Global Pastry Fillings Market

Market Size in USD Billion

CAGR :

%

USD

1.59 Billion

USD

2.43 Billion

2024

2032

USD

1.59 Billion

USD

2.43 Billion

2024

2032

| 2025 –2032 | |

| USD 1.59 Billion | |

| USD 2.43 Billion | |

|

|

|

|

What is the Global Pastry Fillings Market Size and Growth Rate?

- The global pastry fillings market size was valued at USD 1.59 billion in 2024 and is expected to reach USD 2.43 billion by 2032, at a CAGR of 5.41% during the forecast period

- Increasing demand of the product in bakery and confectionery, rising consumption of product due to their versatility and high flavour attributes, increasing popularity of the choux pastries, puff pastries and filo pastries among the consumers, increasing growth of the bakery industry across the globe, rising levels of disposable income along with increasing consumer spending on baked food are some of the major as well as important factors which will such asly to augment the growth of the pastry fillings market

What are the Major Takeaways of Pastry Fillings Market?

- Rapid urbanization, increasing number of innovations in various flavours along with change in consumer habits have led to increased demand for several categories of food and beverages which will further contribute by generating massive opportunities that will lead to the growth of the pastry fillings market in the above mentioned projected timeframe

- Increasing number of supply chain disruptions due to pandemic along with volatility in the prices of raw material which will likely to act as market restraints factor for the growth of the pastry fillings

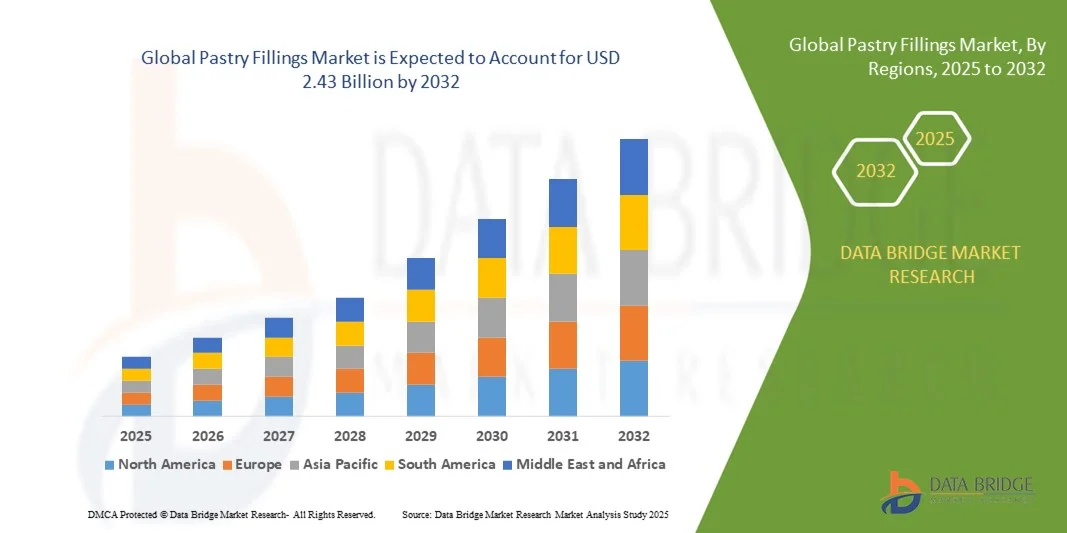

- North America dominated the Pastry Fillings market with the largest revenue share of 38.7% in 2025, driven by strong demand for premium bakery products, widespread consumption of convenience foods, and continuous innovation in dessert formulations

- The Asia-Pacific region is projected to witness the fastest growth of 10.34% in the global pastry fillings market from 2026 to 2033, driven by rising disposable incomes, changing dietary habits, and rapid urbanization

- The creams segment dominated the market with the largest revenue share of 46.2% in 2025, attributed to its versatile use in pastries, donuts, and layered desserts. Its rich texture and wide flavor availability, such as chocolate, vanilla, and custard

Report Scope and Pastry Fillings Market Segmentation

|

Attributes |

Pastry Fillings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pastry Fillings Market?

Rising Demand for Clean-Label and Natural Ingredient-Based Pastry Fillings

- The pastry fillings market is witnessing a major shift toward clean-label, natural, and organic ingredients, driven by increasing consumer awareness of health, transparency, and product authenticity. Bakers and food manufacturers are prioritizing fillings free from artificial preservatives, synthetic colors, and high-fructose syrups, aligning with the broader clean-label movement in the global food industry

- For instance, Puratos Group and Dawn Food Products, Inc. have introduced natural fruit-based fillings made with reduced sugar and clean-label formulations, catering to rising consumer preferences for wholesome and minimally processed bakery ingredients. These innovations highlight the growing alignment between indulgence and wellness in the pastry fillings segment

- The trend is further supported by the expansion of vegan, allergen-free, and plant-based bakery options, encouraging producers to develop fillings using natural stabilizers, fruit purées, and vegetable extracts. This aligns with the shift toward sustainable sourcing and ethical production practices

- Manufacturers are investing in advanced processing technologies to retain fruit flavor, color, and texture while maintaining shelf stability without synthetic additives. This ensures consistent quality, reduced waste, and compliance with clean-label standards

- Rising demand from premium bakery chains, cafés, and patisseries for healthier yet indulgent fillings is propelling innovation in reduced-sugar, fiber-enriched, and nutrient-fortified variants. For instance, AGRANA Beteiligungs-AG has expanded its range of fruit fillings with clean-label credentials to serve both industrial and artisanal markets

- Overall, the growing preference for clean-label and natural pastry fillings is transforming the bakery industry landscape. As health-conscious consumption continues to rise globally, this trend will remain a defining factor driving innovation, product reformulation, and long-term growth in the pastry fillings market

What are the Key Drivers of Pastry Fillings Market?

- The growing global demand for convenience foods and ready-to-eat bakery products is a primary driver boosting the pastry fillings market. Consumers increasingly prefer time-saving bakery items such as croissants, doughnuts, and pastries that incorporate ready-made fillings for flavor enhancement and extended shelf life

- For instance, in 2025, Rich Products Corporation reported a surge in demand for ready-to-use bakery fillings and toppings in North America, supported by rising café culture, quick-service restaurants (QSRs), and the popularity of frozen desserts. This underscores the growing link between lifestyle changes and demand for bakery convenience

- Increasing adoption of automation and advanced food processing technologies in bakery production is enabling consistent product quality, large-scale output, and customized flavor development. This technological integration ensures efficient handling of pastry fillings while reducing production waste

- The rising popularity of premium and artisanal bakery products across global markets is fueling the use of high-quality fillings made from natural fruits, nuts, and dairy-based ingredients. These fillings enhance both the flavor profile and visual appeal of baked goods, appealing to evolving consumer preferences

- Growing urbanization, westernization of diets in developing regions, and rising disposable incomes are further propelling bakery industry expansion, directly influencing the consumption of pastry fillings. The combination of innovation, flavor diversity, and convenience continues to accelerate market growth worldwide

- As global bakery demand continues to rise, the integration of natural ingredients, innovative flavor combinations, and automated production lines will remain central to the expansion of the Pastry Fillings market

Which Factor is Challenging the Growth of the Pastry Fillings Market?

- Volatility in raw material prices, particularly those of fruits, dairy, and sugar, poses a significant challenge to the Pastry Fillings market. These key ingredients are subject to seasonal fluctuations, agricultural yield variations, and global trade dynamics, impacting overall production costs

- For instance, in 2023–2025, global fruit processors such as ANDROS and ZENTIS GmbH & Co. KG reported cost escalations due to rising energy expenses, logistics disruptions, and lower fruit harvests in Europe and Asia. Such volatility has constrained profit margins for filling manufacturers

- The dependency on natural raw materials increases exposure to climate change and supply chain risks, leading to inconsistent availability and variable quality of inputs such as berries, cocoa, and dairy. These uncertainties can disrupt production schedules and affect delivery timelines

- Moreover, compliance with food safety regulations and labeling standards across multiple regions adds to operational complexity and costs, especially for exporters dealing with differing international norms for additives and shelf-life enhancers

- Smaller and regional players face heightened challenges in managing fluctuating input costs and ensuring consistent product quality. As a result, larger corporations are focusing on vertical integration and sustainable sourcing strategies to secure long-term supply stability

- To mitigate these risks, the industry is emphasizing supply chain diversification, ingredient standardization, and the development of plant-based and synthetic alternatives. These approaches are essential for maintaining cost control, production reliability, and resilience in the global Pastry Fillings market

How is the Pastry Fillings Market Segmented?

The market is segmented on the basis of type, source, application, flavour, and sales channel.

- By Type

On the basis of type, the pastry fillings market is segmented into jelly, creams, and crushes. The creams segment dominated the market with the largest revenue share of 46.2% in 2025, attributed to its versatile use in pastries, donuts, and layered desserts. Its rich texture and wide flavor availability, such as chocolate, vanilla, and custard, have made it the most preferred filling for both artisanal and industrial bakers. The segment also benefits from innovations in shelf-stable and freeze-thaw-stable formulations, which enhance product longevity.

The crushes segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising consumer interest in fruit-based and natural ingredients. The demand for clean-label products and healthier dessert options is encouraging manufacturers to launch real fruit crush fillings with no artificial preservatives, expanding their use in bakery and confectionery applications.

- By Source

On the basis of source, the pastry fillings market is categorized into dairy and non-dairy. The dairy segment dominated the market with the largest revenue share of 55.4% in 2025, owing to its traditional usage and superior flavor profile in cream-based fillings. Dairy-based creams and custards provide the desired texture, richness, and mouthfeel preferred in premium bakery products. In addition, advancements in cold chain logistics and extended shelf-life dairy ingredients are supporting their widespread adoption in the bakery and HoReCa sectors.

However, the non-dairy segment is projected to register the fastest CAGR during 2026–2033, primarily due to the growing vegan population and increasing lactose intolerance awareness. The segment’s expansion is supported by the use of plant-based fats, coconut milk, and almond-based alternatives, offering comparable taste and functionality. Major players are investing in R&D to enhance the texture stability and nutritional value of non-dairy pastry fillings.

- By Application

On the basis of application, the pastry fillings market is segmented into HoReCa, bakery and confectionery, and residential. The bakery and confectionery segment dominated the market with the largest revenue share of 49.7% in 2025, driven by the growing consumption of ready-to-eat and premium baked products. The segment benefits from expanding bakery chains, consumer preference for indulgent desserts, and continuous product innovation such as filled croissants and pastries. Manufacturers are increasingly introducing fillings that offer improved bake stability, freeze-thaw resilience, and flavor retention.

The HoReCa segment is expected to exhibit the fastest growth rate during 2026–2033, owing to the rising number of cafes, patisseries, and quick-service restaurants worldwide. The increasing demand for customized desserts and gourmet fillings among chefs and professional bakers is fueling this segment’s growth. In addition, the integration of pre-filled pouches and easy-dispense systems enhances convenience and operational efficiency in commercial kitchens.

- By Flavour

On the basis of flavour, the pastry fillings market is divided into unflavoured and flavoured. The flavoured segment dominated the market with a significant revenue share of 67.3% in 2025, supported by strong consumer preference for diverse and exotic tastes such as chocolate, strawberry, vanilla, and mango. Manufacturers are launching seasonal and regionally inspired flavors to cater to evolving consumer palates and drive product differentiation. In addition, innovations in natural flavor extracts and colorants are propelling the demand for clean-label flavoured fillings in both industrial and artisanal bakery production.

The unflavoured segment is expected to record the fastest CAGR between 2026 and 2033, as it allows greater customization for bakeries and food service operators. Its adaptability to various recipes and ability to be combined with local ingredients make it a preferred choice for specialty bakeries focusing on signature creations and minimalist flavor bases.

- By Sales Channel

On the basis of sales channel, the pastry fillings market is segmented into direct sales and retail. The direct sales segment dominated the market with the largest revenue share of 58.8% in 2025, driven by bulk purchases from bakeries, confectionery manufacturers, and HoReCa clients. This channel ensures consistent supply, cost advantages, and customization opportunities for professional buyers. Direct sales are further strengthened by the presence of established distribution networks and partnerships with bakery ingredient suppliers.

Meanwhile, the retail segment is projected to witness the fastest growth rate during 2026–2033, fueled by the increasing popularity of home baking and the availability of pastry fillings through supermarkets, specialty stores, and e-commerce platforms. The rise in consumer interest in DIY desserts and the convenience of ready-to-use fillings in small packaging formats are boosting sales in the retail category.

Which Region Holds the Largest Share of the Pastry Fillings Market?

- North America dominated the Pastry Fillings market with the largest revenue share of 38.7% in 2025, driven by strong demand for premium bakery products, widespread consumption of convenience foods, and continuous innovation in dessert formulations

- The region’s robust bakery industry, combined with a growing preference for ready-to-use fillings among commercial and home bakers, supports market growth

- High consumer spending on indulgent and artisanal baked goods, coupled with a strong network of established bakery chains and confectionery brands, reinforces North America’s leadership in the global pastry fillings market

U.S. Pastry Fillings Market Insight

The U.S. held the largest share in the North America Pastry Fillings market in 2025, supported by the country’s thriving bakery and confectionery sector, innovative flavor developments, and advanced food processing infrastructure. Demand for clean-label and non-GMO fillings is rising as consumers prioritize transparency and natural ingredients. Leading companies are introducing low-sugar and high-fruit-content pastry fillings to cater to health-conscious consumers. Moreover, the rapid expansion of café chains and frozen bakery segments continues to boost domestic production and consumption, ensuring sustained market dominance.

Canada Pastry Fillings Market Insight

The Canada Pastry Fillings market is experiencing steady growth due to the increasing popularity of gourmet and premium bakery offerings. The country’s multicultural food culture encourages flavor experimentation and fusion-inspired fillings such as maple, berry, and caramel blends. Growth in local patisseries, alongside the expansion of quick-service restaurants, has accelerated the adoption of ready-to-use fillings. In addition, supportive trade policies and the availability of high-quality dairy and fruit ingredients enhance Canada’s production capabilities, strengthening its position within the regional market.

Asia-Pacific Pastry Fillings Market Insight

The Asia-Pacific region is projected to witness the fastest growth of 10.34% in the global pastry fillings market from 2026 to 2033, driven by rising disposable incomes, changing dietary habits, and rapid urbanization. The increasing influence of Western-style bakery culture in countries such as China, India, and Japan is fueling demand for diverse pastry fillings. Expanding food service sectors, coupled with the growing number of bakeries and dessert cafés, further supports regional growth. Local manufacturers are increasingly investing in fruit-based, non-dairy, and tropical-flavored fillings to cater to regional taste preferences and health-conscious consumers.

China Pastry Fillings Market Insight

China accounted for the largest share in the Asia-Pacific Pastry Fillings market in 2025, driven by a booming bakery industry and expanding urban food culture. The rising demand for packaged desserts and sweet bakery snacks is propelling large-scale production of fillings made from local fruits such as mango, lychee, and red bean. Domestic players are strengthening export capabilities while incorporating advanced filling technologies to improve consistency and shelf life. The increasing popularity of bakery chains and online food delivery services is further supporting market expansion across urban centers.

India Pastry Fillings Market Insight

India is experiencing the fastest growth within the Asia-Pacific region, driven by increasing urbanization, a rising middle-class population, and the booming café and bakery culture. Consumers are increasingly embracing fusion desserts and locally flavored pastries that blend traditional sweets with Western-style fillings. Initiatives such as “Make in India” are boosting domestic bakery ingredient manufacturing, while the rising popularity of online bakeries and cloud kitchens is creating new opportunities for pastry filling suppliers. The country’s growing demand for cost-effective, high-quality fillings positions it as a key future market in the region.

Europe Pastry Fillings Market Insight

The Europe Pastry Fillings market continues to expand steadily, supported by strong consumer demand for artisanal, clean-label, and reduced-sugar bakery products. The region’s well-established bakery heritage in countries such as France, Germany, and Italy drives innovation in both traditional and contemporary fillings. Manufacturers are increasingly focusing on natural fruit content and organic ingredients to align with regional food safety and sustainability regulations. Growth in the frozen bakery segment and private-label product development further enhances market opportunities across Europe.

Germany Pastry Fillings Market Insight

Germany remains one of Europe’s largest markets for Pastry Fillings, characterized by a strong preference for high-quality and premium bakery ingredients. The country’s focus on technical innovation and quality assurance has led to the development of high-stability, bake-proof fillings. Demand for fruit-based, clean-label, and allergen-free options continues to rise, driven by the country’s health-conscious population. In addition, the increasing export of German bakery products across the European Union and global markets sustains steady production growth in the filling segment.

U.K. Pastry Fillings Market Insight

The U.K. market is expanding due to growing consumer interest in luxury desserts, indulgent bakery items, and plant-based alternatives. The rise of premium patisseries, coupled with an active home-baking community, fuels consistent demand for high-quality pastry fillings. Post-Brexit localization of ingredient sourcing and the rapid expansion of online retail and specialty bakery stores have strengthened the domestic supply chain. Flavor innovation—particularly in chocolate, caramel, and fruit categories—continues to define the U.K.’s competitive bakery landscape.

Which are the Top Companies in Pastry Fillings Market?

The pastry fillings industry is primarily led by well-established companies, including:

- PURATOS GROUP (Belgium)

- Rich Products Corporation (U.S.)

- Dawn Food Products, Inc. (U.S.)

- Pastry Star (U.S.)

- EFCO Products (U.S.)

- Glazir doo (Slovenia)

- Royal Zeelandia Group BV (Netherlands)

- Bakels Worldwide (Switzerland)

- Pennant Ingredients, Inc. (U.S.)

- Solo Foods (U.S.)

- Bradleys (U.K.)

- Tech Food Sdn Bhd. (Malaysia)

- CSM Bakery Solutions (U.S.)

- I. Rice & Company Inc. (U.S.)

- Doris Italian Market (U.S.)

- Avebe (Netherlands)

- Calpro Food Essentials (India)

- Trisco Foods (Australia)

- ADM (U.S.)

- AGRANA Beteiligungs-AG (Austria)

- ANDROS (France)

- Kandy (Sri Lanka)

- British Bakels (U.K.)

- ZENTIS GMBH & CO. KG (Germany)

What are the Recent Developments in Global Pastry Fillings Market?

- In May 2024, Puratos, a leading multinational company specializing in baking, patisserie, and chocolate ingredients, introduced Sapore Lavida, the first fully traceable active sourdough produced in Belgium. This innovative ingredient is made from 100% whole wheat flour sourced through regenerative agriculture, enabling European bakers to meet the growing demand for locally-made and sustainable sourdough products. This launch reinforces Puratos’ commitment to sustainability and transparency across its bakery ingredient portfolio

- In March 2024, Royal Avebe and the University Medical Center Groningen (UMCG) secured approximately €1.4 million in European funding from the Just Transition Fund (JTF) for their Fibers Project. The initiative focuses on developing starch-based solutions that are both eco-friendly and health-promoting, supporting the transition toward more sustainable food systems. This funding highlights Avebe’s ongoing leadership in sustainable innovation and product diversification

- In November 2022, Dawn Food Products, Inc. launched a new vegan-friendly Vanilla Flavour Crème Filling, crafted without titanium dioxide. Designed for diverse applications such as donuts, pastries, muffins, and cake fillings, this product delivers a smooth texture and rich vanilla flavor while adhering to clean-label trends. This launch underscores Dawn Foods’ dedication to plant-based innovation and evolving consumer preferences in the bakery industry

- In September 2021, Dr. Oetker, a German packaged food leader, acquired Indian start-up Kuppies to strengthen its presence in India’s growing ready-to-eat (RTE) dessert segment. The acquisition included Kuppies’ manufacturing facility, innovation center, and brand assets to support Dr. Oetker’s RTE cake and dessert expansion in the Indian market. This strategic move enhances Dr. Oetker’s regional footprint and aligns with its global growth objectives in convenience foods

- In March 2021, Dawn Foods acquired JABEX, a Polish family-owned manufacturer renowned for its high-quality fruit-based bakery ingredients. The acquisition expanded Dawn Foods’ global manufacturing presence and strengthened its supply chain operations across Central and Eastern Europe. This strategic step enables Dawn Foods to better serve its customers and broaden its product reach within the European bakery ingredients market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pastry Fillings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pastry Fillings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pastry Fillings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.