Global Passive Electronic Components Market

Market Size in USD Billion

CAGR :

%

USD

39.28 Billion

USD

59.23 Billion

2024

2032

USD

39.28 Billion

USD

59.23 Billion

2024

2032

| 2025 –2032 | |

| USD 39.28 Billion | |

| USD 59.23 Billion | |

|

|

|

|

What is the Global Passive Electronic Components Market Size and Growth Rate?

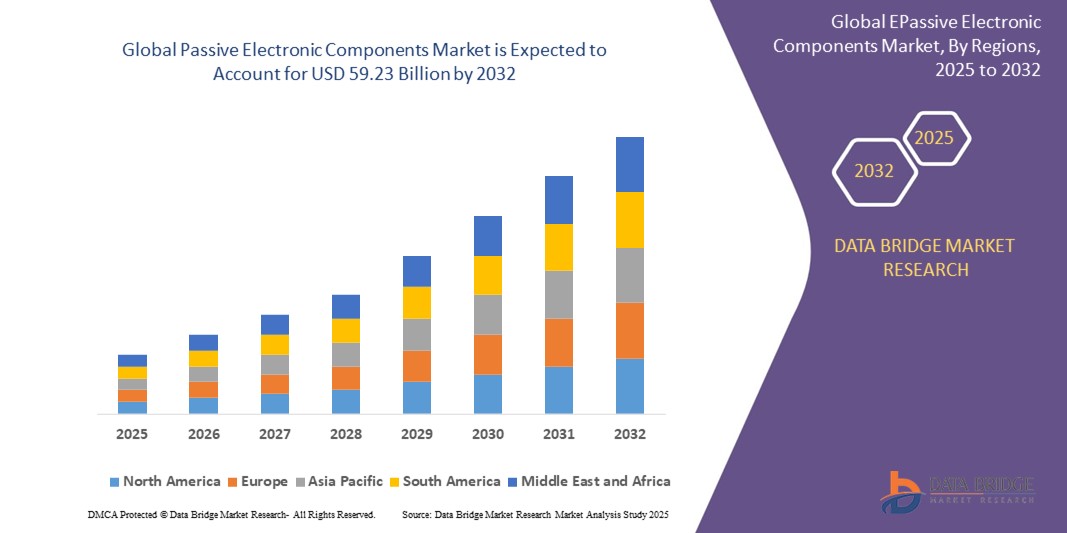

- The global passive electronic components market size was valued at USD 39.28 billion in 2024 and is expected to reach USD 59.23 billion by 2032, at a CAGR of 5.27% during the forecast period

- Market growth is driven by the increasing integration of electronics in automotive, industrial, and consumer devices, along with the growing need for compact and energy-efficient solutions.

- The rising demand for 5G infrastructure, electric vehicles, and advanced consumer electronics continues to propel the use of capacitors, resistors, and inductors, forming the core of passive electronic component applications across industries

What are the Major Takeaways of Passive Electronic Components Market?

- Passive electronic components, including resistors, capacitors, and inductors, are indispensable in modern electronics for signal filtering, voltage regulation, and energy storage critical to the performance and reliability of connected devices

- Increased automobile electrification, expanding IoT ecosystems, and greater demand for smart devices are driving the widespread usage of these components in high-volume and high-performance applications

- As manufacturers focus on miniaturization and thermal stability, passive components are evolving to meet the high-frequency and durability requirements of next-generation technologies

- Asia-Pacific dominated the passive electronic components market with the largest revenue share of 42.36% in 2024, attributed to the rapid expansion of consumer electronics manufacturing, increasing digitization, and strong government support for semiconductor and electronics sectors

- North America is projected to grow at the fastest CAGR of 13.1% from 2025 to 2032, driven by increasing demand from the automotive, aerospace & defense, and telecommunications sectors

- The Ceramic Capacitors segment dominated the market with the largest revenue share of 38.5% in 2024, owing to their compact size, high reliability, and wide usage across consumer electronics, automotive applications, and telecommunications

Report Scope and Passive Electronic Components Market Segmentation

|

Attributes |

Passive Electronic Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Passive Electronic Components Market?

“Miniaturization and Advanced Materials Integration”

- A key and evolving trend in the global passive electronic components market is the shift toward miniaturized components with higher performance and reliability, driven by growing demand in compact electronics, 5G infrastructure, and electric vehicles

- For instance, Murata Manufacturing has introduced ultra-miniature multilayer ceramic capacitors (MLCCs) with advanced dielectric materials for space-constrained applications such as smartphones and wearable devices

- Miniaturization enables manufacturers to integrate more components into smaller circuit boards without compromising performance. Advanced ceramics, polymer films, and hybrid composites are being adopted for improved thermal stability, capacitance retention, and frequency performance

- Moreover, automotive electronics and medical devices require ultra-reliable passive components that can withstand extreme conditions. Companies are responding by enhancing voltage endurance, EMI filtering, and temperature tolerance through innovative material science

- Companies such as TDK Corporation are investing in nano-material research to reduce size and weight while improving energy density and functionality. This supports compact design trends across consumer electronics and industrial automation

- This trend toward miniaturized, high-performance passive components is reshaping the industry by enabling smarter, lighter, and more efficient electronics across sectors such as automotive, telecom, defense, and healthcare

What are the Key Drivers of Passive Electronic Components Market?

- The rising adoption of consumer electronics, electric vehicles, and 5G networks is a primary growth driver for the passive electronic components market. These applications require a wide range of capacitors, inductors, and resistors that can operate reliably at high frequencies and in harsh environments

- For instance, in October 2023, Yageo Corporation announced the expansion of its high-capacitance MLCC production for use in EV inverters and ADAS modules, highlighting the growing demand in the automotive sector

- In addition, the proliferation of IoT devices and wearable technologies is creating a surge in demand for compact passive components that deliver high stability and performance over time

- Governments and enterprises are investing in renewable energy systems and smart grids, which require reliable passive components for power management, surge protection, and signal filtering

- The increasing shift toward automation and industrial IoT further supports market growth, with manufacturers focusing on precision and longevity in harsh operating environments

Which Factor is challenging the Growth of the Passive Electronic Components Market?

- One of the major challenges for the market is the volatile pricing and supply chain disruptions of raw materials, such as rare earth metals and ceramics, which are essential for passive component manufacturing

- For instance, global MLCC shortages in 2021 and ongoing geopolitical tensions have significantly impacted production timelines and cost structures across the electronics industry

- The capital-intensive nature of setting up production lines and the need for advanced fabrication facilities limit market entry for smaller players, concentrating the market among a few large suppliers

- Moreover, the lack of standardization across regions and applications can lead to compatibility issues, especially in fast-developing markets such as electric vehicles and 5G infrastructure

- To address these challenges, companies such as Panasonic and TDK are investing in vertical integration, automation, and regional manufacturing diversification to reduce reliance on single-source supply chains

- Overcoming these hurdles through strategic sourcing, material innovation, and supply chain agility will be critical to ensuring sustainable growth in the passive electronic components market

How is the Passive Electronic Components Market Segmented?

The market is segmented on the basis of capacitor type, inductors, resistors, and end-user industry.

- By Capacitor Type

On the basis of capacitor type, the passive electronic components market is segmented into Ceramic Capacitors, Tantalum Capacitors, Aluminum Electrolytic Capacitors, Paper and Plastic Film Capacitors, and Supercapacitors. The Ceramic Capacitors segment dominated the market with the largest revenue share of 38.5% in 2024, owing to their compact size, high reliability, and wide usage across consumer electronics, automotive applications, and telecommunications. Their ability to support high-frequency circuits and withstand temperature variations makes them a preferred choice for miniaturized devices.

The Supercapacitors segment is projected to witness the fastest growth rate of 20.4% from 2025 to 2032, driven by rising demand in energy storage, electric vehicles (EVs), and backup power applications. Their rapid charging capabilities and longer cycle life compared to traditional batteries are making them increasingly popular in green energy systems.

- By Inductors

On the basis of inductors, the market is segmented into Power Inductors and Frequency Inductors. The Power Inductors segment held the dominant market share of 61.3% in 2024, driven by growing applications in voltage regulation, DC-DC converters, and power supplies across consumer electronics and automotive sectors. Their role in managing energy flow and improving power efficiency in compact devices supports their strong demand.

The Frequency Inductors segment is expected to witness the fastest CAGR during the forecast period, fueled by the increasing demand for signal processing, RF circuits, and telecommunications applications. Their precision in filtering high-frequency noise is crucial for high-speed communication systems.

- By Resistors

On the basis of resistors, the passive electronic components market is segmented into Surface-mounted Chips, Network, Wirewound, Film/Oxide/Foil, and Carbon Resistors. The Surface-mounted Chip Resistors segment dominated the market with the highest revenue share of 44.7% in 2024, due to their extensive use in compact circuit designs for smartphones, tablets, and wearables. Their compatibility with automated PCB assembly and miniaturization trends makes them ideal for high-volume production.

The Film/Oxide/Foil Resistors segment is expected to witness the fastest growth rate from 2025 to 2032, owing to their superior temperature stability, low noise characteristics, and precision tolerance. They are widely used in medical devices, instrumentation, and automotive control systems requiring high accuracy.

- By End-User Industry

On the basis of end-user industry, the market is segmented into Automotive, Consumer Electronics and Computing, Aerospace and Defense, Communications, and Other End-user Industries. The Consumer Electronics and Computing segment held the largest market share of 36.2% in 2024, driven by the surge in global smartphone shipments, wearable devices, smart home appliances, and laptops. The demand for miniaturized and high-performance components is driving rapid innovation and large-scale production in this segment.

The Automotive segment is anticipated to grow at the fastest CAGR during the forecast period, supported by the rising adoption of EVs, advanced driver-assistance systems (ADAS), and infotainment systems. The increasing electronic content in vehicles for safety, powertrain, and communication is significantly expanding the use of capacitors, resistors, and inductors.

Which Region Holds the Largest Share of the Passive Electronic Components Market?

- Asia-Pacific dominated the passive electronic components market with the largest revenue share of 42.36% in 2024, attributed to the rapid expansion of consumer electronics manufacturing, increasing digitization, and strong government support for semiconductor and electronics sectors

- Countries such as China, Japan, South Korea, and India are significantly investing in infrastructure, automotive electronics, and communication technologies, which fuel demand for capacitors, resistors, and inductors

- The region’s cost-effective production capabilities, growing middle-class population, and rising smartphone and automotive sales have solidified Asia-Pacific’s leadership in the market for passive electronic components

China Passive Electronic Components Market Insight

The China passive electronic components market captured the largest revenue share in 2024 within Asia-Pacific, fueled by its position as a global manufacturing powerhouse. The growth is driven by robust demand from the consumer electronics, automotive, and 5G infrastructure sectors. China’s initiatives such as “Made in China 2025” and continued investment in EVs, industrial automation, and smart city projects are expected to further propel the market. The strong presence of local component manufacturers adds competitive advantage in pricing and innovation.

Japan Passive Electronic Components Market Insight

The Japan passive electronic components market is projected to grow at a steady CAGR during the forecast period, supported by its well-established electronics industry, particularly in automotive electronics and medical devices. Japan’s focus on miniaturization and energy efficiency in components, combined with increasing deployment of IoT and robotics, is accelerating market growth. Moreover, Japan’s advanced R&D capabilities and adherence to international quality standards make it a key player in high-reliability applications.

India Passive Electronic Components Market Insight

The India passive electronic components market is expected to grow at a noteworthy CAGR through 2032, driven by the rise of domestic electronics manufacturing, boosted by government schemes such as PLI (Production Linked Incentive) and Digital India. Increasing smartphone penetration, rapid urbanization, and growing automotive and industrial automation sectors are creating strong demand. The influx of foreign direct investment and the shift in global supply chains are positioning India as a growing hub for component manufacturing.

Which Region is the Fastest Growing in the Passive Electronic Components Market?

North America is projected to grow at the fastest CAGR of 13.1% from 2025 to 2032, driven by increasing demand from the automotive, aerospace & defense, and telecommunications sectors. Rising adoption of electric vehicles, 5G technology, and renewable energy systems are creating strong growth opportunities for passive electronic components such as high-voltage capacitors and robust resistors. The region benefits from a strong focus on R&D investments, high consumer demand for smart devices, and supportive government initiatives toward digital infrastructure.

U.S. Passive Electronic Components Market Insight

The U.S. passive electronic components market held the largest revenue share of 83% in 2024 within North America, driven by high consumption of consumer electronics, medical devices, and military-grade electronics. Ongoing advancements in autonomous vehicles, smart manufacturing, and aerospace innovations are creating robust demand. The presence of leading OEMs and technology companies enhances domestic demand and encourages localized component sourcing. Sustainability and energy efficiency are also guiding purchasing decisions, pushing innovation in eco-friendly passive components.

Canada Passive Electronic Components Market Insight

The Canada passive electronic components market is expected to expand at a solid CAGR during the forecast period, supported by a growing focus on clean energy, smart grids, and EV infrastructure. Government-backed technology modernization projects and incentives for domestic electronics manufacturing are expected to drive demand. In addition, the rise in IoT and smart home adoption, coupled with the country’s strong education and R&D base, makes Canada an emerging market for innovative component applications.

Europe Passive Electronic Components Market Insight

The Europe passive electronic components market is projected to witness steady growth throughout the forecast period, led by countries such as Germany, France, and the U.K.. The region's strong automotive sector, emphasis on energy efficiency, and leadership in industrial automation and aerospace technology are key drivers. European regulations supporting sustainability and RoHS compliance also favor the use of high-quality passive components in consumer and industrial electronics.

Germany Passive Electronic Components Market Insight

The Germany passive electronic components market is set to grow at a significant CAGR, underpinned by its dominant automotive industry and increasing investment in smart manufacturing and renewable energy technologies. The country’s engineering excellence and innovation in e-mobility and industrial IoT make it a vital market for capacitors, inductors, and resistors. In addition, Germany’s role as a key exporter of advanced machinery and electronic systems sustains long-term demand.

Which are the Top Companies in Passive Electronic Components Market?

The passive electronic components industry is primarily led by well-established companies, including:

- Panasonic Corporation (Japan)

- TDK Corporation (Japan)

- Vishay Intertechnology Inc. (U.S.)

- Murata Manufacturing Co. Ltd (Japan)

- AVX Corporation (U.S.)

- Taiyo Yuden Co. Ltd (Japan)

- Sagami Elec Co. Ltd (Japan)

- WIMA GmbH & Co KG (Germany)

- Cornell Dubilier Electronics Inc. (U.S.)

- Yageo Corporation (Taiwan)

- Lelon Electronics Corp. (Taiwan)

- United Chemi-Con (U.S.)

- Bourns Inc. (U.S.)

- Wurth Elektronik Group (Germany)

What are the Recent Developments in Global Passive Electronic Components Market?

- In March 2024, KEMET, a division of the YAGEO Group, introduced the T581 series of capacitors, meeting the Military Performance Specification Sheets MIL-PRF-32700/2. Rated at 35V, these capacitors are specifically designed to address the stringent demands of military systems by combining MIL-PRF certification with polymer tantalum technology for superior volumetric efficiency in high-efficiency, fast-switching DC/DC converters. This launch reinforces KEMET’s role in the military-grade capacitor segment with technologically advanced, compact solutions

- In February 2024, Samtec expanded its Edge Rate® connector portfolio by introducing the ERM6 & ERF6 Series, featuring a narrower width, low 5 mm profile, and dense mated configuration. These connectors support 56 Gbps PAM4 high-speed applications, catering to industries such as embedded vision, robotics, instrumentation, and industrial automation. This advancement strengthens Samtec’s presence in high-speed, space-constrained connectivity applications

- In February 2024, TDK Corporation launched the MHQ1005075HA series of inductors, specially engineered for automotive high-frequency circuits. These inductors are designed to meet the rigorous performance requirements of next-generation vehicles, offering compact size and excellent electrical characteristics. This introduction supports TDK’s continued innovation in the evolving automotive electronics landscape

- In January 2024, Murata Manufacturing Co., Ltd. announced the DFE2MCPH_JL series, a new line of automotive-grade power inductors available in 0.33µH and 0.47µH configurations. Tailored for automotive powertrain and safety applications, these inductors leverage Murata’s material and production expertise to deliver reliable performance in systems such as ADAS and In-Vehicle Infotainment (IVI). This release highlights Murata’s leadership in providing high-quality components for critical automotive systems

- In October 2023, Murata Manufacturing Co., Ltd. commenced operations of a new silicone capacitor production line, aimed at enhancing production capacity and addressing the growing demand for advanced passive electronic components across industrial and automotive markets. This expansion marks a strategic move to support global supply and innovation capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.