Global Period Panties Market

Market Size in USD Billion

CAGR :

%

USD

201.20 Billion

USD

678.03 Billion

2025

2033

USD

201.20 Billion

USD

678.03 Billion

2025

2033

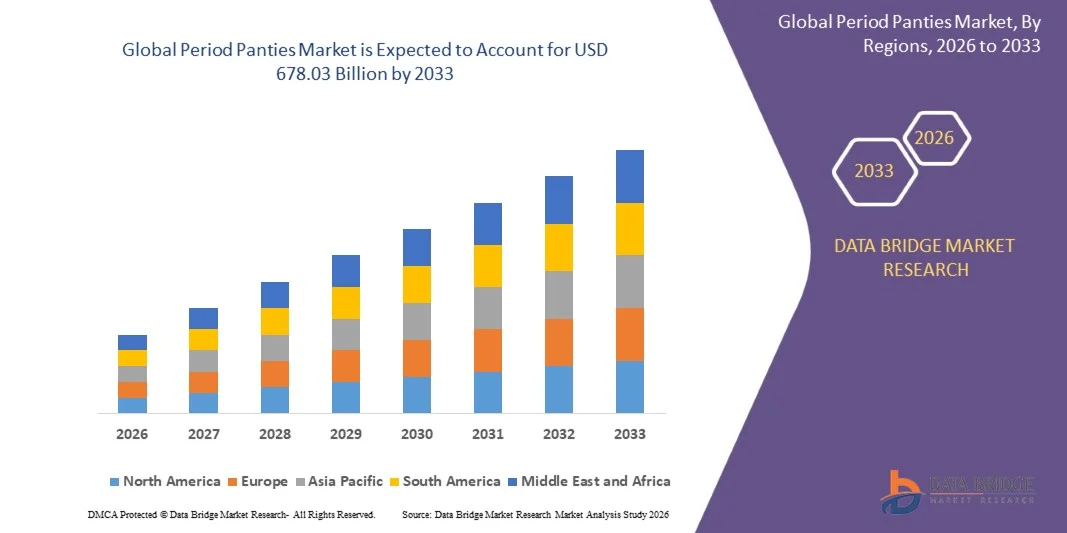

| 2026 –2033 | |

| USD 201.20 Billion | |

| USD 678.03 Billion | |

|

|

|

|

What is the Global Period Panties Market Size and Growth Rate?

- The global period panties market size was valued at USD 201.20 billion in 2025 and is expected to reach USD 678.03 billion by 2033, at a CAGR of16.40% during the forecast period

- Rising awareness of menstrual hygiene, increasing preference for eco-friendly and reusable products, growing adoption of comfortable and leak-proof period underwear, expanding e-commerce penetration, and rising focus on women’s health and wellness are key factors driving the growth of the Period Panties market

What are the Major Takeaways of Period Panties Market?

- Increasing consumer preference for sustainable and innovative period solutions, along with rising disposable income and lifestyle changes, is creating significant growth opportunities for the period panties market

- High product cost, lack of awareness in rural regions, and challenges related to sizing and comfort may act as restraints, limiting the market growth in certain regions

- North America dominated the period panties market with a 42.32% revenue share in 2025, driven by high consumer awareness, strong adoption of premium hygiene products, and rapid growth in e-commerce and retail channels across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, propelled by growing urbanization, rising disposable income, and increasing awareness of menstrual hygiene

- The Bikini segment dominated the market with a 41.2% share in 2025, owing to its popularity among teenagers and working women for everyday comfort, moderate coverage, and style appeal

Report Scope and Period Panties Market Segmentation

|

Attributes |

Period Panties Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Period Panties Market?

“Increasing Shift Toward Sustainable, High-Comfort, and Leak-Proof Period Panties”

- The period panties market is witnessing strong adoption of eco-friendly, reusable, and high-absorbency panties designed to provide comfort, leak protection, and odor control for menstruators

- Manufacturers are introducing multi-layered, moisture-wicking, and antimicrobial fabrics that offer enhanced hygiene, breathability, and compatibility with various body types

- Growing demand for stylish, lightweight, and body-positive designs is driving usage across teenagers, working women, athletes, and postpartum users

- For instance, companies such as Thinx, Ruby Love, Knix, Victoria’s Secret, and Saalt have upgraded their product lines with enhanced absorbency, improved fit, sustainable fabrics, and smart leak indicators

- Increasing consumer awareness about menstrual health, environmental impact, and convenience is accelerating the shift toward premium, reusable, and washable Period Panties

- As lifestyles become more active and health-conscious, Period Panties will remain vital for comfort, confidence, and sustainable menstruation management

What are the Key Drivers of Period Panties Market?

- Rising demand for sustainable, reusable, and eco-friendly menstrual products to reduce plastic waste and promote environmental responsibility

- For instance, in 2025, leading companies such as Thinx, Ruby Love, Knix, Victoria’s Secret, and Saalt expanded their collections to include high-absorbency, leak-proof, and antimicrobial fabrics

- Growing adoption of premium, stylish, and comfortable underwear among working women, athletes, and teenagers is boosting market demand across the U.S., Europe, and Asia-Pacific

- Advancements in fabric technology, absorbent layers, odor-control materials, and moisture-wicking textiles have strengthened product performance, durability, and comfort

- Rising awareness of menstrual hygiene, convenience of reusable products, and availability of e-commerce channels is creating demand for innovative period underwear globally

- Supported by increasing social campaigns, influencer marketing, and online retail expansion, the period panties market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Period Panties Market?

- High costs associated with premium, multi-layered, and eco-friendly fabrics restrict adoption among price-sensitive consumers in emerging markets

- For instance, during 2024–2025, fluctuations in raw material prices, manufacturing costs, and shipping expenses increased retail prices for several global vendors

- Limited awareness regarding reusable period underwear, hygiene benefits, and proper washing care slows adoption in certain regions

- Competition from traditional disposable sanitary products, menstrual cups, and low-cost alternatives creates pricing pressure and reduces market share for premium offerings

- Cultural taboos and conservative consumer attitudes in some regions affect product acceptance and marketing penetration

- To address these challenges, companies are focusing on cost-optimized designs, education campaigns, influencer marketing, and online subscription models to increase global adoption of period panties

How is the Period Panties Market Segmented?

The market is segmented on the basis of product type and distribution channel.

• By Product

On the basis of product type, the period panties market is segmented into Bikini, Boyshort, Hi-waist, and Others. The Bikini segment dominated the market with a 41.2% share in 2025, owing to its popularity among teenagers and working women for everyday comfort, moderate coverage, and style appeal. Bikini period panties offer lightweight, discreet protection, high absorbency, and compatibility with casual and office wear, making them widely preferred across consumers. Their affordability, variety of colors and designs, and suitability for daily use drive strong adoption in retail and e-commerce channels.

The Hi-waist segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing demand for extra coverage, enhanced leak protection, and postpartum support. Rising awareness about comfort, body shaping benefits, and premium fabric technologies is driving growth for Hi-waist offerings across health-conscious and maternity-focused consumer groups.

• By Distribution Channel

On the basis of distribution channel, the period panties market is segmented into Offline and Online. The Offline segment dominated the market with a 54.3% share in 2025, supported by strong presence in retail stores, supermarkets, and specialty lingerie shops where consumers prefer trying products before purchase. Offline channels provide instant availability, personalized assistance, and promotional offers, driving adoption among traditional buyers and first-time users.

The Online segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by e-commerce expansion, subscription-based models, discreet delivery, and wider access to premium and niche brands. Convenience, targeted digital marketing, and increasing trust in online payment systems are encouraging consumers to purchase period panties online, especially in urban and tech-savvy regions across the U.S., Europe, and Asia-Pacific.

Which Region Holds the Largest Share of the Period Panties Market?

- North America dominated the period panties market with a 42.32% revenue share in 2025, driven by high consumer awareness, strong adoption of premium hygiene products, and rapid growth in e-commerce and retail channels across the U.S. and Canada. Increasing preference for sustainable, reusable, and comfortable menstrual products is fueling demand across urban centers. Rising initiatives by health and wellness brands to promote eco-friendly period solutions are further driving regional growth

- Leading companies in North America are expanding their product portfolios, introducing innovative designs such as leak-proof, breathable, and high-absorbency period panties, strengthening the region’s technological and product advantage. Continuous investment in digital marketing, subscription models, and retail distribution is supporting long-term market expansion

- High consumer purchasing power, strong brand loyalty, and growing awareness of women’s health and menstrual hygiene are reinforcing North America’s market leadership

U.S. Period Panties Market Insight

The U.S. is the largest contributor in North America, supported by high disposable income, increasing adoption of sustainable menstrual products, and extensive retail and online presence. Rising awareness about period health, coupled with growing availability of premium products across urban and semi-urban regions, intensifies demand for period panties offering comfort, odor control, and multiple absorbency options. Strong presence of leading brands, subscription-based sales, and influencer-driven marketing further drives market growth.

Canada Period Panties Market Insight

Canada contributes significantly to regional growth, driven by rising awareness of eco-friendly menstrual solutions, availability of premium brands, and government initiatives promoting women’s health. High adoption of online channels and convenience-based shopping habits is increasing market penetration. Universities, corporate wellness programs, and retail campaigns promoting sustainable period products further strengthen regional adoption.

Asia-Pacific Period Panties Market

Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, propelled by growing urbanization, rising disposable income, and increasing awareness of menstrual hygiene. Expanding retail networks, e-commerce adoption, and changing social attitudes toward menstruation are accelerating market growth across China, Japan, India, South Korea, and Southeast Asia. Rising health consciousness and preference for premium, leak-proof, and reusable period panties are further boosting adoption.

China Period Panties Market Insight

China is the largest contributor to Asia-Pacific, supported by increasing awareness of menstrual health, strong e-commerce penetration, and availability of a wide range of products from local and international brands. Growing demand for innovative, comfortable, and eco-friendly period panties is accelerating domestic market growth.

Japan Period Panties Market Insight

Japan shows steady growth, backed by high-quality manufacturing standards, strong retail presence, and awareness of women’s health. Consumers prefer premium, breathable, and multi-absorbency products, driving market adoption.

India Period Panties Market Insight

India is emerging as a key growth hub, driven by urbanization, rising awareness of menstrual hygiene, government campaigns promoting women’s health, and the popularity of e-commerce platforms. Increasing acceptance of reusable and sustainable period panties supports long-term growth.

South Korea Period Panties Market Insight

South Korea contributes significantly due to strong demand for premium, comfortable, and fashion-oriented menstrual products. Rising digital marketing, e-commerce adoption, and health awareness campaigns are accelerating the uptake of period panties across both urban and semi-urban regions.

Which are the Top Companies in Period Panties Market?

The period panties industry is primarily led by well-established companies, including:

- Neione (South Korea)

- Ruby Love (PANTYPROP INC) (U.S.)

- Proof (U.S.)

- Knix Wear, Inc. (Canada)

- Rael (U.S.)

- Saalt, LLC (U.S.)

- Victoria's Secret (U.S.)

- FANNYPANTS (U.S.)

- The Period Company (U.S.)

- Thinx, Inc. (Kimberly-Clark) (U.S.)

What are the Recent Developments in Global Period Panties Market?

- In March 2022, Modibodi partnered with PUMA to introduce a collection of leak-free period underwear and activewear, designed to help women stay comfortable and active during their periods while promoting positive environmental impact, marking a significant step toward sustainable and functional menstrual apparel

- In February 2022, Kimberly-Clark Corporation, a leading provider of menstrual hygiene products, completed its acquisition of a majority stake in Thinx, Inc., a prominent company offering reusable period and incontinence underwear, building on its initial minority investment made in 2019, and strengthening its presence in sustainable menstrual solutions

- In January 2021, Essity launched TENA Silhouette, an absorbent underwear product for menstruation and incontinence, first introduced in Latin America and later rolled out to select international markets through stores and online channels, enhancing comfort and hygiene for women globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.