Global Patch Management Market

Market Size in USD Million

CAGR :

%

USD

710.30 Million

USD

990.30 Million

2024

2032

USD

710.30 Million

USD

990.30 Million

2024

2032

| 2025 –2032 | |

| USD 710.30 Million | |

| USD 990.30 Million | |

|

|

|

|

Patch Management Market Size

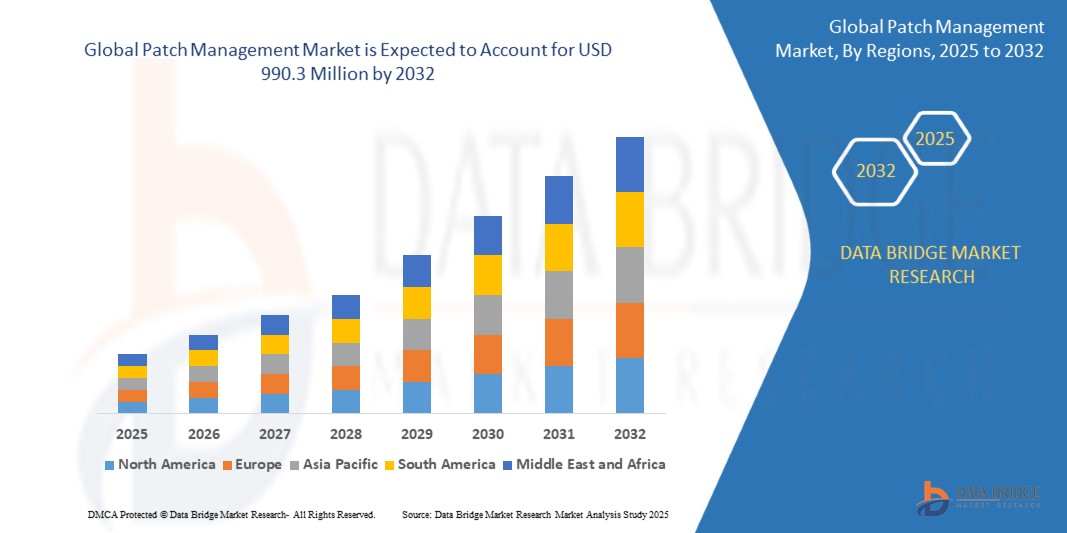

- The global Patch Management market size was valued at USD 710.3 million in 2024 and is expected to reach USD 990.3 million by 2032, at a CAGR of 10.5% during the forecast period

- Rapid adoption of Patch Management engines in e-commerce industry is one of the major factors responsible for this unprecedented market growth.

Patch Management Market Analysis

- Patch Management is a critical IT process involving the acquisition, testing, and installation of code changes (patches) to software applications and systems. It plays a vital role in cybersecurity and performance enhancement by fixing vulnerabilities, bugs, and other issues. Patch Management solutions are widely used across sectors such as BFSI, healthcare, government, retail, and IT & telecom to ensure systems remain secure, compliant, and up to date.

- The increasing frequency of cyberattacks, along with stringent compliance regulations (such as GDPR, HIPAA, and SOX), is significantly propelling the demand for robust Patch Management solutions. Additionally, the growing adoption of cloud computing, remote work setups, and BYOD (Bring Your Own Device) policies are creating lucrative opportunities for the Patch Management market.

- North America dominates the Patch Management market, holding the largest revenue share of 48.01% in 2025. This dominance is attributed to the region’s high awareness of cybersecurity threats, mature IT infrastructure, and the presence of key players offering cutting-edge patching solutions. Enterprises in the U.S. and Canada are increasingly investing in automated Patch Management tools to mitigate security risks and ensure compliance.

- Asia-Pacific is expected to be the fastest-growing region in the Patch Management market during the forecast period. Factors driving this growth include rapid digital transformation, increased government focus on cybersecurity, and the proliferation of connected devices. Countries like India, China, Japan, and South Korea are witnessing heightened demand for scalable and automated Patch Management solutions, particularly from SMBs and large enterprises alike.

- The Software segment is projected to hold the largest market share of 62.1% in the Patch Management market during the forecast period. This is due to the increased adoption of centralized, cloud-based patching platforms that offer real-time monitoring, analytics, and automation. Businesses are prioritizing solutions that can seamlessly manage patches across diverse operating systems, applications, and endpoints from a single dashboard.

Report Scope and Patch Management Market Segmentation

|

Attributes |

Patch Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Patch Management Market Trends

Transforming Enterprise IT Security and Compliance Practices

- Automation and AI Integration: Increasing adoption of AI-driven Patch Management tools is streamlining vulnerability detection, prioritization, and automated patch deployment, reducing manual workloads and human error.

- Cloud-Based Patch Management Solutions Organizations are shifting to cloud-native platforms for scalable, centralized Patch Management across hybrid and remote environments.

- Zero Trust Security Framework Alignment: Patch Management is being embedded into broader zero trust strategies, where continuous validation and timely patching are critical for endpoint security.

- Integration with ITSM and Endpoint Detection & Response (EDR): Enterprises are favoring Patch Management solutions that integrate seamlessly with IT service management and endpoint protection tools to streamline workflows and improve incident response times.

- Real-Time Patch Compliance Monitoring: Growing demand for real-time compliance dashboards and reporting tools to meet industry regulations such as HIPAA, SOX, and PCI-DSS.

- Support for Multi-OS Environments With diverse systems (Windows, macOS, Linux), vendors are offering multi-platform support to simplify patching across varied IT infrastructure.

Patch Management Market Dynamics

Driver

Rising Cyber Threats, Regulatory Pressure, and IT Complexity

- The escalation of ransomware and zero-day vulnerabilities is compelling organizations to adopt proactive Patch Management to reduce security risks.

- Growing emphasis on regulatory compliance (e.g., NIST, ISO 27001, GDPR) is forcing organizations to implement strict patching policies and maintain audit trails.

- The increasing complexity of enterprise IT environments, with a mix of on-prem, cloud, mobile, and IoT devices, is driving demand for unified Patch Management solutions.

- Digital transformation initiatives and expanding remote workforces require efficient patching of endpoints outside the corporate firewall.

- Heightened boardroom and C-suite focus on cybersecurity risk management is making Patch Management a strategic priority in IT governance.

Restraint/Challenge

Resource Constraints, Legacy Systems, and Operational Disruptions

- Many organizations struggle with limited IT staff and resources to manage large-scale, timely patch deployments especially in multi-site environments.

- Legacy systems and critical infrastructure often lack vendor support or are incompatible with modern patching tools, posing significant risk.

- Poorly timed or untested patches can lead to downtime or system conflicts, deterring organizations from aggressive patching schedules.

- Lack of visibility into the full software asset inventory hinders accurate patch targeting and coverage, especially in large enterprises.

- Resistance from business units to apply patches due to concerns over operational disruption can slow down implementation and leave vulnerabilities open.

Patch Management Market Scope

The market is segmented on the basis offering analysis, vertical analysis, type and application.

- By Component

On the basis of component, the Patch Management market is segmented into Patch Management Software and, Services. Software segment dominates the largest market revenue share of 62.1% in 2025 due to growing demand for automated, scalable tools that streamline patch deployment across diverse systems. Enterprises are investing in intelligent platforms with real-time visibility, centralized control, and analytics to manage patches efficiently, reduce downtime, and ensure system security and operational continuity.

The Services segment is anticipated to witness the fastest growth rate of 37.9% from 2025 to 2032 Managed and professional Patch Management services are gaining traction as businesses seek expert support for complex, multi-environment IT infrastructures. Outsourcing patching operations helps companies address resource gaps, accelerate remediation timelines, and ensure compliance. Service providers offer 24/7 monitoring, vulnerability assessments, and tailored patch strategies to minimize risk exposure.

- By Feature

On the basis of Feature the Patch Management market is segmented into Vulnerability Management, Compliance Management and Reporting. The Vulnerability Management held the largest market revenue share in 2025. Patch Management is closely tied to vulnerability management, where timely patching is critical to fixing identified security flaws. Rising threats like ransomware and zero-day attacks are pushing organizations to integrate patching with continuous vulnerability scanning tools, allowing for rapid detection, prioritization, and mitigation of risks in real-time across all endpoints.

The Compliance Management segment is expected to witness the fastest CAGR from 2025 to 2032 With increasing regulatory requirements (GDPR, HIPAA, PCI-DSS), Patch Management has become a cornerstone of compliance strategies. Businesses are adopting patching solutions with built-in auditing, reporting, and policy enforcement to demonstrate adherence. Regular updates ensure systems are not only secure but also meet evolving regulatory standards and governance frameworks.

- By Deployment Mode

On the basis of deployment mode, the Patch Management market is segmented into Cloud and On-Premises. The Cloud held the largest market revenue share in 2025, and it is expected to witness the fastest CAGR from 2025 to 2032. The shift to cloud infrastructure is driving demand for cloud-native Patch Management solutions that offer agility, scalability, and remote accessibility. As businesses deploy hybrid environments, cloud patching tools provide centralized control and automation, allowing seamless updates across virtual machines, containers, and SaaS applications while ensuring minimal disruption and security consistency.

- By End User Vertical

On the basis of End User Vertical, the Patch Management market is segmented into Banking, Financial Services, and Insurance (BFSI), Government and Defence, Retail, Healthcare, Education, IT and Telecom and Others. The Banking segment accounted for the largest market revenue share in 2024 and it is expected to witness the fastest CAGR from 2025 to 2032. The banking and financial services sector is highly targeted by cybercriminals, making timely Patch Management critical for data protection and operational resilience. Regulatory pressure, digital banking growth, and increasing use of third-party applications drive adoption of automated patching solutions to ensure infrastructure hardening, fraud prevention, and compliance with stringent security standards.

North America

North America dominated the Patch Management market with the largest revenue share of 48.01% in 2024, driven by the region's mature IT infrastructure, increasing frequency of cyberattacks, and strict regulatory compliance requirements. Organizations are rapidly adopting automated Patch Management tools to ensure endpoint security, streamline vulnerability remediation, and maintain operational uptime across distributed environments.

U.S.

The U.S. captured 71.2% of North America’s Patch Management revenue in 2025. Market growth is propelled by early adoption of cloud technologies, zero trust architectures, and rising investment in cybersecurity automation. Financial services, government, and healthcare sectors are leading adopters due to stringent compliance mandates such as HIPAA, SOX, and NIST.

Europe

Europe is projected to experience robust growth in the Patch Management market due to increasing digital transformation initiatives and enhanced focus on cybersecurity frameworks like ENISA, GDPR, and ISO 27001. Enterprises are prioritizing real-time patching, particularly across hybrid environments, to mitigate evolving threats and ensure business continuity.

Germany

Germany’s Patch Management market is growing steadily, driven by its strong industrial base and emphasis on automation in manufacturing and IT systems. Enterprises are integrating Patch Management into broader vulnerability management strategies, particularly within automotive, industrial tech, and critical infrastructure, to safeguard against operational risks.

France

France is witnessing rising demand for Patch Management solutions due to growing regulatory compliance pressures and the digitization of public and private sectors. Companies across finance, energy, and retail are deploying centralized patching platforms to manage risks and maintain system integrity in an increasingly complex threat environment.

Asia-Pacific

The Asia-Pacific Patch Management market is expected to grow at the fastest CAGR of over 25.1% in 2025, fueled by rapid digitalization, cloud adoption, and increasing cyberattacks across the region. Governments and enterprises in countries like India, China, and South Korea are focusing on proactive patching strategies to secure expanding IT ecosystems.

Japan

Japan's Patch Management market is supported by the country’s high-tech economy and strong focus on cybersecurity resilience in finance, telecom, and manufacturing. Enterprises are integrating Patch Management into their IT service management systems to reduce vulnerabilities, prevent downtime, and comply with evolving national security standards.

China

China leads the Asia-Pacific region in Patch Management revenue due to its vast enterprise base, growing regulatory oversight, and large-scale digital infrastructure. Organizations are rapidly adopting automated patching tools to manage vulnerabilities across cloud environments, protect sensitive data, and meet domestic cybersecurity law requirements.

Patch Management Market Share

The Patch Management industry is primarily led by well-established companies, including:

- IBM

- Oracle

- Broadcom.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- FUJITSU

- Micro Focus

- Microsoft

- Symantec Corporation.

- NetSPI LLC.

- Cisco Systems, Inc.

- ALIENVAULT, INC.

- Skybox Security, Inc.

- AT&T Intellectual Property.

- Qualys, Inc.

- Zoho Corporation Pvt. Ltd.

- SysAid Technologies Ltd.

- Versata,

- Automox

- GFI Software

Latest Developments in Global Patch Management Market

- In April 2025, Ivanti released Patch for Configuration Manager 2025.2, introducing enhanced database migration visibility, improved automation scheduler, and stability fixes—strengthening enterprise patch deployment reliability for SCCM and Intune-managed environments.

- In June 2025, ManageEngine’s Endpoint Central patched 67 vulnerabilities, including 2 zero-days and 9 critical flaws. Updates spanned Windows, third-party apps, browsers, and network appliances—reflecting comprehensive vendor patch coverage.

- In April 2025, Microsoft enhanced its Secure by Design patch strategy: enabled default automatic patch installs, introduced hotpatches to cut Windows 11 restarts from twelve to four annually, boosting adoption and reducing operational disruption.

- On June 10, 2025, Microsoft’s Patch Tuesday deployed fixes for 65 CVEs (9 critical, 56 important), including one active zero-day—addressing core components like Windows, Office, Visual Studio, and WebDAV.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.