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, owing to rapid urbanization, expanding industrialization, and high adoption of smart and automated power management solutions. The country’s emphasis on developing resilient electrical infrastructure and smart grids, alongside large-scale investments in manufacturing, commercial, and data center facilities, is boosting demand. Domestic production capabilities and the growing middle class further enhance the accessibility of paralleling switchgear systems, positioning China as a key driver of regional market growth.

Paralleling Switchgear Market Share

The paralleling switchgear industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- Caterpillar Inc. (U.S.)

- Cummins Inc. (U.S.)

- Rolls-Royce (MTU Onsite Energy) (U.K.)

- Kohler Co. (U.S.)

- Pioneer Power Solutions. (U.S.)

- Regal Beloit Corporation (U.S.)

- Schneider Electric SE. (France)

- Advanced Power Technologies. (U.S.)

- Enercon Engineering (U.S.)

- INDUSTRIAL ELECTRIC MFG (U.S.)

Latest Developments in Global Paralleling Switchgear Market

- In March 2024, Cummins introduced a new range of paralleling switchgear products designed to offer enhanced scalability and flexibility, addressing the evolving power requirements of data centers and other mission-critical applications. This launch strengthens the market by enabling enterprises to manage growing energy demands more efficiently, improve operational reliability, and adopt modular solutions that can adapt to future expansions, thereby accelerating the adoption of advanced switchgear systems globally

- In 2023, Schneider Electric launched a new line of digital switchgear with advanced monitoring and control capabilities. The enhanced visibility and real-time management provided by these solutions are driving market growth by empowering industries to optimize energy usage, minimize downtime, and integrate seamlessly with automation systems. This development underscores the growing trend toward digitalization in the paralleling switchgear market, highlighting the increasing demand for intelligent, data-driven power management solutions

- In 2022, ABB unveiled a state-of-the-art paralleling switchgear system tailored for renewable energy integration, ensuring seamless power distribution and grid stability. This launch significantly impacts the market by supporting the global transition to renewable energy, enabling efficient load management, and improving the reliability of distributed power systems. It reinforces the role of advanced switchgear in facilitating sustainable energy initiatives and strengthening grid resilience worldwide

- In July 2021, the European Commission’s LIFE Climate Action Program awarded GE Renewable Energy’s Grid Solutions business USD 2.6 million to develop a 245-kilovolt (kV) g3 live tank circuit breaker free from sulphur hexafluoride (SF6). This initiative promotes environmental sustainability by reducing greenhouse gas emissions while maintaining the high performance and compact design of traditional SF6 breakers. The development accelerates market adoption of eco-friendly switchgear technologies and positions GE as a leader in sustainable high-voltage solutions

- In April 2021, GE and Hitachi-ABB Power Grids entered into a non-exclusive cross-licensing agreement to expand their high-voltage equipment offerings through the use of an SF6 alternative gas. By accessing this innovative gas technology, both companies can reduce the environmental footprint of their switchgear while maintaining operational efficiency. This collaboration drives market growth by fostering the adoption of greener solutions, enhancing competitive positioning, and supporting regulatory compliance in regions emphasizing low-carbon technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Paralleling Switchgear Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Paralleling Switchgear Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Paralleling Switchgear Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.