Global Passenger Car Green Tire Market

Market Size in USD Billion

CAGR :

%

USD

12.24 Billion

USD

20.26 Billion

2024

2032

USD

12.24 Billion

USD

20.26 Billion

2024

2032

| 2025 –2032 | |

| USD 12.24 Billion | |

| USD 20.26 Billion | |

|

|

|

|

Passenger Car Green Tire Market Size

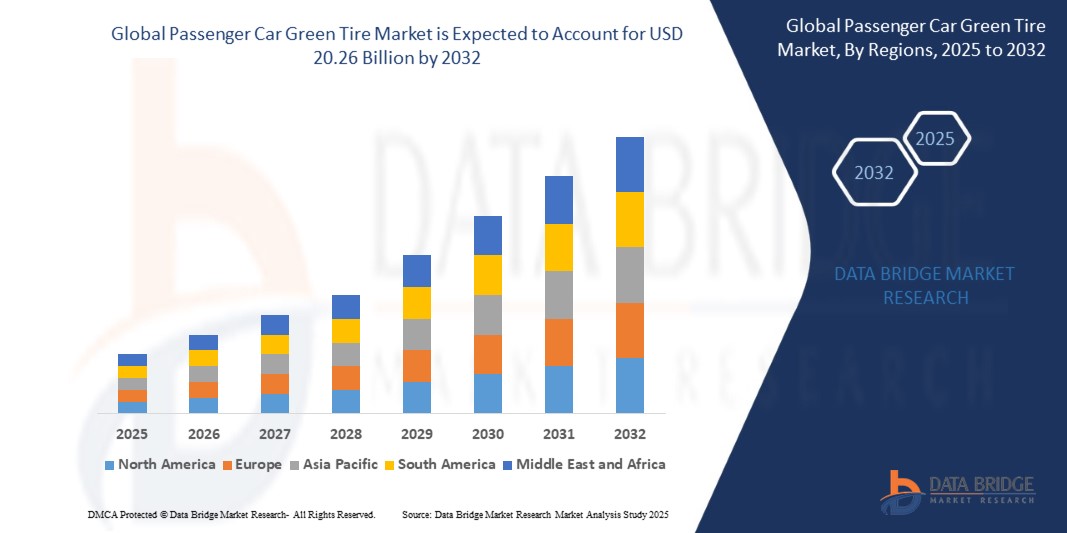

- The global passenger car green tire market size was valued at USD 12.24 billion in 2024 and is expected to reach USD 20.26 billion by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by increasing environmental awareness, stringent government regulations on vehicle emissions, and rising consumer demand for fuel-efficient and sustainable mobility solutions

- Furthermore, growing adoption of green tires by OEMs and in the aftermarket, coupled with advancements in eco-friendly materials and tread designs, is driving higher market penetration. These converging factors are accelerating the uptake of passenger car green tires, thereby significantly boosting the industry’s growth

Passenger Car Green Tire Market Analysis

- Passenger car green tires are designed to reduce rolling resistance, improve fuel efficiency, and minimize environmental impact without compromising safety or performance. They incorporate advanced tread designs and sustainable rubber compounds suitable for both conventional and electric vehicles

- The escalating demand for green tires is primarily fueled by rising fuel costs, increasing vehicle production, government incentives for eco-friendly transportation, and consumer preference for long-lasting, high-performance, and environmentally responsible tire solutions

- North America dominated the passenger car green tire market in 2024, due to stringent fuel efficiency regulations, rising environmental awareness, and growing adoption of eco-friendly mobility solutions

- Asia-Pacific is expected to be the fastest growing region in the passenger car green tire market during the forecast period due to increasing passenger car production, rapid urbanization, and rising environmental consciousness in countries such as China, Japan, and India

- On road tires segment dominated the market with a market share of 62.5% in 2024, due to the high demand for eco-friendly tires in urban and suburban passenger vehicles. On-road green tires are preferred for their fuel efficiency, reduced rolling resistance, and lower carbon footprint, which align with increasing regulatory standards and consumer environmental consciousness. Automotive manufacturers and fleet operators are increasingly adopting on-road green tires to meet sustainability targets while maintaining performance and safety standards

Report Scope and Passenger Car Green Tire Market Segmentation

|

Attributes |

Passenger Car Green Tire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Passenger Car Green Tire Market Trends

Rising Adoption of Green Tires in Electric Vehicles

- The growing penetration of electric vehicles is strongly supporting the adoption of green tires, as EVs require optimized tire technology to balance efficiency, safety, and sustainability. Green tires are designed with low rolling resistance and eco-friendly materials, making them a natural fit for electric vehicle platforms that emphasize energy efficiency

- For instance, Michelin has partnered with several EV manufacturers, supplying green tires customized for electric cars such as reduced rolling resistance tires for Tesla vehicles. These collaborations are intended to improve range and reduce emissions while meeting the performance requirements of rapidly expanding EV fleets

- The emphasis on significantly lowering carbon footprints across mobility ecosystems is driving automakers to prefer suppliers offering sustainable tire solutions. Tire manufacturers are responding with products that use renewable raw materials, recycled rubber, and bio-based polymers to meet emission reduction goals

- The increasing consumer demand for premium EVs is influencing the adoption of specialized tire technology. Green tires ensure energy efficiency and also improve ride comfort, noise reduction, and durability, making them well-suited for high-end electric passenger cars

- Innovations in nanomaterials and silica-based tread compounds are further refining tire performance. Advanced formulations are enhancing grip, fuel efficiency, and wear resistance, enabling green tires to meet the dual demand of sustainability and high performance in electric and hybrid passenger cars

- In addition, government programs incentivizing eco-friendly tire solutions for electric and hybrid fleets are boosting adoption. Policies encouraging CO2 emission reduction through vehicle components are creating favorable momentum for green tire innovations in passenger cars globally

Passenger Car Green Tire Market Dynamics

Driver

Environmental Awareness and Regulations

- The growing global emphasis on reducing greenhouse gas emissions and minimizing dependence on fossil fuels is a key driver of green tire adoption in passenger cars. Consumers and governments alike are supporting sustainable alternatives in the automotive ecosystem, with green tires offering measurable environmental benefits

- For instance, Bridgestone has expanded its green tire line under the Ecopia series, designed to meet strict Japanese and European regulations on rolling resistance and emissions. Partnerships with automakers for supply confirm how regulations and environmental awareness are accelerating green tire uptake

- Stricter regulatory frameworks in Europe, North America, and Asia are placing fuel efficiency and vehicle emission performance as top priorities. Green tires, with their ability to cut CO2 emissions and improve energy efficiency, are emerging as compliant solutions that allow automakers to meet these mandatory requirements

- In addition, heightened consumer awareness around sustainability and environmental preservation is influencing purchasing decisions. Green tires marketed as environmentally responsible products are becoming increasingly attractive to eco-conscious urban consumers

- The growth of sustainability certifications and eco-labels on tire products is further supporting adoption. Standardized labeling that highlights eco-performance makes it easier for consumers to select green tire options, ensuring stronger demand from regulatory and consumer-driven pressures

Restraint/Challenge

Initial Cost and Perception

- One of the major challenges slowing down the widespread adoption of passenger car green tires is their higher initial cost compared to conventional tires. Despite long-term benefits in efficiency and reduced fuel consumption, the upfront pricing deters cost-sensitive consumers, especially in developing countries

- For instance, Continental’s green tire lines with advanced silica compounds are priced higher than traditional alternatives, which has limited faster replacement demand in regions where consumers are focused more on affordability than sustainability. This highlights the impact of price sensitivity and perception on adoption trends

- Consumer perception that green tires compromise on performance, especially in terms of grip and durability, further restricts uptake. Many buyers remain skeptical about whether eco-friendly tires can achieve the same longevity and driving performance as conventional options

- In addition, awareness remains limited in several markets about the long-term cost savings obtained through lower fuel consumption and reduced wear. The lack of consumer education initiatives is restricting adoption

- Competitive pressures from low-cost tire manufacturers also present challenges. Cheaper alternatives dominate significant portions of Asia-Pacific and developing economies, where consumers prioritize price over environmental features, slowing penetration of premium green tire solutions

Passenger Car Green Tire Market Scope

The market is segmented on the basis of type, product type, and application.

• By Type

On the basis of type, the passenger car green tire market is segmented into on-road tires and off-road tires. The on-road tires segment dominated the largest market revenue share of 62.5% in 2024, driven by the high demand for eco-friendly tires in urban and suburban passenger vehicles. On-road green tires are preferred for their fuel efficiency, reduced rolling resistance, and lower carbon footprint, which align with increasing regulatory standards and consumer environmental consciousness. Automotive manufacturers and fleet operators are increasingly adopting on-road green tires to meet sustainability targets while maintaining performance and safety standards. Furthermore, advancements in tread design and material composition enhance grip, wear resistance, and overall driving comfort, further boosting market preference for on-road types.

The off-road tires segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising adoption of SUVs and crossover vehicles in emerging markets. Off-road green tires provide durability and performance in diverse terrains while reducing environmental impact through sustainable rubber compounds. Increasing consumer awareness of eco-friendly mobility options and government incentives promoting green tire adoption in off-road applications are also driving market expansion. The segment benefits from innovations in reinforced sidewall technology and tread patterns that optimize traction and energy efficiency for rugged driving conditions.

• By Product Type

On the basis of product type, the market is segmented into radial green tires and bias green tires. The radial green tires segment held the largest market revenue share in 2024, owing to their superior fuel efficiency, longer tread life, and better performance at higher speeds. Radial green tires are widely preferred by OEMs and aftermarket customers due to their enhanced handling, comfort, and reduced rolling resistance, which contributes to lower carbon emissions and operational costs. Advanced material formulations and eco-friendly compounds further strengthen the segment’s appeal, supporting environmental sustainability goals without compromising vehicle performance.

The bias green tires segment is projected to register the fastest growth from 2025 to 2032, driven by growing demand in commercial vehicles, utility vehicles, and budget passenger cars in developing regions. Bias green tires offer cost-effective solutions for moderate-speed applications while incorporating eco-friendly materials to reduce environmental impact. Technological improvements in rubber composition and tread design have enhanced durability and traction, making bias green tires increasingly competitive. Rising awareness among small fleet operators and rural vehicle owners regarding the benefits of green tires is also fueling adoption in this segment.

• By Application

On the basis of application, the market is segmented into OEMs and aftermarket. The OEM segment dominated the largest market revenue share in 2024, driven by growing collaborations between tire manufacturers and vehicle makers to integrate green tires into new passenger car models. OEM adoption is fueled by regulatory pressure for sustainable transportation and consumer preference for eco-conscious vehicle options. Green tires supplied through OEM channels often benefit from optimized design compatibility, performance guarantees, and marketing support, which enhance consumer trust and long-term adoption. Increasing production of electric and hybrid passenger vehicles also boosts OEM demand for energy-efficient green tires.

The aftermarket segment is expected to witness the fastest growth from 2025 to 2032, supported by rising retrofitting trends and replacement demand in existing vehicles. Consumers are increasingly opting for green tires to reduce fuel consumption, carbon footprint, and road wear, while maintaining vehicle safety and performance. The aftermarket growth is further accelerated by easy availability, cost competitiveness, and increasing awareness programs highlighting environmental and economic benefits. Innovative tire recycling programs and incentives from governments in various regions are also encouraging aftermarket adoption.

Passenger Car Green Tire Market Regional Analysis

- North America dominated the passenger car green tire market with the largest revenue share in 2024, driven by stringent fuel efficiency regulations, rising environmental awareness, and growing adoption of eco-friendly mobility solutions

- Consumers in the region highly prioritize reduced rolling resistance, fuel savings, and sustainable materials offered by green tires for both personal and fleet vehicles

- This widespread adoption is further supported by high vehicle ownership, advanced automotive manufacturing infrastructure, and government incentives promoting eco-friendly tires, establishing green tires as a preferred choice across passenger car segments

U.S. Passenger Car Green Tire Market Insight

The U.S. green tire market captured the largest revenue share in North America in 2024, fueled by growing demand for low-emission and fuel-efficient tires. Consumers are increasingly seeking tires that combine safety, durability, and environmental sustainability. The market is further driven by OEM partnerships promoting green tire integration in new vehicles and aftermarket demand for replacement tires with better fuel economy. Technological advancements in tread design and eco-friendly rubber compounds are accelerating adoption, while government regulations and incentives supporting low-carbon mobility reinforce market growth.

Europe Passenger Car Green Tire Market Insight

The Europe green tire market is projected to expand at a significant CAGR during the forecast period, driven by stringent EU regulations on vehicle emissions and environmental sustainability. Urbanization, increasing passenger car production, and consumer preference for fuel-efficient vehicles are fostering green tire adoption. European consumers are attracted to the combination of safety, comfort, and lower carbon footprint offered by these tires. The market is witnessing growth across OEM and aftermarket channels, with green tires being incorporated into new vehicles as well as replacement programs.

U.K. Passenger Car Green Tire Market Insight

The U.K. green tire market is expected to grow at a notable CAGR over the forecast period, driven by increasing awareness of environmental impact and rising fuel costs. OEM adoption in new vehicles, along with a growing aftermarket for retrofitting eco-friendly tires, is contributing to market expansion. The country’s strong automotive industry, coupled with increasing urban mobility and government incentives for sustainable transportation, is supporting the uptake of green tires.

Germany Passenger Car Green Tire Market Insight

The Germany green tire market is anticipated to expand at a considerable CAGR during the forecast period, supported by high consumer awareness regarding fuel efficiency and sustainability. Germany’s automotive leadership, emphasis on innovation, and stringent environmental standards are driving OEM and aftermarket adoption of green tires. Advanced tread technology and eco-friendly rubber formulations are enabling vehicles to achieve better mileage and reduced carbon emissions, further enhancing market preference.

Asia-Pacific Passenger Car Green Tire Market Insight

The Asia-Pacific green tire market is poised to grow at the fastest CAGR during 2025–2032, fueled by increasing passenger car production, rapid urbanization, and rising environmental consciousness in countries such as China, Japan, and India. The region’s growing middle class and government initiatives promoting fuel efficiency are accelerating green tire adoption. In addition, APAC is emerging as a key manufacturing hub for green tires, improving affordability and availability for both OEM and aftermarket segments.

Japan Passenger Car Green Tire Market Insight

The Japan green tire market is witnessing steady growth due to technological advancement, a strong focus on vehicle efficiency, and the country’s eco-conscious consumer base. Adoption is driven by integration with OEM vehicles and rising demand in the aftermarket for energy-saving tires. Japan’s aging population also favors low-effort, safe, and fuel-efficient tire options for passenger cars.

China Passenger Car Green Tire Market Insight

The China green tire market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, expanding middle-class vehicle ownership, and government policies promoting sustainable transportation. OEM adoption in new cars and increasing aftermarket replacement demand are key drivers. The development of domestic green tire manufacturers and affordable product offerings further accelerate market growth across passenger car segments.

Passenger Car Green Tire Market Share

The passenger car green tire industry is primarily led by well-established companies, including:

- Michelin (France)

- Bridgestone Corporation (Japan)

- Goodyear Tire & Rubber Company (U.S.)

- Continental AG (Germany)

- Pirelli & C. S.p.A (Italy)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Hankook Tire & Technology Co., Ltd. (South Korea)

- Yokohama Rubber Co., Ltd. (Japan)

- Cheng Shin Rubber Industry Co., Ltd. (Taiwan)

- Kumho Tire Co., Inc. (South Korea)

- Nokian Tyres plc (Finland)

- Toyo Tire Corporation (Japan)

- Apollo Tyres Ltd. (India)

- Giti Tire Pte. Ltd. (Singapore)

- Cooper Tire & Rubber Company (U.S.).

Latest Developments in Global Passenger Car Green Tire Market

- In May 2025, JK Tyre & Industries Ltd. launched India’s first sustainable car tire made from 80% sustainable materials, all certified under ISCC Plus standards. This innovation positions JK Tyre as a pioneer in eco-friendly mobility in India, strengthening its competitive edge in the rapidly growing green tire segment while meeting rising consumer demand for environmentally responsible vehicle solutions. The launch is expected to accelerate the adoption of sustainable tires in both OEM and aftermarket segments across the country

- In October 2023, Michelin introduced a new range of radial green tires with enhanced fuel efficiency and durability, designed to meet stringent environmental standards. This launch reinforces Michelin’s leadership in the eco-friendly tire segment, addressing growing consumer and regulatory demand for sustainable mobility solutions. The enhanced performance and durability of these tires are expected to drive wider adoption in both passenger vehicles and fleet operations globally

- In September 2023, Bridgestone Corporation unveiled a series of bias green tires optimized for electric vehicles, offering improved driving range and performance while minimizing environmental impact. This development highlights Bridgestone’s strategic focus on supporting the electric vehicle revolution and sustainable transportation, potentially boosting market penetration in EV-specific tire applications

- In May 2023, Kumho Petrochemical and Hankook Tire partnered to develop green tires using eco-solution-polymerized styrene-butadiene rubber, which incorporates recycled styrene monomer to enhance fuel efficiency and tire wear resistance. Hankook is evaluating these tires to assess their performance and physical properties. This collaboration represents a significant step toward material innovation in the green tire market, reinforcing the trend of sustainable and high-performance tire solutions

- In March 2023, Nokian Tyres announced an expansion initiative in Tennessee with the establishment of a 600,000-square-foot tire warehouse, expanding its U.S. and Canada distribution network. This strategic move is aimed at supporting a production capacity of up to four million tires annually by 2024. The expansion strengthens Nokian Tyres’ market presence in North America, enabling faster delivery of green tire products and improving accessibility for both OEM and aftermarket customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.