Global Pathology Imaging Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

2.86 Billion

2025

2033

USD

1.30 Billion

USD

2.86 Billion

2025

2033

| 2026 –2033 | |

| USD 1.30 Billion | |

| USD 2.86 Billion | |

|

|

|

|

Pathology Imaging Systems Market Size

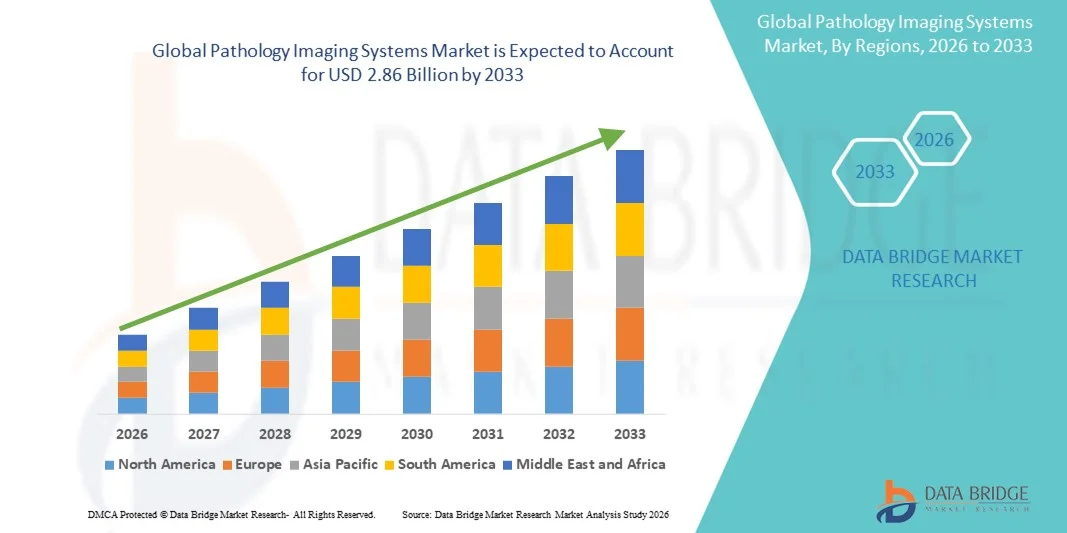

- The global pathology imaging systems market size was valued at USD 1.30 billion in 2025 and is expected to reach USD 2.86 billion by 2033, at a CAGR of10.36% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced imaging technologies, digital pathology solutions, and automated diagnostic systems, leading to improved accuracy, faster results, and streamlined workflows in clinical laboratories, hospitals, and research centers

- Furthermore, rising demand for efficient, high-throughput, and user-friendly imaging systems, along with increasing focus on early disease detection, personalized medicine, and integration with AI-based analysis tools, is establishing pathology imaging systems as essential solutions in modern diagnostics. These converging factors are accelerating the uptake of Pathology Imaging Systems solutions, thereby significantly boosting the industry's growth

Pathology Imaging Systems Market Analysis

- Pathology imaging systems, including digital slide scanners, whole-slide imaging devices, and high-resolution microscopy systems, are increasingly vital components of modern diagnostics and research laboratories due to their ability to improve accuracy, enable remote consultations, and integrate with AI-based analysis tools

- The escalating demand for pathology imaging systems is primarily fueled by rising adoption of digital pathology, increasing prevalence of chronic diseases and cancer, growing demand for high-throughput diagnostics, and the integration of AI and machine learning in clinical workflows

- North America dominated the pathology imaging systems market with the largest revenue share of approximately 38.7% in 2025, supported by advanced healthcare infrastructure, high adoption of digital pathology solutions, and the presence of leading global players, with the U.S. experiencing substantial growth driven by AI-enabled imaging systems and cloud-based diagnostics

- Asia-Pacific is expected to be the fastest-growing region in the pathology imaging systems market during the forecast period due to increasing healthcare spending, rising number of diagnostic centers, growing awareness of advanced pathology solutions, and expanding medical research activities in countries such as China, India, and Japan

- The clinical diagnosis segment accounted for the largest market revenue share of 53.7% in 2025, driven by rising cancer incidence, infectious disease diagnosis, and demand for precision pathology

Report Scope and Pathology Imaging Systems Market Segmentation

|

Attributes |

Pathology Imaging Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Leica Biosystems (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Pathology Imaging Systems Market Trends

Advancements in Digital and High-Resolution Pathology Imaging

- A significant and accelerating trend in the global pathology imaging systems market is the rapid adoption of digital and high-resolution imaging technologies. These advancements are enabling pathologists and healthcare professionals to obtain more accurate, faster, and reproducible diagnostic results

- For instance, the development of whole-slide imaging (WSI) systems and high-definition digital scanners allows laboratories to capture detailed tissue samples and share them digitally across remote locations, supporting telepathology and collaborative diagnostics

- Furthermore, innovations such as automated slide scanners, advanced staining techniques, and integrated imaging platforms are enhancing operational efficiency in pathology labs while reducing human error

- The convergence of improved imaging hardware with software-driven image management platforms is transforming workflows, reducing turnaround times for diagnostic results, and enabling precision medicine initiatives

- This trend toward more efficient, accurate, and accessible pathology imaging is reshaping expectations in clinical diagnostics and is prompting healthcare providers and laboratories to upgrade existing systems to meet rising demand

- Global adoption is further boosted by initiatives to standardize diagnostic procedures and expand telepathology services in both developed and emerging regions

Pathology Imaging Systems Market Dynamics

Driver

Increasing Demand for Accurate and Rapid Diagnostics

- The rising prevalence of chronic diseases, cancer, and infectious conditions globally is driving the demand for advanced pathology imaging systems capable of providing precise and timely diagnostics

- For instance, the growing incidence of cancer in Asia-Pacific and North America has increased the need for high-resolution imaging systems that can detect subtle morphological changes in tissue samples, enabling early intervention

- The need for faster diagnostic turnaround, especially in hospital networks and research laboratories, is prompting the adoption of automated imaging platforms that can handle high sample volumes efficiently

- Furthermore, expanding healthcare infrastructure, rising government initiatives to improve diagnostic capabilities, and increasing investments in advanced laboratory technologies are key factors propelling market growth

- Integration of digital pathology systems in research, pharmaceutical testing, and academic centers is also supporting the global adoption of pathology imaging systems

Restraint/Challenge

High Capital Expenditure and Regulatory Barriers

- Despite strong demand, the adoption of advanced pathology imaging systems faces challenges due to high acquisition and operational costs, which can be prohibitive for small laboratories and healthcare facilities in developing regions

- For instance, premium whole-slide imaging systems and automated scanners often require significant upfront investment, along with ongoing maintenance and software licensing fees, limiting accessibility for price-sensitive institutions

- In addition, stringent regulatory approvals, variations in regional diagnostic standards, and the need for specialized training for laboratory personnel pose hurdles to widespread adoption

- Concerns about interoperability with existing laboratory information systems (LIS) and integration into digital workflows further complicate deployment

- Addressing these challenges through cost-effective solutions, standardized training programs, and regulatory alignment will be critical for sustained global growth in the Pathology Imaging Systems market

Pathology Imaging Systems Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Type

On the basis of type, the Pathology Imaging Systems market is segmented into imaging systems, accessories and software, and services. The imaging systems segment dominated the largest market revenue share of 46.1% in 2025, driven by the widespread adoption of whole-slide imaging scanners, digital microscopes, and automated pathology platforms across hospitals and diagnostic laboratories. Imaging systems are the core component of digital pathology workflows, enabling high-resolution slide digitization and rapid case review. The growing burden of cancer and chronic diseases has increased demand for accurate and high-throughput diagnostic solutions. Hospitals prioritize imaging systems due to their ability to integrate with laboratory information systems and electronic health records. Technological advancements such as AI-assisted image analysis and remote pathology further support dominance. North America accounted for a major share due to early adoption and regulatory approvals. Europe followed closely, supported by government initiatives promoting digital healthcare. Continuous product innovation and replacement of conventional microscopes also contribute to market leadership.

The accessories and software segment is expected to witness the fastest growth, registering a CAGR of 22.4% from 2026 to 2033, fueled by increasing adoption of AI-based image analysis software, cloud-based data storage, and workflow management tools. Software solutions enhance diagnostic accuracy, reduce turnaround time, and enable remote collaboration among pathologists. Accessories such as slide loaders, scanners, and staining modules complement imaging systems and improve laboratory efficiency. Rising investments in digital pathology infrastructure across academic and research institutions further accelerate growth. Pharmaceutical companies increasingly use advanced software for biomarker discovery and drug development. Emerging economies are adopting cost-effective software solutions, supporting expansion. Subscription-based and cloud deployment models improve affordability. Vendors are focusing on interoperability and scalability. These factors collectively drive rapid growth of this segment.

- By Application

On the basis of application, the Pathology Imaging Systems market is segmented into clinical diagnosis and academic research. The clinical diagnosis segment accounted for the largest market revenue share of 53.7% in 2025, driven by rising cancer incidence, infectious disease diagnosis, and demand for precision pathology. Digital pathology systems improve diagnostic accuracy, reduce manual errors, and support faster decision-making in hospitals and diagnostic laboratories. Integration with AI tools enables detection of subtle histopathological patterns. Strong reimbursement frameworks and regulatory approvals in the U.S. and Europe support adoption. Hospitals increasingly deploy digital pathology for routine and complex cases. Telepathology and remote consultations further strengthen dominance. Growing adoption in community hospitals also contributes to revenue growth. Continuous upgrades in imaging resolution and analytics reinforce clinical use. Overall, clinical diagnosis remains the primary revenue-generating application.

The academic research segment is projected to witness the fastest CAGR of 21.1% from 2026 to 2033, supported by increasing funding for biomedical research, genomics, and translational medicine. Universities and research institutes use digital pathology for quantitative analysis, biomarker validation, and pathology training. High-throughput imaging systems enable large-scale studies with improved reproducibility. Collaboration between academic institutions and pharmaceutical companies drives demand. Government funding initiatives in Asia-Pacific and Europe accelerate adoption. Cloud-based platforms enable data sharing and multi-site research. AI-driven tools enhance research efficiency and insights. Expansion of research laboratories globally supports growth. As research intensity increases, this segment will grow rapidly.

- By End User

On the basis of end user, the Pathology Imaging Systems market is segmented into hospitals, diagnostic laboratories, and research organizations. The hospitals segment dominated the market with a revenue share of 48.9% in 2025, owing to high patient volumes, advanced infrastructure, and strong demand for accurate diagnostics. Hospitals adopt digital pathology to improve workflow efficiency, reduce turnaround times, and enable multidisciplinary collaboration. Integration with hospital information systems enhances operational efficiency. North America leads due to early adoption and strong healthcare spending. European hospitals follow, driven by digitization initiatives. Growing prevalence of oncology cases increases reliance on digital pathology. Vendor partnerships and regulatory approvals further support hospital adoption. Hospitals remain the largest end users due to scale and resource availability.

The research organizations segment is expected to register the fastest growth, with a CAGR of 22.0% from 2026 to 2033, driven by increasing investments in life sciences research and drug discovery. Research institutes require advanced imaging systems for tissue analysis, biomarker identification, and translational studies. Pharmaceutical and biotechnology companies increasingly use digital pathology to support clinical trials. Expansion of research infrastructure in Asia-Pacific accelerates adoption. AI-enabled platforms improve research accuracy and productivity. Government and private funding initiatives support laboratory modernization. Cloud-based collaboration tools enable multi-center research. As global research activity intensifies, this segment will witness rapid expansion.

Pathology Imaging Systems Market Regional Analysis

- The North America pathology imaging systems market dominated with the largest revenue share of approximately 38.7% in 2025

- Supported by advanced healthcare infrastructure, high adoption of digital pathology solutions, and the presence of leading global players

- The U.S. experienced substantial growth driven by AI-enabled imaging systems and cloud-based diagnostics

U.S. Pathology Imaging Systems Market Insight

The U.S. pathology imaging systems market captured the major portion of North America’s revenue share in 2025, fueled by early adoption of advanced digital pathology platforms, high demand for automated slide scanning, AI-assisted analysis, and cloud-based diagnostics across hospitals, laboratories, and research institutes.

Europe Pathology Imaging Systems Market Insight

The Europe pathology imaging systems market is projected to expand at a substantial CAGR during the forecast period, driven by increasing investments in digital pathology, growing demand for efficient diagnostic solutions, and technological advancements in imaging systems.

U.K. Pathology Imaging Systems Market Insight

The U.K. pathology imaging systems market is anticipated to grow steadily due to adoption of AI-assisted imaging systems, integration of digital workflows in pathology labs, and increasing demand for faster and accurate diagnostics.

Germany Pathology Imaging Systems Market Insight

The Germany pathology imaging systems market is expected to expand at a considerable CAGR, fueled by rising awareness of advanced diagnostics, well-established healthcare infrastructure, and strong adoption of digital pathology and imaging technologies.

Asia-Pacific Pathology Imaging Systems Market Insight

The Asia-Pacific pathology imaging systems market is expected to grow at the fastest CAGR during the forecast period, driven by increasing healthcare spending, a rising number of diagnostic centers, expanding medical research activities, and growing awareness of advanced pathology solutions in countries such as China, India, and Japan.

Japan Pathology Imaging Systems Market Insight

The Japan pathology imaging systems market is gaining momentum due to rapid adoption of advanced diagnostic tools, AI-enabled imaging platforms, and integration of cloud-based solutions in pathology labs.

China Pathology Imaging Systems Market Insight

The China pathology imaging systems market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising healthcare investments, growing diagnostic infrastructure, increasing adoption of digital pathology systems, and expansion of research and medical institutions.

Pathology Imaging Systems Market Share

The Pathology Imaging Systems industry is primarily led by well-established companies, including:

• Leica Biosystems (Germany)

• Roche Diagnostics (Switzerland)

• Philips Healthcare (Netherlands)

• Olympus Corporation (Japan)

• Carl Zeiss Meditec (Germany)

• Hamamatsu Photonics (Japan)

• 3DHISTECH Ltd. (Hungary)

• Hologic, Inc. (U.S.)

• Akoya Biosciences (U.S.)

• Indica Labs (U.S.)

• PerkinElmer, Inc. (U.S.)

• Sakura Finetek (Japan)

• Motic Digital Pathology (China)

• Objective Imaging Ltd. (U.K.)

• Ventana Medical Systems (U.S.)

• Sectra AB (Sweden)

• Corista LLC (U.S.)

• Inspirata, Inc. (U.S.)

• NEC Corporation (Japan)

• Mikroscan Technologies (U.S.)

Latest Developments in Global Pathology Imaging Systems Market

- In June 2025, Leica Biosystems unveiled its next-generation pathology portfolio at the European Congress on Digital Pathology (ECDP 2025), showcasing high-performance scanners—including the Aperio GT 180 and Aperio FL scanning systems—and intelligent software designed to support comprehensive slide scan, management, and analysis workflows for both research and clinical diagnostics

- In October 2025, Leica Biosystems expanded its digital pathology offerings at Pathology Visions 2025 with multiple launches in the Aperio Digital Pathology portfolio, including the AI-powered Aperio HALO AP image management solution and the Aperio AI Store platform for scalable analysis applications developed with technology partners

- In December 2025, Leica Biosystems further broadened its clinical imaging lineup at the Digital Pathology and AI (DPAI) Congress, introducing the Aperio GT 180 DX scanner, Aperio CS5 DX scanner, and Aperio iQC DX software to enhance slide quality control and diagnostic workflow efficiency for pathology laboratories

- In January 2025, Deciphex secured USD 32.3 million in Series C financing to expand global access to high-quality pathology services through its technology-driven platform, aimed at connecting a network of pathologists and improving diagnostic capabilities worldwide

- In January 2025, Leica Biosystems also made a strategic investment in Indica Labs to accelerate development of AI-powered companion diagnostics and integrated digital pathology solutions, strengthening its AI workflow capabilities within digital pathology systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.