Global Perioperative Pain Blocker Drug Market

Market Size in USD Billion

CAGR :

%

USD

34.17 Billion

USD

49.18 Billion

2024

2032

USD

34.17 Billion

USD

49.18 Billion

2024

2032

| 2025 –2032 | |

| USD 34.17 Billion | |

| USD 49.18 Billion | |

|

|

|

|

Perioperative Pain Blocker Drug Market Size

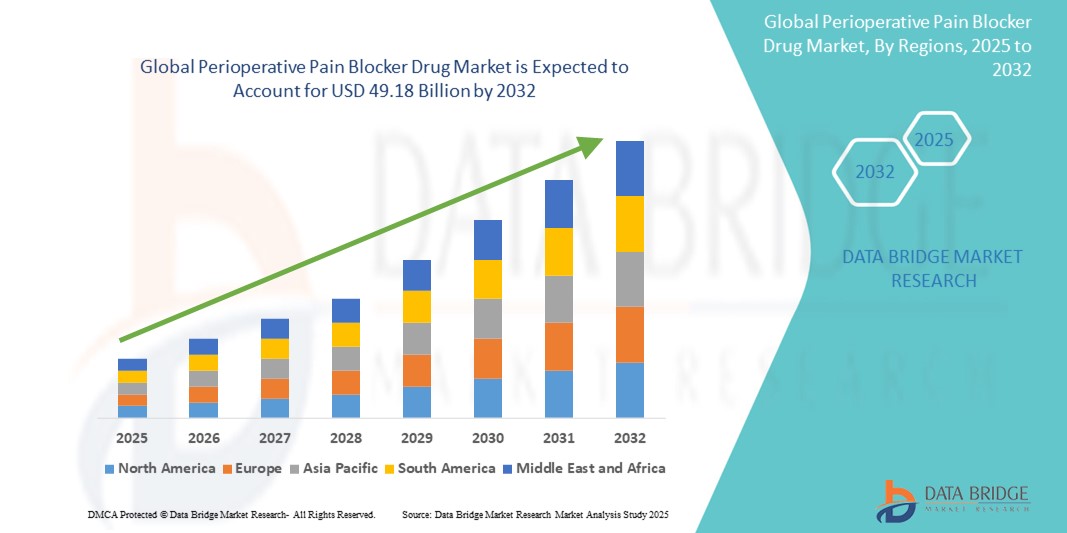

- The global perioperative pain blocker drug market size was valued at USD 34.17 billion in 2024 and is expected to reach USD 49.18 billion by 2032, at a CAGR of 5.34% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected healthcare systems and hospital automation, leading to increased digitalization in both surgical and post-operative pain management settings

- Furthermore, rising patient and provider demand for secure, user-friendly, and integrated solutions for perioperative pain control is establishing perioperative pain blocker drug therapies as the modern standard for pain mitigation in clinical settings

Perioperative Pain Blocker Drug Market Analysis

- Perioperative Pain Blocker Drugs, which help manage and alleviate pain during and immediately after surgical procedures, are becoming increasingly integral to modern surgical care across both hospital and ambulatory settings due to their efficacy in enhancing patient comfort, reducing opioid dependency, and improving recovery times

- The rising demand for perioperative pain blockers is primarily driven by the increasing volume of surgical procedures worldwide, growing awareness of multimodal pain management protocols, and advancements in drug delivery technologies

- North America dominated the perioperative pain blocker drug market with the largest revenue share of 40.6% in 2024, owing to a well-established healthcare infrastructure, early adoption of advanced analgesic protocols, and robust R&D investments by key pharmaceutical players. The U.S. continues to lead the regional market, supported by favorable reimbursement policies and a high prevalence of surgeries among aging demographics

- Asia-Pacific is projected to be the fastest-growing region in the Perioperative Pain Blocker Drug market, with a CAGR of 7.9% from 2025 to 2032, driven by increasing healthcare expenditure, growing surgical volumes in emerging economies such as China and India, and government initiatives to enhance perioperative care

- The local anesthetics segment dominated the market with the largest revenue share of 41.8% in 2024, driven by their widespread use in surgical settings for targeted pain relief with minimal systemic side effects

Report Scope and Perioperative Pain Blocker Drug Market Segmentation

|

Attributes |

Perioperative Pain Blocker Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Perioperative Pain Blocker Drug Market Trends

“Increased Customization and Intelligent Pain Management Solutions”

- A significant and accelerating trend in the global perioperative pain blocker drug market is the deepening integration of intelligent health technologies and personalized medicine approaches. These advancements are significantly enhancing patient convenience and clinician control over perioperative pain management strategies

- For instance, real-time monitoring systems are now being integrated with perioperative pain blockers to tailor dosage and administration based on individual patient response and surgical procedure type, ensuring optimized outcomes and reduced side effects

- Advanced drug delivery methods are also enabling the adjustment of pain blocker release profiles based on surgical variables and postoperative recovery patterns. This allows for more intelligent alerting to clinicians if a patient exhibits atypical pain or adverse reactions, enhancing patient safety and improving clinical workflows

- Furthermore, the seamless integration of perioperative pain blockers with electronic health records (EHRs) and digital post-op recovery platforms facilitates centralized control over patient pain profiles, reducing manual intervention and improving standardization of care

- This trend toward more intelligent, personalized, and outcome-driven perioperative pain management is fundamentally reshaping both hospital protocols and patient expectations. Consequently, pharmaceutical and medtech companies are increasingly focusing on developing pain blockers that offer programmable release, advanced compatibility with surgical planning tools, and reduced dependency on opioids

- The demand for these next-generation perioperative pain blockers is growing rapidly across both developed and emerging healthcare systems, as hospitals and surgical centers prioritize patient satisfaction, procedural efficiency, and reduced hospital stays

Perioperative Pain Blocker Drug Market Dynamics

Driver

“Growing Need Due to Rising Surgical Volumes and Pain Management Requirements”

- The rising global surgical volume, especially in orthopedic, abdominal, and cardiac procedures, has significantly increased the need for effective perioperative pain management solutions

- For instance, in April 2024, Pacira BioSciences announced the expansion of its EXPAREL regional analgesia product line to include novel formulations aimed at reducing opioid reliance during the perioperative phase. Such advancements are expected to drive the Perioperative Pain Blocker Drug industry during the forecast period

- As healthcare providers and institutions prioritize Enhanced Recovery After Surgery (ERAS) protocols, non-opioid perioperative pain blockers are being widely adopted to reduce complications, shorten hospital stays, and improve patient satisfaction

- In addition, the increasing prevalence of chronic conditions such as arthritis and cancer, which often require invasive interventions, further drives the demand for perioperative analgesic drugs

- Technological innovations in drug delivery—such as long-acting injectables, nerve block kits, and patient-controlled analgesia (PCA) systems—are contributing to market growth. The shift toward multimodal pain management approaches continues to boost the adoption of non-opioid Perioperative Pain Blocker Drug formulations across surgical settings

Restraint/Challenge

“Concerns Regarding Side Effects and High Cost of Advanced Analgesics”

- Despite their clinical benefits, perioperative pain blocker drugs—especially newer or branded formulations—often come with high costs that can deter widespread adoption in cost-sensitive healthcare environments

- For instance, certain liposomal formulations, though effective in prolonging analgesic effects, are substantially more expensive than traditional generics, impacting budget allocation in hospitals

- In addition, adverse effects such as allergic reactions, local tissue toxicity, or systemic complications may limit usage in some patient populations, especially in high-risk surgical cases

- There is also variability in regulatory approvals and reimbursement policies across regions, which further complicates market penetration for new entrants and novel drug classes

- To overcome these challenges, manufacturers are focusing on the development of safer, cost-effective, and more targeted drug delivery systems. Increased investment in clinical trials and physician education will also be key to expanding the global reach of Perioperative Pain Blocker Drug therapies

Perioperative Pain Blocker Drug Market Scope

The market is segmented on the basis of drug type, route of administration, dosage form, end user, and distribution channel.

- By Drug Type

On the basis of drug type, the perioperative pain blocker drug market is segmented into local anesthetics, non-steroidal anti-inflammatory drugs (NSAIDs), opioids, alpha-2 adrenergic agonists, and others. The local anesthetics segment dominated the market with the largest revenue share of 41.8% in 2024, driven by their widespread use in surgical settings for targeted pain relief with minimal systemic side effects.

The alpha-2 adrenergic agonists segment is projected to witness the fastest CAGR of 7.9% from 2025 to 2032, due to their ability to reduce opioid requirements and minimize respiratory complications.

- By Route of Administration

On the basis of route of administration, the perioperative pain blocker drug market is segmented into oral, intravenous, epidural, intramuscular, transdermal, and others. The intravenous segment held the largest revenue share of 35.6% in 2024, due to rapid onset and precision in surgical pain control.

The epidural segment is expected to grow at the fastest CAGR of 7.4% during 2025–2032, owing to its high efficacy in long-duration pain management and labor analgesia.

- By Dosage Form

On the basis of dosage form, the perioperative pain blocker drug market is segmented into tablets, capsules, injections, patches, and others. The injections segment accounted for the highest market share of 47.2% in 2024, supported by its use in pre-, intra-, and post-operative phases.

The patches segment is expected to expand at the fastest CAGR of 8.1% from 2025 to 2032, driven by demand for non-invasive, sustained pain relief solutions.

- By End User

On the basis of end user, the perioperative pain blocker drug market is segmented into hospitals, ambulatory surgical centers, clinics, and others. The hospitals segment held the largest share of 48.6% in 2024, driven by the high volume of surgeries and integrated pain management departments.

The ambulatory surgical centers segment is projected to witness the fastest CAGR of 7.8% during the forecast period, due to a surge in day-care surgeries and cost-effective perioperative protocols.

- By Distribution Channel

On the basis of distribution channel, the perioperative pain blocker drug market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market with a revenue share of 52.4% in 2024, benefiting from institutional purchasing and direct dispensing post-surgery.

The online pharmacy segment is anticipated to grow at the fastest CAGR of 8.3% from 2025 to 2032, propelled by expanding digital infrastructure and convenience in post-discharge pain medication access.

Perioperative Pain Blocker Drug Market Regional Analysis

- North America dominated the perioperative pain blocker drug market with the largest revenue share of 40.6% in 2024, driven by high surgical volumes, advanced healthcare infrastructure, and increased preference for non-opioid pain management solutions

- The region’s strong regulatory support for opioid alternatives, coupled with growing awareness of Enhanced Recovery After Surgery (ERAS) protocols, has significantly contributed to the demand for perioperative pain blockers

- Increasing investments by pharmaceutical companies and hospitals in multimodal pain management programs are further accelerating market expansion in both inpatient and outpatient surgical settings

U.S. Perioperative Pain Blocker Drug Market Insight

The U.S. perioperative pain blocker drug market captured the largest revenue share of 81% in 2024 within North America, owing to the growing focus on reducing opioid dependence and increasing adoption of non-opioid analgesics. Strong government initiatives, advanced clinical infrastructure, and the presence of leading pharmaceutical players such as Pacira BioSciences and Johnson & Johnson are driving innovation and availability. The growing trend of ambulatory surgeries and outpatient procedures is also fueling demand for extended-release and nerve block formulations that provide prolonged pain relief post-surgery.

Europe Perioperative Pain Blocker Drug Market Insight

The Europe perioperative pain blocker drug market is projected to expand at a substantial CAGR during the forecast period, driven by heightened emphasis on patient safety and regulatory efforts to curtail opioid use. European healthcare systems are increasingly favoring multimodal and regional anesthesia strategies, which boost the adoption of perioperative pain blockers. Countries such as Germany, France, and the U.K. are seeing significant uptake due to awareness campaigns and public health strategies aimed at reducing post-operative pain complications and hospital readmissions.

U.K. Perioperative Pain Blocker Drug Market Insight

The U.K. Perioperative Pain Blocker drug market is anticipated to grow at a noteworthy CAGR through the forecast period, supported by NHS policies advocating for non-opioid pain therapies and increasing surgical caseloads. Enhanced focus on day-care surgeries and the adoption of patient-controlled analgesia (PCA) systems and long-acting nerve blocks are helping to boost market growth. In addition, partnerships between hospitals and biotech firms for clinical trials are encouraging faster introduction of innovative perioperative analgesic solutions.

Germany Perioperative Pain Blocker Drug Market Insight

The Germany perioperative pain blocker drug market is expected to expand at a considerable CAGR, driven by a well-developed medical infrastructure and increasing preference for minimally invasive and outpatient surgeries. The country’s commitment to reducing opioid usage has accelerated interest in targeted drug delivery solutions such as nerve blocks and long-acting injectables. German manufacturers and hospitals are investing in research collaborations to expand access to advanced pain management drugs aligned with ERAS protocols.

Asia-Pacific Perioperative Pain Blocker Drug Market Insight

The Asia-Pacific perioperative pain blocker drug market is projected to grow at the fastest CAGR of 7.9% during 2025 to 2032, fueled by rising healthcare expenditures, increasing surgical volume, and rapid urbanization in countries such as China, India, and Japan. Government initiatives to modernize hospital infrastructure and promote non-opioid treatment alternatives are contributing to market growth. The availability of cost-effective generics and domestic manufacturing capabilities are making these drugs more accessible across emerging economies.

Japan Perioperative Pain Blocker Drug Market Insight

The Japan perioperative pain blocker drug market is gaining momentum, attributed to a high aging population and increasing prevalence of orthopedic and gastrointestinal Hospitals are integrating advanced pain blocker therapies into ERAS programs to minimize recovery time and hospital stays. The market is also benefiting from Japan’s tech-driven approach to healthcare, including smart infusion pumps and digital patient monitoring integrated with pain blocker regimens.

China Perioperative Pain Blocker Drug Market Insight

The China perioperative pain blocker drug market accounted for the largest revenue share in Asia-Pacific in 2024, driven by its large patient base, fast-growing surgical infrastructure, and domestic drug production. The Chinese government’s push toward expanding universal healthcare access and reducing opioid dependency is leading to greater adoption of perioperative analgesic alternatives. Moreover, the country is witnessing increasing local production and clinical trials for innovative pain blocker drugs aimed at post-surgical recovery enhancement.

Perioperative Pain Blocker Drug Market Share

The perioperative pain blocker drug industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Baxter (U.S.)

- AbbVie Inc. (U.S.)

- Pacira BioSciences, Inc. (U.S.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Lilly (U.S.)

- GSK Plc. (U.K.)

- AstraZeneca (U.K.)

- Purdue Pharma (U.S.)

- Mallinckrodt (Ireland)

- Bayer AG (Germany)

- Amgen Inc. (U.S.)

- Endo Pharmaceuticals (U.S.)

- Heron Therapeutics (U.S.)

Latest Developments in Global Perioperative Pain Blocker Drug Market

- In January 2025, the U.S. FDA approved Journavx (suzetrigine)—an innovative non-opioid oral analgesic—for the treatment of moderate-to-severe acute pain following surgeries such as bunionectomy and abdominoplasty. As the first new class of non-opioid pain medication in over two decades, it offers effective analgesia without the addictive risks associated with opioids

- In March 2025, Vertex Pharmaceuticals announced positive Phase 3 trial outcomes for suzetrigine, demonstrating significant pain reduction comparable to opioid combinations (e.g., hydrocodone–acetaminophen), with fewer side effects such as respiratory depression and sedation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.