Global Patient Registry Software Market

Market Size in USD Billion

CAGR :

%

USD

2.43 Billion

USD

5.64 Billion

2025

2033

USD

2.43 Billion

USD

5.64 Billion

2025

2033

| 2026 –2033 | |

| USD 2.43 Billion | |

| USD 5.64 Billion | |

|

|

|

|

Patient Registry Software Market Size

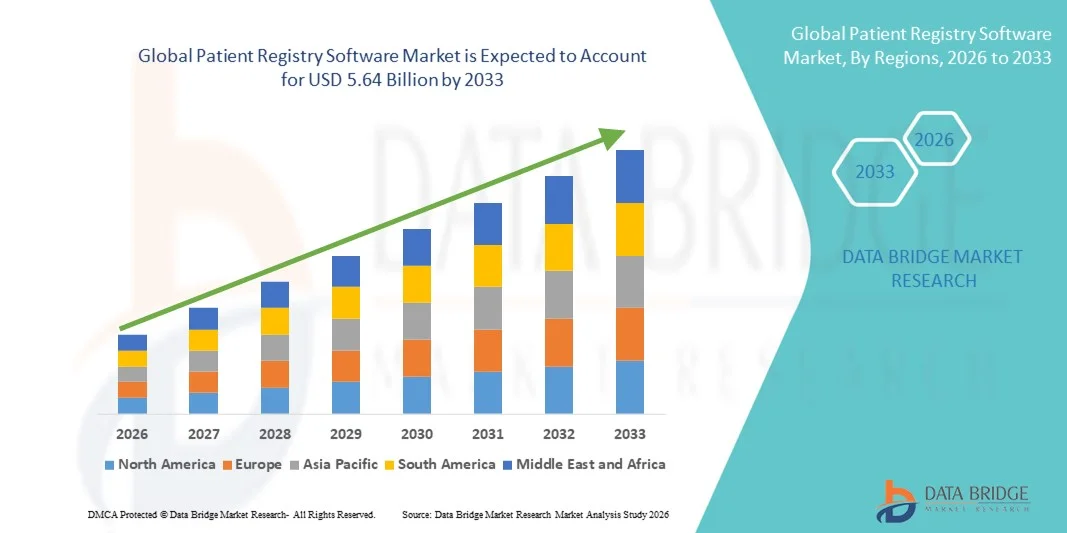

- The global patient registry software market size was valued at USD 2.43 billion in 2025 and is expected to reach USD 5.64 billion by 2033, at a CAGR of 11.12% during the forecast period

- The market growth is largely fueled by the increasing focus on real-world evidence generation, regulatory compliance requirements, and the growing adoption of digital health records and data-driven healthcare systems across hospitals, research institutes, and pharmaceutical companies

- Furthermore, rising demand for efficient data collection, long-term patient outcome tracking, and population health management solutions is positioning patient registry software as a critical tool for clinical research, post-marketing surveillance, and value-based care initiatives. These converging factors are accelerating the adoption of advanced registry platforms, thereby significantly boosting the industry's growth

Patient Registry Software Market Analysis

- Patient registry software, designed to systematically collect, manage, and analyze patient data for specific diseases, conditions, or treatments, is becoming an essential component of modern healthcare systems across hospitals, research organizations, and life sciences companies due to its ability to support real-world evidence generation, regulatory reporting, and long-term outcome tracking

- The escalating demand for patient registry software is primarily fueled by the growing emphasis on value-based care, increasing clinical research activities, rising prevalence of chronic diseases, and the need for efficient data management solutions that ensure regulatory compliance and interoperability with electronic health record systems

- North America dominated the patient registry software market with the largest revenue share of 39.78% in 2025, characterized by advanced healthcare IT infrastructure, strong government support for digital health initiatives, and significant investments in clinical research, with the U.S. witnessing substantial adoption among hospitals, academic research centers, and pharmaceutical companies for post-marketing surveillance and population health management

- Asia-Pacific is expected to be the fastest growing region in the patient registry software market during the forecast period due to expanding healthcare infrastructure, increasing digitization of medical records, and growing investments in clinical trials across emerging economies

- Cloud-based segment dominated the patient registry software market with a market share of 45.6% in 2025, driven by its scalability, cost-effectiveness, enhanced data accessibility, and ability to support multi-center collaborations across geographically dispersed healthcare providers

Report Scope and Patient Registry Software Market Segmentation

|

Attributes |

Patient Registry Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Patient Registry Software Market Trends

Advancing Real-World Evidence Generation Through AI and Cloud Integration

- A significant and accelerating trend in the global patient registry software market is the deepening integration with artificial intelligence (AI), advanced analytics platforms, and cloud-based health ecosystems, significantly enhancing data accuracy, interoperability, and real-time clinical insights across healthcare networks

- For instance, Oracle Health (Cerner) has integrated advanced analytics capabilities within its registry platforms to support population health management, while IQVIA leverages AI-driven tools to enhance real-world evidence generation and regulatory reporting processes

- AI integration in patient registry software enables automated data extraction from electronic health records, predictive analytics for disease progression, and intelligent alerts for patient risk stratification. For instance, certain registry platforms utilize machine learning algorithms to identify care gaps and generate actionable insights for clinicians, while cloud-based systems facilitate seamless multi-center data collaboration and remote access

- The seamless integration of registry platforms with electronic health records, clinical trial management systems, and broader digital health infrastructures facilitates centralized and standardized data governance. Through unified dashboards, stakeholders can manage patient cohorts, monitor outcomes, and streamline reporting processes across institutions, creating a more connected and evidence-driven healthcare environment

- This trend toward more intelligent, scalable, and interoperable registry systems is fundamentally reshaping expectations for clinical data management and regulatory compliance. Consequently, companies such as IQVIA are developing AI-enabled registry solutions with enhanced automation, real-time analytics, and global data standardization capabilities

- The demand for patient registry software offering seamless AI-driven analytics, interoperability, and cloud integration is growing rapidly across healthcare providers, research institutions, and pharmaceutical companies, as organizations increasingly prioritize data-driven decision-making and long-term patient outcome tracking

Patient Registry Software Market Dynamics

Driver

Growing Demand Due to Expansion of Value-Based Care and Clinical Research Activities

- The increasing global shift toward value-based care models, combined with rising clinical research and post-marketing surveillance requirements, is a significant driver for the heightened demand for patient registry software solutions

- For instance, in recent years, IQVIA has expanded its real-world evidence and registry service offerings to support pharmaceutical companies in regulatory submissions and long-term safety monitoring, strengthening the role of registry platforms in drug lifecycle management

- As healthcare providers and regulators emphasize outcome measurement and quality improvement, patient registry software offers structured data capture, longitudinal tracking, automated reporting, and regulatory compliance support, providing a critical upgrade over fragmented manual data systems

- Furthermore, the growing digitization of healthcare systems and widespread adoption of electronic health records are making registry platforms an integral component of integrated healthcare IT ecosystems, enabling interoperability and coordinated care delivery

- The rising prevalence of chronic and rare diseases worldwide is significantly driving the need for long-term longitudinal data collection platforms, as healthcare systems seek comprehensive registries to support disease management programs and precision medicine initiatives

- The ability to monitor patient populations, support rare disease research, and facilitate multi-center collaborations through centralized digital platforms is a key factor propelling adoption among hospitals, academic institutions, and life sciences companies. The rising focus on evidence-based medicine and reimbursement optimization further contributes to sustained market growth

Restraint/Challenge

Data Privacy Concerns and Regulatory Compliance Complexities

- Concerns surrounding patient data privacy, cybersecurity risks, and compliance with stringent healthcare regulations pose significant challenges to broader market adoption. As registry platforms handle sensitive health information, they must adhere to strict regional and international data protection frameworks

- For instance, evolving regulations such as GDPR in Europe and HIPAA requirements in the United States have increased compliance burdens for healthcare IT vendors and providers, sometimes slowing implementation timelines for registry systems

- Addressing these concerns through robust encryption standards, secure data hosting environments, and continuous regulatory updates is crucial for building stakeholder trust. Companies such as Oracle Health and IQVIA emphasize advanced security architectures and compliance certifications to reassure clients. In addition, the high implementation and customization costs of comprehensive registry platforms can be a barrier for smaller healthcare facilities, particularly in emerging economies with limited IT budgets

- While cloud-based deployment models are gradually improving affordability and scalability, the complexity of integrating registry software with legacy hospital information systems can still hinder seamless adoption in certain regions

- Limited technical expertise and resistance to workflow changes among healthcare professionals can slow implementation and effective utilization of registry platforms, particularly in smaller institutions transitioning from paper-based or fragmented digital systems

- Overcoming these challenges through strengthened cybersecurity frameworks, harmonized global data standards, and cost-effective deployment strategies will be vital for ensuring sustainable and long-term growth of the patient registry software market

Patient Registry Software Market Scope

The market is segmented on the basis of type, software, pricing model, deployment model, database, functionality, and end use.

- By Type

On the basis of type, the patient registry software market is segmented into disease registries, health service registries, and product registries. The disease registries segment dominated the market with the largest revenue share in 2025, driven by the growing prevalence of chronic and rare diseases worldwide. These registries enable long-term patient tracking, support regulatory reporting, and provide structured data for clinical research. Healthcare providers and pharmaceutical companies rely on disease registries to monitor patient outcomes and treatment efficacy across multiple centers. The integration of disease registries with electronic health records ensures standardized data collection and improves interoperability. In addition, government initiatives to enhance public health monitoring further strengthen the adoption of disease registries.

The health service registries segment is expected to witness the fastest growth from 2026 to 2033 due to the expansion of value-based care programs and the need for comprehensive service utilization data. Health service registries allow hospitals and payers to evaluate quality metrics, optimize resource allocation, and enhance patient care delivery. Their integration with digital health platforms and EHR systems enables seamless data exchange and better care coordination. The segment also benefits from increasing investments in healthcare IT infrastructure and multi-center collaborations. Rising demand for performance-based healthcare assessments and outcome measurement drives adoption across developed and emerging markets.

- By Software

On the basis of software, the market is segmented into standalone and integrated solutions. The integrated software segment dominated the market in 2025, driven by its ability to connect with EHRs, clinical trial management systems, and analytics platforms. Integrated solutions reduce data duplication, improve workflow efficiency, and enable comprehensive reporting for regulatory compliance and population health management. Healthcare providers prefer integrated systems for centralized data governance and scalable analytics capabilities. Pharmaceutical companies also leverage integrated registries for post-marketing surveillance and real-world evidence generation. The growing emphasis on interoperability and multi-center collaboration supports further adoption of integrated registry software.

The standalone software segment is expected to witness the fastest growth during the forecast period due to its flexibility, cost-effectiveness, and ease of deployment for specialized registry projects. Standalone solutions are ideal for research institutions, rare disease registries, and clinical studies where customization is required. These solutions allow rapid implementation without heavy IT integration and support focused data collection for specific patient cohorts. Standalone software also facilitates targeted reporting for regulatory submissions and clinical trial endpoints. Organizations benefit from the ability to scale functionality based on study needs. Growing demand for customizable and modular solutions is accelerating the adoption of standalone registry software.

- By Pricing Model

On the basis of pricing model, the market is segmented into subscription and ownership models. The subscription model dominated the market in 2025, driven by the increasing adoption of SaaS-based platforms that reduce upfront investment costs. Subscription models allow continuous software updates, cloud access, and scalability across multiple sites. They enable real-time collaboration, remote monitoring, and multi-center data collection. Hospitals, research centers, and pharmaceutical companies prefer subscription models for predictable operational expenses and flexible access. The subscription model also supports AI-based analytics and interoperability with EHR systems, enhancing overall registry value.

The ownership model is expected to witness the fastest growth during the forecast period as large healthcare organizations seek full control over data security, storage, and customization. Ownership models are preferred where sensitive patient data requires localized hosting or strict regulatory compliance. These models allow organizations to fully integrate the software with legacy IT systems and customize workflows. Ownership also supports long-term cost efficiencies for large-scale deployments. Institutions gain complete governance over patient data and analytics processes, which is critical for compliance-heavy environments.

- By Deployment Model

On the basis of deployment model, the market is segmented into on-premise and cloud-based solutions. The cloud-based segment dominated the market in 2025 with a market share of 45.6%, driven by the scalability, centralized access, and cost-efficiency of cloud deployments. Cloud-based registries allow real-time data access across multiple locations and support multi-center collaborations. They reduce infrastructure costs and simplify maintenance while ensuring compliance with security regulations. Cloud solutions enable remote monitoring, automated reporting, and integration with AI-driven analytics tools. Healthcare providers and pharmaceutical companies increasingly prefer cloud deployment for evidence generation and population health management. The segment benefits from rapid digital transformation in healthcare worldwide.

The on-premise segment is expected to witness the fastest growth during the forecast period due to rising concerns over data privacy, regulatory compliance, and localized control of patient information. On-premise deployment allows institutions to store sensitive data within their own infrastructure and maintain strict access controls. Hospitals with established IT systems prefer on-premise solutions for deep customization and integration with legacy platforms. On-premise registries also allow tailored workflows for large-scale clinical trials and research studies. The segment is growing in regions with strict regulatory frameworks and high emphasis on data sovereignty.

- By Database

On the basis of database, the market is segmented into commercial and public databases. The commercial database segment dominated the market in 2025, driven by its high-quality, validated data that supports clinical research, post-marketing surveillance, and regulatory compliance. Commercial databases offer advanced analytics, AI insights, and secure access, making them ideal for pharmaceutical and biotech companies. Hospitals leverage these databases for improved patient care management and population health analytics. They also support real-world evidence generation for clinical trials and drug development. The reliability, standardization, and security of commercial databases drive widespread adoption.

The public database segment is expected to witness the fastest growth during the forecast period due to government initiatives encouraging open-access registries for epidemiology, policy-making, and disease surveillance. Public databases facilitate cross-institution collaboration, promote transparency, and reduce duplication of data collection efforts. Researchers and healthcare providers use these databases to analyze population health trends and monitor disease progression. Cloud integration and AI analytics enhance the usability of public registries. Expanding healthcare infrastructure in emerging markets also fuels adoption of public databases.

- By Functionality

On the basis of functionality, the market is segmented into population health management (PHM), patient care management, health information exchange, point-of-care solutions, product outcome evaluation, and medical research & clinical studies. The PHM segment dominated the market in 2025, driven by the need to improve patient outcomes, manage chronic diseases, and optimize resource utilization. PHM registries enable predictive analytics, risk stratification, and care coordination. Hospitals, payers, and research organizations leverage PHM functionality for value-based care programs. These solutions facilitate longitudinal patient monitoring and automated reporting. Integration with EHR systems enhances PHM effectiveness across multi-center networks.

The medical research & clinical studies segment is expected to witness the fastest growth during the forecast period due to the rising number of clinical trials, regulatory requirements for post-marketing surveillance, and demand for real-world evidence. Registries in this segment enable standardized data collection, longitudinal patient tracking, and multi-center collaboration. They support drug development, safety monitoring, and evidence-based decision-making. AI-driven analytics and cloud integration further enhance research capabilities. Pharmaceutical and biotech companies are increasingly investing in registry platforms for large-scale studies.

- By End Use

On the basis of end use, the market is segmented into government organizations & third-party administrators, hospitals & medical practices, private payers, pharmaceutical, biotechnology & medical device companies, and research centers. The hospitals & medical practices segment dominated the market in 2025, driven by the need for integrated patient data management, improved clinical workflows, and compliance with reporting requirements. Hospitals leverage registries to track patient outcomes, monitor treatments, and manage chronic disease programs. Integration with EHRs supports centralized data governance and multi-center collaboration. The segment benefits from digital health adoption and population health initiatives.

The pharmaceutical, biotechnology & medical device companies segment is expected to witness the fastest growth during the forecast period due to increasing clinical trials, post-marketing surveillance, and real-world evidence generation. Registries allow these companies to monitor long-term product outcomes, support regulatory submissions, and optimize drug development. Cloud-based and AI-enabled platforms further enhance collaboration and data analytics. Growth is also fueled by rising investments in rare disease and specialty therapy research. Multi-country registry adoption supports global regulatory compliance and market expansion.

Patient Registry Software Market Regional Analysis

- North America dominated the patient registry software market with the largest revenue share of 39.78% in 2025, characterized by advanced healthcare IT infrastructure, strong government support for digital health initiatives, and significant investments in clinical research

- Healthcare providers, research centers, and pharmaceutical companies in the region prioritize patient registry software for real-world evidence generation, clinical trial support, and long-term patient outcome tracking

- This widespread adoption is further supported by high healthcare expenditure, government initiatives promoting electronic health records, and the growing emphasis on value-based care, establishing patient registry software as a critical tool for hospitals, payers, and life sciences organizations

The U.S. Patient Registry Software Market Insight

The U.S. patient registry software market captured the largest revenue share of 82% in 2025 within North America, driven by advanced healthcare IT infrastructure and widespread adoption of electronic health records. Healthcare providers, research institutions, and pharmaceutical companies are increasingly prioritizing registry platforms for real-world evidence generation, post-marketing surveillance, and longitudinal patient outcome tracking. The rising trend of value-based care and government initiatives promoting interoperability and clinical data standardization further propels market growth. Moreover, AI-enabled analytics, cloud-based deployment, and integration with clinical trial management systems are enhancing operational efficiency. The growing focus on rare disease research and multi-center collaborations is also expanding the demand for specialized registry solutions. Consequently, the U.S. remains the dominant hub for patient registry software adoption in North America.

Europe Patient Registry Software Market Insight

The Europe patient registry software market is projected to expand at a significant CAGR throughout the forecast period, driven by stringent healthcare regulations and increasing emphasis on evidence-based care. Government initiatives supporting national and regional health registries are promoting the adoption of digital platforms for disease tracking, clinical research, and population health management. Increasing investments in healthcare IT infrastructure and integration with electronic health records are also boosting market growth. European healthcare providers and pharmaceutical companies are adopting registries to ensure compliance, optimize patient outcomes, and facilitate multi-center studies. The rising focus on chronic disease management and health system digitization is further contributing to market expansion across residential and hospital settings.

U.K. Patient Registry Software Market Insight

The U.K. patient registry software market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the government’s support for digital health initiatives and the NHS’s push for centralized patient data systems. Hospitals, research centers, and pharmaceutical companies increasingly rely on registry platforms for clinical trial support, post-marketing surveillance, and longitudinal patient outcome tracking. The rising prevalence of chronic and rare diseases is driving adoption, as registries provide structured data for regulatory compliance and research purposes. In addition, integration with EHR systems and cloud-based platforms is enhancing real-time accessibility and interoperability. Growing awareness of value-based care models and patient-centric approaches further stimulates demand for robust registry solutions.

Germany Patient Registry Software Market Insight

The Germany patient registry software market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of healthcare digitization and stringent data protection regulations. Hospitals and research institutions are adopting registry solutions to monitor patient outcomes, support clinical studies, and comply with EU and national regulatory standards. Germany’s well-developed healthcare infrastructure, focus on innovation, and government-backed programs for chronic disease monitoring promote registry adoption. Integration with electronic health records, AI-driven analytics, and secure cloud deployment is becoming increasingly prevalent. The emphasis on privacy-focused, compliant solutions aligns with local expectations, particularly in multi-center and longitudinal patient studies.

Asia-Pacific Patient Registry Software Market Insight

The Asia-Pacific patient registry software market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing healthcare digitization, urbanization, and rising investments in clinical research across countries such as China, Japan, and India. Governments are promoting national and regional registries to improve disease surveillance, patient outcomes, and policy-making. The growing adoption of electronic health records and AI-enabled analytics enhances the utility of registry platforms in hospitals, research centers, and pharmaceutical companies. Expanding healthcare infrastructure and digital health initiatives support multi-center collaborations. In addition, increasing awareness of value-based care and rare disease tracking is further accelerating the adoption of patient registry software in the region.

Japan Patient Registry Software Market Insight

The Japan patient registry software market is gaining momentum due to the country’s advanced healthcare infrastructure, high-tech culture, and demand for precise patient data management. Hospitals, research centers, and life sciences companies increasingly use registries for real-world evidence generation, clinical trial support, and population health monitoring. Integration with EHRs, AI analytics, and cloud platforms enhances longitudinal patient tracking and operational efficiency. Japan’s aging population drives demand for monitoring chronic disease outcomes and providing better care coordination. The country’s emphasis on data security and regulatory compliance ensures adoption of robust and standardized registry solutions. Multi-center and cross-institution collaborations further expand market growth.

India Patient Registry Software Market Insight

The India patient registry software market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to expanding healthcare infrastructure, rapid urbanization, and increasing adoption of digital health solutions. Hospitals, research centers, and pharmaceutical companies are increasingly leveraging registry platforms for post-marketing surveillance, clinical trials, and population health management. Government initiatives supporting digital health and smart hospital programs are accelerating adoption. Affordable cloud-based solutions and the growing number of domestic IT vendors further enhance accessibility. Rising awareness of rare disease tracking and value-based care models drives demand for specialized registry solutions. The combination of technological readiness, supportive policies, and growing clinical research activities propels the Indian market forward.

Patient Registry Software Market Share

The Patient Registry Software industry is primarily led by well-established companies, including:

- ImageTrend (U.S.)

- Global Vision Technologies (U.S.)

- Dacima Software Inc. (Canada)

- Evado Clinical Pty Ltd (Australia)

- FIGmd Inc. (U.S.)

- M2S Industries (U.S.)

- IQVIA Holdings Inc. (U.S.)

- Optum, Inc. (U.S.)

- McKesson Corporation (U.S.)

- Syneos Health Inc. (U.S.)

- Advarra Inc. (U.S.)

- OpenText Corporation (Canada)

- Premier Inc. (U.S.)

- Advera Health Analytics (U.S.)

- ArborMetrix Inc. (U.S.)

- Medrio Inc. (U.S.)

- OM1 Inc. (U.S.)

- Open Registry (U.S.)

- Orion Health Corp. (New Zealand)

- IFA Systems AG (Switzerland)

What are the Recent Developments in Global Patient Registry Software Market?

- In February 2025, Harmony Healthcare IT announced the launch of ClearWay, an AI‑powered platform designed to automate clinical data abstraction and registry submission, significantly reducing abstraction time by up to 80% and enhancing operational efficiency for registry workflows

- In June 2024, OM1 unveiled its Registries Center of Excellence, a specialized hub offering expert consultation, design support, and advanced analytics capabilities to streamline patient registry operations and evidence generation in real‑world research and clinical studies

- In April 2023, OM1 rolled out a new AI‑based real‑world evidence (RWE) platform to help deliver personalized insights on diagnosis, treatment paths, clinical trials, and outcomes, supporting enhanced registry capabilities for clinical and research applications

- In February 2023, the Polycystic Kidney Disease (PKD) Foundation partnered with IQVIA to develop the ADPKD Registry, aimed at tracking longitudinal quality‑of‑life data to support research and improve disease management using interoperable EHR data

- In July 2021, OM1 launched a Multiple Sclerosis (MS) Registry that enrolled more than 20,000 patients to collect deep clinical data for research and trial planning, marking one of the largest condition‑specific registry initiatives at the time

- https://www.harmonyhit.com/harmony-healthcare-it-launches-clearway-to-revolutionize-clinical-data-abstraction-and-registry-submission-process/

- https://www.businesswire.com/news/home/20240613534316/en/OM1-a-Pioneer-in-Patient-Registries-Launches-Its-Registries-Center-of-Excellence

- https://www.clinicaltrialsarena.com/news/om1-personalised-medicine/

- https://www.pharmiweb.com/press-release/2025-05-08/global-patient-registry-software-market-key-drivers-behind-the-11-14-cagr-growth-by-2027

- https://www.7wireventures.com/news/om1-launches-multiple-sclerosis-registry-with-more-than-20000-patients-prospectively-followed-with-deep-clinical-data/

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.