Global Permanent Magnet Motor Market

Market Size in USD Billion

CAGR :

%

USD

51.62 Billion

USD

94.64 Billion

2024

2032

USD

51.62 Billion

USD

94.64 Billion

2024

2032

| 2025 –2032 | |

| USD 51.62 Billion | |

| USD 94.64 Billion | |

|

|

|

|

Permanent Magnet Motor Market Size

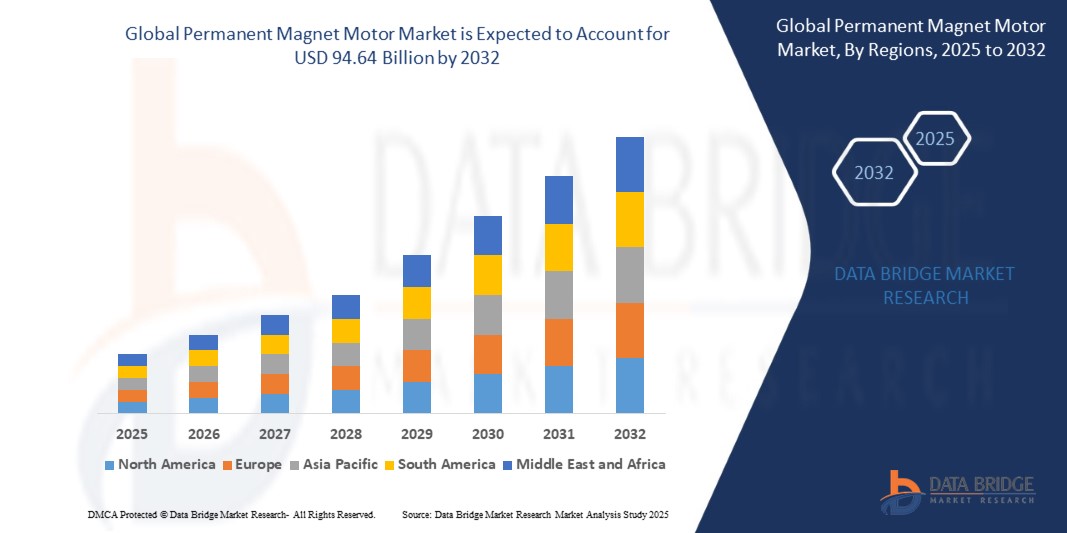

- The global permanent magnet motor market size was valued at USD 51.62 billion in 2024 and is expected to reach USD 94.64 billion by 2032, at a CAGR of 7.87% during the forecast period

- The market growth is largely fueled by increasing adoption of electric vehicles, renewable energy systems, and industrial automation, which require efficient, high-performance motors for energy savings and reliability

- Furthermore, advancements in motor design, including higher power density, improved torque, and reduced losses, are driving manufacturers and end-users to prefer permanent magnet motors over conventional alternatives. These factors are accelerating adoption across automotive, aerospace, robotics, and renewable energy sectors, thereby significantly boosting market growth

Permanent Magnet Motor Market Analysis

- Permanent magnet motors (PMMs) are electric motors that use permanent magnets in the rotor to generate magnetic flux, improving efficiency, torque density, and responsiveness. These motors are widely used in EVs, wind turbines, robotics, and industrial machinery for precise control and reduced energy consumption

- The growing demand for energy-efficient and compact motor solutions is primarily driven by stricter energy regulations, rising electrification in transportation, and increasing automation across industries. The combination of high performance, low maintenance, and long operational life is positioning PMMs as a preferred choice for modern applications

- North America dominated the permanent magnet motor market in 2024, due to high adoption of electric vehicles, industrial automation, and energy-efficient machinery

- Asia-Pacific is expected to be the fastest growing region in the permanent magnet motor market during the forecast period due to rapid industrialization, urbanization, and growing electric vehicle adoption in countries such as China, Japan, and India

- Direct current (DC) motor segment dominated the market with a market share of 52.5% in 2024, due to its established efficiency, precise speed control, and high torque output at low speeds. DC permanent magnet motors are widely preferred in applications requiring smooth and accurate motion control, such as robotics, automotive systems, and industrial machinery. Their ease of integration with electronic controllers and low maintenance requirements further enhance their adoption across diverse sectors. The segment’s ability to deliver consistent performance under varying load conditions and compact form factor also reinforces its dominant position in the market.

Report Scope and Permanent Magnet Motor Market Segmentation

|

Attributes |

Permanent Magnet Motor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Permanent Magnet Motor Market Trends

Rising Electrification in Transportation and Industrial Automation

- The market for permanent magnet motors is rapidly expanding as electrification accelerates across transportation, including electric vehicles, railways, and marine applications. These motors offer high torque density, efficiency, and compactness, making them ideal for next-generation mobility and automation infrastructure

- For instance, Nidec Corporation supplies permanent magnet motors to leading EV manufacturers for traction and auxiliary systems, with strong adoption in electric cars and e-buses as automakers transition toward zero-emission platforms

- Widespread investment in smart factories and robotics is pushing demand for precision and energy-efficient drives, with permanent magnet motors used in conveyor systems, robotic arms, and process automation for higher productivity and lower operational costs

- Growth of renewable energy projects is stimulating use of permanent magnet generators in wind turbines and hydroelectric installations, supporting grid stability and clean power integration

- In addition, marine and aerospace applications are adopting permanent magnet motors to achieve lightweight, reliable performance for propulsion and auxiliary systems, benefiting from reduced maintenance and higher efficiency

- Increasing adoption of high-speed rail and metro systems is driving demand for permanent magnet synchronous motors, which improve acceleration, reliability, and energy savings in densely populated urban regions worldwide

- The development of advanced control electronics and variable frequency drives is expanding the market, as permanent magnet motors can be precisely managed for optimized energy consumption and operational flexibility

Permanent Magnet Motor Market Dynamics

Driver

Increasing Demand for Energy-Efficient Motors

- Escalating energy costs and strict environmental regulations are intensifying demand for high-efficiency motors across industrial, commercial, and transportation sectors. Permanent magnet motors deliver better energy conversion, minimized losses, and lower carbon emissions

- For instance, Siemens offers permanent magnet motors for industrial compressors, pumps, and fans, achieving substantial energy savings and improved reliability for facility operators and manufacturers targeting sustainability goals

- Government policies supporting energy efficiency upgrades in manufacturing and building automation boost investments in permanent magnet solutions, resulting in operational savings for both public and private entities

- In addition, growing consumer awareness and end-user demand for sustainable products are driving procurement of energy-efficient appliances and automation systems based on permanent magnet motor technology

- Major investments in forward-compatible infrastructure, including smart grids and IoT-enabled devices, further reinforce demand for motors with maximum efficiency and long-term cost-effectiveness

- Expanding urbanization and mobility needs require powertrains and auxiliary drives with high performance and efficiency. Permanent magnet motors offer the required compactness, power-to-weight ratio, and operational longevity for EVs, escalators, and automated transport systems

Restraint/Challenge

Supply Chain Volatility of Rare Earth Elements

- A critical challenge confronting the market is the reliance on rare earth magnets, particularly neodymium and samarium cobalt, which are subject to supply chain disruptions, price swings, and geopolitical risks

- For instance, after periodic export restrictions and price spikes from China, ABB and other global players reported increased costs and procurement delays for rare earth magnets used in permanent magnet motor production, impacting delivery timelines and margin planning

- The concentration of rare earth mining and processing in limited geographic regions exposes manufacturers to increased risk, making long-term production planning more complex and speculative

- In addition, competition for rare earth elements with other advanced technology sectors—such as wind energy, mobile electronics, and defense—amplifies shortages and price volatility

- Environmental and regulatory scrutiny of rare earth mining also influences supply chain stability, with stricter standards impacting resource extraction, processing capabilities, and availability for motor makers

- Alternate magnet technologies and recycling initiatives are emerging but require further R&D investments and supply chain adaptation before they can fully offset risks and ensure market stability

Permanent Magnet Motor Market Scope

The market is segmented on the basis of motor type, magnetic material type, and end-user.

• By Motor Type

On the basis of motor type, the permanent magnet motor market is segmented into Direct Current (DC) motors and Alternating Current (AC) motors. The DC motor segment dominated the largest market revenue share of 52.5% in 2024, driven by its established efficiency, precise speed control, and high torque output at low speeds. DC permanent magnet motors are widely preferred in applications requiring smooth and accurate motion control, such as robotics, automotive systems, and industrial machinery. Their ease of integration with electronic controllers and low maintenance requirements further enhance their adoption across diverse sectors. The segment’s ability to deliver consistent performance under varying load conditions and compact form factor also reinforces its dominant position in the market.

The AC motor segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in industrial automation, HVAC systems, and energy-efficient commercial applications. AC permanent magnet motors offer high reliability, lower operational costs, and compatibility with smart control systems, making them attractive for large-scale industrial deployments. Their scalability, reduced energy losses, and long operational lifespan contribute to their rising demand in modern industrial and infrastructure projects.

• By Magnetic Material Type

On the basis of magnetic material type, the permanent magnet motor market is segmented into Ferrite, Neodymium, Samarium Cobalt, and Other materials. The Neodymium segment dominated the largest market revenue share in 2024, owing to its exceptional magnetic strength, high energy density, and efficiency in compact motor designs. Neodymium magnets enable permanent magnet motors to deliver superior torque and speed performance, making them ideal for high-performance automotive, aerospace, and industrial applications. Their growing adoption is also driven by increasing demand for lightweight, energy-efficient motors in electric vehicles and renewable energy systems. In addition, Neodymium-based motors support miniaturization without compromising output, aligning with modern technological trends.

The Ferrite segment is expected to witness the fastest growth from 2025 to 2032, driven by its cost-effectiveness and wide availability. Ferrite magnets are increasingly preferred in general industrial, consumer appliance, and low-to-medium performance applications. Their thermal stability, corrosion resistance, and suitability for large-scale manufacturing contribute to their rising demand. As industries focus on balancing performance with affordability, ferrite permanent magnet motors are emerging as a reliable and economically viable alternative.

• By End-user

On the basis of end-user, the permanent magnet motor market is segmented into Automotive, General Industrial, Energy Sector, Water and Wastewater Management, Mining, Oil and Gas, Aerospace and Defense, and Other sectors. The Automotive segment dominated the largest market revenue share in 2024, driven by the accelerating adoption of electric and hybrid vehicles requiring high-efficiency, compact, and high-torque motors. Permanent magnet motors in automotive applications enhance vehicle performance, reduce energy consumption, and contribute to lower emissions. The growing focus on smart mobility, lightweight vehicle design, and electrification initiatives further strengthens the dominance of this segment.

The General Industrial segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing deployment in robotics, automation systems, conveyor systems, and manufacturing equipment. Industrial applications demand motors with high reliability, precision, and energy efficiency, which permanent magnet motors efficiently provide. Rising industrial automation, modernization of production facilities, and government incentives for energy-efficient machinery are driving this surge. The ability of these motors to operate with low maintenance, high durability, and adaptable configurations makes them highly attractive for expanding industrial operations globally.

Permanent Magnet Motor Market Regional Analysis

- North America dominated the permanent magnet motor market with the largest revenue share in 2024, driven by high adoption of electric vehicles, industrial automation, and energy-efficient machinery

- Consumers and industries in the region prioritize high-performance, energy-efficient motors for automotive, aerospace, and industrial applications

- This widespread adoption is further supported by strong R&D capabilities, advanced manufacturing infrastructure, and government incentives for electrification and energy efficiency, establishing permanent magnet motors as a preferred solution across multiple sectors

U.S. Permanent Magnet Motor Market Insight

The U.S. permanent magnet motor market captured the largest revenue share in 2024 within North America, fueled by the rising adoption of electric vehicles and automation technologies. Growing investments in industrial automation, robotics, and renewable energy projects are driving demand for high-efficiency motors. The expanding trend of electrification in transportation and industrial machinery further propels market growth. Moreover, integration of advanced motor control technologies and focus on energy savings are significantly contributing to the market’s expansion.

Europe Permanent Magnet Motor Market Insight

The Europe permanent magnet motor market is projected to grow at a substantial CAGR during the forecast period, primarily driven by stringent energy efficiency regulations and the increasing adoption of electric and hybrid vehicles. Rising industrial automation and government initiatives promoting sustainable energy solutions are fostering the use of permanent magnet motors. European industries are also adopting these motors for applications requiring precision, reliability, and compact designs. Growth is being observed across automotive, industrial, and renewable energy sectors.

U.K. Permanent Magnet Motor Market Insight

The U.K. permanent magnet motor market is expected to expand at a noteworthy CAGR during the forecast period, fueled by electrification in automotive and industrial sectors. Rising awareness of energy-efficient technologies and government incentives for low-carbon transportation are boosting market adoption. The U.K.’s strong industrial base and focus on innovation, combined with a growing demand for compact and high-performance motors, are anticipated to continue driving market growth.

Germany Permanent Magnet Motor Market Insight

The Germany permanent magnet motor market is projected to grow at a considerable CAGR, driven by industrial automation, automotive electrification, and renewable energy projects. Germany’s emphasis on technological advancement and sustainability supports the adoption of high-efficiency permanent magnet motors. The integration of these motors in smart manufacturing, robotics, and energy-efficient machinery is becoming increasingly prevalent, reflecting local demand for precision, durability, and low energy consumption.

Asia-Pacific Permanent Magnet Motor Market Insight

The Asia-Pacific permanent magnet motor market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and growing electric vehicle adoption in countries such as China, Japan, and India. Government initiatives promoting electrification and smart manufacturing are accelerating the adoption of permanent magnet motors. Furthermore, the region’s status as a major manufacturing hub for motor components ensures affordability and accessibility, expanding the market across automotive, industrial, and energy sectors.

Japan Permanent Magnet Motor Market Insight

The Japan permanent magnet motor market is gaining momentum due to the country’s focus on high-tech automation, electric vehicles, and robotics. Japanese industries prioritize energy efficiency, precision, and reliability, making permanent magnet motors a preferred choice. The adoption of smart manufacturing and integration with advanced motor control systems are fueling market growth. Moreover, Japan’s aging workforce encourages automation, further boosting demand for high-performance, low-maintenance motors.

China Permanent Magnet Motor Market Insight

The China permanent magnet motor market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, urbanization, and increasing electric vehicle production. China is a leading hub for manufacturing motor components, ensuring cost-effective solutions. Rising adoption of renewable energy, smart factories, and electric mobility is driving demand across automotive, industrial, and energy sectors. Government support for green technologies and domestic manufacturing further propels market growth.

Permanent Magnet Motor Market Share

The permanent magnet motor industry is primarily led by well-established companies, including:

- Siemens AG (Germany)

- Rockwell Automation (U.S.)

- ABB Limited (Switzerland)

- Franklin Electric Company Inc. (U.S.)

- Allied Motion Technologies Inc. (U.S.)

- Toshiba Corporation (Japan)

- Ametek Inc. (U.S.)

- Johnson Electric Holdings Ltd (Hong Kong)

- GIC Manufacturing, LLC (Autotrol Corporation) (U.S.)

- Robert Bosch GmbH (Germany)

- Danaher Corporation (U.S.)

- Bonfiglioli Group (Italy)

- Aerotech Corporation (U.S.)

- Crouzet Automatismes (France)

- Buhler Motors GmbH (Germany)

- Nidec Corporation (Japan)

Latest Developments in Global Permanent Magnet Motor Market

- In September 2024, WEG signed an agreement to acquire Turkey-based Volt Electric Motors to strengthen its industrial and commercial motor business. With Volt’s production capacity of 1 million motors annually and strong regional presence, this acquisition allows WEG to expand its footprint across Europe, the Middle East, and Central Asia, meeting growing regional demand and enhancing its competitiveness in the global motor market

- In April 2024, Rockwell Automation released its latest firmware update for the PowerFlex 6000T VFD, enabling highly efficient permanent magnet motor applications in high-speed, medium-voltage operations. Designed for industries such as oil & gas, HVAC, metals, and forestry, the update supports outputs up to 120 Hz and 680 A, while predictive maintenance through TotalFORCE technology optimizes operational uptime. This innovation drives market adoption of smart, reliable, and high-performance motor solutions

- In December 2024, ABB (Switzerland) agreed to acquire the power electronics business of Gamesa Electric from Siemens Gamesa, enhancing its renewable power conversion portfolio. The acquisition, which includes DFIG wind converters, BESS, and solar inverters with approximately 400 employees and two manufacturing facilities in Spain, is expected to strengthen ABB Motion’s market position and meet growing demand for integrated, sustainable energy solutions. Gamesa Electric’s reported revenue of €170 million in 2024 underlines the strategic value of this expansion

- In July 2022, Collins Aerospace unveiled the first operational prototype of a 500-kilowatt electric motor for the Airlander 10 aircraft in collaboration with Hybrid Air Vehicles and the University of Nottingham. Designed for a power density of 9 kW/kg and 98% efficiency, the motor’s advanced topology and composite construction using permanent magnets support high-performance aviation applications. This development positions Collins Aerospace as a key player in the emerging electric aviation market, driving adoption of lightweight, efficient electric propulsion systems

- In April 2022, NIDEC CORPORATION introduced the SynRA synchronous motor, offering IE4 and IE5 efficiency when paired with the ID300 Perfectspeed drive for HVAC and pumping applications. Its magnet-free, easy-to-replace design lowers maintenance costs and ensures compatibility with existing VFDs, while advanced variable speed control reduces wear and improves energy savings. This innovation strengthens NIDEC’s market position by addressing the growing demand for energy-efficient and low-maintenance motor solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.