Global Parasitology Identification Market

Market Size in USD Billion

CAGR :

%

USD

4.59 Billion

USD

7.32 Billion

2024

2032

USD

4.59 Billion

USD

7.32 Billion

2024

2032

| 2025 –2032 | |

| USD 4.59 Billion | |

| USD 7.32 Billion | |

|

|

|

|

Parasitology Identification Market Size

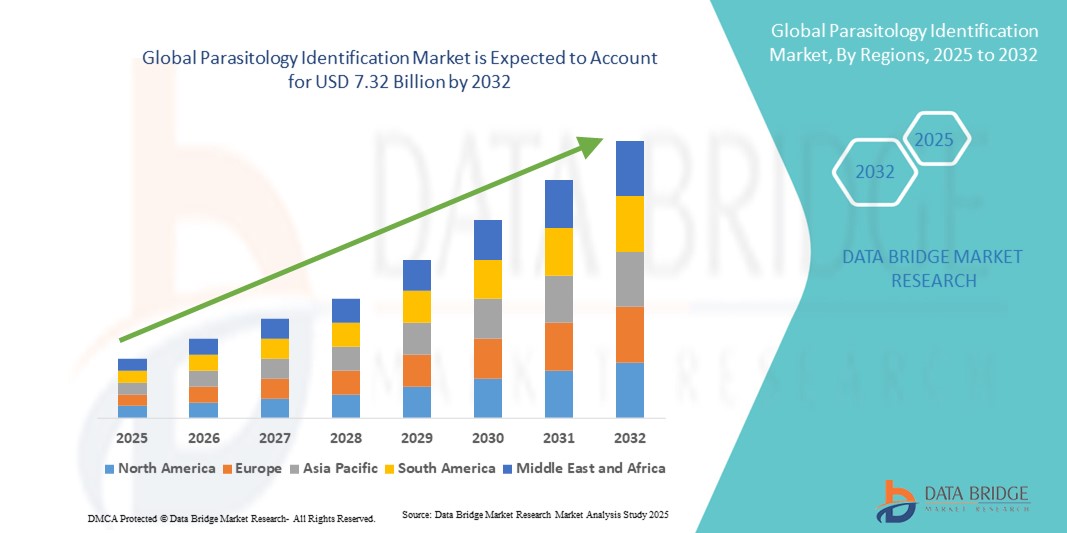

- The global parasitology identification market size was valued at USD 4.59 billion in 2024 and is expected to reach USD 7.32 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of parasitic infections across humans and animals, coupled with the rising need for rapid and accurate diagnostic methods in both clinical and research settings

- Furthermore, growing awareness among healthcare professionals and researchers about the importance of early detection and precise identification of parasites is establishing advanced Parasitology Identification solutions as the preferred choice. These converging factors are accelerating the adoption of Parasitology Identification technologies, thereby significantly boosting the industry's growth

Parasitology Identification Market Analysis

- Parasitology Identifications play a critical role in diagnosing and monitoring parasitic infections, providing accurate and timely results for both clinical and research applications across healthcare and laboratory settings

- The increasing prevalence of parasitic diseases, coupled with rising awareness about early detection and effective treatment, is driving the demand for advanced Parasitology Identification solutions. In addition, expanding healthcare infrastructure and investments in diagnostic technologies are further fueling market growth

- North America dominated the parasitology identification market with the largest revenue share of 35.05% in 2024, supported by a well-established healthcare system, strong presence of key industry players, and high adoption of advanced diagnostic instruments in hospitals and laboratories. The U.S. accounted for the majority of the regional revenue, driven by widespread clinical research initiatives, early adoption of innovative diagnostic techniques, and comprehensive awareness programs targeting healthcare professionals and patients

- Asia-Pacific is expected to be the fastest-growing region in the parasitology identification market during the forecast period, driven by increasing healthcare investments, rising disposable incomes, and growing awareness of parasitic infections in countries such as China, India, and Japan. Expansion of laboratory infrastructure and government initiatives to improve disease surveillance are also contributing to market growth

- The Devices segment dominated the parasitology identification market with the largest market revenue share of 61.5% in 2024, driven by increasing adoption of advanced diagnostic instruments that provide rapid and highly accurate detection of parasitic infections

Report Scope and Parasitology Identification Market Segmentation

|

Attributes |

Parasitology Identification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Parasitology Identification Market Trends

Advancements in Diagnostic Accuracy and Rapid Detection

- A significant and accelerating trend in the global parasitology identification market is the increasing adoption of advanced diagnostic technologies and rapid detection methods. These innovations are significantly enhancing the accuracy, speed, and reliability of parasitic disease diagnosis across clinical and research settings

- For instance, recent developments in molecular diagnostic platforms and immunoassays have enabled faster detection of parasitic infections such as malaria, giardiasis, and leishmaniasis, providing healthcare professionals with timely and actionable insights for treatment decisions. Similarly, point-of-care testing kits are increasingly being deployed in endemic regions to facilitate immediate diagnosis and improve patient outcomes

- Integration of multiplex testing and automated sample processing in Parasitology Identification enables laboratories to screen for multiple parasites simultaneously, reducing turnaround time and minimizing human error. High-throughput diagnostic platforms are supporting large-scale epidemiological studies and improving surveillance of parasitic infections in both urban and rural populations

- The seamless incorporation of Parasitology Identification solutions into broader laboratory workflows allows centralized management of testing, reporting, and data analysis. Through standardized protocols, laboratories can ensure consistent quality, enhance reproducibility, and streamline patient management for parasitic diseases.

- This trend towards more precise, rapid, and integrated diagnostic solutions is fundamentally reshaping expectations for parasitology testing. Consequently, companies and research institutions are developing next-generation platforms with enhanced sensitivity, specificity, and ease of use, ensuring accurate detection across diverse clinical and field settings

- The demand for advanced Parasitology Identification solutions is growing rapidly across hospitals, research institutes, and diagnostic laboratories, as healthcare providers and public health agencies increasingly prioritize rapid, reliable, and scalable diagnostic capabilities to combat parasitic infections effectively

Parasitology Identification Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Parasitic Infections and Advancements in Diagnostic Solutions

- The increasing prevalence of parasitic infections worldwide, combined with the growing demand for accurate and timely diagnostic solutions, is a significant driver for the heightened adoption of Parasitology Identifications

- For instance, in April 2024, leading diagnostic companies announced advancements in automated parasitology testing platforms, focusing on faster detection and higher accuracy for clinical and research laboratories. Such innovations are expected to drive growth in the Parasitology Identification industry during the forecast period

- As healthcare providers and researchers seek to improve patient outcomes and streamline laboratory workflows, Parasitology Identifications offer advanced capabilities, including rapid detection, high sensitivity, and reliable differentiation of parasitic species, providing a substantial upgrade over conventional microscopy-based methods

- Furthermore, the rising focus on disease surveillance, early detection programs, and laboratory automation is making Parasitology Identifications an integral part of clinical and research settings, supporting large-scale testing and epidemiological studies

- The growing availability of user-friendly diagnostic solutions, combined with the increasing emphasis on accurate and timely results in hospitals, diagnostic centers, and research institutions, is further contributing to market growth

Restraint/Challenge

Concerns Regarding High Costs and Technical Expertise Requirements

- The relatively high cost of advanced Parasitology Identification systems, along with the need for trained personnel to operate sophisticated instruments, poses a challenge to broader market adoption, particularly in developing regions or smaller laboratories

- In addition, ongoing maintenance and calibration requirements can increase the total cost of ownership, making some institutions hesitant to invest in state-of-the-art diagnostic equipment

- Addressing these challenges through the development of cost-effective, easy-to-use, and scalable diagnostic solutions is crucial for expanding market penetration. Companies are increasingly focusing on automation, integrated platforms, and simplified workflows to reduce the need for specialized expertise while maintaining high accuracy

- While equipment costs are gradually decreasing and more affordable options are becoming available, the perceived investment in high-end diagnostic systems can still hinder widespread adoption in resource-constrained settings

- Overcoming these barriers through affordable solutions, training programs for laboratory staff, and partnerships with healthcare institutions will be vital for sustained growth in the Parasitology Identification market

Parasitology Identification Market Scope

The market is segmented on the basis of products, methods, pathogen type, sample, stool concentration and preparation, and end-user.

- By Products

On the basis of products, the parasitology identification market is segmented into devices and consumables & accessories. The devices segment dominated the largest market revenue share of 61.5% in 2024, driven by increasing adoption of advanced diagnostic instruments that provide rapid and highly accurate detection of parasitic infections. Instruments such as automated microscopes, molecular diagnostic platforms, and MALDI-TOF MS systems offer higher sensitivity and reproducibility compared to conventional methods. Hospitals, research institutes, and diagnostic laboratories are increasingly relying on devices for routine diagnostics, outbreak investigations, and large-scale epidemiological studies. Integration with laboratory information systems and automation enhances efficiency and throughput. Technological advancements in multiplex detection and point-of-care devices further contribute to the segment’s dominance. In addition, government funding and private investments in laboratory infrastructure support widespread adoption. The segment’s robustness in terms of accuracy, speed, and scalability makes it the preferred choice in clinical and research applications.

The consumables & accessories segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, driven by the recurring need for reagents, staining kits, slides, and culture media across diagnostic laboratories and research institutes. Rising awareness about standardized laboratory protocols and increasing frequency of parasitology testing ensures consistent demand. Field-based screening programs in endemic regions further fuel growth. Innovations in pre-prepared and user-friendly consumables facilitate faster turnaround times. Public health initiatives and NGO-supported programs for parasite control enhance segment adoption. Their affordability and scalability make them highly attractive in resource-limited settings.

- By Methods

On the basis of methods, the parasitology identification market is segmented into microscopic identification, fecal identification, immunological techniques, morphological identification, molecular techniques, rapid diagnostic tests (RDTs), Maldi-TOF MS, and others. The Molecular Techniques segment dominated the market in 2024 with a revenue share of 54.2%, due to their high sensitivity and specificity, even in cases with low parasitic loads. PCR-based assays and real-time PCR methods enable precise identification of parasite species, allowing clinicians to implement targeted treatment strategies. Hospitals and research centers increasingly adopt molecular techniques for routine diagnostics, outbreak investigations, and large-scale epidemiological surveillance. Advances in multiplex PCR allow simultaneous detection of multiple pathogens, improving efficiency. Molecular techniques reduce false negatives and enable detection of asymptomatic carriers, supporting public health control measures. The rising prevalence of parasitic infections globally drives their adoption. Automated molecular platforms further enhance throughput and accuracy, solidifying dominance in modern laboratories.

The RDTs segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, as RDTs provide immediate results with minimal laboratory infrastructure, making them suitable for field-based testing and low-resource settings. Their portability and ease of use allow quick screening in endemic areas and during outbreaks. Increased public health funding and governmental initiatives to improve access to rapid diagnostics support growth. RDTs enable early intervention and timely treatment, reducing disease burden. Multiplex RDTs capable of detecting multiple infections simultaneously are gaining popularity. Rising awareness among healthcare providers and patients drives adoption. Their cost-effectiveness, speed, and operational simplicity make them the fastest-growing method segment.

- By Pathogen Type

On the basis of pathogen type, the parasitology identification market is segmented into protozoan, helminths, arthropodes, tapeworm, and ectoparasites. The protozoan segment dominated the market in 2024 with a revenue share of 58.0%, driven by the high prevalence of infections such as malaria, giardiasis, and leishmaniasis. Protozoan parasites contribute significantly to the global disease burden, necessitating advanced diagnostic solutions for early detection and species-level identification. Hospitals and research institutions rely on molecular and immunological techniques for accurate diagnostics. Ongoing public health campaigns and WHO initiatives targeting protozoan diseases further reinforce segment dominance. The availability of rapid and reliable detection methods facilitates timely treatment and reduces complications. Research investments in protozoan parasitology support continuous innovation. The growing need for accurate surveillance and outbreak control also underpins the segment’s leadership in the market.

The helminths segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, fueled by school deworming programs, soil-transmitted helminth initiatives, and public health campaigns in developing regions. Field-based and laboratory-based detection methods for helminths are widely adopted to monitor infection prevalence. Low-cost diagnostic kits make helminth testing accessible in resource-limited settings. Epidemiological studies and government-supported parasitic control programs boost demand. Rising awareness of the health impacts of helminth infections enhances adoption. Technological advances in stool-based and molecular helminth detection further accelerate market penetration.

- By Sample

On the basis of sample, the parasitology identification market is segmented into feces, blood, urine, cerebrospinal fluid (CSF), serum and plasma, and others. The feces segment dominated the market in 2024 with a revenue share of 55.6%, as stool specimens are the primary sample for gastrointestinal parasite detection. Fecal analysis allows identification of protozoan cysts, helminth eggs, and larvae. Standardized laboratory protocols for fecal examination support routine diagnostics and epidemiological studies. High prevalence of intestinal parasitic infections globally drives segment demand. Automated and semi-automated fecal diagnostic systems enhance efficiency and accuracy. Hospitals, research institutes, and diagnostic centers widely adopt fecal testing. It remains cost-effective, reliable, and scalable for mass screening programs.

The blood segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, primarily due to the increasing use of blood-based tests for systemic parasitic infections such as malaria and filariasis. Blood samples are critical for molecular and immunological assays, enabling rapid and sensitive detection. Expansion of serological testing and automated blood diagnostics enhances throughput and reduces errors. Public health initiatives and epidemiological surveillance programs in endemic regions drive segment growth. Blood-based diagnostics are preferred for early detection and treatment monitoring. Rising adoption of point-of-care blood tests in resource-limited areas further accelerates market expansion.

- By Stool Concentration and Preparation

On the basis of stool concentration and preparation, the parasitology identification market is segmented into concentration technique and un-concentration technique. The concentration technique segment dominated the market in 2024 with a revenue share of 52.8%, as it enhances detection of eggs, cysts, and larvae in stool specimens. Techniques like flotation, sedimentation, and formalin-ethyl acetate concentration improve diagnostic sensitivity, especially for low-intensity infections. Laboratories adopt these methods to ensure accuracy and reliability in routine diagnostics and epidemiological surveys. Concentration techniques reduce false negatives and facilitate detection in asymptomatic patients. High adoption in hospitals and research centers ensures steady demand. Standardization of protocols supports reproducibility and comparability of results. Increasing awareness about best laboratory practices strengthens segment dominance.

The un-concentration technique segment is expected to witness the fastest CAGR of 17.5% from 2025 to 2032, driven by its simplicity and suitability for field-based applications. These methods reduce sample preparation time and allow rapid testing, making them ideal for point-of-care diagnostics in remote or resource-limited settings. Portable diagnostic kits often rely on un-concentrated stool methods. Growing adoption in large-scale screening programs accelerates growth. The segment benefits from ease of use, minimal equipment requirements, and quick result generation. Government and NGO-supported parasitic control initiatives further promote adoption. Rising demand for rapid epidemiological monitoring ensures this segment’s fast growth.

- By End-User

On the basis of end-user, the parasitology identification market is segmented into hospitals, diagnostic centers, clinics, ambulatory surgical centres, and others. The hospitals segment dominated the market in 2024 with a revenue share of 59.2%, due to advanced laboratory infrastructure, higher patient throughput, and ability to perform comprehensive parasitology testing. Hospitals integrate multiple diagnostic methods, including molecular, immunological, and microscopic techniques, for accurate and timely results. Routine patient diagnostics, outbreak management, and research applications contribute to segment leadership. Large-scale testing capacity and skilled personnel strengthen adoption. Government funding and healthcare initiatives further support hospitals as key end-users. Standardized laboratory workflows and quality control measures reinforce dominance.

The diagnostic centers segment is expected to witness the fastest CAGR of 20.2% from 2025 to 2032, driven by growing outsourcing of diagnostic services and expansion of independent laboratories. These centers provide cost-effective, rapid, and scalable testing solutions for large populations. Increasing demand from urban and semi-urban areas for quick diagnostics supports growth. Specialized parasitology testing facilities in diagnostic centers enhance accessibility. Epidemiological studies and public health surveillance programs often utilize diagnostic center networks. Flexibility in test offerings and convenience for patients accelerate adoption. Continuous investment in advanced equipment ensures reliable results, fueling rapid segment growth.

Parasitology Identification Market Regional Analysis

- North America dominated the parasitology identification market with the largest revenue share of 35.05% in 2024

- Supported by a well-established healthcare system, strong presence of key industry players, and high adoption of advanced diagnostic instruments in hospitals and laboratories

- The U.S. accounted for the majority of the regional revenue, driven by widespread clinical research initiatives, early adoption of innovative diagnostic techniques, and comprehensive awareness programs targeting healthcare professionals and patients

U.S. Parasitology Identification Market Insight

The U.S. parasitology identification market captured the largest revenue share within North America in 2024, fueled by extensive clinical research activities, growing focus on accurate and timely diagnosis of parasitic infections, and increasing awareness among healthcare professionals regarding advanced diagnostic solutions. The presence of leading diagnostic companies, along with ongoing initiatives for improving laboratory infrastructure and training personnel, further supports market expansion.

Europe Parasitology Identification Market Insight

The Europe parasitology identification market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent healthcare regulations, rising incidence of parasitic infections, and growing adoption of advanced laboratory equipment. Increasing urbanization and investment in healthcare infrastructure are fostering the uptake of Parasitology Identifications across hospitals, diagnostic centers, and research institutions. The region is witnessing significant growth across clinical laboratories and research facilities, with new technologies being incorporated into both existing setups and new establishments.

U.K. Parasitology Identification Market Insight

The U.K. parasitology identification market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of parasitic diseases, improvements in diagnostic infrastructure, and government-supported healthcare initiatives. Increased focus on disease surveillance and laboratory automation is encouraging hospitals and research centers to adopt advanced Parasitology Identification solutions.

Germany Parasitology Identification Market Insight

The Germany parasitology identification market is expected to expand at a considerable CAGR during the forecast period, fueled by growing investments in healthcare infrastructure, technological advancements in diagnostic equipment, and increasing awareness regarding parasitic infections. Germany’s emphasis on innovation and quality in healthcare promotes the adoption of Parasitology Identifications in hospitals and laboratories, with a preference for accurate, reliable, and high-throughput diagnostic solutions.

Asia-Pacific Parasitology Identification Market Insight

The Asia-Pacific parasitology identification market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing healthcare investments, rising disposable incomes, and growing awareness of parasitic infections in countries such as China, India, and Japan. Expansion of laboratory infrastructure, government initiatives to improve disease surveillance, and the rising focus on public health are driving the adoption of advanced Parasitology Identification solutions across hospitals, research institutions, and diagnostic centers.

Japan Parasitology Identification Market Insight

The Japan parasitology identification market is gaining momentum due to the country’s high focus on healthcare quality, rapid urbanization, and emphasis on early and accurate disease diagnosis. Increasing prevalence of parasitic infections in certain regions and rising awareness among healthcare professionals are contributing to the growth of the market. In addition, advancements in laboratory technologies and the demand for streamlined diagnostic processes are supporting market expansion.

China Parasitology Identification Market Insight

The China parasitology identification market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, growing disposable incomes, and increasing awareness of parasitic infections. Government initiatives for public health improvement, rising investments in diagnostic laboratories, and the presence of domestic diagnostic equipment manufacturers are key factors propelling market growth in China.

Parasitology Identification Market Share

The Parasitology Identification industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- BIOMÉRIEUX (France)

- Bruker (U.S.)

- Quest Diagnostics (U.S.)

- Akron Biotech (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- altona Diagnostics GmbH (Germany)

- Biomerica (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Creative Diagnostics (U.S.)

- Luminex Corporation (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- R-Biopharm AG (Germany)

- Shimadzu Corporation (Japan)

- Avantor, Inc. (U.S.)

- Hardy Diagnostics (U.S.)

- TECHLAB, Inc. (U.S.)

- Alpha-Tec (U.S.)

Latest Developments in Global Parasitology Identification Market

- In March 2025, ARUP Laboratories expanded its AI-augmented parasitology screening tool to include wet-mount slides, becoming the first laboratory to apply AI screening to the entire ova and parasite testing process. This advancement enhances diagnostic sensitivity and efficiency

- In August 2025, Researchers introduced the Parasite Genome Identification Platform (PGIP), a web server designed for the rapid taxonomic identification of parasite genomes. PGIP simplifies and accelerates genomic analysis and classification of parasitic organisms, facilitating quicker and more accurate diagnostics

- In June 2025, Kyoto University and Kyoto Prefectural University of Medicine developed a digital database utilizing existing slide specimens of parasite eggs, adult parasites, and arthropods. This resource supports international practical training and research, particularly within medical education programs

- In July 2025, Quest Diagnostics launched a new diagnostic laboratory test for the Oropouche virus, employing polymerase chain reaction (PCR) technology. Serology testing was also introduced later in the quarter, expanding diagnostic capabilities for this emerging infectious disease

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.