Global Pd 1pd L1 Inhibitor Drug Market

Market Size in USD Billion

CAGR :

%

USD

42.26 Billion

USD

72.61 Billion

2025

2033

USD

42.26 Billion

USD

72.61 Billion

2025

2033

| 2026 –2033 | |

| USD 42.26 Billion | |

| USD 72.61 Billion | |

|

|

|

|

PD-1/PD-L1 Inhibitor Drug Market Size

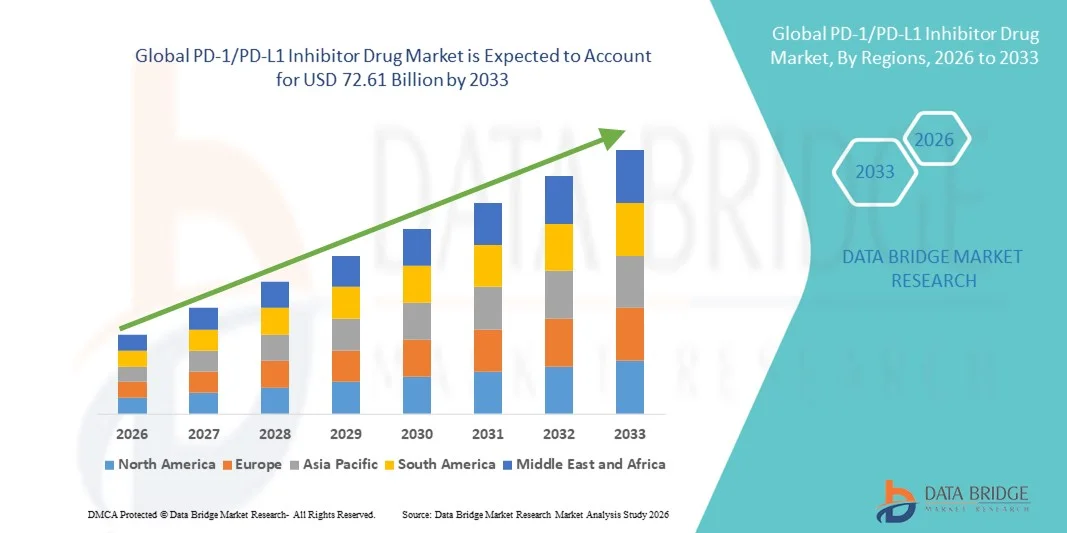

- The global PD-1/PD-L1 Inhibitor Drug market size was valued at USD 42.26 billion in 2025 and is expected to reach USD 72.61 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by increasing incidence of cancer worldwide, rapid adoption of immunotherapy treatments, and technological advancements in biologics and monoclonal antibody therapies

- Furthermore, rising demand for targeted therapies with higher efficacy and lower side effects is driving the uptake of PD-1/PD-L1 Inhibitor Drug solutions, thereby significantly boosting the industry's growth

PD-1/PD-L1 Inhibitor Drug Market Analysis

- PD-1/PD-L1 inhibitors, offering targeted immunotherapy for various cancers, are increasingly vital components of modern oncology treatment protocols in both hospital and clinical settings due to their enhanced efficacy, reduced side effects, and ability to improve patient survival rates

- The escalating demand for PD-1/PD-L1 inhibitors is primarily fueled by the rising prevalence of cancers, growing adoption of immunotherapy treatments, and a strong preference for personalized oncology therapies

- North America dominated the PD-1/PD-L1 Inhibitor Drug market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of innovative cancer therapies, and a strong presence of key pharmaceutical players, with the U.S. experiencing substantial growth in PD-1/PD-L1 Inhibitor Drug usage driven by clinical approvals and R&D advancements

- Asia-Pacific is expected to be the fastest growing region in the PD-1/PD-L1 Inhibitor Drug market during the forecast period due to increasing healthcare spending, expanding oncology treatment centers, and rising awareness about immunotherapy in emerging economies such as China and India

- The monoclonal antibodies segment held the largest market revenue share of 45% in 2025, driven by their established efficacy and safety in multiple oncology indications

Report Scope and PD-1/PD-L1 Inhibitor Drug Market Segmentation

|

Attributes |

PD-1/PD-L1 Inhibitor Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

PD-1/PD-L1 Inhibitor Drug Market Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the global PD-1/PD-L1 inhibitor drug market is the increasing adoption of immune checkpoint inhibitors as a frontline treatment for a variety of cancers, including melanoma, non-small cell lung cancer, renal cell carcinoma, bladder cancer, and head and neck cancers. This shift is driven by the proven efficacy of PD-1/PD-L1 inhibitors in improving overall survival and progression-free survival in oncology patients

- Combination therapy approaches, pairing PD-1/PD-L1 inhibitors with chemotherapeutics, targeted therapies, or other immunotherapies, are gaining momentum

- For instance, Keytruda (pembrolizumab) is now often administered alongside chemotherapy for first-line treatment of metastatic non-small cell lung cancer, while Opdivo (nivolumab) is combined with Yervoy (ipilimumab) in melanoma patients to improve response rates

- The market is witnessing rapid growth in biomarker-driven therapy, where PD-L1 expression levels guide patient selection, enabling personalized treatment strategies and optimizing clinical outcomes

- There is an increasing number of ongoing and completed clinical trials globally assessing novel PD-1/PD-L1 inhibitor molecules, supporting the continuous expansion of therapeutic indications

- Physicians are progressively adopting PD-1/PD-L1 inhibitors due to their comparatively favorable safety profile over traditional chemotherapies, allowing for longer-term treatment and improved patient quality of life

- Growing patient awareness, improved education on immunotherapy options, and collaboration between pharmaceutical companies and healthcare providers are further reinforcing the uptake of PD-1/PD-L1 inhibitors across diverse patient populations

PD-1/PD-L1 Inhibitor Drug Market Dynamics

Driver

Increasing Cancer Prevalence and Favorable Regulatory Support

- The rising global incidence of cancer is a primary driver for the PD-1/PD-L1 inhibitor drug market, with millions of new cancer cases diagnosed each year, creating a substantial patient pool eligible for immunotherapy treatments

- Supportive regulatory frameworks in North America, Europe, and parts of Asia, including accelerated approvals, breakthrough therapy designations, and priority review programs, are enabling faster market entry and wider accessibility of PD-1/PD-L1 inhibitors

- For instance, in 2021, the U.S. FDA granted accelerated approval to Merck’s Keytruda for adjuvant treatment of renal cell carcinoma, allowing earlier access for high-risk patients, while the European Medicines Agency approved Opdivo for combination therapy in metastatic small-cell lung cancer

- Increasing investments in oncology research and expansion of hospital oncology centers, particularly in Asia-Pacific, are providing infrastructure for the adoption of immunotherapies and ensuring treatment availability to a broader patient base

- Advances in diagnostic tools, such as companion diagnostics and PD-L1 expression testing, are allowing clinicians to select suitable patients more accurately, improving therapeutic outcomes and encouraging adoption

- Pharmaceutical companies are actively expanding their product portfolios, developing next-generation PD-1/PD-L1 inhibitors, and exploring combination therapies that extend treatment efficacy and applicability

- Enhanced collaborations between hospitals, research institutions, and biotech companies are accelerating knowledge sharing, patient access programs, and awareness campaigns, thereby driving market growth

Restraint/Challenge

High Treatment Costs, Limited Accessibility, and Safety Management

- The high cost of PD-1/PD-L1 inhibitors represents a key challenge, restricting access in low- and middle-income countries and among patients without comprehensive insurance coverage

- Management of immune-related adverse events, including colitis, pneumonitis, hepatitis, and endocrinopathies, necessitates specialized care, increasing treatment complexity, patient monitoring requirements, and associated healthcare costs

- For instance, hospitals often require multidisciplinary teams to manage severe immune-related adverse events, such as nivolumab-induced pneumonitis in lung cancer patients, resulting in hospitalization and additional treatment costs, which can limit the therapy’s practical use in resource-constrained settings

- Uncertainty surrounding long-term efficacy in certain patient populations, as well as the potential development of resistance to PD-1/PD-L1 therapies, may limit adoption in specific segments

- Restricted reimbursement policies in some regions and the lack of government-funded immunotherapy programs can impede patient access to these therapies

- Manufacturing complexities and stringent storage requirements for biologics add to distribution challenges, influencing treatment availability and overall market expansion

- Addressing these challenges through cost-effective production, expanded insurance coverage, patient assistance programs, and ongoing clinical research into safer, more effective treatment regimens will be essential for sustained market growth

PD-1/PD-L1 Inhibitor Drug Market Scope

The market is segmented on the basis of type, mechanism of action, and application.

- By Type

On the basis of type, the PD-1/PD-L1 Inhibitor Drug market is segmented into PD-1 inhibitors, PD-L1 inhibitors, combination therapies, and others. The PD-1 inhibitors segment dominated the largest market revenue share of 42.5% in 2025, driven by their established clinical efficacy in multiple cancer types, especially lung cancer, melanoma, and renal cell carcinoma. Their durable response rates and favorable safety profiles make them widely prescribed in oncology centers. Continuous R&D efforts and the approval of next-generation PD-1 inhibitors strengthen adoption globally. Strong partnerships between pharmaceutical companies and healthcare institutions further support market penetration. Government reimbursement policies in key markets such as the U.S., Europe, and Japan enhance patient access. PD-1 inhibitors are also integrated into first-line, second-line, and adjuvant therapy protocols, increasing market share. The segment benefits from ongoing clinical trials targeting novel combinations. Patient preference for monotherapy options with manageable side effects drives utilization. The increasing awareness of immunotherapy benefits among oncologists and patients reinforces segment dominance. The PD-1 inhibitors segment remains a key revenue driver for major pharmaceutical players worldwide, maintaining its leadership position.

The combination therapies segment is anticipated to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by growing clinical evidence supporting combination regimens with chemotherapy, targeted therapy, or other immunotherapies. Combination therapies help overcome resistance to monotherapy and improve overall survival rates in various cancers. Pharmaceutical companies are actively investing in combination clinical trials across multiple indications, including lung, melanoma, and gastric cancers. The rising adoption of personalized medicine and precision oncology further accelerates growth. Emerging markets are increasingly adopting these therapies due to growing healthcare infrastructure. Regulatory approvals for combination treatments are expanding, opening new opportunities. Physician preference for enhanced efficacy drives uptake in both hospital and outpatient oncology centers. Insurance coverage for combination regimens is gradually improving patient access. Patient demand for innovative treatments with higher response rates supports market expansion. Overall, combination therapies are expected to see strong adoption globally, especially in North America and Asia-Pacific, positioning this segment as the fastest-growing in the market.

- By Mechanism of Action

On the basis of mechanism of action, the PD-1/PD-L1 Inhibitor Drug market is segmented into monoclonal antibodies, immune checkpoint blockers, fusion proteins, and others. The monoclonal antibodies segment held the largest market revenue share of 45% in 2025, driven by their established efficacy and safety in multiple oncology indications. Monoclonal antibodies are widely used in standard immunotherapy protocols and approved for a variety of cancer types. Their targeted mechanism minimizes off-target effects and supports long-term therapy. Continuous innovation in antibody engineering enhances specificity, potency, and durability. The segment benefits from strong pipelines of new-generation antibodies under clinical trials. Adoption in both developed and emerging markets is increasing due to better patient awareness and reimbursement schemes. Hospitals and oncology centers prefer monoclonal antibodies for first-line treatment in combination with other therapies. Government support and regulatory approvals further boost adoption globally. Collaboration between biopharmaceutical companies accelerates commercialization. Monoclonal antibodies remain the backbone of PD-1/PD-L1 immunotherapy, ensuring sustained revenue growth and market dominance.

The immune checkpoint blockers segment is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, driven by research on novel checkpoint targets and next-generation inhibitors. These blockers are being increasingly tested in combination with PD-1/PD-L1 therapies to improve patient outcomes. Clinical trials targeting multiple pathways are expanding globally. Rising incidence of cancers and growing awareness of immunotherapy benefits boost adoption. Regulatory support for innovative immunotherapy trials accelerates market penetration. Hospitals and cancer treatment centers are rapidly adopting immune checkpoint blockers as part of precision medicine. Increasing approvals for combination therapies enhance uptake in both first-line and refractory cancer patients. Emerging markets are witnessing higher adoption due to rising healthcare investments. Physician preference for advanced immunotherapy options further drives growth. The segment is forecasted to expand across North America, Europe, and Asia-Pacific, positioning it as the fastest-growing mechanism segment.

- By Application

On the basis of application, the PD-1/PD-L1 Inhibitor Drug market is segmented into lung cancer, melanoma, renal cell carcinoma, head & neck cancer, bladder cancer, gastric cancer, and others. The lung cancer segment accounted for the largest market revenue share of 38% in 2025, owing to high prevalence, strong clinical evidence supporting PD-1/PD-L1 efficacy, and adoption in first-line and second-line treatment protocols. Regulatory approvals in major markets such as the U.S., Europe, and Japan enhance patient access. Increasing government support for oncology care and reimbursement coverage strengthens adoption. Hospitals, oncology centers, and specialized clinics prefer PD-1/PD-L1 inhibitors for lung cancer due to durable response and manageable safety profile. Rising awareness among physicians and patients drives widespread utilization. Oncology societies and guidelines increasingly recommend PD-1/PD-L1 inhibitors in standard care pathways. Continuous clinical trials in combination with chemotherapy or targeted therapies further boost adoption. Patient preference for immunotherapy over conventional chemotherapy increases market share. Lung cancer remains the primary revenue-generating indication globally.

The melanoma segment is expected to witness the fastest CAGR of 20.2% from 2026 to 2033, driven by rising incidence rates, early diagnosis, and strong clinical efficacy of PD-1/PD-L1 inhibitors. These drugs are widely adopted in adjuvant and neoadjuvant therapies for melanoma, improving overall survival and progression-free survival. Increased awareness among dermatologists and oncologists accelerates uptake. Clinical trials exploring novel combinations with targeted therapies support market growth. Expanding healthcare infrastructure and insurance coverage in North America, Europe, and Asia-Pacific improve accessibility. Emerging markets are witnessing growing adoption due to improved cancer detection and treatment centers. Physicians prefer immunotherapy for advanced melanoma due to durable responses. Patient preference for therapies with fewer side effects supports expansion. Overall, the melanoma segment is poised to grow rapidly, making it the fastest-growing application in the market.

PD-1/PD-L1 Inhibitor Drug Market Regional Analysis

- North America dominated the PD-1/PD-L1 Inhibitor Drug market with the largest revenue share of 42.5% in 2025, driven by advanced healthcare infrastructure, high adoption of innovative cancer therapies, and a strong presence of leading pharmaceutical companies. The U.S. accounts for the majority of regional revenue due to widespread clinical approvals of PD-1 and PD-L1 inhibitors across multiple cancer indications, including lung cancer, melanoma, and renal cell carcinoma

- High R&D investments, well-established oncology centers, and robust reimbursement policies support market growth. The increasing prevalence of cancer and rising patient awareness regarding immunotherapy benefits further fuel adoption. Hospitals and specialized cancer treatment centers actively integrate these therapies into first-line and combination treatment regimens. Collaboration between pharmaceutical companies and healthcare providers strengthens penetration. Clinical trial activity remains strong, expanding the use of next-generation PD-1/PD-L1 inhibitors. The segment benefits from supportive regulatory frameworks and insurance coverage, facilitating patient access

- Moreover, increasing adoption of precision medicine and personalized oncology treatments enhances overall utilization. Continuous innovation in monoclonal antibodies and immune checkpoint inhibitors ensures that North America remains the dominant regional market for PD-1/PD-L1 inhibitors

U.S. PD-1/PD-L1 Inhibitor Drug Market Insight

The U.S. PD-1/PD-L1 Inhibitor Drug market captured the largest revenue share within North America in 2025, fueled by a high number of clinical approvals, advanced oncology research facilities, and strong adoption of innovative immunotherapies. Physicians increasingly prefer PD-1/PD-L1 inhibitors due to their efficacy and manageable safety profiles. Continuous investment in R&D pipelines, coupled with patient awareness programs, strengthens market penetration. Adoption is supported by government initiatives, insurance coverage, and academic collaborations. Ongoing combination therapy trials further expand clinical applications. The increasing number of cancer treatment centers enhances access across urban and semi-urban areas. U.S.-based pharmaceutical companies dominate production and commercialization, reinforcing leadership. The segment is projected to maintain steady growth due to favorable regulatory policies, technological advancements, and the rising incidence of target cancer types.

Europe PD-1/PD-L1 Inhibitor Drug Market Insight

The Europe PD-1/PD-L1 Inhibitor Drug market is projected to expand at a substantial CAGR of 11.2% during the forecast period. Growth is primarily driven by increasing prevalence of cancers such as lung cancer, melanoma, and renal cell carcinoma, combined with strong adoption of immunotherapy in oncology protocols. Countries such as Germany, France, and the U.K. have well-established healthcare systems that support reimbursement and patient access to PD-1/PD-L1 inhibitors. Clinical trials and research collaborations between European universities and pharmaceutical companies promote innovation and wider adoption. Regulatory approvals in major EU markets ensure availability for first-line and combination treatments. Hospitals and specialty oncology centers are increasingly integrating PD-1/PD-L1 inhibitors into standard care pathways. The growing geriatric population and rising cancer awareness campaigns among patients further drive adoption. European oncology practitioners are highly inclined toward evidence-based immunotherapies, which reinforces market expansion. In addition, partnerships between government and private sectors facilitate patient access and affordability. Overall, the European region is witnessing steady revenue growth across both established and emerging markets.

U.K. PD-1/PD-L1 Inhibitor Drug Market Insight

The U.K. PD-1/PD-L1 Inhibitor Drug market is expected to grow at a CAGR of 10.8% during the forecast period. The growth is driven by increasing incidence of cancers like melanoma and lung cancer, coupled with high adoption of immunotherapy in public and private hospitals. The National Health Service (NHS) plays a critical role in patient access and reimbursement. Awareness campaigns for immunotherapy options are growing, helping drive patient acceptance. Ongoing clinical trials in oncology centers further support adoption. Hospitals and specialized cancer treatment facilities increasingly rely on PD-1/PD-L1 inhibitors as part of combination regimens. The robust research ecosystem in the U.K. enables early adoption of next-generation therapies. Government-backed initiatives and funding for immuno-oncology research contribute to market growth. In addition, collaborations with global pharmaceutical companies ensure access to novel PD-1/PD-L1 drugs. The U.K. remains a key market in Europe due to its advanced healthcare infrastructure and proactive oncology research environment.

Germany PD-1/PD-L1 Inhibitor Drug Market Insight

The Germany PD-1/PD-L1 Inhibitor Drug market is expected to expand at a CAGR of 11.5% during the forecast period, fueled by strong healthcare infrastructure, high R&D investment, and early adoption of innovative immunotherapies. Hospitals and specialized oncology centers widely prescribe PD-1/PD-L1 inhibitors for lung cancer, melanoma, and renal cell carcinoma. Government reimbursement policies and patient access programs facilitate adoption. Clinical trial activity and collaborations with global pharmaceutical companies promote development of next-generation drugs. Rising cancer prevalence and increasing awareness of immunotherapy benefits further support market growth. Germany’s emphasis on precision medicine and personalized oncology strengthens the adoption of PD-1/PD-L1 inhibitors. Advanced manufacturing capabilities and strategic partnerships with pharmaceutical companies ensure steady supply. Increasing insurance coverage and patient assistance programs improve accessibility across both urban and semi-urban regions. The segment remains a key contributor to Europe’s overall market revenue.

Asia-Pacific PD-1/PD-L1 Inhibitor Drug Market Insight

The Asia-Pacific PD-1/PD-L1 Inhibitor Drug market is poised to grow at the fastest CAGR of 14.8% from 2026 to 2033, driven by increasing healthcare expenditure, expanding oncology treatment centers, and rising awareness of immunotherapy in emerging economies such as China and India. The region’s large patient base, coupled with improving healthcare infrastructure, accelerates adoption. Government initiatives promoting cancer treatment programs and insurance reimbursement further enhance patient access. Pharmaceutical companies are actively investing in clinical trials and collaborations with local hospitals. Increasing incidence of lung cancer, melanoma, and gastric cancer fuels demand. Emerging countries are rapidly adopting PD-1/PD-L1 therapies due to growing affordability and accessibility. Rising awareness among physicians and patients promotes early adoption. In addition, improving diagnostic infrastructure enables timely initiation of immunotherapy treatments. Asia-Pacific is also emerging as a key market for combination therapies and next-generation inhibitors. Expansion of oncology research centers supports continued adoption. Overall, the region is expected to witness strong revenue growth, making it the fastest-growing market globally.

Japan PD-1/PD-L1 Inhibitor Drug Market Insight

The Japan PD-1/PD-L1 Inhibitor Drug market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and high awareness of immunotherapy benefits. Japan’s oncology centers are rapidly integrating PD-1/PD-L1 inhibitors for lung cancer, melanoma, and gastric cancer. The country emphasizes patient access through reimbursement programs and early clinical adoption. High R&D investments in biotechnology and pharmaceutical research support introduction of new drugs. Combination therapy trials are increasingly common. Japanese physicians prefer immunotherapies for improved safety and efficacy profiles. Ongoing regulatory approvals and government support promote widespread utilization. Patient preference for targeted therapies over conventional chemotherapy further drives adoption. The country is also focusing on precision oncology initiatives, enabling tailored treatment approaches. Overall, Japan represents a key market within Asia-Pacific for PD-1/PD-L1 inhibitors.

China PD-1/PD-L1 Inhibitor Drug Market Insight

The China PD-1/PD-L1 Inhibitor Drug market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising cancer incidence, increasing healthcare investments, and growing awareness of immunotherapy benefits. China has become one of the largest markets for PD-1/PD-L1 inhibitors due to expanding oncology treatment centers and favorable government policies supporting access. Clinical trial activity is strong, with domestic pharmaceutical companies actively developing PD-1/PD-L1 drugs. Rising patient demand for advanced therapies in lung, melanoma, and gastric cancers accelerates adoption. Reimbursement schemes and patient assistance programs improve accessibility. Hospitals and specialty clinics are increasingly implementing combination therapy protocols. Increasing partnerships between global and local pharmaceutical companies boost supply and innovation. Growth in diagnostic capabilities enables earlier treatment initiation. Overall, China is a pivotal market driving Asia-Pacific’s position as the fastest-growing regional market.

PD-1/PD-L1 Inhibitor Drug Market Share

The PD-1/PD-L1 Inhibitor Drug industry is primarily led by well-established companies, including:

- Bristol-Myers Squibb (U.S.)

- Merck & Co. (U.S.)

- AstraZeneca (U.K.)

- Roche (Switzerland)

- BeiGene (China)

- Novartis (Switzerland)

- Amplimmune (U.S.)

- CureTech (Israel)

- Incyte Corporation (U.S.)

- Shenzhen Chipscreen Biosciences (China)

- Hanwha Chemical (South Korea)

- Eli Lilly and Company (U.S.)

- Symbio Pharmaceuticals (China)

- Merus N.V. (Netherlands)

- Argonaut Therapeutics (U.S.)

- Regeneron Pharmaceuticals (U.S.)

- Innovent Biologics (China)

- Celgene (U.S.)

- Arcus Biosciences (U.S.)

Latest Developments in Global PD-1/PD-L1 Inhibitor Drug Market

- In March 2023, retifanlimab (Zynyz) — a PD‑1 blocking monoclonal antibody — was approved for medical use in the United States for the treatment of metastatic or recurrent locally advanced Merkel cell carcinoma, providing another PD‑1 inhibitor option for a rare cancer type

- In September 2023, BeiGene’s Tislelizumab received European Union approval for indications in advanced or metastatic cancers, expanding geographic access for this PD‑1 inhibitor beyond China and supporting its global oncology pipeline

- In December 2023, Angle launched the Portrait PD‑L1 test, a liquid biopsy diagnostic for evaluating PD‑L1 expression on circulating tumour cells, improving precision in patient selection for PD‑1/PD‑L1 inhibitors and helping guide immunotherapy decisions

- In October 2024, Merck and Moderna initiated the INTerpath‑009 Phase 3 trial, combining KEYTRUDA (pembrolizumab) with mRNA‑4157 (V940) for non‑small cell lung cancer, representing an innovative approach pairing PD‑1 inhibition with neoantigen‑based personalized immunotherapy

- In December 2024, the U.S. FDA approved UNLOXCYT (cosibelimab‑ipdl), the first PD‑L1 blocking antibody for metastatic or locally advanced cutaneous squamous cell carcinoma, expanding the PD‑L1 inhibitor portfolio and broadening clinical use

- In June 2025, pembrolizumab (Keytruda) received FDA approval for perioperative treatment of resectable, locally advanced head and neck squamous cell carcinoma (HNSCC) with PD‑L1 expression, marking a new indication that expands use of PD‑1 inhibition in earlier‑stage cancer management

- In September 2025, the FDA approved a subcutaneous formulation of pembrolizumab (Keytruda Qlex) for all previously approved solid tumour indications, offering patients a more convenient PD‑1 inhibitor dosing option that may improve compliance

- In October 2025, cemiplimab — another PD‑1 inhibitor — was approved by the FDA as adjuvant therapy for adults with high‑risk cutaneous squamous cell carcinoma following surgery and radiation, illustrating continued expansion of PD‑1 inhibitor indications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.