Global Peanut Oil Market

Market Size in USD Billion

CAGR :

%

USD

2.70 Billion

USD

3.70 Billion

2024

2032

USD

2.70 Billion

USD

3.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.70 Billion | |

| USD 3.70 Billion | |

|

|

|

|

Peanut Oil Market Size

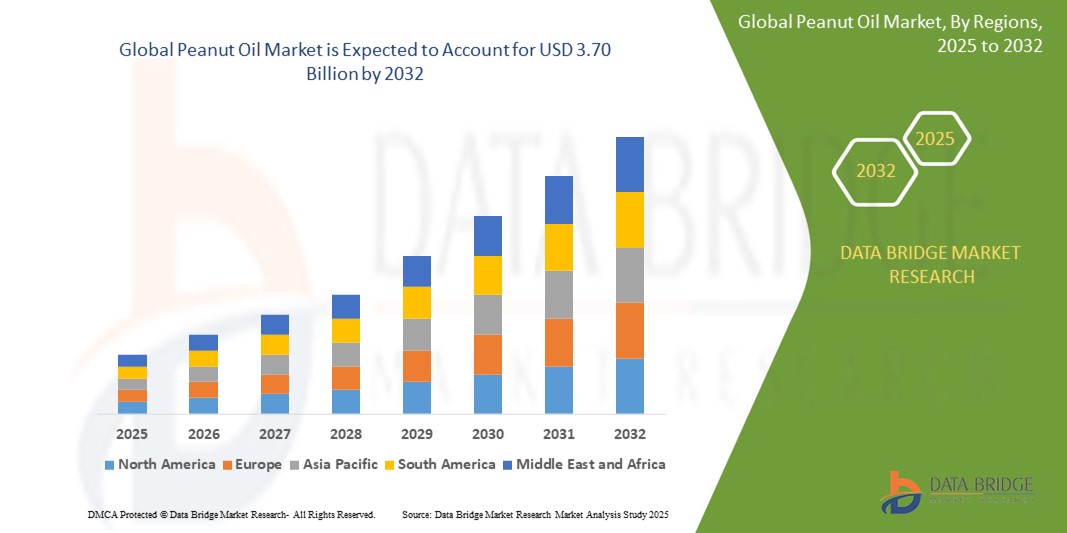

- The global peanut oil market size was valued at USD 2.70 billion in 2024 and is expected to reach USD 3.70 billion by 2032, at a CAGR of 4.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for healthier cooking oils, rising awareness of the nutritional benefits of peanut oil, and expanding applications in food processing and the pharmaceutical sector

- In addition, the growing popularity of plant-based diets and rising disposable incomes in emerging economies are further accelerating market expansion

Peanut Oil Market Analysis

- The peanut oil market is experiencing steady growth due to its wide usage in culinary applications, particularly in frying and baking, where its mild flavor and high smoke point are highly valued by consumers and food service providers

- With increasing consumer focus on natural and unrefined oils, peanut oil is gaining traction in households and gourmet kitchens, supported by rising demand for premium edible oils across various segments

- North America holds the largest revenue share of 35% in the peanut oil market, supported by increasing consumer focus on healthy and natural oils and reflecting strong consumer awareness and evolving dietary preferences toward healthier oils

- The Asia-Pacific region is expected to witness the highest growth rate in the global peanut oil market, driven by increasing demand for natural and healthy cooking oils, rapid urbanization, and rising disposable incomes in countries such as China and India

- The conventional peanuts segment holds the largest market revenue share of around 65% in 2024, attributed to its widespread cultivation and consistent supply. Conventional peanut oil remains the preferred choice for many consumers due to its availability and cost-effectiveness

Report Scope and Peanut Oil Market Segmentation

|

Attributes |

Peanut Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Peanut Oil Market Trends

“Growing Preference for Cold-Pressed and Unrefined Peanut Oil”

- Consumers are increasingly shifting towards cold-pressed and unrefined peanut oil due to its natural extraction process, which retains essential nutrients and flavor without the use of chemicals or high heat

- Health-conscious individuals prefer unrefined variants as they are rich in antioxidants, vitamin E, and phytochemicals, contributing to heart health and better digestion

- This trend is supported by the rising demand for clean-label and minimally processed food products, especially in countries such as the U.S. and India where awareness around healthy cooking oils is expanding

- Small-scale and artisanal brands are capitalizing on this preference by launching premium, cold-pressed peanut oil products in glass bottles with organic certification

- For instance, brands such as 24 Mantra Organic and Natureland Organics in India

- Food enthusiasts and chefs are incorporating cold-pressed peanut oil in salad dressings and stir-fry recipes, favoring its rich, nutty aroma and nutritional value over refined alternatives

Peanut Oil Market Dynamics

Driver

“Rising Demand for Healthy and Natural Cooking Oils”

- Increasing consumer preference for healthy and natural cooking oils is driving demand for peanut oil due to its nutritional benefits

- Peanut oil is valued for its high smoke point and content of unsaturated fats, antioxidants, and vitamin E, making it ideal for deep frying and high-heat cooking

- Growing awareness of lifestyle diseases such as cardiovascular disorders and obesity encourages consumers to choose oils that support heart health and weight management

- The popularity of traditional and home-cooked meals in countries such as China and India boost peanut oil consumption, where it is often considered a kitchen staple

- For instance, peanut oil is commonly used in Indian cooking for its flavor and health benefits

- The clean-label trend and preference for chemical-free, naturally extracted oils increase peanut oil’s appeal among urban and health-conscious consumers worldwide

Restraint/Challenge

“Fluctuating Raw Material Prices and Allergy Concerns”

- The peanut oil market faces challenges from fluctuating prices of raw peanuts caused by weather sensitivity and disease outbreaks affecting crop yields

- Price volatility disrupts supply consistency and impacts profit margins for manufacturers and retailers, especially in countries reliant on peanut imports

- Growing concerns over peanut allergies, especially in Western countries such as the U.S., restrict the use of peanut oil in foodservice and manufacturing sectors

- Foodservice providers and manufacturers often avoid peanut oil to prevent allergic reactions, limiting its application in many products

- Regulatory requirements for allergen labelling add complexity and restrict peanut oil usage in packaged foods, posing challenges for market growth in developed regions where allergen awareness is high

Peanut Oil Market Scope

The peanut oil market is segmented on the basis of source, type, application, packaging, product, and end user.

- By Source

On the basis of source, the peanut oil market is segmented into conventional peanuts, organic peanuts, and non-GMO peanuts. The conventional peanuts segment holds the largest market revenue share of around 65% in 2024, attributed to its widespread cultivation and consistent supply. Conventional peanut oil remains the preferred choice for many consumers due to its availability and cost-effectiveness.

The organic peanuts segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer awareness around health, sustainability, and chemical-free farming practices. Increasing demand from health-conscious consumers and premium product positioning supports the expansion of organic peanut oil.

- By Type

On the basis of type, the market is segmented into refined and unrefined peanut oil. The refined segment holds the largest market revenue share of approximately 70% in 2024, favored for its neutral flavor, extended shelf life, and versatility in cooking applications.

The unrefined segment is expected to witness the fastest growth rate from 2025 to 2032, due to its natural flavor and perceived health benefits, gaining popularity among gourmet and specialty food consumers. Consumers looking for chemical-free and minimally processed oils are driving demand for unrefined peanut oil.

- By Application

On the basis of application, the peanut oil market is segmented into personal care products, food, pharmaceutical, and others. The food segment accounts for the largest market revenue share of over 75% in 2024, driven by extensive use in cooking, frying, and food processing industries globally.

The personal care products segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the oil’s moisturizing and antioxidant properties and its incorporation into skincare and cosmetic formulations. The pharmaceutical segment is also gradually gaining importance due to peanut oil’s use as a carrier oil in various medicinal products.

- By Packaging

On the basis of packaging, the market is segmented into glass containers, plastic containers, cartons, plastic pouches, and others. Plastic containers hold the largest market share of about 55% in 2024 due to affordability, durability, and convenience for consumers in retail settings.

Glass containers is expected to witness the fastest growth rate from 2025 to 2032, especially in the premium and organic peanut oil segments, owing to their eco-friendly appeal and ability to preserve oil quality and flavor. Sustainable packaging trends are encouraging manufacturers to innovate in packaging options to attract environmentally conscious buyers.

- By Product

On the basis of product, the peanut oil market is segmented into cold pressed and hot pressed. The hot-pressed segment dominates with a market share of nearly 68% in 2024, favored for its higher yield and cost-efficiency in production processes.

The cold-pressed segment is expected to witness the fastest growth rate from 2025 to 2032, for its retention of natural nutrients and suitability for health-conscious consumers, showing the fastest growth during the forecast period. The preference for cold-pressed oils in gourmet cooking and organic product lines supports this upward trend.

- By End User

On the basis of end user, the market is segmented into home, restaurant, food manufacture, and others. The home segment holds the largest market revenue share of around 60% in 2024, driven by increasing consumer preference for cooking at home with healthier oils and greater awareness of nutrition.

The restaurant segment is expected to witness the fastest growth rate from 2025 to 2032, as commercial kitchens seek versatile and cost-effective cooking oils to meet diverse culinary demands. Food manufacturers also contribute significantly to demand, utilizing peanut oil in processed foods, snacks, and ready-to-eat products to enhance flavor and texture.

Peanut Oil Market Regional Analysis

- North America holds the largest revenue share of 35% in the peanut oil market, supported by increasing consumer focus on healthy and natural oils and reflecting strong consumer awareness and evolving dietary preferences toward healthier oils

- The U.S. leads this growth, with consumers favoring peanut oil for its high smoke point and nutritional profile

- Demand from food manufacturers for versatile cooking oils also boosts market expansion in the region

- The presence of well-established foodservice industries and growing adoption of peanut oil in commercial kitchens further drive market growth

U.S. Peanut Oil Market Insight

The U.S. peanut oil market commands a significant share in North America, fuelled by rising consumer demand for heart-healthy and high smoke point oils. The growing popularity of peanut oil in commercial kitchens and among home cooks for frying and baking enhances market growth. In addition, foodservice providers’ adoption of peanut oil for its flavor and cooking performance supports sustained market expansion.

Europe Peanut Oil Market Insight

The Europe’s peanut oil market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of healthy eating and the presence of niche gourmet food segments. The U.K. shows particular interest in peanut oil for specialty cooking, while Germany’s focus on organic and natural products supports market adoption.

U.K. Peanut Oil Market Insight

The U.K. market for peanut oil is expected to witness the fastest growth rate from 2025 to 2032, influenced by increasing consumer interest in ethnic cuisines and health-focused cooking oils. Availability through retail and online channels also enhances accessibility, encouraging market penetration.

Germany Peanut Oil Market Insight

The Germany’s peanut oil market is evolving with a focus on organic and natural product offerings. Consumers show rising preference for oils with clean labels and nutritional benefits, supporting gradual market expansion.

Asia-Pacific Peanut Oil Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, propelled by traditional usage in countries such as China and India. Increasing disposable incomes and growing preference for authentic and nutritious cooking oils encourage widespread usage in both households and the foodservice industry.

China Peanut Oil Market Insight

The China represents a major peanut oil market within Asia-Pacific, with strong demand fueled by traditional culinary practices and growing health awareness. The country’s expanding middle class and urbanization support increased consumption in residential and commercial kitchens.

Japan Peanut Oil Market Insight

The Japan’s peanut oil market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing health awareness and demand for natural cooking oils. Traditional Japanese cuisine’s emphasis on quality ingredients supports peanut oil use, while a growing interest in international cooking styles is expanding its applications. The aging population also favors oils that offer health benefits, contributing to steady market development.

Peanut Oil Market Share

The Peanut Oil industry is primarily led by well-established companies, including:

- Georgia-Pacific Chemicals LLC (U.S.)

- Kraton Corporation (Netherlands)

- Eagle Imports (U.S.)

- PAG KIMYA SAN. TIC. LTD. STI. (Turkey)

- GrantChem, Inc. (U.S.)

- LLC PK "XimProm" (Russia)

- AKAY TIC SAN KOLL STI - YUKSEL AKAYLAR (Turkey)

- Fujian Qina Trading Co. Ltd. (China)

- IBRAHIM WALI MOHAMMAD & CO. (Pakistan)

- G.C. RUTTEMAN & Co. B.V. (Netherlands)

- MALPLAST INDUSTRIES LIMITED (Kenya)

- Akay Ticaret Ve Sanayi Koll.Sti. (Turkey)

- Matole Ltd (Hungary)

- Finis Vegetable Oil B.V. (Netherlands)

- Bettcher Industries, Inc. (U.S.)

- Anko Food Machine Co. Ltd. (Taiwan)

- Heat and Control, Inc. (U.S.)

- BAADER (Germany)

- Dover Corporation (U.S.)

Latest Developments in Global Peanut Oil Market

- In August 2023, Tata Consumer Products entered the premium cold-pressed oils market by launching its 'Tata Simply Better' brand, offering four variants including Virgin Cold Pressed Coconut Oil and Cold Pressed Groundnut Oil. This moves targets health-conscious consumers seeking pure, unrefined cooking oils, enhancing Tata’s presence in the premium segment

- In October 2023, Bunge expanded its refining capabilities by signing an asset purchase agreement for a state-of-the-art port-based refinery at the IMTT Avondale Terminal in Louisiana. This multi-oil refinery is expected to boost operational efficiency and broaden Bunge’s customer base

- In 2022, Shree Ram Proteins Ltd announced plans to diversify by building a new oil refinery, aiming to launch Rape Seed, Groundnut, and Cottonseed Oils by early 2023 to meet rising domestic demand and expand its product portfolio

- In November 2022, Chemsta commissioned a 200 TPD refinery for the Luhua Group in Xiangyang, producing high-quality rapeseed and peanut oils. This development reflects Chemsta’s commitment to increasing production capacity and meeting market needs with advanced processing technologies

- In June 2022, Gulab Oils revamped its edible oil range and embarked on a nationwide expansion, aiming to increase daily production capacity from 100 to 1,000 tons and extend its market reach to ten states by 2024, supporting growing consumer demand

- In April 2022, Gemini Edibles & Fats India Ltd expanded its Freedom Healthy Cooking Oil range by launching a 5-liter jar of Freedom Groundnut Oil, popular in southern India for its flavor and health benefits, addressing consumer preferences for quality oils

- In November 2021, Cargill strengthened its position in southern India by acquiring a refinery in Nellore, Andhra Pradesh, investing USD 35 million to upgrade production capacity, which is expected to improve supply chain efficiency and meet increasing regional demand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Peanut Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Peanut Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Peanut Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.