Global Pathogen Rapid Seq Screening Devices Market

Market Size in USD million

CAGR :

%

USD

495.00 million

USD

1,798.49 million

2024

2032

USD

495.00 million

USD

1,798.49 million

2024

2032

| 2025 –2032 | |

| USD 495.00 million | |

| USD 1,798.49 million | |

|

|

|

|

Pathogen Rapid-Seq Screening Devices Market Size

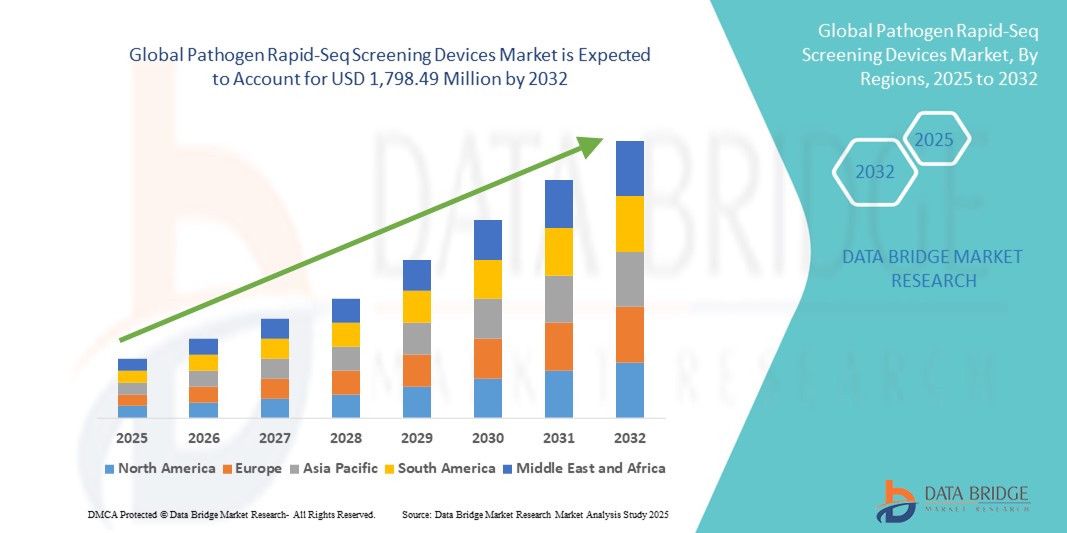

- The global pathogen rapid-seq screening devices market size was valued at USD 495.00 million in 2024 and is expected to reach USD 1,798.49 million by 2032, at a CAGR of 17.50% during the forecast period

- The market growth is largely fueled by the increasing incidence of infectious diseases, rising global demand for early pathogen detection, and advancements in sequencing technologies that enable faster, more accurate diagnostics across healthcare and public health sectors

- Furthermore, growing applications in clinical diagnostics, food safety, environmental monitoring, and veterinary health are establishing rapid-seq screening devices as a vital tool for global biosurveillance. These converging factors are accelerating adoption, thereby significantly boosting the industry's growth

Pathogen Rapid-Seq Screening Devices Market Analysis

- Pathogen rapid-seq screening devices, designed for high-speed and accurate identification of bacterial, viral, fungal, and parasitic pathogens, are increasingly essential across clinical diagnostics, food safety, environmental monitoring, and veterinary applications due to their efficiency, scalability, and integration with molecular and sequencing technologies

- The escalating demand for these devices is primarily fueled by the rising global burden of infectious diseases, heightened focus on pandemic preparedness, and rapid advancements in molecular diagnostics and sequencing that enable faster and more precise pathogen detection

- North America dominated the pathogen rapid-seq screening devices market with the largest revenue share of 39.7% in 2024, supported by advanced healthcare infrastructure, extensive R&D investments, and strong governmental biosurveillance programs, with the U.S. driving adoption through active participation from key biotech and sequencing players

- Asia-Pacific is expected to be the fastest growing region in the pathogen rapid-seq screening devices market during the forecast period, driven by growing healthcare investments, expanding genomic research initiatives, and increasing demand for rapid diagnostics in densely populated nations

- Bacterial pathogen segment dominated the pathogen rapid-seq screening devices market with a share of 42.1% in 2024, reflecting the high global prevalence of bacterial infections and the urgent need for rapid detection solutions in both clinical and food safety applications

Report Scope and Pathogen Rapid-Seq Screening Devices Market Segmentation

|

Attributes |

Pathogen Rapid-Seq Screening Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pathogen Rapid-Seq Screening Devices Market Trends

Integration of AI-Powered Bioinformatics and Cloud-Based Surveillance

- A significant and accelerating trend in the global pathogen rapid-seq screening devices market is the integration of artificial intelligence (AI) and cloud-based bioinformatics platforms that enable faster, more accurate, and large-scale interpretation of pathogen genomic data. This convergence enhances early detection, outbreak prediction, and real-time surveillance

- For instance, Illumina’s partnership with public health agencies has enabled cloud-based genomic surveillance tools to rapidly track COVID-19 variants, while Thermo Fisher Scientific’s solutions integrate AI-driven analytics for identifying antimicrobial resistance markers

- AI-powered platforms are increasingly being used to optimize sequencing workflows, reducing turnaround time by automating error correction and mutation analysis, while simultaneously improving precision in pathogen identification. Moreover, integration with secure cloud platforms allows laboratories worldwide to share genomic data instantly, facilitating cross-border collaboration for global health

- This seamless integration of sequencing devices with AI and cloud ecosystems is enabling centralized control over pathogen monitoring, similar to how connected devices unify data streams in smart homes. Through unified dashboards, public health authorities can analyze pathogen data alongside epidemiological, environmental, and clinical inputs, creating a holistic view of outbreak risk

- The trend towards intelligent, automated, and globally connected screening systems is fundamentally reshaping expectations in diagnostics and surveillance. Companies such as Oxford Nanopore Technologies are developing portable sequencing devices with real-time cloud connectivity and AI-based pathogen identification, making genomic analysis accessible in both centralized labs and field environments

- The demand for AI-integrated pathogen rapid-seq solutions is growing rapidly across clinical, food safety, veterinary, and public health sectors, as stakeholders increasingly prioritize speed, scalability, and predictive analytics to counter rising infectious disease threats

Pathogen Rapid-Seq Screening Devices Market Dynamics

Driver

Rising Global Burden of Infectious Diseases and Biosurveillance Needs

- The increasing prevalence of infectious diseases, the threat of pandemics, and the urgent need for robust biosurveillance are major drivers fueling demand for pathogen rapid-seq screening devices

- For instance, during the COVID-19 pandemic, rapid sequencing devices were essential for tracking variants globally, with agencies such as the CDC and WHO investing heavily in sequencing infrastructure. Such initiatives are expected to continue, driving market growth

- As healthcare systems and governments seek more effective outbreak preparedness solutions, rapid-seq devices offer critical advantages, including early detection, genomic tracing, and support for antimicrobial resistance (AMR) monitoring

- Furthermore, the rising adoption of precision medicine and the integration of genomic sequencing in hospitals and reference laboratories are positioning rapid-seq devices as indispensable tools for diagnostics, treatment selection, and public health management

- Their applications extend beyond healthcare into food safety, environmental monitoring, and veterinary diagnostics, where the ability to identify pathogens swiftly ensures supply chain safety and zoonotic disease control. The increasing affordability of sequencing platforms and portable devices is further expanding their adoption across developed and emerging markets

Restraint/Challenge

High Cost, Technical Complexity, and Data Security Concerns

- The high cost of sequencing instruments and consumables, combined with the technical expertise required to operate them, remains a key challenge to widespread adoption, particularly in low- and middle-income countries

- For instance, advanced NGS platforms and cloud-based analytics can require significant upfront investments, making them less accessible to smaller clinics and research labs. This limits adoption in resource-constrained settings despite rising demand

- In addition, concerns about data security and privacy in cloud-based genomic platforms are increasing. Sensitive pathogen genomic data, if compromised, could pose both personal and national security risks, making compliance with data protection regulations a critical issue for manufacturers

- High-profile reports of cybersecurity risks in healthcare data systems have raised caution among potential adopters. Companies such as Illumina and QIAGEN emphasize their advanced encryption and secure authentication measures to reassure customers

- While costs are gradually declining with technological advances, the perceived premium for sequencing technologies and concerns over secure data handling still hinder wider deployment

- Overcoming these barriers through affordable device innovation, cloud security enhancements, and user-friendly automation will be crucial for sustainable growth in this market

Pathogen Rapid-Seq Screening Devices Market Scope

The market is segmented on the basis of pathogen type, technology, application, and end user.

- By Pathogen Type

On the basis of pathogen type, the pathogen rapid-seq screening devices market is segmented into bacterial, fungal, parasitic, and viral. The bacterial segment dominated the market with the largest revenue share of 42.1% in 2024, driven by the high global prevalence of bacterial infections such as E. coli, Salmonella, and Staphylococcus aureus. Foodborne outbreaks and hospital-acquired infections remain major public health threats, compelling governments and industries to adopt rapid bacterial screening solutions. Bacterial pathogens are also the primary focus of food safety regulations, reinforcing consistent demand for advanced detection methods. The ability of rapid-seq platforms to provide both identification and antimicrobial resistance (AMR) profiling has further cemented bacterial testing as the dominant category in this market.

The viral segment is anticipated to witness the fastest growth rate of 20.9% from 2025 to 2032, fueled by the increasing frequency of viral outbreaks and pandemics such as COVID-19, influenza, and emerging zoonotic viruses. Rapid sequencing has proven critical in monitoring viral mutations, vaccine efficacy, and global biosurveillance. Public health agencies and research institutes are investing heavily in viral sequencing infrastructure, particularly in Asia-Pacific and North America. Growing awareness of the importance of genomic surveillance and preparedness for future pandemics is expected to accelerate adoption in this segment.

- By Technology

On the basis of technology, the pathogen rapid-seq screening devices market is segmented into isothermal amplification, PCR, microarray, and sequencing. The PCR segment dominated the market with the largest revenue share of 44.8% in 2024, owing to its long-standing use as the gold standard for pathogen detection across hospitals, laboratories, and food safety testing facilities. Real-time PCR offers high sensitivity, cost-effectiveness, and established regulatory approval, making it the most widely used method. The relative affordability of PCR devices compared to advanced sequencing platforms ensures broader accessibility across both developed and emerging markets. In addition, PCR’s adaptability for point-of-care diagnostics strengthens its dominance in the current landscape.

The sequencing segment is projected to be the fastest growing with a CAGR of 22.5% from 2025 to 2032, driven by its ability to deliver comprehensive genomic data for pathogen identification, antimicrobial resistance detection, and outbreak tracing. Next-generation sequencing (NGS) platforms have demonstrated unmatched performance during global health crises, particularly in tracking SARS-CoV-2 variants. Continuous innovations in portable sequencing devices, coupled with falling costs and AI-driven bioinformatics, are making sequencing technologies more accessible. Their increasing use in precision medicine, public health, and biosurveillance programs is expected to accelerate growth at a rapid pace.

- By Application

On the basis of application, the pathogen rapid-seq screening devices market is segmented into clinical diagnostics, environmental monitoring, food safety testing, and veterinary diagnostics. The clinical diagnostics segment dominated the market with the largest revenue share of 46.2% in 2024, owing to the rising burden of infectious diseases and the urgent need for faster, more accurate diagnostics in hospitals and reference laboratories. The ability of rapid-seq devices to detect mixed infections, drug resistance markers, and novel pathogens has made them vital in precision medicine. Increasing integration into hospital laboratories and global funding for infectious disease management are reinforcing this segment’s leadership.

The food safety testing segment is expected to grow at the fastest CAGR of 21.3% from 2025 to 2032, driven by increasing concerns over foodborne illnesses and strict international safety regulations. Rapid-seq devices offer superior speed and accuracy compared to conventional microbial culture methods, enabling early detection of pathogens in processing plants, logistics hubs, and retail outlets. With globalization of the food supply chain, companies and regulators are prioritizing advanced sequencing technologies to reduce contamination risks. Growing consumer demand for safe and traceable food products is expected to further accelerate adoption.

- By End User

On the basis of end user, the pathogen rapid-seq screening devices market is segmented into academic & research institutes, clinics, hospitals, and reference laboratories. The academic & research institutes segment dominated the market with the largest revenue share of 50.1% in 2024, reflecting the strong role of universities, government labs, and research centers in advancing pathogen genomics. Heavy investments in sequencing projects, international collaborations, and large-scale research initiatives such as the Global Pathogen Surveillance Network support this dominance. Academic institutions often act as the first adopters of cutting-edge sequencing platforms, influencing adoption trends across healthcare and industry.

The hospitals segment is anticipated to be the fastest growing with a CAGR of 20.7% from 2025 to 2032, fueled by the rapid integration of molecular and sequencing diagnostics into clinical workflows. Hospitals are increasingly using rapid-seq devices for real-time infection diagnosis, antimicrobial resistance detection, and outbreak control. The push toward precision medicine, coupled with the rising number of hospital-acquired infections, is accelerating demand in this setting. As sequencing becomes more cost-effective and automated, hospitals are expected to adopt these devices widely, making this the fastest-expanding end-user category.

Pathogen Rapid-Seq Screening Devices Market Regional Analysis

- North America dominated the pathogen rapid-seq screening devices market with the largest revenue share of 39.7% in 2024, supported by advanced healthcare infrastructure, extensive R&D investments, and strong governmental biosurveillance programs

- The region benefits from well-established healthcare systems, leading research institutes, and government-led initiatives such as the CDC’s genomic tracking programs, which continue to expand the adoption of rapid sequencing devices

- Growing concerns over antimicrobial resistance and the need for real-time outbreak monitoring have further accelerated demand. The region’s strong biotechnology ecosystem, coupled with high awareness among healthcare providers, has firmly positioned North America as the global leader in this market

U.S. Pathogen Rapid-Seq Screening Devices Market Insight

The U.S. pathogen rapid-seq screening devices market captured the largest revenue share of 78% in 2024 within North America, driven by heavy investments in genomic surveillance and infectious disease diagnostics. The country’s strong healthcare infrastructure and government-led initiatives, such as CDC’s pathogen tracking programs, are fueling adoption. Growing demand for rapid outbreak response tools, alongside the increasing integration of AI-driven sequencing platforms, continues to propel market growth. Furthermore, the U.S. biotechnology ecosystem and collaborations between academic institutions and device manufacturers strongly support innovation in this field.

Europe Pathogen Rapid-Seq Screening Devices Market Insight

The Europe pathogen rapid-seq screening devices market is projected to expand at a substantial CAGR throughout the forecast period, supported by strict EU regulations on food safety, public health monitoring, and infectious disease control. Rising investments in pathogen surveillance across hospitals and laboratories are fostering widespread adoption. European consumers and healthcare providers value the precision, speed, and compliance features these devices deliver. The region is also experiencing significant uptake across clinical diagnostics and food safety applications, with rapid-seq devices integrated into both public health frameworks and private laboratory networks.

U.K. Pathogen Rapid-Seq Screening Devices Market Insight

The U.K. pathogen rapid-seq screening devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the government’s strong focus on genomic medicine and infectious disease preparedness. The U.K.’s established genomic infrastructure, including initiatives such as Genomics England, supports rapid deployment of sequencing devices. Rising awareness about antimicrobial resistance, coupled with demand for real-time pathogen monitoring, is encouraging hospitals, clinics, and research centers to adopt advanced sequencing platforms for both clinical and surveillance purposes.

Germany Pathogen Rapid-Seq Screening Devices Market Insight

The Germany pathogen rapid-seq screening devices market is expected to expand at a considerable CAGR during the forecast period, fueled by its emphasis on precision diagnostics, innovation, and sustainability in healthcare. Germany’s strong biotechnology and pharmaceutical industry supports the rapid uptake of sequencing-based technologies in clinical and research applications. Increasing demand for eco-friendly, high-throughput solutions is driving innovation, with hospitals and laboratories prioritizing devices that balance efficiency, security, and data privacy. Integration with Germany’s digital health initiatives is further strengthening adoption across clinical settings.

Asia-Pacific Pathogen Rapid-Seq Screening Devices Market Insight

The Asia-Pacific pathogen rapid-seq screening devices market is poised to grow at the fastest CAGR of 23.5% from 2025 to 2032, driven by rapid urbanization, rising healthcare investments, and technological advancements in countries such as China, Japan, and India. The region’s growing burden of infectious diseases and foodborne illnesses is accelerating demand for faster, portable diagnostic solutions. Government-led digital health and biosurveillance programs are expanding the adoption of sequencing devices. In addition, APAC’s role as a key manufacturing hub for sequencing technologies ensures affordability and accessibility, making these devices available to a broader consumer base.

Japan Pathogen Rapid-Seq Screening Devices Market Insight

The Japan pathogen rapid-seq screening devices market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for precision diagnostics. Japanese healthcare facilities are increasingly integrating sequencing devices with other IoT-enabled laboratory tools to strengthen pathogen surveillance. The rising incidence of hospital-acquired infections and public concern for safety are fueling adoption. Furthermore, Japan’s aging population is spurring demand for fast, reliable diagnostic tools in both hospital and community health settings, enhancing market growth.

India Pathogen Rapid-Seq Screening Devices Market Insight

The India pathogen rapid-seq screening devices market accounted for the largest revenue share in Asia-Pacific in 2024, driven by a rapidly growing middle class, urbanization, and government initiatives promoting digital health and smart diagnostics. India represents one of the fastest-expanding markets for pathogen detection due to its high infectious disease burden. The push for smart cities, investment in biotech startups, and affordable device availability from domestic and international players are fueling demand. In addition, the use of sequencing devices in both food safety testing and clinical diagnostics is rapidly expanding across the country.

Pathogen Rapid-Seq Screening Devices Market Share

The pathogen rapid-seq screening devices industry is primarily led by well-established companies, including:

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Pacific Biosciences of California, Inc. (U.S.)

- QIAGEN N.V. (Netherlands)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bio-Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- BGI Genomics Co., Ltd. (China)

- GenScript Biotech Corporation (China)

- Danaher Corporation (U.S.)

- Bruker (U.S.)

- PerkinElmer (U.S.)

- Takara Bio Inc. (Japan)

- Integrated DNA Technologies, Inc. (U.S.)

- Eurofins Scientific SE (Luxembourg)

- Macrogen, Inc. (South Korea)

- 10x Genomics, Inc. (U.S.)

- BIOMÉRIEUX (France)

- Natera, Inc. (U.S.)

What are the Recent Developments in Global Pathogen Rapid-Seq Screening Devices Market?

- In June 2025, Integrated DNA Technologies (IDT), unveiled new additions to its infectious disease portfolio at ASM Microbe 2025, including a PrimeTime Influenza Kit—the first fully comprehensive qPCR solution for influenza A/B, and PrimeTime Research Pathogen Panels, which are customizable, high-throughput panels covering respiratory, gastrointestinal, sexual health, and other pathogen areas

- In June 2025, bioMérieux acquired Day Zero Diagnostics, gaining access to advanced sequencing-based rapid diagnostics capable of identifying bacterial species and antibiotic resistance profiles directly from whole blood samples within hours a process that traditionally takes 2–5 days

- In February 2025, Roche unveiled its novel "Sequencing by Expansion (SBX)" technology, introducing a new category of next-generation sequencing with ultra-rapid, high-throughput capability using expanded synthetic molecules (“Xpandomers”) decoded by a sensor module. SBX dramatically reduces time-to-genome from days to hours, promising game-changing applications in diagnostics and research

- In December 2024, Delve Bio introduced its Delve Detect genomic infectious disease test, a metagenomic next-generation sequencing (mNGS) platform capable of identifying over 68,000 pathogens in a single unbiased test. This breakthrough enables broader and deeper pathogen detection for routine and rare diseases with a single sample

- In October 2024, Illumina launched its compact and lower-cost MiSeq i100 benchtop sequencers, designed for smaller research and testing labs with enhanced accessibility. Starting at USD 49,000, the i100 systems feature faster run times (~4 hours), onboard and cloud-accessible programs for respiratory and urinary pathogen panels, influenza surveillance, and cancer research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.