Global Pentane Plus Market

Market Size in USD Million

CAGR :

%

USD

126.29 Million

USD

171.51 Million

2025

2033

USD

126.29 Million

USD

171.51 Million

2025

2033

| 2026 –2033 | |

| USD 126.29 Million | |

| USD 171.51 Million | |

|

|

|

|

Pentane Plus Market Size

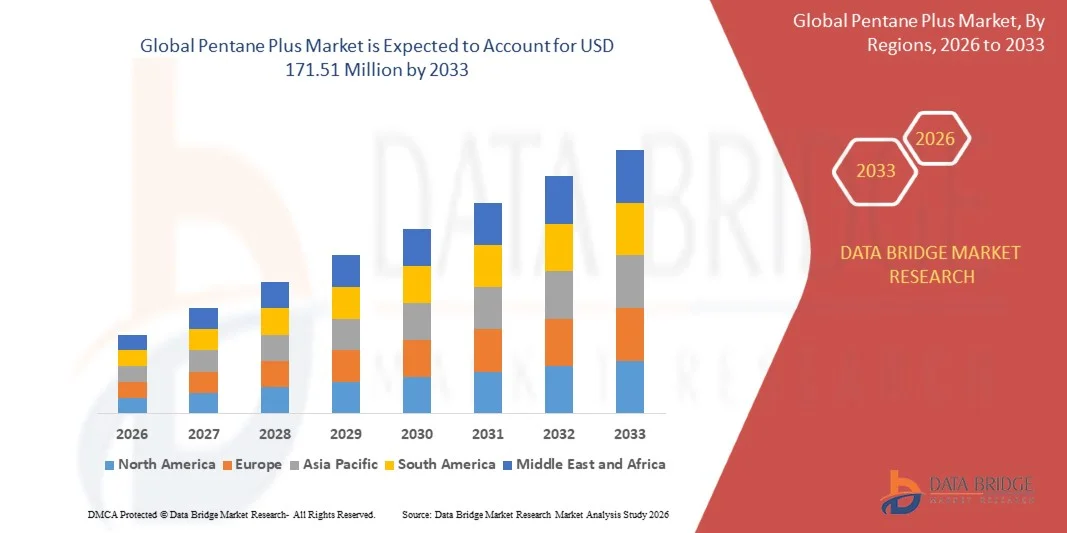

- The global pentane plus market size was valued at USD 126.29 million in 2025 and is expected to reach USD 171.51 million by 2033, at a CAGR of 3.90% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance fuels, chemical solvents, and polyurethane products across industrial, automotive, and construction sectors. Growing urbanization and industrialization are driving consumption of pentane-based products, supporting market expansion globally

- Furthermore, rising demand for energy-efficient, high-octane fuels and environmentally compliant chemical intermediates is positioning Pentane Plus as a critical input for multiple industries. These converging factors are accelerating adoption in key applications such as fuel blending, polyurethane blowing agents, and specialty chemicals, thereby significantly boosting the industry's growth

Pentane Plus Market Analysis

- Pentane Plus, widely used as a high-octane fuel component, chemical solvent, and blowing agent for polyurethane foams, is increasingly becoming a vital raw material in industrial and chemical applications due to its efficiency, volatility, and performance-enhancing properties

- The escalating demand for Pentane Plus is primarily fueled by growth in automotive fuel consumption, rising production of polyurethane-based insulation and packaging materials, and expanding chemical manufacturing activities across emerging and developed markets, reinforcing its strategic importance in multiple value chains

- North America dominated the pentane plus market with a share of 49.1% in 2025, due to the high consumption of industrial chemicals and growing demand for high-performance fuels

- Asia-Pacific is expected to be the fastest growing region in the pentane plus market during the forecast period due to rapid industrialization, urbanization, and rising demand for high-octane fuels and chemical solvents in countries such as China, Japan, and India

- High octane number segment dominated the market with a market share of 51.7% in 2025, due to its critical role in enhancing engine performance and fuel efficiency in transportation fuels. The segment benefits from increasing demand for premium gasoline and specialty fuel blends that improve combustion efficiency and reduce knocking in modern engines. High octane Pentane Plus is also preferred in chemical and industrial applications requiring consistent volatility and energy content. Strong regulatory support for cleaner, high-performance fuels further reinforces market adoption

Report Scope and Pentane Plus Market Segmentation

|

Attributes |

Pentane Plus Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pentane Plus Market Trends

Growing Demand for High-Octane Fuels and Chemical Intermediates

- An emerging trend in the pentane plus market is the increasing utilization of this compound as a high-octane blending component in gasoline production and as a critical feedstock for chemical intermediates. Its superior volatility and combustion characteristics make it valuable in improving the performance and efficiency of transportation fuels while supporting petrochemical synthesis operations across industries

- For instance, ExxonMobil expanded its petrochemical capacity at the Baytown complex in Texas to produce high-purity pentane and other hydrocarbon fractions for blending and chemical applications. This expansion supported the growing demand from refineries and polymer manufacturers for premium grade pentane plus used in fuel optimization and as a precursor for plastic production

- Global fuel demand fluctuations and tightening emission standards are pushing refiners toward high-octane products to meet stringent performance and environmental requirements. Pentane plus is being increasingly incorporated in gasoline formulations to enhance combustion quality while reducing exhaust emissions from internal combustion engines

- The compound is gaining importance in the chemical manufacturing sector as an intermediate for producing specialty chemicals, foaming agents, and solvents used in various industrial applications. Its compatibility with other light hydrocarbons enhances its utility in diversified chemical reactions and product formulations

- Export growth from North America and the Middle East, supported by large-scale natural gas processing facilities, has strengthened the global pentane plus supply chain. These regions continue to invest in upgrading natural gas liquid (NGL) fractionation capacity to meet international fuel and chemical production requirements

- The growing trend toward integrated energy and chemical manufacturing systems underlines the strategic importance of pentane plus in balancing high-octane fuel production with expanding chemical intermediate markets. This shift is positioning pentane plus as a vital link between the fuel and petrochemical value chains, supporting both industrial growth and energy efficiency goals

Pentane Plus Market Dynamics

Driver

Rising Industrialization and Polyurethane Production

- The continuous rise in industrialization and rapid expansion of manufacturing sectors are major drivers for the growth of the pentane plus market. Its role as a key blowing agent and solvent in polyurethane foam production is strengthening due to increasing demand from insulation, construction, and automotive applications

- For instance, BASF SE announced capacity enhancement for its polyurethane production units in China and South Korea, incorporating pentane plus as a preferred blowing agent to replace high-global-warming hydrofluorocarbon (HFC) alternatives. This strategic investment supports sustainable building insulation materials and energy-efficient product lines in Asia Pacific markets

- Industrial growth in emerging economies has increased the consumption of pentane-based foams used in refrigeration appliances, panels, and thermal insulation systems. This rising demand aligns with global emphasis on improved energy efficiency and compliance with environmental performance standards

- The expansion of petrochemical industries coupled with technological advancements in foam manufacturing is supporting widespread adoption of pentane plus as a cost-effective and eco-friendly raw material. Higher durability, improved foam structure, and better thermal efficiency are gained through the use of pentane blends in production lines

- The global shift toward energy-efficient construction materials and greener manufacturing processes continues to reinforce pentane plus usage across multiple end-use sectors. This sustained demand highlights its growing significance in supporting industrial development and eco-compliant polymer production on a global scale

Restraint/Challenge

Feedstock Supply Constraints and Price Volatility

- Feedstock availability and price volatility represent a key restraint for the pentane plus market. As the compound is primarily derived from natural gas liquids and refinery processes, supply variations resulting from crude oil price fluctuations significantly affect market stability and production planning

- For instance, disruptions in natural gas extraction and refining activities due to maintenance shutdowns and geopolitical tensions led to constrained NGL output, impacting companies such as Phillips 66 and Chevron Phillips Chemical. These supply interruptions resulted in increased procurement challenges and price instability for downstream manufacturers

- The dependency on upstream hydrocarbon extraction operations increases the vulnerability of pentane plus producers to feedstock shortages and market imbalances. Rising energy prices and logistics disruptions further exacerbate cost pressures across supply and distribution networks

- Production cost escalation affects the affordability of pentane-based blowing agents and solvents, leading manufacturers to explore alternative materials where cost-efficiency is critical. Such market dynamics may limit pentane plus adoption in regions with less developed refining infrastructure

- Ensuring steady feedstock availability through diversification of supply sources, long-term contracts, and investments in scalable gas processing capacities will be essential to counter price volatility. Stabilizing feedstock markets and improving value chain resilience will play a key role in sustaining the long-term growth of the pentane plus market

Pentane Plus Market Scope

The market is segmented on the basis of type, product type, and application.

- By Type

On the basis of type, the Pentane Plus market is segmented into n-Pentane, Isopentane, and Neopentane. The n-Pentane segment dominated the market with the largest revenue share in 2025, driven by its widespread use in industrial and chemical applications due to its high volatility and favorable physical properties. Manufacturers prefer n-Pentane for use as a blowing agent in polyurethane production and as a solvent in the chemical industry, owing to its efficiency and cost-effectiveness. The segment also benefits from strong compatibility with transportation fuel blends and a well-established supply chain, enhancing its market preference. n-Pentane’s consistent quality and stability make it a preferred choice for large-scale industrial operations and commercial users, supporting steady demand growth.

The Isopentane segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in high-octane fuel blends and polyurethane foams. Its lower freezing point and superior thermodynamic properties make it particularly suitable for applications requiring enhanced volatility and energy efficiency. Growing demand from the automotive and construction sectors for advanced foam insulation and environmentally efficient fuels is driving its rapid uptake. In addition, technological advancements in refining and blending processes further support the expansion of the Isopentane segment.

- By Product Type

On the basis of product type, the Pentane Plus market is segmented into high octane number and low octane number. The high octane number segment dominated the market with a share of 51.7% in 2025, driven by its critical role in enhancing engine performance and fuel efficiency in transportation fuels. The segment benefits from increasing demand for premium gasoline and specialty fuel blends that improve combustion efficiency and reduce knocking in modern engines. High octane Pentane Plus is also preferred in chemical and industrial applications requiring consistent volatility and energy content. Strong regulatory support for cleaner, high-performance fuels further reinforces market adoption.

The low octane number segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand in cost-sensitive fuel blends and certain solvent applications. Its affordability and adaptability make it ideal for large-scale industrial use where extreme fuel performance is not critical. The segment is further supported by growth in emerging markets where low-cost fuel alternatives are increasingly favored. In addition, innovations in additive blending and processing techniques are enabling broader application of low octane Pentane Plus.

- By Application

On the basis of application, the Pentane Plus market is segmented into transportation fuel, polyurethane blowing agent, chemical solvent, electronic cleaning, and others. The transportation fuel segment dominated the market in 2025, driven by the growing need for high-performance, efficient fuel blends in automotive and industrial engines. Pentane Plus is widely used to enhance octane ratings, improve combustion efficiency, and reduce emissions, making it a preferred choice among fuel refiners and distributors. The segment also benefits from increasing adoption of advanced fuel formulations in emerging economies to meet rising vehicle demand. Integration with environmentally friendly additives and compliance with stringent emission norms further supports its market leadership.

The polyurethane blowing agent segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in construction, insulation, and furniture applications. Pentane Plus is preferred for producing lightweight, energy-efficient foam materials that offer thermal insulation and structural performance. Growth is further supported by increasing urbanization, industrialization, and regulatory incentives promoting energy-efficient building materials. In addition, advancements in foam technology and green building initiatives are accelerating the adoption of Pentane Plus as a key blowing agent.

Pentane Plus Market Regional Analysis

- North America dominated the pentane plus market with the largest revenue share of 49.1% in 2025, driven by the high consumption of industrial chemicals and growing demand for high-performance fuels

- Consumers and industrial users in the region prioritize efficiency, quality, and regulatory-compliant fuel and chemical solutions, establishing Pentane Plus as a preferred choice

- This widespread adoption is further supported by advanced refining infrastructure, high industrial activity, and increasing emphasis on energy-efficient applications, strengthening the market’s leadership in both commercial and industrial sectors

U.S. Pentane Plus Market Insight

The U.S. Pentane Plus market captured the largest revenue share in 2025 within North America, fueled by rising consumption in transportation fuels, polyurethane production, and chemical solvent applications. The market growth is supported by technological advancements in refining and blending processes, alongside strong industrial demand for high-octane fuel and high-quality chemical intermediates. Increasing focus on energy efficiency and environmental regulations encouraging cleaner fuel solutions is further propelling market adoption. In addition, rising investments in polyurethane foam production and chemical manufacturing are expanding the application base for Pentane Plus.

Europe Pentane Plus Market Insight

The Europe Pentane Plus market is projected to grow at a significant CAGR throughout the forecast period, primarily driven by stringent environmental regulations and the rising demand for high-performance fuels and chemical solvents. Industrial and automotive sectors in the region are increasingly adopting Pentane Plus to meet efficiency and sustainability standards. Growth is also supported by rising polyurethane foam manufacturing for construction and insulation purposes. European consumers and manufacturers are increasingly prioritizing energy-efficient and low-emission solutions, further fueling market expansion.

U.K. Pentane Plus Market Insight

The U.K. Pentane Plus market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for high-octane fuels and chemical intermediates in the industrial and transportation sectors. Environmental compliance and efficiency standards are encouraging manufacturers to adopt Pentane Plus for chemical and fuel applications. The country’s robust chemical manufacturing infrastructure, coupled with increasing research and development in fuel additives, is expected to continue driving market growth.

Germany Pentane Plus Market Insight

The Germany Pentane Plus market is expected to expand at a considerable CAGR during the forecast period, fueled by strong demand from automotive fuel blending and chemical manufacturing industries. Germany’s focus on innovation, energy efficiency, and sustainable industrial practices promotes the adoption of Pentane Plus as a key industrial chemical. The integration of Pentane Plus in polyurethane foam production and high-performance fuel formulations is increasingly prevalent, with local manufacturers favoring high-quality, compliant products.

Asia-Pacific Pentane Plus Market Insight

The Asia-Pacific Pentane Plus market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid industrialization, urbanization, and rising demand for high-octane fuels and chemical solvents in countries such as China, Japan, and India. The region's expanding manufacturing base for chemicals and polyurethane products is boosting Pentane Plus consumption. Furthermore, increasing government initiatives promoting energy efficiency, advanced fuel standards, and industrial growth are enhancing adoption. Affordability and availability of Pentane Plus from local and international suppliers are also widening the consumer base across APAC.

Japan Pentane Plus Market Insight

The Japan Pentane Plus market is gaining traction due to the country’s advanced chemical and automotive industries, along with strong emphasis on energy-efficient fuel and industrial solutions. Growing demand for polyurethane foam production, chemical solvents, and high-performance fuels is driving market adoption. The integration of Pentane Plus in advanced industrial applications, including electronics cleaning and specialty chemical manufacturing, is fueling growth. In addition, Japan’s aging population and focus on automation in manufacturing are likely to encourage the use of reliable and efficient chemical solutions.

China Pentane Plus Market Insight

The China Pentane Plus market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrial growth, rising automotive fuel consumption, and increasing chemical manufacturing activities. The country’s expanding middle-class and urbanization trends are boosting demand for high-quality fuels and chemical intermediates. Strong domestic production capacity and support for energy-efficient manufacturing processes are key factors propelling market growth. Furthermore, government policies promoting industrial expansion and technological advancement in fuel and chemical sectors are accelerating the adoption of Pentane Plus in China.

Pentane Plus Market Share

The pentane plus industry is primarily led by well-established companies, including:

- Phillips 66 Company (U.S.)

- SHELL (Netherlands)

- HCS Group (Germany)

- INEOS (U.K.)

- LG Chem (South Korea)

- YEOCHUN NCC CO., LTD. (South Korea)

- SK Global Chemical Co., Ltd (South Korea)

- Merck KGaA (Germany)

- SABIC (Saudi Arabia)

- Petrochemical Commercial Company (Saudi Arabia)

- Tradeasia International (Singapore)

- TCI Chemicals (India) Pvt. Ltd. (India)

- Jun Yuan Petroleum Group (China)

- Parchem Fine & Specialty Chemicals (U.S.)

- SOUTH HAMPTON RESOURCES (U.S.)

- SynQuest Laboratories (U.S.)

- Aeropres Corporation (U.S.)

- Choice Organochem LLP (India)

- Datta Hydro-chem (P) Limited (India)

- Central Drug House (India)

Latest Developments in Global Pentane Plus Market

- In June 2025, ExxonMobil signed a major contract to supply Pentane Plus streams to a leading polyolefins producer in Asia. This development highlights the growing adoption of pentane in high-volume downstream sectors such as polyurethane and specialty chemicals. By securing this contract, ExxonMobil expands its footprint in the rapidly growing Asian market, where industrial and automotive sectors are increasingly demanding high-octane fuel components and chemical intermediates. The deal also positions the company as a reliable supplier in a region where pentane consumption is expected to rise sharply due to urbanization and industrialization

- In April 2025, Shell and LyondellBasell announced a strategic collaboration to co-develop and secure Pentane Plus feedstock for a new European petrochemical complex. This partnership ensures a stable supply of raw materials for downstream production, addressing rising demand for high-performance fuels and chemical applications. It reinforces both companies’ market presence in Europe, enables economies of scale in feedstock sourcing, and supports expansion into polyurethane, fuel additive, and solvent applications. By integrating production and supply strategies, the collaboration mitigates supply-chain risks while promoting market growth in the region

- In February 2025, SABIC acquired a controlling stake in a pentane‑rich feedstock processing facility from a regional refinery operator. This acquisition secures a stable, long-term supply of Pentane Plus feedstock, enabling SABIC to reliably meet rising demand in high-octane fuels, polyurethane foam production, and chemical solvent applications. The move strengthens SABIC’s competitive positioning by vertically integrating its supply chain, reducing dependency on external suppliers, and ensuring consistent product quality, which is critical for industrial and commercial customers seeking uninterrupted access to premium Pentane Plus products

- In December 2024, ExxonMobil launched a new line of pentane-based refrigerants designed for industrial cooling and HVAC applications. This product launch diversifies the traditional use of Pentane Plus beyond fuels and chemical solvents, tapping into emerging opportunities in energy-efficient refrigeration. It signals innovation in product development, allowing the company to capture new market segments while aligning with global sustainability trends. The introduction of industrial-grade, environmentally compliant pentane refrigerants expands revenue potential and positions ExxonMobil as a technology-driven leader in specialty pentane applications

- In November 2024, Shell expanded its pentane extraction and processing facilities to increase upstream capacity and feedstock availability for oil & gas and chemical industries. This capacity expansion ensures consistent supply of Pentane Plus, reducing risks associated with shortages amid rising global demand. The initiative strengthens Shell’s ability to serve industrial, automotive, and chemical sectors, supports new application development, and reinforces its leadership in the market. By scaling production infrastructure, the company also enhances operational efficiency and meets growing regional and global consumption requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pentane Plus Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pentane Plus Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pentane Plus Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.