Global Parkinsons Disorder Drugs Market

Market Size in USD Billion

CAGR :

%

USD

5.19 Billion

USD

13.70 Billion

2024

2032

USD

5.19 Billion

USD

13.70 Billion

2024

2032

| 2025 –2032 | |

| USD 5.19 Billion | |

| USD 13.70 Billion | |

|

|

|

|

Parkinson’s Disorder Drugs Market Size

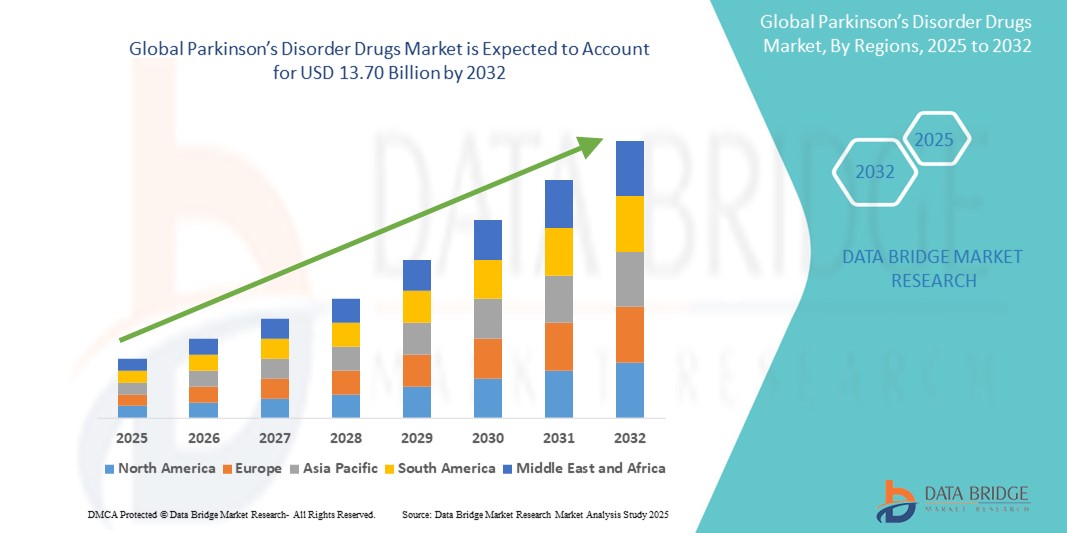

- The global Parkinson’s disorder drugs market size was valued at USD 5.19 billion in 2024 and is expected to reach USD 13.70 billion by 2032, at a CAGR of 12.90% during the forecast period

- The market growth is largely fueled by the growing adoption of innovative treatment therapies and technological advancements in drug development, leading to enhanced efficacy and patient compliance in managing Parkinson’s disease symptoms. Increased R&D investment by pharmaceutical companies is contributing to a more robust and diverse Parkinson’s Disorder Drugs pipeline across global markets

- Furthermore, rising global prevalence of Parkinson’s disease, especially among the aging population, is driving the demand for effective and long-term treatment solutions. These converging factors are accelerating the uptake of Parkinson’s Disorder Drugs, thereby significantly boosting the industry's growth

Parkinson’s Disorder Drugs Market Analysis

- Parkinson’s Disorder Drugs, used to manage motor symptoms such as tremors, stiffness, and slowed movement, are becoming increasingly vital components of neurological care due to rising disease prevalence, aging populations, and advances in drug formulations that offer enhanced efficacy and fewer side effects

- The escalating demand for Parkinson’s Disorder Drugs is primarily fueled by the growing incidence of Parkinson’s disease, improved diagnostic capabilities, and increased public and healthcare awareness about early intervention and long-term management

- North America dominated the Parkinson’s disorder drugs market with the largest revenue share of 38.9% in 2024, characterized by advanced healthcare infrastructure, high treatment accessibility, and strong presence of key pharmaceutical players. The U.S. continues to witness substantial growth in Parkinson’s treatments, driven by innovation in extended-release formulations and patient-friendly drug delivery systems

- Asia-Pacific is expected to be the fastest-growing region in the Parkinson’s disorder drugs market during the forecast period, projected to grow at a CAGR of 8.5% from 2025 to 2032, fueled by an aging population, increasing diagnosis rates, rising healthcare expenditure, and growing availability of neurologists in countries like China, India, and Japan

- The Oral segment dominated the Parkinson’s disorder drugs market with a market share of 63.4% in 2024, attributed to its ease of administration, wide availability, and patient preference for non-invasive treatment options. Oral therapies remain the cornerstone for initiating Parkinson’s treatment

Report Scope and Parkinson’s Disorder Drugs Market Segmentation

|

Attributes |

Parkinson’s Disorder Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Parkinson’s Disorder Drugs Market Trends

“Rising Prevalence of Parkinson’s Disease and Advancements in Drug Therapy”

- A key driving force in the global Parkinson’s disorder drugs market is the increasing prevalence of Parkinson’s disease, especially among the aging population. As the global population over 60 continues to rise, so does the demand for effective therapies to manage motor and non-motor symptoms associated with Parkinson’s

- Pharmaceutical companies are intensifying their R&D efforts to develop more effective and targeted treatment options. For instance, novel drug formulations that offer extended release, enhanced blood-brain barrier penetration, or dual mechanisms of action are being introduced to improve symptom control and patient compliance

- Breakthroughs in understanding the underlying pathology of Parkinson’s are also contributing to new treatment avenues, including drugs targeting alpha-synuclein aggregation and neuroinflammation—two major factors in disease progression

- Furthermore, combination therapies involving levodopa, dopamine agonists, and MAO-B inhibitors are gaining traction for their synergistic benefits in managing advanced Parkinson’s symptoms. These advancements are expanding the therapeutic landscape and improving the quality of life for patients

- Market players are also focusing on developing convenient routes of administration such as transdermal patches, inhalable formulations, and subcutaneous infusions to address the limitations of traditional oral medications, especially in patients with dysphagia or advanced disease stages

- The robust pipeline of Parkinson’s disorder drugs, increasing public awareness, and support from healthcare organizations are further catalyzing market growth across both developed and emerging regions

Parkinson’s Disorder Drugs Market Dynamics

Driver

“Growing Need Due to Rising Prevalence and Aging Population”

- The increasing prevalence of Parkinson’s disease (PD) worldwide, particularly among the elderly population, is a significant driver for the growing demand for Parkinson’s Disorder Drugs

- For instance, in April 2024, Neurocrine Biosciences announced advancements in clinical trials for its novel dopamine agonist targeting early-stage Parkinson’s symptoms. Such strategies by key companies are expected to drive the Parkinson’s Disorder Drugs industry growth during the forecast period

- As awareness about Parkinson’s disease symptoms and diagnosis improves, more patients are seeking pharmacological solutions to manage motor and non-motor symptoms such as tremors, rigidity, depression, and sleep disturbances

- Furthermore, the global increase in life expectancy is contributing to a growing elderly demographic—most affected by PD—thus expanding the target population for anti-parkinsonian medications

- The development and availability of newer formulations (e.g., extended-release, transdermal patches, and inhalable levodopa) offer enhanced symptom control and patient convenience, fueling market adoption

- Increasing efforts in early diagnosis and personalized medicine are also pushing forward the demand for Parkinson’s treatment options tailored to patient-specific disease progression

- The introduction of pipeline drugs with novel mechanisms of action, including glutamate antagonists, adenosine A2A receptor inhibitors, and gene therapy, is poised to redefine the treatment landscape

- Growing support from government healthcare programs and NGOs focused on neurological disorders further contributes to Parkinson’s disorder drug accessibility and awareness, thereby promoting long-term market growth

Restraint/Challenge

“High Treatment Costs and Limited Disease-Modifying Options “

- The high cost of advanced Parkinson’s disorder drugs and emerging therapies, such as levodopa-carbidopa intestinal gel or gene-based treatments, continues to be a significant barrier for patients—particularly in low- and middle-income countries

- For instance, while deep brain stimulation and continuous drug infusion therapies offer improved outcomes for late-stage patients, the associated costs often limit their adoption without sufficient insurance coverage

- Another key challenge is the lack of truly disease-modifying drugs; current therapies primarily aim at symptom management and do not slow disease progression, leaving a large unmet clinical need

- Drug efficacy often diminishes over time, and long-term use of traditional medications like levodopa can lead to complications such as dyskinesia, necessitating alternative treatment plans

- Strict regulatory requirements and lengthy approval timelines for new PD therapies can delay the introduction of novel solutions to the market, restraining innovation

- Patient non-compliance due to complex dosing regimens and adverse side effects (e.g., hallucinations, orthostatic hypotension) can negatively impact treatment outcomes and drug adherence

- Limited availability of specialist care in rural or underserved regions hampers timely diagnosis and access to appropriate drug therapy

- To overcome these challenges, the industry must focus on cost-effective innovation, improving patient-centric formulations, and strengthening healthcare infrastructure for wider drug distribution and awareness

Parkinson’s Disorder Drugs Market Scope

The market is segmented on the basis of drug class, route of administration, distribution channel, and others.

- By Drug Class

On the basis of drug class, the Parkinson’s disorder drugs market is segmented into decarboxylase inhibitors, dopamine agonists, monoamine oxidase type B (MAO-B) inhibitors, and others. The decarboxylase inhibitors segment dominated the market with the largest revenue share of 42.6% in 2024, driven by their critical role in enhancing levodopa efficacy and reducing peripheral side effects. Their proven clinical outcomes and widespread adoption in combination therapy contribute significantly to market dominance.

The dopamine agonists segment is anticipated to grow at the fastest CAGR of 7.9% from 2025 to 2032, owing to their effectiveness in early-stage Parkinson’s and reduced motor complications, making them a preferred option for long-term management.

- By Route of Administration

On the basis of route of administration, the Parkinson’s disorder drugs market is segmented into oral, injection, and transdermal. The oral segment held the largest market share of 63.4% in 2024, attributed to its ease of administration, wide availability, and patient preference for non-invasive treatment options. Oral therapies remain the cornerstone for initiating Parkinson’s treatment.

The transdermal segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, supported by advantages like steady drug delivery, reduced gastrointestinal complications, and enhanced patient compliance, especially in elderly patients.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospitals, online pharmacy, and others. The hospitals segment dominated with the largest revenue share of 49.1% in 2024, driven by expert clinical care, structured neurological diagnostics, and access to a wide range of prescription therapies. Hospitals are the primary point of care for both new and advanced Parkinson’s cases.

The online pharmacy segment is expected to witness the highest CAGR of 9.2% from 2025 to 2032, owing to the increasing adoption of telehealth, doorstep delivery services, and the convenience of online prescription renewals, especially among chronic illness patients and caregivers.

Parkinson’s Disorder Drugs Market Regional Analysis

- North America dominated the Parkinson’s disorder drugs market with the largest revenue share of 38.9% in 2024, driven by an aging population, advanced healthcare infrastructure, and increased awareness of neurological disorders

- The high prevalence of Parkinson’s disease (PD), robust investment in R&D, and widespread availability of FDA-approved drugs further fuel the regional market growth

- Supportive reimbursement policies and the presence of major pharmaceutical companies also contribute to the region’s dominance

U.S. Parkinson’s Disorder Drugs Market Insight

The U.S. Parkinson’s disorder drugs market captured the largest revenue share of 75% in 2024 within North America, supported by early diagnosis rates, large patient pools, and high healthcare spending. Continued innovation in drug formulations, such as extended-release and infusion therapies, combined with strong advocacy and awareness programs, drives market growth. Furthermore, significant support from organizations like the Parkinson’s Foundation and the Michael J. Fox Foundation enhances both treatment accessibility and research funding.

Europe Parkinson’s Disorder Drugs Market Insight

The Europe Parkinson’s disorder drugs market is projected to expand at a substantial CAGR during the forecast period, fueled by rising incidences of Parkinson’s, growing elderly demographics, and well-established public healthcare systems. Many European countries offer reimbursement for PD medications, improving treatment adherence. Advancements in neuroscience research and growing clinical collaboration across countries such as Germany, France, and the U.K. are also accelerating new drug approvals and adoption.

U.K. Parkinson’s Disorder Drugs Market Insight

The U.K. Parkinson’s disorder drugs market is anticipated to grow at a noteworthy CAGR during the forecast period due to increasing public and private investments in neurological care and ongoing clinical trials. Enhanced access to NHS-supported therapies and multidisciplinary care approaches for managing Parkinson’s symptoms are creating a favorable environment for market expansion. Increasing early diagnosis efforts and patient-centric treatment models are further supporting long-term growth.

Germany Parkinson’s Disorder Drugs Market Insight

The Germany Parkinson’s disorder drugs market is expected to expand steadily, underpinned by a strong pharmaceutical sector, government-funded research programs, and a well-developed network of neurology clinics. The adoption of combination therapies and newer dopamine agonists is increasing, and ongoing efforts in personalized medicine are expected to improve treatment outcomes. Public awareness campaigns and caregiver support systems are also driving early treatment uptake.

Asia-Pacific Parkinson’s Disorder Drugs Market Insight

The Asia-Pacific Parkinson’s disorder drugs market is poised to grow at the fastest CAGR of 8.5% from 2025 to 2032, driven by growing elderly populations, increasing healthcare expenditures, and rising disease awareness in countries like China, Japan, and India. Government initiatives to improve access to neurology care, coupled with the growing presence of global and regional pharmaceutical firms, are significantly contributing to market growth. Investment in medical infrastructure and expanded insurance coverage for chronic conditions like Parkinson’s are helping penetrate previously underserved areas.

Japan Parkinson’s Disorder Drugs Market Insight

The Japan Parkinson’s disorder drugs market is gaining momentum due to a high prevalence of Parkinson’s among the elderly and a technologically advanced healthcare system. Strong government support for neurological disorder research and availability of branded and generic medications are accelerating market penetration. Collaborations between Japanese pharma companies and global players are introducing innovative therapies for managing advanced stages of Parkinson’s.

China Parkinson’s Disorder Drugs Market Insight

The China Parkinson’s disorder drugs market accounted for the largest market share in the Asia-Pacific region in 2024, supported by rapid urbanization, improved healthcare access, and an expanding middle class. China's increased focus on chronic disease management and domestic drug manufacturing capabilities is creating a competitive and rapidly evolving market landscape. The launch of cost-effective generics and biosimilars, coupled with growing investments in neurology, is expected to further boost market size.

Parkinson’s Disorder Drugs Market Share

The Parkinson’s disorder drugs industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Newron Pharmaceuticals S.p.A. (Italy)

- F. Hoffmann-La Roche Ltd (Switzerland)

- AbbVie Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Amneal Pharmaceuticals Inc. (U.S.)

- UCB S.A. (Belgium)

- Sun Pharmaceutical Industries Ltd. (India)

- Lundbeck A/S (Denmark)

- Pfizer Inc. (U.S.)

- Ipsen Pharma (France)

- Takeda Pharmaceutical Company Limited (Japan)

- Kyowa Kirin Co., Ltd. (Japan)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- Denali Therapeutics (U.S.)

Latest Developments in Global Parkinson’s Disorder Drugs Market

- In June 2025, the Michael J. Fox Foundation announced that ND0612, a 24‑hour under‑the‑skin infusion of levodopa/carbidopa, was formally resubmitted to the FDA after addressing prior safety and manufacturing concerns. Approval could bring a third continuous infusion treatment to patients experiencing motor fluctuations

- In February 2025, the FDA approved Onapgo (apomorphine hydrochloride), the second under‑the‑skin infusion therapy for Parkinson’s disease in the U.S. It provides continuous symptom control and is the first apomorphine infusion approved

- In April 2025, tavapadon, a once-daily oral dopamine D₁/D₅ partial agonist developed by AbbVie, demonstrated rapid and sustained motor improvement in early-stage Parkinson’s during TEMPO trials. It is now being evaluated for FDA approval

- In April 2025, BlueRock Therapeutics published 18‑month Phase 1 data for its cell therapy bemdaneprocel in Nature. Safe and without serious adverse events, it is now poised to enter Phase 3 trials in

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.