Global Pass By Noise Testing Market

Market Size in USD Billion

CAGR :

%

USD

1.50 Billion

USD

2.80 Billion

2024

2032

USD

1.50 Billion

USD

2.80 Billion

2024

2032

| 2025 –2032 | |

| USD 1.50 Billion | |

| USD 2.80 Billion | |

|

|

|

|

Pass-By Noise Testing Market Size

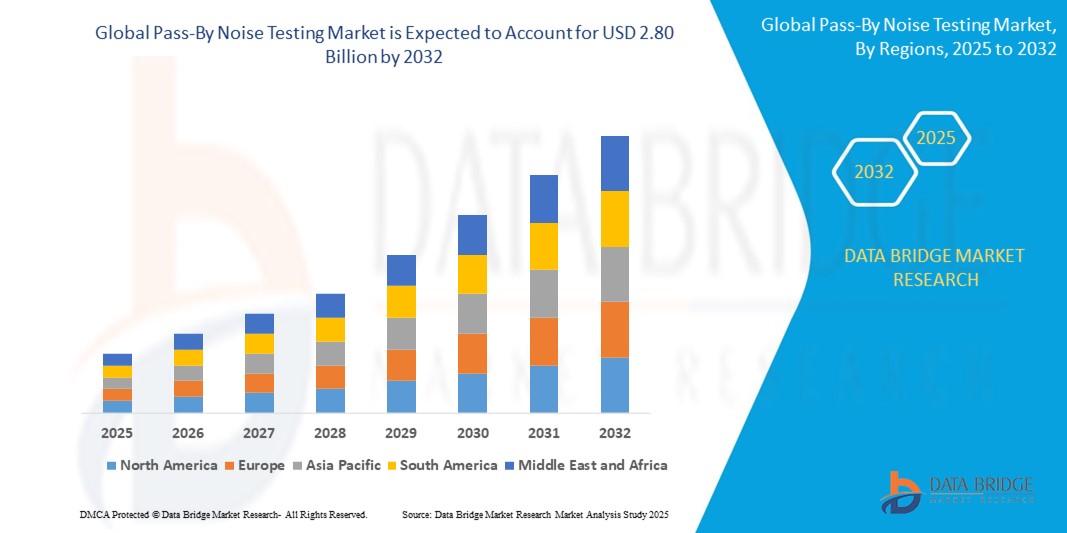

- The global pass-by noise testing market size was valued at USD 1.50 billion in 2024 and is expected to reach USD 2.80 billion by 2032, at a CAGR of 4.43% during the forecast period

- The market growth is largely fueled by stringent global vehicle noise regulations and the increasing emphasis on improving acoustic performance across automotive and industrial sectors, prompting manufacturers to adopt advanced noise testing systems

- Furthermore, the rising production of electric and hybrid vehicles, which require precise NVH (Noise, Vibration, and Harshness) analysis due to their quiet drivetrains, is accelerating the demand for pass-by noise testing solutions, thereby significantly boosting the industry's growth

Pass-By Noise Testing Market Analysis

- Pass-by noise testing is a standardized method used to measure the external noise levels emitted by vehicles under specific conditions, ensuring compliance with regulatory thresholds set by bodies such as the UNECE and ISO

- The market is witnessing strong momentum due to growing environmental concerns, expanding vehicle fleets, and technological advancements in sensor systems, data acquisition, and edge AI analytics, which enable more accurate, real-time acoustic assessments across diverse vehicle types

- North America dominated the pass-by noise testing market with a share of 40.5% in 2024, due to stringent vehicle noise regulations and high investment in automotive testing infrastructure

- Middle East and Africa is expected to be the fastest growing region in the pass-by noise testing market during the forecast period due to gradual enforcement of noise regulations and the modernization of transportation infrastructure in the Gulf Cooperation Council (GCC) region

- Hardware segment dominated the market with a market share of 58.8% in 2024, due to the high demand for precise sound measurement equipment such as microphones, sound level meters, accelerometers, and data acquisition systems. Automotive and aerospace manufacturers rely heavily on robust hardware setups for in-field and laboratory noise testing, ensuring compliance with regulatory noise emission standards. The rising stringency of pass-by noise regulations across various regions is further reinforcing the need for advanced hardware solutions that can deliver real-time, high-fidelity acoustic data during vehicle testing

Report Scope and Pass-By Noise Testing Market Segmentation

|

Attributes |

Pass-By Noise Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Pass-By Noise Testing Market Trends

“Rising Focus on Quality Seedbeds”

- The pass-by noise testing market is expanding rapidly due to heightened efforts to reduce vehicle noise pollution and comply with increasingly stringent government regulations on automotive noise emissions

- For instance, leading companies and automotive manufacturers are investing in advanced testing technologies such as AI-powered microphones, real-time data acquisition systems, and wireless sensors to improve testing precision, automate data analysis, and ensure compliance with ISO 362 and other international standards

- The adoption of electric vehicles (EVs) and hybrid vehicles is accelerating demand for pass-by noise testing, as these vehicles present new acoustic profiles and regulatory requirements for low-level noise measurement

- Technological advancements—including AI-driven automation, predictive analytics, and user-friendly data analysis software—are streamlining the testing process, reducing human error, and enabling more efficient compliance monitoring

- The growth of the global automotive sector, particularly in emerging markets, is driving higher production volumes and necessitating scalable, cost-effective noise testing solutions to maintain quality and regulatory standards

- In conclusion, the convergence of regulatory pressure, automotive innovation, and advanced testing technologies is positioning pass-by noise testing as an essential quality assurance and compliance tool for the future of vehicle manufacturing

Pass-By Noise Testing Market Dynamics

Driver

“Consumer Demand for Quieter Vehicles”

- Rising consumer expectations for quieter and more comfortable vehicles are prompting automakers to prioritize acoustic performance in both traditional and electric vehicle designs

- For instance, automotive manufacturers are increasingly integrating pass-by noise testing into their R&D and quality control processes to differentiate their products and meet customer demands for reduced cabin and environmental noise

- Stringent noise emission regulations in major automotive markets such as Europe, North America, and Asia Pacific are compelling companies to adopt advanced noise testing protocols to ensure compliance and avoid penalties

- The shift toward urbanization and increased vehicle density in cities is intensifying the focus on noise pollution control, further boosting demand for accurate and reliable pass-by noise testing systems

- Investments in electric and hybrid vehicle production are driving innovation in noise control and testing, as these vehicles require new approaches to measure and manage different acoustic characteristics

Restraint/Challenge

“High Costs of Testing Equipment”

- The significant upfront investment required for specialized pass-by noise testing equipment, test tracks, and advanced measurement tools can be a barrier for smaller manufacturers and testing facilities

- For instance, the need for precise, high-quality microphones, AI-driven sensors, and compliant test environments increases both capital and operational expenses, making it challenging for some companies to adopt or upgrade their testing infrastructure

- Regular calibration, maintenance, and software updates add to the total cost of ownership, impacting long-term budgeting and resource allocation

- The complexity of adhering to evolving international standards and regulatory requirements necessitates ongoing training and technical expertise, further raising operational costs

- Intense competition and the demand for scalable, cost-effective solutions put additional pressure on providers to innovate while keeping prices accessible for a broad range of automotive industry stakeholders

Pass-By Noise Testing Market Scope

The market is segmented on the basis of type, investigative technique, end-user industry, and solution type.

- By Type

On the basis of type, the pass-by noise testing market is segmented into hardware and software. The hardware segment dominated the largest market revenue share of 58.8% in 2024, primarily due to the high demand for precise sound measurement equipment such as microphones, sound level meters, accelerometers, and data acquisition systems. Automotive and aerospace manufacturers rely heavily on robust hardware setups for in-field and laboratory noise testing, ensuring compliance with regulatory noise emission standards. The rising stringency of pass-by noise regulations across various regions is further reinforcing the need for advanced hardware solutions that can deliver real-time, high-fidelity acoustic data during vehicle testing.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by advancements in analytical tools and simulation platforms that enhance the efficiency and accuracy of acoustic analysis. Software solutions enable comprehensive post-processing, visualization, and pattern recognition of noise sources, thereby reducing the need for repeated physical testing. As industries increasingly adopt digital twins and virtual prototyping, the role of noise testing software is expanding to include predictive modeling and integration with broader NVH (Noise, Vibration, and Harshness) platforms.

- By Investigative Technique

On the basis of investigative technique, the market is segmented into modal analysis and operating deflection shape (ODS) analysis. The modal analysis segment held the largest market revenue share in 2024, supported by its extensive application in structural noise diagnosis and vibration mode identification. Modal analysis is crucial for understanding how a structure behaves under dynamic loads, which in turn helps in mitigating resonance-related noise issues in automotive and industrial machinery. OEMs and component manufacturers utilize modal analysis to validate design assumptions and fine-tune structural properties, making it indispensable for pass-by noise reduction efforts.

The operating deflection shape (ODS) analysis segment is projected to register the fastest CAGR during the forecast period, owing to its growing use in real-time noise source localization without requiring a full modal model. ODS analysis enables engineers to visualize the actual operational vibration patterns of machines and structures under working conditions, facilitating immediate corrective action. The method’s simplicity, cost-effectiveness, and ability to be conducted with minimal preparation make it increasingly attractive across industries focused on operational diagnostics and compliance.

- By End User Industry

On the basis of end user industry, the market is segmented into automotive and transportation, aerospace and defence, power generation, consumer electronics, construction, industrial equipment, mining and metallurgy, and others. The automotive and transportation segment dominated the market in 2024, driven by stringent international noise emission regulations such as UN ECE R51, along with consumer demand for quieter and more refined vehicles. Automakers are extensively investing in pass-by noise testing to ensure legal compliance, protect brand reputation, and improve vehicle acoustic comfort. The segment also benefits from innovation in electric and hybrid vehicles, which pose new challenges for noise testing due to their reduced engine noise and increased prominence of auxiliary sounds.

The consumer electronics segment is expected to grow at the fastest pace through 2032, supported by increasing emphasis on sound quality and user experience in devices such as air purifiers, vacuum cleaners, laptops, and gaming consoles. Manufacturers are using pass-by and environmental noise testing to minimize operational sound emissions and meet regulatory standards while enhancing product appeal in noise-sensitive environments. The miniaturization of microphones and portable test equipment has further enabled widespread acoustic performance validation across the consumer electronics manufacturing lifecycle.

Pass-By Noise Testing Market Regional Analysis

- North America dominated the pass-by noise testing market with the largest revenue share of 40.5% in 2024, driven by stringent vehicle noise regulations and high investment in automotive testing infrastructure

- The region’s advanced automotive R&D ecosystem, particularly in the U.S. and Canada, supports widespread adoption of pass-by noise testing solutions for regulatory compliance and performance optimization

- Growth is further supported by the presence of major OEMs, strong focus on vehicle safety and environmental impact, and continued innovation in NVH (noise, vibration, and harshness) testing technologies

U.S. Pass-By Noise Testing Market Insight

The U.S. pass-by noise testing market captured the largest revenue share in 2024 within North America, fueled by the growing need to comply with federal and state-level vehicle noise emission standards. The presence of multiple vehicle testing facilities, rising production of electric and hybrid vehicles, and increasing public demand for quieter transportation solutions are driving market growth. Investments in modernizing testing equipment and integrating advanced software analytics are also enhancing the market outlook.

Europe Pass-By Noise Testing Market Insight

The Europe pass-by noise testing market is expected to grow at a significant CAGR during the forecast period, driven by the enforcement of EU Regulation No. 540/2014 and amendments such as WLTP (Worldwide Harmonized Light Vehicles Test Procedure). Major automotive manufacturing countries such as Germany, France, and Italy are actively investing in compliant testing infrastructure. Rising public sensitivity to environmental noise and the push for sustainable urban mobility are boosting demand for advanced noise testing solutions.

Germany Pass-By Noise Testing Market Insight

Germany held the largest share in the Europe pass-by noise testing market in 2024 due to its dominant automotive sector and strict adherence to EU noise regulations. German automakers are investing heavily in NVH optimization to meet both regulatory standards and consumer expectations for quieter vehicles. The presence of world-leading automotive OEMs and testing equipment manufacturers reinforces Germany’s leadership in this space.

U.K. Pass-By Noise Testing Market Insight

The U.K. pass-by noise testing market is projected to witness steady growth, supported by government efforts to reduce noise pollution in urban areas and initiatives promoting sustainable transportation. The transition to electric mobility and a strong emphasis on R&D within academic and private institutions are further propelling adoption of pass-by noise testing technologies across the automotive and industrial sectors.

Middle East and Africa Pass-By Noise Testing Market Insight

The Middle East and Africa pass-by noise testing market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by gradual enforcement of noise regulations and the modernization of transportation infrastructure in the Gulf Cooperation Council (GCC) region. Countries such as the UAE and Saudi Arabia are increasingly investing in vehicle testing technologies to align with global emission and noise standards.

U.A.E. Pass-By Noise Testing Market Insight

The U.A.E. market is witnessing growing demand for pass-by noise testing solutions due to a surge in automotive imports, infrastructure development, and government-led sustainability initiatives. The focus on smart cities and transport noise management, along with growing public awareness of environmental health impacts, is expected to support long-term market growth in the country.

Pass-By Noise Testing Market Share

The pass-by noise testing industry is primarily led by well-established companies, including:

- m+p international Mess- und Rechnertechnik GmbH (Germany)

- Anthony Best Dynamics Limited (UK)

- National Instruments Corp. (U.S.)

- Brüel & Kjær (Denmark)

- Siemens (Germany)

- HEAD Acoustics GmbH (Germany)

- imc Test & Measurement GmbH (Germany)

- Prosig Ltd. (UK)

- GRAS Sound & Vibration (Denmark)

- Dewesoft d.o.o. (Slovenia)

- Benstone Instruments USA (U.S.)

- ESI Group (France)

- Thermotron Industries (U.S.)

- Kistler Group (Switzerland)

- IMV Corporation (Japan)

- Econ Technologies, Inc. (U.S.)

- Polytec GmbH (Germany)

Latest Developments in Global Pass-By Noise Testing Market

- In December 2024, PIMIC introduced the Clarity NC100, a Deep Neural Network (DNN)-based Environmental Noise Cancellation (ENC) chip that redefines performance and edge AI computing efficiency. In collaboration with Taiwan-based MEMS microphone manufacturer ZillTek, the California-based company will showcase at CES 2025 an integrated edge AI chip and digital microphone solution designed to tackle noise cancellation challenges within a unified package

- In June 2023, Bertrandt inaugurated its first North African facility in Rabat, Morocco. This new site is focused on electrical and product development, electronic systems, and industrialization services tailored for the local market. It is expected to become a key part of Bertrandt's transnational development network

- In April 2022, Dewesoft d.o.o. and Hottinger Brüel & Kjær (Spectris) announced the creation of a joint venture named Blueberry (OpenDAQ). This collaboration combines their expertise to establish a new industry benchmark for data acquisition systems, featuring a unified Software Development Kit (SDK) and standardized interfaces

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pass By Noise Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pass By Noise Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pass By Noise Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.