Global Paraquat Market

Market Size in USD Billion

CAGR :

%

USD

1.69 Billion

USD

3.50 Billion

2025

2033

USD

1.69 Billion

USD

3.50 Billion

2025

2033

| 2026 –2033 | |

| USD 1.69 Billion | |

| USD 3.50 Billion | |

|

|

|

|

Paraquat Market Size

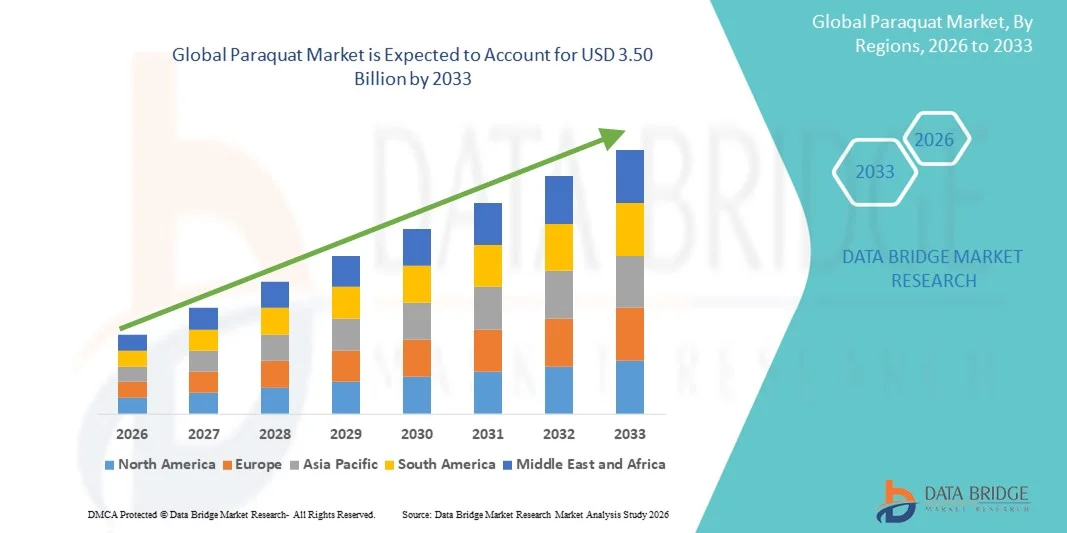

- The global paraquat market size was valued at USD 1.69 billion in 2025 and is expected to reach USD 3.50 billion by 2033, at a CAGR of 9.50% during the forecast period

- The market growth is largely fuelled by strong demand for fast-acting and non-selective herbicides to control weeds in large-scale agricultural operations

- Increasing adoption of paraquat in plantation crops such as oil palm, rubber, and sugarcane is supporting consistent consumption

Paraquat Market Analysis

- The market is driven by the need for efficient weed management solutions that enhance crop productivity and reduce labor dependency

- Paraquat’s rapid action and effectiveness in no-till and conservation farming practices make it a preferred choice among commercial farmers

- North America dominated the paraquat market with the largest revenue share in 2025, driven by high adoption of commercial and plantation-scale farming, increasing demand for efficient weed management, and widespread awareness of chemical herbicide benefits

- Asia-Pacific region is expected to witness the highest growth rate in the global paraquat market, driven by rapid urbanization, expansion of cash crops and plantations, government support for modern agriculture, and growing demand for labor-efficient herbicide solutions

- The Paraquat Aqueous Solution segment held the largest market revenue share in 2025, driven by its ease of application, quick absorption, and suitability for large-scale commercial farming. This type is widely preferred for controlling a broad spectrum of weeds in plantation crops, row crops, and field crops, making it the most commonly used formulation among end-users.

Report Scope and Paraquat Market Segmentation

|

Attributes |

Paraquat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• ANKAR INDUSTRIES (P) LTD (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Paraquat Market Trends

Rising Demand for Fast-Acting and Non-Selective Herbicides

- The increasing need for rapid and effective weed control is significantly shaping the paraquat market, as farmers seek solutions that deliver immediate results and minimize crop competition. Paraquat is gaining traction due to its fast-acting, contact-based action, making it highly effective for pre-planting and inter-row weed management. This trend is strengthening its role in commercial and plantation farming systems while helping reduce labor costs and improve overall operational efficiency

- Growing pressure to improve crop yields and reduce manual labor is accelerating the adoption of chemical herbicides such as paraquat. Farmers are increasingly relying on non-selective herbicides to manage weeds efficiently, particularly in large-scale agricultural operations where labor shortages persist. The consistent performance of paraquat under varying climatic conditions also enhances its reliability among end-users

- The expansion of plantation crops and cash crops is influencing purchasing decisions, with paraquat being widely used in oil palm, rubber, cotton, and sugarcane cultivation. Its effectiveness in controlling a broad spectrum of weeds supports its continued demand across diverse crop cycles. In addition, the herbicide’s compatibility with integrated weed management programs reinforces its adoption in modern farming practices

- For instance, in 2024, agricultural producers in parts of Latin America and Southeast Asia reported increased paraquat usage during pre-planting and post-harvest weed management due to its rapid action and cost efficiency compared to alternative herbicides. The adoption was particularly notable among commercial plantation farms seeking to optimize productivity and reduce operational delays

- While demand for fast-acting herbicides is driving market growth, sustained adoption depends on regulatory compliance, safe handling practices, and farmer awareness regarding proper application methods. Continuous training and adherence to safety standards are critical to minimizing health risks and ensuring long-term market sustainability

Paraquat Market Dynamics

Driver

Rising Need for Efficient Weed Management in Commercial Agriculture

- The growing emphasis on improving agricultural productivity is a major driver for the paraquat market. Farmers are increasingly adopting herbicides that offer quick weed suppression to protect crop yields and optimize land use. Paraquat’s ability to deliver visible results within hours supports its continued use in intensive farming systems and reduces dependency on manual labor

- Increasing cultivation of plantation and perennial crops is influencing herbicide demand, as these crops require frequent and effective weed control. Paraquat is widely preferred for its reliability in controlling weeds without long residual effects on soil, making it suitable for repeated applications. The herbicide also helps maintain crop health by preventing weed-related nutrient competition

- Agrochemical companies and distributors are actively promoting paraquat-based formulations through agricultural extension programs and dealer networks. These efforts are supported by the need for affordable weed control solutions, particularly in developing economies with cost-sensitive farming communities. Marketing campaigns emphasizing efficiency and yield enhancement are further boosting adoption

- For instance, in 2023, plantation operators in countries such as Indonesia and Brazil increased procurement of paraquat products to manage weed growth efficiently during peak growing seasons, citing reduced labor dependency and faster field turnaround. The herbicide also enabled these operators to maintain crop uniformity and optimize harvest schedules

- Although efficiency-driven demand is supporting market growth, long-term adoption will depend on balancing productivity benefits with evolving regulatory frameworks and sustainability considerations. Companies investing in safer formulations and controlled-use products are better positioned to navigate regulatory challenges and maintain market share

Restraint/Challenge

Stringent Regulatory Restrictions and Health Concerns

- Increasing regulatory scrutiny on paraquat usage remains a key challenge for the market. Concerns related to human health and environmental impact have led to bans or strict usage regulations in several countries, limiting market expansion in regulated regions. The restrictions also compel manufacturers to invest in compliance measures, increasing operational costs

- Public awareness regarding the toxicity of paraquat has influenced policy decisions and farmer perceptions. In regions with strict enforcement, farmers are gradually shifting toward alternative herbicides or integrated weed management practices, affecting demand stability. Negative media coverage and health advisories further amplify caution among end-users

- Compliance requirements such as mandatory training, protective equipment, and controlled application increase operational complexity for farmers. These factors can discourage small-scale farmers from using paraquat, especially where regulatory monitoring is stringent. In addition, the need for proper disposal and handling adds logistical challenges for distributors and retailers

- For instance, in 2024, regulatory authorities in parts of Europe and select Asian countries reinforced restrictions on paraquat usage, prompting distributors to scale back sales and focus on compliant formulations and alternatives. Some countries also introduced stricter reporting and tracking protocols, impacting product circulation and availability

- Addressing these challenges will require industry focus on regulatory alignment, improved safety education, and the development of controlled-use solutions to sustain the global paraquat market over the long term. Companies that invest in safer packaging, targeted training programs, and localized compliance strategies are better equipped to maintain market growth while ensuring responsible usage

Paraquat Market Scope

The market is segmented on the basis of type and application

- By Type

On the basis of type, the global paraquat market is segmented into Paraquat Aqueous Solution, Paraquat Soluble Granule, Paraquat Water Soluble Gel, and Others. The Paraquat Aqueous Solution segment held the largest market revenue share in 2025, driven by its ease of application, quick absorption, and suitability for large-scale commercial farming. This type is widely preferred for controlling a broad spectrum of weeds in plantation crops, row crops, and field crops, making it the most commonly used formulation among end-users.

The Paraquat Soluble Granule segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its enhanced stability, reduced spillage, and ease of transport. Granule formulations are particularly popular among plantation operators and small-scale farmers for their convenience and precise dosing, making them an attractive alternative to liquid formulations.

- By Application

On the basis of application, the global paraquat market is segmented into Farms, Plantations and Estates, Non-Agricultural Weed Control, and Others. The Plantations and Estates segment held the largest revenue share in 2025, fueled by the widespread use of paraquat in cash crops such as oil palm, sugarcane, rubber, and cotton. Large-scale operators prefer paraquat for its rapid action, cost efficiency, and ability to reduce manual labor.

The Farms segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption among commercial and smallholder farmers seeking efficient weed control solutions. Growing awareness about productivity enhancement and labor optimization is encouraging farmers to integrate paraquat into routine crop management practices.

Paraquat Market Regional Analysis

- North America dominated the paraquat market with the largest revenue share in 2025, driven by high adoption of commercial and plantation-scale farming, increasing demand for efficient weed management, and widespread awareness of chemical herbicide benefits

- Farmers in the region highly value the rapid action, cost efficiency, and broad-spectrum weed control offered by paraquat, which supports higher crop yields and reduces manual labor requirements

- This widespread adoption is further supported by advanced agricultural infrastructure, availability of agrochemical distributors, and strong presence of major paraquat manufacturers, establishing paraquat as a preferred solution across farms, plantations, and estates

U.S. Paraquat Market Insight

The U.S. paraquat market captured the largest revenue share in 2025 within North America, fueled by the increasing need for fast-acting herbicides in commercial farming and large-scale plantation operations. Farmers are focusing on efficiency, crop yield optimization, and labor cost reduction, driving demand for paraquat. The growing integration of precision agriculture techniques and automated spraying systems further supports the market’s expansion.

Europe Paraquat Market Insight

The Europe paraquat market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for efficient weed management in cash crops and large-scale farming operations. European farmers are adopting modern herbicides to improve productivity, reduce manual labor, and comply with sustainable agricultural practices. The region is experiencing significant growth across farms, plantations, and non-agricultural weed control applications.

U.K. Paraquat Market Insight

The U.K. paraquat market is expected to witness the fastest growth rate from 2026 to 2033, driven by the need for higher productivity and cost-effective weed management solutions. Increasing mechanization in agriculture and the preference for high-efficiency herbicides are encouraging adoption. The country’s well-established distribution channels and agrochemical support systems further facilitate market growth.

Germany Paraquat Market Insight

The Germany paraquat market is expected to witness steady growth from 2026 to 2033, fueled by increasing awareness of efficient weed control practices and the need to maintain crop yields in commercial farming. Germany’s focus on precision agriculture and sustainable practices promotes the adoption of paraquat, particularly in plantation crops and high-value cash crops. Farmers are increasingly integrating chemical herbicides with modern farming techniques for improved field management.

Asia-Pacific Paraquat Market Insight

The Asia-Pacific paraquat market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing agricultural commercialization, and growing awareness of herbicide benefits in countries such as China, India, and Indonesia. Government initiatives supporting modern farming and productivity enhancement are promoting the adoption of paraquat. In addition, local manufacturing of herbicide formulations is improving affordability and accessibility for farmers across the region.

Japan Paraquat Market Insight

The Japan paraquat market is expected to witness significant growth from 2026 to 2033 due to high adoption of modern farming practices, commercial plantation operations, and the need for efficient weed management. Japanese farmers increasingly prefer paraquat for its fast action, reliability, and compatibility with precision spraying techniques. The focus on labor efficiency and maintaining crop yields further supports market growth.

China Paraquat Market Insight

The China paraquat market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanization, high rates of agricultural commercialization, and increasing adoption of chemical herbicides. Paraquat is widely used in plantation crops, row crops, and non-agricultural weed control applications. Expanding domestic production, government support for high-yield agriculture, and affordable herbicide formulations are key factors propelling the market in China.

Paraquat Market Share

The Paraquat industry is primarily led by well-established companies, including:

• ANKAR INDUSTRIES (P) LTD (India)

• BHASKAR AGRO (India)

• CANARY AGRO CHEMICALS PRIVATE LIMITED (India)

• JAYALAKSHMI FERTILISERS (India)

• Kalyani Industries Limited (India)

• Sigma-Aldrich Co (U.S.)

• Corteva (U.S.)

• SinoHarvest (China)

• Toshi Automatic Systems (India)

• Aroxa Crop Science Private Limited (India)

• Greenland Bio-Science (India)

• India Agro Science & Tech (India)

• Ambachem Industries (U.K.)

Latest Developments in Global Paraquat Market

- In August 2025, Syngenta AG (CH) entered into a strategic partnership with a leading agricultural technology firm to develop precision application technologies for paraquat. This collaboration aims to enhance herbicide efficacy while minimizing environmental impact. The initiative highlights Syngenta’s focus on sustainable innovation and is expected to strengthen its market leadership by aligning with global trends toward environmentally responsible farming practices

- In September 2025, BASF SE (DE) completed the acquisition of a regional competitor, expanding its presence in the Asia-Pacific paraquat market. The acquisition enhances BASF’s product portfolio and strengthens its distribution network in a high-growth region. This strategic move consolidates the company’s market position and improves its competitive advantage, enabling broader access to commercial and plantation-scale farmers

- In July 2025, Nufarm Limited (AU) launched a new paraquat formulation designed to comply with stringent European regulatory standards. The product introduction reflects Nufarm’s proactive approach to regulatory compliance and innovation. By offering a market-ready solution for highly regulated regions, the company is poised to capture additional market share and strengthen its competitive positioning in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.