Global Pepper Flavor Market

Market Size in USD Million

CAGR :

%

USD

376.47 Million

USD

568.19 Million

2024

2032

USD

376.47 Million

USD

568.19 Million

2024

2032

| 2025 –2032 | |

| USD 376.47 Million | |

| USD 568.19 Million | |

|

|

|

|

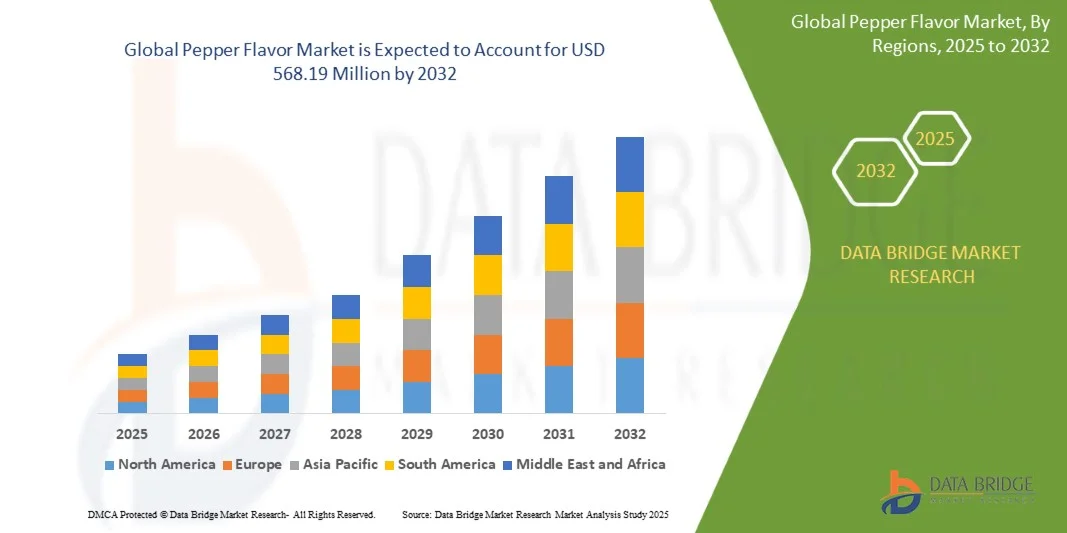

What is the Global Pepper Flavor Market Size and Growth Rate?

- The global pepper flavor market size was valued at USD 376.47 million in 2024 and is expected to reach USD 568.19 million by 2032, at a CAGR of 5.28% during the forecast period

- The market expansion is primarily driven by increasing consumer awareness of flavor customization in food and beverages, along with rising demand for natural and clean-label ingredients in processed foods

- Moreover, the growing inclination toward ethnic and spicy cuisines, coupled with the rising adoption of pepper flavor in ready-to-eat meals, sauces, and seasonings, is accelerating market growth and solidifying pepper flavors as a staple ingredient in modern culinary applications

What are the Major Takeaways of Pepper Flavor Market?

- Pepper flavors are emerging as essential additives in food and beverage products due to their ability to enhance taste, aroma, and overall consumer experience, making them critical for product differentiation in a competitive market

- The increasing demand is fueled by health-conscious consumers seeking natural, preservative-free flavorings, alongside the rising popularity of international cuisines and spicy foods across restaurants, food service, and packaged products

- Asia-Pacific dominated the pepper flavor market with the largest revenue share of 36.54% in 2024, driven by the region’s strong agricultural base, widespread culinary use, and high consumption of processed and packaged foods incorporating pepper flavors

- The North America pepper flavor market is poised to grow at the fastest CAGR of 11.35% during the forecast period of 2025 to 2032, fueled by rising consumer demand for convenience foods, ready-to-cook meal kits, and premium flavoring solutions

- The Black Pepper segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its robust flavor profile, widespread culinary use, and versatility across food and beverage applications

Report Scope and Pepper Flavor Market Segmentation

|

Attributes |

Pepper Flavor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pepper Flavor Market?

“Rising Demand for Natural and Clean-Label Pepper Flavors”

- A major trend in the global pepper flavor market is the growing preference for natural, clean-label, and plant-based flavor solutions, driven by increasing consumer awareness about health, wellness, and food safety

- For instance, manufacturers are now developing organic pepper extracts and solvent-free essential oils to cater to clean-label product requirements, offering authentic taste without artificial additives

- Technological innovations, such as microencapsulation and spray-drying techniques, allow controlled flavor release, enhanced shelf-life, and retention of aroma, meeting the rising expectations of food and beverage manufacturers

- The adoption of plant-derived flavor ingredients also enables seamless integration into snacks, sauces, processed foods, and beverages, providing consistent taste profiles and improving consumer satisfaction

- Companies such as Ajinomoto, McCormick, and Givaudan are increasingly focusing on sustainable, natural sourcing and functional formulations to differentiate products and strengthen market presence

- This trend is shaping product development strategies, positioning natural and clean-label pepper flavors as the preferred choice for both food manufacturers and end consumer

What are the Key Drivers of Pepper Flavor Market?

- Growing consumer inclination towards healthy, natural, and clean-label food products is driving the demand for pepper flavors in various processed and ready-to-eat foods

- The increasing foodservice and processed food industry growth, particularly in snacks, sauces, and ready meals, is boosting the adoption of versatile pepper flavors

- Rising awareness about food safety and authenticity encourages manufacturers to replace synthetic flavors with natural or plant-based alternatives

- The expansion of global spice and seasoning applications, coupled with rising culinary exploration trends, fuels consistent market growth

- Technological advancements in flavor extraction and encapsulation allow enhanced aroma retention and longer shelf life, meeting the needs of both industrial and retail applications

- The demand for high-quality, sustainable, and functional flavor ingredients across food, beverage, and nutraceutical industries further strengthens the market trajectory

Which Factor is Challenging the Growth of the Pepper Flavor Market?

- The high cost of natural and clean-label pepper flavors compared to synthetic alternatives poses a challenge, especially for price-sensitive food manufacturers in developing regions

- Variability in raw material supply and quality, due to climate and seasonal factors, can affect consistency in flavor profiles, limiting adoption

- Regulatory compliance for organic, natural, and clean-label certifications varies across regions, adding complexity and cost to product development

- Technical challenges in achieving stable flavor retention during processing, storage, and distribution can reduce overall effectiveness

- To overcome these challenges, manufacturers are investing in advanced extraction methods, supply chain optimization, and R&D for cost-effective natural solutions, ensuring accessibility, quality, and compliance

How is the Pepper Flavor Market Segmented?

The market is segmented on the basis of species, form, category, and application.

• By Species

On the basis of species, the pepper flavor market is segmented into Black Pepper, White Pepper, Green Pepper, and Red Pepper. The Black Pepper segment dominated the market with the largest revenue share of 42.5% in 2024, driven by its robust flavor profile, widespread culinary use, and versatility across food and beverage applications. Black pepper is highly favored in processed foods, sauces, snacks, and ready-to-eat meals due to its intense aroma and longer shelf-life.

The Green Pepper segment is anticipated to witness the fastest growth rate of 23.1% from 2025 to 2032, fueled by rising demand for gourmet, specialty, and health-oriented products. Green pepper is increasingly incorporated into premium sauces, organic seasonings, and functional food products due to its milder flavor and perceived health benefits. The growing consumer preference for unique culinary experiences and natural ingredients is expected to continue propelling the adoption of green pepper flavors globally.

• By Form

On the basis of form, the pepper flavor market is segmented into Liquid and Dry. The Dry form segment accounted for the largest market revenue share of 55% in 2024, owing to its ease of storage, long shelf-life, and adaptability across multiple food processing applications. Dry pepper flavors are commonly used in snacks, baked goods, sauces, and seasoning blends, providing consistent aroma and taste.

The Liquid form segment is projected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by increasing demand in ready-to-drink beverages, sauces, and marinades where rapid dispersion and uniform flavor delivery are crucial. Advancements in extraction and microencapsulation technologies are enabling liquid pepper flavors to retain aroma and potency, further enhancing their adoption in industrial food processing and culinary applications.

• By Category

On the basis of category, the pepper flavor market is segmented into Organic and Conventional. The Conventional segment dominated the market with a revenue share of 61% in 2024, largely due to its affordability, mass production, and widespread availability for mainstream food and beverage manufacturers. Conventional pepper flavors are preferred in packaged foods, processed snacks, and large-scale commercial applications.

The Organic segment is expected to witness the fastest growth rate of 25.2% from 2025 to 2032, driven by increasing consumer awareness of natural, chemical-free, and sustainable food products. Organic pepper flavors are increasingly incorporated into premium sauces, seasonings, and ready-to-eat meals, catering to health-conscious consumers and the expanding clean-label food trend. The rising demand for traceable, ethically sourced, and environmentally friendly ingredients is expected to accelerate the organic pepper flavor segment globally.

• By Application

On the basis of application, the pepper flavor market is segmented into Household Sector, Food Service Sector, Industrial Sector, Condiments and Seasoning, Baked Goods, Processed Food and Snacks, Beverages, and Others. The Household Sector dominated the market with the largest revenue share of 38% in 2024, driven by increasing consumer demand for premium cooking experiences, convenience, and home-cooked meals enhanced with authentic pepper flavors.

The Processed Food and Snacks segment is anticipated to witness the fastest CAGR of 21.8% from 2025 to 2032, fueled by the rapid growth of ready-to-eat meals, savory snacks, sauces, and frozen food products. Rising consumer preference for flavorful, convenient, and preservative-free processed foods is expected to drive significant adoption of pepper flavors in industrial and commercial food manufacturing, positioning this segment as a key growth driver in the market.

Which Region Holds the Largest Share of the Pepper Flavor Market?

- Asia-Pacific dominated the pepper flavor market with the largest revenue share of 36.54% in 2024, driven by the region’s strong agricultural base, widespread culinary use, and high consumption of processed and packaged foods incorporating pepper flavors

- Consumers in the region highly value the availability of diverse pepper varieties, including black, white, green, and red, which are integrated into both traditional and modern cuisines

- This widespread adoption is further supported by increasing disposable incomes, rapid urbanization, and growing industrial food production, establishing Asia-Pacific as the key region for pepper flavor demand

China Pepper Flavor Market Insight

The China pepper flavor market captured the largest revenue share of 38% in 2024 within Asia-Pacific, fueled by rapid urbanization, growing culinary diversity, and increased consumer preference for fresh, natural, and flavor-rich ingredients. Rising investments in food processing and manufacturing, along with strong domestic brands, further drive market growth.

Japan Pepper Flavor Market Insight

The Japan pepper flavor market is experiencing notable growth due to increasing demand for gourmet and premium culinary products. Consumers are embracing Pepper Flavors for enhancing both traditional Japanese dishes and international cuisines. The focus on quality, safety, and natural ingredients is driving steady adoption across households and restaurants.

India Pepper Flavor Market Insight

The India pepper flavor market is expanding rapidly, driven by a growing middle class, increasing disposable income, and an evolving food culture. Pepper Flavors are widely adopted in both home cooking and the hospitality sector, with a rising preference for ready-to-use and convenient flavoring solutions.

Which Region is the Fastest Growing Region in the Pepper Flavor Market?

The North America pepper flavor market is poised to grow at the fastest CAGR of 11.35% during the forecast period of 2025 to 2032, fueled by rising consumer demand for convenience foods, ready-to-cook meal kits, and premium flavoring solutions. The region’s adoption of modern cooking habits, online food delivery services, and growing interest in culinary experimentation are accelerating the uptake of Pepper Flavors.

U.S. Pepper Flavor Market Insight

The U.S. pepper flavor market is witnessing rapid growth due to rising consumer awareness about seasoning variety, natural ingredients, and gourmet cooking at home. The integration of Pepper Flavors in meal kits, restaurants, and packaged foods is expanding, driven by increasing e-commerce penetration and the popularity of home-cooked meals.

Canada Pepper Flavor Market Insight

The Canada pepper flavor market is expanding at a substantial rate as consumers increasingly seek convenience, high-quality spices, and flavor-enhancing solutions. Growing health-consciousness and demand for natural, additive-free flavors are key factors supporting market adoption in both households and the foodservice industry.

Which are the Top Companies in Pepper Flavor Market?

The pepper flavor industry is primarily led by well-established companies, including:

- Ajinomoto Co., Inc. (Japan)

- McCormick and Company (U.S.)

- T. Hasegawa Co., Ltd. (Japan)

- Sensient Technologies Corporation (U.S.)

- Olam International (Singapore)

- Everest Spices (India)

- The British Pepper and Spice Co. Ltd. (U.K.)

- International Flavors and Fragrances (IFF) (U.S.)

- Givaudan (Switzerland)

- Symrise AG (Germany)

- Kraft Heinz Company (U.S.)

- Nestlé S.A. (Switzerland)

- Döhler GmbH (Germany)

- Firmenich SA (Switzerland)

- WILD Flavors and Specialty Ingredients (Switzerland)

- Cargill, Inc. (U.S.)

- Vanilla Food Company (India)

What are the Recent Developments in Global Pepper Flavor Market?

- In October 2024, Oregon State University introduced two new mild habanero pepper varieties, Notta Hotta and Mild Thing, developed by vegetable breeder Jim Myers. These peppers preserve the fruity and floral flavors typical of traditional habaneros while significantly reducing heat, offering versatile options for culinary applications. This launch highlights innovation in creating flavorful yet milder pepper varieties

- In March 2024, McCormick unveiled four new seasoning blends for chefs, including Cracked Black Pepper and Garlic with Sea Salt. This premium, multipurpose seasoning features coarse particulates to enhance flavors in dishes such as steak, pizza, and fries, while supporting consistency and labor efficiency in professional kitchens. The launch strengthens McCormick’s position in the high-quality, on-trend seasoning market

- In October 2023, Tata Chemicals, India’s leading salt manufacturer, launched its Tata Salt Flavoritz range, which includes black pepper powder. Packaged in hourglass-shaped HDPE sprinkler bottles in 50-gram packs, these flavored salts offer convenience and consistent seasoning for consumers, reinforcing Tata Chemicals’ innovation in value-added salt products

- In January 2023, Primal Kitchen introduced a new Air Fryer Spray Oil, combining coconut MCT oil with garlic, black pepper, and onion extracts. Designed to enhance cooking experiences while avoiding drawbacks of traditional sprays, this product provides a flavorful, healthier cooking alternative

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pepper Flavor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pepper Flavor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pepper Flavor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.