Global Payment Processor Market

Market Size in USD Billion

CAGR :

%

USD

54.32 Billion

USD

110.00 Billion

2024

2032

USD

54.32 Billion

USD

110.00 Billion

2024

2032

| 2025 –2032 | |

| USD 54.32 Billion | |

| USD 110.00 Billion | |

|

|

|

|

Payment Processor Market Size

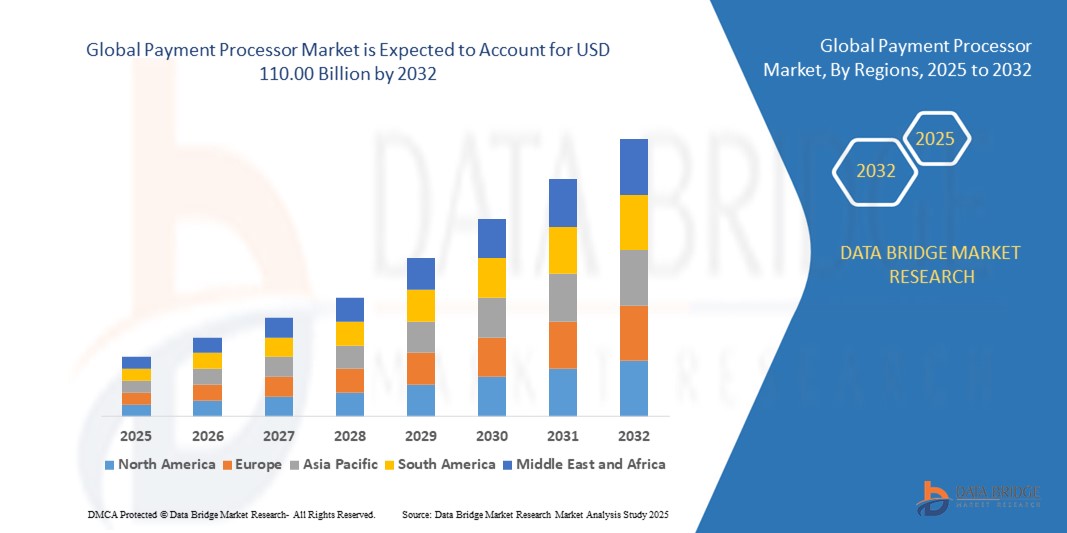

- The global payment processor market size was valued at USD 54.32 billion in 2024 and is expected to reach USD 110.00 billion by 2032, at a CAGR of 9.22% during the forecast period

- The market growth is largely fueled by the rising adoption of digital payment methods and rapid technological advancements in financial services infrastructure, leading to increased transaction volumes across retail, e-commerce, and service-based sectors

- Furthermore, growing consumer demand for fast, secure, and frictionless payment experiences is driving businesses to adopt integrated payment processor solutions that support omnichannel commerce, real-time settlements, and enhanced fraud prevention. These converging factors are significantly boosting the industry's growth

Payment Processor Market Analysis

- Payment processors are technology platforms that facilitate the authorization, routing, and settlement of electronic transactions between consumers, merchants, and financial institutions. These systems support a wide range of payment methods including cards, wallets, ACH, and real-time payments across multiple channels

- The expanding payment processor market is driven by increased digital commerce, government initiatives promoting cashless economies, and the growing reliance on secure, scalable, and data-driven payment infrastructures across industries

- North America dominated the payment processor market with a share of 32.2% in 2024, due to the high volume of digital transactions, early adoption of advanced fintech solutions, and a well-established e-commerce infrastructure

- Asia-Pacific is expected to be the fastest growing region in the payment processor market during the forecast period due to rapid growth in mobile internet usage, expanding e-commerce landscape, and favorable government policies for digital inclusion

- Cloud based segment dominated the market with a market share of 59.1% in 2024, due to the scalability, cost-effectiveness, and ease of integration that cloud platforms offer. Payment processors are increasingly leveraging cloud infrastructure to enhance transaction speed, enable real-time analytics, and support global payment gateways. Cloud-based deployment also facilitates seamless upgrades, robust data security frameworks, and easier compliance with evolving regulatory standards, making it highly attractive to businesses of all sizes

Report Scope and Payment Processor Market Segmentation

|

Attributes |

Payment Processor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Payment Processor Market Trends

Integration of AI and Machine Learning in Payment Processing

- The payment processor market is experiencing major transformation as providers increasingly embed artificial intelligence (AI) and machine learning (ML) into transaction monitoring, fraud detection, and personalized payment experiences, set to boost accuracy, speed, and security

- For instance, industry leaders such as Stripe, Adyen, Worldpay, and Fiserv are leveraging advanced AI algorithms to assess behavioral patterns, flag suspicious activity in real time, automate chargeback management, and enable dynamic risk scoring for merchants, resulting in lower fraud rates and better operational efficiency

- Machine learning tools support adaptive authentication, seamless checkout flows, and automated compliance, enhancing both merchant operations and user satisfaction

- Embedded AI enables payment processors to personalize offers, recommend optimal payment routes, anticipate user needs, and optimize transaction costs at scale

- The use of predictive analytics streamlines onboarding, improves underwriting decisions for merchant account approvals, and supports revenue maximization for platforms and marketplaces

- The continuous evolution of AI/ML technologies ensures competitive differentiation, frequent system updates, and the ability to rapidly respond to emerging fraud vectors and regulatory requirements

Payment Processor Market Dynamics

Driver

Intervention and Rapid Adoption of Emerging Technologies

- Rapid advancements in technology—including mobile payments, contactless transactions, NFC, biometric authentication, and blockchain—are accelerating adoption of payment processing solutions across retail, digital commerce, and omnichannel environments

- For instance, payment processors such as Global Payments and PayPal are at the forefront of rolling out tap-to-pay, digital wallet integration, crypto acceptance, and real-time cross-border payment support to satisfy evolving consumer expectations for convenience and flexibility

- The proliferation of e-commerce, expansion of point-of-sale (POS) infrastructure, and digitization of small and medium businesses (SMEs) further fuel demand for integrated, automated, and secure payment processing services

- Open banking initiatives, API-driven platforms, and embedded finance facilitate seamless connectivity between merchants, consumers, banks, and fintech apps—powering new payment experiences and revenue streams

- Payment ecosystem innovation enables merchants to accept a broader range of payment types—including cards, wallets, and emerging payment methods—improving global reach and catering to diverse customer segments

Restraint/Challenge

Rising Security Concerns

- Rising complexity in payment ecosystems, coupled with the increasing frequency and sophistication of cyber threats, presents significant security challenges for payment processors who must guard against data breaches, fraud, and regulatory non-compliance

- For instance, high-profile breaches or coordinated cyberattacks can expose sensitive payment information or disrupt transaction flows, requiring firms such as Adyen and Fiserv to invest continuously in tokenization, end-to-end encryption, PCI DSS compliance, and AI-powered fraud prevention

- Global expansion introduces regional security regulations and data protection laws, creating operational complexity and mandating continual system upgrades

- The surge in CNP (card-not-present) transactions, particularly in e-commerce, amplifies exposure to phishing, credential stuffing, and synthetic fraud attacks

- Merchant and consumer trust hinges upon the ability of processors to deliver frictionless yet secure experiences, demanding transparency, real-time alerts, and robust dispute resolution processes

Payment Processor Market Scope

The market is segmented on the basis of payment method, deployment mode, and end-user vertical.

- By Payment Method

On the basis of payment method, the payment processor market is segmented into debit card, credit card, e-wallet, automated clearing house (ACH), and others. The credit card segment accounted for the largest market revenue share in 2024, primarily due to the widespread acceptance of credit card payments across both physical and digital commerce environments. Credit cards remain a preferred mode of payment among consumers for their benefits such as rewards, cashback, and credit limits. Merchants also favor credit card transactions for their high transaction success rates and global interoperability. The reliability and integration of credit card processing with fraud prevention tools and chargeback systems contribute to their dominance in the market.

The e-wallet segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by increasing smartphone penetration, rising consumer preference for contactless transactions, and the growing ecosystem of mobile payment apps. E-wallets offer unmatched convenience, especially for online and peer-to-peer payments, and are supported by value-added features such as transaction alerts, QR code scanning, and loyalty integration. Their rapid adoption in emerging economies and alignment with digital banking trends make them a major growth catalyst in the payment processor industry.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into on-premises and cloud-based. The cloud-based segment held the largest market revenue share of 59.1% in 2024, fueled by the scalability, cost-effectiveness, and ease of integration that cloud platforms offer. Payment processors are increasingly leveraging cloud infrastructure to enhance transaction speed, enable real-time analytics, and support global payment gateways. Cloud-based deployment also facilitates seamless upgrades, robust data security frameworks, and easier compliance with evolving regulatory standards, making it highly attractive to businesses of all sizes.

The on-premises segment is expected to witness steady growth, particularly in organizations with strict data residency requirements and legacy system dependencies. Industries such as government, defense, and highly regulated financial institutions often prefer on-premises solutions to maintain direct control over sensitive data and comply with region-specific legal mandates. This deployment model allows enterprises to customize infrastructure according to their internal policies and integrate with existing legacy systems. It also offers enhanced control over access management, system updates, and security configurations. While operational costs are typically higher, the perceived advantages in security and compliance continue to drive adoption. Thus, on-premises deployment remains a viable choice for businesses prioritizing data sovereignty and infrastructure control..

- By End User Vertical

On the basis of end user vertical, the market is segmented into banking financial services and insurance (BFSI), government and utilities, telecom and IT, healthcare, real estate, retail and e-commerce, media and entertainment, travel and hospitality, and others. The BFSI segment captured the largest revenue share in 2024, as financial institutions increasingly invest in robust payment processing systems to manage growing transaction volumes and improve customer experience. Advanced fraud detection, instant settlement capabilities, and API-driven platforms are key differentiators in the BFSI sector. Regulatory compliance, data transparency, and system reliability are paramount, prompting banks and insurers to prioritize cutting-edge processing technologies.

The retail and e-commerce segment is projected to experience the fastest growth from 2025 to 2032, propelled by the surge in online shopping, omnichannel commerce, and mobile payment options. Retailers demand seamless, real-time transaction processing with multi-currency support and integrated customer engagement features such as loyalty tracking and personalized offers. The expansion of global e-commerce platforms and direct-to-consumer models is driving merchants to adopt flexible and secure payment processor solutions at scale.

Payment Processor Market Regional Analysis

- North America dominated the payment processor market with the largest revenue share of 32.2% in 2024, driven by the high volume of digital transactions, early adoption of advanced fintech solutions, and a well-established e-commerce infrastructure

- Businesses and consumers in the region increasingly rely on secure, efficient, and real-time payment processing solutions, supported by widespread credit card usage, mobile wallet adoption, and high-speed internet penetration

- The region's strong regulatory frameworks, along with the presence of major financial institutions and payment technology providers, continue to support the widespread adoption of innovative processing platforms across various industries

U.S. Payment Processor Market Insight

The U.S. payment processor market captured the largest revenue share in 2024 within North America, fueled by a surge in cashless transactions and continuous innovation in digital payment technologies. The presence of leading fintech players, along with strong consumer demand for contactless payments, digital wallets, and buy-now-pay-later services, is driving rapid market expansion. Increased reliance on cloud-based processing platforms, driven by real-time data analytics, API integrations, and AI-powered fraud detection, continues to enhance market efficiency and security across sectors such as retail, BFSI, and healthcare.

Europe Payment Processor Market Insight

The Europe payment processor market is projected to grow at a notable CAGR over the forecast period, supported by strong regulatory backing for digital payments and the rollout of pan-European payment initiatives. The transition away from cash, combined with robust e-commerce penetration, is fueling demand for reliable, multi-channel payment processing solutions. European businesses are adopting advanced processors to meet growing consumer expectations for speed, security, and omnichannel support, particularly in sectors such as retail, government, and telecom.

U.K. Payment Processor Market Insight

The U.K. payment processor market is expected to expand significantly during the forecast period, driven by rising consumer preference for mobile and contactless payments. The U.K.’s open banking framework and fintech-friendly environment are fostering the rapid deployment of innovative payment processing solutions. With a tech-savvy population and a highly digitized retail ecosystem, the demand for seamless and secure transaction platforms continues to rise across both online and in-store channels.

Germany Payment Processor Market Insight

The Germany payment processor market is projected to grow at a strong CAGR, bolstered by increasing digitalization in financial services and a steady shift towards cashless payments. The market benefits from Germany’s robust banking sector, expanding e-commerce industry, and rising consumer confidence in digital financial tools. Businesses are embracing processing solutions that ensure data protection, compliance with EU regulations, and integration with enterprise systems, fueling further adoption.

Asia-Pacific Payment Processor Market Insight

The Asia-Pacific payment processor market is expected to witness the fastest CAGR from 2025 to 2032, led by the digital transformation of economies such as China, India, and Southeast Asian countries. The rapid growth in mobile internet usage, expanding e-commerce landscape, and favorable government policies for digital inclusion are accelerating the adoption of advanced payment processors. The region’s thriving fintech ecosystem and increasing demand for real-time, cross-border payment solutions are further propelling market growth.

Japan Payment Processor Market Insight

The Japan payment processor market is gaining traction due to the country’s steady movement toward a cashless society and its strong focus on convenience and security. Japan’s payment processing infrastructure is evolving to support mobile wallets, QR-code payments, and integrated point-of-sale systems. The government's cashless initiatives and the growing use of digital platforms in transportation, retail, and hospitality sectors are key drivers of market expansion.

China Payment Processor Market Insight

The China payment processor market held the largest revenue share in the Asia-Pacific region in 2024, driven by the dominance of mobile payments and strong penetration of digital financial services. Platforms such as Alipay and WeChat Pay are deeply integrated into daily consumer life, driving massive volumes of real-time transactions. The government’s push for financial digitization and the rise of smart cities are further accelerating demand for agile, scalable, and secure processing solutions across urban and rural regions alike.

Payment Processor Market Share

The payment processor industry is primarily led by well-established companies, including:

- ACI Worldwide (U.S.)

- PayPal, Inc. (U.S.)

- Novatti Group Ltd (Australia)

- Global Payments Inc. (U.S.)

- Visa (U.S.)

- Stripe, Inc. (Ireland)

- Google, LLC (U.S.)

- Finastra. (U.K.)

- SAMSUNG (South Korea)

- Amazon Web Services, Inc. (U.S.)

- Financial Software & Systems Pvt. Ltd. (U.S.)

- Aurus Inc. (U.S.)

- Adyen (Netherlands)

- Apple Inc. (U.S.)

- Fiserv, Inc. (U.S.)

- WEX Inc. (U.S.)

- wirecard (U.S.)

- Mastercard. (U.S.)

Latest Developments in Global Payment Processor Market

- In August 2024, Razorpay launched Push Provisioning, a first-of-its-kind innovation in the Indian payments landscape, enabling merchants to tokenize customer cards at the point of issuance. This strategic move significantly enhances user onboarding and payment efficiency by boosting card activation rates by up to 40% and improving conversion rates by 5%. As the first player in the market to roll out this capability, Razorpay is setting a new standard for card-based digital transactions, reinforcing its position as a key enabler of secure and frictionless payment experiences in India

- In August 2024, Adyen, a global payment solutions leader, announced its expansion into India after receiving authorization from the Reserve Bank of India to function as an Online Payment Aggregator. This approval allows Adyen to process both domestic and cross-border transactions, enhancing its capabilities to serve global and local merchants in one of the world’s fastest-growing payment markets. The company also established a technology hub in Bengaluru to drive payment innovation, demonstrating its long-term commitment to strengthening India’s digital payment infrastructure and catering to a rapidly evolving consumer base

- In January 2020, PayPal Holdings Inc. entered into a strategic partnership with UnionPay International (UPI) to broaden their global acceptance networks. As part of the agreement, PayPal committed to enabling UnionPay card acceptance wherever PayPal is used. This collaboration opened up significant cross-border shopping opportunities for UnionPay cardholders and expanded PayPal’s international payment acceptance, especially in Asia, thereby boosting transaction volumes and merchant reach across both platforms

- In January 2020, PayU acquired a controlling stake in digital credit platform PaySense, marking a key consolidation in India’s consumer lending space. The deal included the integration of PayU’s LazyPay with PaySense to create a full-stack digital lending platform tailored for Indian consumers. This merger enhanced PayU’s capabilities in underwriting, risk assessment, and disbursal, positioning it to better serve the growing demand for quick, digital-first credit solutions in India’s expanding fintech ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.