Global Pcsk9 Inhibitors Market

Market Size in USD Billion

CAGR :

%

USD

3.23 Billion

USD

12.76 Billion

2024

2032

USD

3.23 Billion

USD

12.76 Billion

2024

2032

| 2025 –2032 | |

| USD 3.23 Billion | |

| USD 12.76 Billion | |

|

|

|

|

PCSK9 Inhibitors Market Size

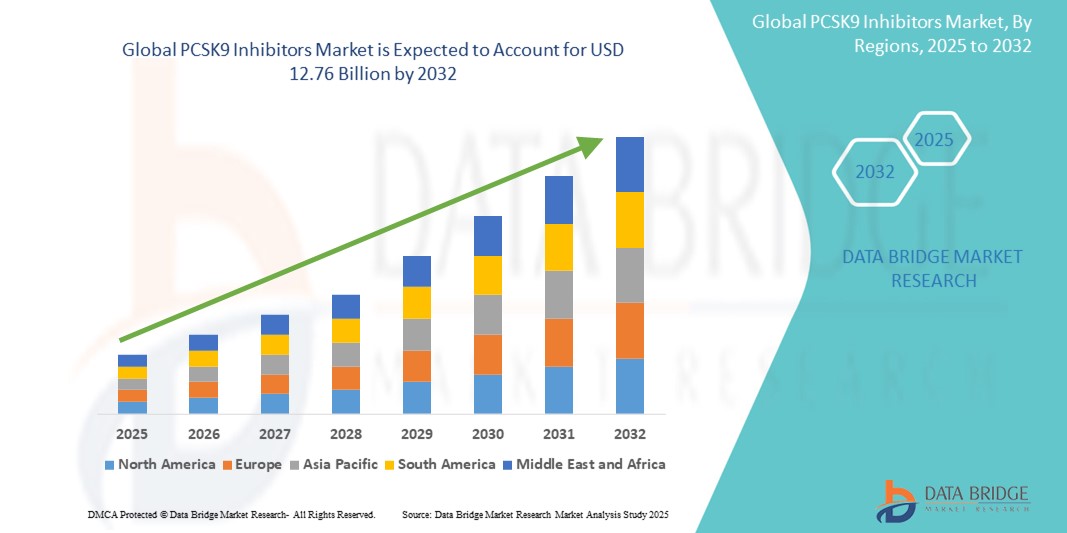

- The global PCSK9 inhibitors market size was valued at USD 3.23 billion in 2024 and is expected to reach USD 12.76 billion by 2032, at a CAGR of 18.73% during the forecast period

- This growth is driven by factors such as the rising prevalence of cardiovascular diseases and familial hypercholesterolemia, along with increasing demand for effective cholesterol-lowering therapies

PCSK9 Inhibitors Market Analysis

- PCSK9 inhibitors are a class of lipid-lowering therapies that work by targeting the proprotein convertase subtilisin/kexin type 9 enzyme, significantly reducing LDL cholesterol levels, especially in patients unresponsive to statins

- The market growth is primarily driven by the increasing prevalence of cardiovascular diseases, growing geriatric population, and rising awareness about cholesterol management

- North America is expected to dominate the PCSK9 Inhibitorss market with a market share of 50.5%, due to advanced healthcare systems, strong reimbursement frameworks, and widespread awareness of cardiovascular disease prevention

- Europe is expected to be the fastest growing region in the PCSK9 Inhibitors market with a market share of 30.5%, during the forecast period due to rising cardiovascular disease burden and proactive government-led cholesterol screening initiatives

- Evolocumab segment is expected to dominate the market with a market share of 71.8% due to its proven efficacy in significantly lowering LDL cholesterol levels and reducing cardiovascular event risks.

Report Scope and PCSK9 Inhibitors Market Segmentation

|

Attributes |

PCSK9 Inhibitors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PCSK9 Inhibitors Market Trends

“Growing Adoption of Monoclonal Antibodies & Long-Acting Therapies for Cholesterol Management”

- One prominent trend in the PCSK9 inhibitors market is the increasing adoption of monoclonal antibody-based therapies, such as evolocumab and alirocumab, due to their strong efficacy and safety profiles

- These biologics offer substantial LDL cholesterol reduction, especially for patients with familial hypercholesterolemia or those who are statin-intolerant, improving cardiovascular outcomes

- For instance, evolocumab has shown sustained LDL-C reductions of over 60% in clinical trials, and its long-acting dosing regimen (biweekly or monthly) enhances patient adherence and convenience

- This trend is driving the shift toward personalized cholesterol management, accelerating the development and uptake of next-generation PCSK9 inhibitors and expanding the market across high-risk patient populations

PCSK9 Inhibitors Market Dynamics

Driver

“Rising Cardiovascular Disease Burden and Unmet Need in Cholesterol Management”

- The growing global burden of cardiovascular diseases, driven by sedentary lifestyles, poor dietary habits, and aging populations, is a key factor propelling demand for PCSK9 inhibitors

- High LDL cholesterol is a major risk factor for atherosclerosis and coronary artery disease, prompting greater reliance on targeted therapies when statins alone are insufficient or poorly tolerated

- PCSK9 inhibitors offer a vital solution by significantly lowering LDL-C levels and reducing cardiovascular events, especially in high-risk and familial hypercholesterolemia patients

For instance,

- According to the World Health Organization (2023), cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million deaths each year, reinforcing the urgent need for effective lipid-lowering therapies such as PCSK9 inhibitors

- Consequently, the increasing incidence of cardiovascular disease and the unmet need in cholesterol management are fueling the widespread adoption and growth of the PCSK9 inhibitors market

Opportunity

“Development of Next-Generation PCSK9 Therapies and RNA-based Inhibitors”

- The market presents significant opportunity through the development of next-generation PCSK9 therapies, including RNA-based treatments such as inclisiran, which offers a novel mechanism of action and prolonged dosing intervals

- RNA interference (RNAi) therapies target PCSK9 production at the genetic level, allowing for biannual dosing and improved patient adherence compared to monoclonal antibodies requiring more frequent injections

- These innovations not only improve convenience and treatment compliance but also open new doors for managing high-risk populations and patients with statin intolerance or familial hypercholesterolemia

For instance,

- In December 2021, Novartis received approval for inclisiran (Leqvio) in multiple regions, including the U.S. and Europe, marking a key milestone for RNA-based cholesterol therapies. Inclisiran’s twice-yearly dosing schedule is designed to simplify treatment and reduce the burden on healthcare systems

- The advancement of RNA-based PCSK9 inhibitors and other long-acting therapies creates a substantial growth opportunity by addressing unmet clinical needs, expanding treatment accessibility, and improving long-term cardiovascular outcomes

Restraint/Challenge

“High Cost of Therapy Limiting Accessibility and Adoption”

- The high cost of PCSK9 inhibitors remains a major challenge, limiting their widespread adoption, particularly in low- and middle-income countries where healthcare budgets are constrained

- Therapies such as evolocumab and alirocumab can cost thouands of dollars annually per patient, making them less accessible without substantial insurance coverage or reimbursement support

- This financial burden affects both patients and healthcare systems, potentially leading to underutilization of these otherwise effective treatments in managing high-risk cholesterol conditions

For instance,

- According to a report by the Institute for Clinical and Economic Review (ICER), the initial pricing of PCSK9 inhibitors exceeded cost-effectiveness thresholds, prompting concerns over affordability and long-term sustainability within public and private healthcare systems

- As a result, despite their clinical benefits, the high cost of PCSK9 inhibitors poses a barrier to equitable access, impacting market penetration and slowing adoption in regions with limited reimbursement frameworks

PCSK9 Inhibitors Market Scope

The market is segmented on the basis of drug, modality, indication, route of administration, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Drug |

|

|

By Modality |

|

|

By Indication |

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

In 2025, the evolocumab is projected to dominate the market with a largest share in drug segment

The evolocumab segment is expected to dominate the PCSK9 Inhibitors market with the largest share of 71.8% in 2024 due to its proven efficacy in significantly lowering LDL cholesterol levels and reducing cardiovascular event risks. It benefits from strong clinical trial outcomes, broad regulatory approvals, and widespread physician and patient adoption. In addition, its established brand presence and support programs contribute to its market leadership.

The familial hyper cholesterolemia is expected to account for the largest share during the forecast period in indication market

In 2025, the familial hyper cholesterolemia segment is expected to dominate the market with the largest market share of 43.1% due to its high prevalence and the urgent need for effective treatment options in genetically predisposed individuals. PCSK9 inhibitors offer significant LDL cholesterol reduction where traditional statins may be insufficient. Early diagnosis and growing awareness of genetic lipid disorders further support the segment’s growth.

PCSK9 Inhibitors Market Regional Analysis

“North America Holds the Largest Share in the PCSK9 Inhibitors Market”

- North America dominates the PCSK9 Inhibitors market with a market share of estimated 50.5%, driven, by advanced healthcare systems, strong reimbursement frameworks, and widespread awareness of cardiovascular disease prevention

- U.S. holds a market share of 42.1%, due to high adoption of novel biologics, increasing prevalence of hypercholesterolemia, and strong presence of major pharmaceutical companies such as Amgen and Regeneron

- Robust clinical research, frequent product approvals, and supportive regulatory environments further contribute to regional market growth

- In addition, the Increasing use of PCSK9 inhibitors for both primary and secondary cardiovascular prevention, combined with favorable coverage by public and private insurers, sustains North America’s market leadership

“Europe is Projected to Register the Highest CAGR in the PCSK9 Inhibitors Market”

- Europe is expected to witness the fastest growth in the PCSK9 inhibitors market with a projected market share of 30.5%, supported by rising cardiovascular disease burden and proactive government-led cholesterol screening initiatives

- Countries such as Germany, the UK, and France are at the forefront due to well-established healthcare infrastructure, strong reimbursement models, and increased physician awareness regarding PCSK9-targeted therapies

- Germany leads in terms of drug uptake due to rapid incorporation of innovative treatments into clinical practice and efficient payer systems

- France is projected to register the highest CAGR in the region, driven by government-supported cardiovascular health programs, early diagnosis campaigns, and increasing demand for long-acting lipid-lowering therapies

PCSK9 Inhibitors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amgen Inc. (U.S.)

- Regeneron Pharmaceuticals Inc. (U.S.)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Merck & Co., Inc., (U.S.)

- Lilly (U.S.)

- AbbVie Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Silence Therapeutics (U.K.)

- Arrowhead Pharmaceuticals, Inc. (U.S.)

- Ionis Pharmaceuticals (U.S.)

- Kowa Company (Japan)

- Lupin (India)

- Boehringer Ingelheim International GmbH (Germany)

Latest Developments in Global PCSK9 Inhibitors Market

- In April 2025, AstraZeneca announced that its experimental oral PCSK9 inhibitor, AZD0780, achieved a 50.7% reduction in LDL cholesterol over 12 weeks when added to statin therapy. This positions it as a strong competitor to existing injectable PCSK9 inhibitors, offering the advantage of oral administration without the need for fasting

- In April 2025 that its single-dose gene-editing therapy, VERVE-101, achieved an average 59% reduction in LDL cholesterol among high-dose recipients in a Phase 1 trial. The therapy, utilizing CRISPR-based base-editing, offers a potentially lifelong solution for patients with genetically elevated LDL-C

- In April 2025, Verve Therapeutics' stock surged by 12.27% in pre-market trading, driven by the company's announcement of promising trial results for its cholesterol drug, VERVE-102

- In Febuary 2025, Despite previous approvals, inclisiran, a small interfering RNA therapy targeting PCSK9, was not included in the American Association of Clinical Endocrinology's 2025 guidelines for dyslipidemia management. The decision was based on limited evidence regarding its impact on cardiovascular outcomes

- In December 2024, LIB Therapeutics submitted a Biologics License Application to the FDA for lerodalcibep, a next-generation PCSK9 inhibitor designed for once-monthly administration. The therapy aims to address limitations of existing treatments by offering a more convenient dosing schedule and improved stability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.