Global Peptide Api Market

Market Size in USD Billion

CAGR :

%

USD

7.89 Billion

USD

16.07 Billion

2024

2032

USD

7.89 Billion

USD

16.07 Billion

2024

2032

| 2025 –2032 | |

| USD 7.89 Billion | |

| USD 16.07 Billion | |

|

|

|

|

Peptide API Market Analysis

The global peptide API market is driven by the increasing prevalence of chronic diseases, including cancer, diabetes, and cardiovascular disorders, which are among the leading causes of morbidity and mortality worldwide. According to the International Diabetes Federation (IDF), approximately 537 billion adults aged 20-79 were living with diabetes in 2021, and this number is projected to rise to 783 billion by 2045, creating significant demand for peptide-based therapeutic APIs like glucagon-like peptide-1 (GLP-1) analogs. Additionally, the World Health Organization (WHO) reports that nearly 10 billion deaths in 2020 were attributed to cancer, underlining the need for innovative peptide-based anticancer drugs. The increasing adoption of peptides in targeted therapies due to their high specificity and safety profile further accelerates their application in addressing these rising healthcare burdens.

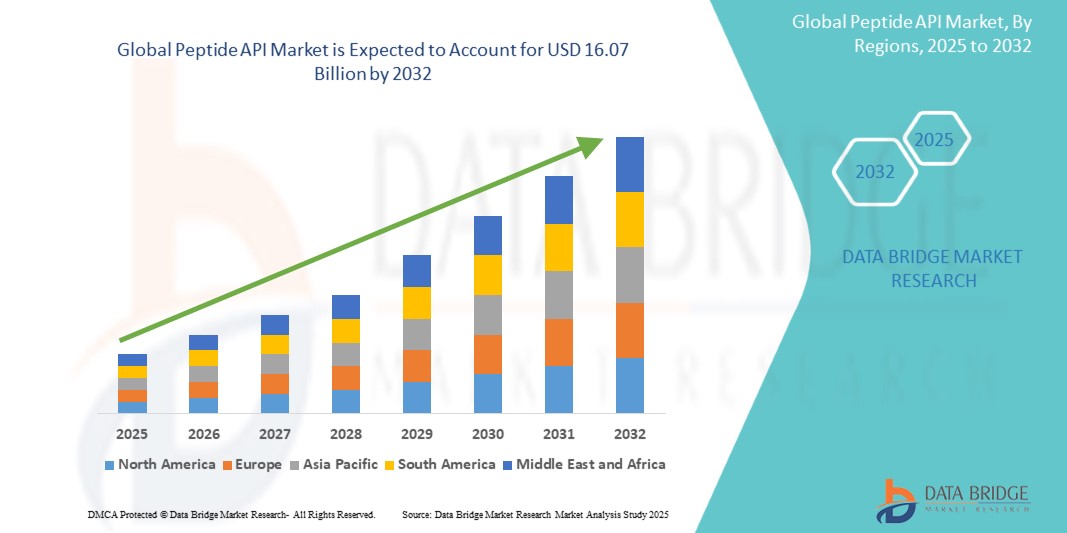

Peptide API Market Size

Global peptide API market size was valued at USD 7.89 billion in 2024 and is projected to reach USD 16.07 billion by 2032, with a CAGR of 9.30% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Peptide API Market Trends

“Advancements in Peptide Synthesis Technologies”

Advancements in peptide synthesis technologies have streamlined the production process, improving efficiency and scalability while maintaining high purity levels. Techniques such as solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS) have been enhanced with automation and hybrid approaches, enabling the production of complex and long-chain peptides with greater precision. Innovations like microwave-assisted peptide synthesis and flow chemistry have further reduced synthesis time and minimized waste, addressing challenges associated with traditional batch production. These advancements support the development of more sophisticated peptide-based APIs, facilitating their application in areas such as oncology, metabolic disorders, and rare diseases.

Report Scope and Peptide API Market Segmentation

|

Attributes |

Peptide API Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Novo Nordisk A/S (Denmark), Bachem Holding AG (Switzerland), AstraZeneca (UK), Merck KGaA (Germany), Amgen Inc. (U.S.), H. Lundbeck A/S (Denmark), PeptiDream Inc. (Japan), PolyPeptide Group (France), Thermo Fisher Scientific Inc. (U.S.), AmbioPharm, Inc. (U.S.), CordenPharma International GmbH (Germany), Lonza Group Ltd. (Switzerland), CSBio Company, Inc. (U.S.), ChemPartner Co., Ltd. (China), Dr. Reddy's Laboratories Ltd. (India), Teva Pharmaceutical Industries Ltd. (Israel), Ferring Pharmaceuticals (Switzerland), Pfizer Inc. (U.S.), among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Peptide API Market Definition

Peptide API (Active Pharmaceutical Ingredient) refers to a biologically active compound composed of short chains of amino acids (peptides) that are used in the formulation of therapeutic drugs. Peptide APIs are designed to interact with specific biological targets in the body to produce a desired therapeutic effect. They can be utilized in various therapeutic areas, including oncology, diabetes, cardiovascular diseases, and autoimmune disorders. Peptide APIs mimic naturally occurring biological molecules, offering high specificity and fewer side effects compared to traditional small molecule drugs, which makes them essential components of modern pharmaceuticals.

Peptide API Market Dynamics

Drivers

- Increasing Prevalence of Chronic Diseases

The rising incidence of chronic conditions such as diabetes, cancer, and cardiovascular diseases significantly drives the demand for effective peptide-based therapeutics. As these diseases become more prevalent due to aging populations and unhealthy lifestyles, a larger patient base seeks targeted treatment options. Peptides offer the advantage of specificity, allowing them to interact with specific receptors and minimize damage to healthy cells, which is particularly important in cancer therapy. Many peptide therapeutics, such as insulin for diabetes management, have demonstrated efficacy in managing these chronic conditions while often exhibiting improved safety profiles compared to traditional small molecule drugs.

For instance,

- In March 2022, according to an article published by National Institutes of Health, approximately 21% of the elderly population in India are reported to have at least one chronic disease, with 17% of seniors in rural areas and 29% in urban areas affected. Hypertension and diabetes represent around 68% of these chronic conditions

This growing reliance on peptide-based therapeutics underscores their critical role in addressing the increasing prevalence of chronic conditions. Their specificity, efficacy, and improved safety profiles position peptides as indispensable tools in modern medicine, catering to the evolving needs of a diverse and expanding patient population.

- Ongoing Research and Development

The pharmaceutical and biotechnology industries are significantly investing in the research and development of peptide-based drugs aimed at treating chronic diseases, reflecting a strong commitment to innovation in healthcare. This concentrated focus on developing new peptide therapeutics is driven by the increasing prevalence of chronic conditions such as diabetes, hypertension, and cancer, which demand effective treatment solutions. As these industries advance their R&D efforts, they are likely to discover and develop novel peptide drugs that can provide targeted and more effective treatment options compared to existing therapies. This introduction of innovative peptide-based treatments not only addresses the unmet medical needs of patients but also stimulates market demand as healthcare providers and patients seek out these advanced therapies. Consequently, the ongoing investment and emphasis on peptide drug development are expected to significantly contribute to the growth of the global Peptide API Market.

For instance,

- In October 2023, according to an article published by National Institutes of Health, the therapeutic applications of peptides are an increasingly popular research area, evidenced by the approval of 26 peptide drugs by the Food and Drug Administration (FDA) from 2016 to 2022, amidst a total of 315 new drug approvals during that period. Additionally, there are over 200 peptides currently in clinical development and around 600 undergoing preclinical studies

The ongoing investment in peptide drug research and development highlights the commitment of the pharmaceutical and biotechnology sectors to addressing unmet medical needs. This focus on innovation is poised to expand the therapeutic landscape, offering advanced and targeted treatment options that enhance patient outcomes and further propel the growth of the global Peptide API market.

Opportunities

- Advancements in Technology

Innovations in peptide synthesis and purification technologies are revolutionizing the production of peptide APIs by significantly improving efficiency and scalability. Automated synthesis platforms enable the rapid and precise assembly of peptide chains, reducing the time and labor involved in the synthesis process. This automation minimizes human error, enhances reproducibility, and allows for the production of complex peptides that may be challenging to synthesize manually. Additionally, advancements in purification methods, such as high-performance liquid chromatography (HPLC) and membrane filtration techniques, facilitate the efficient separation and purification of peptides from impurities and by-products. These enhanced purification processes not only increase yield and purity but also reduce production costs and time. As a result, pharmaceutical companies can scale up production to meet growing market demand for peptide therapeutics while ensuring consistent quality.

- Strategic Collaborations and Partnerships

Collaborations between pharmaceutical companies and biotechnology firms play a crucial role in accelerating research and development (R&D) efforts, particularly in the field of peptide therapeutics. By pooling resources, expertise, and technology, these partnerships enable both parties to leverage each other's strengths and capabilities, significantly enhancing the innovation process. Pharmaceutical companies often possess robust infrastructure, regulatory knowledge, and extensive market access, while biotechnology firms typically bring cutting-edge research, specialized technologies, and novel peptide designs to the table. This synergy allows for streamlined R&D processes, where the challenges of peptide synthesis, optimization, and clinical trials can be addressed more efficiently. Additionally, collaborations can lead to shared funding, reducing financial risks associated with developing new therapies. The combined expertise accelerates the discovery and development timelines, facilitating faster market entry for new peptide therapeutics that can address unmet medical needs. As a result, these strategic alliances not only foster innovation but also enhance competitiveness in the rapidly evolving pharmaceutical environment.

For instance,

- In April 2024, CordenPharma and GENEPEP marked one year of collaboration, which began in 2023, to support biotech companies in peptide discovery, development, and early clinical manufacturing. The partnership combines CordenPharma’s cGMP manufacturing, regulatory expertise, and market access with GENEPEP’s drug development and discovery capabilities

Strategic collaborations and partnerships offer a transformative opportunity for advancing peptide therapeutics by combining the strengths of pharmaceutical companies and biotechnology firms. This collaborative approach accelerates innovation, reduces development risks, and enables faster market introduction of novel peptide therapies, enhancing the industry's ability to address unmet medical needs while maintaining a competitive edge.

Restraints/Challenges

- High Production Costs

The production of peptide APIs can be expensive due to complex synthesis processes, the need for high-purity raw materials, and advanced purification techniques. These high production costs can limit the accessibility of peptide-based therapies, making it challenging for manufacturers to maintain competitive pricing in the market. Additionally, smaller biotech companies may struggle to invest in the necessary infrastructure and technologies, potentially hindering innovation and market entry for new peptide therapeutics.

For instance,

- Peptide API production demands significant costs and infrastructure, as it involves a complex, multi-step synthesis process with numerous chemical stages, followed by intensive purification efforts. These high production costs and intricate manufacturing requirements act as a restraint for the global Peptide API Market, limiting accessibility and increasing barriers for smaller manufacturers

High production costs present a significant restraint for the peptide API market, as they can hinder affordability, limit accessibility, and pose challenges for smaller companies attempting to innovate or compete. Addressing these cost barriers is essential to ensure broader adoption and sustained growth in the peptide therapeutics environment.

- Complexity of Peptide Design and Synthesis

The complexity of peptide design and synthesis poses a significant challenge in the global peptide API market. Peptides, often consisting of 20 or more amino acids, require precise sequence arrangement to achieve their desired therapeutic effects. This intricate design process involves balancing stability, solubility, and bioavailability, while minimizing immunogenicity and degradation by enzymes. Synthesizing these molecules further complicates production, as it demands advanced techniques like solid-phase or liquid-phase synthesis and stringent purification processes to achieve high purity and yield. Additionally, the synthesis of long-chain or cyclic peptides often leads to aggregation, misfolding, or low efficiency, increasing costs and time. Incorporating non-natural amino acids or complex modifications to enhance therapeutic properties adds another layer of difficulty. These challenges require expertise, cutting-edge technology, and significant investment, which can hinder the rapid development and commercialization of peptide-based drugs, especially for smaller or emerging players in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Peptide API Market Scope

The market is segmented on the basis of product type, therapeutic area, route of administration, source, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Hormonal Peptides

- Cyclic Peptides

- Linear Peptides

- Peptide Derivatives

Therapeutic Area

- Oncology

- Diabetes

- Cardiovascular

- Central Nervous System (CNS)

- Infectious Diseases, Others

Route of Administration

- Injectables

- Oral

- Others

Source

- Natural Sources

- Synthetic Sources

Application

- Research and Development

- Commercial Production

Peptide API Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product type, therapeutic area, route of administration, source, and application as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to its robust biotechnology sector, significant investment in research and development, advanced healthcare infrastructure, and a strong focus on innovation in peptide therapeutics.

Asia-Pacific is expected to be the fastest growing due to increasing healthcare expenditure, a rising prevalence of chronic diseases, growing biopharmaceutical industries, and expanding access to advanced therapeutic options in emerging economies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Peptide API Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Peptide API Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- Bachem Holding AG (Switzerland)

- AstraZeneca (UK)

- Merck KGaA (Germany)

- Amgen Inc. (U.S.)

- H. Lundbeck A/S (Denmark)

- PeptiDream Inc. (Japan)

- PolyPeptide Group (France)

- Thermo Fisher Scientific Inc. (U.S.)

- AmbioPharm, Inc. (U.S.)

- CordenPharma International GmbH (Germany)

- Lonza Group Ltd. (Switzerland)

- CSBio Company, Inc. (U.S.)

- ChemPartner Co., Ltd. (China)

- Dr. Reddy's Laboratories Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Ferring Pharmaceuticals (Switzerland)

- Pfizer Inc. (U.S.)

Latest Developments in Peptide API Market

- In May 2024, Donaldson Company, Inc. and PolyPeptide Group AG have partnered to develop a large-scale solvent recovery system for peptide purification. Peptides, used as APIs, are expanding in therapeutic areas such as oncology, metabolic disorders, and neurology. This collaboration will enhance production efficiency, reducing costs and supporting the growing demand for peptide-based therapies

- In April 2024, CordenPharma and GENEPEP, in their 2023 partnership, are combining CordenPharma's cGMP manufacturing and regulatory expertise with GENEPEP's strengths in peptide drug discovery and development. This collaboration supports biotech companies in advancing peptides through early clinical phases. It will enhance the companies' capabilities in delivering high-quality peptide therapies while accelerating time-to-market for innovative treatments

- In March 2024, AstraZeneca has reached an agreement to acquire Amolyt Pharma, a clinical-stage biotech focused on rare endocrine diseases. This acquisition will strengthen the Alexion Rare Disease pipeline and expand its bone metabolism portfolio with eneboparatide (AZP-3601), a Phase III investigational peptide for hypoparathyroidism. It will enhance AstraZeneca’s position in rare disease treatments, particularly in bone metabolism, and support its growth in this specialized therapeutic area

- In January 2024, WuXi AppTec expanded its manufacturing capabilities with two new peptide plants in Changzhou and Taixing, China, increasing solid-phase peptide synthesis reactor volume to 32,000 L. The plants will feature digital systems and automated solvent delivery to optimize production and reduce cycle time. This expansion will enhance production efficiency, improve scalability, and help meet the growing demand for peptide-based therapeutics

- In November 2023, Novo Nordisk has announced plans to invest over 42 billion Danish kroner from 2023 onward to expand its manufacturing facilities in Kalundborg, Denmark, primarily focusing on increasing active pharmaceutical ingredient (API) capacity along with packaging capabilities. This investment is expected to enhance the company's global production capacity, enabling it to meet the rising demand for its products and support future growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.