Global Pea Starch For Food Industry Market

Market Size in USD Million

CAGR :

%

USD

455.07 Million

USD

758.82 Million

2025

2033

USD

455.07 Million

USD

758.82 Million

2025

2033

| 2026 –2033 | |

| USD 455.07 Million | |

| USD 758.82 Million | |

|

|

|

|

Global Pea Starch for Food Industry Market Size

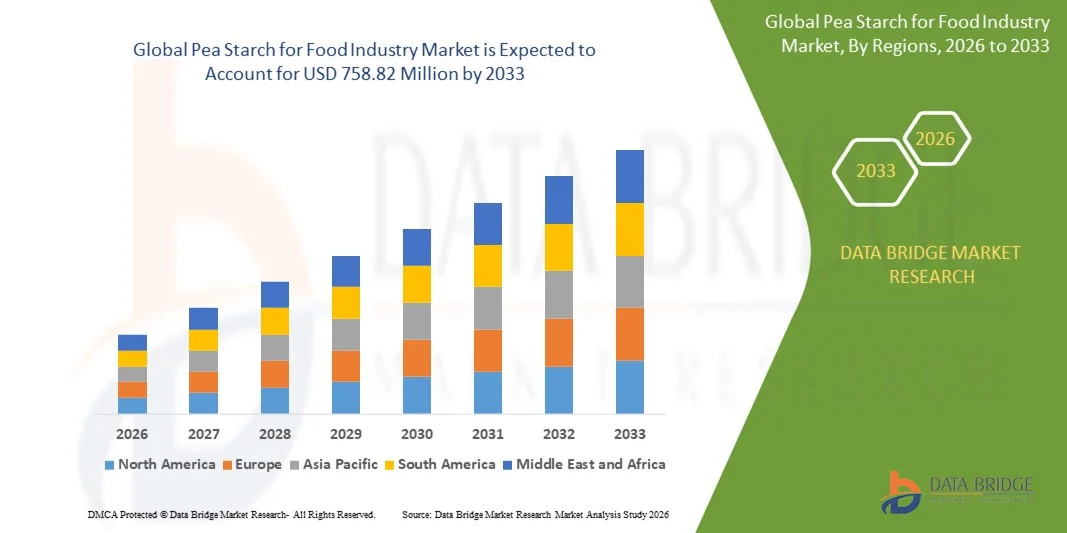

- The Global Pea Starch for Food Industry Market was valued at USD 455.07 million in 2025 and is projected to reach USD 758.82 million by 2033, expanding at a CAGR of 6.60% over the forecast period.

- Market growth is being driven by the rising use of pea-based ingredients in processed foods, clean-label formulations, and plant-based product innovations, supported by advances in food processing technologies.

- Additionally, increasing consumer demand for natural, allergen-free, and nutritionally enhanced food solutions is positioning pea starch as a preferred functional ingredient, accelerating its adoption and significantly boosting overall market expansion.

Global Pea Starch for Food Industry Market Analysis

- Pea starch, widely used as a functional ingredient in processed foods, bakery products, dairy alternatives, and convenience meals, is becoming an essential component in modern food formulation due to its clean-label appeal, high gelatinization properties, and suitability for diverse processing conditions.

- The rising demand for pea starch is primarily driven by the global shift toward plant-based diets, increasing preference for natural and allergen-free ingredients, and the growing use of pea-derived components in gluten-free and high-protein food products.

- Asia-Pacific dominated the Global Pea Starch for Food Industry Market with the largest revenue share of 35% in 2025, supported by strong consumer adoption of clean-label foods, high disposable incomes, and the presence of major food manufacturers, with the U.S. experiencing significant growth in pea-based ingredient utilization fueled by innovation in plant-based and functional food categories.

- North America is expected to be the fastest-growing region in the Global Pea Starch for Food Industry Market during the forecast period, driven by rapid urbanization, rising disposable incomes, and increased consumption of convenience foods and nutritional products.

- The food grade segment dominated the market with the largest revenue share of 52.4% in 2025, driven by the growing use of pea starch in processed foods, bakery items, dairy alternatives, and plant-based formulations.

Report Scope and Global Pea Starch for Food Industry Market Segmentation

|

Attributes |

Pea Starch for Food Industry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Pea Starch for Food Industry Market Trends

Innovation in Functional and Clean-Label Applications

- A significant and accelerating trend in the Global Pea Starch for Food Industry Market is the increasing incorporation of pea starch into functional, clean-label, and plant-based food products. This trend is driven by consumer demand for natural, allergen-free ingredients that provide both nutritional benefits and improved food texture.

- For instance, pea starch is increasingly used in gluten-free bakery products, dairy alternatives, and ready-to-eat meals to enhance mouthfeel, viscosity, and stability without relying on artificial additives. Similarly, its use in protein-enriched snacks allows manufacturers to improve nutritional profiles while maintaining desirable texture and shelf life.

- Advances in processing technologies are enabling pea starch to deliver specialized functionalities, such as improved gelation, water-holding capacity, and emulsification, making it suitable for a wider range of applications. For example, some manufacturers are developing pre-gelatinized pea starches that simplify formulation in instant soups, sauces, and plant-based dairy products.

- The versatility of pea starch facilitates its integration across multiple food categories, allowing food companies to create innovative products that meet clean-label and plant-based trends. This supports centralized formulation strategies where a single ingredient can provide multiple functional benefits across different product lines.

- This trend towards functional, natural, and multi-purpose ingredients is fundamentally reshaping product development in the food industry. Consequently, companies such as Cargill and Roquette are innovating pea starch solutions with enhanced solubility, texturizing properties, and nutritional profiles to cater to evolving consumer preferences.

- The demand for pea starch in functional, clean-label, and plant-based applications is growing rapidly across both retail and foodservice sectors, as consumers increasingly prioritize health, convenience, and sustainable food choices.

Global Pea Starch for Food Industry Market Dynamics

Driver

Growing Demand Driven by Health-Conscious and Plant-Based Food Trends

- The rising consumer focus on health, wellness, and plant-based diets is a significant driver for the increasing demand for pea starch in the food industry. As more consumers seek natural, allergen-free, and protein-rich alternatives, pea starch has emerged as a preferred ingredient in functional and clean-label formulations.

- For instance, in 2025, Roquette launched a range of pre-gelatinized pea starches aimed at improving texture and nutritional content in plant-based dairy alternatives and gluten-free bakery products. Such innovations by key companies are expected to further propel the market during the forecast period.

- As consumers increasingly prioritize foods that align with health, dietary restrictions, and sustainable sourcing, pea starch provides functional benefits such as gelation, emulsification, and water-binding capacity, making it a versatile ingredient across multiple food categories.

- Furthermore, the growing popularity of plant-based and convenience foods is driving manufacturers to adopt pea starch for its clean-label appeal and compatibility with various processing technologies.

- The demand is also fueled by the ability to improve product texture, shelf life, and nutritional content, as well as meet consumer expectations for minimally processed and allergen-free food options. The trend towards reformulating traditional foods with plant-based ingredients is contributing significantly to market growth across both retail and foodservice sectors.

Restraint/Challenge

Supply Constraints and Price Volatility

- Fluctuations in pea crop yields, influenced by climatic conditions, soil quality, and agricultural practices, pose a significant challenge to the stable supply of pea starch. Such variability can lead to price volatility and affect the profitability of food manufacturers relying on this ingredient.

- For instance, years of lower-than-expected pea harvests in key production regions such as Canada and China have led to temporary spikes in pea starch prices, impacting cost-sensitive product formulations.

- Additionally, the processing of pea starch requires specialized equipment and technology, which can limit the scalability for smaller manufacturers and contribute to higher production costs.

- While the industry is investing in improving agricultural practices and supply chain resilience, the relatively higher cost of pea starch compared to conventional starches such as corn or wheat can still be a barrier for widespread adoption, particularly in emerging markets.

- Overcoming these challenges through crop yield optimization, contract farming agreements, and strategic sourcing initiatives will be crucial for ensuring consistent supply, controlling costs, and supporting sustained market growth.

Global Pea Starch for Food Industry Market Scope

Pea starch for food industry market is segmented on the basis of source, grade, application and function.

- By Grade

On the basis of grade, the Global Pea Starch for Food Industry Market is segmented into food, feed, and industrial grades. The food grade segment dominated the market with the largest revenue share of 52.4% in 2025, driven by the growing use of pea starch in processed foods, bakery items, dairy alternatives, and plant-based formulations. Food-grade pea starch is preferred for its clean-label appeal, allergen-free properties, and functional benefits such as gelling, thickening, and emulsification. Manufacturers increasingly leverage it to improve texture, mouthfeel, and nutritional profiles in consumer-ready products.

The feed grade segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, fueled by rising demand for high-protein, plant-based ingredients in animal nutrition and aquafeed formulations. Its functional and cost-effective properties are making it a preferred alternative to conventional starches in feed applications.

- By Application

On the basis of application, the market is segmented into snacks and savory products, soups and sauces, meat and poultry products, confectionery products, bakery products, and dairy products. The bakery products segment held the largest market revenue share of 38.9% in 2025, due to the high adoption of pea starch in gluten-free, high-protein, and clean-label baked goods. Pea starch enhances texture, moisture retention, and shelf life, making it ideal for both industrial and retail bakery products.

The soups and sauces segment is anticipated to register the fastest CAGR of 21.3% during the forecast period, driven by the increasing consumer preference for convenient, ready-to-eat meals and plant-based sauces that require natural thickening and emulsifying agents. Pea starch’s gelling and water-binding properties make it a highly versatile ingredient for these applications.

- By Source

On the basis of source, the Global Pea Starch for Food Industry Market is segmented into organic and inorganic sources. The inorganic segment dominated the market with a revenue share of 61.2% in 2025, attributed to large-scale commercial production, cost efficiency, and widespread availability of conventionally grown peas. Inorganic pea starch meets industrial-scale demands for functional applications in processed foods, snacks, and bakery items.

the organic segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by rising consumer preference for organic and non-GMO ingredients. The surge in clean-label and sustainable food trends is encouraging food manufacturers to adopt organic pea starch across premium food and health-oriented product lines.

- By Function

On the basis of function, the market is segmented into binding and thickening, gelling, texturizing, film forming, and other functions. The binding and thickening segment held the largest revenue share of 44.5% in 2025, owing to its extensive use in soups, sauces, bakery fillings, and dairy alternatives, where it enhances viscosity, texture, and stability. Pea starch’s natural, allergen-free profile also makes it ideal for replacing synthetic thickeners.

The gelling segment is projected to witness the fastest CAGR of 22.4% during the forecast period, fueled by its application in plant-based gels, meat analogues, and dessert products. The ability of pea starch to form stable gels while maintaining nutritional benefits is driving its growing adoption in innovative food formulations.

Global Pea Starch for Food Industry Market Regional Analysis

- Asia-Pacific dominated the Global Pea Starch for Food Industry Market with the largest revenue share of 35% in 2025, driven by the growing demand for plant-based, clean-label, and high-protein food products.

- Consumers in the region increasingly prefer natural, allergen-free ingredients, and manufacturers are leveraging pea starch for its functional benefits such as thickening, gelling, and texturizing in bakery, dairy alternatives, and convenience foods.

- This widespread adoption is further supported by high disposable incomes, strong health and wellness awareness, and a well-established food processing industry, positioning pea starch as a preferred ingredient for both large-scale industrial applications and premium consumer food products.

U.S. Pea Starch Market Insight

The U.S. pea starch market captured the largest revenue share of 81% in 2025 within North America, driven by the rising demand for plant-based, clean-label, and protein-enriched food products. Consumers are increasingly prioritizing allergen-free and natural ingredients in bakery, dairy alternatives, and convenience foods. The growing trend of health-conscious eating, combined with innovation in functional ingredients and expanding adoption of gluten-free and vegan formulations, further fuels market growth. Moreover, the focus on sustainable sourcing and eco-friendly production practices is boosting the preference for pea starch over traditional starches.

Europe Pea Starch Market Insight

The Europe pea starch market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the growing adoption of plant-based diets, regulatory support for clean-label foods, and increasing consumer awareness regarding health and nutrition. The region’s strong food processing industry and innovation in gluten-free, bakery, and dairy alternatives are fostering the integration of pea starch. European consumers increasingly demand natural thickening, gelling, and texturizing agents, supporting market growth across both retail and industrial food applications.

U.K. Pea Starch Market Insight

The U.K. pea starch market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising interest in functional foods and clean-label formulations. Consumers and manufacturers alike are focusing on plant-based and allergen-free ingredients, driving the adoption of pea starch in bakery, dairy, and snack products. Additionally, the U.K.’s strong retail and foodservice infrastructure, combined with innovation in health-oriented food products, continues to stimulate market expansion.

Germany Pea Starch Market Insight

The Germany pea starch market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of health and nutrition, coupled with a strong plant-based food culture. Germany’s well-developed food processing infrastructure, focus on sustainability, and demand for high-quality functional ingredients promote the use of pea starch in bakery, dairy alternatives, and processed foods. Manufacturers are increasingly leveraging its gelling, thickening, and texturizing properties to meet consumer expectations for clean-label and allergen-free products.

Asia-Pacific Pea Starch Market Insight

The Asia-Pacific pea starch market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing demand for plant-based and clean-label foods in countries such as China, Japan, and India. The region’s expanding food processing sector, combined with growing awareness of health and nutrition, is accelerating the adoption of pea starch across bakery, dairy alternatives, and convenience food products.

Japan Pea Starch Market Insight

The Japan pea starch market is gaining momentum due to the country’s health-conscious population, aging demographics, and preference for functional foods. The market is driven by the rising adoption of plant-based alternatives, gluten-free products, and convenience foods, where pea starch serves as a natural thickener and gelling agent. Integration of pea starch in innovative formulations for snacks, desserts, and dairy alternatives is fueling growth.

China Pea Starch Market Insight

The China pea starch market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding middle class, urbanization, and increasing demand for clean-label and plant-based foods. Pea starch is being widely adopted in bakery, dairy alternatives, and snack applications, driven by health-conscious consumers and growing functional food trends. Strong domestic production capabilities and government initiatives supporting plant-based and sustainable food ingredients are key factors propelling market growth in China.

Global Pea Starch for Food Industry Market Share

The Pea Starch for Food Industry industry is primarily led by well-established companies, including:

• Roquette Frères (France)

• Cargill, Inc. (U.S.)

• Ingredion Incorporated (U.S.)

• Emsland Group (Germany)

• Avebe (Netherlands)

• Puris (U.S.)

• Cosucra Groupe Warcoing (Belgium)

• Qingdao VTR Bio-Tech Co., Ltd. (China)

• COFCO Biochemical (China)

• Shandong Heze Green Agriculture Co., Ltd. (China)

• Tate & Lyle PLC (U.K.)

• Archer Daniels Midland Company (U.S.)

• Kerry Group (Ireland)

• SunOpta Inc. (Canada)

• Roquette Klötze GmbH (Germany)

• Global Bio-Chem Technology Group Co., Ltd. (China)

• Suzhou Sweet Pea Starch Co., Ltd. (China)

• Farbest Brands, Inc. (U.S.)

• Axiom Foods, Inc. (U.S.)

• Bioriginal Food & Science Corp. (Canada)

What are the Recent Developments in Global Pea Starch for Food Industry Market?

- In April 2024, Ingredion Incorporated, a global leader in specialty ingredients, launched a strategic initiative in South Africa to expand the use of pea starch in bakery, dairy alternatives, and snack products. This initiative highlights the company’s commitment to providing sustainable, plant-based functional ingredients tailored to the growing demand for clean-label and high-protein foods in the region. By leveraging its global expertise and innovative product portfolio, Ingredion is strengthening its presence in the rapidly growing Global Pea Starch for Food Industry Market.

- In March 2024, Roquette Frères, a leading French company specializing in plant-based ingredients, introduced a high-purity pea starch variant for industrial food applications, including soups, sauces, and meat analogues. This development addresses the rising need for allergen-free, functional starches with superior gelling and thickening properties, reinforcing Roquette’s position as an innovator in the global pea starch market.

- In March 2024, Cargill, Inc. successfully partnered with several major food manufacturers in India to implement pea starch-based formulations for bakery and dairy alternative products. This collaboration leverages Cargill’s expertise in functional starches to meet the growing demand for plant-based and clean-label solutions, contributing to the adoption of sustainable ingredients in the region.

- In February 2024, Emsland Group, a leading European pea starch producer, announced a strategic partnership with Asian food manufacturers to supply high-quality starch for snacks and confectionery products. This collaboration enhances ingredient accessibility while promoting innovation in texture, binding, and gelling applications, underscoring Emsland’s commitment to expanding its footprint in the global market.

- In January 2024, Avebe, a prominent starch and functional ingredient supplier, unveiled a new line of organic pea starch at the Food Ingredients Europe (FIE) 2024 exhibition. The new product offers improved functionality for bakery, dairy, and snack applications while meeting rising consumer demand for clean-label, plant-based ingredients. Avebe’s launch highlights its focus on innovation, sustainability, and addressing evolving global food industry needs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pea Starch For Food Industry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pea Starch For Food Industry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pea Starch For Food Industry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.