Global Passive Temperature Controlled Packaging Market

Market Size in USD Billion

CAGR :

%

USD

8.41 Billion

USD

18.29 Billion

2024

2032

USD

8.41 Billion

USD

18.29 Billion

2024

2032

| 2025 –2032 | |

| USD 8.41 Billion | |

| USD 18.29 Billion | |

|

|

|

|

Passive Temperature Controlled Packaging Market Size

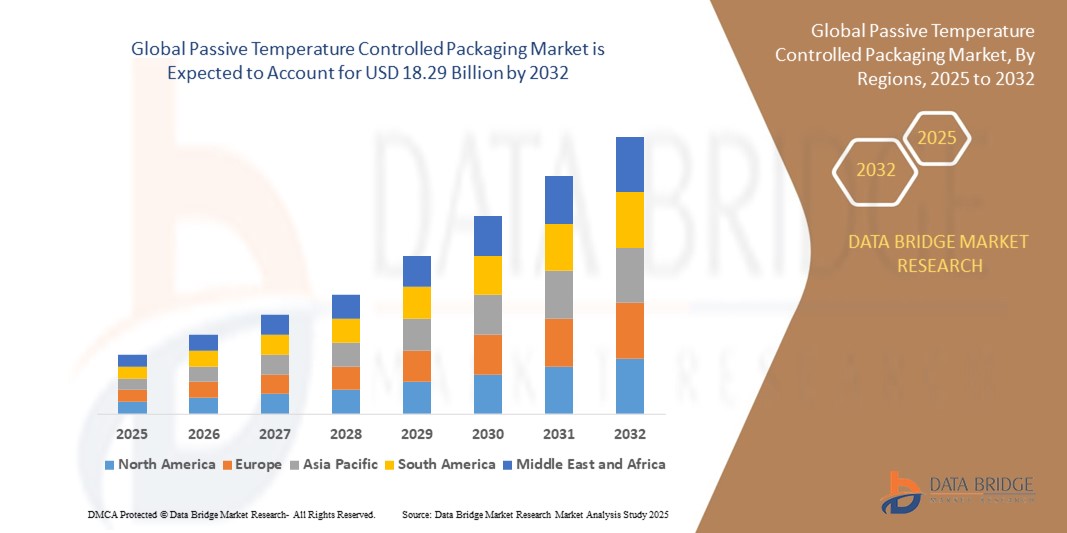

- The global passive temperature controlled packaging market size was valued at USD 8.41 billion in 2024 and is expected to reach USD 18.29 billion by 2032, at a CAGR of 10.20% during the forecast period

- The market growth is primarily driven by the increasing demand for temperature-sensitive products in the food and beverage and healthcare sectors, coupled with advancements in sustainable packaging solutions and cold chain logistics

- Rising consumer awareness of product safety, stringent regulations for pharmaceutical and perishable goods transportation, and the growing e-commerce sector are key factors accelerating the adoption of passive temperature controlled packaging solutions

Passive Temperature Controlled Packaging Market Analysis

- Passive temperature controlled packaging, designed to maintain specific temperature ranges for sensitive products during storage and transportation, is a critical component of modern cold chain logistics, particularly in the food and beverage and healthcare industries

- The surge in demand is fueled by the growing need for reliable cold chain solutions, increased global trade of perishable goods, and the expansion of pharmaceutical supply chains requiring temperature stability

- North America dominated the passive temperature controlled packaging market with the largest revenue share of 42.5% in 2024, driven by advanced cold chain infrastructure, high adoption of innovative packaging solutions, and a strong presence of key players in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing healthcare expenditure, and the booming e-commerce sector in countries such as China, India, and Japan

- The plastic segment dominated the largest market revenue share of 62.5% in 2024, driven by its durability, lightweight properties, and cost-effectiveness, making it ideal for temperature-sensitive shipments. Plastics such as expanded polystyrene (EPS) and polyurethane offer superior insulation for maintaining temperature stability

Report Scope and Passive Temperature Controlled Packaging Market Segmentation

|

Attributes |

Passive Temperature Controlled Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Passive Temperature Controlled Packaging Market Trends

Increasing Adoption of Sustainable Materials and Smart Technologies

- The global passive temperature-controlled packaging market is experiencing a significant trend toward the use of sustainable and eco-friendly materials, such as biodegradable paper and paperboard, to align with global sustainability goals

- Advanced technologies, including IoT sensors and real-time temperature monitoring systems, are being integrated into packaging solutions to enhance transparency and ensure precise temperature control during transit

- Phase Change Materials (PCMs) are gaining popularity for their ability to maintain stable temperatures by absorbing and releasing thermal energy, improving efficiency and reducing environmental impact

- Companies are developing innovative solutions, such as recyclable insulated shippers and reusable containers, to cater to the rising demand for environmentally conscious packaging

- For instance, solutions such as Softbox’s Tempcell ECO, a fully recyclable parcel shipper, are designed to meet stringent temperature requirements while minimizing waste

- These advancements are enhancing the appeal of passive temperature-controlled packaging for industries such as pharmaceuticals and food and beverages, driving market growth

Passive Temperature Controlled Packaging Market Dynamics

Driver

Rising Demand for Temperature-Sensitive Products in Pharmaceuticals and Food Industries

- The increasing global demand for temperature-sensitive products, such as vaccines, biologics, and perishable foods, is a major driver for the passive temperature-controlled packaging market

- These packaging solutions ensure product integrity and safety during transportation and storage, meeting strict regulatory requirements for pharmaceuticals and food safety

- The growth of e-commerce, particularly in food delivery and online grocery services, is fueling demand for reliable packaging to maintain product quality during last-mile delivery

- Government regulations, such as those enforced by the FDA and WHO, mandate precise temperature control for pharmaceuticals, further boosting the adoption of passive packaging solutions

- The expansion of cold chain logistics, supported by advancements in insulation and refrigerant technologies, is enabling the safe transport of sensitive goods across longer distances

- This demand is particularly strong in North America, which dominates the market due to its robust pharmaceutical and healthcare sectors

Restraint/Challenge

High Initial Costs and Regulatory Complexities

- The high upfront costs associated with developing and implementing passive temperature-controlled packaging solutions, including advanced materials such as PCMs and vacuum insulated panels (VIPs), can be a barrier, particularly for small and medium-sized enterprises (SMEs) in emerging markets

- The integration of smart technologies, such as IoT sensors, adds to the cost, making adoption challenging in cost-sensitive regions

- Data security and compliance with varying global regulations on temperature-sensitive product transportation pose significant challenges. The collection and transmission of temperature data raise concerns about breaches and compliance with data protection laws

- The fragmented regulatory landscape across countries complicates operations for manufacturers and service providers, requiring tailored solutions to meet diverse standards

- These factors can limit market expansion, especially in regions with lower awareness of advanced packaging solutions or heightened cost sensitivity

Passive Temperature Controlled Packaging market Scope

The market is segmented on the basis of material, product type, application, business, and end-use.

- By Material

On the basis of material, the global passive temperature controlled packaging market is segmented into plastic, paper and paperboard, and others. The plastic segment dominated the largest market revenue share of 62.5% in 2024, driven by its durability, lightweight properties, and cost-effectiveness, making it ideal for temperature-sensitive shipments. Plastics such as expanded polystyrene (EPS) and polyurethane offer superior insulation for maintaining temperature stability.

The paper and paperboard segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for sustainable and eco-friendly packaging solutions. Biodegradable and recyclable materials are gaining traction due to environmental regulations and consumer preference for green packaging.

- By Product Type

On the basis of product type, the global passive temperature controlled packaging market is segmented into insulated shippers, insulated containers, refrigerants, and others. Insulated shippers dominated with a market revenue share of 48.0% in 2024, attributed to their widespread use in transporting temperature-sensitive goods such as pharmaceuticals and perishable foods. Their ability to maintain consistent temperatures during transit makes them a preferred choice.

The refrigerants segment is anticipated to experience the fastest growth rate of 18.2% from 2025 to 2032, driven by advancements in phase-change materials (PCMs) and gel packs, which enhance cooling efficiency and support longer transit times for temperature-sensitive products.

- By Application

On the basis of application, the global passive temperature controlled packaging market is segmented into frozen, chilled, and ambient applications. The chilled application segment held the largest market revenue share of 55.0% in 2024, driven by the high demand for temperature-controlled packaging in the pharmaceutical and food industries, particularly for vaccines, biologics, and dairy products.

The frozen application segment is expected to grow rapidly from 2025 to 2032, fueled by the rising global demand for frozen foods and the expansion of cold chain logistics, especially in emerging markets.

- By Business

On the basis of business, the global passive temperature controlled packaging market is segmented into warehousing and transportation. The transportation segment accounted for the largest market revenue share of 60.5% in 2024, driven by the critical need for reliable temperature-controlled logistics to ensure product integrity during transit, particularly for pharmaceuticals and perishable goods.

The warehousing segment is projected to witness significant growth from 2025 to 2032, supported by the increasing adoption of cold storage facilities and the expansion of e-commerce, particularly for food and beverage products requiring temperature-controlled storage.

- By End-Use

On the basis of end-use, the global passive temperature controlled packaging market is segmented into food and beverages, healthcare, and others. The healthcare segment dominated with a market revenue share of 52.5% in 2024, driven by the growing need for temperature-sensitive packaging for pharmaceuticals, vaccines, and biologics, coupled with stringent regulatory requirements for product safety.

The food and beverages segment is expected to grow at the fastest rate of 19.0% from 2025 to 2032, propelled by the rising demand for perishable goods, ready-to-eat meals, and frozen products, supported by the growth of online grocery delivery services.

Passive Temperature Controlled Packaging Market Regional Analysis

- North America dominated the passive temperature controlled packaging market with the largest revenue share of 42.5% in 2024, driven by advanced cold chain infrastructure, high adoption of innovative packaging solutions, and a strong presence of key players in the U.S. and Canada

- Consumers and industries prioritize passive temperature-controlled packaging for maintaining product integrity, ensuring safe transportation of perishable goods, and complying with stringent regulatory standards, particularly in regions with varied climatic conditions

- Growth is supported by advancements in packaging materials, such as high-performance insulators and eco-friendly refrigerants, alongside rising adoption in both food and beverage and healthcare sectors

U.S. Passive Temperature Controlled Packaging Market Insight

The U.S. smart lock market captured the largest revenue share of 87.6% in 2024 within North America, fueled by strong strong demand in the healthcare and food and beverage industries. Growing awareness of the need for reliable cold chain logistics and stringent regulations for temperature-sensitive products drive market expansion. The trend toward sustainable packaging solutions and increasing e-commerce activities further boost the adoption of insulated shippers and containers.

Europe Passive Temperature Controlled Packaging Market Insight

The European market for passive temperature-controlled packaging is expected to witness significant growth, supported by regulatory focus on product safety and sustainability. Industries prioritize packaging solutions that maintain temperature stability while reducing environmental impact. Growth is prominent in both warehousing and transportation applications, with countries such as Germany and France showing notable adoption due to rising demand in healthcare and food logistics.

U.K. Passive Temperature Controlled Packaging Market Insight

The U.K. market is expected to experience rapid growth, driven by demand for efficient temperature-controlled solutions in urban logistics and healthcare. Increased focus on sustainable packaging materials, such as paper and paperboard, and growing awareness of product safety standards encourage adoption. Evolving regulations for food and pharmaceutical transportation further influence market trends, balancing performance with compliance.

Germany Passive Temperature Controlled Packaging Market Insight

Germany is expected to witness the fastest growth rate in the European passive temperature-controlled packaging market, attributed to its advanced logistics infrastructure and strong focus on healthcare and food safety. German industries prefer high-performance insulated containers and refrigerants that ensure product integrity and contribute to energy efficiency. The integration of these solutions in both warehousing and transportation supports sustained market growth.

Asia-Pacific Passive Temperature Controlled Packaging Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding food and beverage production, rising healthcare demands, and increasing disposable incomes in countries such as China, India, and Japan. Growing awareness of cold chain logistics, product safety, and sustainability is boosting demand. Government initiatives promoting energy-efficient and eco-friendly packaging solutions further encourage the use of advanced passive temperature-controlled packaging.

Japan Passive Temperature Controlled Packaging Market Insight

Japan’s passive temperature-controlled packaging market is expected to witness rapid growth due to strong consumer and industry preference for high-quality, reliable packaging solutions that ensure product safety and compliance. The presence of major food and healthcare manufacturers and the integration of advanced packaging in warehousing and transportation accelerate market penetration. Rising interest in sustainable and recyclable materials also contributes to growth.

China Passive Temperature Controlled Packaging Market Insight

China holds the largest share of the Asia-Pacific passive temperature-controlled packaging market, propelled by rapid urbanization, increasing e-commerce, and growing demand for temperature-sensitive logistics solutions. The country’s expanding healthcare sector and focus on food safety support the adoption of advanced insulated shippers and containers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Passive Temperature Controlled Packaging Market Share

The passive temperature controlled packaging industry is primarily led by well-established companies, including:

- Avery Dennison Corporation (U.S.)

- 3M (U.S.)

- BASF SE (Germany)

- Amcor plc (Australia)

- Honeywell International Inc (U.S.)

- Chevron Phillips Chemical Company LLC. (U.S.)

- Sonoco Products Company (U.S.)

- Peli BioThermal Limited (U.S.)

- Sofrigam (France)

- Deutsche Post AG (Germany)

- United Parcel Service of America, Inc. (U.S.)

- FedEx (U.S.)

- DPD (France)

- AmerisourceBergen Corporation (U.S.)

- DS Smith (U.K.)

- Biotempak (Turkey)

- IGH Holdings, Inc. (U.S.)

- APEX Packaging Corporation (U.S.)

- Cold Chain Technologies, Inc. (U.S.)

What are the Recent Developments in Global Passive Temperature Controlled Packaging Market?

- In April 2025, Cold Chain Technologies (CCT) introduced the CCT Tower Elite, a reusable, universal temperature-controlled pallet shipper tailored for the life sciences industry. With a 1,600-liter capacity and compatibility with both Euro and US pallets, it offers a global solution for transporting sensitive pharmaceuticals. Noted as the lightest in its class, the unit ensures cost-effective and ergonomic handling while maintaining temperature stability across four ranges for over 120 hours without external power. Integrated IoT data loggers enable real-time tracking and temperature monitoring, enhancing visibility and compliance throughout the supply chain

- In January 2025, DS Smith introduced TailorTemp, a fiber-based, fully recyclable cold-chain packaging solution at Pharmapack Europe 2025. Designed specifically for the pharmaceutical and biotech industries, TailorTemp features corrugated cardboard insulating inserts and an outer casing that maintain critical temperature conditions for up to 36 hours. Developed using a parametric algorithm in collaboration with a thermal transfer lab, the packaging is customizable, plastic-free, and supports sustainability goals by replacing expanded polystyrene (EPS). DS Smith also plans to extend its cooling capability to 96 hours, reinforcing its commitment to eco-conscious innovation in cold-chain logistics

- In October 2024, Peli BioThermal introduced the Crēdo Vault™, a reusable bulk shipper engineered for temperature-sensitive pharmaceutical and life sciences cargo. Designed to meet ISTA 7D standards, it delivers exceptional thermal reliability across three ranges: below −20°C (120 hours), +2°C to +8°C (144 hours), and +15°C to +25°C (168 hours). Its lightweight, durable design supports temperature interchangeability, accommodates four units per PMC pallet, and is compatible with EU and ISO formats. Integrated IoT monitoring enables real-time tracking and data visibility, ensuring product integrity and optimizing cold-chain logistics

- In October 2023, BioLife Solutions expanded its product portfolio to strengthen its offerings in temperature-controlled transport, addressing the rising demand from the biopharmaceutical and cell therapy sectors. The company introduced advanced solutions designed to ensure the safe and compliant movement of temperature-sensitive biologics, including live cells and gene therapies. This expansion builds on BioLife’s existing cold-chain technologies—such as evo Smart Shippers, Stirling Ultracold freezers, and SciSafe biostorage services—to deliver integrated, secure, and intelligent logistics support for critical therapies

- In September 2023, Pluss Advanced Technologies (PLUSS) launched two innovative temperature-controlled packaging solutions for the pharmaceutical sector: the Celsure XL Pallet Shipper for bulk shipments and the Celsure VIP Multi-Use Parcel Shipper for smaller deliveries. Both leverage phase change material (PCM) technology to ensure precise thermal protection across geographies and seasons. Celsure XL offers extended temperature stability and cost-efficiency for long-haul logistics, while Celsure VIP combines vacuum insulation with reusability to reduce freight costs and environmental impact. These India-manufactured solutions provide a sustainable, high-performance alternative to conventional gel pack systems and leased containers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Passive Temperature Controlled Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Passive Temperature Controlled Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Passive Temperature Controlled Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.