Global Patient Engagement Technology Market

Market Size in USD Million

CAGR :

%

USD

16,027.20 Million

USD

74,870.66 Million

2022

2030

USD

16,027.20 Million

USD

74,870.66 Million

2022

2030

| 2023 –2030 | |

| USD 16,027.20 Million | |

| USD 74,870.66 Million | |

|

|

|

|

Patient Engagement Technology Market Analysis and Size

Growing technological developments, adoption of EHR and m health solutions, the prevalence of chronic diseases, supportive initiatives by key market stakeholders, and healthcare consumerism are some of the market's key drivers. According to NextGen Healthcare's 2021 survey, 83% of ambulatory healthcare survey respondents believed that patient engagement solutions were critical to organizational financial success and patient outcomes. According to the survey, the COVID-19 pandemic fuelled market growth.

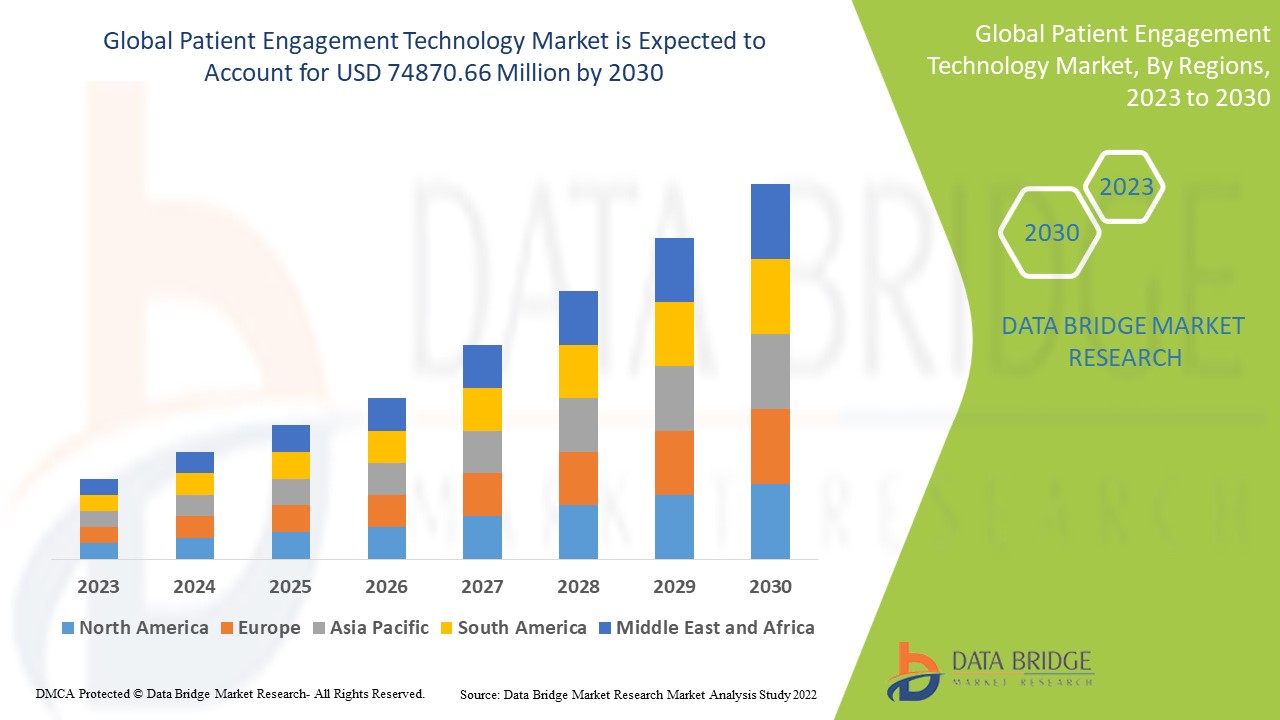

Data Bridge Market Research analyses that the patient engagement technology market which was USD 16027.20 million in 2022, is expected to reach USD 74870.66 million by 2030, at a CAGR of 21.25% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Patient Engagement Technology Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Delivery Type (Web Based, Cloud Based, On Premise), Component (Software, Service, Hardware), Application (Social Management, Health Management, Home Healthcare Management, Financial Health Management), End- User (Payers, Providers, Individual Users), Therapeutic Area (Chronic Diseases, Fitness, Women Health, Mental Health, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Allscripts Healthcare, LLC (U.S.), Athenahealth (U.S.), Oracle (U.S.), Lincor (Ireland), Oneview Ltd. (Ireland), Medecision (U.S.), MCKESSON CORPORATION (U.S.), Orion Health group of companies (U.S.), GetWellNetwork, Inc. (U.S.), Get Real Health (U.S.), PATIENTPOINT, LLC (U.S.), SONIFI Health Incorporated. (U.S.), CipherHealth Inc (U.S.), PALANTIR (U.S.), HealthHub Patient Engagement Solutions (Canada), IQVIA (U.S.) |

|

Market Opportunities |

|

Market Definition

Patient engagement is the process of enlisting patients as partners in their healthcare. Patients who participate can improve their health literacy and become empowered to participate in the care plan decision-making process. When technology is added to the mix, care teams can create a collection of on-demand health self-management, communication, and education services. Customer Relationship Management (CRM) software, telehealth, and wearable devices are all examples of patient engagement technology solutions.

Patient Engagement Technology Market Dynamics

Drivers

- Rise in diabetes

Factors such as the increasing burden of chronic diseases and an increase in the geriatric population have prompted the global adoption of patient engagement solutions. For instance, according to the American Diabetes Association 2020, 1.5 million new cases of diabetes are diagnosed in the United States each year. Companies are focusing on the development of patient-centric engagement solutions in response to the growing number of diabetic patients.

- Growing number of smartphone users

The growing number of smartphone users around the world has accelerated the adoption of mHealth across the sector, both from providers and consumers. Healthcare apps are becoming more popular, and they are simple to install on smartphones. These apps can be linked to wearable devices and help users manage their overall health, which has increased patients' reliance on mHealth apps. As a result, the COVID-19 pandemic is expected to significantly impact digital transformation.

Opportunities

- Government initiatives

Favourable government initiatives are likely to have an impact on market growth in the coming years. For instance, in 2018, the FDA launched the Patient and Caregiver Connection programme. Throughout the treatment evaluation and surveillance, the programme aimed to foster engagement with patients, patient advocates, and caregivers. Furthermore, favourable government initiatives encourage the adoption of these solutions in developing countries such as India. For instance, Columbia Asia Hospitals, launched a patient engagement application suite in collaboration with MphRx in March 2019. This programme aims to digitally transform healthcare services, improve patient engagement, and lead to clinical excellence.

Restraints/Challenges

- High cost associated with deployment

Lack of health literacy, high deployment costs, a shortage of qualified IT professionals, and patient information protection are all anticipated to restrain market growth.

This patient engagement technology market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the patient engagement technology market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In December 2020, Roche launched a digital platform to personalize diabetes management in Thailand. In Thailand, there are 4.3 million diabetics, half of whom are analysed and treated, and only one-third of those analyzed and treated meet their treatment goals.

- In May 2020, Microsoft launched its first sector-specific cloud, Microsoft Cloud for Healthcare. With telehealth and data analytics features, the platform is designed to help providers advance patient engagement and collaboration among health teams.

Global Patient Engagement Technology Market Scope

The patient engagement technology market is segmented on the basis of delivery type, component, application, end-users and therapeutic area. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Delivery Type

- Web Based

- Cloud Based

- On Premise

Component

- Software

- Service

- Hardware

Application

- Social Management

- Health Management

- Home Healthcare Management

- Financial Health Management

End-User

- Payers

- Providers

- Individual Users

Therapeutic Area

- Chronic Diseases

- Fitness

- Women Health

- Mental Health

- Others

Patient Engagement Technology Market Regional Analysis/Insights

The patient engagement technology market is analyzed and market size insights and trends are provided by country, delivery type, component, application, end-users and therapeutic area as referenced above.

The countries covered in the patient engagement technology market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the patient engagement technology market because of rising awareness about the patient engagement solutions.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 owing to the growing healthcare infrastructure.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The patient engagement technology market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for patient engagement technology market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the patient engagement technology market. The data is available for historic period 2011-2021.

Competitive Landscape and Patient Engagement Technology Market Share Analysis

The patient engagement technology market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to patient engagement technology market.

Some of the major players operating in the patient engagement technology market are:

- Allscripts Healthcare, LLC (U.S.)

- Athenahealth (U.S.)

- Oracle (U.S.)

- Lincor (Ireland)

- Oneview Ltd. (Ireland)

- Medecision (U.S.)

- MCKESSON CORPORATION (U.S.)

- Orion Health group of companies (U.S.)

- GetWellNetwork, Inc. (U.S.)

- Get Real Health (U.S.)

- PATIENTPOINT, LLC (U.S.)

- SONIFI Health Incorporated. (U.S.)

- CipherHealth Inc (U.S.)

- PALANTIR (U.S.)

- HealthHub Patient Engagement Solutions (Canada)

- IQVIA (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY LANDSCAPE

5.3 TECHNOLOGICAL TRENDS

5.4 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

5.6 COMPANY COMPARITIVE ANALYSIS

5.7 KEY STRATEGIC DECISIONS

6 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 INTEGRATED

6.2.2 STANDALONE

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 TRAINING AND EDUCATION

6.3.3 IMPLEMENTATION

6.3.4 SUPPORT SERVICES

7 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD-BASED

7.3 ON-PREMISE

8 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY THERAPEUTIC AREA

8.1 OVERVIEW

8.2 CHRONIC DISEASE MANAGEMENT

8.3 HEALTH AND WELLNESS

8.4 OTHERS

9 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY TYPE

9.1 OVERVIEW

9.2 WORKFLOW SOLUTIONS

9.2.1 PATIENT CONSENT SOLUTION

9.2.2 APPOINTMENT SCHEDULING

9.2.3 ONLINE SELF‑SCHEDULING

9.2.4 CHATBOT SCHEDULING

9.2.5 IVR SCHEDULING

9.2.6 PATIENT PORTAL SCHEDULING

9.2.6.1. VIRTUAL VISITS

9.2.6.2. RESPONSE CALLS

9.2.6.3. ACTIVITY TRACKING

9.2.6.4. POST-DIAGNOSIS COMMUNICATION

9.2.6.5. PATIENT EDUCATION

9.2.6.6. EVENT REMINDERS

9.2.6.7. HEALTH SURVEYS

9.2.6.8. POST-FEEDBACK PATIENT ENGAGEMENT

9.2.6.9. OTHERS

9.3 INFRASTRUCTURE SOLUTIONS

9.3.1 EHR AUGMENTATION

9.3.2 EHEALTH ADAPTOR SETS

9.3.3 MASTER PATIENT INDEX

9.3.4 HEALTHCARE PROVIDER DIRECTORY

9.3.5 TERMINOLOGY SERVER

9.3.6 OTHERS

10 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 HEALTH MANAGEMENT

10.2.1 WOMEN’S HEALTH

10.2.2 MENTAL HEALTH

10.2.3 OTHERS

10.3 HOME HEALTH MANAGEMENT

10.3.1 MONITORING AND COMPLIANCE TOOLS

10.3.2 VIRTUAL CARE

10.3.3 SELF SERVICE SOLUTION

10.3.4 WALK IN CLINICS

10.4 SOCIAL & BEHAVIORAL MANAGEMENT

10.5 FITNESS MANAGEMENT

10.5.1 DAILY MEDICATION

10.5.2 CALORIE COUNT

10.5.3 EXERCISE AND STEP COUNT

10.6 FINANCIAL HEALTH MANAGEMENT

10.6.1 AUTOMATION AND DIGITALIZATION

10.6.2 PAYMENT STRUCTURING

10.6.3 INSURANCE COVERAGE

10.7 OTHERS

11 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY END USER

11.1 OVERVIEW

11.2 PROVIDERS

11.2.1 HOSPITALS

11.2.1.1. ACUTE CARE HOSPITALS

11.2.1.2. LONG-TERM CARE HOSPITALS

11.2.1.3. PSYCHIATRIC HOSPITALS

11.2.1.4. OTHERS

11.2.2 NURSING FACILITIES

11.2.3 CHILDREN'S CLINICS

11.2.4 MENTAL HEALTH FACILITIES

11.2.5 HOME HEALTH

11.2.6 REHABILITATION CENTERS

11.2.6.1. OUTPATIENT

11.2.6.2. INPATIENT

11.2.7 PSYCHIATRIC FACILITIES

11.2.8 PHARMACIES

11.2.9 OTHERS

11.3 PAYERS

11.3.1 PRIVATE

11.3.2 PUBLIC

11.4 OTHERS

12 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY PRICING STRUCTURE

12.1 OVERVIEW

12.2 ONE TIME LICENSE

12.3 SUBSCRIPTION

12.3.1 MONTHLY

12.3.2 ANNUAL

13 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY OPERATING DEVICE

13.1 OVERVIEW

13.2 WINDOW

13.3 MAC

13.4 LINUX

13.5 MOBILE

13.5.1 ANDROID

13.5.2 IPHONE AND IPAD

14 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, BY REGION

GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 FRANCE

14.2.3 U.K.

14.2.4 ITALY

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 TURKEY

14.2.8 POLAND

14.2.9 DENMARK

14.2.10 SWEDEN

14.2.11 BELGIUM

14.2.12 NETHERLANDS

14.2.13 SWITZERLAND

14.2.14 REST OF EUROPE

14.3 ASIA PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 AUSTRALIA AND NEW ZEALAND

14.3.6 SINGAPORE

14.3.7 THAILAND

14.3.8 MALAYSIA

14.3.9 INDONESIA

14.3.10 PHILIPPINES

14.3.11 TAIWAN

14.3.12 VIETNAM

14.3.13 REST OF ASIA PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 COLOMBIA

14.4.4 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 U.A.E

14.5.5 ISRAEL

14.5.6 QATAR

14.5.7 KUWAIT

14.5.8 REST OF MIDDLE EAST AND AFRICA

14.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.4 COMPANY SHARE ANALYSIS: EUROPE

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL PATIENT ENGAGEMENT TECHNOLOGY MARKET, COMPANY PROFILE

17.1 ALLSCRIPTS HEALTHCARE LLC

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ADVANCEDMD, INC.

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 NUANCE

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 WEAVE

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 LUMA HEALTH

17.6 SOLUTIONREACH

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 OHMD, INC.

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 REVENUEWELL

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 UPDOX

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 RXNT

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 ATHENAHEALTH

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 NXGN MANAGEMENT, LLC

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 CISCO

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 IBM

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 MODERNIZING MEDICINE

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 NEXUS CLINICAL LLC

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 PROGNOCIS

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 NET HEALTH

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 DOCVILLA

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 CARECLOUD

17.20.1 COMPANY OVERVIEW

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 MEND VIP, INC.

17.21.1 COMPANY OVERVIEW

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 KLARA TECHNOLOGIES, INC

17.22.1 COMPANY OVERVIEW

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 TATA CONSULTANCY SERVICES LIMITED

17.23.1 COMPANY OVERVIEW

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.