Global Peptide Therapeutics Contract Api Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

3.48 Billion

USD

6.16 Billion

2024

2032

USD

3.48 Billion

USD

6.16 Billion

2024

2032

| 2025 –2032 | |

| USD 3.48 Billion | |

| USD 6.16 Billion | |

|

|

|

|

Peptide Therapeutics Contract API Manufacturing Market Size

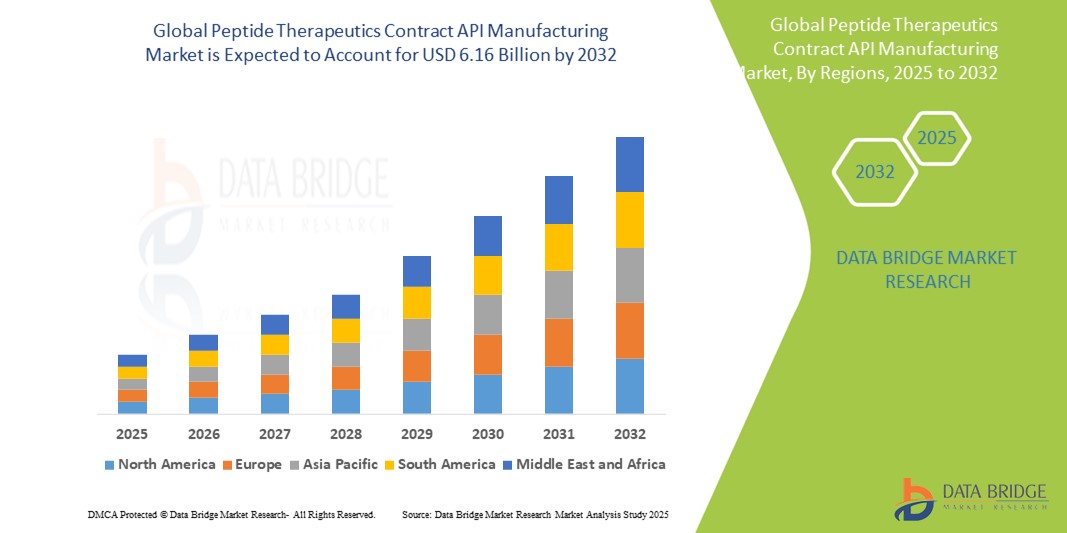

- The global peptide therapeutics contract API manufacturing market size was valued at USD 3.48 billion in 2024 and is expected to reach USD 6.16 billion by 2032, at a CAGR of 9.00% during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic diseases, advancements in peptide synthesis technologies, and expansion of biopharmaceutical research and development

Peptide Therapeutics Contract API Manufacturing Market Analysis

- Peptide therapeutics contract API manufacturing involves the outsourcing of active pharmaceutical ingredient (API) production for peptide-based drugs. This approach allows pharmaceutical companies to leverage specialized expertise and facilities, ensuring efficient and cost-effective manufacturing processes

- The market's growth is significantly driven by the increasing adoption of peptide-based therapeutics, advancements in synthesis technology, and the trend toward outsourcing pharmaceutical manufacturing to specialized API manufacturers. Peptides are gaining traction in pharmaceutical research due to their high specificity, low toxicity, and favorable therapeutic index

- North America is expected to dominate the peptide therapeutics contract API manufacturing market with share of 40.3%, driven by a strong pharmaceutical industry advanced healthcare infrastructure, and significant investments in biotechnology

- Asia-Pacific is expected to be the fastest growing region in the peptide therapeutics contract API manufacturing market with a share of 23.6%, driven by rapid healthcare infrastructure development, increasing demand for innovative therapies, and supportive government policies

- Chemical synthesis segment is expected to dominate the market with a market share of 41.8%, due to the high efficiency and scalability of SPPS. This method enables automated, stepwise peptide production with high purity and supports large-scale manufacturing, further contributing to its widespread adoption in therapeutic peptide production

Report Scope and Peptide Therapeutics Contract API Manufacturing Market Segmentation

|

Attributes |

Peptide Therapeutics Contract API Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Peptide Therapeutics Contract API Manufacturing Market Trends

“Advancements in Peptide API Manufacturing & Outsourcing Trends”

- A prominent trend in peptide API manufacturing is the increasing adoption of advanced synthesis technologies, such as solid-phase peptide synthesis (SPPS), liquid-phase peptide synthesis (LPPS), and microwave-assisted techniques. These innovations enhance production efficiency, reduce costs, and enable the synthesis of complex peptide structures, thereby improving scalability and quality control

- The growing demand for GLP-1 receptor agonists, driven by the rising prevalence of type 2 diabetes and obesity, is significantly impacting the peptide API market. Pharmaceutical companies are investing heavily in expanding manufacturing capacities to meet this demand

- For instance, Eli Lilly has committed an additional USD 5.3 billion to a new Indiana manufacturing site to boost production of its diabetes and weight loss drugs, Mounjaro and Zepbound

- Outsourcing peptide API manufacturing to Contract Manufacturing Organizations (CMOs) is becoming increasingly prevalent, especially in regions such as Asia-Pacific. Countries such as India and China offer cost-effective production facilities, making them attractive destinations for pharmaceutical companies seeking to reduce expenses and enhance efficiency

- The integration of green chemistry and sustainable manufacturing processes is gaining traction in the peptide API industry. Companies are exploring environmentally friendly methods, including the use of recombinant DNA technology, to minimize chemical byproducts and reduce environmental impact

Peptide Therapeutics Contract API Manufacturing Market Dynamics

Driver

“Increasing Demand for Peptide-Based Therapies”

- The growing demand for peptide-based therapeutics in the treatment of various chronic and complex diseases, such as cancer, diabetes, and autoimmune disorders, is driving the need for peptide therapeutics contract API manufacturing services

- Peptides are becoming increasingly favoured due to their specificity and potency, offering targeted therapies with fewer side effects compared to traditional small-molecule drugs

- The global rise in chronic diseases, along with the expanding pipeline of peptide-based drug candidates, is leading to increased demand for efficient, scalable peptide production

For instance,

- In November 2023, a report published by the World Health Organization (WHO) projected those chronic diseases such as cancer and diabetes would continue to rise globally, with cancer alone accounting for over 16 million new cases by 2040. This presents an increased need for peptide-based treatments that offer precision targeting for such diseases

- As the demand for peptides grows, there is a greater need for specialized contract API manufacturers that can meet the high standards of peptide production and deliver cost-effective, scalable solutions to pharmaceutical companies

Opportunity

“Advancements in Peptide Synthesis and Production Technologies”

- The development of more advanced peptide synthesis technologies, such as solid-phase peptide synthesis (SPPS) and recombinant DNA technology, is enabling more efficient and cost-effective production of peptides

- Contract API manufacturers can leverage these new technologies to scale up production while maintaining high purity and quality, meeting the increasing demand for therapeutic peptides

- Innovations in automation and continuous manufacturing techniques are expected to further reduce costs and production timelines, opening up opportunities for the wider adoption of peptide-based therapies

For instance,

- In January 2025, a study published in Nature Biotechnology highlighted advancements in continuous-flow peptide synthesis, which allows for faster and more efficient production of peptides. The study suggested that the application of these technologies could help meet the growing demand for peptides in the pharmaceutical industry while reducing manufacturing costs and time to market

- These advancements will not only lower production costs but also enhance the scalability and flexibility of contract manufacturers, creating significant opportunities in the peptide therapeutics market

Restraint/Challenge

“High Production Costs and Complex Manufacturing Processes”

- The production of peptides involves complex and time-consuming processes, such as solid-phase peptide synthesis, purification, and quality control, leading to high manufacturing costs

- Peptide API production requires specialized facilities and expertise, adding to the overall cost of manufacturing. This can present a barrier to entry for smaller contract manufacturers or pharmaceutical companies with limited budgets

For instance,

- In October 2024, a report from the International Society for Pharmaceutical Engineering (ISPE) emphasized the challenges faced by contract peptide manufacturers in managing the high costs associated with the production of therapeutic peptides. These costs can be attributed to the specialized equipment required, the complexity of synthesis processes, and the stringent regulatory requirements

- As a result, these challenges can limit the affordability of peptide therapeutics, particularly for smaller pharmaceutical companies and healthcare systems in emerging markets, slowing down the overall market growth

Peptide Therapeutics Contract API Manufacturing Market Scope

The market is segmented on the basis of scale of operation, synthesis method and enterprise type.

|

Segmentation |

Sub-Segmentation |

|

By Scale of Operation |

|

|

By Synthesis Method |

|

|

By Enterprise Type |

|

In 2025, the chemical synthesis is projected to dominate the market with a largest share in synthesis method segment

The chemical synthesis segment, is expected to dominate the peptide therapeutics contract API manufacturing market with the largest share of approximately 41.8% in 2025. This dominance is attributed to the high efficiency and scalability of SPPS, which enables automated, stepwise peptide production with high purity. The method's ability to support large-scale manufacturing and its widespread adoption in therapeutic peptide production further contribute to its market leadership.

The large enterprise is expected to account for the largest share during the forecast period in enterprise type market

In 2025, the large enterprises segment is expected to dominate the peptide therapeutics contract API manufacturing market, accounting for over 40.6% of the global installed peptide manufacturing capacity. This dominance is driven by their extensive resources, advanced technologies, and established infrastructures, which enable them to meet the complex requirements of peptide API manufacturing. Their ability to support efficient production, comply with stringent regulatory standards, and manage large-scale operations further solidifies their leadership in the market.

Peptide Therapeutics Contract API Manufacturing Market Regional Analysis

“North America Holds the Largest Share in the Peptide Therapeutics Contract API Manufacturing Market”

- North America dominates the peptide therapeutics contract API manufacturing market with share of 40.3%, driven by a strong pharmaceutical industry advanced healthcare infrastructure, and significant investments in biotechnology

- U.S. holds a 30.9% share of the market, supported by a high demand for innovative peptide-based therapies for chronic diseases such as cancer, diabetes, and cardiovascular disorders

- The region's well-established regulatory framework, coupled with the presence of major contract manufacturers and extensive research and development activities, further strengthens its market position

- In addition, the rising prevalence of chronic diseases and the growing focus on precision medicine and biologics are fueling the demand for peptide therapeutics, contributing to market expansion

“Asia-Pacific is Projected to Register the Highest CAGR in the Peptide Therapeutics Contract API Manufacturing Market”

- Asia-Pacific is expected to witness the highest growth rate in the peptide therapeutics contract API manufacturing market with a share of 23.6%, driven by rapid healthcare infrastructure development, increasing demand for innovative therapies, and supportive government policies

- Countries such as China, India, and South Korea are emerging as major markets due to their expanding pharmaceutical manufacturing capabilities, cost-effective production, and growing biotech sectors

- China, with its large patient population and government support for biotech innovation, remains a critical market for peptide therapeutics, attracting significant foreign investments

- India is projected to register the highest CAGR of 6.3% in the market, supported by a growing pharmaceutical industry, increasing focus on biopharmaceuticals, and a rapidly expanding contract manufacturing sector

Peptide Therapeutics Contract API Manufacturing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bachem Group (Switzerland)

- CordenPharma (Germany)

- Lonza (Switzerland)

- PolyPeptide Group (Sweden)

- AmbioPharm Inc. (U.S.)

- WuXi AppTec (China)

- CEM Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- JITSUBO CO,LTD. (Japan)

- ChemPartner (China)

- ApexBio Technology (U.S.)

- Biotage (Sweden)

- AnaSpec (U.S.)

- Syngene International Limited (India)

- BCNPeptides (Spain)

- CPC Scientific Inc. (U.S.)

- Creative Peptides (U.S.)

- CSBio (U.S.)

- Hybio Pharmaceutical Co., Ltd. (U.S.)

- Senn Chemicals (Switzerland)

Latest Developments in Global Peptide Therapeutics Contract API Manufacturing Market

- In January 2025, Bachem Holding AG, a leading peptide manufacturer, announced the expansion of its manufacturing capacity in Switzerland, aiming to meet the growing global demand for peptide APIs. The new facility will include advanced solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS) capabilities, enabling the production of highly complex peptides with improved scalability and efficiency. The investment also focuses on integrating cutting-edge purification technologies to ensure high-quality peptide APIs for pharmaceutical applications

- In October 2024, Lonza Group AG announced the completion of its peptide manufacturing facility expansion in Visp, Switzerland. The facility now features state-of-the-art production technologies, including continuous flow manufacturing, which significantly reduces production time and cost. This strategic move strengthens Lonza's position as a key player in the global peptide API market, supporting the growing demand for personalized medicine and biologics

- In September 2024, Polypeptide Group unveiled a new, fully automated peptide synthesis platform at its Malmö, Sweden, facility. This platform leverages advanced automation and AI-driven process control to enhance efficiency, reduce batch-to-batch variability, and optimize production costs. The company also announced plans to invest in downstream processing capabilities to improve peptide purification and scalability

- In September 2024, AmbioPharm Inc. launched a new state-of-the-art manufacturing facility in South Carolina, U.S., focused on the production of high-purity peptide APIs for clinical and commercial applications. The facility includes cutting-edge SPPS and purification technologies, designed to support the increasing demand for complex peptide therapeutics in the global market

- In August 2024, WuXi AppTec announced the expansion of its peptide manufacturing capabilities at its Changzhou, China, site. The expansion includes the addition of large-scale reactors, advanced analytical testing facilities, and a fully integrated quality control system, enhancing its ability to deliver high-quality peptide APIs for pharmaceutical clients worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.