Global Pc Peripheral Input Devices Market

Market Size in USD Billion

CAGR :

%

USD

53.88 Billion

USD

102.34 Billion

2024

2032

USD

53.88 Billion

USD

102.34 Billion

2024

2032

| 2025 –2032 | |

| USD 53.88 Billion | |

| USD 102.34 Billion | |

|

|

|

|

PC Peripheral Input Devices Market Size

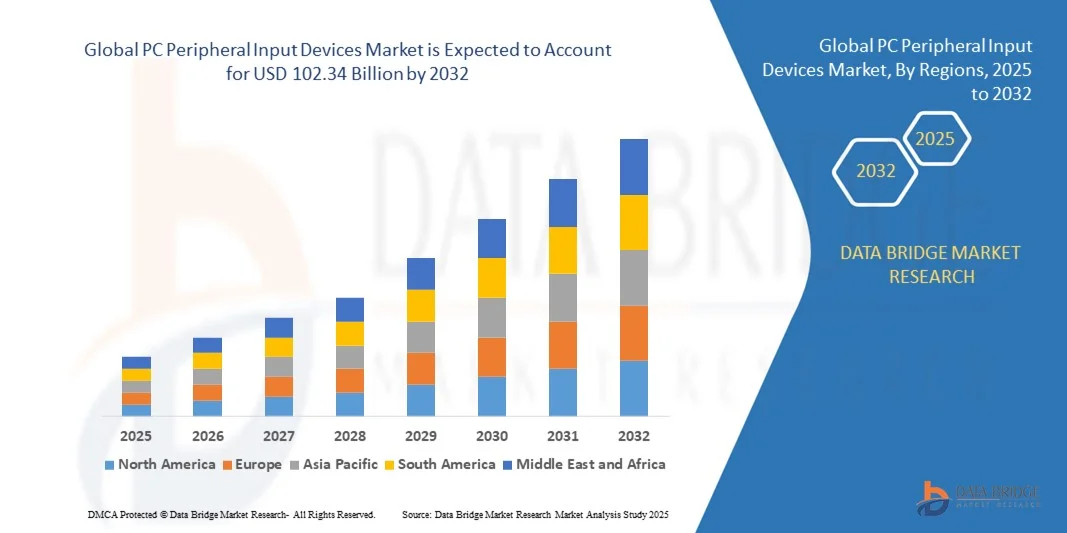

- The global PC peripheral input devices market size was valued at USD 53.88 billion in 2024 and is expected to reach USD 102.34 billion by 2032, at a CAGR of 8.35% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced computing accessories, increasing adoption of gaming peripherals, and the growing integration of wireless and ergonomic input devices

- Technological advancements such as AI-enabled features, customizable controls, and cloud-based connectivity are further driving the adoption of next-generation input devices

PC Peripheral Input Devices Market Analysis

- The market is witnessing strong growth due to the rising digital transformation across enterprises, expansion of the gaming and e-sports industry, and the continuous development of innovative products with enhanced precision, comfort, and connectivity

- Growing consumer preference for wireless keyboards, mice, and touchpads, coupled with advancements in sensor technologies, is boosting adoption across both professional and personal use cases

- North America dominated the PC peripheral input devices market with the largest revenue share of 39.8% in 2024, driven by the widespread adoption of advanced computing accessories in both professional and personal settings. The strong presence of leading manufacturers, coupled with rising demand for high-performance gaming peripherals and remote working tools, supports market growth in the region

- Asia-Pacific region is expected to witness the highest growth rate in the global PC peripheral input devices market, driven by increasing disposable incomes, rapid technological adoption in countries such as China, Japan, and India, and the strong presence of regional manufacturing hubs ensuring affordability and accessibility

- The PC segment held the largest market revenue share in 2024, driven by the rising demand for productivity-enhancing peripherals in both professional and educational settings. Keyboards, mice, and webcams tailored for office and remote work applications are seeing widespread adoption, supported by the expansion of hybrid work models and digital learning.

Report Scope and PC Peripheral Input Devices Market Segmentation

|

Attributes |

PC Peripheral Input Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

PC Peripheral Input Devices Market Trends

Growing Demand For Wireless And Ergonomic Peripherals

- The rapid adoption of wireless input devices such as keyboards, mice, and headsets is reshaping the PC peripherals landscape by providing users with enhanced flexibility and clutter-free workspaces. These devices allow seamless mobility, making them highly suitable for modern offices and gaming setups where comfort and convenience are priorities

- Rising demand for ergonomic peripherals is accelerating adoption among professionals and gamers seeking to reduce repetitive strain injuries and improve efficiency. Products such as split keyboards, vertical mice, and adjustable controllers are increasingly integrated into daily workflows, enhancing long-term user comfort

- Increasing affordability and availability of wireless devices across multiple price ranges are driving mass adoption in both developed and developing markets. This is enabling more frequent upgrades and wider acceptance of premium devices, boosting overall market penetration

- For instance, in 2023, several global PC accessory brands launched budget-friendly wireless keyboards and mice tailored for students and small businesses, resulting in stronger adoption across emerging economies. These devices combined affordability with reliable performance, meeting both productivity and educational needs

- While wireless and ergonomic peripherals are fueling growth, long-term success will depend on innovations in battery life, connectivity stability, and product durability. Manufacturers must continue to address these challenges to fully capture the expanding market demand

PC Peripheral Input Devices Market Dynamics

Driver

Rising Growth Of Gaming And E-Sports Industry

- The rapid expansion of the gaming and e-sports sector is significantly driving demand for high-performance peripherals such as gaming mice, mechanical keyboards, and specialized controllers. Competitive players and enthusiasts are prioritizing precision, speed, and customization, making advanced peripherals essential for gameplay

- Consumers are increasingly investing in gaming accessories that provide immersive experiences, such as RGB lighting, programmable keys, and high-DPI sensors. This trend is further amplified by the global popularity of streaming and online gaming communities, which boost visibility and influence consumer preferences

- Growing partnerships between peripheral manufacturers and e-sports organizations are fostering product innovation and marketing reach. Branded gear and tournament sponsorships are increasing adoption across both casual and professional gamers

- For instance, in 2022, leading global gaming tournaments partnered with peripheral manufacturers to supply advanced keyboards and headsets, driving heightened brand exposure and boosting sales of professional-grade devices worldwide

- While gaming peripherals are a major driver of market expansion, success relies on balancing affordability with innovation to cater to both high-end e-sports professionals and mainstream casual gamers

Restraint/Challenge

High Cost Of Premium Peripherals And Compatibility Limitations

- The elevated price of premium input devices such as mechanical keyboards, high-DPI gaming mice, and advanced VR controllers restricts access among cost-sensitive consumers, particularly in developing economies. Affordability remains a major barrier to widespread adoption of advanced peripherals

- Compatibility limitations also hinder adoption, as many peripherals require updated operating systems, specialized drivers, or proprietary connectivity solutions. This can deter users who face technical barriers or lack supporting hardware

- Distribution challenges in certain regions further restrict access to premium devices, with many markets still dominated by low-cost, wired alternatives. As a result, consumers in price-sensitive regions often delay upgrades or opt for basic models, limiting the penetration of advanced products

- For instance, in 2023, several small retailers across Latin America reported that premium gaming peripherals accounted for less than 15% of total sales, with consumers preferring lower-cost wired devices due to budget constraints and limited product availability

- While innovations continue to push the boundaries of design and performance, solving affordability and compatibility challenges remains critical. Manufacturers must focus on modular, cost-effective solutions and broader ecosystem integration to maximize long-term market growth

PC Peripheral Input Devices Market Scope

The market is segmented on the basis of device type and connectivity.

- By Device Type

On the basis of device type, the PC peripheral input devices market is segmented into PC and Gaming Consoles. The PC segment held the largest market revenue share in 2024, driven by the rising demand for productivity-enhancing peripherals in both professional and educational settings. Keyboards, mice, and webcams tailored for office and remote work applications are seeing widespread adoption, supported by the expansion of hybrid work models and digital learning.

The Gaming Consoles segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the booming global e-sports industry, increasing sales of gaming consoles, and the rising popularity of immersive peripherals such as gaming controllers, joysticks, and VR-enabled devices. Enhanced demand for high-precision accessories among competitive and casual gamers is set to drive segment expansion.

- By Connectivity

On the basis of connectivity, the market is segmented into Wired PC Peripherals and Wireless PC Peripherals. The Wired PC Peripherals segment held the largest market revenue share in 2024, supported by their affordability, durability, and widespread use in cost-sensitive markets such as educational institutions, cybercafés, and small businesses. Wired devices also continue to dominate in regions with limited wireless infrastructure, ensuring consistent demand.

The Wireless PC Peripherals segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer preference for convenience, portability, and clutter-free setups. Adoption is further boosted by advancements in battery life, Bluetooth and Wi-Fi connectivity, and seamless integration with cloud-based platforms and smart devices. Growing popularity of wireless keyboards, mice, and gaming accessories is expected to propel strong future growth.

PC Peripheral Input Devices Market Regional Analysis

- North America dominated the PC peripheral input devices market with the largest revenue share of 39.8% in 2024, driven by the widespread adoption of advanced computing accessories in both professional and personal settings. The strong presence of leading manufacturers, coupled with rising demand for high-performance gaming peripherals and remote working tools, supports market growth in the region

- Consumers in North America value the seamless integration, durability, and advanced features offered by modern input devices such as wireless keyboards, precision mice, and high-quality webcams

- The region’s strong disposable income, expanding e-sports ecosystem, and growing reliance on digital communication technologies are reinforcing demand, making North America a dominant market for both productivity-focused and entertainment-driven peripherals

U.S. PC Peripheral Input Devices Market Insight

The U.S. PC peripheral input devices market captured the largest revenue share in 2024 within North America, supported by rising demand for gaming consoles, streaming tools, and remote work solutions. The strong trend toward digitalization and hybrid work has boosted adoption of webcams, headsets, and wireless accessories. Growing popularity of e-sports and gaming content creation further drives the use of specialized peripherals. In addition, integration with cloud platforms, AI-enabled features, and voice assistants are key factors strengthening the U.S. market.

Europe PC Peripheral Input Devices Market Insight

The Europe PC peripheral input devices market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising investments in digital infrastructure and the growing demand for efficient work-from-home setups. European consumers are increasingly adopting ergonomic devices to enhance comfort and reduce repetitive strain. The demand for gaming accessories is also rising across countries with strong e-sports communities. Peripheral integration in both professional and personal environments, as well as sustainability-focused innovations, are shaping Europe’s market growth.

U.K. PC Peripheral Input Devices Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s rapid adoption of gaming peripherals and increasing reliance on remote collaboration tools. Growing concerns around productivity, combined with the trend of immersive entertainment, are pushing demand for advanced accessories such as wireless headsets, VR-enabled devices, and customizable keyboards. The U.K.’s strong digital ecosystem and e-commerce infrastructure further boost peripheral adoption across both residential and commercial users.

Germany PC Peripheral Input Devices Market Insight

The Germany PC peripheral input devices market is expected to witness the fastest growth rate from 2025 to 2032, driven by high consumer preference for technologically advanced and sustainable solutions. The country’s emphasis on quality and innovation fosters adoption of premium peripherals, particularly in professional and enterprise environments. Gaming is also a major growth driver, with demand for precision devices such as high-DPI mice and mechanical keyboards rising steadily. Germany’s strong manufacturing base and focus on eco-friendly technology are further contributing to market expansion.

Asia-Pacific PC Peripheral Input Devices Market Insight

The Asia-Pacific PC peripheral input devices market is expected to witness the fastest growth rate from 2025 to 2032, driven by urbanization, rising disposable incomes, and a booming gaming culture in countries such as China, Japan, and India. Increasing adoption of digital learning and remote work, supported by government-led digitalization initiatives, is accelerating peripheral demand. As the region emerges as a major hub for peripheral production, affordability and wide product availability are fostering rapid adoption among both budget-conscious and premium users.

Japan PC Peripheral Input Devices Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced technology ecosystem, high gaming penetration, and increasing demand for ergonomic peripherals. Japanese consumers value high-precision, compact, and energy-efficient devices, aligning with the region’s cultural preference for quality and efficiency. Integration with IoT-enabled devices and demand for peripherals compatible with smart homes and gaming consoles are further fueling growth. In addition, the aging population is driving demand for user-friendly and ergonomically designed products.

China PC Peripheral Input Devices Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid digital transformation, a growing middle-class population, and large-scale adoption of gaming and e-learning solutions. China’s strong domestic manufacturing base ensures a wide range of affordable and advanced peripherals, boosting accessibility for both consumers and enterprises. Rising government initiatives toward digital education and smart city development are also expanding adoption. Moreover, the popularity of e-sports and content creation is driving strong demand for gaming-focused peripherals.

PC Peripheral Input Devices Market Share

The PC Peripheral Input Devices industry is primarily led by well-established companies, including:

- Canon Inc. (U.S.)

- Dell Technologies Inc. (U.S.)

- HP Inc. (U.S.)

- Logitech International S.A. (France)

- Microsoft Corporation (U.S.)

- Acer Inc. (U.S.)

- Apple Inc. (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Corsair Gaming, Inc. (U.S.)

- Razer Inc. (U.S.)

- Western Digital Corporation (U.S.)

- Seagate Technology Holdings (U.S.)

- Xerox Holdings Corporation (U.S.)

- Kensington Computer Products Group (U.K.)

- Amstrad Consumer Electronics plc (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.